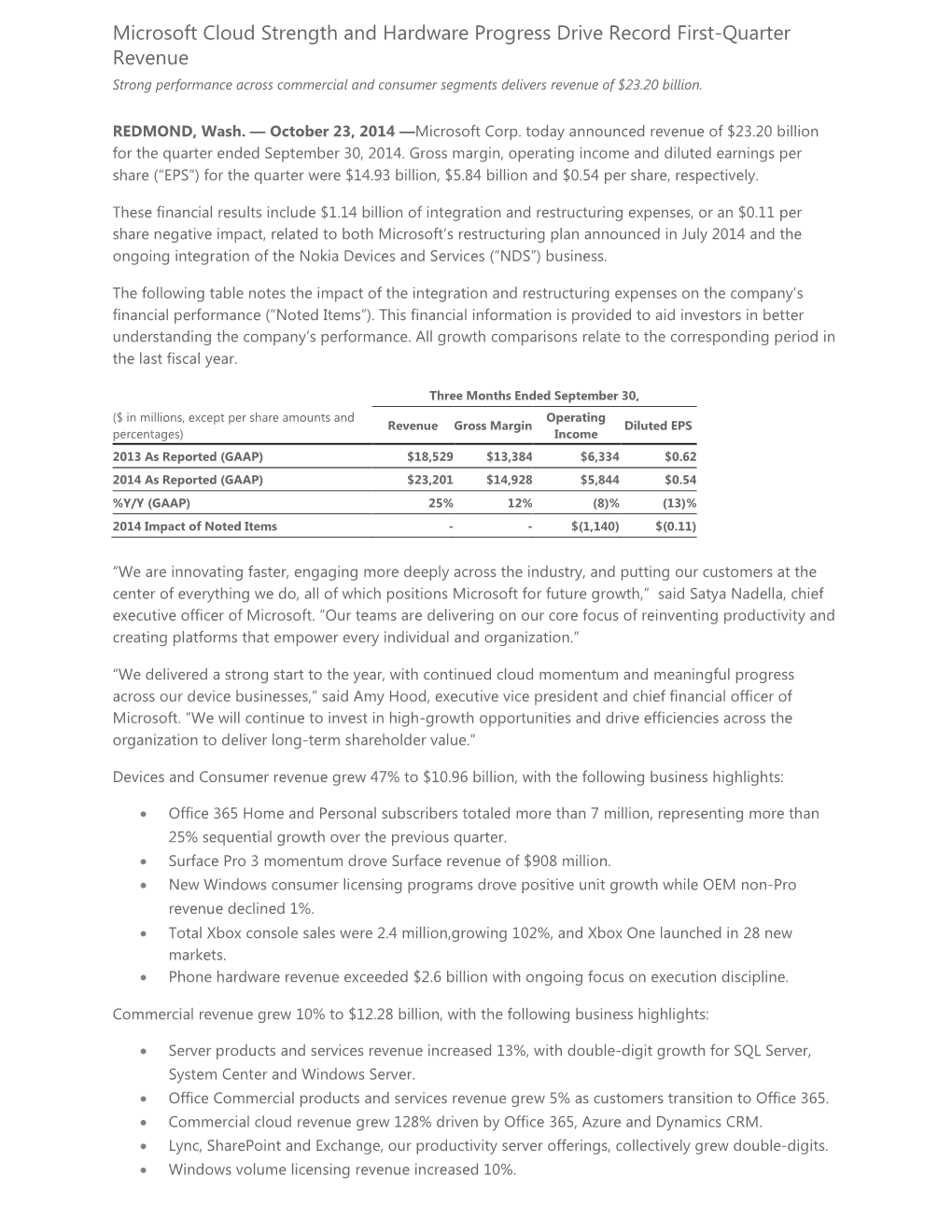

Microsoft Cloud Strength and Hardware Progress Drive

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Historyofdiversityinfographic-12.22.2016 Updates

3 0 0 DigiGirlz graduates 100% Human Rights Campaign Woman’s Conference expanded to Employee 47 Networks Global Employee Corporate Equality Index Score Resource 1 consecutive years W Groups omen 7 regional5 hubs Hispanic/Latinos Blacks s r e b m e Asians disAbility m f o s d n a s u o h T ents ar LGBT P Q 2016 Toni Townes-Whitley named one of top 100 most influential blacks in Javier Soltero corporate America named one of top influential 2016 Hispanic professionals in IT # #4 on Woman Engineer 2016 4 Magazine’s “Top 50 Amy Hood TOP 50 named one of the seven most Employers” list powerful women in technology Inaugural member of 2016 Jenny Lay-Flurrie HRC’s Business Coalition named Chief Accessibility Officer 2016 for the Equality Act Launch of Inclusive 2016 Hiring for Disabilities website (starting with Minority Engineer Magazine’s U.S.-based positions) 6 Top 50 Employers - #6 2016 Peggy Johnson Unconscious Bias training made Kevin Dallas named #2 on list of 26 most available to the industry 2016 named one of top 100 most influential powerful female engineers blacks in corporate America 2016 U.S. Business Leadership Network (USBLN) Employer of the Year Partner with NCWIT to 2015 launch TECHNOLOchicas Leveraging diversity $75 million expansion 2015 to serve the customer of YouthSpark Set industry standard in the U.S. by increasing paid 2015 Launch of Inclusive Design 2015 parental leave to 12 weeks; total of 20 weeks of paid program and documentary leave for new birth mothers Autism pilot hires 2015 Microsoft releases 10 roles across 8 Windows 10 divisions in the U.S. -

Proposal for an Undergraduate Major in Esports and Game Studies B.S

4/16/2019 Proposal for an Undergraduate Major in Esports and Game Studies B.S. Arts and Sciences PRELMINARY PROPOSAL FOR A BACHELOR OF SCIENCE IN Esports and Game Studies I. Proposed Major This new major will be a Bachelor of Science degree through the College of Arts and Sciences in Esports and Game Studies (EGS). Initially, the major will focus on three tracks: 1.) Esports and Game Creation, 2.) Esports Management, and 3.) Application of Games in Medicine and Health. Additional concentrations and certificate programs may be proposed once the major becomes well established. II. Rationale A. Describe the rationale/purpose of the major. This new four-year Arts & Sciences major is a true collaboration between five colleges at The Ohio State University: 1) The College of Arts & Sciences, 2) The Fisher College of Business, 3) The College of Education and Human Ecology, 4) The College of Engineering, and 5) The College of Medicine. This new degree is a multidisciplinary collaboration that is driven by industry needs. The Esports and Game industry is growing at an enormous pace over the past few years. According to Newzoo’s 2018 Global Esports Market Report the global esports revenues have grown over 30% for the past three years and this rate is expected to continue beyond 2021. The revenues in the industry were $250 million in 2015 and expected to reach $1.65 billion by 2021. This growth has created a dearth of properly trained college graduates to fill industry needs. This new UG major has been created to fill the void in industry. -

Microsoft Cloud Strength Highlights Second Quarter Results

Microsoft Cloud Strength Highlights Second Quarter Results Commercial cloud annualized revenue run rate exceeds $9.4 billion; Windows 10 active on over 200 million devices REDMOND, Wash. — January 28, 2016 — Microsoft Corp. today announced the following results for the quarter ended December 31, 2015: • Revenue was $23.8 billion GAAP, and $25.7 billion non-GAAP • Operating income was $6.0 billion GAAP, and $7.9 billion non-GAAP • Net income was $5.0 billion GAAP, and $6.3 billion non-GAAP • Earnings per share was $0.62 GAAP, and $0.78 non-GAAP During the quarter, Microsoft returned $6.5 billion to shareholders in the form of share repurchases and dividends. “Businesses everywhere are using the Microsoft Cloud as their digital platform to drive their ambitious transformation agendas,” said Satya Nadella, chief executive officer at Microsoft. “Businesses are also piloting Windows 10, which will drive deployments beyond 200 million active devices.” The following table reconciles our financial results reported in accordance with generally accepted accounting principles (“GAAP”) to non-GAAP financial results. Microsoft has provided this non-GAAP financial information to aid investors in better understanding the company’s performance. All growth comparisons relate to the corresponding period in the last fiscal year. Three Months Ended December 31, Operating Earnings per ($ in millions, except per share amounts) Revenue Income Net Income Share 2014 As Reported (GAAP) $26,470 $7,776 $5,863 $0.71 Net Impact from Revenue Deferrals (326 ) (326) (248) -

Microsoft Corporation One Microsoft Way Redmond, Washington 98052, U.S.A

Microsoft Corporation One Microsoft Way Redmond, Washington 98052, U.S.A. MICROSOFT CORPORATION 2003 EMPLOYEE STOCK PURCHASE PLAN, AS AMENDED, EFFECTIVE JANUARY 1, 2013 (THE "ESPP") Prospectus for the employees of certain European Economic Area ("EEA") subsidiaries of Microsoft Corporation, subject to the applicable legislation in each country Pursuant to articles L. 412-1 and L. 621-8 of the Code Monétaire et Financier and its General Regulation, in particular articles 211-1 to 216-1 thereof, the Autorité des marchés financiers has attached visa number 14-333 dated June 26, 2014 onto this prospectus. This prospectus was established by the issuer and incurs the responsibility of its signatories. The visa, pursuant to the provisions of Article L. 621-8-1-I of the Code Monétaire et Financier, was granted after the AMF has verified that the document is complete and comprehensible, and that the information it contains is consistent. The visa represents neither the approval of the worthiness of the operation nor the authentication of the financial and accounting information presented. This prospectus will be made available in printed form to employees of the EEA subsidiaries of Microsoft Corporation based in states in which offerings under the plan listed above are considered public offerings, subject to the applicable legislation in each country, at the respective head offices of their employers. In addition, this prospectus along with summary translations (as applicable) will be posted on Microsoft Corporation’s intranet, and free copies will be available to the employees upon request by contacting the human resources department of their employer. This prospectus, together with the French translation of its summary, will also be available on the website of the AMF, www.amf-france.org. -

Microsoft FY20 Second Quarter Earnings Conference Call Michael

Microsoft FY20 Second Quarter Earnings Conference Call Michael Spencer, Satya Nadella, Amy Hood Wednesday, January 29, 2020 Michael Spencer: Good afternoon and thank you for joining us today. On the call with me are Satya Nadella, chief executive officer, Amy Hood, chief financial officer, Frank Brod, chief accounting officer, and Keith Dolliver, deputy general counsel. On the Microsoft Investor Relations website, you can find our earnings press release and financial summary slide deck, which is intended to supplement our prepared remarks during today’s call and provides the reconciliation of differences between GAAP and non-GAAP financial measures. Unless otherwise specified, we will refer to non-GAAP metrics on the call. The non-GAAP financial measures provided should not be considered as a substitute for or superior to the measures of financial performance prepared in accordance with GAAP. They are included as additional clarifying items to aid investors in further understanding the company's second quarter performance in addition to the impact these items and events have on the financial results. All growth comparisons we make on the call today relate to the corresponding period of last year unless otherwise noted. We will also provide growth rates in constant currency, when available, as a framework for assessing how our underlying businesses performed, excluding the effect of foreign currency rate fluctuations. Where growth rates are the same in constant currency, we will refer to the growth rate only. We will post our prepared remarks to our website immediately following the call until the complete transcript is available. Today's call is being webcast live and recorded. -

As a Student, Dr. Ken Mattox Decided Choir Was Not for Him. More Than 50 Years Later, It’S Plain to See He Made the Right Choice

As a student, Dr. Ken Mattox decided choir was not for him. More than 50 years later, it’s plain to see he made the right choice. Page 2 The President’s Pen WBU well positioned for difficult future in education he 2014-15 school year at Way- nation, and our pricing structure places land Baptist University is under- us in a strong competitive position in what Tway. It is hard to believe that the has become an increasingly dynamic and new semester is already upon us! Initial changing educational market. indicators are that this term will be a good Traditional resource streams are dimin- one for the WBU family. Every fall brings ishing in significance. new possibilities and opportunities, and In Washington, D.C., the reauthorization Dr. Paul Armes our faculty and staff are excited about the of the Higher Education Act promises to be President prospects of the coming semester. Way- a long and difficult struggle. Pell Grants, Wayland Baptist University land exists not only to teach our students awarded by the national government to about the wonderful world in which we students who demonstrate the greatest live, but to encourage and enable them to financial need, will be questioned and find their place in God’s plan for their life. examined and questioned again. All who serve at the university continue to In Texas, the new legislative session I firmly believe be thankful for God’s evident and obvious next year means another round of affirm- blessing upon this institution. ing and defending the importance of the “that Wayland Bap- I know you are aware that the face of Tuition Equalization Grant program. -

07222020 Inspire Brad Smith

07222020 Inspire Brad Smith BRAD SMITH: Hello, everybody. I'm delighted to help welcome you this year to Microsoft Inspire. Every July is a special time for those of us who work at Microsoft, because we get together with all of you. We get together in person, we talk together, we get to be together. It's a reminder every year to me that Microsoft isn't just a company, it's a community. Well we can't get together this year, but out of every challenge there's a new opportunity. I bet you're asking yourself right now, why am I sitting in a kayak? Well, we can't be together in person, but with this video format, I can not only talk to you about what I usually talk about at Inspire, Microsoft's role in the world, but also show you around our community, Microsoft's hometown, Seattle. Let me start with where I am right now. The waters here were, for generations, the home of the Duwamish Native American tribe. Now, this is what's called Lake Union. I think that word union means something for us today, because this lake would ultimately unite not only the waters of this region, but help Seattle come together and bring a new union of people from North America to Asia and beyond. And when you think about our community all together, that's what we're using digital technology to do today, to serve the world, to bring the world together. Let me show you around and we'll talk about what we're doing around the world. -

Ultimate Guide to M&A: Microsoft + Linkedin Case Study

Ultimate Guide to M&A: Microsoft + LinkedIn Case Study 1 Table of Contents Ultimate Guide to M&A: Microsoft + LinkedIn Case Study .......................................................................................................... 1 Appendices .................................................................................................................................................................................................. 21 How Buyers Pay in M&A: Cash vs Stock Acquisitions ................................................................................................................................................................ 22 Premiums Paid Analysis in M&A ........................................................................................................................................................................................................... 26 Tender Offer vs. Merger.............................................................................................................................................................................................................................. 31 Asset Sale vs. Stock Sale .............................................................................................................................................................................................................................. 36 Deal Documents: Where to Find Information About M&A Transactions ....................................................................................................................... -

Exhibit D.5.B Implications Relevant to Metro's Request to Amend the CP and for Permits As Any

Appendix A ESA Litigation The established facts are that listed salmon and steelhead use Burlington Bottoms. McCarthy Creek is a salmon spawning stream. These species also use Burlington Creek. It seems highly likely that, given the slopes, type of soil in the BCF, and the more extreme weather events brought on by global warming, that harm will result from almost any version of the trails Metro has thus far proposed, because fine silt does the most harm to fish. The definition of "take," which triggers EPA liablity is expansive under the Act, and is further expansively refined by administrative rule. Set forth below is an excerpt from the Habit:iJ Conservation Planning and Incidental Take Permit Processing fiandbook (NOAA Fisheries, 2016). This excerpt is probably as good a summary of the ESA take provisions and rules, and their Exhibit D.5.b implications relevant to Metro's request to amend the CP and for permits as any: Section 9 of the ESA prohibits the take of any fish or wildlife species listed as endangered. Section 9 prohibits damage or destruction of plants listed as endangered on Federal property or on non-Federal lands when doing so in knowing violation of any State law or regulation or in the course of any violation of a State criminal trespass law. Take is defined as "harass, harm, pursue, hunt, shoot, wound, kill, trap, capture, or collect, or to attempt to engage in any such conduct." FWS further defines "harm" (50 CFR 17.3) as " ... an act which actually kills or injures wildlife. Such act may include significant habitat modification or degradation where it actually kills or injures wildlife by significantly impairing essential behavioral patterns, including breeding, feeding, or sheltering." The NMFS definition of "harm" (50 CFR 222.102) is very similar, but adds more specific terms related to fish. -

Así Ha Sido La Gran Reestructuración De Microsoft

Así ha sido la gran reestructuración de Microsoft Que Microsoft preparaba una reestructuración titánica que le ayudase a ser más competitiva en un mundo tecnológico en incesante cambio y cada vez más marcado por fenómenos como el cloud computing y la movilidad era un secreto a voces. Imagen: magemaker / Shutterstock.com Y ahora ha dejado de ser un secreto para convertirse en todo un entramado de cambios de directiva, organización por temáticas y filosofía de trabajo queel CEO de la compañía, Steve Ballmer, ha comunicado a sus empleados a través de un correo electrónico. A lo largo de todo el mensaje oficial subyace la idea de“una Microsoft” más unida, más colaborativa, más eficiente y más veloz que permita a sus creativos seguir enganchados al carro de la innovación y crear toda una serie de dispositivos y servicios para particulares y empresas de todo el mundo con los que “llevar a cabo las actividades que éstos más valoran, ya sea en casa, en el trabajo o entremedias”. “Se trata de una gran tarea”, ha reconocido Ballmer. Es algo que “toca casi todas las piezas de lo que hacemos y cómo trabajamos. Cambia nuestra estructura organizativa, la forma en la que colaboramos, cómo asignamos recursos, la forma en la que capacitamos a nuestros ingenieros y también cómo comercializamos” finalmente los productos y los servicios. Organización por funciones En primer lugar, la idea de Microsoft es sustentarse sobre“una sola estrategia como una sola compañía” en vez de optar por los retos individuales divididos por unidades de negocio y a pesar de que se seguirán produciendo múltiples dispositivos de hardware y servicios. -

The Role of the Home Environment in Early Weight Trajectories

THE ROLE OF THE HOME ENVIRONMENT IN EARLY WEIGHT TRAJECTORIES Stephanie Georgina Schrempft A thesis submitted for the degree of Doctor of Philosophy UCL Declaration I, Stephanie Schrempft, confirm that the work presented in this thesis is my own. Where information has been derived from other sources, I confirm that this has been indicated. Acknowledgements I would like to thank: Professor Jane Wardle for the wonderful opportunity to study at the Health Behaviour Research Centre (HBRC); it has been a challenging and rewarding experience, which has put me in good stead for the future; My supervisors Dr Ellen van Jaarsveld and Dr Abigail Fisher for their invaluable support throughout my time at the HBRC; Dr Clare Llewellyn for her statistical support and general advice; Laura McDonald and Amy Ronaldson for assisting with the home environment telephone interviews; Dr Aiden Doherty, Dr Charlie Foster, and Dr Paul Kelly for their advice on using SenseCam; and the SenseCam steering committee for loaning the SenseCams; All of the families who took part in my research; My fellow PhD students for their friendship and good humour; And my family for always being there. This thesis is dedicated in fond memory of Professor John Wattam-Bell (1953 – 2013). Abstract Dramatic increases in the prevalence of overweight and obesity have prompted a focus on prevention. Weight is known to have a strong genetic basis, but the speed of change in rates of overweight and obesity against a relatively stable gene pool suggests that exposure to an ‘obesogenic’ environment is important. The home environment is thought to play a key role in early weight trajectories, providing an avenue for long-term obesity prevention. -

Microsoft: New Wine in an Old Bottle?

HK1039 ALI FARHOOMAND MICROSOFT: NEW WINE IN AN OLD BOTTLE? Within four weeks of becoming the new CEO of Microsoft, Satya Nadella laid out the major challenges that awaited him in the two letters he sent to everyone at Microsoft.1 He defined Microsoft’s battlefield as the “mobile-first and cloud-first world.” 2 That was where Microsoft needed to get its products and technology right, to build platforms and ecosystems and to integrate Nokia devices, services and the new mobile capabilities. In order to do so, Microsoft needed to zero in on a mobile and cloud-first world and do new things. In his view, “industry does not respect tradition – it only respects innovation.” And in order to innovate, he needed his 130,000-strong staff around the world to lead and help drive cultural change, to find Microsoft’s swing so that the team was “in such perfect unison that no single action by any one is out of synch with those of all the others.”3 Many challenges awaited Microsoft in its transformative journey. On platforms, the future of Windows was not clear. On devices, Microsoft needed to find ways to woo application developers to build its mobile ecosystem. On integration, the company had to find ways to transfer and to grow the mobile capability acquired from Nokia. And most importantly, Nadella had to figure out how he could achieve cultural changes to focus everyone on innovation via collaboration. The Business Legacy Business Performance When Steve Ballmer retired, he left behind a record high revenue year in 2013 but a trail of sluggish stock performance [see Exhibit 1 for the company’s revenue and net income figures 1 Nadella, S.