FY 2020 Announcement.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2019 Academic Report Governor’S Scholars Program

2019 academic report governor’s scholars program alumni day july 13, 2019 1 Letter from the Executive Director 2 2019 Scholars by County 3 Focus Area Classes 3 Agribusiness & Biotechnology 4 Architectural Design 5 Astronomy 6 Biological & Environmental Issues 7 Business, Accounting, & Entrepreneurship 8 Communication & Social Theory 9 Creative Writing & Literary Studies 10 Cultural Anthropology 11 Dramatic Expression 12 Engineering 13 Film Studies 13 Forensic Science table of contents 15 Healthcare Industry 16 Historical Analysis 17 International Relations 18 Journalism & Mass Media 19 Modes of Mathematical Thinking 20 Music Theory & Performance 21 Philosophy 21 Physical Science 22 Political & Legal Issues 23 Psychology & Behavioral Studies 24 Spanish Language & Culture 25 Visual Arts 26 General Studies Classes 28 Scholar Experience Survey Results 32 Scholar In-State Data 33 Additional Information from the executive director Dear supporters and friends of the Governor’s Scholars Program, The 37th summer of the GSP represents a milestone in the trajectory of our beloved Program. It was a summer to renovate our commitment to the intellectual, academic, and personal growth of young leaders and maintain the unity of our learning community as “one program on three sites.” It was also a summer to honor the past and reconnect our alumni’s achievements with the bright future of many new generations to be served by the GSP. On June 13, more than 1,100 scholars—both past and present—all gathered together on Centre College’s campus for Alumni Day. Although Alumni Day has been a recurring event on our three campuses, for the first time this year we united the scholars in one place to meet with GSP alumni who have become leaders throughout our Commonwealth. -

European Electronic Cigarette & Vaporizer Market

EUROPEAN ELECTRONIC CIGARETTE & VAPORIZER MARKET Size, Share, Analysis & Forecast: 2015-2025 European Electronic Cigarette & E Vapor Market Size, Share, Analysis & Forecast: 2015-2025 BIS Research is a leading market intelligence and technology research company. BIS Research publishes in-depth market intelligence reports focusing on the market estimations, technology analysis, emerging high-growth applications, deeply segmented granular country-level market data and other important market parameters useful in the strategic decision making for senior management. BIS Research provides multi-client reports, company profiles, databases, and custom research services. Copyright © 2015 BIS Research All Rights Reserved. This document contains highly confidential information and is the sole property of BIS Research. Disclosing, copying, circulating, quoting or otherwise reproducing any or all contents of this document is strictly prohibited. Access to this information is provided exclusively for the benefit of the people or organization concerned. It may not be accessed by, or offered whether for sale or otherwise to any third party. BIS Research Sample Pages 2 European Electronic Cigarette & E Vapor Market Size, Share, Analysis & Forecast: 2015-2025 1 E-CIGARETTE MARKET DYNAMICS 1.1 INTRODUCTION The market dynamics section of the report examines the diverse factors which govern the production and consumption of e-cigarettes in the European market. This analysis will provide an in-depth understanding of the direction in which the market is headed and the impacts of various factors on it. This section covers the market dynamics – namely the drivers, challenges, and the opportunities in the electronic cigarette market, listing and analyzing several factors that positively and negatively affect it. -

Spring 2003 Vol

ISSN 1536-4003 University of California, Berkeley Center forSlavic and East European Studies Newsletter Notes from the Director Spring 2003 Vol. 20, No. 1 In these unsettled times, it behooves us more than ever to understand the In this issue: causes and consequences of violence inflicted by extremist groups. The Notes from the Director .....................1 United States is not alone in facing profound challenges following the Bear Treks ........................................2 terrorist attacks of September 11, 2001. Like us, our West European allies are Berkeley-Stanford Conference ...........3 struggling to find a reasonable balance between respect for civil liberties Spring Courses .................................4 and freedom of expression on the one hand and the need to protect society Michael Carpenter from acts of terrorism carried out in the name of extremist ideologies. So, too, The Modern Slave Trade in is Russia wrestling with these issues, as highlighted most dramatically by Post-Communist Europe ...................5 the ongoing violence and human rights abuses being perpetrated by federal Michael Kunichika forces in Chechnya, as well as human rights violations and acts of terrorism A Window On the Lake: On and by the Chechen resistance, such as the recent hostage-taking incident in Around Stalin's Belomorkanal ...........9 Moscow. Nor should it be assumed that the only extremist challenge in Campus Visitors ............................. 16 Russia, or indeed elsewhere, comes from Islamist extremists. As Vladimir Christine Kulke Putin put it in his state of the nation address on April 18, 2002: “The growth Book Review: Historical Atlas of of extremism presents a serious threat to stability and public safety in our Central Europe ............................... -

Brands MSA Manufacturers Dateadded 1839 Blue 100'S Box

Brands MSA Manufacturers DateAdded 1839 Blue 100's Box Premier Manufacturing 7/1/2021 1839 Blue King Box Premier Manufacturing 7/1/2021 1839 Menthol Blue 100's Box Premier Manufacturing 7/1/2021 1839 Menthol Blue King Box Premier Manufacturing 7/1/2021 1839 Menthol Green 100's Box Premier Manufacturing 7/1/2021 1839 Menthol Green King Box Premier Manufacturing 7/1/2021 1839 Non Filter King Box Premier Manufacturing 7/1/2021 1839 Red 100's Box Premier Manufacturing 7/1/2021 1839 Red King Box Premier Manufacturing 7/1/2021 1839 RYO 16oz Blue Premier Manufacturing 7/1/2021 1839 RYO 16oz Full Flavor Premier Manufacturing 7/1/2021 1839 RYO 16oz Menthol Premier Manufacturing 7/1/2021 1839 RYO 6 oz Full Flavor Premier Manufacturing 7/1/2021 1839 RYO 6oz Blue Premier Manufacturing 7/1/2021 1839 RYO 6oz Menthol Premier Manufacturing 7/1/2021 1839 Silver 100's Box Premier Manufacturing 7/1/2021 1839 Silver King Box Premier Manufacturing 7/1/2021 1st Class Blue 100's Box Premier Manufacturing 7/1/2021 1st Class Blue King Box Premier Manufacturing 7/1/2021 1st Class Menthol Green 100's Box Premier Manufacturing 7/1/2021 1st Class Menthol Green King Box Premier Manufacturing 7/1/2021 1st Class Menthol Silver 100's Box Premier Manufacturing 7/1/2021 1st Class Non Filter King Box Premier Manufacturing 7/1/2021 1st Class Red 100's Box Premier Manufacturing 7/1/2021 1st Class Red King Box Premier Manufacturing 7/1/2021 1st Class Silver 100's Box Premier Manufacturing 7/1/2021 24/7 Gold 100's Xcaliber International 7/1/2021 24/7 Gold King Xcaliber International 7/1/2021 24/7 Menthol 100's Xcaliber International 7/1/2021 24/7 Menthol Gold 100's Xcaliber International 7/1/2021 24/7 Menthol King Xcaliber International 7/1/2021 24/7 Red 100's Xcaliber International 7/1/2021 24/7 Red King Xcaliber International 7/1/2021 24/7 Silver Xcaliber International 7/1/2021 Amsterdam Shag 35g Pouch or 150g Tin Peter Stokkebye Tobaksfabrik A/S 7/1/2021 Bali Shag RYO gold or navy pouch or canister Top Tobacco L.P. -

Vaping Lingo Dictionary

Vaping Lingo Dictionary High vaping rates among youth and young adults have introduced a plethora of new terms and keeping up with the latest lingo can be difficult. If you are wondering what the young people in your life are talking about, here is a list of some popular words, phrases, products and general language used to refer to vaping/e-cigarette use. POPULAR VAPE BRANDS & DEVICES Closed Pod System (uses disposable pods) JUUL BLU NJOY VUSE Vibe VUSE Alto Open/Refillable System Box Mod Suorin Drop Suorin Air NOVO Vape Juice Disposables BIDI Stick Cuvie (HQD) Puff Bars Posh Vape Stig POPULAR TERMS, PHRASES & SLANG USED BY YOUNG VAPERS The part that provides power to the heating element to warm Battery, Batt the e-liquid and produce vapor Blanks Empty cartridges a user can fill with the e-juice of their choice Cartridge, Cart A refillable vape juice container Used to recharge the e-cig battery once it has been depleted Charger Clone A knock-off of an original device that is typically less expensive A type of device that uses disposable pods containing e-liquid (typically ~200-500 puffs). The body of these devices can be recharged and the disposable pods can be replaced with new Closed Pod System compatible pods. What vapers call the vape mist that’s produced during vaping Clouds A Dab pen is used primarily for consuming THC concentrates and using the device is typically also referred to as “vaping.” These devices look and work much like other vape pens. Dab pen The “most prominent in a class of largely counterfeit brands, with common packaging that is easily available online and used by distributors to market THC-containing cartridges," according to a Centers for Disease Control and Prevention report on e- cigarette or vaping product use-associated lung injury. -

Group Income Statement

news release www.bat.com 06 May 2009 BRITISH AMERICAN TOBACCO p.l.c. INTERIM MANAGEMENT STATEMENT FOR THE THREE MONTHS ENDED 31 MARCH 2009 • Strong revenue growth at both constant and current exchange rates • Volumes from subsidiaries increased 7 per cent to 170 billion • All four Global Drive Brands grew volume, with overall growth of 7 per cent Trading update British American Tobacco had a good start to 2009 and is continuing to build on the success achieved in 2008. Group revenue for the three months grew strongly in constant currency terms, driven by the continued good pricing momentum and volume growth from the acquisitions made in the middle of last year (Skandinavisk Tobakskompagni (ST) and Tekel). All regions contributed to this good result. Revenue benefited further from the favourable impact of significant exchange rate movements which more than offset the adverse transactional impact of exchange rates on costs. Group volumes from subsidiaries were 170 billion, up 7 per cent, mainly as a result of the acquisitions of ST and Tekel. Excluding the benefits of these acquisitions, volumes were in line with last year with premium volumes slightly ahead. The four Global Drive Brands continued their strong performance and achieved overall volume growth of 7 per cent. Dunhill was up 8 per cent, Kent 3 per cent, Lucky Strike 4 per cent and Pall Mall grew by 11 per cent. Cigarette volumes The segmental analysis of the volumes of subsidiaries is as follows: 3 months to Year to 31.03.09 31.03.08 31.12.08 bns bns bns Asia-Pacific 43.3 42.9 179.5 Americas 37.9 39.2 161.0 Western Europe 29.7 25.1 122.6 Eastern Europe 27.1 29.1 137.3 Africa and Middle East 31.5 22.1 114.2 169.5 158.4 714.6 Trading environment This performance was achieved against general trading conditions which became tougher during the quarter with lower industry volumes in a number of key markets and a deceleration of growth in the premium segment. -

Technical Project Lead Memorandum: SE Report SE0003731

DEPARTMENT OF HEALTH & HUMAN SERVICES Food and Drug Ad ministration Center for Tobacco Products Office of Science Technical Project Lead Memorandum: SE Report SE0003731 \ ~ ·;;c " ' • lf• ~ ·•t:· ~,. ) N$Vi Prod~ct .Jf ~ ~ ~ ,.J· Product Name Newport Non-Menthol Gold Box Package Size 20 cigarettes per pack, 10 packs per carton Package Type Box Product ID 2003905 A pplicant Lorillard Tobacco Company Status Regular Product Ca tegory Ciga rette Product Sub-Category Conventiona l Filtered -·; Recommendation f ~f ! ~r ~, l : Issue a Substantial Equivalence (S E) order Technical Project Lead (TPL) : Signature: (b) (6} ~~~~ ------------ Matthew R. Holman, Ph.D . Director Division of Product Science Signatory Decision: ~ur with TPL Recommendation and Basis of Recommendation 0 Concu r with TPL Recommendation with additional comments (see separate memo) 0 Do Not Concur w.itf\ TPL Recommendation (see separate memo) (b) (6} Date: (. (z. 'f J 1J r 1 Director Office of Science Page 1 of 7 TPL Memorandum SE0003731: Newport Non-Menthol Gold Box TABLE OF CONTENTS 1. BACKGROUND .......................................................................................................3 1.1. PREDICATE INFORMATION ......................................................................................3 1.2. OVERVIEW OF SUBSTANTIAL EQUIVALENCE CLAIM AND REVIEW .................................3 1.3. REGULATORY ACTIVITY RELATED TO THIS MEMO ......................................................3 1.4. SCOPE OF MEMO ..................................................................................................4 -

Imperial-Ham-La:Layout 1

CMAJ Special report Destroyed documents: uncovering the science that Imperial Tobacco Canada sought to conceal David Hammond MSc PhD, Michael Chaiton MSc, Alex Lee BSc, Neil Collishaw MA Previously published at www.cmaj.ca Abstract provided a wealth of information about the conduct of the tobacco industry, the health effects of smoking and the role Background: In 1992, British American Tobacco had its of cigarette design in promoting addiction.2 Canadian affiliate, Imperial Tobacco Canada, destroy inter- A number of the most sensitive documents were concealed nal research documents that could expose the company to or destroyed before the trial as the threat of litigation grew.3,4 liability or embarrassment. Sixty of these destroyed docu- Based on advice from their lawyers, companies such as ments were subsequently uncovered in British American British American Tobacco instituted a policy of document Tobacco’s files. destruction.5 A.G. Thomas, the head of Group Security at Methods: Legal counsel for Imperial Tobacco Canada pro- British American Tobacco, explained the criteria for selecting vided a list of 60 destroyed documents to British American reports for destruction: “In determining whether a redundant Tobacco. Information in this list was used to search for document contains sensitive information, holders should copies of the documents in British American Tobacco files released through court disclosure. We reviewed and sum- apply the rule of thumb of whether the contents would harm marized this information. or embarrass the Company or an individual if they were to be made public.”6 Results: Imperial Tobacco destroyed documents that British American Tobacco’s destruction policy was most included evidence from scientific reviews prepared by rigorously pursued by its subsidiaries in the United States, British American Tobacco’s researchers, as well as 47 ori - gin al research studies, 35 of which examined the biological Canada and Australia, likely because of the imminent threat activity and carcinogenicity of tobacco smoke. -

Sproule Et Al V. Santa Fe Natural Tobacco

Case 0:15-cv-62064-JAL Document 1 Entered on FLSD Docket 09/30/2015 Page 1 of 20 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF FLORIDA JUSTIN SPROULE, individually and on behalf of all others similarly situated, No. Plaintiff, JURY TRIAL DEMANDED v. SANTA FE NATURAL TOBACCO COMPANY, INC., and REYNOLDS AMERICAN INC., Defendants. / CLASS ACTION COMPLAINT Plaintiff, Justin Sproule, individually, and on behalf of all others similarly situated in the United States, by and through the undersigned counsel, files this Class Action Complaint, and alleges against Defendants, Santa Fe Natural Tobacco Company, Inc. and Reynolds American Inc., as follows: INTRODUCTION 1. Defendants manufacture, market, and sell Natural American Spirit cigarettes (“American Spirits”). Defendants’ product labeling and advertising describes these cigarettes as “Natural,” “Additive Free,” “100% Additive Free,” “Organic,” and an “unadulterated tobacco product.”1 These terms are intended to suggest that American Spirits are healthier, safer, and present a lower risk of tobacco-related disease than other tobacco products. Defendants, however, have no competent or reliable scientific evidence to back their labeling and advertising claims. Defendants’ claims are patently deceptive, especially in today’s market, where these terms have a 1 https://www.sfntc.com/site/ourCompany/sfntc-story/ (last visited Aug. 28, 2015). Case 0:15-cv-62064-JAL Document 1 Entered on FLSD Docket 09/30/2015 Page 2 of 20 potent meaning for the health-and environmentally-conscious consumer. Moreover, as the FDA recently determined, American Spirits are in fact ‘adulterated.’ Using these deceptive terms, Defendants are able to successfully price American Spirits higher than other competitive cigarette brands. -

On Appeal from the Court of Appeal for British Columbia

Court File No. 33563 IN THE SUPREME COURT OF CANADA (ON APPEAL FROM THE COURT OF APPEAL FOR BRITISH COLUMBIA) BETWEEN: THE ATTORNEY GENERAL OF CANADA APPELLANT/RESPONDENT BY CROSS-APPEAL (THIRD PARTY) – and – IMPERIAL TOBACCO CANADA LIMITED, ROTHMANS, BENSON & HEDGES INC., ROTHMANS INC., JTI-MACDONALD CORP., B.A.T INDUSTRIES P.L.C., BRITISH AMERICAN TOBACCO (INVESTMENTS) LIMITED, CARRERAS ROTHMANS LIMITED, PHILIP MORRIS USA INC., PHILIP MORRIS INTERNATIONAL INC., R.J. REYNOLDS TOBACCO COMPANY and R.J. REYNOLDS TOBACCO INTERNATIONAL, INC. RESPONDENTS/APPELLANTS BY CROSS-APPEAL (APPELLANTS) – and – HER MAJESTY THE QUEEN IN RIGHT OF BRITISH COLUMBIA RESPONDENT (RESPONDENT) – and – ATTORNEY GENERAL OF BRITISH COLUMBIA and ATTORNEY GENERAL OF NEW BRUNSWICK INTERVENERS CONSOLIDATED FACTUM OF RESPONDENTS ON APPEAL AND CONSOLIDATED FACTUM OF APPELLANTS ON CROSS-APPEAL OF ROTHMANS, BENSON & HEDGES INC., ROTHMANS INC., PHILIP MORRIS USA INC. AND PHILIP MORRIS INTERNATIONAL INC. (pursuant to Rules 42 and 43 of the Rules of the Supreme Court of Canada) COUNSEL FOR ROTHMANS, BENSON & OTTAWA AGENT FOR ROTHMANS, HEDGES INC. AND ROTHMANS INC. BENSON & HEDGES INC. AND MACAULAY McCOLL LLP ROTHMANS INC. 1575 – 650 West Georgia Street GOWLING LAFLEUR HENDERSON LLP Vancouver, British Columbia V6B 4N9 2600 – 160 Elgin Street Telephone: 604-687-9811 Ottawa, Ontario K1P 1C3 Facsimile: 604-687-8716 Telephone: 613-233-1781 KENNETH N. AFFLECK, Q.C. Facsimile: 613-563-9869 HENRY S. BROWN, Q.C. COUNSEL FOR PHILIP MORRIS USA OTTAWA AGENT FOR PHILIP MORRIS INC. USA INC. DAVIS & COMPANY LLP GOWLING LAFLEUR HENDERSON LLP 2800 – 666 Burrard Street 2600 – 160 Elgin Street Vancouver, British Columbia V7Y 1K2 Ottawa, Ontario K1P 1C3 Telephone: 604-687-9444 Telephone: 613-233-1781 Facsimile: 604-687-1612 Facsimile: 613-563-9869 D. -

Imperial Tobacco Canada Limited and Imperial Tobacco Company Limited

Court File No. CV-19-616077-00CL Imperial Tobacco Canada Limited and Imperial Tobacco Company Limited PRE-FILING REPORT OF THE PROPOSED MONITOR March 12, 2019 TABLE OF CONTENTS GENERAL .....................................................................................................................................1 INTRODUCTION ............................................................................................................................1 BACKGROUND ..............................................................................................................................6 FORUM .........................................................................................................................................14 ACCOMMODATION AGREEMENT ................................................................................................15 THE TOBACCO CLAIMANT REPRESENTATIVE .............................................................................17 IMPERIAL’S CASH FLOW FORECAST ..........................................................................................18 COURT-ORDERED CHARGES .......................................................................................................20 CHAPTER 15 PROCEEDINGS ........................................................................................................23 RELIEF SOUGHT ...........................................................................................................................24 CONCLUSION ...............................................................................................................................25 -

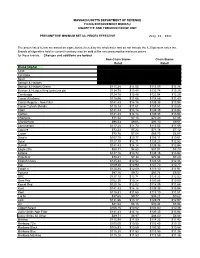

Cigarette Minimum Retail Price List

MASSACHUSETTS DEPARTMENT OF REVENUE FILING ENFORCEMENT BUREAU CIGARETTE AND TOBACCO EXCISE UNIT PRESUMPTIVE MINIMUM RETAIL PRICES EFFECTIVE July 26, 2021 The prices listed below are based on cigarettes delivered by the wholesaler and do not include the 6.25 percent sales tax. Brands of cigarettes held in current inventory may be sold at the new presumptive minimum prices for those brands. Changes and additions are bolded. Non-Chain Stores Chain Stores Retail Retail Brand (Alpha) Carton Pack Carton Pack 1839 $86.64 $8.66 $85.38 $8.54 1st Class $71.49 $7.15 $70.44 $7.04 Basic $122.21 $12.22 $120.41 $12.04 Benson & Hedges $136.55 $13.66 $134.54 $13.45 Benson & Hedges Green $115.28 $11.53 $113.59 $11.36 Benson & Hedges King (princess pk) $134.75 $13.48 $132.78 $13.28 Cambridge $124.78 $12.48 $122.94 $12.29 Camel All others $116.56 $11.66 $114.85 $11.49 Camel Regular - Non Filter $141.43 $14.14 $139.35 $13.94 Camel Turkish Blends $110.14 $11.01 $108.51 $10.85 Capri $141.43 $14.14 $139.35 $13.94 Carlton $141.43 $14.14 $139.35 $13.94 Checkers $71.54 $7.15 $70.49 $7.05 Chesterfield $96.53 $9.65 $95.10 $9.51 Commander $117.28 $11.73 $115.55 $11.56 Couture $72.23 $7.22 $71.16 $7.12 Crown $70.76 $7.08 $69.73 $6.97 Dave's $107.70 $10.77 $106.11 $10.61 Doral $127.10 $12.71 $125.23 $12.52 Dunhill $141.43 $14.14 $139.35 $13.94 Eagle 20's $88.31 $8.83 $87.01 $8.70 Eclipse $137.16 $13.72 $135.15 $13.52 Edgefield $73.41 $7.34 $72.34 $7.23 English Ovals $125.44 $12.54 $123.59 $12.36 Eve $109.30 $10.93 $107.70 $10.77 Export A $120.88 $12.09 $119.10 $11.91