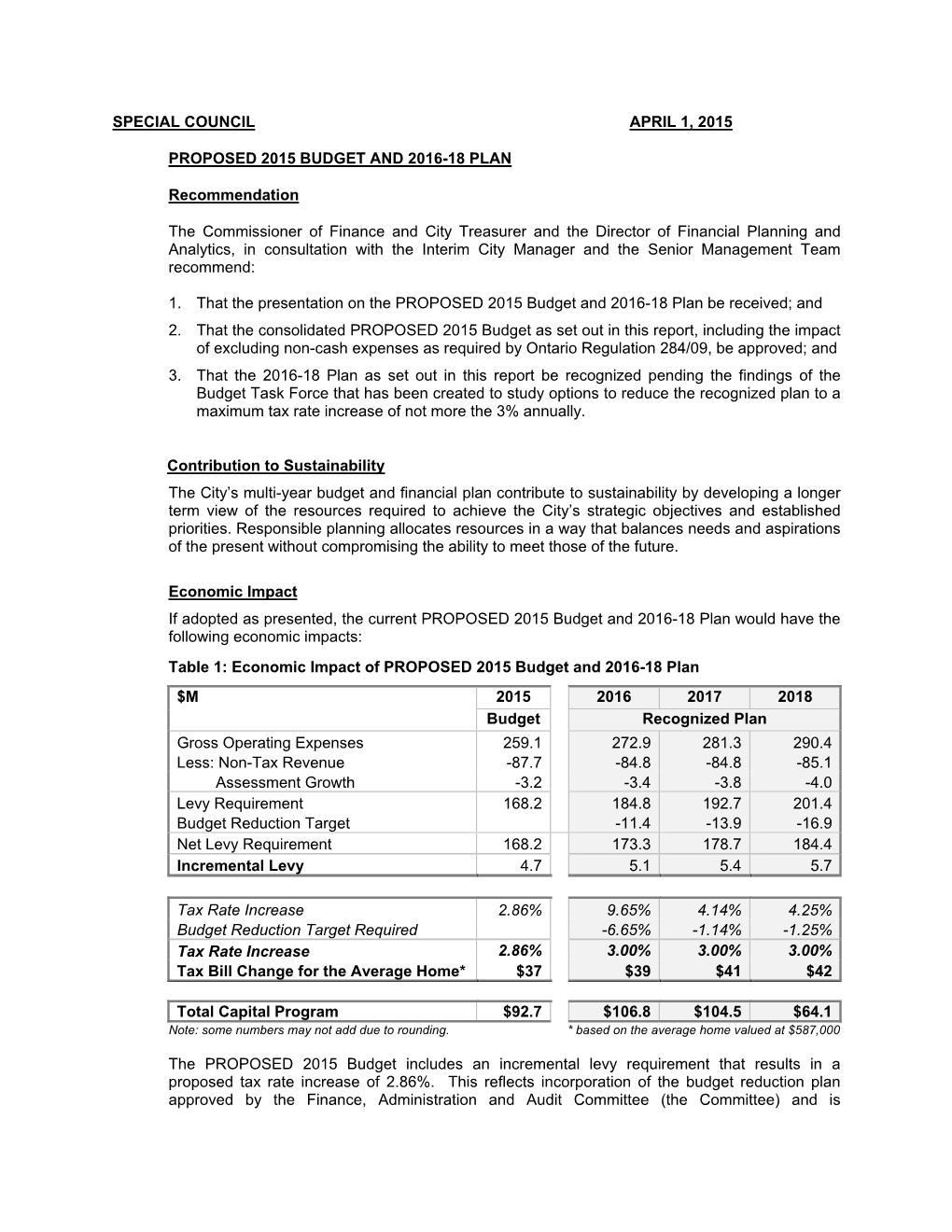

Proposed 2015 Budget and 2016-18 Plan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cordova TH-1C • 1707 Sq

Only you hold the powerFINELY CRAFTED TOWNHOMES to write your story THE ARTHUR CHAPTER ONE Unsurpassed in style, uncompromising in quality. - ARTHUR 02 THE ARTHUR CHAPTER ONE We can all have the life we have dreamed of – the life we have envisioned in our minds time This is a tale of a wonderful journey that is waiting to be yours, in the heart of a beautiful community in Maple. This is a neighbourhood where the homes are spectacular, the lifestyle after time. It all begins here. is captivating and the setting is absolutely endearing. This is the story of The Arthur. A TRADITIONAL TAKE 04 05 THE ARTHUR CHAPTER TWO A TALE OF CRAFTSMANSHIP timeless architecture Every great story begins with a pinch of inspiration. The Arthur emerged from a concept of bringing the community’s rich history and allure to the architecture and style of the project. This yields remarkable brilliance in the stylistic exteriors which showcase a traditional take on townhome design, finished off with state of the art craftsmanship. 07 THE ARTHUR CHAPTER TWO Family friendly The Arthur is perfectly positioned for families – set within an established community with architecturally controlled exteriors. This boutique collection of townhomes is immediately warm and inviting, complete with a community park exclusive for residents. WELCOMING STREETSCAPE 08 09 THE ARTHUR CHAPTER TWO CLASSICALLY INSPIRED INTERIORS Dwell in The Arthur highlights timeless grace throughout masterful interiors which are impeccably fashioned to deliver comfort and sophistication and ultimately create a feeling of effortless elegance and rustic flair Opulence. in each home. Successful design is determined by the details, and here the details truly are the design. -

Programmed Projects 2020-2023

West @ @ East Other Government Agencies/ Utilities Projects City of Vaughan City of Vaughan IDev Project Description Project # GTA WEST BOUNDARY (2020 Construction in red. Design, EA, Master/ Intergrated Plans, Studies in green, broken line includes watermain replacment) (2020 Construction in red. Design, EA, Master/ Intergrated Plans, Studies in green, broken line includes watermain replacment) Infrastructure Management Department, Infrastructure Delivery Department, Facility Management Department and Parks Delivery Department Infrastructure Management Department, Infrastructure Delivery Department, Facility Management Department and Parks Delivery Department York/ Peel Region Projects (Environmental Assessment, Design & Construction - in blue) 20-10 TP Ranch King-Vaughan Road transfered to York Region in 2018 IDev IDev Trail Project Description Project Description Major Mackenzie Drive Reconstruction Phase 2 - Islington Ave to Barons St (incl. Sidewalk, Active Transportation Facility, Watermain & LED Street Park an R ch T Project # Project # 18-25TP ra (Bathurst Street to Pine Valley Drive). i l R t Lighting by York Region on City's behalf). Construction on going. o e Y a e d tr R S S tallionsC ld Infrastructure Management Projects ou a Facility Management Major Projects A rt n Mill Road (COV) o D ) Highway 27 CPR Bridge Replacement & Road Widening (incl. Sidewalk, Streetlighting & LED Street Lighting upgrade by York Region on City's behalf). D c M 19-21TP R (! Construction on going. King-Vaughan Road (COV) N King-Vaughan Road (COV) King-Vaughan Road (YR) King-Vaughan Road (YR) 15-08MP Woodbridge Core Area Functional Servicing Strategy Study ×Ö 14-01BLD Woodbridge Operations Centre Ramp Improvements. Construction start anticipated in 2020. King-Vaughan Road (YR) Y (! U 25-03TP ( Major Mackenzie Drive Reconstruction Phase 1b - Pine Valley Dr to Islington Ave (incl. -

Download Certificate

FORM 9 CERTIFICATE OF SUBSTANTIAL PERFORMANCE OF THE CONTRACT UNDER SECTION 32 OF THE ACT Construction Act Corporation of the City of Vaughan, in the Regional Municipality of York , (County/District/Regional Municipality/Town/City in which premises are situated) 2141 Major Mackenzie Drive, Vaughan, Ontario L6A 1T1 , (street address and city, town, etc., or, if there is no street address, the location of the premises) This is to certify that the contract for the following improvement: T19-097 Safety Surfacing Replacements (short description of the improvement) to the above premises was substantially performed on October 9, 2020 . (date substantially performed) Date certificate signed: October 13, 2020 (payment certifier where there is one) (owner and contractor, where there is no payment certifier) City of Vaughan, Parks Delivery Name of owner: Department Address for service: City of Vaughan, 2141 Major Mackenzie Drive, Vaughan, Ontario, L6A 1T1 Name of contractor: Pine Valley Corp. Address for service: 125 Edilcan Drive, Concord, Ontario. L4K 3S6 Name of payment certifier (where applicable): Maxime Grandmaison Address: City of Vaughan, 2141 Major Mackenzie Drive, Vaughan, Ontario, L6A 1T1 (Use A or B, whichever is appropriate) A. Identification of premises for preservation of liens: City of Vaughan, Maple Airport Park, 121 Avro Road, Vaughan, Ontario, L6A 1Y7 (if a lien attaches to the premises, a legal description of the premises, including all property identifier numbers and addresses for the premises) B. Office to which claim for lien must be given to preserve lien: City of Vaughan, 2141 Major Mackenzie Drive, Vaughan, Ontario (if the lien does not attach to the premises, the name and address of the person or body to whom the claim for lien must be given) CA-9-E (2018/04) . -

2016 Annual Report

2016 The Federal Gas Tax Fund Annual Report – Part II Table of Contents Compliance and Financial Audit Statements, Federal Gas Tax Fund ............. A 1-9 Audit Based Attestation .................................................................................................... B 1 Municipal Compliance Audit Reports ........................................................................... C 1-44 2016 to 2018 Federal Gas Tax Fund Allocations ....................................................... D 1-11 2016 Federal Gas Tax Fund Projects ............................................................................. E 1-314 A-1 A-3 A-4 - A-5 A-6 " # A-7 - A-9 A-2 A-3 A-4 A-5 & ' ()*! + ,- ) *. ,- )*. -(/0)- ( 1 %**) $2 1 3" 4 .)5*)*$ & .*) 52)$! )2*)*2)5! 3" 4 3.%)5.). 4 3)2*5)22)$2!4 3" 4 3 )*)554 35)**)$!$4 -(/0 22).$! 225)* -(/0) ( 1 225)* 1 225)* A-6 + ,- )*. 0 ' %) **$) & 3&4) 8 0 ) / 0 3/04& ( 3 4 # " , & & 30 4 ( - 9 0 19!$ - 0 3 ( 4 **$ **59 0 :- ) **2) 19 .- 0 3 ( 4 ** *!9 / *!)/0) &)8 0 & ( 3 49 ( ( 3*! *249 ; )& - - < - < = ' ()*! -< ( ) 9 /0 - & ( 9/0 *9$> & 9 # 3 # 4 - /0 ? 9# ( /0&9 () # ( - - -

Major Mackenzie Drive Culvert Replacement

MAJOR MACKENZIE DRIVE CULVERT REPLACEMENT PROJECT Successfully Planning, Executing, and Minimizing the Impacts of an eight-week, Double Culvert Construction Under a Major Urban Arterial Ontario Public Works Association Award Submissions 2019 Public Works Project of the Year The Regional Municipality of York Transportation Services TABLE OF CONTENTS Project Overview ........................................................................... 1 Project Background ...................................................................... 2 Construction Management and Schedule ............................ 4 Construction Safety ...................................................................... 6 Community Relations .................................................................. 8 Protecting the Environment ....................................................12 Accomplishments under Adverse Conditions ....................14 Why this Project is Important .................................................16 Conclusion ....................................................................................17 PROJECT OVERVIEW The Regional Municipality of York (York Region) recently undertook Given the various sensitivities surrounding the temporary road an emergency culvert replacement for a large 50-year old corrugated closure, York Region pre-qualified three top general contractors steel pipe arch (CSPA) culvert in the City of Vaughan. The culvert to bid on this project. Coco Paving Inc. was awarded the contract. conveys the West Don River under -

Major Mackenzie Drive Schedule 'C' Environmental Assessment Study

Major Mackenzie Drive Schedule ‘C’ Environmental Assessment Study From McNaughton Road / Avro Road to Keele Street Regional Municipality of York December 20, 2018 From McNaughton Road / Avro Road to Keele Street east for the horizon year of 2020. A future EA study will assess long-term transportation needs, Executive Summary including capacity and multi-modal improvements to the corridor. In particular, the EA study: Introduction Reviewed existing conditions and operational challenges along this section of Major Mackenzie The Regional Municipality of York (York Region) has completed a Schedule “C” Municipal Class Drive Environmental Assessment (EA) study to review the short-term transportation operational needs Identified opportunities for improvement and possible solutions along Major Mackenzie Drive West (referred to as Major Mackenzie Drive for the purpose of this Investigated and recommended alternative designs for the preferred solution report), from McNaughton Road / Avro Road to Keele Street in the City of Vaughan. Collected, documented and assessed input and feedback from residents and affected groups York Region is responsible for monitoring its transportation network and implementing required within the study area improvements in a timely manner. Concerns raised regarding traffic operations on Major Mackenzie Drive within the study limits included challenging access to and from businesses, congestion, queuing Study Area and need for pedestrian crossings. These issues led York Region to investigate short-term (2020) The study area is 1.4 km long and is bounded by McNaughton Road/Avro Road to the west and operational improvements for the corridor. A future EA study will assess the long-term transportation Keele Street to the east, in the Village of Maple, located in the City of Vaughan. -

Executive Committee Meeting #1/15

INDEX TO EXECUTIVE COMMITTEE MEETING #1/15 Friday, February 6, 2015 MINUTES Minutes of Meeting #11/14, held on January 16, 2015 1 CORRESPONDENCE A letter dated February 3, 2015 from John D. Srebot, General Council re: 184448 Ontario Limited 1 LONG TERM OFFICE ACCOMMODATION PROJECT 5 LOWER DON 1D-2D FLOOD MODEL Request for Proposal #10000145 9 2015 BUDGET PROCESS Status Report 12 LANDSCAPE TRAINING PROGRAM 37 ONTARIO REGULATION 166/06, AS AMENDED CITY OF BRAMPTON 21 WEST OF MCVEAN DRIVE/NORTH OF COUNTRYSIDE DRIVE 21 CITY OF TORONTO 21 CITY OF TORONTO 22 184448 ONTARIO LIMITED 22 99 WAYMAR HEIGHTS 23 CORSICA DEVELOPMENT INC. C/O METRUS DEVELOPMENT INC. 23 CITY OF MISSISSAUGA 24 ROYAL LASER DEVELOPMENTS INC. 24 CITY OF TORONTO 25 ENBRIDGE GAS DISTRIBUTION INC. 26 35 HEATHERWOOD CRESCENT 26 84 SCIBERRAS ROAD 26 WEINS CANADA INC. 27 KEUNING CONSTRUCTION LTD. 27 375 ELLIS PARK ROAD 27 CITY OF TORONTO 27 ONTARIO REGULATION 166/06, AS AMENDED, CONT'D 87 VALECREST DRIVE 28 1044771 ONTARIO INC. 28 1044771 ONTARIO INC. (SUN HUNG KAI) 28 411 LAWRENCE AVENUE EAST 28 56 DON RIVER BOULEVARD 28 1313688 ONTARIO INC. 29 775 EASTERN AVENUE 29 CITY OF VAUGHAN 29 120 WOLF CREEK CRESCENT 30 136 WILLIS ROAD 30 REGIONAL MUNICIPALITY OF YORK 30 2964 SEABREEZE ROAD 31 8242 MAYFIELD ROAD 31 JOHN STREET AND HEMLOCK STREET 31 220 LAKELAND CRESCENT 32 CITY OF MARKHAM 32 CITY OF TORONTO 32 CITY OF TORONTO 33 ENBRIDGE GAS DISTRIBUTION INC. 33 10 RIPPLE STREET 34 3 PETUNIA STREET 34 2 GROVETREE ROAD 34 12 BAYSHILL DRIVE 35 7 COLCHESTER COURT 35 486 HIDDEN TRAIL 35 33 GARTHWOOD DRIVE 35 114 FERRIS ROAD 36 6 CONNABLE DRIVE 36 1 KAIA COURT 36 61 NAPANEE STREET 36 25 AUSTIN RUMBLE COURT 37 MEETING OF THE EXECUTIVE COMMITTEE #1/15 February 6, 2015 The Executive Committee Meeting #1/15, was held in Weston Room B, Black Creek Pioneer Village, on Friday, February 6, 2015. -

Council Meeting 7 Pm

Town of Whitchurch-Stouffville Council Agenda Tuesday March 6, 2018 7:00 PM Council Chambers 111 Sandiford Drive Please ensure cell phones are turned off or set to be silent. Council Meetings will be audio-recorded and made available online. Speakers may only register to speak to Staff Reports listed on the agenda. Chair: Mayor Altmann Page 1. Call to Order 2. Roll Call 3. Introduction of Addendum Items 1. Memorandum from Deputy Director, Development Services, re: Housekeeping Changes to By-law Number 2018-028-ZO and Staff Report DS-006-18 4. Confirmation of Agenda 1. To confirm the agenda That Council confirm the agenda, as circulated. 5. Declarations of Pecuniary Interest 6. Adoption of Minutes 8 - 14 1. To adopt the minutes That Council adopt the minutes from the regular meeting of Council on February 20, 2018, as circulated. 7. Recognitions 8. Delegations/Petitions Delegates may speak for up to 10 minutes of uninterrupted time and only on the matter indicated on your delegation request form. Page 1 of 226 Council Agenda March 6, 2018 As per the Town Procedural By-law, when addressing Council, the speaker shall be respectful of all persons and refrain from entering into cross debate with members of Council, Town Staff and members of the audience. Following the delegation, Council members may ask questions to obtain additional information or seek clarification from the speaker but shall not make statements to or enter into debate with the speaker. Once the question period is deemed complete by the Chair, Council members will deliberate the matter at hand without interruption. -

Title Subtitle

Parks Development Off Road Trail Updates June 2014 1 About Parks Development Role • Responsible for major capital park and open space projects (retrofits/redevelopments & new construction) • Projects often include significant planning with other departments and regulating authorities, such as Toronto and Regional Conservation Authority (TRCA), Ministry of Natural Resources (MNR) and York Region • Design development through to the construction stage of these off road projects can take several years to complete, pending level of approval required 2 Proposed Multi Use Community Trail Systems in the City of Vaughan (Planning Map ) 3 Existing Off Road Trail Systems in the City of Vaughan 4 Pedestrian Bridge Replacements Completed: Marita Payne Park, Thornhill : Galvanized Bridge, Winter 2014 (Don River) 5 Pedestrian Bridge Replacements Tender Ready Projects: Keffer Marsh Bridge, Mackenzie Glen Open Space Thornhill (Don River) Bridge, Maple (Don River) 6 Pedestrian Bridge Replacements 2014/2015 Projects Approved & Currently in Design and Development Stage: 1. Maple Airport Open Space: Metal Bridge (Don River) Concrete Bridge (Don River) 2. Marita Payne Park: 3. Pine Grove Bridge: Metal Bridge (Humber River) 4. Uplands Golf and Ski Centre: Metal Bridge (E. Don River) 5. West Don Valley Open Space: Metal Bridge (Don River) 7 Bartley Smith Greenway Trail Signage Improvements Scope: Adding new and enhanced signage from Steeles Avenue to Teston Road Purpose: Improve usability, accessibility, and safety of trail system Timeline: Completion Fall 2014 -

Draft 2014 Budget and 2015-2017 Plan Update

CITY OF VAUGHAN EXTRACT FROM COUNCIL MEETING MINUTES OF JANUARY 28, 2014 Item 1, Report No. 1, of the Finance, Administration and Audit Committee, which was adopted without amendment by the Council of the City of Vaughan on January 28, 2014. 1 DRAFT 2014 BUDGET AND 2015-2017 PLAN UPDATE This matter was deferred to the January 20, 2014, Finance, Administration and Audit Committee meeting to continue deliberations (see OTHER MATTERS CONSIDERED BY THE COMMITTEE, Item 2.1: DRAFT 2014 BUDGET AND 2015-2017 PLAN UPDATE) Draft 2014 Budget and 2015-2017 Plan UPDATE Finance, Administration & Audit Committee January 15, 2014 Financial Sustainability Always a Key Priority Presentation Agenda • Meeting purpose • The budget objective & key principles • Budget adjustments • Budget highlights • Ice Storm • Implications of reductions • Taxes in Perspective • Next steps 2 Draft 2014 Budget 2015-2017 Plan Meeting Purpose • Provide an update on the budget and plan • Receive public input • Obtain Committee direction on the budget • Schedule a date for Special Council (14 days public notice) (Further committee adjustments and/or direction will be incorporated in a consolidated report for this meeting) 2 Draft 2014 Budget 2015-2017 Plan Budget Objective “To balance the pressures of maintaining existing services and growth requirements against available future City funding and resources necessary to undertake and manage operations and initiatives” Key Principles • Guided by the City’s Strategic Plan • Financial sustainability • Planning for the future • Provide value for tax dollars 4 Draft 2014 Budget 2015-2017 Plan The Draft Budget Outcome Plan 2014 2015 2016 2017 Rate Incr. $ (m) Bill Incr. Rate Incr. -

Maple Community Plan Amendment N0-150 to the Official Plan of the Vaughan Planning Area

-MAPLE COMMUNITY PLAN AMENDMENT N0-150 TO THE OFFICIAL PLAN OF THE VAUGHAN PLANNING AREA -- KING :·I 1111111 I I I II I I }II II I I IIIIJ I I I IIIII Jill I 111111.,. 1111111111 IJ 11111,1111/11 1111111~1 111111 Ill i111111111 ~ H''~-< • ~~~~ ~l b '~~ ~ \\ \ \,:?s ~ ~ ; ) ~ ""'K~~~-\~:.'8'1--,jf--~:>----+-+~,---6-~>--~~: ; tO )( \ ~ ; ) I -·••••.. ~ •• ~~ I , ; METROPOUTAN TORONTO JULY 1984 > • .- MAPLE COMMUNITY PLAN Amendment Number 150 to the Official Plan of the Town of Vaughan Planning Area OPA 150 was approved in part by the Minister of Municipal Affairs and Housing with modifications on July 16th, 1984, save and except for the following which were deferred for further consideration pursuant to Section 14(3) of the Planning Act: 1. Maple Community Plan, Index, Page (iii) DEFERRAL No. 1 4.0 Special Use Areas 2. Section 4.0 Special Use Areas, pages 20 to 21 inclusive, DEFERRAL No. 2 3. Section 7.0 Rural Area, page 26 _.DEFERRAL No. 3 4. Schedule 'A' Maple Community Plan, lands outlined in blue - labelled DEFERRAL No. 4 5. Schedule 'A' Maple Community Plan, lands outlined in green - labelled DEFERRAL No. 5 6. Schedule 'A' Maple Community Plan, lands outlined in red - labelled DEFERRAL No. 6 7. Schedule 'A' Maple Community Plan, lands outlined in green - labelled DEFERRAL No. 7 8. Schedule 'A' Maple Community Plan, the boundary of the amendment area, outlined in red and labelled - DEFERRAL No. 8 9. Schedule 'A' Maple Community Plan, the lands outlined in red - labelled DEFERRAL No. 9 A further portion, namely "Schedule 'A' Maple Community Plan, the boundary of the amendment area, outlined in red and labelled DEFERRAL No. -

Amendment No. 100 to the Official Plan of the Town of Vaughan Planning Area

AMENDMENT NO. 100 TO THE OFFICIAL PLAN OF THE TOWN OF VAUGHAN PLANNING AREA THE MAPLE COMMUNITY PLAN AUGUST 8, 1978 < • AMENDMENT NO. 100 TO THE OFFICIAL PLAN OF THE TOWN OF VAUGHAN PLANNING AREA The following text, Key Map and Schedule including Part 2 entitled "The Official Plan for the Maple Community", the Key Map and Schedule "A" entitled "Land Use" constitute Amendment Number lOO to the Town Plan of The Town of Vaughan Planning Area. Attached hereto, but not constituting part of the Amendment are Part l entitled "Background and Con text" and Appendices l to 5. These con tain background and supportive data to the Amendment. I, ROBERT JOSEPH DOUGLAS, Deputy Clerk of The Corporation of the Town of Vaughan, in the Regional Muni cipality of York, do hereby certify that the attached is a true original copy of By-law Number 122-78 passed by the Council of the Town of Vaughan on the 8th day of August, 1978. l Dated at the Town of Vaughan this lst day of September, 1978. THE MAPLE COMMUNITY PLAN 1 PART 1 BACKGROUND AND CONTEXT 1.1 Purpose The purpose of this Amendment is to furnish development guidelines for the Maple Community in the Town of Vaughan. The Official Plan of the Vaughan Planning Area designates the general land use patterns to guide the future development of the municipality and sets the framework for the formulation of more detailed land use policies. The Official Plan designates the land in the general area of Maple as "Residential Area" and stipulates that the future de velopment of extensive residential areas will be controlled through secondary plans, passed as amendments to the Official Plan prior to rezoning.