Directors, Supervisors and Senior Management

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Quantitative Evaluation for the Threat Degree of a Thermal Reservoir to Deep Coal Mining

Hindawi Geofluids Volume 2020, Article ID 8885633, 15 pages https://doi.org/10.1155/2020/8885633 Research Article Quantitative Evaluation for the Threat Degree of a Thermal Reservoir to Deep Coal Mining Yun Chen ,1 Xinyi Wang ,1,2,3 Yanqi Zhao ,1 Haolin Shi ,1 Xiaoman Liu ,1 and Zhigang Niu 4 1School of Resource and Environment, Henan Polytechnic University, Jiaozuo 454000, China 2Collaborative Innovation Center of Coalbed Methane and Shale Gas for Central Plains Economic Region of Henan Province, Jiaozuo 454000, China 3State Collaborative Innovation Center of Coal Work Safety and Clean-Efficiency Utilization, Jiaozuo 454000, China 4Henan Provincial Coal Geological Survey and Research Institute, Zhengzhou 450052, China Correspondence should be addressed to Xinyi Wang; [email protected] and Yanqi Zhao; [email protected] Received 25 May 2020; Revised 7 September 2020; Accepted 19 October 2020; Published 9 November 2020 Academic Editor: Hualei Zhang Copyright © 2020 Yun Chen et al. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. Taking the Suiqi coalfield located in North China as the object, where the coal seam burial depth is more than 1100 m, the water abundance of the roof pore thermal storage aquifer is better than average, the ground temperature is abnormally high, and hydrogeological data are relatively lacking, this paper selects and determines eight index factors that influence the mining of the coalfield. Based on the analytic hierarchy process (AHP), the index factor weight is defined, and then, the threat degree of the roof thermal storage aquifer to the coal mining is quantitatively evaluated and divided by using the fuzzy variable set theory. -

2018 Interim Report

Chi na CITI Important Notice The Board of Directors, the Board of Supervisors, C B (A joint stock company incorporated directors, supervisors and senior management members of the Bank guarantee that the an in the People’s Republic of China with limited liability) information contained in the 2018 Interim Report k does not include any false records, misleading Corpora Stock Code: 0998 statements or material omissions, and assume several and joint liabilities for its truthfulness, accuracy and completeness. The meeting of the Board of Directors of the Bank ti adopted the Bank’s 2018 Interim Report and Interim on Results Announcement on 27 August 2018. All of the L 10 eligible directors attended the meeting, with 8 of imi them attending the meeting onsite, and Director Zhu Gaoming and Director Wan Liming entrusting ted Director Huang Fang to attend and vote on their behalf as proxies, respectively. The supervisors and senior management members of the Bank attended 2018 the meeting as non-voting delegates. The Bank will neither distribute profits nor transfer In capital reserve to share capital for the first half of terim Re 2018. The 2018 Interim Financial Reports that the Bank prepared in accordance with the PRC Accounting Standards and the International Financial Reporting po Standards (IFRS) were reviewed respectively by rt PricewaterhouseCoopers Zhong Tian LLP and PricewaterhouseCoopers in accordance with the relevant PRC and Hong Kong review standards. Ms. Li Qingping as Chairperson of the Board of Directors, Mr. Sun Deshun as President of the Bank, Mr. Fang Heying as Vice President and Chief Financial Officer of the Bank and Ms. -

Directors, Supervisors and Senior Management

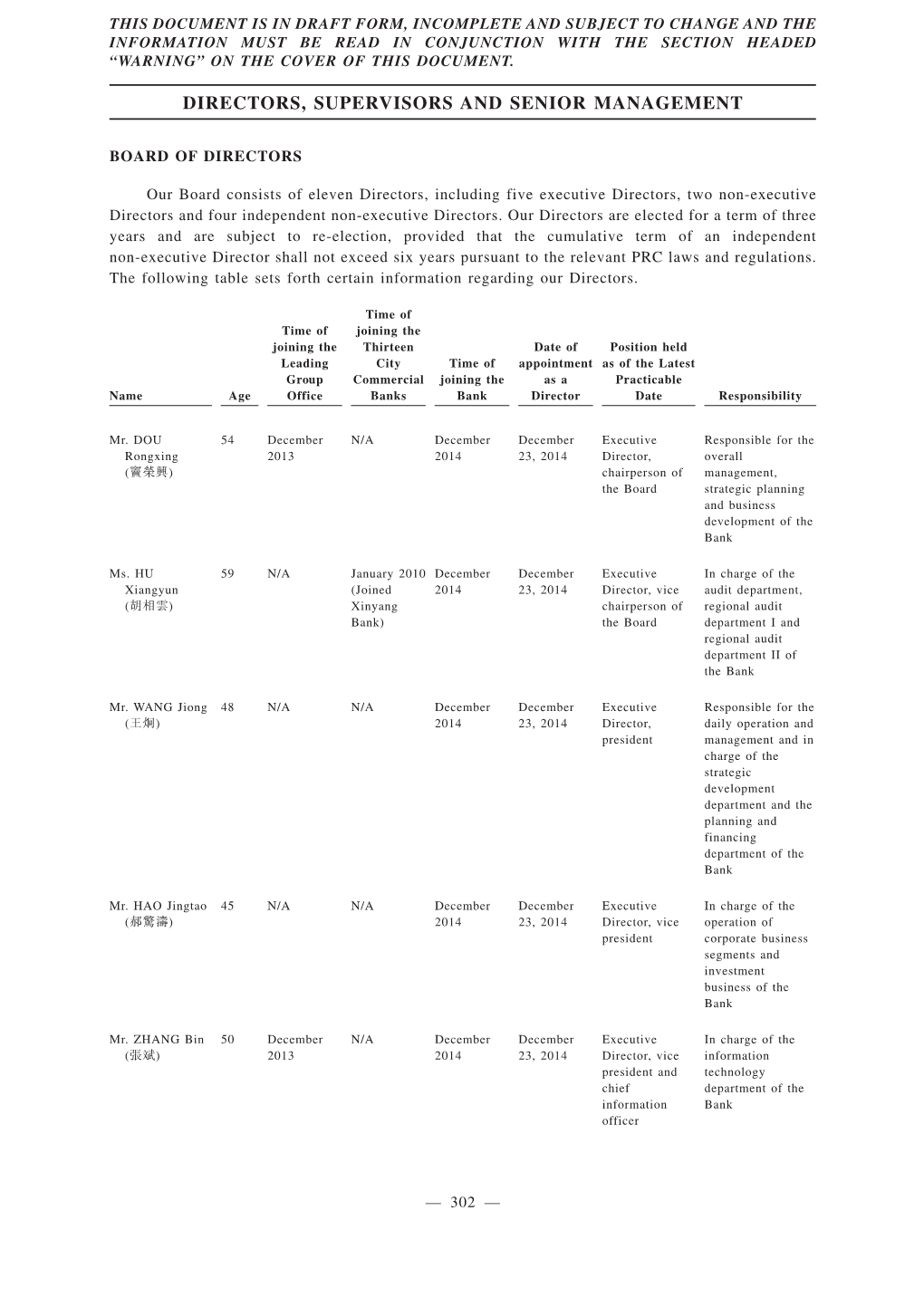

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT. DIRECTORS, SUPERVISORS AND SENIOR MANAGEMENT BOARD OF DIRECTORS App1A-41(1) The Board consists of eleven Directors, including five executive Directors, two non-executive 3rd Sch 6 Directors and four independent non-executive Directors. The Directors are elected for a term of three years and are subject to re-election, provided that the cumulative term of an independent non-executive Director shall not exceed six years pursuant to the relevant PRC laws and regulations. The following table sets forth certain information regarding the Directors. Time of Time of joining the joining the Thirteen Date of Position held Leading City Time of appointment as of the Latest Group Commercial joining the as a Practicable Name Age Office Banks Bank Director Date Responsibility Mr. DOU 54 December N/A December December Executive Responsible for the Rongxing 2013 2014 23, 2014 Director, overall management, (竇榮興) chairperson of strategic planning and the Board business development of the Bank Ms. HU 59 N/A January 2010 December December Executive In charge of the audit Xiangyun (Joined 2014 23, 2014 Director, vice department, regional (胡相雲) Xinyang chairperson of audit department I and Bank) the Board regional audit department II of the Bank Mr. WANG Jiong 49 N/A N/A December December Executive Responsible for the (王炯) 2014 23, 2014 Director, daily operation and president management and in charge of the strategic development department and the planning and financing department of the Bank Mr. -

Global Offering

CHINA CHUNLAI EDUCATION GROUP CO., LTD. 中國春來教育集團有限公司 (incorporated in the Cayman Islands with limited liability) Stock Code: 1969 GLOBAL OFFERING Sole Sponsor Joint Global Coordinators Joint Bookrunners and Joint Lead Managers IMPORTANT IMPORTANT: If you are in doubt about any of the contents of this document, you should obtain independent professional advice. CHINA CHUNLAI EDUCATION GROUP CO., LTD. 中國春來教育集團有限公司 (incorporated in the Cayman Islands with limited liability) GLOBAL OFFERING Number of Offer Shares under the Global Offering : 300,000,000 Shares (subject to the Over-allotment Option) Number of Hong Kong Public Offer Shares : 30,000,000 Shares (subject to reallocation) Number of International Offering Shares : 270,000,000 Shares (subject to reallocation and the Over-allotment Option) Maximum Offer Price : HK$2.98 per Offer Share plus brokerage of 1%, SFC transaction levy of 0.0027% and Stock Exchange trading fee of 0.005% (payable in full on application in Hong Kong dollars, subject to refund) Nominal Value : HK$0.00001 per Share Stock Code : 1969 Sole Sponsor Joint Global Coordinators Joint Bookrunners and Joint Lead Managers Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. A copy of this document, having attached thereto the documents specified in the paragraph headed “Documents Delivered to the Registrar of Companies” in Appendix VI to this document, has been registered by the Registrar of Companies in Hong Kong as required by section 342C of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Chapter 32 of the Laws of Hong Kong). -

Table of Codes for Each Court of Each Level

Table of Codes for Each Court of Each Level Corresponding Type Chinese Court Region Court Name Administrative Name Code Code Area Supreme People’s Court 最高人民法院 最高法 Higher People's Court of 北京市高级人民 Beijing 京 110000 1 Beijing Municipality 法院 Municipality No. 1 Intermediate People's 北京市第一中级 京 01 2 Court of Beijing Municipality 人民法院 Shijingshan Shijingshan District People’s 北京市石景山区 京 0107 110107 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Haidian District of Haidian District People’s 北京市海淀区人 京 0108 110108 Beijing 1 Court of Beijing Municipality 民法院 Municipality Mentougou Mentougou District People’s 北京市门头沟区 京 0109 110109 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Changping Changping District People’s 北京市昌平区人 京 0114 110114 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Yanqing County People’s 延庆县人民法院 京 0229 110229 Yanqing County 1 Court No. 2 Intermediate People's 北京市第二中级 京 02 2 Court of Beijing Municipality 人民法院 Dongcheng Dongcheng District People’s 北京市东城区人 京 0101 110101 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Xicheng District Xicheng District People’s 北京市西城区人 京 0102 110102 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Fengtai District of Fengtai District People’s 北京市丰台区人 京 0106 110106 Beijing 1 Court of Beijing Municipality 民法院 Municipality 1 Fangshan District Fangshan District People’s 北京市房山区人 京 0111 110111 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Daxing District of Daxing District People’s 北京市大兴区人 京 0115 -

Education of Traditional Folk Arts and Crafts and Discipline Construction of Art Design

IOSR Journal of Research & Method in Education (IOSR-JRME) e-ISSN: 2320–1959.p- ISSN: 2320–1940 Volume 9, Issue 6 Ser. III. (Nov. - Dec .2019), PP 74-76 www.iosrjournals.org Education of Traditional Folk Arts and Crafts and Discipline Construction of Art Design Zhang Sufang (Anyang Wenfeng District Shuobo Painting and Calligraphy Art School, Anyang China) Abstract: The art design is a young discipline in China, which needs to be further strengthened and accelerated in development. With the rise of intangible cultural heritage research,the traditional folk arts and crafts has gradually been valued in the design discipline, which plays a significant role in the construction of design disciplines to provide resource support for design disciplines, especially incurriculum, profession, and discipline research. Key words: Traditional folk craft, Art education, Art design, Discipline construction ----------------------------------------------------------------------------------------------------------------------------- --------- Date of Submission: 02-12-2019 Date of acceptance: 18-12-2019 ----------------------------------------------------------------------------------------------------------------------------- ---------- I. Introduction Traditional folk arts and crafts, as an important part of folk art, are used to express folk culture and life, which have important practical value. From the perspective of its usage objects, traditional folk arts and crafts are relative to court arts and crafts; From perspective of the development history of arts and crafts, traditional folk arts and crafts are relative to modern arts and crafts. its creators are basically labouring people engaged in material production. In recent years, intangible cultural heritage has been receiving more and more attention from the world. traditional folk arts and crafts have been gradually focused in academic field. They have been added into the classrooms of many art colleges, not only enriching and perfecting the original art education system, but also benefiting for the art design discipline. -

A Case Study of Flood Risk Evaluation Based on Emergy Theory and Cloud Model in Anyang Region, China

water Article A Case Study of Flood Risk Evaluation Based on Emergy Theory and Cloud Model in Anyang Region, China Zening Wu, Yuhai Cui and Yuan Guo * School of Water Conservancy Engineering, Zhengzhou University, Zhengzhou 450001, China; [email protected] (Z.W.); [email protected] (Y.C.) * Correspondence: [email protected]; Tel.: +86-182-1194-3436 Abstract: With the progression of climate change, the intensity and frequency of extreme rainfall have increased in many parts of the world, while the continuous acceleration of urbanization has made cities more vulnerable to floods. In order to effectively estimate and assess the risks brought by flood disasters, this paper proposes a regional flood disaster risk assessment model combining emergy theory and the cloud model. The emergy theory can measure many kinds of hazardous factor and convert them into unified solar emergy (sej) for quantification. The cloud model can transform the uncertainty in flood risk assessment into certainty in an appropriate way, making the urban flood risk assessment more accurate and effective. In this study, the flood risk assessment model combines the advantages of the two research methods to establish a natural and social dual flood risk assessment system. Based on this, the risk assessment system of the flood hazard cloud model is established. This model was used in a flood disaster risk assessment, and the risk level was divided into five levels: very low risk, low risk, medium risk, high risk, and very high risk. Flood hazard risk results were obtained by using the entropy weight method and fuzzy transformation method. -

SUNAC CHINA HOLDINGS LIMITED 融創中國控股有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 01918)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no 14.88 responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. SUNAC CHINA HOLDINGS LIMITED 融創中國控股有限公司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 01918) (1) VERY SUBSTANTIAL ACQUISITION ENTERING INTO OF FRAMEWORK AGREEMENT IN RELATION TO THE COOPERATION OF TARGET PROJECT COMPANIES AND TARGET HOTEL ASSETS AND (2) RESUMPTION OF TRADING IN SHARES THE COOPERATION The Board is pleased to announce that, on 10 July 2017, Sunac Real Estate, an indirect wholly-owned subsidiary of the Company as the buyer, and Dalian Wanda Commercial Properties as the seller entered into the Framework Agreement, pursuant to which the Buyer agreed to acquire, and the Seller agreed to dispose of 91% equity interest of the 13 cultural and tourism project companies in the PRC (i.e. the Target Project Companies) and 100% interest of the 76 city hotels (i.e. the Target Hotel Assets) at the consideration of approximately RMB29,575,000,000 and RMB33,595,260,800 respectively. Thus, the total consideration for the Cooperation is approximately RMB63,170,260,800. Before completion of the Cooperation, the Seller held 100% equity interest of the Target Project Companies and 100% interest of the Target Hotel Assets. After completion of the Cooperation, the Buyer will hold 91% equity interest of the Target Project Companies and 100% interest of the Target Hotel Assets, while the Seller will continue to hold 9% equity interest of the Target Project Companies. -

Shijianzhuang-Zhengzhou Railway Project Public Disclosure Authorized

Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized Shijianzhuang-Zhengzhou Railway Project Railway Shijianzhuang-Zhengzhou Resettlement Executive Summary Executive January Action 2007 Plan Contents A. Project Introduction 1. Significance and Purpose of Project Construction 2. Project Composition 3. Measures for Avoidance or mitigation of impact due to LAR B. Scope of Impacts 4. General 4.1 Land to be acquired 4.2 Dwelling Houses or other Buildings to be Demolited and Relocated 4.2.1 Demolition Coverage for Project 4.2.2 Demolition Coverage for Environment Impact and Environment Protection 4.3 Fixed assets taken 4.4 Businesses (and employees) affected by temporary or permanent displacement 5. Impact on Socio-Cultural Environment 5.1 Nationalities 5.2 Cultural Relics C. Policy Objectives, Principles and Definitions 6. Laws, Rehlations and Documents 7. Policy Objectives 8. Policy Principles 9. Definition of "Affected Population" 10. Definition of "Replacement Cost " D. Compensation 1 1. Compensation 1 1.1 Land compensation fee 11.2 Woodland 11.3 Young crop compensation 1 1.4 Relocation subsidy to householders 11.5 Compensation for loss of business 1 employment opportunities 1 1.6 Relocation of public buildings 1 1.7 Land adjustment 11.8 Training courses 11.9 Compensation qualifications and closing date E. Rehabilitation Measures 12.1 House Demolition and Restoration Plan 12.1.1 New Site Planning, Development and Selection 12.1.2 Ways of house rehabilitation 12.1.3 Implement -

Expressions of PCNA, P53, P21waf-1 and Cell

P.O.Box 2345, Beijing 100023,China World J Gastroenterol 2003;9(7):1601-1603 Fax: +86-10-85381893 World Journal of Gastroenterology E-mail: [email protected] www.wjgnet.com Copyright © 2003 by The WJG Press ISSN 1007-9327 • BRIEF REPORTS • Expressions of PCNA, p53, p21WAF-1 and cell proliferation in fetal esophageal epithelia: Comparative study with adult esophageal lesions from subjects at high-incidence area for esophageal cancer in Henan, North China Ying Xing, Yu Ning, Li-Qiang Ru, Li-Dong Wang Ying Xing, Li-Qiang Ru, Department of Neurobiology, Tongji Xing Y, Ning Y, Ru LQ, Wang LD. Expressions of PCNA, p53, Medical College, Huazhong University of Science and Technology, p21WAF-1 and cell proliferation in fetal esophageal epithelia: Wuhan, 430030, Hubei Province, China Comparative study with adult esophageal lesions from subjects Yu Ning, Department of Physiology, College of Medicine, Zhengzhou at high-incidence area for esophageal cancer in Henan, North University, Zhengzhou, 450052, Henan Province, China China. World J Gastroenterol 2003; 9(7): 1601-1603 Li-Dong Wang, Laboratory for Cancer Research, College of Medicine, http://www.wjgnet.com/1007-9327/9/1601.asp Zhengzhou University, Zhengzhou, 450052, Henan Province, China Supported by National Distinguished Young Scientist Foundation of China, No.30025016 Correspondence to: Dr. Li-Dong Wang, Professor of Pathology and INTRODUCTION Oncology and Ying Xing, Professor of Physiology, Laboratory for Cancer Research, College of Medicine, Zhengzhou University, Fetal esophageal epithelium is characterized by cellular Zhengzhou 450052, Henan Province, China. [email protected] hyperproliferation. Tumor suppressor genes have been known Telephone: +86-371-6970165 Fax: +86-371-6970165 to suppress malignant cell proliferation through encoding Received: 2003-03-02 Accepted: 2003-03-25 corresponding proteins that inhibit cell cycle. -

Flood Adaptive Landscapes in the Yellow River Basin of China

Journal of Landscape Architecture ISSN: 1862-6033 (Print) 2164-604X (Online) Journal homepage: http://www.tandfonline.com/loi/rjla20 Living with Water: Flood Adaptive Landscapes in the Yellow River Basin of China Kongjian Yu , Zhang Lei & Li Dihua To cite this article: Kongjian Yu , Zhang Lei & Li Dihua (2008) Living with Water: Flood Adaptive Landscapes in the Yellow River Basin of China, Journal of Landscape Architecture, 3:2, 6-17, DOI: 10.1080/18626033.2008.9723400 To link to this article: https://doi.org/10.1080/18626033.2008.9723400 Published online: 01 Feb 2012. Submit your article to this journal Article views: 364 View related articles Citing articles: 3 View citing articles Full Terms & Conditions of access and use can be found at http://www.tandfonline.com/action/journalInformation?journalCode=rjla20 living with Water: Flood adaptive landscapes in the yellow river Basin of China Kongjian Yu, Zhang Lei, Li Dihua the graduate school of landscape architecture, Peking University Abstract Introduction This paper is a report on a research project. It shows how the past expe- Global warming and climate change may increase flood hazards in some rience of adaptive strategies that have evolved in the long history of sur- regions and drought in others. While reducing greenhouse gas emissions vival under hazardous conditions is inspiring for us in facing future un- is a priority, it is of no less significance to develop adaptive strategies to certainty. Based on a study of several ancient cities in the Yellow River lessen the potential hazards caused by climate change. The past experience floodplain, this paper discusses the disastrous experience of floods and of adaptive strategies evolved in the long history of survival under hazard- waterlogging and finds three major adaptive landscape strategies: siting ous conditions is inspiring for us in facing future uncertainty. -

The Sociolinguistic Analysis of the Names of the Local Restaurants -- Taking Wenfeng District in Anyang Cty As an Example

SSH, 2020, Volume 9 ttp://paper.ieti.net/ssh/index.html DOI: http://dx.doi.org/10.6896/IETITSSH.202010_9.0001 The Sociolinguistic Analysis of the Names of the Local Restaurants -- Taking Wenfeng District in Anyang Cty as An Example Cui Jing Guangdong University of Science and Technology, SongShan hu Campus, Dongguan city, Guangdong province, China [email protected] KEYWORDS: Restaurants’ Names, Sociolinguistics, Linguistic Variation ABSTRACT: There is an old saying in China called "Food is the first necessity of the people". Chinese food is famous and has a long history. Chinese local restaurants different names have been influenced by different political, economic, environmental, and cultural backgrounds, which is a miniature of the national culture in different historical periods. This article aims to analyze the different types of restaurants’ names used in Wenfeng district, Anyang city, Henan province, China, from social factors and linguistic factors in order to make some contribution to the Chinese diet and diet culture external communication and advocacy, and overseas Chinese restaurants’ chain expansion. 1 INTRODUCTION Chinese dietary culture has a long history, and the name of the restaurant also contains deep social and linguistic factors. In this paper, the author tries to explore the internal factors of sociolinguistics by analyzing real data from 1st Jan. 2017- 1st Jan. 2018 by the restaurants in Wenfeng District, Anyang city, Henan province. 2 ORGANIZATION OF THE TEXT 2.1 Literature Review The author searched sociolinguistics by CNKI + name, and the relevant 240 papers in 28th Jan.2018, for example, in 2013, Hong-bo Ma published an article Social linguistics Analysis of Anyang City’s restaurant Names, and it contains too many names, but ignores the social factors of occupational factors.