Network18 Media & Investments Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Morden Pharma

Morden Pharma https://www.indiamart.com/morden-pharma/ Network18 Publishing is India’s leading media company with strong market presence in diverse publishing business areas spanning Consumer Magazines, B2B space. Popular titles that come under the Network18 Publishing’s Business to ... About Us Network18 Publishing is India’s leading media company with strong market presence in diverse publishing business areas spanning Consumer Magazines, B2B space. Popular titles that come under the Network18 Publishing’s Business to Consumer (B2C) umbrella are Overdrive, Better Photography, Better Interiors. These magazines today are the epitome of passion based communities in India. In addition to publications, Network18 Publishing magazines also have allied events, exhibitions, awards, seminars & brand solutions. Network18 Publishing talks & interacts with their members not only through magazines but also on the web through respective magazine sites & social media. Network18 Publishing magazines have also had their presence felt on TV with shows such as Overdrive on CNBC TV18, CNN IBN & CNBC Awaaz & Awaaz Entrepreneur on CNBC Awaaz. Overdrive is one of the most downloaded iPad apps in India. The B2B division offers multiple solutions spanning Websites, Events and Tradeshows to help help businesses multiply & establish their ground. For more information, please visit https://www.indiamart.com/morden-pharma/aboutus.html OTHER PRODUCTS P r o d u c t s & S e r v i c e s Better Interiors Magazines Better Photography Magazines AV Max Magazines Editorial Statement Magazines F a c t s h e e t Nature of Business :Service Provider CONTACT US Morden Pharma Contact Person: Tanushree Bose Ruby House, A Wing, J.K. -

NW18 Cov Letter-Investors' Update 30.06.2020.Jpg

EARNINGS RELEASE: Q1 2020-21 Mumbai, 22nd July, 2020 – Network18 Media & Investments Limited today announced its results for the quarter ended 30th June 2020. Summary Consolidated Financials . COVID-19 linked clampdown on spending by advertisers dragged ad-revenues sharply, especially on Entertainment. However, TV subscription revenue remained resilient, and Digital subscriptions have accelerated. The business strategy and operating methodology were re-engineered amidst a strategic review to address the current challenging environment. The cost base was comprehensively reset across verticals, as the organisation embraced tech-solutions and a leaner, nimbler approach. Operating EBITDA dipped on account of the revenue drag. However, aggressive and broad-based cost-controls across business verticals limited the fall. Consolidated PAT improved YoY led by a decline in finance costs. Q1FY21 Q1FY20 Growth Consolidated Operating Revenue (Rs Cr) 807 1,245 -35% Consolidated Operating EBITDA (Rs Cr) 27 46 -41% Highlights for the quarter Peak impact of COVID-19 absorbed through the quarter: Viewership in both TV and Digital media rose substantially during the lockdown, but advertising revenue was impacted as the pandemic affected consumption across advertiser categories. While News was relatively better off due to a surge in viewership, General Entertainment suffered due to no original content being produced during the lockdown and nil movie releases. Resilience in TV subscription and Digital syndication revenue partly blunted the impact, limiting the fall in Operating Revenue to 35% YoY. Linear TV subscription revenue remained resilient, 6% YoY growth in Q1: The broadcast industry was able to deliver uninterrupted services despite logistical challenges posed by the lockdown. While some rationing was witnessed (Eg: TV connections in offices, etc), subscriptions have held strong in general. -

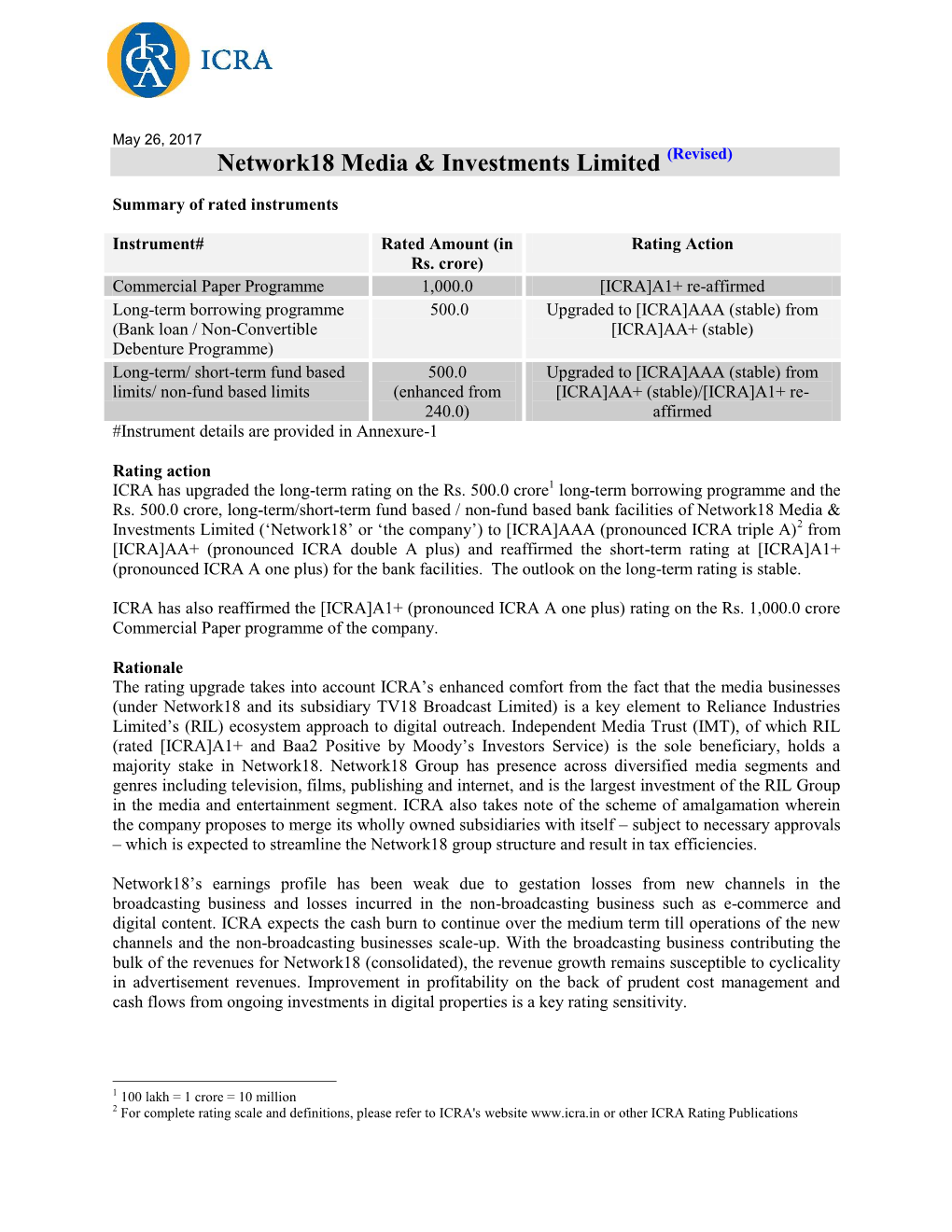

Network18 Media & Investments Limited: Update Summary of Rating

April 14, 2020 Network18 Media & Investments Limited: Update Summary of rating action Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) Commercial Paper Programme 1,500.0 1,500.0 [ICRA]A1+; outstanding Short-term, Fund-based / Non-fund 500.0 500.0 [ICRA]A1+; outstanding Based Bank Facilities Total 2,000.0 2,000.0 *Instrument details are provided in Annexure-1 Rationale The ongoing lockdown due to the coronavirus outbreak is likely to have an adverse impact on the advertisement revenues of the broadcasters in Q1 FY2021, as the corporates look to prune advertisement spends. Thus, ICRA has a Negative outlook on the industry. With advertisement comprising around 60-65% of the overall revenues of Network18 Media & Investments Limited (Network18), there is likely to be an adverse impact on its consolidated revenues and profitability during Q1 FY2021. There could also be marginal impact on the company’s consolidated Q4 FY2020 operating performance, as the lockdown was declared at the end of the quarter. Nevertheless, as per the Network18 management, subscription revenues are likely to remain stable supporting the operating performance. However, at a standalone level, the company has limited operations with large debt on its books making it dependent on cash flow support from its subsidiary, TV18 Broadcast Limited (TV18, rated [ICRA]A1+) for funding its losses and on its parentage for refinancing its existing debt. ICRA expects the company to avail additional debt or refinance its existing debt based on its strong parentage, which provides significant refinancing ability and can help to meet any short-term funding mismatch. -

Download Document

EARNINGS RELEASE: Q2 2018-19 Mumbai, 15th October, 2018 – Network18 Media & Investments Limited today announced its results for the quarter ended 30th September 2018. Summary Consolidated Financials (restated for current structure of ownership) Q2FY19 Q2FY18 Growth Consolidated Operating Revenue (Rs Cr) 1,237 1,138 9% Consolidated Operating EBITDA (Rs Cr) 92 58 59% Network18 reported a 59% jump in operating EBITDA to Rs. 92 crores in Q2FY19, driven by improved performance of regional channels (both news and entertainment); despite gestation losses of Colors Tamil and new launch Colors Kannada Cinema. While headline operating revenue grew 9% (on a comparable basis), revenue ex-movies grew 14% YoY, underscoring tailwinds in broadcasting. Highlights for the quarter The industry ad-environment has substantially improved compared with the previous year, though certain pockets of the market (mobiles, auto, colas, etc) are yet to resume advertising full- throttle. Broad-based growth in regional markets and upcoming festive season are positives. Broadcast subsidiary TV18 posted 17% revenue growth ex-movies on a comparable basis: . Advertising revenue for TV18 grew at ~18% YoY overall. Regional channels across news and entertainment drove viewership growth and ad-revenues for the portfolio, reducing our dependence on national channels. Subscription revenue for our entire bouquet grew 16% YoY. We are in negotiations with two of India’s leading DTH players for long-term deals on terms commensurate with the strength of our channel bouquet. TV18’s News bouquet (20 channels) is #1; News viewership share rose to 10.7%: . The viewership share of our regional news cluster has risen further to 5.7%, vs sub-2% two years ago. -

Q4 2016-17 Summary Consolidated Financials Highlights for the Quarter

EARNINGS RELEASE: Q4 2016-17 Mumbai, 19th April, 2017 – Network18 Media & Investments Limited today announced its results for the quarter and year ended 31st March, 2017. Summary Consolidated Financials Q4 Q4 Growth Growth Particulars (in Rs Crores) FY17 FY16 FY17 FY16 YoY% YoY% Revenue (incl. proportionate share of JVs) 898.4 898.8 0% 3,471.1 3,321.0 5% Segment profit (incl. prop. share of JVs) (65.5) 65.3 -200% (272.8) 145.3 -288% Adjusted Segment profit (incl. prop. share of JVs)* 5.0 65.3 -92% (26.1) 145.3 -118% Revenue (as per Ind AS) 387.7 473.2 -18% 1,491.0 1,527.3 -2% Operating profit (as per Ind AS) 20.7 82.7 -75% (138.0) 52.0 -365% Adjusted Operating profit (as per Ind AS)* 55.2 82.7 -33% (31.1) 52.0 -160% (*) - Adjusted for the impact of new initiatives launched within a year /one-time expense Network18 posted consolidated revenues of Rs. 3,471 crores (including proportionate share of JVs) in FY17 a 5% YoY growth, driven largely by its TV operations. Segment profits were significantly impacted by pullback in advertising spends in the latter half, operating losses of the new initiatives in regional and digital broadcasting, and losses in digital commerce businesses. Highlights for the quarter Tepid ad-industry environment dragged revenues, especially in regional markets. The media industry is still facing impact of deferment of advertising spends that kicked-in from November-December 2016 on likely slow-down in consumer spending. Further, the revival of advertising spends has been witnessed at a much faster clip for national channels, while regional markets are still recovering with a lag. -

Major Products and Brands

Reliance Industries Limited Enhancing the quality of life. Starting up to a digital life. Annual Report 2015-16 Major Products and Brands Business/Brand Product / Service Brand Logo End Uses REFINING AND MARKETING REFINING Propylene Feedstock for polypropylene Naphtha Feedstock for petrochemicals such as ethylene, propylene & fertilisers, etc. and as fuel in power plants Gasoline Transport fuel Superior Kerosene Oil Domestic fuel High Speed Diesel Transport fuel Sulphur Feedstock for fertilisers and pharmaceuticals Petroleum Coke Fuel for power plants and cement plants Alkylate High Octane blend stock for gasoline PETROLEUM RETAIL GAPCO Petroleum Retail Retail distribution of fuels Reliance Gas Liquefied Petroleum Gas (LPG) Domestic, commercial and industrial fuel Reliance Transportation fuels Retail distribution of fuels Petroleum Retail Reliance Jet / Aviation Turbine Fuel Aviation fuel Aviation Auto LPG Auto LPG Auto fuel outlet Trans Connect Fleet Management Services Fleet Management Solutions A1 Plaza Highway Hospitality Services Highway food plaza R-Care Vehicle care services Vehicle service, repair and preventive maintenance Qwik Mart Convenience shopping Shopping of beverages, snacks, gifts on highways Refresh Foods Passengers amenities/food court on highways Relstar Lubricants Lubricants PETROCHEMICALS POLYMERS Repol Polypropylene (PP) Woven sacks for packaging of cement, food-grain, sugar, fertiliser; leno bags for packaging of fruits & vegetables, TQ & BOPP films for packaging of textiles, films and containers for processed -

TV18 Broadcast Limited

TV18 Broadcast Limited Instrument Amount Rating Action Rs. Crore Long-Term/Short-Term Fund Rs. 354 Crore Upgraded to [ICRA]AA+ (Stable) Based /Non-Fund based Limits (PY: Rs 370 Crore) from [ICRA]A (positive)/ [ICRA]A1+ reaffirmed Fixed Deposits Programme Nil Upgraded to MAA+ (Stable) from MA (positive) and placed on Notice of Withdrawal Commercial Paper Programme Rs. 400 Crore (includes Rs. [ICRA]A1+ reaffirmed/ re- 200 crore CP Programme assigned reaffirmed and re-assigned structured obligation limits of Rs. 200 crore) The ratings assigned to the Rs 354 crore (PY: Rs 370 crore) bank facilities of TV18 Broadcast Limited (‘TV18’ or ‘the company’) have been upgraded/reaffirmed at [ICRA]AA+/[ICRA]A1+ (pronounced ICRA double A plus/ICRA A one plus) from [ICRA]A/[ICRA]A1+ (pronounced ICRA A/ ICRA A one plus). The outlook on the long-term rating has been changed to “Stable” from “Positive”. The short-term rating on the Rs 200 crore Commercial Paper Programme of TV18 has been reaffirmed at [ICRA]A1+ (pronounced ICRA A one plus). ICRA has also reassigned the rating on the Rs 200 crore Commercial Paper Programme of TV18 to [ICRA]A1+ (pronounced ICRA A one plus) from [ICRA]A1+(SO) (pronounced ICRA A one plus Structured Obligation) as there is no standby facility against the same and added the same to the total Commercial Paper Progamme limits that aggregate to Rs. 400 crore. ICRA has also upgraded the rating assigned to the Fixed Deposit Programme of TV18 to MAA+ (Stable) (pronounced M double A plus with Stable outlook) from MA (Positive) (pronounced M A with Positive outlook) and placed the same on Notice of Withdrawal for six months at the request of the company. -

Q4 2018-19 Summary Consolidated Financials Highlights for the Quarter

EARNINGS RELEASE: Q4 2018-19 Mumbai, 15th April, 2019 – Network18 Media & Investments Limited today announced its results for the quarter and financial year ended 31st March 2019. Summary Consolidated Financials FY19 ex-film revenue rose 7% YoY on continued regional growth and a reviving ad- environment. Implementation of New tariff order impacted Q4, dragging full-year growth; but is likely to be a medium-term positive. FY19 EBITDA was up 13% YoY despite Rs 131 Cr investments into new regional channels, launch of FirstPost Print and Digital expansions (VOOT International & Kids, CricketNext). Regional News gestation losses reduced 42% YoY. Business-as-usual Entertainment EBITDA margins rose to 9% (vs 5%). (restated for current structure of ownership) Q4FY19 Q4FY18 Growth FY19 FY18 Growth Consolidated Operating Revenue (Rs Cr) 1,231 1,597 -23% 5,116 5,027 2% Revenue Ex-film production 1,183 1,268 -7% 4,901 4,577 7% Consolidated Operating EBITDA (Rs Cr) 12 54 -79% 212 188 13% Q4FY19 ex-film revenues dipped 7% YoY (headline revenue was down 23% due to movie ‘Padmaavat’ last year), led by flux around implementation of the new tariff order, and Nidahas trophy cricket and other live events, and union budget coverage in the base quarter which were absent this year. Highlights for the quarter Flux around implementation of new tariff order (NTO) from 1st Feb 2019: . Advertisers pulled back spends due to lack of stable viewership data. Viewership has been impacted for all major broadcasters as process of consumers choosing channels/packs and on-ground realignments in distribution value-chain are still underway. -

Download Brochure

MIT INSTITUTE OF DESIGN RAJBAUG, LONI KALBHOR, PUNE 412201 T. 020. 3069 3694/ 95/ 96/ 97 www.mitid.edu.in DESIGN EDUCATION AT MITID Ensure Karman Let Phalam the process is right in action the product evolve by itself CONTENT Who we are 01 Industrial Design 26 Philosophy 02 Product Design 27 Habitat 03 Transport Design 33 Faculty 05 Interior space and furniture Design 39 Infrastructure 14 Retail Design 43 Rajbaug 19 User Experience Design 47 How to get there 21 Communication Design 49 Admissions 22 Graphic Design 51 Design as a career 23 Animation Design 59 Film & Video Design 67 Fashion Design 71 Pre Design 79 Training & placement 86 PHILOSOPHY WHO WE ARE About MAEERs MIT The Maharashtra Academy of Engineering & Educational Research Founded : 1983 (MAEER) was established as a society and trust with the sole aim of creating and developing professional education facilities to train the Education at the MIT Institute of Design has been categorized into aspiring young generation and thus to provide dedicated, ambitious mainly three domains. The first is the domain of ‘skill’, Sadhan. These and skilled professionals to serve the society and the nation at large. are those design skills and design tools that should help students MAEER believes that the union of Science and Spirituality alone SADHAN to communicate convincingly, the outcome of every stage of the will bring Harmony and Peace to The Humanity, as said by Swami design process. For this, they will learn to employ all necessary Vivekananda. The vision of the founders of MAEER is to create a media and materials. -

Network18 Media & Investments Limited

November 09, 2020 Network18 Media & Investments Limited: Rating reaffirmed Summary of rating action Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) Commercial Paper Programme 1,500.0 1,500.0 [ICRA]A1+ reaffirmed Long-term / Short-term, Fund- [ICRA]A1+ reaffirmed based / Non-fund based Bank 500.0 500.0 Facilities Total 2,000.0 2,000.0 *Instrument details are provided in Annexure-1 Rationale The rating reaffirmation factors in Network18 Media & Investments Limited’s (Network18) strong parentage, which lends support to the company’s financial profile and provides a significant refinancing ability. The media businesses under Network18 and its 51.17% subsidiary, TV18 Broadcast Limited (TV18, rated [ICRA]A1+) remain strategically important to Reliance Industries Limited’s (RIL, rated [ICRA]AAA (Stable) / [ICRA]A1+ and Baa2 (Stable) by Moody’s Investors Service) ecosystem approach to digital outreach. Independent Media Trust (IMT), of which RIL is the sole beneficiary, holds a majority stake (73.15%) in Network18. In FY2018, TV18 raised its stake in Viacom18 Media Private Limited (Viacom18), its joint venture (JV) with Viacom Inc., to 51% from 50%, thereby gaining operational control of the JV, further reiterating the Group’s commitment to the media business. The strategic importance of the media business to the RIL Group, given that this is the largest investment of the Group in the media and entertainment segment, augurs well for the future business growth of the company. The Network18 Group has diversified presence across media segments and genres including television, films, publishing and internet, and is the largest investment of the RIL Group in the media and entertainment segment. -

About Network18 Group

About Network18 Group Network18 Group is a media and entertainment group with interests in broadcasting, digital, movies, e- commerce, magazines, mobile content and allied businesses. TV18 Broadcast Limited [BSE: 532800, NSE: TV18BRDCST] is the broadcasting arm of Network18. TV18 operates India’s largest bouquet of News channels across 15 languages and 26 states; with marquee properties like CNBC-TV18 in Business News and CNN News18 in English News. Through its JV Viacom18, it also operates a portfolio of entertainment channels across genres, including leading premium local and global brands like Colors, Nickelodeon and MTV. Viacom18 also operates OTT platform VOOT, and produces and distributes films through Viacom18 Motion Pictures. Through TV18, the network operates a bouquet of 13 regional news channels under the News18 brand name. TV18 also operates a joint venture with the Lokmat Group which houses the Marathi news channel News18 Lokmat. To cover the global audience & sizable NRI population, TV18 operates News18, a twenty-four hour television news channel designed to give global audiences a window into the world’s largest democracy. TV18’s Infotainment JV AETN18 that operates channels such as History and FYI, and distribution/syndication JV Indiacast complete the bouquet of offerings, making TV18 a full- portfolio broadcast player. Through 'Network18 Media & Investments Ltd.' [BSE: 532798, NSE: Network18], the group operates its digital, publishing and e-commerce assets including moneycontrol.com, news18.com, cnbctv18.com and firstpost.com. Network18 has significant interest in e-commerce property, bookmyshow.com and also publishes Forbes India, the nation's first local edition of a foreign news magazine in collaboration with Forbes Media. -

Network 18 Media & Investments Limited

Network 18 Media & Investments Limited February 14, 2018 Summary of rated instruments Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) Commercial Paper Programme 1,000.0 1,500.0 [ICRA]A1+; Assigned Long-term Borrowing Programme 500.0 [ICRA]AAA (Stable) (Bank Loan / Non-Convertible 500.0 Outstanding Debenture Programme) Long-term/ Short-term, Fund-based [ICRA]AAA (Stable) / 500.0 500.0 Limits/ Non-fund Based Limits [ICRA]A1+ Outstanding Total 2,000.0 2,500.0 - * Instrument details are provided in Annexure-1 Rating action ICRA has assigned an [ICRA]A1+ (pronounced ICRA A one plus)1 rating to the Rs. 1,500 crore (enhanced from Rs. 1,000.0 crore2) commercial paper programme of Network 18 Media & Investments Limited (‘Network18’ or ‘the company’). ICRA also has [ICRA]AAA (pronounced ICRA triple A) rating outstanding on the company’s long-term borrowing programme and [ICRA]AAA and [ICRA]A1+ ratings outstanding on the Rs. 500.0 crore long-term/ short-term, fund-based limits/ non- fund based limits of the company. The outlook on the long-term rating is ‘Stable’. Rationale The assigned rating continues to factor in ICRA’s comfort from the fact that the media and digital businesses (under Network18 and its subsidiary TV18 Broadcast Limited, TV18) are a key element to Reliance Industries Limited’s (RIL) ecosystem approach to digital outreach. Independent Media Trust (IMT), of which RIL (rated [ICRA]AAA (Stable) / [ICRA]A1+ and Baa2 Stable by Moody’s Investors Service) is the sole beneficiary, holds a major stake in Network18.