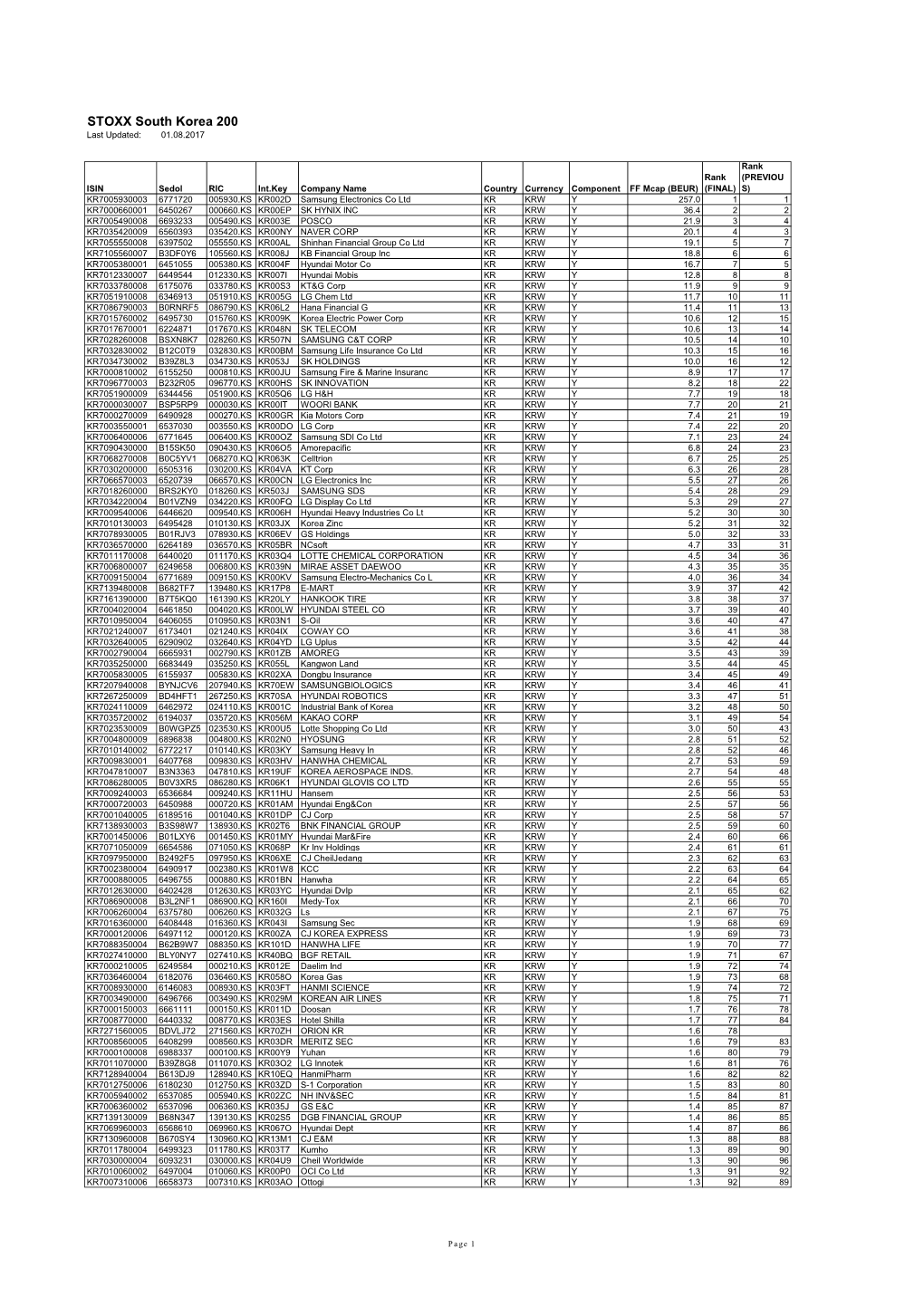

STOXX South Korea 200 Last Updated: 01.08.2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

KOREA Morning Focus

December 14, 2017 KOREA Morning Focus Company News & Analysis Major Indices Close Chg Chg (%) Hanwha Corp. (000880/Buy/TP: W56,000) Upgrade rating & Present TP ' KOSPI 2,480.55 19.55 0.79 Earnings to improve on Hanwha E&C s normalization KOSPI 200 326.18 2.11 0.65 KOSDAQ 772.22 11.82 1.55 Sector News & Analysis Turnover ('000 shares, Wbn) Non-ferrous metals (Overweight) Volume Value Impact of Glencore’s zinc production restart KOSPI 251,104 5,028 KOSPI 200 89,459 4,107 KOSDAQ 1,131,049 5,394 Market Cap (Wbn) Value KOSPI 1,613,324 KOSDAQ 274,605 KOSPI Turnover (Wbn) Buy Sell Net Foreign 1,443 1,648 -205 Institutional 1,585 886 698 Retail 1,945 2,461 -515 KOSDAQ Turnover (Wbn) Buy Sell Net Foreign 412 324 88 Institutional 285 192 93 Retail 4,695 4,869 -174 Program Buy / Sell (Wbn) Buy Sell Net KOSPI 1,513 1,206 307 KOSDAQ 206 120 86 Advances & Declines Advances Declines Unchanged KOSPI 566 244 67 KOSDAQ 733 408 100 KOSPI Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Samsung Electronics 2,566,000 -39,000 570 Hynix 76,800 -1,000 265 KODEX KOSDAQ150 LEVERAGE 17,680 280 191 NCsoft 488,000 22,000 189 KODEX 200 32,670 255 160 KOSDAQ Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value SillaJen 89,100 1,100 319 New Pride 4,850 145 263 Celltrion Healthcare 93,100 6,100 231 TissueGene(Reg.S) 54,100 4,300 225 Celltrion 210,000 4,400 205 Note: As of December 13, 2017 Mirae Asset Daewoo Research Hanwha Corp. -

OSB Representative Participant List by Industry

OSB Representative Participant List by Industry Aerospace • KAWASAKI • VOLVO • CATERPILLAR • ADVANCED COATING • KEDDEG COMPANY • XI'AN AIRCRAFT INDUSTRY • CHINA FAW GROUP TECHNOLOGIES GROUP • KOREAN AIRLINES • CHINA INTERNATIONAL Agriculture • AIRBUS MARINE CONTAINERS • L3 COMMUNICATIONS • AIRCELLE • AGRICOLA FORNACE • CHRYSLER • LOCKHEED MARTIN • ALLIANT TECHSYSTEMS • CARGILL • COMMERCIAL VEHICLE • M7 AEROSPACE GROUP • AVICHINA • E. RITTER & COMPANY • • MESSIER-BUGATTI- CONTINENTAL AIRLINES • BAE SYSTEMS • EXOPLAST DOWTY • CONTINENTAL • BE AEROSPACE • MITSUBISHI HEAVY • JOHN DEERE AUTOMOTIVE INDUSTRIES • • BELL HELICOPTER • MAUI PINEAPPLE CONTINENTAL • NASA COMPANY AUTOMOTIVE SYSTEMS • BOMBARDIER • • NGC INTEGRATED • USDA COOPER-STANDARD • CAE SYSTEMS AUTOMOTIVE Automotive • • CORNING • CESSNA AIRCRAFT NORTHROP GRUMMAN • AGCO • COMPANY • PRECISION CASTPARTS COSMA INDUSTRIAL DO • COBHAM CORP. • ALLIED SPECIALTY BRASIL • VEHICLES • CRP INDUSTRIES • COMAC RAYTHEON • AMSTED INDUSTRIES • • CUMMINS • DANAHER RAYTHEON E-SYSTEMS • ANHUI JIANGHUAI • • DAF TRUCKS • DASSAULT AVIATION RAYTHEON MISSLE AUTOMOBILE SYSTEMS COMPANY • • ARVINMERITOR DAIHATSU MOTOR • EATON • RAYTHEON NCS • • ASHOK LEYLAND DAIMLER • EMBRAER • RAYTHEON RMS • • ATC LOGISTICS & DALPHI METAL ESPANA • EUROPEAN AERONAUTIC • ROLLS-ROYCE DEFENCE AND SPACE ELECTRONICS • DANA HOLDING COMPANY • ROTORCRAFT • AUDI CORPORATION • FINMECCANICA ENTERPRISES • • AUTOZONE DANA INDÚSTRIAS • SAAB • FLIR SYSTEMS • • BAE SYSTEMS DELPHI • SMITH'S DETECTION • FUJI • • BECK/ARNLEY DENSO CORPORATION -

Film/Broadcast Content the Increasing Role of “Tentpoles” in the Content Industry

Film/Broadcast Content The increasing role of “tentpoles” in the content industry The need for tentpoles in the content industry Overweight (Maintain) The content industry and a tent have one thing in common: both need a tentpole to support the entire structure. In the content industry, tentpoles are defined as hit titles Industry Report that provide a source of steady cash flow, such as the blockbuster films of movie studios July 27, 2015 and the top-rated programs of TV networks. The content industry is vulnerable to the success or failure of a title as well as changes in seasonality. Establishing a tentpole by investing around 70% of the annual budget on Daewoo Securities Co., Ltd. just one or two projects could prove an effective strategy against such risks. If tentpole [Telecom Service / Media] films or shows become a hit, they can compensate for losses made elsewhere. Creating a long-term tentpole lineup, increasing the number of tentpoles, and being able to predict Jee-hyun Moon future revenue can lead to a structural improvement in the business. In other words, +822-768-3615 tentpoles can make the content industry more predictable. [email protected] Tentpole strategies used in the film distribution and broadcasting industries The tentpole strategy is primarily used in the film distribution and broadcasting industries. A major proponent of the strategy is Walt Disney, which plans its five-year release lineup based on its Disney and Marble Comics franchises. The media giant has recently seen its film profits steadily grow after releasing a string of successful tentpole movies every quarter. -

Case M.9638 — Hyundai Motor Group/Aptiv/JV) Candidate Case for Simplified Procedure

C 26/4 EN Offi cial Jour nal of the European Union 27.1.2020 Prior notification of a concentration (Case M.9638 — Hyundai Motor Group/Aptiv/JV) Candidate case for simplified procedure (Text with EEA relevance) (2020/C 26/03) 1. On 17 January 2020, the Commission received notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 (1). This notification concerns the following undertakings: — Aptiv PLC (‘Aptiv’, Ireland), — Hyundai Motor Company, Kia Motors Corporation and Hyundai Mobis, all belonging to Hyundai Motor Group (‘HMG’, South Korea). Aptiv and HMG acquire within the meaning of Article 3(1)(b) and 3(4) of the Merger Regulation joint control of a newly created company constituting a joint venture (‘JV’, US) The concentration is accomplished by way of purchase of shares in a newly created company constituting a joint venture. 2. The business activities of the undertakings concerned are: — for Aptiv: global technology and mobility company primarily serving the automotive sector. Aptiv designs and manufactures vehicle components and safety technology solutions, — for HMG: an international group of companies with a diverse portfolio of business activities, including the manufacture and sale of all types of motor vehicles. HMG’s key affiliates include its auto-making arms HMC and Kia as well as its auto-parts making unit Mobis. The JV will design, develop, and commercialise autonomous driving software technologies, services, systems, vehicle architecture and other related enabling offerings with respect to Society of Automotive Engineers (‘SAE’) Levels 4 and/or 5 of autonomous driving. 3. On preliminary examination, the Commission finds that the notified transaction could fall within the scope of the Merger Regulation. -

FTSE Korea 30/18 Capped

2 FTSE Russell Publications 19 August 2021 FTSE Korea 30/18 Capped Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Alteogen 0.19 KOREA Hyundai Engineering & Construction 0.35 KOREA NH Investment & Securities 0.14 KOREA AmoreG 0.15 KOREA Hyundai Glovis 0.32 KOREA NHN 0.07 KOREA Amorepacific Corp 0.65 KOREA Hyundai Heavy Industries 0.29 KOREA Nong Shim 0.08 KOREA Amorepacific Pfd. 0.08 KOREA Hyundai Marine & Fire Insurance 0.13 KOREA OCI 0.17 KOREA BGF Retail 0.09 KOREA Hyundai Merchant Marine 1.02 KOREA Orion 0.21 KOREA BNK Financial Group 0.18 KOREA Hyundai Mipo Dockyard 0.15 KOREA Ottogi 0.06 KOREA Celltrion Healthcare 0.68 KOREA Hyundai Mobis 1.53 KOREA Paradise 0.07 KOREA Celltrion Inc 2.29 KOREA Hyundai Motor 2.74 KOREA Posco 1.85 KOREA Celltrion Pharm 0.24 KOREA Hyundai Motor 2nd Pfd. 0.33 KOREA Posco Chemical 0.32 KOREA Cheil Worldwide 0.14 KOREA Hyundai Motor Pfd. 0.21 KOREA Posco International 0.09 KOREA CJ Cheiljedang 0.3 KOREA Hyundai Steel 0.33 KOREA S1 Corporation 0.13 KOREA CJ CheilJedang Pfd. 0.02 KOREA Hyundai Wia 0.13 KOREA Samsung Biologics 0.92 KOREA CJ Corp 0.11 KOREA Industrial Bank of Korea 0.22 KOREA Samsung C&T 0.94 KOREA CJ ENM 0.15 KOREA Kakao 3.65 KOREA Samsung Card 0.08 KOREA CJ Logistics 0.12 KOREA Kangwon Land 0.23 KOREA Samsung Electro-Mechanics 0.81 KOREA Coway 0.36 KOREA KB Financial Group 1.78 KOREA Samsung Electronics 25.36 KOREA Daewoo Engineering & Construction 0.12 KOREA KCC Corp 0.12 KOREA Samsung Electronics Pfd. -

View Complaint

Case 1:15-cv-01221-RGA Document 4 Filed 03/24/16 Page 1 of 19 PageID #: 81 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF DELAWARE DELAWARE DISPLAY GROUP LLC § and INNOVATIVE DISPLAY § TECHNOLOGIES LLC, § § C.A. No. 15-cv-1221-RGA § Plaintiffs, § JURY TRIAL DEMANDED § v. § § LG ELECTRONICS, INC., § LG ELECTRONICS U.S.A., INC., § LG ELECTRONICS MOBILECOMM § U.S.A., INC.,LG DISPLAY CO., LTD., § and LG DISPLAY AMERICA, INC. § § § Defendants. § PLAINTIFFS’ FIRST AMENDED COMPLAINT Delaware Display Group LLC and Innovative Display Technologies LLC (collectively, “Plaintiffs”) by and through their undersigned counsel, file this First Amended Complaint against LG Electronics, Inc.; LG Electronics U.S.A., Inc.; LG Electronics Mobilecomm U.S.A., Inc., LG Display Co., Ltd.; and LG Display America, Inc. (collectively, “LG”) THE PARTIES 1. Delaware Display Group LLC (“DDG”) is a Delaware limited liability company with its principal place of business located at 2400 Dallas Parkway, Suite 200, Plano, Texas 75093. 2. Innovative Display Technologies LLC (“IDT”) is a Texas limited liability company with its principal place of business located at 2400 Dallas Parkway, Suite 200, Plano, Texas 75093. 1 Case 1:15-cv-01221-RGA Document 4 Filed 03/24/16 Page 2 of 19 PageID #: 82 3. Upon information and belief, LG Electronics, Inc. (“LG Electronics”) is a corporation in South Korea located at LG Twin Tower 128, Yeoui-daero, Yeongdeungpo-gu, Seoul, Korea, 150-721, South Korea. Upon information and belief, LG Electronics may be served with process in South Korea pursuant to the Hague Convention on the Service Abroad of Judicial and Extrajudicial Documents in Civil or Commercial Matters. -

In the United States District Court for The

IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF DELAWARE ) PARALLEL NETWORKS, LLC, ) ) Plaintiff, ) C.A. No.__________ ) v. ) JURY TRIAL DEMANDED ) NCSOFT WEST CORPORATION, ) ) Defendant. ) ) COMPLAINT FOR PATENT INFRINGEMENT Plaintiff Parallel Networks, LLC (“Parallel”) files this Complaint for patent infringement against Defendant NCSoft West Corporation (“NCSoft” or “Defendant”) and alleges as follows: PARTIES 1. Plaintiff Parallel Networks, LLC is a Delaware limited liability company having its principal place of business at 1105 N. Market St., Suite 300, Wilmington, Delaware 19801. 2. On information and belief, NCSoft West Corporation is a corporation organized under the laws of the State of Washington, and has a principal place of business at 1501 4th Ave. Ste. 2050, Seattle, Washington 98101, and/or is conducting business through an affiliate located at this address. JURISDICTION AND VENUE 3. This civil action for patent infringement arises under the Patent Laws of the United States, 35 U.S.C. §§ 1 et seq. This Court has jurisdiction over the claims presented herein pursuant to 28 U.S.C. §§ 1331 and 1338(a). 01:13887534.1 4. On information and belief, NCSoft makes, imports, sells, and/or offers for sale the Accused Instrumentalities (as defined below) within the United States, including this District, that infringe one or more claims of United States Patent No. 7,188,145 entitled “METHOD AND SYSTEM FOR DYNAMIC DISTRIBUTED DATA CACHING” (the “'145 Patent”). The '145 Patent was duly and legally issued by the United States Patent and Trademark Office on March 6, 2007. A true and correct copy of the '145 Patent is attached hereto as Exhibit 1. -

KOREA Morning Focus

March 15, 2018 KOREA Morning Focus Company News & Analysis Major Indices Close Chg Chg (%) SM Entertainment (041510/Buy/TP: W50,000) KOSPI 2,486.08 -8.41 -0.34 Positive on KeyEast/FNC Add Culture acquisition KOSPI 200 321.99 -0.99 -0.31 KOSDAQ 886.92 0.67 0.08 Sector News & Analysis Turnover ('000 shares, Wbn) Volume Value Internet/Game (Overweight) KOSPI 357,035 6,259 Japan visit note: Expanding lifestyle presence KOSPI 200 74,841 4,749 KOSDAQ 920,060 5,181 Market Cap (Wbn) Value KOSPI 1,652,629 KOSDAQ 285,293 KOSPI Turnover (Wbn) Buy Sell Net Foreign 1,580 1,709 -130 Institutional 1,232 1,375 -142 Retail 3,437 3,154 283 KOSDAQ Turnover (Wbn) Buy Sell Net Foreign 366 440 -74 Institutional 184 235 -51 Retail 4,617 4,481 136 Program Buy / Sell (Wbn) Buy Sell Net KOSPI 1,309 1,502 -192 KOSDAQ 187 197 -10 Advances & Declines Advances Declines Unchanged KOSPI 324 502 61 KOSDAQ 525 638 92 KOSPI Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Samsung Electronics 2,588,000 5,000 645 Celltrion 306,500 -4,500 582 Hynix 90,700 700 512 Pharmicell 8,710 2,010 230 KODEX LEVERAGE 17,215 -40 212 KOSDAQ Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value SillaJen 119,900 2,600 250 NATURECELL 54,600 2,000 171 CIS 2,495 265 138 Diostech 38,550 250 108 Celltrion Healthcare 104,900 0 92 Note: As of March 14, 2018 Mirae Asset Daewoo Research SM Entertainment (041510 KQ) Positive on KeyEast/FNC Add Culture acquisition Entertainment Acquisition of rivals to strengthen content production business; Maintain positive view Company Update We reaffirm our Buy call and target price of W50,000 on SM Entertainment. -

Potential Partners

INVESTMENT OPPORTUNITIES IN KOREA PotentialIndustry Partners Trends List of Related Companies Company name Major items Website Location Sugar, processed meat, instant CJ Cheiljedang www.cj.co.kr Seoul Potential foods, etc. Lotte Chilsung Beverage company.lottechilsung.co.kr Seoul Beverage Starch, sauce, processed meat, Daesang www.daesang.co.kr Seoul Partners etc. Instant noodles, processed Ottogi www.ottogi.co.kr Gyeonggi-do seafood, etc. Noodles including instant noodles Nongshim www.nongshim.com Seoul and macaroni Lotte Foods Lotte Foods www.lottefoods.co.kr Seoul Paris Croissant Bakery production www.pariscroissant.co.kr Gyeonggi-do Oriental Brewery Production of malt and beer www.ob.co.kr Seoul Company Seoul Dairy Production of liquid milk and other www.seoulmilk.co.kr Seoul Cooperative dairy products Samyang Sugar, flour, etc. www.samyangcorp.com Seoul Alcoholic beverages including soju Hite Jinro www.hitejinro.com Seoul and beer Processed seafood, dairy Dongwon F&B www.dongwonfnb.com Seoul products, etc. Lotte Confectionery Cookies, cocoa products, etc. www.lotteconf.co.kr Seoul Dongsuh Foods Coffee processing www.dongsuh.co.kr Seoul Korea Ginseng Production of ginseng products www.kgc.co.kr Daejeon Corp. Dairy products, coffee products, Maeil Dairies www.maeil.com Seoul etc. Coca-Cola Production of other nonalcoholic Gyeongsang www.ccbk.co.kr Beverage Company beverages nam-do INVESTMENT OPPORTUNITIES IN KOREA PotentialIndustry Partners Trends Company name Major items Website Location Related Associations Nonghyup Feed Production of feed formula www.nonghyupsaryo.co.kr Seoul Name of association Website Main roles Dongwon Home Production of natural and multi- www.dwhf.co.kr Seoul Food compound seasonings Information on the food industry, training on Korea Foods Industry www.kfia.or.kr food safety, support for the development of TS Corporation Sugar www.ts.co.kr Incheon Association government policies, export support, etc. -

Posco International Corporation

POSCO INTERNATIONAL CORPORATION Sustainability Report 2019 About This Report The 2019 POSCO INTERNATIONAL Sustainability Report, the forth annual publication, illustrate the Company’s performance fulfill- ing its economic, social, and environmental responsibility. POSCO INTERNATIONAL aims to transparently disclose its sustainability management activities for the year 2019 and communicate with wide-ranging stakeholders. Reporting Guidelines Global Reporting Initiative(GRI) Standards: Core Option Reporting Period January 1, 2019 ~ December 31, 2019 * 2017 ~ H1 of 2020 for a portion of the performance data Reporting Scope Economy: On a consolidated basis in accordance with the K-IFRS 〮 Society & Environment: POSCO INTERNATIONAL Headquarters, 〮 POSCO SPS1), and overseas worksites (Myanmar, Indonesia, and Uzbekistan) Areas where major operations are based: Republic of Korea 〮 1) This refers to the STS Division, the TMC Division and the Plate Fabrication Division that were split off as subsidiaries in April 2020. Reporting Cycle Annually(publication of the most recent report: 2019) Assurance Financial data: Earnst & Young Han Young 〮 Non-financial data: DNV GL 〮 Contact Details Address: 165 Convensia-daero(POSCO Tower-Songdo), Yeonsu-gu, Incheon, Republic of Korea Tel: +82-2-759-2861 Department in charge: Sustainability Management Section E-mail: [email protected] POSCO INTERNATIONAL CORPORATION Sustainability Report 2019 03 Global CSR Activities 01 We Make Sustainability 02 Sustainability Management Strategy 102 Global CSR Overview -

Nitro Games Signs Agreement with Netmarble EMEA

COMPANY RELEASE 29 July 2019 12:05 (EEST) Nitro Games signs Agreement with Netmarble EMEA Nitro Games & Netmarble EMEA have signed an Agreement to introduce Heroes of Warland to Arabic and Turkish speaking audiences. Nitro Games has signed a Game Distribution and Servicing Agreement with Netmarble EMEA, the regional office of Netmarble Games, a giant Korean games publisher and one of the fastest growing mobile gaming companies in the world today. The Agreement covers licensing of Nitro Games’ game ”Heroes of Warland” to Netmarble EMEA for publishing in Arabic and Turkish speaking countries. Terms overview: Period: 3 years from Commercial Launch Service Fees: 500.000,00 EUR, paid in installments to Nitro Games, tied to launch progression Royalties: Net 35% to Nitro Games Territories: Turkey, Middle-East, and Africa Target launch: H2 2019, starting with soft-launch Platforms: iOS and Android “Heroes of Warland has gone through a major overhaul during the first half of this year. We’re now proceeding to release this new version also with Netmarble EMEA, by introducing the game to Turkish and Arabic speaking audiences. The first step in the MEA region is a soft-launch that is starting soon.”, says Jussi Tähtinen, CEO & Co-Founder Nitro Games Plc. For more information: Jussi Tähtinen, CEO & Co-Founder Phone: +358 44 388 1071 Email: [email protected] Sverker Littorin, Board member, IR Advisor Phone: +46 70 875 53 09 Email: [email protected] This company announcement contains information that Nitro Games Plc is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication by aforementioned contact person on 29 July 2019 at 12:05 (EEST). -

STOXX Asia 100 Last Updated: 03.07.2017

STOXX Asia 100 Last Updated: 03.07.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) KR7005930003 6771720 005930.KS KR002D Samsung Electronics Co Ltd KR KRW Y 256.2 1 1 JP3633400001 6900643 7203.T 690064 Toyota Motor Corp. JP JPY Y 128.5 2 2 TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.6 3 3 JP3902900004 6335171 8306.T 659668 Mitsubishi UFJ Financial Group JP JPY Y 83.5 4 4 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 77.2 5 5 JP3436100006 6770620 9984.T 677062 Softbank Group Corp. JP JPY Y 61.7 6 7 JP3735400008 6641373 9432.T 664137 Nippon Telegraph & Telephone C JP JPY Y 58.7 7 8 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 58.2 8 6 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 52.6 9 12 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 52.0 10 10 JP3890350006 6563024 8316.T 656302 Sumitomo Mitsui Financial Grou JP JPY Y 48.3 11 15 INE040A01026 B5Q3JZ5 HDBK.BO IN00CH HDFC Bank Ltd IN INR Y 45.4 12 13 JP3854600008 6435145 7267.T 643514 Honda Motor Co. Ltd. JP JPY Y 43.3 13 14 JP3435000009 6821506 6758.T 682150 Sony Corp. JP JPY Y 42.3 14 17 JP3496400007 6248990 9433.T 624899 KDDI Corp. JP JPY Y 42.2 15 16 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.1 16 19 JP3885780001 6591014 8411.T 625024 Mizuho Financial Group Inc.