Country Analysis Brief: South Korea

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Company Title Work Country Aksa Akrilik Kimya Sanayii A.S General Manager & Board Member Turkey Marketing, Sales & New Business Aksa Akrilik Kimya Sanayii A.S

Company Title Work Country Aksa Akrilik Kimya Sanayii A.S General Manager & Board Member Turkey Marketing, Sales & New Business Aksa Akrilik Kimya Sanayii A.S. Turkey Development Director Aksa Akrilik Kimya Sanayii A.S. Raw Materials Supply Chain Executive Turkey AnQore B.V. CEO Netherlands AnQore B.V. Sr. Product Sales Manager Netherlands AnQore B.V. Director Marketing & Sales Netherlands Apcotex Industries Limited DGM-Sourcing India Apcotex Industries Limited DGM-Procurement India Arlanxeo Deutschland GmbH Director Procurement Germany Asahi Kasei Corporation Senior General Manager Japan Asahi Kasei Corporation Lead Executive Officer Japan Asahi Kasei Corporation Manager Japan Asahi Kasei Corporation Assistant Manager South Korea Asahi Kasei Corporation General Manager South Korea Asahi Kasei Corporation Manager South Korea Ascend Performance Materials AN Product Manager USA Ascend Performance Materials Global Business Director Chemicals USA Bangkok Synthetics Co.,Ltd. Procurement Engineer Thailand BASF Procurement Manager China BASF (China) Co., Ltd. Senior Manager China BASF SE Director Basic Chemicals Germany BASF SE Global buyer Germany Black Rose Industries Ltd. Executive Director India Bloomberg News Reporter Singapore Braskem Account Manager Brazil Information & System Integration Chemical Logitec Co., Ltd. Japan Department Chemicals Planning Dept. Chemicals Management Group Japan China Petrochemical Development Specialist Taiwan Corporation CJ Bio Malaysia Sdn Bhd CEO Malaysia Cornerstone Chemical Co. CEO USA Cornerstone Chemical -

Hanwha Techwin Brochire 2021

Company Overview A global leader in the video surveillance Hanwha Group HQ Golden Tower, Seoul, industry, Hanwha Techwin South Korea 2021 – A year of opportunities This new year will, without doubt, bring many exciting opportunities for manufacturers, such as Hanwha Techwin, to help system integrators and our distribution partners grow their businesses. Over recent years, growth in the sales of security cameras, recording devices and video management software platforms has been fuelled by businesses and organisations recognising the need to take their security to a higher level. As IoT devices have become more popular over the years, managers responsible for security all share the same goals of protecting property, people Top 5 video surveillance and assets against a context of increasingly sophisticated cyber-attacks. trends for 2021 It is therefore not surprising to learn that the global professional The market research reports and feedback from customers video surveillance equipment market is predicted to continue to give weight to predictions as to what the top trends and significantly increase over the coming years, with Berg Insight, a hot topics will be during 2021: leading IoT market research provider, estimating that the number 1. With increased functionality now being included of cameras installed across Europe and North America will grow in edge-based Deep Learning AI solutions, there is from a 2019 total of 183 million, to 420.3 million cameras in 2024. likely to be a large increase in the number of devices As end-users’ expectations rise as to what they can expect to deployed which can process data at the edge. -

Hanwha Profile 2020

Hanwha Profile 2020 A “We engage and listen to our customers to create the solutions they trust us to build.” Contents 02 CHAIRMAN’S MESSAGE 08 BUSINESS HIGHLIGHTS 10 Chemicals & Materials 20 Aerospace & Mechatronics 28 Solar Energy 36 Finance 46 Services & Leisure 54 Construction 62 Hanwha OVERVIEW 64 Hanwha’s Vision, Spirit & Core Values 66 Hanwha Today 68 Milestones 70 Financial Highlights 72 Hanwha BUSINESSES 75 Manufacturing & Construction 93 Finance 99 Services & Leisure 104 CORPORATE SOCIAL RESPONSIBILITY 112 GLOBAL NETWORK & DIRECTORY B 1 Chairman’s Message The world has already moved beyond the Fourth Industrial Revolution. It is now heading toward the next industrial revolution. So are we. At Hanwha, we believe in building trust and strengthening loyalty. Our customers trust us because we’ve earned it over time. In turn, we strengthen our loyalty to the people we serve through contributions to society. Trust and loyalty are in the DNA of every Hanwha employee, motivating us to build for the good of all, amid constant changes and despite them. As a company, our never-ending goal is to improve the lives of everyone we touch. We seek to raise the standards of living and improve the quality of life. We know this is easily said but difficult to attain. And yet, if we persevere, continue to innovate and build for a better tomorrow, the future is ours to imagine. In 2010, Hanwha’s vision of “Quality Growth 2020” was unveiled. Since then, we have made significant strides toward realizing this vision through our expertise and innovations that have grown exponentially across the company’s core businesses. -

Down to Its Recoverable Amount

Hanwha Total Petrochemical Co., Ltd. and its subsidiaries Consolidated financial statements for the years ended December 31, 2020 and 2019 with the independent auditor’s report Table of contents Independent auditor’s report Page Consolidated financial statements Consolidated statements of financial position 1 Consolidated statements of comprehensive income 3 Consolidated statements of changes in equity 4 Consolidated statements of cash flows 5 Notes to the consolidated financial statements 6 Ernst & Young Han Young Taeyoung Building, 111, Yeouigongwon-ro, Yeongdeungpo-gu, Seoul 07241 Korea Tel: +82 2 3787 6600 Fax: +82 2 783 5890 ey.com/kr Independent auditor’s report The Shareholders and Board of Directors Hanwha Total Petrochemical Co., Ltd. Opinion We have audited the consolidated financial statements of Hanwha Total Petrochemical Co., Ltd. (the “Company”) and its subsidiaries (collectively referred to as the “Group”), which comprise the consolidated statements of financial position as of December 31, 2020 and 2019, and the consolidated statements of comprehensive income, consolidated statements of changes in equity and consolidated statements of cash flows for the years then ended, and notes to the consolidated financial statements, including a summary of significant accounting policies. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Group as of December 31, 2020 and 2019, and its consolidated financial performance and its consolidated cash flows for the years then ended in accordance with Korean International Financial Reporting Standards (“KIFRS”). Basis for opinion We conducted our audit in accordance with Korean Auditing Standards (“KGAAS”). Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the consolidated financial statements section of our report. -

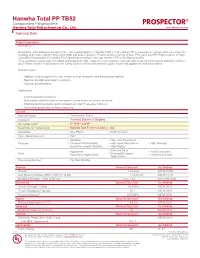

Technical Datasheet: Hanwha Total PP TB52

Hanwha Total PP TB52 Compounded Polypropylene Hanwha Total Petrochemical Co., Ltd. www.ulprospector.com Technical Data Product Description Description Manufactured by adding an inorganic filler, talc to polypropylene, Hanwha Total' s heat-resistant PP compounds are designed for use in injection molding, and feature highly improved strength and heat-resistance. Produced with a variety of base PPs, such as HIPP (High Isotactic or High Crystalline Polypropylene), Hanwha Total' special processing technology results in PP of the highest quality. These products feature superior rigidity and impact strength, long-term heat resistance and anti-static property. Dimensional stability is another plus! These Hanwha Total products are widely used in electric and electronic parts, household appliances and automobiles. Characteristics • Addition of an inorganic filler, talc enhances heat-resistance and dimensional stability; • Superior strength and impact-resistance; • Superior processability. Applications • Electric/electronic products • Dish washer and microwave oven parts such as doors, air covers, air ducts; • Washing machines parts (such as balances), and TV speaker cabinets; • Household goods such as food containers. General Material Status • Commercial: Active Literature 1 • Technical Datasheet (English) UL Yellow Card 2 • E140331-222954 Search for UL Yellow Card • Hanwha Total Petrochemical Co., Ltd. Availability • Asia Pacific • North America Filler / Reinforcement • Talc • Antistatic • High Heat Resistance Features • Excellent Processability -

Brochure Lineup 2019 Q1 Final

Product line-up 1st Quarter 2019 Hanwha Energy Hanwha Total Petrochemical Hanwha Hanwha E&C Manufacturing Hanwha Defense & Hanwha Chemical Construction Hanwha City Development Hanwha Systems Hanwha Hanwha Life Hanwha Hotels & Resorts Hanwha is ranked as the 8th largest Hanwha Hanwha 63 City Investment & corporation in South Korea based on Securities Service Finances & asset size, and is a Fortune 500 company. Leisure Hanwha S&C Hanwha networks, Hanwha’s global businesses General Insurance Hanwha Galleria span the manufacturing and construction; Hanwha Savings Bank With its 25 years of technological knowledge and expertise in optical and image processing, Hanwha Techwin is leading the CCTV and video surveillance market. 1977 Established the company is the signature brand of Hanwha Techwin’s security business. 1991 Initiation of video surveillance business It embodies the spirit of building a safe, secure, and connected world. 2010 Samsung Techwin acquires Samsung’s video surveillance business Core 2012 value 2013 Release of Wisenet3 camera 2015 Hanwha group acquires Samsung Techwin and Hanwha Techwin is established 2016 Development of WISENET5 ISP Chip (SoC) 2017 Release of Wisenet X camera Complete Assured Value-added Seamless Security Partner-assured Added Usability Dependable Quality Buyer-assured Added Flexibility Comprehensive User-assured Added Possibility Based on world class optical image processing technology, Solutions Wisenet provides high-resolution cameras, recording devices and enterprise management software. For -

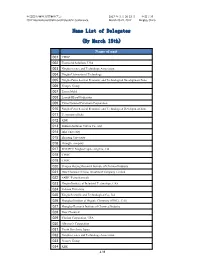

Name List of Delegates (By March 15Th)

中国国际烯烃及聚烯烃大会 2017 年 3 月 20-22 日 中国宁波 2017 International Olefin and Polyolefin Conference March 20-22, 2017 Ningbo, China Name List of Delegates (By March 15th) Name of unit 001 CIESC 002 Townsend Solutions, USA 003 Ningbo science and Technology Association 004 Ningbo University of Technology 005 Ningbo Petrochemical Economic and Technological Development Zone 006 Sinopec Group 007 Exxon Mobil 008 LyondellBasell Industries 009 China National Petroleum Corporation 010 Ningbo Petrochemical Economic and Technological Development Zone 011 Tecnimont of Italy 012 KBR 013 Suzhou Antiwear Valves Co., Ltd 014 Inha University 015 Zhejiang University 016 Zhongke company 017 SINOPEC Ningbo Engineering Co., Ltd 018 CIESC 019 CIESC 020 Sinopec Beijing Research Institute of Chemical Industry 021 Dow Chemical (China) Investment Company Limited 022 SABIC Petrochemicals 023 Ningbo Institute of Industrial Technology, CAS 024 Sichuan University 025 Kingfa Scientific and Technological Co., Ltd 026 Shanghai Institute of Organic Chemistry (SIOC) , CAS 027 Shanghai Research Institute of Chemical Industry 028 Dow Chemical 029 Clariant Corporation, USA 030 Albemarle Corporation 031 Tosoh Finechem, Japan 032 Ningbo science and Technology Association 033 Sinopec Group 034 KBR 1 / 8 中国国际烯烃及聚烯烃大会 2017 年 3 月 20-22 日 中国宁波 2017 International Olefin and Polyolefin Conference March 20-22, 2017 Ningbo, China 035 KBR 036 KBR 037 Townsend Solutions, USA 038 ExxonMobil Asia Pacific Research and Development Company, Ltd. 039 ExxonMobil Asia Pacific Research and Development Company, Ltd. 040 ExxonMobil Asia Pacific Research and Development Company, Ltd. 041 ExxonMobil Asia Pacific Research and Development Company, Ltd. 042 ExxonMobil Asia Pacific Research and Development Company, Ltd. -

Focus on Hydrogen: Korea's New Energy Roadmap

FOCUS ON HYDROGEN: KOREA'S NEW ENERGY ROADMAP Korea's Hydrogen Economy Roadmap is a plan to create a comprehensive hydrogen ecosystem in Korea by 2040. This Key issues briefing highlights the key aspects of the roadmap and recent • Hydrogen Economy Roadmap was announced on 17 January developments in pushing forward the hydrogen agenda in 2019 Korea. • Hydrogen Economy Promotion and Safety Management Act HYDROGEN ECONOMY ROADMAP was enacted on 4 February 2020 and will come into force The Korean Ministry of Trade, Industry and Economy (MOTIE) published its on 5 February 2021 Hydrogen Economy Roadmap on 17 January 2019. Korea's vision in the • Both private and public sectors roadmap is to become a leading country in the new global hydrogen economy actively investing in hydrogen with the support of two pillars: fuel cell electric vehicles (FCEVs) and fuel cells. using technology and This is not surprising given that Korean companies are equipped with world- infrastructure class technologies in FCEVs and fuel cells. • Korea's Roadmap is more focused on economic growth Targets and industrial competitiveness The roadmap sets out the following specific targets: than climate change objectives Mobility – Production/installation on a cumulative basis Note: Figures in brackets indicate amounts for domestic consumption 2018 2022 2040 81,000 > 6,200,000 FCEVs 1,800 (67,000) (2,900,000) - Passenger 1,800 79,000 5,900,000 Vehicles (900) (65,000) (2,750,000) 120,000 - Taxis - - (80,000) 2 2,000 60,000 - Buses (all) (all) (40,000) 120,000 - Trucks - - -

플랜트사업 주요실적 Project Customer End User Item Site

플랜트사업 주요실적 국내 FACILITY SUPPLIED PROJECT CUSTOMER END USER ITEM SITE TYPE YEAR BUKPYEONG THERMAL POWER THERMAL POWER PLANT BOILER BHI STX POWER RG,ETC KOREA 2015~2013 PLANT PRESSURE PART HANGER DONGDUCHOEN HRSG DONGDUCHEON THERMAL POWER PROJECT - EXTERNAL BHI VS,CS,SN,ST,ETC KOREA 2015~2013 DREAM POWER PLANT HANGER SIN INCHEON HRSG MODULE KOREA SOUTHERN THERMAL POWER BHI VS,CS,ETC KOREA 2015~2013 REPLACEMENT & POWER CORP PLANT S.BORE V-PJT IBL & OBL SK E&C SK INNOVATION PETROCHEMICAL VS,CS,ST,CD,ETC KOREA 2015~2013 TAEAN THERMAL POWER PLANT KOREA WESTERN THERMAL POWER DAELIM INDUSTRIAL VS,CS,RG KOREA 2015~2012 PROJECT #9/10 - POWER CORP PLANT BOILER DAEGU WASTE ENERY FACILITY BTO GS E&C DAEGU CITY PETROCHEMICAL VS,CS,ST,RG,ETC KOREA 2015, 2014 PROJECT HANAM HRSG & LINK & HPU & MSP & LOP & DOOSAN E&C SK E&S CO-GENERATION VS,CS,ST,RG,ETC KOREA 2015, 2014 CHP) KUMHO POLYCHEM KUMHO POSCO ENGINEERING PETROCHEMICAL VS KOREA 2015, 2014 YEP-V PROJECT PETROCHEMICAL KWANGYANG SNG POSCO E&C POSCO STEELWORKS VS,CS,ST KOREA 2015, 2014 PROJECT NON FERROUS COMPLEX #1 & #2 KOREA ZINC KOREA ZINC PETROCHEMICAL VS, CS KOREA 2015, 2014 PROJECT PDH PROJECT SK E&C SK ADVANCED PETROCHEMICAL VS,CS,ST,CD,ETC KOREA 2015, 2014 SAMCHEOK GREEN KOREA SOUTHERN THERMAL POWER POWER FACTORY SUNGCHANG E&C VS,CS,ST,ETC KOREA 2015, 2014 POWER CORP PLANT PROCESSING S.BORE SAMCHEOK GREEN KOREA SOUTHERN THERMAL POWER POWER MISC(LARGE HYUNDAI E&C VS,CS,ETC KOREA 2015, 2014 POWER CORP PLANT BORE)SUPPORT SAMCHEOK PRODUCTION BASE KYUNGNAM KOREA SOUTHERN 1STAGE 1-4 STORAGE OIL&GAS -

Hanwha Profile 2018

Hanwha Profile 2018 A “We engage and listen to our end users to envision the solutions our customers trust us to build.” Contents Seung Youn Kim 02 CHAIRMAN’S MESSAGE 08 BUSINESS HIGHLIGHTS 10 Chemicals & Materials 20 Aerospace & Mechatronics 28 Solar Energy 36 Finance 46 Services & Leisure 54 Construction 62 Hanwha OVERVIEW 64 Hanwha’s Vision, Spirit & Core Values 66 Hanwha Today 68 Milestones 70 Financial Highlights 72 Hanwha BUSINESSES 75 Manufacturing & Construction 94 Finance 100 Services & Leisure 106 CORPORATE SOCIAL RESPONSIBILITY 114 GLOBAL NETWORK & DIRECTORY B 1 Chairman’s Message For more than 60 years, Hanwha has grown steadily and evolved by anticipating changes and embracing challenges. In times when others have sought cost reductions, we looked for opportunities and innovated. In so doing, we did more than stay afloat, we stood out and excelled. At the heart of our success was our belief that we were doing the right thing—improving the life for everyone whose lives we touched. We continue believing in this mission and it’s what inspires us to build for all, including the generations today and the generations to come. It’s why we’re continuing to foster trust and loyalty. But after 60 years, we’re facing a landscape that has also evolved and where competition is fierce and change is rapid. The Fourth Industrial Revolution is upon us; uncertainty looms ahead. But for us, we remain steadfast to what we’ve always done and what we must do. We must find opportunities in the midst of change and in spite of challenges. -

Hanwha Profile 2017

Hanwha Profile 2017 A “We listen and engage our end users to envision the solution our customers trust us to build.” Contents Seung Youn Kim 02 CHAIRMAN’S MESSAGE 06 BUSINESS HIGHLIGHTS 08 Chemicals & Materials 18 Aerospace & Mechatronics 26 Solar Energy 34 Finance 44 Services & Leisure 52 Construction 60 Hanwha OVERVIEW 62 Our Vision, Spirit & Core Values 64 Hanwha Today 66 Milestones 68 Financial Highlights 70 Hanwha BUSINESSES 73 Manufacturing & Construction 91 Finance 97 Services & Leisure 104 CORPORATE SOCIAL RESPONSIBILITY 112 GLOBAL NETWORK & DIRECTORY B 1 Chairman’s Message At Hanwha, we continue to grow by building on trust and loyalty—the basis of our relationship with customers. At the same time, we’re staying committed to our vision to improve the quality of life for everyone whose lives we touch. We’re doing both to provide our customers with the highest possible value while building sustainable returns for our partners. Our businesses in advanced chemicals, sustainable energy, aerospace, and financial services have been providing practical solutions to real-world challenges. In 2016, both our solutions along with the results of our investments in future businesses and advanced infrastructure have led to record revenues of more than USD 53.89 billion and resulted in more than USD 150.25 billion in assets. We also rose 50 places higher on the Fortune Global 500 Company list and still stayed highly competitive in every industry. Our success can be attributed to our strategic response to rapid changes in customer needs, markets and industries. So when we saw change, we changed. We innovated and pivoted to develop differentiated solutions that were one step ahead. -

BR 18 2020 4Q Lineup Brochure V14 NDAA V5.Indd

NDAA Compliant Product line-up 2020 HanwhaSecurity.com Hanwha Group Founded in 1952, Hanwha is a FORTUNE Global 500 company Hanwha delivers energy to customers to and the 7th largest business group in Korea, comprising of 76 domestic affiliates and 351 global networks around the world. make our future Hanwha’s business area included span aerospace & mechatronics, more vibrant and sustainable. chemicals & materials, solar energy, finance, service & leisure, and construction. By integrating its growing number of affiliate enterprises worldwide, Hanwha is harnessing the power of sustainable, quality growth to continually increase the value we bring to customers. Products & Services Aerospace & Mechatronics Chemicals & Materials Hanwha Corporation Hanwha Chemical (Machinery / Explosives) Hanwha Total Petrochemical Hanwha Aerospace Hanwha Advanced Materials Hanwha Techwin Hanwha General Chemical Hanwha Systems Yeochun NCC Hanwha Defense Hanwha Power Systems Finance Hanwha Precision Machinery Hanwha Investment & Securities Hanwha Life Solar Energy Hanwha General Insurance Hanwha Q CELLS Hanwha Asset Management Hanwha Energy Hanwha Savings Bank Hanwha Solar Power Construction Services & Leisure Hanwha Engineering & Construction Hanwha Hotels & Resorts Hanwha City Development Hanwha Galleria Hanwha Galleria Timeworld Hanwha 63 City Hanwha Station Development Hanwha Techwin brings you A leading global security company, Hanwha Techwin has built its professional expertise in the video surveillance business through its world-leading optical, security solutions manufacturing and image processing technologies, accumulated about that deliver values beyond safety. 30 years since our first launch of a surveillance camera in 1991. As the world welcomes the 4th Industrial Revolution, we are leading the market by taking advantage of next-generation technologies, such as Deep Learning, Artificial Intelligence (AI) and Business Intelligence (BI).