Morning Focus

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

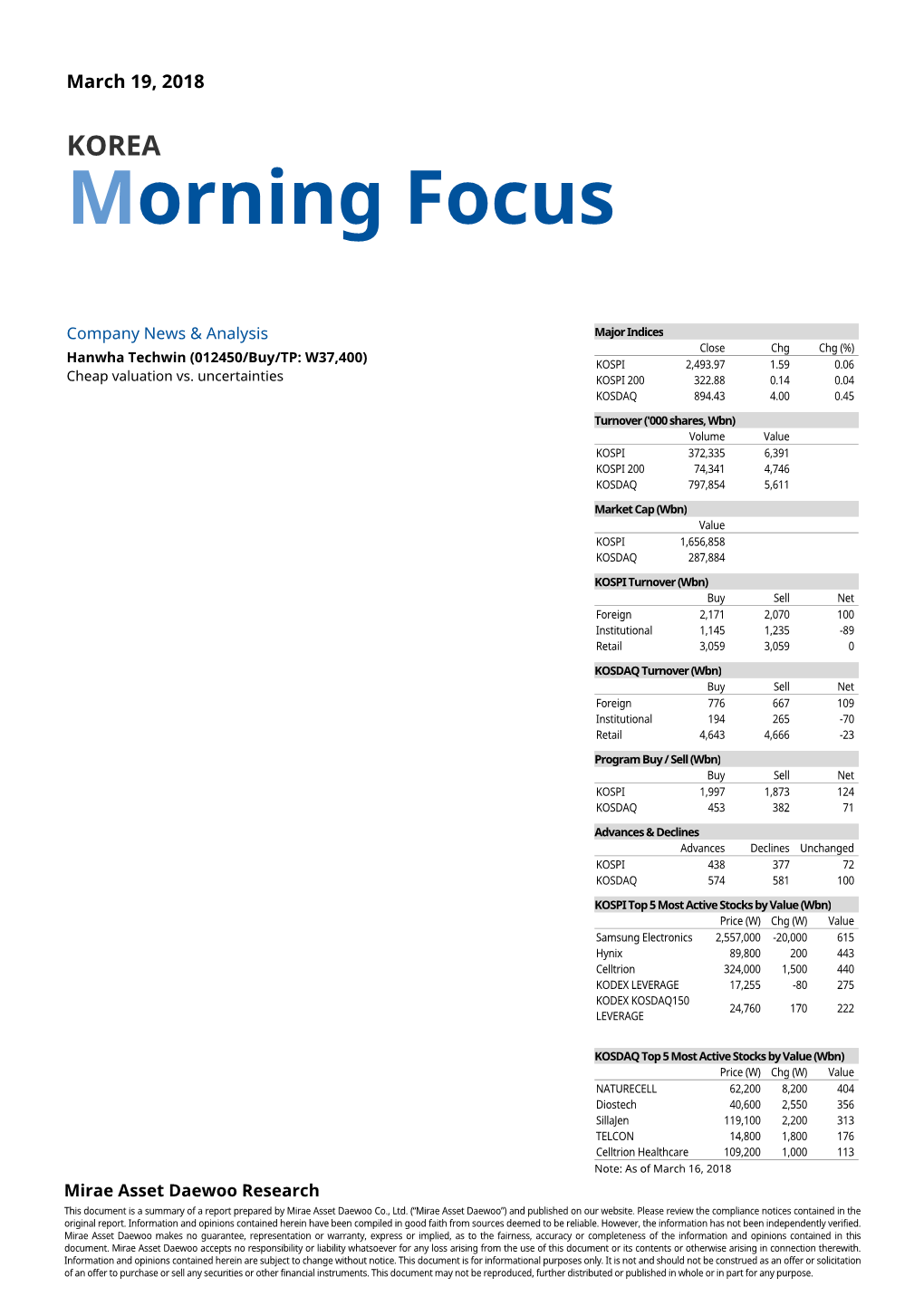

KOREA Morning Focus

December 14, 2017 KOREA Morning Focus Company News & Analysis Major Indices Close Chg Chg (%) Hanwha Corp. (000880/Buy/TP: W56,000) Upgrade rating & Present TP ' KOSPI 2,480.55 19.55 0.79 Earnings to improve on Hanwha E&C s normalization KOSPI 200 326.18 2.11 0.65 KOSDAQ 772.22 11.82 1.55 Sector News & Analysis Turnover ('000 shares, Wbn) Non-ferrous metals (Overweight) Volume Value Impact of Glencore’s zinc production restart KOSPI 251,104 5,028 KOSPI 200 89,459 4,107 KOSDAQ 1,131,049 5,394 Market Cap (Wbn) Value KOSPI 1,613,324 KOSDAQ 274,605 KOSPI Turnover (Wbn) Buy Sell Net Foreign 1,443 1,648 -205 Institutional 1,585 886 698 Retail 1,945 2,461 -515 KOSDAQ Turnover (Wbn) Buy Sell Net Foreign 412 324 88 Institutional 285 192 93 Retail 4,695 4,869 -174 Program Buy / Sell (Wbn) Buy Sell Net KOSPI 1,513 1,206 307 KOSDAQ 206 120 86 Advances & Declines Advances Declines Unchanged KOSPI 566 244 67 KOSDAQ 733 408 100 KOSPI Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Samsung Electronics 2,566,000 -39,000 570 Hynix 76,800 -1,000 265 KODEX KOSDAQ150 LEVERAGE 17,680 280 191 NCsoft 488,000 22,000 189 KODEX 200 32,670 255 160 KOSDAQ Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value SillaJen 89,100 1,100 319 New Pride 4,850 145 263 Celltrion Healthcare 93,100 6,100 231 TissueGene(Reg.S) 54,100 4,300 225 Celltrion 210,000 4,400 205 Note: As of December 13, 2017 Mirae Asset Daewoo Research Hanwha Corp. -

STOXX Asia 100 Last Updated: 03.07.2017

STOXX Asia 100 Last Updated: 03.07.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) KR7005930003 6771720 005930.KS KR002D Samsung Electronics Co Ltd KR KRW Y 256.2 1 1 JP3633400001 6900643 7203.T 690064 Toyota Motor Corp. JP JPY Y 128.5 2 2 TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.6 3 3 JP3902900004 6335171 8306.T 659668 Mitsubishi UFJ Financial Group JP JPY Y 83.5 4 4 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 77.2 5 5 JP3436100006 6770620 9984.T 677062 Softbank Group Corp. JP JPY Y 61.7 6 7 JP3735400008 6641373 9432.T 664137 Nippon Telegraph & Telephone C JP JPY Y 58.7 7 8 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 58.2 8 6 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 52.6 9 12 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 52.0 10 10 JP3890350006 6563024 8316.T 656302 Sumitomo Mitsui Financial Grou JP JPY Y 48.3 11 15 INE040A01026 B5Q3JZ5 HDBK.BO IN00CH HDFC Bank Ltd IN INR Y 45.4 12 13 JP3854600008 6435145 7267.T 643514 Honda Motor Co. Ltd. JP JPY Y 43.3 13 14 JP3435000009 6821506 6758.T 682150 Sony Corp. JP JPY Y 42.3 14 17 JP3496400007 6248990 9433.T 624899 KDDI Corp. JP JPY Y 42.2 15 16 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.1 16 19 JP3885780001 6591014 8411.T 625024 Mizuho Financial Group Inc. -

Samsung C&T Corporation and Subsidiaries

Samsung C&T Corporation and Subsidiaries Consolidated Interim Financial Statements September 30, 2017 and 2016 Samsung C&T Corporation and Subsidiaries Index September 30, 2017 and 2016 Pages Report on Review of Interim Financial Statements ………………………............................... 1 - 5 Consolidated Interim Financial Statements Consolidated Interim Statements of Financial Position …………………………………………….. 6 - 8 Consolidated Interim Statements of Comprehensive Income....................................................... 9 - 10 Consolidated Interim Statements of Changes in Equity..............................…………................... 11 - 12 Consolidated Interim Statements of Cash Flows…………………………………………………….. 13 - 14 Notes to the Consolidated Interim Financial Statements....................................……....……....... 15 - 102 Report on Review of Interim Financial Statements (English Translation of a Report Originally Issued in Korean) To the Shareholders and Board of Directors of Samsung C&T Corporation Reviewed Financial Statements We have reviewed the accompanying consolidated interim financial statements of Samsung C&T Corporation (the Company) and its subsidiaries (collectively referred to as the “Group”). These financial statements consist of the consolidated interim statement of financial position of the Group as at September 30, 2017, and the related consolidated interim statements of comprehensive income for the three-month and nine-months periods ended September 30, 2017 and 2016, and consolidated interim statements of changes in equity -

Hanwha Profile 2020

Hanwha Profile 2020 A “We engage and listen to our customers to create the solutions they trust us to build.” Contents 02 CHAIRMAN’S MESSAGE 08 BUSINESS HIGHLIGHTS 10 Chemicals & Materials 20 Aerospace & Mechatronics 28 Solar Energy 36 Finance 46 Services & Leisure 54 Construction 62 Hanwha OVERVIEW 64 Hanwha’s Vision, Spirit & Core Values 66 Hanwha Today 68 Milestones 70 Financial Highlights 72 Hanwha BUSINESSES 75 Manufacturing & Construction 93 Finance 99 Services & Leisure 104 CORPORATE SOCIAL RESPONSIBILITY 112 GLOBAL NETWORK & DIRECTORY B 1 Chairman’s Message The world has already moved beyond the Fourth Industrial Revolution. It is now heading toward the next industrial revolution. So are we. At Hanwha, we believe in building trust and strengthening loyalty. Our customers trust us because we’ve earned it over time. In turn, we strengthen our loyalty to the people we serve through contributions to society. Trust and loyalty are in the DNA of every Hanwha employee, motivating us to build for the good of all, amid constant changes and despite them. As a company, our never-ending goal is to improve the lives of everyone we touch. We seek to raise the standards of living and improve the quality of life. We know this is easily said but difficult to attain. And yet, if we persevere, continue to innovate and build for a better tomorrow, the future is ours to imagine. In 2010, Hanwha’s vision of “Quality Growth 2020” was unveiled. Since then, we have made significant strides toward realizing this vision through our expertise and innovations that have grown exponentially across the company’s core businesses. -

STOXX South Korea 200 Last Updated: 01.06.2017

STOXX South Korea 200 Last Updated: 01.06.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) KR7005930003 6771720 005930.KS KR002D Samsung Electronics Co Ltd KR KRW Y 249.7 1 1 KR7000660001 6450267 000660.KS KR00EP SK HYNIX INC KR KRW Y 26.3 2 2 KR7035420009 6560393 035420.KS KR00NY NAVER CORP KR KRW Y 22.1 3 3 KR7005380001 6451055 005380.KS KR004F Hyundai Motor Co KR KRW Y 21.1 4 4 KR7055550008 6397502 055550.KS KR00AL Shinhan Financial Group Co Ltd KR KRW Y 18.6 5 5 KR7105560007 B3DF0Y6 105560.KS KR008J KB Financial Group Inc KR KRW Y 17.8 6 6 KR7005490008 6693233 005490.KS KR003E POSCO KR KRW Y 16.7 7 7 KR7012330007 6449544 012330.KS KR007I Hyundai Mobis KR KRW Y 15.0 8 8 KR7028260008 BSXN8K7 028260.KS KR507N SAMSUNG C&T CORP KR KRW Y 13.0 9 9 KR7017670001 6224871 017670.KS KR048N SK TELECOM KR KRW Y 12.2 10 10 KR7033780008 6175076 033780.KS KR00S3 KT&G Corp KR KRW Y 12.1 11 12 KR7051910008 6346913 051910.KS KR005G LG Chem Ltd KR KRW Y 11.3 12 13 KR7015760002 6495730 015760.KS KR009K Korea Electric Power Corp KR KRW Y 10.6 13 11 KR7034730002 B39Z8L3 034730.KS KR053J SK HOLDINGS KR KRW Y 10.6 14 15 KR7032830002 B12C0T9 032830.KS KR00BM Samsung Life Insurance Co Ltd KR KRW Y 10.5 15 14 KR7086790003 B0RNRF5 086790.KS KR06L2 Hana Financial G KR KRW Y 9.7 16 16 KR7000810002 6155250 000810.KS KR00JU Samsung Fire & Marine Insuranc KR KRW Y 9.4 17 17 KR7090430000 B15SK50 090430.KS KR06O5 Amorepacific KR KRW Y 8.6 18 21 KR7000270009 6490928 000270.KS KR00GR Kia Motors Corp KR KRW -

One-Asia Morning Focus

May 13, 2020 One-Asia Morning Focus Today’s reports NCsoft (036570 KS/Buy/TP: W970,000) Raise TP – Our top global gaming pick for 2020-21; Raise TP Hanwha Aerospace (012450 KS/Buy/TP: W33,000) Lower TP – Stability of defense business to stand out Shinsegae (004170 KS/Buy/TP: W360,000) – 1Q20 review: More leveraged to tailwinds than headwinds Global performance monitor: Two-day change (%) Asia xJPN World EM World DM Korea Japan China Taiwan HK India Indonesia Singapore Thailand Index 0.86 0.47 -0.05 -1.80 0.38 1.23 -0.40 1.24 -0.04 -0.25 0.03 3.12 Growth 0.65 1.12 0.64 -0.76 0.48 1.74 -0.92 1.59 -0.29 0.79 0.21 3.62 Value N/A 0.47 -0.72 -3.07 0.27 0.56 0.15 0.85 0.20 -1.54 -0.16 2.58 Semicon. & equip. 0.85 0.87 0.48 0.41 1.87 0.30 -0.90 -1.98 N/A N/A N/A N/A Tech hardware & equip. 0.24 0.24 0.75 -2.15 0.80 0.12 0.09 1.64 6.94 N/A -1.06 N/A Comm. & prof. services 0.07 0.07 -0.24 1.23 3.42 -0.82 -0.22 N/A -3.99 -1.02 N/A N/A Software & services 0.86 0.74 0.54 -0.41 0.56 -1.03 -0.32 0.94 2.21 N/A -2.18 N/A Media & entertainment 2.78 2.73 0.70 3.97 0.91 0.07 2.06 -0.12 -2.24 N/A -2.24 N/A Consumer goods 1.15 1.00 -0.53 -0.98 1.03 2.15 -0.85 1.09 1.31 1.67 N/A 3.59 Consumer services 0.12 -0.62 -1.17 -4.81 2.26 -1.03 3.82 1.46 -0.03 2.74 0.35 2.49 F&B & tobacco 0.21 -0.03 -0.10 -0.73 1.21 -0.03 -1.92 1.85 1.87 1.94 9.76 5.10 Food & staples retailing 1.17 0.02 0.47 -2.04 1.31 0.72 -0.39 1.25 2.19 N/A 0.99 2.85 Retailing 1.51 1.38 0.95 -4.43 0.39 -1.88 0.13 -0.58 -0.88 -0.50 -0.89 3.91 HH & personal products -0.91 -1.17 -0.17 -2.21 0.99 -0.62 -

Down to Its Recoverable Amount

Hanwha Total Petrochemical Co., Ltd. and its subsidiaries Consolidated financial statements for the years ended December 31, 2020 and 2019 with the independent auditor’s report Table of contents Independent auditor’s report Page Consolidated financial statements Consolidated statements of financial position 1 Consolidated statements of comprehensive income 3 Consolidated statements of changes in equity 4 Consolidated statements of cash flows 5 Notes to the consolidated financial statements 6 Ernst & Young Han Young Taeyoung Building, 111, Yeouigongwon-ro, Yeongdeungpo-gu, Seoul 07241 Korea Tel: +82 2 3787 6600 Fax: +82 2 783 5890 ey.com/kr Independent auditor’s report The Shareholders and Board of Directors Hanwha Total Petrochemical Co., Ltd. Opinion We have audited the consolidated financial statements of Hanwha Total Petrochemical Co., Ltd. (the “Company”) and its subsidiaries (collectively referred to as the “Group”), which comprise the consolidated statements of financial position as of December 31, 2020 and 2019, and the consolidated statements of comprehensive income, consolidated statements of changes in equity and consolidated statements of cash flows for the years then ended, and notes to the consolidated financial statements, including a summary of significant accounting policies. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Group as of December 31, 2020 and 2019, and its consolidated financial performance and its consolidated cash flows for the years then ended in accordance with Korean International Financial Reporting Standards (“KIFRS”). Basis for opinion We conducted our audit in accordance with Korean Auditing Standards (“KGAAS”). Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the consolidated financial statements section of our report. -

Cyber Securitypen Test Report

Wisenet X, P, Q, L Series Cameras CYBER SECURITY PEN TEST REPORT Contents: April 3rd, 2020 Introduction 1 INTRODUCTION Test Purpose 1 Hanwha Techwin have performed We believe this activity will make our Test Model 2 penetration test for our products through product more secure. We expect that Test Method 2 trusted third party white hacker who can disclosure of the processes and results make a professional diagnosis using of these activities to our customers will Summary of Findings 2 hacking tools and hacking techniques lead to their trust. Impact Assessment since long time ago. Criteria 3 Vulnerability Summary 4 About RaonSecurity 5 Grading Report 5 Notice 7 About S-CERT 7 TEST PURPOSE Penetration testing should be performed commitment to product security from a for a variety of reasons. customer perspective and provide trust that their private information and control Some of the common reasons why system will be protected securely on Hanwha Techwin as manufacturer operation. perform penetration tests include: Penetration testing allows manufacturers Penetration testing can prevent to proactively assess for emerging or vulnerabilities which can lead to serious newly discovered vulnerabilities that were personal information leakage due to the not known or have not yet been widely nature of surveillance equipment. published. Penetration testing can identify Simple penetration testing can be vulnerabilities inadvertently introduced integrated into the internal QA process of during development process, such as the Software Development Life Cycle to source code changes or platform prevent security bugs from entering into upgrade. production systems. Some relevant regulatory standards But, for more robust testing, it is good to require penetration tests are performed. -

Usaa Fund Holdings Usaa Emerging Markets Fund

USAA FUND HOLDINGS As of June 30, 2021 USAA EMERGING MARKETS FUND CUSIP TICKER SECURITY NAME SHARES/PAR/CONTRACTS MARKET VALUE 00215W100 ASX ASE TECHNOLOGY HOLDING 320,811.00 2,582,528.55 01609W102 BABA ALIBABA GROUP HOLDING LTD 114,144.00 25,885,576.32 02364W105 AMX AMERICA MOVIL-SERIES L 234,928.00 3,523,920.00 056752108 BIDU BAIDU INC 20,857.00 4,252,742.30 059460303 BBD US BANCO BRADESCO SA 638,001.00 3,272,945.13 05968L102 CIB US BANCOLOMBIA SA 128,169.00 3,691,267.20 151290889 CX CEMEX SAB DE CV 453,727.00 3,811,306.80 2100845 CHILE C BANCO DE CHILE 19,988,545.00 1,974,073.06 21240E105 VLRS CONTROLADORA VUELA CIA-AD 105,167.00 2,020,258.07 2196286 VALE3 B VALE SA 202,600.00 4,613,619.00 2328595 BBAS3 B BANCO DO BRASIL 508,495.00 3,285,197.53 2347608 FM CN FIRST QUANTUM MINERALS 450,329.00 10,380,748.37 2421041 GFNORTE GRUPO FINANCIERO BANORTE 970,008.00 6,267,065.58 2491914 KIMBERA KIMBERLY-CLA M-A 1,220,800.00 2,166,643.89 2563017 ALSEA* ALSEA SAB DE CV 962,119.00 1,712,371.28 2643674 GRUPO MEXICO SAB DE CV 769,309.00 3,619,314.87 2683777 BRDT3 B PETROBRAS DISTRIBUIDORA S 967,700.00 5,191,473.50 2840970 CCRO3 B CCR SA 916,020.00 2,477,372.52 2946663 GCC* MM GRUPO CEMENTOS DE CHIHU 128,734.00 1,039,662.07 40415F101 HDFC BANK, LTD. -

Samsung C&T Corporation and Subsidiaries

Samsung C&T Corporation and Subsidiaries Interim Consolidated Financial Statements June 30, 2016 and 2015 Samsung C&T Corporation and Subsidiaries Index June 30, 2016 and 2015 Pages Report on Review of Interim Consolidated Financial Statements ………………………........ 1 - 5 Interim Consolidated Financial Statements Interim Consolidated Statements of Financial Position …………………………………………….. 6 - 8 Interim Consolidated Statements of Comprehensive Income....................................................... 9 - 10 Interim Consolidated Statements of Changes in Equity..............................…………................... 11 - 12 Interim Consolidated Statements of Cash Flows…………………………………………………….. 13 - 14 Notes to Interim Consolidated Financial Statements...........................................……………... ... 15 - 92 Report on Review of Interim Financial Statements (English Translation of a Report Originally Issued in Korean) To the Board of Directors and Shareholders of Samsung C&T Corporation Reviewed Financial Statements We have reviewed the accompanying interim consolidated financial statements of Samsung C&T Corporation (the “Company”) and its subsidiaries (collectively the “Group”). These financial statements consist of the interim consolidated statement of financial position as of June 30, 2016, and the related interim consolidated statements of comprehensive income for the three-month and six- month periods ended June 30, 2016 and 2015, and interim consolidated statements of changes in equity and cash flows for the six-month periods ended June -

Monthly Insight a Spring Cold Spell

April 2018 Monthly InsighT A spring cold spell Wonjae Park Chuljoong Kim +822-3774-1426 +822-3774-1464 [email protected] [email protected] Young-gun Kim SeungHo Yoo +822-3774-1583 +822-3774-1832 [email protected] [email protected] Analysts who prepared this report are registered as research analysts in Korea but not in any other jurisdiction, including the U.S. PLEASE SEE ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES & DISCLAIMERS IN APPENDIX 1 AT THE END OF REPORT. Contents I. Investment strategy .......................................... 3 II. Top picks ........................................................... 8 III. Sector view ....................................................... 10 IV. Think big ......................................................... 15 V. Global IT navigation ...................................... 22 Spotlight stocks & other notable stocks …………….… 25 2| Monthly InsighT Mirae Asset Daewoo Research I. Investment strategy Strong demand for semiconductors/passive components and home appliances/TVs vs. sluggish smartphone sales, declining panel prices, and won appreciation II. Top picks III. Sector view IV. Think big V. Global IT navigation Spotlight stocks & other notable stocks 3| Monthly InsighT Mirae Asset Daewoo Research I. Investment strategy Mirae Asset Daewoo IT universe share performance March: -0.7% for spotlight stocks and +7.7% for other notable stocks Monthly InsighT cumulative returns Cumulative returns Avg. of spotlight stocks -0.7 Avg. of spotlight stocks 106.3 SKC Kolon PI 14.6 Avg. of other notable stocks -31.0 KOSPI 18.2 Samsung SDI 12.6 KOSDAQ 52.8 (%) -100 0 100 200 LGE 9.6 Note: September 2014 – March 2018 Humax 2.2 -1Y Avg. of spotlight stocks 14.9 LG Innotek -4.5 Avg. of other notable stocks 14.1 KOSPI 13.2 Innox Advanced Materials -10.2 KOSDAQ 40.7 (%) -20-100 1020304050 LGD -12.4 Note: April 2017-March 2018 SSC -17.0 March Avg. -

FTSE Developed Asia Pacific Ex Japan

FTSE Russell Publications FTSE Developed Asia Pacific ex 20 May 2018 Japan Indicative Index Weight Data as at Closing on 30 March 2018 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) AAC Technologies Holdings 0.47 HONG KONG Commonwealth Bank of Australia 3.63 AUSTRALIA Healthscope 0.1 AUSTRALIA Adelaide Brighton 0.08 AUSTRALIA Computershare 0.24 AUSTRALIA Henderson Land Dev 0.26 HONG KONG AGL Energy 0.41 AUSTRALIA Contact Energy 0.1 NEW Hite Jinro 0.02 KOREA AIA Group Ltd. 3.83 HONG KONG ZEALAND Hong Kong & China Gas 0.63 HONG KONG Air New Zealand 0.04 NEW Coway 0.16 KOREA Hong Kong Exchanges & Clearing 1.51 HONG KONG ZEALAND Crown Resorts 0.13 AUSTRALIA Hongkong Land Holdings 0.3 HONG KONG ALS 0.11 AUSTRALIA CSL 2.03 AUSTRALIA Hopewell Highway Infrastructure 0.02 HONG KONG Alumina 0.17 AUSTRALIA CSR 0.08 AUSTRALIA Hopewell Holdings 0.08 HONG KONG Amcor 0.47 AUSTRALIA Daelim Industrial 0.07 KOREA Hotel Shilla 0.1 KOREA AmoreG 0.14 KOREA Daewoo Engineering & Construction 0.03 KOREA Huabao International Holdings 0.02 HONG KONG Amorepacific Corp 0.35 KOREA Dah Sing 0.03 HONG KONG Hutchison Port Holdings Trust 0.06 SINGAPORE Amorepacific Pfd. 0.06 KOREA Dah Sing Banking Group 0.03 HONG KONG Hutchison Telecommunications Hong 0.02 HONG KONG AMP 0.42 AUSTRALIA Dairy Farm International Holdings 0.09 HONG KONG Kong Ltd Ansell 0.1 AUSTRALIA DB Insurance 0.11 KOREA Hyosung Corp 0.1 KOREA APA Group 0.27 AUSTRALIA DBS Group Holdings 1.4 SINGAPORE Hysan Development 0.12 HONG KONG Aristocrat