Down to Its Recoverable Amount

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

KOREA Morning Focus

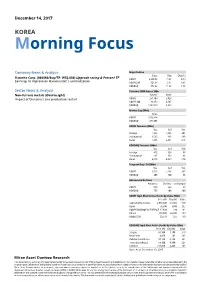

December 14, 2017 KOREA Morning Focus Company News & Analysis Major Indices Close Chg Chg (%) Hanwha Corp. (000880/Buy/TP: W56,000) Upgrade rating & Present TP ' KOSPI 2,480.55 19.55 0.79 Earnings to improve on Hanwha E&C s normalization KOSPI 200 326.18 2.11 0.65 KOSDAQ 772.22 11.82 1.55 Sector News & Analysis Turnover ('000 shares, Wbn) Non-ferrous metals (Overweight) Volume Value Impact of Glencore’s zinc production restart KOSPI 251,104 5,028 KOSPI 200 89,459 4,107 KOSDAQ 1,131,049 5,394 Market Cap (Wbn) Value KOSPI 1,613,324 KOSDAQ 274,605 KOSPI Turnover (Wbn) Buy Sell Net Foreign 1,443 1,648 -205 Institutional 1,585 886 698 Retail 1,945 2,461 -515 KOSDAQ Turnover (Wbn) Buy Sell Net Foreign 412 324 88 Institutional 285 192 93 Retail 4,695 4,869 -174 Program Buy / Sell (Wbn) Buy Sell Net KOSPI 1,513 1,206 307 KOSDAQ 206 120 86 Advances & Declines Advances Declines Unchanged KOSPI 566 244 67 KOSDAQ 733 408 100 KOSPI Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Samsung Electronics 2,566,000 -39,000 570 Hynix 76,800 -1,000 265 KODEX KOSDAQ150 LEVERAGE 17,680 280 191 NCsoft 488,000 22,000 189 KODEX 200 32,670 255 160 KOSDAQ Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value SillaJen 89,100 1,100 319 New Pride 4,850 145 263 Celltrion Healthcare 93,100 6,100 231 TissueGene(Reg.S) 54,100 4,300 225 Celltrion 210,000 4,400 205 Note: As of December 13, 2017 Mirae Asset Daewoo Research Hanwha Corp. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

STOXX Asia 100 Last Updated: 03.07.2017

STOXX Asia 100 Last Updated: 03.07.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) KR7005930003 6771720 005930.KS KR002D Samsung Electronics Co Ltd KR KRW Y 256.2 1 1 JP3633400001 6900643 7203.T 690064 Toyota Motor Corp. JP JPY Y 128.5 2 2 TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.6 3 3 JP3902900004 6335171 8306.T 659668 Mitsubishi UFJ Financial Group JP JPY Y 83.5 4 4 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 77.2 5 5 JP3436100006 6770620 9984.T 677062 Softbank Group Corp. JP JPY Y 61.7 6 7 JP3735400008 6641373 9432.T 664137 Nippon Telegraph & Telephone C JP JPY Y 58.7 7 8 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 58.2 8 6 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 52.6 9 12 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 52.0 10 10 JP3890350006 6563024 8316.T 656302 Sumitomo Mitsui Financial Grou JP JPY Y 48.3 11 15 INE040A01026 B5Q3JZ5 HDBK.BO IN00CH HDFC Bank Ltd IN INR Y 45.4 12 13 JP3854600008 6435145 7267.T 643514 Honda Motor Co. Ltd. JP JPY Y 43.3 13 14 JP3435000009 6821506 6758.T 682150 Sony Corp. JP JPY Y 42.3 14 17 JP3496400007 6248990 9433.T 624899 KDDI Corp. JP JPY Y 42.2 15 16 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.1 16 19 JP3885780001 6591014 8411.T 625024 Mizuho Financial Group Inc. -

Confirmed Attendees Include

7 May 2019 | Seoul 9-10 May 2019 | Tokyo Connecting Korean capital to Building global infrastructure with global infrastructure Japanese capital #iiSeoul #iiTokyo Confirmed attendees include: » Aberdeen Standard Investments » Asset Management One Investments » ABL Life Insurance » Asset Management One » Construction Workers Mutual Aid » AES Infrastructure Advisors Alternative Investments Association » Ahlstrom Capital » AXA Life Insurance » Credit Agricole CIB » AIA Life Insurance » bfinance » Cresta Fund Management » AIA Life Korea » BlackRock » Daido Life Insurance » AIP » Bloomberg NEF » Dai-ichi Life Insurance » AISIN Employees’ Pension Fund » BNP Paribas » Daiwa House Industry Pension Fund » Alberta Investment Management » BOT Lease Corporation » Brookfield Asset Management » Dalmore Capital » Alinda Capital Partners » Cabinet Office of Japan » Dalmore Capital/Pareto Capital » Altamar Infrastructurals » Campbell Lutyens » DB Insurance » AMP » Cantor Fitzgerald » DBJ Asset Management » AMP Capital » Capital Dynamics Inc » DENSO Pension Fund » Antin Infrastructure Partners » CBRE Caledon Capital » Department for International Trade » ArcLight Capital Partners LLC Management » Development Bank of Japan » Argo Infrastructure Partners » CDPQ Asia Pacific » DGB Life Insurance » Asahi Mutual Life Insurance » China Ping An Insurance Overseas » DIF (Holdings) » ASMA Capital Partners BSC » Eaton Partners » Columbia Threadneedle » Engie Secure your place today and gain unrivalled insight into the minds of the investors that are shaping the -

Company Title Work Country Aksa Akrilik Kimya Sanayii A.S General Manager & Board Member Turkey Marketing, Sales & New Business Aksa Akrilik Kimya Sanayii A.S

Company Title Work Country Aksa Akrilik Kimya Sanayii A.S General Manager & Board Member Turkey Marketing, Sales & New Business Aksa Akrilik Kimya Sanayii A.S. Turkey Development Director Aksa Akrilik Kimya Sanayii A.S. Raw Materials Supply Chain Executive Turkey AnQore B.V. CEO Netherlands AnQore B.V. Sr. Product Sales Manager Netherlands AnQore B.V. Director Marketing & Sales Netherlands Apcotex Industries Limited DGM-Sourcing India Apcotex Industries Limited DGM-Procurement India Arlanxeo Deutschland GmbH Director Procurement Germany Asahi Kasei Corporation Senior General Manager Japan Asahi Kasei Corporation Lead Executive Officer Japan Asahi Kasei Corporation Manager Japan Asahi Kasei Corporation Assistant Manager South Korea Asahi Kasei Corporation General Manager South Korea Asahi Kasei Corporation Manager South Korea Ascend Performance Materials AN Product Manager USA Ascend Performance Materials Global Business Director Chemicals USA Bangkok Synthetics Co.,Ltd. Procurement Engineer Thailand BASF Procurement Manager China BASF (China) Co., Ltd. Senior Manager China BASF SE Director Basic Chemicals Germany BASF SE Global buyer Germany Black Rose Industries Ltd. Executive Director India Bloomberg News Reporter Singapore Braskem Account Manager Brazil Information & System Integration Chemical Logitec Co., Ltd. Japan Department Chemicals Planning Dept. Chemicals Management Group Japan China Petrochemical Development Specialist Taiwan Corporation CJ Bio Malaysia Sdn Bhd CEO Malaysia Cornerstone Chemical Co. CEO USA Cornerstone Chemical -

Korean Insurance Industry

KOREAN INSURANCE INDUSTRY INDUSTRY INSURANCE KOREAN 2020 KOREAN INSURANCE INDUSTRY 2020 KOREAN INSURANCE INDUSTRY 2020 Foreword In 2019, the global real GDP slowed with the trade dispute between China and the United States and a slowdown in domestic investment. The uncertainty in the financial market has expanded. Korean economy grew by 2.0% in 2019, which is 0.9%p lower than 2.9% in 2018. As private consumption and exports weakened amid the current downturn in investment. The Bank of Korea (BOK) cut the base rate by 25 basis points two times, in both July and October 2019 in order to support economic recovery and moderate the downward pressure on prices. Financial market uncertainty has increased as the KRW/USD exchange rate rose and the stock market fell. In 2019, premiums in the insurance industry increased by 5.0%. The life insurance premium in 2019 increased by 5.8% mainly due to pension plans premiums’ sharp increase. However, the premiums in private life insurance have been shrinking for five consecutive years. The non-life insurance premium in 2019 increased by 5.0% mainly in pension plans, long-term insurance, Casualty, Automobile. Despite the growth in premiums, the insurance industry's profitability deteriorated due to continued negative margins, intensifying competition, and worsening loss ratio. The environment surrounding the insurance industry, such as low economic growth, deepening low interest rates, and an aging population is unfavorable to the insurance industry. In addition, changes in accounting standards and solvency regulation, which are scheduled to be introduced in 2023, are also expected to act as a burden on the insurance industry. -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

Samsung C&T Corporation and Subsidiaries

Samsung C&T Corporation and Subsidiaries Consolidated Interim Financial Statements September 30, 2017 and 2016 Samsung C&T Corporation and Subsidiaries Index September 30, 2017 and 2016 Pages Report on Review of Interim Financial Statements ………………………............................... 1 - 5 Consolidated Interim Financial Statements Consolidated Interim Statements of Financial Position …………………………………………….. 6 - 8 Consolidated Interim Statements of Comprehensive Income....................................................... 9 - 10 Consolidated Interim Statements of Changes in Equity..............................…………................... 11 - 12 Consolidated Interim Statements of Cash Flows…………………………………………………….. 13 - 14 Notes to the Consolidated Interim Financial Statements....................................……....……....... 15 - 102 Report on Review of Interim Financial Statements (English Translation of a Report Originally Issued in Korean) To the Shareholders and Board of Directors of Samsung C&T Corporation Reviewed Financial Statements We have reviewed the accompanying consolidated interim financial statements of Samsung C&T Corporation (the Company) and its subsidiaries (collectively referred to as the “Group”). These financial statements consist of the consolidated interim statement of financial position of the Group as at September 30, 2017, and the related consolidated interim statements of comprehensive income for the three-month and nine-months periods ended September 30, 2017 and 2016, and consolidated interim statements of changes in equity -

ING Life Insurance Korea Annual Report 12903D.Pdf

ING LIFE 2017 ANNUAL REPORT ANNUAL 2017 LIFE ING 2017 ANNUAL REPORT Insured for New Growth Insured for New Growth Leading Provider of Insurance ING Life Insurance Korea, Ltd. (ING Life) has been keeping pace with the development and growth of the life insurance industry in Korea ever since its establishment in 1987. Marking the 30th anniversary in 2017, we are preparing for a new way forward to achieve stronger growth while shaping a sustainable future. We will create new values by thinking outside the box, backed by our long-time accumulated knowledge and experience, and based on our corporate culture of communication and trust. This is the first Annual Report of ING Life since its initial public offering (IPO). We have published this report to share the efforts we made to grow together with our shareholders and other stakeholders as a reliable financial partner, and the outcome of such efforts. Formats Compass This report is published in both This report has been published as an printed and PDF formats, giving our interactive PDF, allowing readers to move stakeholders the option to choose their easily to pages in the report, and includes preferred communication format. shortcuts to related web pages. Printed Report Reference page Interactive PDF Website link Video clipclips This report is available in PDF format which can be downloaded at www.inglife.co.kr Company History 2017 30th anniversary of the founding of ING Life Insurance Korea ING Life Insurance Korea years of innovation 30 Listed on KOSPI (as #079440.KS) Received an exclusive -

Hanwha Techwin Brochire 2021

Company Overview A global leader in the video surveillance Hanwha Group HQ Golden Tower, Seoul, industry, Hanwha Techwin South Korea 2021 – A year of opportunities This new year will, without doubt, bring many exciting opportunities for manufacturers, such as Hanwha Techwin, to help system integrators and our distribution partners grow their businesses. Over recent years, growth in the sales of security cameras, recording devices and video management software platforms has been fuelled by businesses and organisations recognising the need to take their security to a higher level. As IoT devices have become more popular over the years, managers responsible for security all share the same goals of protecting property, people Top 5 video surveillance and assets against a context of increasingly sophisticated cyber-attacks. trends for 2021 It is therefore not surprising to learn that the global professional The market research reports and feedback from customers video surveillance equipment market is predicted to continue to give weight to predictions as to what the top trends and significantly increase over the coming years, with Berg Insight, a hot topics will be during 2021: leading IoT market research provider, estimating that the number 1. With increased functionality now being included of cameras installed across Europe and North America will grow in edge-based Deep Learning AI solutions, there is from a 2019 total of 183 million, to 420.3 million cameras in 2024. likely to be a large increase in the number of devices As end-users’ expectations rise as to what they can expect to deployed which can process data at the edge. -

Hanwha Profile 2020

Hanwha Profile 2020 A “We engage and listen to our customers to create the solutions they trust us to build.” Contents 02 CHAIRMAN’S MESSAGE 08 BUSINESS HIGHLIGHTS 10 Chemicals & Materials 20 Aerospace & Mechatronics 28 Solar Energy 36 Finance 46 Services & Leisure 54 Construction 62 Hanwha OVERVIEW 64 Hanwha’s Vision, Spirit & Core Values 66 Hanwha Today 68 Milestones 70 Financial Highlights 72 Hanwha BUSINESSES 75 Manufacturing & Construction 93 Finance 99 Services & Leisure 104 CORPORATE SOCIAL RESPONSIBILITY 112 GLOBAL NETWORK & DIRECTORY B 1 Chairman’s Message The world has already moved beyond the Fourth Industrial Revolution. It is now heading toward the next industrial revolution. So are we. At Hanwha, we believe in building trust and strengthening loyalty. Our customers trust us because we’ve earned it over time. In turn, we strengthen our loyalty to the people we serve through contributions to society. Trust and loyalty are in the DNA of every Hanwha employee, motivating us to build for the good of all, amid constant changes and despite them. As a company, our never-ending goal is to improve the lives of everyone we touch. We seek to raise the standards of living and improve the quality of life. We know this is easily said but difficult to attain. And yet, if we persevere, continue to innovate and build for a better tomorrow, the future is ours to imagine. In 2010, Hanwha’s vision of “Quality Growth 2020” was unveiled. Since then, we have made significant strides toward realizing this vision through our expertise and innovations that have grown exponentially across the company’s core businesses. -

Korea Insight

KOREA INSIGHT KOREA ECONOMIC INSTITUTE OF AMERICA Volume 1, Number 9 December 1999 KOREA.COM: A NEW ENGINE FOR Qualcomm, Click-to-Asia are just a few of the companies that have entered the market, helping to established Internet Service GROWTH Providers (ISP) throughout Korea. On December 15th, Hyundai Electronics launched its first Internet phone. This digital phone, by R. Ben Weber with CDMA (code division multiple access) technology, is ex- pected to garner 12.5% of the global CDMA market. The com- Earlier this month, five hundred employees of Hanwha Group bination of wireless technology with Internet access will no doubt marched into the street in front of their headquarters in down- provide a surge in Koreas potential for e-commerce. town Seoul and with much fanfare, proclaimed Hanwha Group an Internet company. By investing over 300 billion won over Currently, Koreas e-commerce is estimated at 200 billion won. the next three years, management hopes to generate more than It is expected to triple to 590 billion won by the end of 2000. 30 percent of its revenues via the Internet. Although it is limited to only consulting and EDI (electronic date interchange), the beginning of next year will be marked by Hanwha is not alone. Korean companies by the hundreds are a rapid expansion into the business-to-business commerce (B2B) looking at the Internet as their future. Internet usage in Korea by Korean businesses. Recently, E*Trade Group of Korea, a has increased from 1.6 million users in 1997 to an estimated United States joint venture in Korea, received preliminary 6.3 million by years end.