Hanwha Profile 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Confirmed Attendees Include

7 May 2019 | Seoul 9-10 May 2019 | Tokyo Connecting Korean capital to Building global infrastructure with global infrastructure Japanese capital #iiSeoul #iiTokyo Confirmed attendees include: » Aberdeen Standard Investments » Asset Management One Investments » ABL Life Insurance » Asset Management One » Construction Workers Mutual Aid » AES Infrastructure Advisors Alternative Investments Association » Ahlstrom Capital » AXA Life Insurance » Credit Agricole CIB » AIA Life Insurance » bfinance » Cresta Fund Management » AIA Life Korea » BlackRock » Daido Life Insurance » AIP » Bloomberg NEF » Dai-ichi Life Insurance » AISIN Employees’ Pension Fund » BNP Paribas » Daiwa House Industry Pension Fund » Alberta Investment Management » BOT Lease Corporation » Brookfield Asset Management » Dalmore Capital » Alinda Capital Partners » Cabinet Office of Japan » Dalmore Capital/Pareto Capital » Altamar Infrastructurals » Campbell Lutyens » DB Insurance » AMP » Cantor Fitzgerald » DBJ Asset Management » AMP Capital » Capital Dynamics Inc » DENSO Pension Fund » Antin Infrastructure Partners » CBRE Caledon Capital » Department for International Trade » ArcLight Capital Partners LLC Management » Development Bank of Japan » Argo Infrastructure Partners » CDPQ Asia Pacific » DGB Life Insurance » Asahi Mutual Life Insurance » China Ping An Insurance Overseas » DIF (Holdings) » ASMA Capital Partners BSC » Eaton Partners » Columbia Threadneedle » Engie Secure your place today and gain unrivalled insight into the minds of the investors that are shaping the -

Company Title Work Country Aksa Akrilik Kimya Sanayii A.S General Manager & Board Member Turkey Marketing, Sales & New Business Aksa Akrilik Kimya Sanayii A.S

Company Title Work Country Aksa Akrilik Kimya Sanayii A.S General Manager & Board Member Turkey Marketing, Sales & New Business Aksa Akrilik Kimya Sanayii A.S. Turkey Development Director Aksa Akrilik Kimya Sanayii A.S. Raw Materials Supply Chain Executive Turkey AnQore B.V. CEO Netherlands AnQore B.V. Sr. Product Sales Manager Netherlands AnQore B.V. Director Marketing & Sales Netherlands Apcotex Industries Limited DGM-Sourcing India Apcotex Industries Limited DGM-Procurement India Arlanxeo Deutschland GmbH Director Procurement Germany Asahi Kasei Corporation Senior General Manager Japan Asahi Kasei Corporation Lead Executive Officer Japan Asahi Kasei Corporation Manager Japan Asahi Kasei Corporation Assistant Manager South Korea Asahi Kasei Corporation General Manager South Korea Asahi Kasei Corporation Manager South Korea Ascend Performance Materials AN Product Manager USA Ascend Performance Materials Global Business Director Chemicals USA Bangkok Synthetics Co.,Ltd. Procurement Engineer Thailand BASF Procurement Manager China BASF (China) Co., Ltd. Senior Manager China BASF SE Director Basic Chemicals Germany BASF SE Global buyer Germany Black Rose Industries Ltd. Executive Director India Bloomberg News Reporter Singapore Braskem Account Manager Brazil Information & System Integration Chemical Logitec Co., Ltd. Japan Department Chemicals Planning Dept. Chemicals Management Group Japan China Petrochemical Development Specialist Taiwan Corporation CJ Bio Malaysia Sdn Bhd CEO Malaysia Cornerstone Chemical Co. CEO USA Cornerstone Chemical -

Korean Insurance Industry

KOREAN INSURANCE INDUSTRY INDUSTRY INSURANCE KOREAN 2020 KOREAN INSURANCE INDUSTRY 2020 KOREAN INSURANCE INDUSTRY 2020 Foreword In 2019, the global real GDP slowed with the trade dispute between China and the United States and a slowdown in domestic investment. The uncertainty in the financial market has expanded. Korean economy grew by 2.0% in 2019, which is 0.9%p lower than 2.9% in 2018. As private consumption and exports weakened amid the current downturn in investment. The Bank of Korea (BOK) cut the base rate by 25 basis points two times, in both July and October 2019 in order to support economic recovery and moderate the downward pressure on prices. Financial market uncertainty has increased as the KRW/USD exchange rate rose and the stock market fell. In 2019, premiums in the insurance industry increased by 5.0%. The life insurance premium in 2019 increased by 5.8% mainly due to pension plans premiums’ sharp increase. However, the premiums in private life insurance have been shrinking for five consecutive years. The non-life insurance premium in 2019 increased by 5.0% mainly in pension plans, long-term insurance, Casualty, Automobile. Despite the growth in premiums, the insurance industry's profitability deteriorated due to continued negative margins, intensifying competition, and worsening loss ratio. The environment surrounding the insurance industry, such as low economic growth, deepening low interest rates, and an aging population is unfavorable to the insurance industry. In addition, changes in accounting standards and solvency regulation, which are scheduled to be introduced in 2023, are also expected to act as a burden on the insurance industry. -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

ING Life Insurance Korea Annual Report 12903D.Pdf

ING LIFE 2017 ANNUAL REPORT ANNUAL 2017 LIFE ING 2017 ANNUAL REPORT Insured for New Growth Insured for New Growth Leading Provider of Insurance ING Life Insurance Korea, Ltd. (ING Life) has been keeping pace with the development and growth of the life insurance industry in Korea ever since its establishment in 1987. Marking the 30th anniversary in 2017, we are preparing for a new way forward to achieve stronger growth while shaping a sustainable future. We will create new values by thinking outside the box, backed by our long-time accumulated knowledge and experience, and based on our corporate culture of communication and trust. This is the first Annual Report of ING Life since its initial public offering (IPO). We have published this report to share the efforts we made to grow together with our shareholders and other stakeholders as a reliable financial partner, and the outcome of such efforts. Formats Compass This report is published in both This report has been published as an printed and PDF formats, giving our interactive PDF, allowing readers to move stakeholders the option to choose their easily to pages in the report, and includes preferred communication format. shortcuts to related web pages. Printed Report Reference page Interactive PDF Website link Video clipclips This report is available in PDF format which can be downloaded at www.inglife.co.kr Company History 2017 30th anniversary of the founding of ING Life Insurance Korea ING Life Insurance Korea years of innovation 30 Listed on KOSPI (as #079440.KS) Received an exclusive -

Hanwha Techwin Brochire 2021

Company Overview A global leader in the video surveillance Hanwha Group HQ Golden Tower, Seoul, industry, Hanwha Techwin South Korea 2021 – A year of opportunities This new year will, without doubt, bring many exciting opportunities for manufacturers, such as Hanwha Techwin, to help system integrators and our distribution partners grow their businesses. Over recent years, growth in the sales of security cameras, recording devices and video management software platforms has been fuelled by businesses and organisations recognising the need to take their security to a higher level. As IoT devices have become more popular over the years, managers responsible for security all share the same goals of protecting property, people Top 5 video surveillance and assets against a context of increasingly sophisticated cyber-attacks. trends for 2021 It is therefore not surprising to learn that the global professional The market research reports and feedback from customers video surveillance equipment market is predicted to continue to give weight to predictions as to what the top trends and significantly increase over the coming years, with Berg Insight, a hot topics will be during 2021: leading IoT market research provider, estimating that the number 1. With increased functionality now being included of cameras installed across Europe and North America will grow in edge-based Deep Learning AI solutions, there is from a 2019 total of 183 million, to 420.3 million cameras in 2024. likely to be a large increase in the number of devices As end-users’ expectations rise as to what they can expect to deployed which can process data at the edge. -

Hanwha Profile 2020

Hanwha Profile 2020 A “We engage and listen to our customers to create the solutions they trust us to build.” Contents 02 CHAIRMAN’S MESSAGE 08 BUSINESS HIGHLIGHTS 10 Chemicals & Materials 20 Aerospace & Mechatronics 28 Solar Energy 36 Finance 46 Services & Leisure 54 Construction 62 Hanwha OVERVIEW 64 Hanwha’s Vision, Spirit & Core Values 66 Hanwha Today 68 Milestones 70 Financial Highlights 72 Hanwha BUSINESSES 75 Manufacturing & Construction 93 Finance 99 Services & Leisure 104 CORPORATE SOCIAL RESPONSIBILITY 112 GLOBAL NETWORK & DIRECTORY B 1 Chairman’s Message The world has already moved beyond the Fourth Industrial Revolution. It is now heading toward the next industrial revolution. So are we. At Hanwha, we believe in building trust and strengthening loyalty. Our customers trust us because we’ve earned it over time. In turn, we strengthen our loyalty to the people we serve through contributions to society. Trust and loyalty are in the DNA of every Hanwha employee, motivating us to build for the good of all, amid constant changes and despite them. As a company, our never-ending goal is to improve the lives of everyone we touch. We seek to raise the standards of living and improve the quality of life. We know this is easily said but difficult to attain. And yet, if we persevere, continue to innovate and build for a better tomorrow, the future is ours to imagine. In 2010, Hanwha’s vision of “Quality Growth 2020” was unveiled. Since then, we have made significant strides toward realizing this vision through our expertise and innovations that have grown exponentially across the company’s core businesses. -

Down to Its Recoverable Amount

Hanwha Total Petrochemical Co., Ltd. and its subsidiaries Consolidated financial statements for the years ended December 31, 2020 and 2019 with the independent auditor’s report Table of contents Independent auditor’s report Page Consolidated financial statements Consolidated statements of financial position 1 Consolidated statements of comprehensive income 3 Consolidated statements of changes in equity 4 Consolidated statements of cash flows 5 Notes to the consolidated financial statements 6 Ernst & Young Han Young Taeyoung Building, 111, Yeouigongwon-ro, Yeongdeungpo-gu, Seoul 07241 Korea Tel: +82 2 3787 6600 Fax: +82 2 783 5890 ey.com/kr Independent auditor’s report The Shareholders and Board of Directors Hanwha Total Petrochemical Co., Ltd. Opinion We have audited the consolidated financial statements of Hanwha Total Petrochemical Co., Ltd. (the “Company”) and its subsidiaries (collectively referred to as the “Group”), which comprise the consolidated statements of financial position as of December 31, 2020 and 2019, and the consolidated statements of comprehensive income, consolidated statements of changes in equity and consolidated statements of cash flows for the years then ended, and notes to the consolidated financial statements, including a summary of significant accounting policies. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Group as of December 31, 2020 and 2019, and its consolidated financial performance and its consolidated cash flows for the years then ended in accordance with Korean International Financial Reporting Standards (“KIFRS”). Basis for opinion We conducted our audit in accordance with Korean Auditing Standards (“KGAAS”). Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the consolidated financial statements section of our report. -

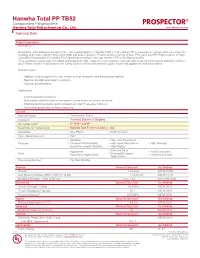

Technical Datasheet: Hanwha Total PP TB52

Hanwha Total PP TB52 Compounded Polypropylene Hanwha Total Petrochemical Co., Ltd. www.ulprospector.com Technical Data Product Description Description Manufactured by adding an inorganic filler, talc to polypropylene, Hanwha Total' s heat-resistant PP compounds are designed for use in injection molding, and feature highly improved strength and heat-resistance. Produced with a variety of base PPs, such as HIPP (High Isotactic or High Crystalline Polypropylene), Hanwha Total' special processing technology results in PP of the highest quality. These products feature superior rigidity and impact strength, long-term heat resistance and anti-static property. Dimensional stability is another plus! These Hanwha Total products are widely used in electric and electronic parts, household appliances and automobiles. Characteristics • Addition of an inorganic filler, talc enhances heat-resistance and dimensional stability; • Superior strength and impact-resistance; • Superior processability. Applications • Electric/electronic products • Dish washer and microwave oven parts such as doors, air covers, air ducts; • Washing machines parts (such as balances), and TV speaker cabinets; • Household goods such as food containers. General Material Status • Commercial: Active Literature 1 • Technical Datasheet (English) UL Yellow Card 2 • E140331-222954 Search for UL Yellow Card • Hanwha Total Petrochemical Co., Ltd. Availability • Asia Pacific • North America Filler / Reinforcement • Talc • Antistatic • High Heat Resistance Features • Excellent Processability -

Country Analysis Brief: South Korea

Country Analysis Brief: South Korea Last Updated: July 2018 Overview South Korea relies on imports to meet about 98% of its fossil fuel consumption as a result of insufficient domestic resources. The country is one of the world’s leading energy importers. South Korea ranks among the world’s top five importers of liquefied natural gas (LNG), coal, crude oil, and refined products.1 South Korea has no international oil or natural gas pipelines and relies exclusively on tanker shipments of LNG and crude oil. Despite its lack of domestic energy resources, South Korea is home to some of the largest and most advanced oil refineries in the world. In an effort to improve the nation’s energy security, oil and natural gas companies are aggressively seeking overseas exploration and production opportunities. Figure 1. Map of South Korea Source: U.S. Department of State U.S. Energy Information Administration Page | 1 South Korea was the world’s eighth-largest energy consumer in 2017, according to estimates from the BP Statistical Review of World Energy 2018.2 South Korea’s highly developed economy drives its energy consumption, and economic growth is fueled by exports, most notably exports of electronics, semiconductors, and petrochemicals. The country also is home to one of the world’s top shipbuilding industries. Real gross domestic product (GDP) has edged up since 2015 to 3.1% in 2017 as demand for the country’s exports strengthened.3 South Korea’s economy is heavily dependent on export markets, particularly within Asia. Exports in the region have increased over the past two years, which has boosted South Korea’s energy use. -

Media Release Keppel Capital's Alpha Asia Macro Trends Fund III

Media Release Keppel Capital’s Alpha Asia Macro Trends Fund III acquires three Grade A freehold commercial buildings in Seoul for KRW 430 billion Singapore, 29 April 2019 – Keppel Capital Holdings Pte. Ltd. (Keppel Capital), through Alpha Asia Macro Trends Fund III (AAMTF III), has entered into an agreement with a Korean asset management company to acquire 100% stakes in three Grade A freehold commercial buildings located in three major business districts in Seoul at a total acquisition price of about KRW 430 billion (approximately S$510 million1). The portfolio of three commercial buildings comprises Yeouido Finance Tower, located in the Yeouido business district (YBD), Nonhyun Building, located in the Gangnam business district (GBD), and Naeja Building, located in the Gwanghwamun central business district (CBD). The acquisition of the three buildings is expected to be completed in the second quarter of 2019. AAMTF III is managed by Alpha Investment Partners Limited (Alpha), the private fund management arm of Keppel Capital. Concurrently, Keppel Investment Management Co., Ltd. (Keppel Investment Management), the asset management arm of Keppel Capital in South Korea, will be appointed the local asset manager for the three properties. Mr Alvin Mah, CEO of Alpha, said, “The acquisition of the portfolio is in line with AAMTF III’s strategy of creating value and driving returns for our investors. These prime commercial properties are well-located in major business districts of Seoul and have good connectivity and high accessibility to public transportation. Their addition to AAMTF III also aids in the diversification of the fund’s portfolio.” Mr Robert Sung, CEO of Keppel Investment Management, said, “Driven by both foreign and domestic investors, real estate investments have been strong in Seoul.