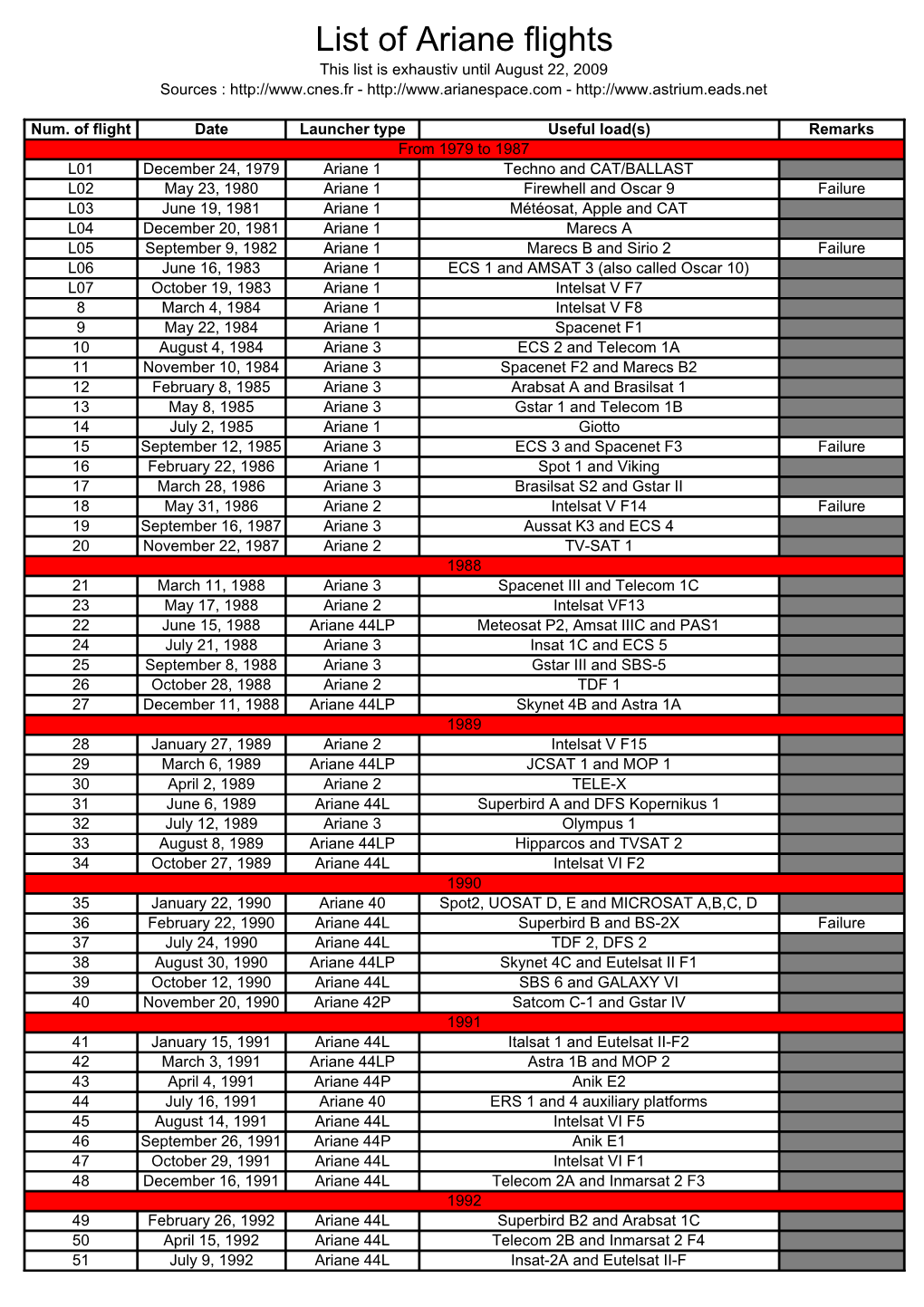

List of Ariane Flights This List Is Exhaustiv Until August 22, 2009 Sources : -

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Turksat 1C Coverage Area Was Enlarged by Two Big Zones Different from Turksat 1B Coverage Areas

Uydu Haberleşme Dr. Cahit Karakuş 2018 - Istanbul Uydu Haberleşme Sistemleri Haberleşme sistemlerine genel bir bakış • Geniş band iletim ortamı - Fiber Kablo: E1 / E3 , STM-1 / STM-256 , DWDM - Telsiz: Wi-Max, WCDMA - Uydu • Bilgi transfer hızı ve güvenliği Haberleşme Sektörü IP Tabanında Birleşti Bilgisayar Kitle İletişim Araçları • Internet erişim • TV / Radyo / Veri dağıtım • Intranet erişim/ERP Hareketlilik • Radyo / TV yayın, Basım • E-mail Yüksek Hız • VHF ve UHF radio • E- Eğitim servisler • Eğlence • E- Ticaret • Multimedia bilgisi information IPIP Hareketlilik Bireysel servisler Hareketlilik Geniş bant Telekomünikasyon servisler • Hareketlilik • Internet üzerinden telefon görüşmesi IP • Devre anahtarlamadan paket anahtarlamaya GW network GW • Geniş bant veri Uydu Teknolojisi • Satellite access equipment Antenna, PA, LNB, Connector, Cable, Wavequide • Positioning • Operating frequencies • Service models • Standards 5 Uydu Pozisyonları • GEO (Geosynchronous Earth Orbit, altitude >36.000km, >120ms 1-way delay, 33% footprint) • MEO (Medium Earth Orbit, altitude 5.000-10.000km, 15-30ms 1-way delay, ILS) • LEO (Low Earth Orbit, altitude 300-3.000km, 1-10ms 1-way delay, ILS) (ILS: Instrument Landing System) • Higher altitude means higher – round-trip-delay – launching cost – satellite lifetime and size – footprint/coverage – bit-error-rate (BER) and signal attenuation – need for transmission power 6 Uydu Çeşitleri o Geostationary Earth Orbit (GEO) o yaklaşık 36000 km o Medium Earth Orbit (MEO) 5000-10000 km Low Earth Orbit (LEO) 200-3000 km 7/29 LEO • Circular Low Earth Orbit (LEO) • The altitude of the satellite is constant and equals to several hundreds of kilometres. • The period is of the order of one and half hours. • The orbit is nearly 90o inclination, which guarantees that the satellite will pass over every region of the Earth. -

Space Debris

IADC-11-04 April 2013 Space Debris IADC Assessment Report for 2010 Issued by the IADC Steering Group Table of Contents 1. Foreword .......................................................................... 1 2. IADC Highlights ................................................................ 2 3. Space Debris Activities in the United Nations ................... 4 4. Earth Satellite Population .................................................. 6 5. Satellite Launches, Reentries and Retirements ................ 10 6. Satellite Fragmentations ................................................... 15 7. Collision Avoidance .......................................................... 17 8. Orbital Debris Removal ..................................................... 18 9. Major Meetings Addressing Space Debris ........................ 20 Appendix: Satellite Break-ups, 2000-2010 ............................ 22 IADC Assessment Report for 2010 i Acronyms ADR Active Debris Removal ASI Italian Space Agency CNES Centre National d’Etudes Spatiales (France) CNSA China National Space Agency CSA Canadian Space Agency COPUOS Committee on the Peaceful Uses of Outer Space, United Nations DLR German Aerospace Center ESA European Space Agency GEO Geosynchronous Orbit region (region near 35,786 km altitude where the orbital period of a satellite matches that of the rotation rate of the Earth) IADC Inter-Agency Space Debris Coordination Committee ISRO Indian Space Research Organization ISS International Space Station JAXA Japan Aerospace Exploration Agency LEO Low -

Asamblea General A/AC.105/661 5 De Diciembre De 1996

NACIONES UNIDAS Distr. GENERAL Asamblea General A/AC.105/661 5 de diciembre de 1996 ESPAÑOL Original:ÁRABE/ESPAÑOL / INGLÉS COMISIÓN SOBRE LA UTILIZACIÓN DEL ESPACIO ULTRATERRESTRE CON FINES PACÍFICOS APLICACIÓN DE LAS RECOMENDACIONES DE LA SEGUNDA CONFERENCIA DE LAS NACIONES UNIDAS SOBRE LA EXPLORACIÓN Y UTILIZACIÓN DEL ESPACIO ULTRATERRESTRE CON FINES PACÍFICOS Cooperación internacional para la utilización del espacio ultraterrestre con fines pacíficos: actividades de los Estados Miembros Nota de la Secretaría ÍNDICE Página INTRODUCCIÓN ........................................................................ 2 RESPUESTAS RECIBIDAS DE LOS ESTADOS MIEMBROS ................................... 3 Alemania .......................................................................... 3 Austria ............................................................................ 3 Bulgaria ........................................................................... 18 Ecuador ........................................................................... 20 Estados Unidos de América ........................................................... 22 Fiji ............................................................................... 27 India ............................................................................. 27 Irlanda ............................................................................ 30 Japón ............................................................................. 32 Jordania .......................................................................... -

Quarterly Launch Report

Commercial Space Transportation QUARTERLY LAUNCH REPORT Featuring the launch results from the previous quarter and forecasts for the next two quarters. 1st Quarter 1997 U n i t e d S t a t e s D e p a r t me n t o f T r a n sp o r t a t i o n • F e d e r a l A v i a t io n A d m in i st r a t i o n A s so c i a t e A d mi n is t r a t o r f o r C o mm e r c ia l S p a c e T r a n s p o r t a t io n QUARTERLY LAUNCH R EPORT 1 1ST QUARTER 1997 R EPORT Objectives This report summarizes recent and scheduled worldwide commercial, civil, and military orbital space launch events. Scheduled launches listed in this report are vehicle/payload combinations that have been identified in open sources, including industry references, company manifests, periodicals, and government documents. Note that such dates are subject to change. This report highlights commercial launch activities, classifying commercial launches as one or more of the following: • Internationally competed launch events (i.e., launch opportunities considered available in principle to competitors in the international launch services market), • Any launches licensed by the Office of the Associate Administrator for Commercial Space Transportation of the Federal Aviation Administration under U.S. Code Title 49, Section 701, Subsection 9 (previously known as the Commercial Space Launch Act), and • Certain European launches of post, telegraph and telecommunications payloads on Ariane vehicles. -

CPA-022-2006 Versão

Referência: CPA-022-2006 Versão: Status: 1.0 Ativo Data: Natureza: Número de páginas: 29/novembro/2006 Aberto 67 Origem: Revisado por: Aprovado por: Ney de Freitas e Marcos de Alencar – 4Biz Assessoria e GT-01 GT-01 Consultoria Título: Panorama/Diagnóstico de Satélites Desenvolvidos e Operantes ao Longo dos Últimos Cinco Anos e Tendências Futuras Lista de Distribuição Organização Para Cópias INPE Grupos Temáticos, Grupo Gestor, Grupo Orientador e Grupo Consultivo do Planejamento Estratégico Histórico do Documento Versão Alterações 1.0 Estudo elaborado sob contrato junto ao Centro de Gestão e Estudos Estratégicos (CGEE). Data: 29/11/2006 Hora: 11:00 Versão: 1.0 Pág: - PLANEJAMENTO ESTRATÉGICO OBJETIVO DO ESTUDO Panorama/Diagnóstico de Satélites Desenvolvidos e Operantes ao Longo dos Últimos Cinco Anos e Tendências Futuras Contratado pelo CGEE – Centro de Gestão e Estudos Estratégicos Elaborado por Ney Menandro Garcia de Freitas Marcus Franco Costa de Alencar Outubro 2006 Panorama/Diagnóstico de Satélites Desenvolvidos e Operantes ao Longo dos Últimos Cinco Anos e Tendências Futuras Indice 1. INTRODUÇÃO .................................................................................................................4 2. DEFINIÇÕES....................................................................................................................4 2.1. CRITÉRIOS DE CATEGORIZAÇÃO ............................................................................4 2.2. ABREVIATURAS E SIGLAS........................................................................................6 -

Loral Space & Communications

LORAL SPACE & COMMUNICATIONS LTD FORM 10-K (Annual Report) Filed 3/31/1997 For Period Ending 12/31/1996 Address 600 THIRD AVE C/O LORAL SPACECOM CORP NEW YORK, New York 10016 Telephone 212-697-1105 CIK 0001006269 Industry Electronic Instr. & Controls Sector Technology Fiscal Year 12/31 SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM APRIL 1, 1996 TO DECEMBER 31, 1996 Commission file number 1-14180 LORAL SPACE & COMMUNICATIONS LTD. 600 Third Avenue New York, New York 10016 Telephone: (212) 697-1105 Jurisdiction of incorporation: Bermuda IRS identification number: 13-3867424 Securities registered pursuant to Section 12(b) of the Act: NAME OF EACH EXCHANGE TITLE OF EACH CLASS ON WHICH REGISTERED - ------------------------------------------------------------------ ------------------------ Common Stock, $.01 par value...................................... New York Stock Exchange The registrant has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months or such shorter period as the registrant was required to file such reports and has been subject to such filing requirements for the past 90 days. Disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is contained in the registrant's definitive proxy statement incorporated by reference in Part III of this Form 10-K. At February 28, 1997, 191,092,308 common shares were outstanding, and the aggregate market value of such shares (based upon the closing price on the New York Stock Exchange) held by non-affiliates of the registrant was approximately $3 billion. -

CABLE SATELLITES : the NEXT GENERATION Issues Facing Cable Operators and Programmers

CABLE SATELLITES : THE NEXT GENERATION Issues Facing Cable Operators and Programmers Robert Zitter Home Box Office, Inc. A development that will impact the ABSTRACT cable industry is the FCC mandate to phase-in a uniform 2-degree spacing The deployment of next-generation between U.S. domestic satellites. The satellites in compliance with the FCC's intent of the plan is to alleviate uniform 2-degree spacing plan, together overcrowding in the U.S. orbital arc. It with the movement of cable times the deployment of next generation programming, will occur during the next satellites with improvements in ground two years. A discussion of the transition station receiving characteristics in order scenario, the technical differences in the to control the ensuing increase in new satellites, and ground station adjacent satellite interference. requirements reveals that Cable TV and SMATV facilities will require This paper discusses the satellite reconfiguration and in some cases and orbital changes that are expected to replacement may be necessary. The occur during the next two years, and satellite movement and programming presents some critical issues and transfers in the early nineties compel the challenges facing satellite programmers cable industry to examine the future and cable operators . performance of existing facilities. o Time of Replacements In the early days, 4-degrees of separation within the two segments o Introduction assigned to U.S. domestic communication satellites -- 70 to I 04 C-Band satellites have become a degrees and 117 to 143 degrees West reliable means of delivery for cable Longitude (oWL) -- consisting of 15 television programs and have played an satellite slots were found adequate. -

Click Below to Download

April 2007 Worldwide Satellite Magazine Vol. 5 No. 1 ? The Future of Satellite Broadcasting 2 TABLE OF CONTENTS Vol. 5 No. 1, April 2007 Click on the title to go directly to the story COVER STORY FEATUREFEATURE REGIONAL UPDATES T 19 / The Future of 23 / The Satellite 26 / Exploring the 30 / High-Jinks over Broadcasting Channel Wars Fixed Satellite the Middle East Service by Chris Forrester Market A new entrant into the market is shaking things up By Howard Greenfield By Patrick French, NSR by Bruce R. Elbert in the Middle Eastern satellite market. The explosion of new Commercial satellite The FSS satellite applications and hybrid operators are scrambling .business has been broadband models are driving to get as many video marked by stable growth CASE STUDY channels under their the future of broadcasting. and profitability due to the 35 / Tools for wing. steadily increasing demand for new Broadcasters to VIEWPOINT applications. Deliver Interference- free HD Content by Bob Potter 38 / After Iraq: What’s Communications Systems Next for the Satellite Monitors (CSMs) are providing Industry? an essential tool for broadcasters wanting to deliver by Alan Gottlieb interference-free HD content. New opportunities exists in a post-Iraq War satellite industry. REGULAR DEPARTMENTS 3 / Notes from the 43 / Market Intelligence: 41 / EXECUTIVE Editor India’s Satellite Crisis: SPOTLIGH Capacity Barriers and Interview with 4 / Calendar of Events “Spectrum Grab” presented by the Global Integral Systems 5 / Industry News VSAT Forum CEO Peter Gaffney 46 / Stock Quotes / Peter Gaffney who took 10 / Executive Moves over as CEO of Integral Advertisers’ Index Systems from founder 15 / New Products and Steve Chamberlain Services: speaks to SatMagazine Update on Satellites April 2007 on a variety of issues. -

Quarterly Launch Report

Commercial Space Transportation QUARTERLY LAUNCH REPORT Featuring the launch results from the previous quarter and forecasts for the next two quarters. 4th Quarter 1996 U n i t e d S t a t e s D e p a r t m e n t o f T r a n s p o r t a t i o n • F e d e r a l A v i a t i o n A d m i n i s t r a t i o n A s s o c i a t e A d m i n i s t r a t o r f o r C o m m e r c i a l S p a c e T r a n s p o r t a t i o n QUARTERLY LAUNCH REPORT 1 4TH QUARTER REPORT Objectives This report summarizes recent and scheduled worldwide commercial, civil, and military orbital space launch events. Scheduled launches listed in this report are vehicle/payload combinations that have been identified in open sources, including industry references, company manifests, periodicals, and government documents. Note that such dates are subject to change. This report highlights commercial launch activities, classifying commercial launches as one or more of the following: • Internationally competed launch events (i.e., launch opportunities considered available in principle to competitors in the international launch services market), • Any launches licensed by the Office of the Associate Administrator for Commercial Space Transportation of the Federal Aviation Administration under U.S. -

Classification of Geosynchronous Objects

esoc European Space Operations Centre Robert-Bosch-Strasse 5 D-64293 Darmstadt Germany T +49 (0)6151 900 www.esa.int CLASSIFICATION OF GEOSYNCHRONOUS OBJECTS Produced with the DISCOS Database Prepared by T. Flohrer & S. Frey Reference GEN-DB-LOG-00195-OPS-GR Issue 18 Revision 0 Date of Issue 3 June 2016 Status ISSUED Document Type TN European Space Agency Agence spatiale europeenne´ Abstract This is a status report on geosynchronous objects as of 1 January 2016. Based on orbital data in ESA’s DISCOS database and on orbital data provided by KIAM the situation near the geostationary ring is analysed. From 1434 objects for which orbital data are available (of which 2 are outdated, i.e. the last available state dates back to 180 or more days before the reference date), 471 are actively controlled, 747 are drifting above, below or through GEO, 190 are in a libration orbit and 15 are in a highly inclined orbit. For 11 objects the status could not be determined. Furthermore, there are 50 uncontrolled objects without orbital data (of which 44 have not been cata- logued). Thus the total number of known objects in the geostationary region is 1484. In issue 18 the previously used definition of ”near the geostationary ring” has been slightly adapted. If you detect any error or if you have any comment or question please contact: Tim Flohrer, PhD European Space Agency European Space Operations Center Space Debris Office (OPS-GR) Robert-Bosch-Str. 5 64293 Darmstadt, Germany Tel.: +49-6151-903058 E-mail: tim.fl[email protected] Page 1 / 178 European Space Agency CLASSIFICATION OF GEOSYNCHRONOUS OBJECTS Agence spatiale europeenne´ Date 3 June 2016 Issue 18 Rev 0 Table of contents 1 Introduction 3 2 Sources 4 2.1 USSTRATCOM Two-Line Elements (TLEs) . -

Advances in Space Research Forecasting the Impact of an 1859

Advances in Space Research Forecasting the Impact of an 1859-calibre Superstorm on Satellite Resources Sten Odenwald1,2, James Green2, William Taylor1,2 1. QSS Group, Inc., 4500 Forbes Blvd., Lanham, MD, 20706. 2. NASA, Goddard Space Flight Center, Greenbelt, MD 20771 Submitted: June 30, 2005, Accepted: September 25, 2005 Abstract: We have developed simple models to assess the economic impacts to the current satellite resource caused by the worst-case scenario of a hypothetical superstorm event occurring during the next sunspot cycle. Although the consequences may be severe, our worse-case scenario does not include the complete failure of the entire 937 operating satellites in the current population, which have a replacement value of ~$170-230 billion, and supporting a ~$90 billion/year industry. Our estimates suggest a potential economic loss of < $70 billion for lost revenue (~$44 billion) and satellite replacement for GEO satellites (~$24 billion) caused by a ‘once a century’ single storm similar to the 1859 superstorm. We estimate that 80 satellites (LEO, MEO, GEO) may be disabled as a consequence of a superstorm event. Additional impacts may include the failure of many of the GPS, GLONASS and Galileo satellite systems in MEO. Approximately 97 LEO satellites, which normally would not have re-entered for many decades, may prematurely de-orbit by ca 2021 as a result of the temporarily increased atmospheric drag caused by a superstorm event occurring in ca 2012. The $100 billion International Space Station may lose significant altitude, placing it in critical need for re-boosting by an amount potentially outside the range of typical Space Shuttle operations, which are in any case scheduled to end in 2010. -

Commercial Spacecraft Mission Model Update

Commercial Space Transportation Advisory Committee (COMSTAC) Report of the COMSTAC Technology & Innovation Working Group Commercial Spacecraft Mission Model Update May 1998 Associate Administrator for Commercial Space Transportation Federal Aviation Administration U.S. Department of Transportation M5528/98ml Printed for DOT/FAA/AST by Rocketdyne Propulsion & Power, Boeing North American, Inc. Report of the COMSTAC Technology & Innovation Working Group COMMERCIAL SPACECRAFT MISSION MODEL UPDATE May 1998 Paul Fuller, Chairman Technology & Innovation Working Group Commercial Space Transportation Advisory Committee (COMSTAC) Associative Administrator for Commercial Space Transportation Federal Aviation Administration U.S. Department of Transportation TABLE OF CONTENTS COMMERCIAL MISSION MODEL UPDATE........................................................................ 1 1. Introduction................................................................................................................ 1 2. 1998 Mission Model Update Methodology.................................................................. 1 3. Conclusions ................................................................................................................ 2 4. Recommendations....................................................................................................... 3 5. References .................................................................................................................. 3 APPENDIX A – 1998 DISCUSSION AND RESULTS........................................................