Annual Report 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

In the United States District Court for the District Of

Case 1:16-cv-00296-JB-LF Document 132 Filed 12/21/17 Page 1 of 249 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF NEW MEXICO IN RE: SANTA FE NATURAL TOBACCO COMPANY MARKETING & SALES PRACTICES AND PRODUCTS LIABILITY LITIGATION No. MD 16-2695 JB/LF MEMORANDUM OPINION AND ORDER THIS MATTER comes before the Court on: (i) the Defendants’ Request for Judicial Notice in Support of Motion to Dismiss, filed November 18, 2016 (Doc. 71)(“First JN Motion”); (ii) Defendants’ Second Motion for Judicial Notice in Support of the Motion to Dismiss the Consolidated Amended Complaint, filed February 23, 2017 (Doc. 91)(“Second JN Motion”); (iii) Defendants’ Third Motion for Judicial Notice in Support of the Motion to Dismiss the Consolidated Amended Complaint, filed May 30, 2017 (Doc. 109)(“Third JN Motion”); and (iv) the Defendants’ Motion to Dismiss the Consolidated Amended Complaint and Incorporated Memorandum of Law, filed February 23, 2017 (Doc. 90)(“MTD”). The Court held hearings on June 16, 2017 and July 20, 2017. The primary issues are: (i) whether the Court may consider the items presented in the First JN Motion, the Second JN Motion, and the Third JN Motion without converting the MTD into one for summary judgment; (ii) whether the Court may exercise personal jurisdiction over Reynolds American, Inc. for claims that were not brought in a North Carolina forum; (iii) whether the Federal Trade Commission’s Decision and Order, In re Santa Fe Nat. Tobacco Co., No. C-3952 (FTC June 12, 2000), filed November 18, 2016 (Doc. 71)(“Consent Order”), requiring Defendant Santa Fe Natural Tobacco Company, Inc. -

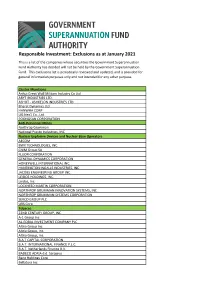

2021 01 GSF Website Version and Format.Xlsx

Responsible Investment: Exclusions as at January 2021 This is a list of the companies whose securities the Government Superannuation Fund Authority has decided will not be held by the Government Superannuation Fund. This exclusions list is periodically reviewed and updated, and is provided for general information purposes only and not intended for any other purpose. Cluster Munitions Anhui Great Wall Military Industry Co Ltd ARYT INDUSTRIES LTD. ASHOT ‐ ASHKELON INDUSTRIES LTD. Bharat Dynamics Ltd HANWHA CORP LIG Nex1 Co., Ltd. POONGSAN CORPORATION Anti‐Personnel Mines Northrop Grumman National Presto Industries, INC Nuclear Explosive Devices and Nuclear Base Operators AECOM BWX TECHNOLOGIES, INC. CNIM Group SA FLUOR CORPORATION GENERAL DYNAMICS CORPORATION HONEYWELL INTERNATIONAL INC. HUNTINGTON INGALLS INDUSTRIES, INC. JACOBS ENGINEERING GROUP INC. LEIDOS HOLDINGS, INC. Leidos, Inc. LOCKHEED MARTIN CORPORATION NORTHROP GRUMMAN INNOVATION SYSTEMS, INC. NORTHROP GRUMMAN SYSTEMS CORPORATION SERCO GROUP PLC URS Corp Tobacco 22ND CENTURY GROUP, INC. A‐1 Group Inc AL‐EQBAL INVESTMENT COMPANY PLC Altria Group Inc Altria Group, Inc. Altria Group, Inc. B.A.T CAPITAL CORPORATION B.A.T. INTERNATIONAL FINANCE P.L.C. B.A.T. Netherlands Finance B.V. BADECO ADRIA d.d. Sarajevo Bang Holdings Corp Bellatora Inc Tobacco continued Bots Inc BRITISH AMERICAN TOBACCO (MALAYSIA) BERHAD BRITISH AMERICAN TOBACCO BANGLADESH CO. LTD. British American Tobacco Holdings (The Netherlands) B.V. British American Tobacco Kenya plc BRITISH AMERICAN TOBACCO P.L.C. BRITISH AMERICAN TOBACCO P.L.C. British American Tobacco Uganda British American Tobacco Vranje a.d. Vranje British American Tobacco Zambia PLC British American Tobacco Zimbabwe (Holdings) Ltd Bulgartabac holding AD Carreras Ltd Cerealcom SA Alexandria CEYLON TOBACCO COMPANY PLC China Boton Group Company Limited Coka Duvanska Industrija ad Coka CONG TY CO PHAN NGAN SON CTO Public Company Ltd Duvanska industrija ad Bujanovac Eastern Company SAE ELECTRONIC CIGARETTES INTERNATIONAL GROUP, LTD. -

FY 2020 Announcement.Pdf

17 February 2021 –PRELIMINARY RESULTS BRITISH AMERICAN TOBACCO p.l.c. YEAR ENDED 31 DECEMBER 2020 ‘ACCELERATING TRANSFORMATION’ GROWTH IN NEW CATEGORIES AND GROUP EARNINGS DESPITE COVID-19 PERFORMANCE HIGHLIGHTS REPORTED ADJUSTED Current Vs 2019 Current Vs 2019 rates Rates (constant) Cigarette and THP volume share +30 bps Cigarette and THP value share +20 bps Non-Combustibles consumers1 13.5m +3.0m Revenue (£m) £25,776m -0.4% £25,776m +3.3% Profit from operations (£m) £9,962m +10.5% £11,365m +4.8% Operating margin (%) +38.6% +380 bps +44.1% +100 bps2 Diluted EPS (pence) 278.9p +12.0% 331.7p +5.5% Net cash generated from operating activities (£m) £9,786m +8.8% Free cash flow after dividends (£m) £2,550m +32.7% Cash conversion (%)2 98.2% -160 bps 103.0% +650 bps Borrowings3 (£m) £43,968m -3.1% Adjusted Net Debt (£m) £39,451m -5.3% Dividend per share (pence) 215.6p +2.5% The use of non-GAAP measures, including adjusting items and constant currencies, are further discussed on pages 48 to 53, with reconciliations from the most comparable IFRS measure provided. Note – 1. Internal estimate. 2. Movement in adjusted operating margin and operating cash conversion are provided at current rates. 3. Borrowings includes lease liabilities. Delivering today Building A Better TomorrowTM • Revenue, profit from operations and earnings • 1 growth* absorbing estimated 2.5% COVID-19 revenue 13.5m consumers of our non-combustible products , headwind adding 3m in 2020. On track to 50m by 2030 • New Categories revenue up 15%*, accelerating • Combustible revenue -

Tobacco Labelling -.:: GEOCITIES.Ws

Council Directive 89/622/EC concerning the labelling of tobacco products, as amended TAR AND NICOTINE CONTENTS OF THE CIGARETTES SOLD ON THE EUROPEAN MARKET AUSTRIA Brand Tar Yield Nicotine Yield Mg. Mg. List 1 A3 14.0 0.8 A3 Filter 11.0 0.6 Belvedere 11.0 0.8 Camel Filters 14.0 1.1 Camel Filters 100 13.0 1.1 Camel Lights 8.0 0.7 Casablanca 6.0 0.6 Casablanca Ultra 2.0 0.2 Corso 4.0 0.4 Da Capo 9.0 0.4 Dames 9.0 0.6 Dames Filter Box 9.0 0.6 Ernte 23 13.0 0.8 Falk 5.0 0.4 Flirt 14.0 0.9 Flirt Filter 11.0 0.6 Golden Smart 12.0 0.8 HB 13.0 0.9 HB 100 14.0 1.0 Hobby 11.0 0.8 Hobby Box 11.0 0.8 Hobby Extra 11.0 0.8 Johnny Filter 11.0 0.9 Jonny 14.0 1.0 Kent 10.0 0.8 Kim 8.0 0.6 Kim Superlights 4.0 0.4 Lord Extra 8.0 0.6 Lucky Strike 13.0 1.0 Lucky Strike Lights 9.0 0.7 Marlboro 13.0 0.9 Marlboro 100 14.0 1.0 Marlboro Lights 7.0 0.6 Malboro Medium 9.0 0.7 Maverick 11.0 0.8 Memphis Classic 11.0 0.8 Memphis Blue 12.0 0.8 Memphis International 13.0 1.0 Memphis International 100 14.0 1.0 Memphis Lights 7.0 0.6 Memphis Lights 100 9.0 0.7 Memphis Medium 9.0 0.6 Memphis Menthol 7.0 0.5 Men 11.0 0.9 Men Light 5.0 0.5 Milde Sorte 8.0 0.5 Milde Sorte 1 1.0 0.1 Milde Sorte 100 9.0 0.5 Milde Sorte Super 6.0 0.3 Milde Sorte Ultra 4.0 0.4 Parisienne Mild 8.0 0.7 Parisienne Super 11.0 0.9 Peter Stuyvesant 12.0 0.8 Philip Morris Super Lights 4.0 0.4 Ronson 13.0 1.1 Smart Export 10.0 0.8 Treff 14.0 0.9 Trend 5.0 0.2 Trussardi Light 100 6.0 0.5 United E 12.0 0.9 Winston 13.0 0.9 York 9.0 0.7 List 2 Auslese de luxe 1.0 0.1 Benson & Hedges 12.0 1.0 Camel 15.0 1.0 -

The Reason Given for the UK's Decision to Float Sterling Was the Weight of International Short-Term Capital

- Issue No. 181 No. 190, July 6, 1972 The Pound Afloat: The reason given for the U.K.'s decision to float sterling was the weight of international short-term capital movements which, despite concerted intervention from the Bank of England and European central banks, had necessitated massive sup port operations. The U.K. is anxious that the rate should quickly o.s move to a "realistic" level, at or around the old parity of %2. 40 - r,/, .• representing an effective 8% devaluation against the dollar. A w formal devaluation coupled with a wage freeze was urged by the :,I' Bank of England, but this would be politically embarrassing in the }t!IJ light of the U.K. Chancellor's repeated statements that the pound was "not at an unrealistic rate." The decision to float has been taken in spite of a danger that this may provoke an international or European monetary crisis. European markets tend to consider sterling as the dollar's first line of defense and, although the U.S. Treasury reaffirmed the Smithsonian Agreement, there are fears throughout Europe that pressure on the U.S. currency could disrupt the exchange rate re lationship established last December. On the Continent, the Dutch and Belgians have put forward a scheme for a joint float of Common Market currencies against the dollar. It will not easily be implemented, since speculation in the ex change markets has pushed the various EEC countries in different directions. The Germans have been under pressure to revalue, the Italians to devalue. Total opposition to a Community float is ex pected from France (this would sever the ties between the franc and gold), and the French also are adamant that Britain should re affirm its allegiance to the European monetary agreement and return to a fixed parity. -

Carreras-Limited-Annual-Report-2012

Carreras has had a rich history in Jamaica. From as early as the 1930s, Carreras UK sold some of its cigarette brands in Jamaica. In the late 1950's to the early 1960's those cigarettes were distributed by Bonitto Brothers. The relationship with Jamaica deepened when in 1962 Carreras of Jamaica was registered 'to carry on business as tobacco and cigar merchants and importers of and dealers in tobacco, cigars, cigarettes, snuff, matchlights, pipes and any other articles required by or useful to smokers…' From 1975 to 1994, we diversified our operations to own 11 different companies* in the service, agriculture and manufacturing sectors, but divested ourselves of the non- tobacco businesses in 2004. In June 1999, BAT merged with Rothmans International and acquired controlling interest in Carreras Limited. Carreras has a special place in Jamaica's history as the first Company to establish a manufacturing plant in post- independent Jamaica. We take this distinction seriously and have been exemplary in contributing to the nation's growth and development over these last 50 years. We have built a reputation for producing high quality cigarette brands to meet the diverse tastes of our consumers, created employment, especially during the period of our significantly diversified operations, discharged our fiduciary responsibilities with the History utmost care and implemented corporate social responsibility initiatives which have empowered numerous lives. We salute Jamaica as together we celebrate this important milestone in both our histories, -

Imperial-Ham-La:Layout 1

CMAJ Special report Destroyed documents: uncovering the science that Imperial Tobacco Canada sought to conceal David Hammond MSc PhD, Michael Chaiton MSc, Alex Lee BSc, Neil Collishaw MA Previously published at www.cmaj.ca Abstract provided a wealth of information about the conduct of the tobacco industry, the health effects of smoking and the role Background: In 1992, British American Tobacco had its of cigarette design in promoting addiction.2 Canadian affiliate, Imperial Tobacco Canada, destroy inter- A number of the most sensitive documents were concealed nal research documents that could expose the company to or destroyed before the trial as the threat of litigation grew.3,4 liability or embarrassment. Sixty of these destroyed docu- Based on advice from their lawyers, companies such as ments were subsequently uncovered in British American British American Tobacco instituted a policy of document Tobacco’s files. destruction.5 A.G. Thomas, the head of Group Security at Methods: Legal counsel for Imperial Tobacco Canada pro- British American Tobacco, explained the criteria for selecting vided a list of 60 destroyed documents to British American reports for destruction: “In determining whether a redundant Tobacco. Information in this list was used to search for document contains sensitive information, holders should copies of the documents in British American Tobacco files released through court disclosure. We reviewed and sum- apply the rule of thumb of whether the contents would harm marized this information. or embarrass the Company or an individual if they were to be made public.”6 Results: Imperial Tobacco destroyed documents that British American Tobacco’s destruction policy was most included evidence from scientific reviews prepared by rigorously pursued by its subsidiaries in the United States, British American Tobacco’s researchers, as well as 47 ori - gin al research studies, 35 of which examined the biological Canada and Australia, likely because of the imminent threat activity and carcinogenicity of tobacco smoke. -

Negativliste. Tobaksselskaber. Oktober 2016

Negativliste. Tobaksselskaber. Oktober 2016 Læsevejledning: Indrykket til venstre med fed tekst fremgår koncernen. Nedenunder, med almindelig tekst, fremgår de underliggende selskaber, som der ikke må investeres i. Alimentation Couche Tard Inc Alimentation Couche-Tard Inc Couche-Tard Inc Alliance One International Inc Alliance One International Inc Altria Group Inc Altria Client Services Inc Altria Consumer Engagement Services Inc Altria Corporate Services Inc Altria Corporate Services International Inc Altria Enterprises II LLC Altria Enterprises LLC Altria Finance Cayman Islands Ltd Altria Finance Europe AG Altria Group Distribution Co Altria Group Inc Altria Import Export Services LLC Altria Insurance Ireland Ltd Altria International Sales Inc Altria Reinsurance Ireland Ltd Altria Sales & Distribution Inc Altria Ventures Inc Altria Ventures International Holdings BV Batavia Trading Corp CA Tabacalera Nacional Fabrica de Cigarrillos El Progreso SA Industria de Tabaco Leon Jimenes SA Industrias Del Tabaco Alimentos Y Bebidas SA International Smokeless Tobacco Co Inc National Smokeless Tobacco Co Ltd Philip Morris AB Philip Morris Albania Sh pk Philip Morris ApS Philip Morris Asia Ltd Philip Morris Baltic UAB Philip Morris Belgium BVBA Philip Morris Belgium Holdings BVBA Philip Morris Belgrade doo Philip Morris BH doo Philip Morris Brasil SA Philip Morris Bulgaria EEOD Philip Morris Capital Corp Philip Morris Capital Corp /Rye Brook Philip Morris Chile Comercializadora Ltda Philip Morris China Holdings SARL Philip Morris China Management -

On Appeal from the Court of Appeal for British Columbia

Court File No. 33563 IN THE SUPREME COURT OF CANADA (ON APPEAL FROM THE COURT OF APPEAL FOR BRITISH COLUMBIA) BETWEEN: THE ATTORNEY GENERAL OF CANADA APPELLANT/RESPONDENT BY CROSS-APPEAL (THIRD PARTY) – and – IMPERIAL TOBACCO CANADA LIMITED, ROTHMANS, BENSON & HEDGES INC., ROTHMANS INC., JTI-MACDONALD CORP., B.A.T INDUSTRIES P.L.C., BRITISH AMERICAN TOBACCO (INVESTMENTS) LIMITED, CARRERAS ROTHMANS LIMITED, PHILIP MORRIS USA INC., PHILIP MORRIS INTERNATIONAL INC., R.J. REYNOLDS TOBACCO COMPANY and R.J. REYNOLDS TOBACCO INTERNATIONAL, INC. RESPONDENTS/APPELLANTS BY CROSS-APPEAL (APPELLANTS) – and – HER MAJESTY THE QUEEN IN RIGHT OF BRITISH COLUMBIA RESPONDENT (RESPONDENT) – and – ATTORNEY GENERAL OF BRITISH COLUMBIA and ATTORNEY GENERAL OF NEW BRUNSWICK INTERVENERS CONSOLIDATED FACTUM OF RESPONDENTS ON APPEAL AND CONSOLIDATED FACTUM OF APPELLANTS ON CROSS-APPEAL OF ROTHMANS, BENSON & HEDGES INC., ROTHMANS INC., PHILIP MORRIS USA INC. AND PHILIP MORRIS INTERNATIONAL INC. (pursuant to Rules 42 and 43 of the Rules of the Supreme Court of Canada) COUNSEL FOR ROTHMANS, BENSON & OTTAWA AGENT FOR ROTHMANS, HEDGES INC. AND ROTHMANS INC. BENSON & HEDGES INC. AND MACAULAY McCOLL LLP ROTHMANS INC. 1575 – 650 West Georgia Street GOWLING LAFLEUR HENDERSON LLP Vancouver, British Columbia V6B 4N9 2600 – 160 Elgin Street Telephone: 604-687-9811 Ottawa, Ontario K1P 1C3 Facsimile: 604-687-8716 Telephone: 613-233-1781 KENNETH N. AFFLECK, Q.C. Facsimile: 613-563-9869 HENRY S. BROWN, Q.C. COUNSEL FOR PHILIP MORRIS USA OTTAWA AGENT FOR PHILIP MORRIS INC. USA INC. DAVIS & COMPANY LLP GOWLING LAFLEUR HENDERSON LLP 2800 – 666 Burrard Street 2600 – 160 Elgin Street Vancouver, British Columbia V7Y 1K2 Ottawa, Ontario K1P 1C3 Telephone: 604-687-9444 Telephone: 613-233-1781 Facsimile: 604-687-1612 Facsimile: 613-563-9869 D. -

The Future of Tobacco Sponsorship of Sport in Canada by John Anthony

The Future of Tobacco Sponsorship of Sport in Canada by John Anthony McKibbon A Thesis Submitted to the College of Graduate Studies and Research through the Department of Kinesiology in partial Fulfilment of the Requirements for the Degree of Master of Human Kinetics at the University of Windsor Windsor. Ontario, Canada 2000 National Library Bibliothèque nationale 1*1 of Canada du Canada Acquisitions and Acquisitions et Bibiiographic Services services bibliographiques 395 Wellington Street 395. nw, Welligtori OttawaON KlAOM OttawaON KlAON4 Canada canada The author has granted a non- L'auteur a accordé une licence non exclusive licence allowing the exclusive permettant à la National Library of Canada to Bibliothèque nationale du Canada de reproduce, loan, distribute or sel1 reproduire, prêter, distribuer ou copies of this thesis in microfom, vendre des copies de cette thèse sous paper or electronic formats. la forme de microfiche/film, de reproduction sur papier ou sur format électronique. The author retains ownership of the L'auteur conserve la propriété du copyright in this thesis. Neither the droit d'auteur qui protège cette thèse. thesis nor substantial extracts fiom it Ni la thèse ni des extraits substantiels rnay be printed or otherwise de celle-ci ne doivent être imprimés reproduced without the author's ou autrement reproduits sans son permission. autorisation. The Future of Tobacco Sponsorship of Sport in Canada 02000 John Anthony McKibbon This study was designed to uncover the predictions of experts regarding the fùture of tobacco sponsorship of sport in Canada. The Delphi Technique was used as the research protocol. A census of al1 marketing managers of tobacco brands involved in sport sponsonhip (N=4) and elite sporting events that utilize sponsorship funds from tobacco companies (N=7) were involved in the study. -

Imperial Tobacco Canada Limited and Imperial Tobacco Company Limited

Court File No. CV-19-616077-00CL Imperial Tobacco Canada Limited and Imperial Tobacco Company Limited PRE-FILING REPORT OF THE PROPOSED MONITOR March 12, 2019 TABLE OF CONTENTS GENERAL .....................................................................................................................................1 INTRODUCTION ............................................................................................................................1 BACKGROUND ..............................................................................................................................6 FORUM .........................................................................................................................................14 ACCOMMODATION AGREEMENT ................................................................................................15 THE TOBACCO CLAIMANT REPRESENTATIVE .............................................................................17 IMPERIAL’S CASH FLOW FORECAST ..........................................................................................18 COURT-ORDERED CHARGES .......................................................................................................20 CHAPTER 15 PROCEEDINGS ........................................................................................................23 RELIEF SOUGHT ...........................................................................................................................24 CONCLUSION ...............................................................................................................................25 -

Ceylon Tobacco Company Plc Annual Report 2020

The Next CEYLON TOBACCO COMPANY PLC Step ANNUAL REPORT 2020 Contents Overview Our ESG Performance Financial Statements 2 CTC at a Glance 54 Environment 100 Finance Director’s Review 3 The Year in Numbers 59 Social 102 Financial Reporting Calendar 4 About the Report 64 Governance 103 Independent Auditor's Report 6 Our New Corporate Logo 105 Statement of Profit or Loss and other Our Leadership 7 Our Response to COVID-19 Comprehensive Income 68 Board of Directors 8 Performance Highlights 106 Statement of Financial Position 72 Executive Committee 107 Statement of Changes in Equity Executive Review and 108 Statement of Cash Flows Strategic Positioning Governance and Risk 109 Notes to the Financial Statements 10 Chairman’s Review 76 Board Governance 143 Statement of Value Added 14 Managing Director & CEO’s Review 77 Driving Strategy and Performance 18 Value Creation Model 80 Compliance Overview Supplementary Information 82 Corporate Governance 20 Value Creation and Trade-offs 144 Share Information 85 Risk Management 22 Strategy for Accelerated Growth 148 Notes 88 Assessment of Going Concern 24 Industry Overview 151 Notice of Meeting 89 Statement of Internal Controls 25 Our Sustainability Agenda 152 AGM 2021 Instructions to Shareholders 90 Report of the Board of Directors 26 Stakeholder Value 153 Form of Proxy 93 Statement of Directors’ Responsibilities 28 Material Matters 155 Appendices for Financial Statements IBC Corporate Information Performance and Value Creation 94 Report of the Audit Committee 30 Delivering our Strategy 96 Report of the Related Party Transactions 30 Illicit Trade and Beedi Review Committee 32 Product Responsibility 97 Report of the Board Compensation and 34 Optimising the Manufacturing Footprint Remuneration Committee 36 Leveraging Our Brands 98 Report of the Nominations Committee 38 Our Product SKUs 40 Sustainable Supply Chain 43 Strength in Distribution 45 Managing People 50 Ensuring a Safe Working Environment Online references: http://www.ceylontobaccocompany.com Scan the QR Code with your smart device to view this report online.