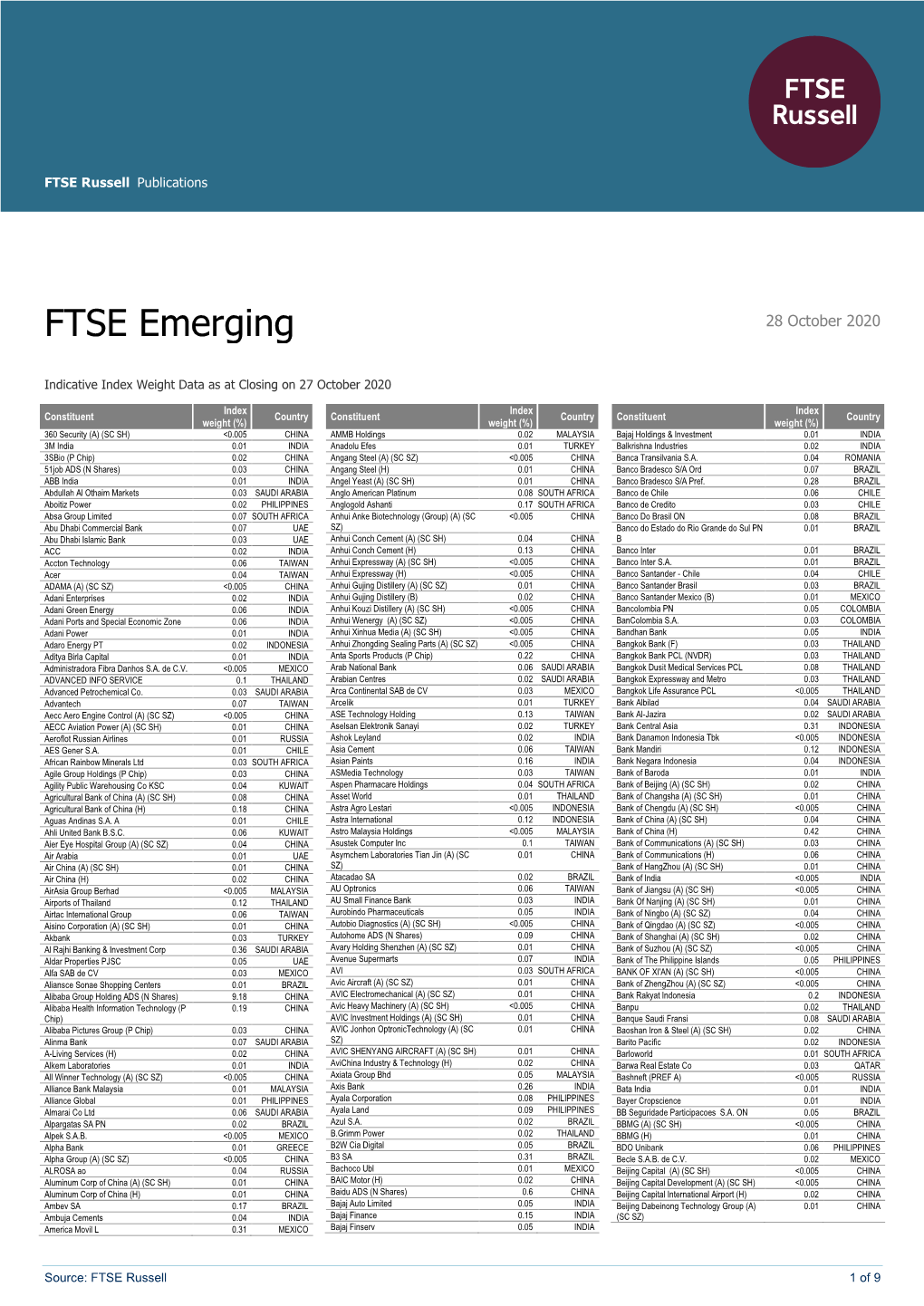

Index Weight Data As at Closing on 27 October 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Creating Emerging Markets – Oral History Collection Ricardo Salinas

Creating Emerging Markets – Oral History Collection Ricardo Salinas Pliego, CEO, Grupo Salinas and Grupo Elektra Interviewed by Regina García Cuéllar, Researcher, Harvard Business School May 31, 2013 in Mexico City, Mexico Audio interview conducted in Spanish The Creating Emerging Markets Oral History Collection is part of the collections of Baker Library, Harvard Business School. The transcripts are made available for academic research and teaching. Any other use - including commercial reuse, mounting on other systems, or other forms of redistribution - requires permission of Harvard Business School. When use is made of these texts, it is the responsibility of the user to obtain the additional permissions for requests to cite and to observe the laws of copyright and the educational fair use guidelines. Research Inquiries & Requests to Cite Oral History Collection: Please contact Rachel Wise, HBS Archivist, [email protected] or Laura Linard, Director of Special Collections, [email protected] Preferred Citation: Interview with Ricardo Salinas Pliego, interviewed by Regina García Cuéllar, Mexico City, Mexico, May 31, 2013, Creating Emerging Markets Oral History Collection, Baker Library Historical Collections, Harvard Business School. Baker Library Historical Collections Baker Library | Bloomberg Center Harvard Business School Boston, MA 02163 617.495.6411 [email protected] http://www.library.hbs.edu/hc © 2013 Copyright Notice The Creating Emerging Markets Oral History Collection is owned by the President and Fellows of Harvard College. Interview with Ricardo Salinas Pliego Interviewed by Regina García Cuellar May 31, 2013 Mexico City, Mexico Audio interview conducted in Spanish RG: Desde pequeño ¿cuáles fueron los valores en su casa que han permeado a ser quién es? RS: ¿Por dónde comenzaremos? En mi infancia. -

ANNUAL REPORT 2020 Important

stock code : 000063.SZ 763.HK ANNUAL REPORT 2020 Important The Board of Directors, Supervisory Committee and the Directors, Supervisors and senior management of the Company warrant that the contents of this report are true, accurate and complete without any false information, misleading statements or material omissions, and collectively and individually accept legal responsibility therefor. There are no Directors, Supervisors or senior management who do not warrant or who dispute the truthfulness, accuracy and completeness of the contents of this report. This report has been considered and approved at the Thirty-third Meeting of the Eighth Session of the Board of Directors of the Company. The respective financial statements of the Group for the year ended 31 December 2020 were prepared in accordance with PRC Accounting Standards for Business Enterprises and with Hong Kong Financial Reporting Standards respectively, and had been audited by Ernst & Young Hua Ming LLP and Ernst & Young, and an unqualified auditors’ report has been issued by each of them. During the year, there was no significant deficiency in internal control in relation to financial reporting of the Company, nor was any significant deficiency in internal control in relation to non-financial reporting identified. Mr. Li Zixue, Chairman of the Company, Ms. Li Ying, Chief Financial Officer of the Company and Mr. Xu Jianrui, Head of Finance Division of the Company, hereby declare that they warrant the truthfulness, accuracy and completeness of the financial reports contained in this report. In view of the state of affairs of the Company, the proposal for profit distribution for 2020 is as follows: distribution of RMB2 in cash (before tax) for every 10 shares to all shareholders based on the total share capital (including A shares and H shares) as at the record date for profit distribution and dividend payment. -

Annual Report 2011

possibilities ANNUAL REPORT 2011 CONTENTS About the company ............................................................................... 2 Key financial & operational highlights ............................................. 12 Key events of 2011 & early 2012 ...................................................... 14 Bright upside potential from the reorganization ............................. 18 Strong market position ................................................................... 20 Up in the “Clouds” ........................................................................... 22 Chairman’s statement ........................................................................ 24 Letter from the President ................................................................... 26 Strategy .............................................................................................. 28 M&A activity ........................................................................................ 31 Corporate governance ........................................................................ 34 Board of Directors & committees .................................................... 34 Management Board & committees ................................................. 37 Internal Audit Commission ............................................................. 40 Remuneration of members of the Board of Directors and the Management Board ............................................................. 40 Dividend policy ................................................................................ -

Oportunidades De Inversión En El Mercado Asegurador Saudí

COLEGIO UNIVERSITARIO DE ESTUDIOS FINANCIEROS GRADO EN ADMINISTRACIÓN Y DIRECCIÓN DE EMPRESAS Trabajo Fin de GRADO Oportunidades De Inversión En El Mercado Asegurador Saudí Autor: Durán Vieira, Emilio Tutor: Bobillo Carballo, Elvira Madrid, junio de 2018 Tabla de contenido INTRODUCCIÓN ............................................................................................................ 4 1. ARABIA SAUDÍ ....................................................................................................... 5 1.1. Situación macroeconómica ............................................................................ 6 2. SECTOR SEGUROS................................................................................................ 11 2.1. Tamaño del mercado de seguros no vida ..................................................... 13 2.2. Penetración del mercado ............................................................................. 14 2.3. Densidad del mercado ................................................................................. 15 2.4. Ratio combinado ......................................................................................... 16 2.5. Ratio de retención ....................................................................................... 17 2.6. Clasificación por tipo de seguro ................................................................... 18 2.6.1. Seguros de vida .................................................................................... 18 2.6.2. Seguros de vehículos .......................................................................... -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

2020 Brazil Equity Strategy Outlook Economic Growth to Drive Markets in 2020 December 2019 Carlos E

2020 Brazil Strategy Outlook Carlos E. Sequeira, CFA [email protected] +1 646 924-2479 Osni Carfi [email protected] +55 11 3383-2634 1 2020 Brazil Equity Strategy Outlook Economic growth to drive markets in 2020 December 2019 Carlos E. Sequeira, CFA [email protected] +1 646 924-2479 Osni Carfi [email protected] +55 11 3383-2634 LEGAL DISCLAIMERS & DISCLOSURES: www.btgpactual.com/research/Disclaimers/Overview.aspx We expect Brazilian equities to continue its run in 2020 ✓Economic recovery to drive equities further up – We expect Brazilian equities to continue its run in 2020, after performing strongly for four years in a row – the Ibovespa is up 147% in BRL from 2016 to 2019. – Even though the performance has been strong, we anticipate the next leg of the rally to be just starting and to be supported by an accelerated economic recovery. – At this point, signs that the economy is picking up are evident. We expect investments and household consumption to be the main drivers of economic growth in 2020, fueled by employment growth, credit expansion and another round of economic reforms. ✓A new round of economic reforms are expected in 2020 – In 2019, the government and congress focused its efforts to approve a much waited and essential reform of Brazil’s pension system – with savings estimated at R$800bn in the next 10 years. – For 2020, the administration and congress are already working on a series of additional constitutional amendments aiming at consolidating Brazil’s fiscal accounts and overhauling the country’s public administration. -

Financial Statements Fidelity® Global Ex U.S

Fidelity® Emerging Markets Index Fund Fidelity® Global ex U.S. Index Fund Semi-Annual Report April 30, 2021 Contents Note to Shareholders 3 Fidelity® Emerging Markets Index Fund 4 Investment Summary 5 Schedule of Investments 23 Financial Statements Fidelity® Global ex U.S. Index Fund 27 Investment Summary 28 Schedule of Investments 55 Financial Statements Notes to Financial Statements 59 Shareholder Expense Example 64 Liquidity Risk Management Program 65 To view a fund’s proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission’s (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines. The funds or securities referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds or securities or any index on which such funds or securities are based. The prospectus contains a more detailed description of the limited relationship MSCI has with Fidelity and any related funds. Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation. Other third-party marks appearing herein are the property of their respective owners. All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved. This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. -

Franklin India Fund LU0231204701 31 August 2021

Franklin Templeton Investment Funds India Equity Franklin India Fund LU0231204701 31 August 2021 Fund Fact Sheet For Professional Client Use Only. Not for distribution to Retail Clients. Fund Overview Performance Base Currency for Fund USD Performance over 5 Years in Share Class Currency (%) Total Net Assets (USD) 1.44 billion Franklin India Fund I (acc) USD MSCI India Index-NR Fund Inception Date 25.10.2005 200 Number of Issuers 45 180 Benchmark MSCI India Index-NR 160 Investment Style Blend Morningstar Category™ India Equity 140 Summary of Investment Objective 120 The Fund aims to achieve long-term capital appreciation by 100 principally investing in equity securities of companies of any size located or performing business predominately in India. 80 Fund Management 60 08/16 02/17 08/17 02/18 08/18 02/19 08/19 02/20 08/20 02/21 08/21 Sukumar Rajah: Singapore Discrete Annual Performance in Share Class Currency (%) Ratings - I (acc) USD 08/20 08/19 08/18 08/17 08/16 08/21 08/20 08/19 08/18 08/17 Overall Morningstar Rating™: I (acc) USD 53.68 3.31 -9.75 -0.35 12.92 Asset Allocation Benchmark in USD 53.15 3.00 -7.64 7.12 17.46 Performance in Share Class Currency (%) Cumulative Since 1 Mth 3 Mths 6 Mths YTD 1 Yr 3 Yrs 5 Yrs Incept I (acc) USD 8.00 10.33 21.17 24.53 53.68 43.28 61.24 518.48 % Benchmark in USD 10.94 11.12 22.35 25.75 53.15 45.68 83.30 371.80 Equity 103.05 Category Average 7.59 10.63 20.10 25.82 52.53 37.90 66.00 355.61 Cash & Cash Equivalents -3.05 Calendar Year Performance in Share Class Currency (%) 2020 2019 2018 2017 2016 I (acc) USD 13.92 8.35 -14.74 39.23 2.82 Benchmark in USD 15.55 7.58 -7.31 38.76 -1.43 Past performance is not an indicator or a guarantee of future performance. -

20210506001-Equity Outlook May 2021-BROCHURE

EQUITY M AY 2 0 2 1 13.2% 48.4% -0.4% Nifty 50 - Last 5 years Nifty 50 - Last 1 year Nifty 50 - MTD (CAGR) (Absolute) (Absolute) QUICK TAKE Equity market valuations are broadly reasonable We remain bullish on equities Investors are suggested to have their adjusted for the cyclical low in earnings and from a medium to long term asset allocation plan based on one’s risk potential for revival going forward. perspective. appetite and future goals in life. KEY HIGHLIGHTS MARKETS Equity markets saw yet another volatile month driven by news Markets have entered a period of consolidation over the past few flow and policy action. The broader markets continued to weeks as they digest earnings and news flow. While the global outperform frontline stocks driven by high quality mid and small picture is positive, in India the key aspect to monitor is the peak of caps finding favour with investors. Frontline benchmarks, S&P the second wave and the progress of the vaccination drive. From a BSE Sensex & NIFTY 50 ended the month down 1.5% & 0.4% valuations standpoint, the beta normalization is likely to give way respectively. NIFTY Midcap 100 registered a gain of 2.1% while to fundamentals based long term growth. To that effect earnings NIFTY Smallcap 100 rose 5.6%. After a strong start to the year, so far have brought valuations to long term averages. India has lagged its global peers over the last few months Our portfolio companies today encompass a cross section of understandably so on account of the Covid news irking foreign growth ideas ideally suited to benefit from gaps left by weaker investors. -

Catching the Wave

Mexico: Catching the wave Economic reform, strong demographics and investment- focused corporates mean that Mexico is a market on the move. But how should you deal in a country that also brings complexity? Corbis/Ivan Vdovin Key insights razil might be a darling of investors, The short-term outlook is also generally • The Mexican economy is set to become but Mexico may soon eclipse it. The positive. Although the International Monetary the largest Latin American economy country is on course to overtake Fund recently cut Mexico’s growth forecast to within a decade, overtaking Brazil. Brazil and become the region’s 1.8% for this year, it expects growth to return • This growth is partly down to Mexico’s Blargest economy within a decade, according to 3% in 2014 as ongoing structural reforms strong fundamentals, such as demographics and political reform. to research by investment bank Nomura. bear fruit. Additionally, capital market • Mexico’s consumer sector has seen “Mexico is now in the moment, as a result activity is thriving. Dealogic figures show that more deals this year than any other of macro and micro factors and industrial Mexico’s equity capital market is having a industry in the country, in part thanks policies,” says Roberto Cuarón, Partner, record year — raising US$10.4b in 2013. to developing consumer credit firing Valuation and Business Modelling, EY, Mexico. the sector’s growth. “Other countries haven’t yet driven away the Economic reform • The country has also garnered a effects of the 2008 crisis.” A big factor behind the investment drive reputation as being a key position in A swelling middle class has made is the progress of reforms, introduced by corporates’ global supply chains. -

ABSTRACT: in India Till 1991 There Was Only One Television Channel

ABSTRACT: In India till 1991 there was only one television channel –Doordarshan, the public service broadcaster. With the opening up of the Indian economy in early 1990s enabled the entry of private broadcasters in India. The number of television channels has proliferated manifold. By 2005 India had more than 200 digital channels. The number of television channels has grown from around 600 in 2010 to 800 in 2012.This includes more than 400 news and current affairs channel. Technological changes have caused intense competition in news and general entertainment channels, as a result of which there is growth in regional and niche channels. The growth of cable and satellite television and direct to home television services has continued to drive television as the most preferred medium among advertisers. Broadcasters are also tapping into online and mobile media to increase their revenue. This paper seeks to study the impact of privatisation on media policy of the Government of India and how it has evolved various institutional mechanisms to deal with the growth of television as the medium to study the effect of privatisation and convergence on media regulations as television is the most powerful medium. The visual images transmitted by television reach large section of the Indian population irrespective of linguistic and cultural differences. GROWTH OF THE TELEVISION INDUSTRY IN INDIA: Television began in India in 1959 as an educational project supported by the United Nations Educational Scientific and Cultural Organisation (UNESCO) and the Ford Foundation. Television was based on the model of a public broadcasting system prevalent in many countries of Europe. -

Of 21 Voya Emerging Markets Index Portfolio Portfolio Holdings As of August 31, 2021 (Unaudited)

Voya Emerging Markets Index Portfolio Portfolio Holdings as of August 31, 2021 (Unaudited) Ticker Security Name Crncy Country Price Quantity Market Value VNET 21Vianet Group, Inc. USD China 19.79 8,311 $164,475 QFIN 360 DigiTech, Inc. USD China 22.80 8,162 $186,094 601360 360 Security Technology, Inc. - A Shares CNY China 1.84 29,600 $54,506 1530 3SBio, Inc. HKD China 1.11 111,500 $124,214 JOBS 51job, Inc. USD China 76.80 2,743 $210,662 3319 A-Living Smart City Services Co. Ltd. HKD China 3.97 54,250 $215,608 2018 AAC Technologies Holdings, Inc. HKD China 5.54 72,500 $401,916 AOTHAI Abdullah Al Othaim Markets Co. SAR Saudi Arabia 30.74 4,275 $131,424 M AEV Aboitiz Equity Ventures, Inc. PHP Philippines 0.86 180,620 $155,767 ABG Absa Group Ltd. ZAR South Africa 10.83 70,934 $768,205 ADCB Abu Dhabi Commercial Bank PJSC AED United Arab Emirates 2.04 280,089 $572,661 ADIB Abu Dhabi Islamic Bank PJSC AED United Arab Emirates 1.54 99,971 $153,456 ADNOC Abu Dhabi National Oil Co. for Distribution PJSC AED United Arab Emirates 1.23 199,367 $245,264 DIS ACC ACC Ltd. INR India 33.00 7,090 $233,946 2345 Accton Technology Corp. TWD Taiwan 10.13 50,000 $506,568 2353 Acer, Inc. TWD Taiwan 0.91 286,462 $259,982 ADE Adani Enterprises Ltd. INR India 21.72 26,370 $572,781 ADANIG Adani Green Energy Ltd. INR India 14.60 38,606 $563,753 R ADSEZ Adani Ports & Special Economic Zone, Ltd.