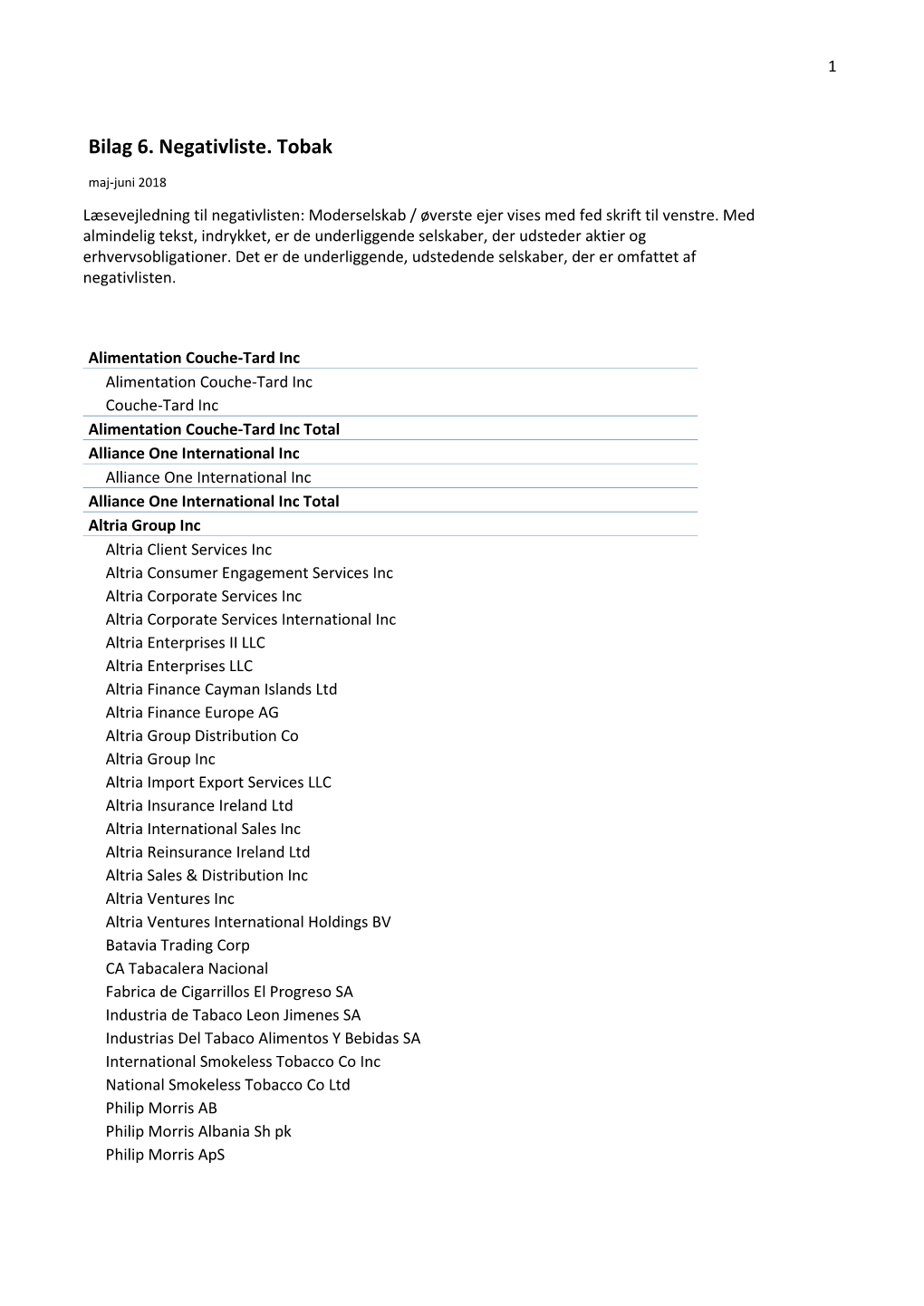

Bilag 6. Negativliste. Tobak

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tobacco Labelling -.:: GEOCITIES.Ws

Council Directive 89/622/EC concerning the labelling of tobacco products, as amended TAR AND NICOTINE CONTENTS OF THE CIGARETTES SOLD ON THE EUROPEAN MARKET AUSTRIA Brand Tar Yield Nicotine Yield Mg. Mg. List 1 A3 14.0 0.8 A3 Filter 11.0 0.6 Belvedere 11.0 0.8 Camel Filters 14.0 1.1 Camel Filters 100 13.0 1.1 Camel Lights 8.0 0.7 Casablanca 6.0 0.6 Casablanca Ultra 2.0 0.2 Corso 4.0 0.4 Da Capo 9.0 0.4 Dames 9.0 0.6 Dames Filter Box 9.0 0.6 Ernte 23 13.0 0.8 Falk 5.0 0.4 Flirt 14.0 0.9 Flirt Filter 11.0 0.6 Golden Smart 12.0 0.8 HB 13.0 0.9 HB 100 14.0 1.0 Hobby 11.0 0.8 Hobby Box 11.0 0.8 Hobby Extra 11.0 0.8 Johnny Filter 11.0 0.9 Jonny 14.0 1.0 Kent 10.0 0.8 Kim 8.0 0.6 Kim Superlights 4.0 0.4 Lord Extra 8.0 0.6 Lucky Strike 13.0 1.0 Lucky Strike Lights 9.0 0.7 Marlboro 13.0 0.9 Marlboro 100 14.0 1.0 Marlboro Lights 7.0 0.6 Malboro Medium 9.0 0.7 Maverick 11.0 0.8 Memphis Classic 11.0 0.8 Memphis Blue 12.0 0.8 Memphis International 13.0 1.0 Memphis International 100 14.0 1.0 Memphis Lights 7.0 0.6 Memphis Lights 100 9.0 0.7 Memphis Medium 9.0 0.6 Memphis Menthol 7.0 0.5 Men 11.0 0.9 Men Light 5.0 0.5 Milde Sorte 8.0 0.5 Milde Sorte 1 1.0 0.1 Milde Sorte 100 9.0 0.5 Milde Sorte Super 6.0 0.3 Milde Sorte Ultra 4.0 0.4 Parisienne Mild 8.0 0.7 Parisienne Super 11.0 0.9 Peter Stuyvesant 12.0 0.8 Philip Morris Super Lights 4.0 0.4 Ronson 13.0 1.1 Smart Export 10.0 0.8 Treff 14.0 0.9 Trend 5.0 0.2 Trussardi Light 100 6.0 0.5 United E 12.0 0.9 Winston 13.0 0.9 York 9.0 0.7 List 2 Auslese de luxe 1.0 0.1 Benson & Hedges 12.0 1.0 Camel 15.0 1.0 -

Annual-Report-2020.Pdf

LAPORAN TAHUNAN LAPORAN TAHUNAN 2020 ANNUAL REPORT 2020 ANNUAL REPORT ANNUAL Kantor Pusat Headquarters Jl. Rungkut Industri Raya No.18 Surabaya 60293, Indonesia Telephone: +62-31-8431-699 Tbk. PT HM SAMPOERNA Facsimile: +62-31-8430-986 Kantor Perwakilan di Jakarta Corporate Representative Office in Jakarta One Pacific Place, 18th Floor Sudirman Central Business District (SCBD) Jl. Jend. Sudirman Kav.52-53 Jakarta 12190, Indonesia PT HM SAMPOERNA Tbk. Telephone: +62-21-5151-234 Facsimile: +62-21-5152-234 Website: www.sampoerna.com 2020 Email: [email protected] LAPORAN TAHUNAN | ANNUAL REPORT LAPORAN TAHUNAN LAPORAN TAHUNAN LAPORAN TAHUNAN 2020 ANNUAL REPORT 2020 ANNUAL REPORT ANNUAL Kantor Pusat Headquarters Jl. Rungkut Industri Raya No.18 Surabaya 60293, Indonesia Telephone: +62-31-8431-699 PT HM S Facsimile: +62-31-8430-986 Kantor Perwakilan di Jakarta Corporate Representative Office in Jakarta AMPOERNA One Pacific Place, 18th Floor Sudirman Central Business District (SCBD) Jl. Jend. Sudirman Kav.52-53 Jakarta 12190, Indonesia Telephone: +62-21-5151-234 Tbk. Facsimile: +62-21-5152-234 Website: www.sampoerna.com Email: [email protected] 2020 LAPORAN TAHUNAN | ANNUAL REPORT Daftar Isi Contents Ikhtisar Highlights Sekilas Sampoerna 4 Sampoerna at a Glance Fakta-fakta Penting 2020 6 2020 Key Facts Ikhtisar Utama 2020 8 Key Highlights 2020 Kinerja Utama dan Ikhtisar Keuangan 14 Key Performance and Financial Highlights Ikhtisar Saham 15 Stock Highlights Penghargaan dan Sertifikasi 16 Awards and Certifications -

The Reason Given for the UK's Decision to Float Sterling Was the Weight of International Short-Term Capital

- Issue No. 181 No. 190, July 6, 1972 The Pound Afloat: The reason given for the U.K.'s decision to float sterling was the weight of international short-term capital movements which, despite concerted intervention from the Bank of England and European central banks, had necessitated massive sup port operations. The U.K. is anxious that the rate should quickly o.s move to a "realistic" level, at or around the old parity of %2. 40 - r,/, .• representing an effective 8% devaluation against the dollar. A w formal devaluation coupled with a wage freeze was urged by the :,I' Bank of England, but this would be politically embarrassing in the }t!IJ light of the U.K. Chancellor's repeated statements that the pound was "not at an unrealistic rate." The decision to float has been taken in spite of a danger that this may provoke an international or European monetary crisis. European markets tend to consider sterling as the dollar's first line of defense and, although the U.S. Treasury reaffirmed the Smithsonian Agreement, there are fears throughout Europe that pressure on the U.S. currency could disrupt the exchange rate re lationship established last December. On the Continent, the Dutch and Belgians have put forward a scheme for a joint float of Common Market currencies against the dollar. It will not easily be implemented, since speculation in the ex change markets has pushed the various EEC countries in different directions. The Germans have been under pressure to revalue, the Italians to devalue. Total opposition to a Community float is ex pected from France (this would sever the ties between the franc and gold), and the French also are adamant that Britain should re affirm its allegiance to the European monetary agreement and return to a fixed parity. -

1 Introduction

Formulation of an Integrated River Basin Management and Development Master Plan for Marikina River Basin VOLUME 1: EXECUTIVE SUMMARY 1 INTRODUCTION The Philippines, through RBCO-DENR had defined 20 major river basins spread all over the country. These basins are defined as major because of their importance, serving as lifeblood and driver of the economy of communities inside and outside the basins. One of these river basins is the Marikina River Basin (Figure 1). Figure 1 Marikina River Basin Map 1 | P a g e Formulation of an Integrated River Basin Management and Development Master Plan for Marikina River Basin VOLUME 1: EXECUTIVE SUMMARY Marikina River Basin is currently not in its best of condition. Just like other river basins of the Philippines, MRB is faced with problems. These include: a) rapid urban development and rapid increase in population and the consequent excessive and indiscriminate discharge of pollutants and wastes which are; b) Improper land use management and increase in conflicts over land uses and allocation; c) Rapidly depleting water resources and consequent conflicts over water use and allocation; and e) lack of capacity and resources of stakeholders and responsible organizations to pursue appropriate developmental solutions. The consequence of the confluence of the above problems is the decline in the ability of the river basin to provide the goods and services it should ideally provide if it were in desirable state or condition. This is further specifically manifested in its lack of ability to provide the service of preventing or reducing floods in the lower catchments of the basin. There is rising trend in occurrence of floods, water pollution and water induced disasters within and in the lower catchments of the basin. -

Current Status of the Reduced Propensity Ignition Cigarette Program in Hawaii

Hawaii State Fire Council Current Status of the Reduced Propensity Ignition Cigarette Program in Hawaii Submitted to The Twenty-Eighth State Legislature Regular Session June 2015 2014 Reduced Ignition Propensity Cigarette Report to the Hawaii State Legislature Table of Contents Executive Summary .…………………………………………………………………….... 4 Purpose ..………………………………………………………………………....................4 Mission of the State Fire Council………………………………………………………......4 Smoking-Material Fire Facts……………………………………………………….............5 Reduced Ignition Propensity Cigarettes (RIPC) Defined……………………………......6 RIPC Regulatory History…………………………………………………………………….7 RIPC Review for Hawaii…………………………………………………………………….9 RIPC Accomplishments in Hawaii (January 1 to June 30, 2014)……………………..10 RIPC Future Considerations……………………………………………………………....14 Conclusion………………………………………………………………………….............15 Bibliography…………………………………………………………………………………17 Appendices Appendix A: All Cigarette Fires (State of Hawaii) with Property and Contents Loss Related to Cigarettes 2003 to 2013………………………………………………………18 Appendix B: Building Fires Caused by Cigarettes (State of Hawaii) with Property and Contents Loss 2003 to 2013………………………………………………………………19 Appendix C: Cigarette Related Building Fires 2003 to 2013…………………………..20 Appendix D: Injuries/Fatalities Due To Cigarette Fire 2003 to 2013 ………………....21 Appendix E: HRS 132C……………………………………………………………...........22 Appendix F: Estimated RIPC Budget 2014-2016………………………………...........32 Appendix G: List of RIPC Brands Being Sold in Hawaii………………………………..33 2 2014 -

2020 Fourth-Quarter and Full-Year Results February 4, 2021

Delivering a Smoke-Free Future 2020 Fourth-Quarter and Full-Year Results February 4, 2021 Introduction • A glossary of key terms and definitions, including the definition for reduced-risk products, or "RRPs," additional heated tobacco unit market data, as well as adjustments, other calculations and reconciliations to the most directly comparable U.S. GAAP measures are at the end of today’s webcast slides, which are posted on our website • Unless otherwise stated, all references to IQOS are to our IQOS heat-not-burn devices and consumables • Comparisons presented on a like-for-like basis reflect pro forma 2019 results, which have been adjusted for the deconsolidation of our Canadian subsidiary, Rothmans, Benson & Hedges, Inc. (RBH), effective March 22, 2019 • Growth rates presented on an organic basis reflect currency-neutral underlying results and "like-for-like" comparisons, where applicable 2 Forward-Looking and Cautionary Statements • This presentation and related discussion contain projections of future results and other forward-looking statements. Achievement of future results is subject to risks, uncertainties and inaccurate assumptions. In the event that risks or uncertainties materialize, or underlying assumptions prove inaccurate, actual results could vary materially from those contained in such forward-looking statements. Pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, PMI is identifying important factors that, individually or in the aggregate, could cause actual results and -

Carreras-Limited-Annual-Report-2012

Carreras has had a rich history in Jamaica. From as early as the 1930s, Carreras UK sold some of its cigarette brands in Jamaica. In the late 1950's to the early 1960's those cigarettes were distributed by Bonitto Brothers. The relationship with Jamaica deepened when in 1962 Carreras of Jamaica was registered 'to carry on business as tobacco and cigar merchants and importers of and dealers in tobacco, cigars, cigarettes, snuff, matchlights, pipes and any other articles required by or useful to smokers…' From 1975 to 1994, we diversified our operations to own 11 different companies* in the service, agriculture and manufacturing sectors, but divested ourselves of the non- tobacco businesses in 2004. In June 1999, BAT merged with Rothmans International and acquired controlling interest in Carreras Limited. Carreras has a special place in Jamaica's history as the first Company to establish a manufacturing plant in post- independent Jamaica. We take this distinction seriously and have been exemplary in contributing to the nation's growth and development over these last 50 years. We have built a reputation for producing high quality cigarette brands to meet the diverse tastes of our consumers, created employment, especially during the period of our significantly diversified operations, discharged our fiduciary responsibilities with the History utmost care and implemented corporate social responsibility initiatives which have empowered numerous lives. We salute Jamaica as together we celebrate this important milestone in both our histories, -

Signalling Virtue, Promoting Harm: Unhealthy Commodity Industries and COVID-19

SIGNALLING VIRTUE, PROMOTING HARM Unhealthy commodity industries and COVID-19 Acknowledgements This report was written by Jeff Collin, Global Health Policy Unit, University of Edinburgh, SPECTRUM; Rob Ralston, Global Health Policy Unit, University of Edinburgh, SPECTRUM; Sarah Hill, Global Health Policy Unit, University of Edinburgh, SPECTRUM; Lucinda Westerman, NCD Alliance. NCD Alliance and SPECTRUM wish to thank the many individuals and organisations who generously contributed to the crowdsourcing initiative on which this report is based. The authors wish to thank the following individuals for contributions to the report and project: Claire Leppold, Rachel Barry, Katie Dain, Nina Renshaw and those who contributed testimonies to the report, including those who wish to remain anonymous. Editorial coordination: Jimena Márquez Design, layout, illustrations and infographics: Mar Nieto © 2020 NCD Alliance, SPECTRUM Published by the NCD Alliance & SPECTRUM Suggested citation Collin J; Ralston R; Hill SE, Westerman L (2020) Signalling Virtue, Promoting Harm: Unhealthy commodity industries and COVID-19. NCD Alliance, SPECTRUM Table of contents Executive Summary 4 INTRODUCTION 6 Our approach to mapping industry responses 7 Using this report 9 CHAPTER I ADAPTING MARKETING AND PROMOTIONS TO LEVERAGE THE PANDEMIC 11 1. Putting a halo on unhealthy commodities: Appropriating front line workers 11 2. ‘Combatting the pandemic’ via marketing and promotions 13 3. Selling social distancing, commodifying PPE 14 4. Accelerating digitalisation, increasing availability 15 CHAPTER II CORPORATE SOCIAL RESPONSIBILITY AND PHILANTHROPY 18 1. Supporting communities to protect core interests 18 2. Addressing shortages and health systems strengthening 19 3. Corporate philanthropy and COVID-19 funds 21 4. Creating “solutions”, shaping the agenda 22 CHAPTER III PURSUING PARTNERSHIPS, COVETING COLLABORATION 23 1. -

Negativliste. Tobaksselskaber. Oktober 2016

Negativliste. Tobaksselskaber. Oktober 2016 Læsevejledning: Indrykket til venstre med fed tekst fremgår koncernen. Nedenunder, med almindelig tekst, fremgår de underliggende selskaber, som der ikke må investeres i. Alimentation Couche Tard Inc Alimentation Couche-Tard Inc Couche-Tard Inc Alliance One International Inc Alliance One International Inc Altria Group Inc Altria Client Services Inc Altria Consumer Engagement Services Inc Altria Corporate Services Inc Altria Corporate Services International Inc Altria Enterprises II LLC Altria Enterprises LLC Altria Finance Cayman Islands Ltd Altria Finance Europe AG Altria Group Distribution Co Altria Group Inc Altria Import Export Services LLC Altria Insurance Ireland Ltd Altria International Sales Inc Altria Reinsurance Ireland Ltd Altria Sales & Distribution Inc Altria Ventures Inc Altria Ventures International Holdings BV Batavia Trading Corp CA Tabacalera Nacional Fabrica de Cigarrillos El Progreso SA Industria de Tabaco Leon Jimenes SA Industrias Del Tabaco Alimentos Y Bebidas SA International Smokeless Tobacco Co Inc National Smokeless Tobacco Co Ltd Philip Morris AB Philip Morris Albania Sh pk Philip Morris ApS Philip Morris Asia Ltd Philip Morris Baltic UAB Philip Morris Belgium BVBA Philip Morris Belgium Holdings BVBA Philip Morris Belgrade doo Philip Morris BH doo Philip Morris Brasil SA Philip Morris Bulgaria EEOD Philip Morris Capital Corp Philip Morris Capital Corp /Rye Brook Philip Morris Chile Comercializadora Ltda Philip Morris China Holdings SARL Philip Morris China Management -

Complete Annual Report

Philip Morris International 2016 Annual Report THIS CHANGES EVERYTHING 2016 Philip Morris Annual Report_LCC/ANC Review Copy February 22 - Layout 2 We’ve built the world’s most successful cigarette company with the world’s most popular and iconic brands. Now we’ve made a dramatic decision. We’ve started building PMI’s future on breakthrough smoke-free products that are a much better choice than cigarette smoking. We’re investing to make these products the Philip Morris icons of the future. In these changing times, we’ve set a new course for the company. We’re going to lead a full-scale effort to ensure that smoke- free products replace cigarettes to the benefit of adult smokers, society, our company and our shareholders. Reduced-Risk Products - Our Product Platforms Heated Tobacco Products Products Without Tobacco Platform Platform 1 3 IQOS, using the consumables Platform 3 is based on HeatSticks or HEETS, acquired technology that features an electronic holder uses a chemical process to that heats tobacco rather Platform create a nicotine-containing than burning it, thereby 2 vapor. We are exploring two Platform creating a nicotine-containing routes for this platform: one 4 vapor with significantly fewer TEEPS uses a pressed with electronics and one harmful toxicants compared to carbon heat source that, once without. A city launch of the Products under this platform cigarette smoke. ignited, heats the tobacco product is planned in 2017. are e-vapor products – without burning it, to generate battery-powered devices a nicotine-containing vapor that produce an aerosol by with a reduction in harmful vaporizing a nicotine solution. -

2009 Annual Report About PMI

2009 Annual Report About PMI Philip Morris International Inc. (PMI) is the leading inter- Contents 2 Highlights national tobacco company, with seven of the world’s top 3 Letter to Shareholders 15 brands, including Marlboro, the number one cigarette 6 2009 Business Highlights 8 Profitable Growth Through brand worldwide. PMI has more than 77,000 employees Innovation 16 Responsibility and its products are sold in approximately 160 coun- 17 Board of Directors/ tries. In 2009, the company held an estimated 15.4% Company Management 18 Financial Review share of the total international cigarette market outside 85 Comparison of Cumulative of the U.S., or 26.0% excluding the People’s Republic of Total Return 86 Reconciliation of China and the U.S. Non-GAAP Measures 88 Shareholder Information Highlights n Full-Year Reported Diluted Earnings per Share of $3.24 versus $3.31 in 2008 n Full-Year Reported Diluted Earnings per Share excluding currency of $3.77, up 13.9% n Full-Year Adjusted Diluted Earnings per Share of $3.29 versus $3.31 in 2008 n Full-Year Adjusted Diluted Earnings per Share excluding currency of $3.82, up 15.4% n During 2009, PMI repurchased 129.7 million shares of its common stock for $5.5 billion n PMI increased its regular quarterly dividend during 2009 by 7.4%, to an annualized rate of $2.32 per share n In July 2009, PMI announced an agreement to purchase the Colombian cigarette manufacturer, Productora Tabacalera de Colombia, Protabaco Ltda., for $452 million n In September 2009, PMI acquired Swedish Match South Africa (Proprietary) Limited, for approximately $256 million n In February 2010, PMI announced a new share repurchase program of $12 billion over 3 years n In February 2010, PMI announced the creation of a new company in the Philippines resulting from the unification of the business operations of Fortune Tobacco Corporation and Philip Morris Philippines Manufacturing Inc. -

The Future of Tobacco Sponsorship of Sport in Canada by John Anthony

The Future of Tobacco Sponsorship of Sport in Canada by John Anthony McKibbon A Thesis Submitted to the College of Graduate Studies and Research through the Department of Kinesiology in partial Fulfilment of the Requirements for the Degree of Master of Human Kinetics at the University of Windsor Windsor. Ontario, Canada 2000 National Library Bibliothèque nationale 1*1 of Canada du Canada Acquisitions and Acquisitions et Bibiiographic Services services bibliographiques 395 Wellington Street 395. nw, Welligtori OttawaON KlAOM OttawaON KlAON4 Canada canada The author has granted a non- L'auteur a accordé une licence non exclusive licence allowing the exclusive permettant à la National Library of Canada to Bibliothèque nationale du Canada de reproduce, loan, distribute or sel1 reproduire, prêter, distribuer ou copies of this thesis in microfom, vendre des copies de cette thèse sous paper or electronic formats. la forme de microfiche/film, de reproduction sur papier ou sur format électronique. The author retains ownership of the L'auteur conserve la propriété du copyright in this thesis. Neither the droit d'auteur qui protège cette thèse. thesis nor substantial extracts fiom it Ni la thèse ni des extraits substantiels rnay be printed or otherwise de celle-ci ne doivent être imprimés reproduced without the author's ou autrement reproduits sans son permission. autorisation. The Future of Tobacco Sponsorship of Sport in Canada 02000 John Anthony McKibbon This study was designed to uncover the predictions of experts regarding the fùture of tobacco sponsorship of sport in Canada. The Delphi Technique was used as the research protocol. A census of al1 marketing managers of tobacco brands involved in sport sponsonhip (N=4) and elite sporting events that utilize sponsorship funds from tobacco companies (N=7) were involved in the study.