Case No COMP/M.3191 - PHILIP MORRIS / PAPASTRATOS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Registered in England and Wales, Wholly Owned

RELATED UNDERTAKINGS In accordance with Section 409 of the Companies Act 2006 a full list of subsidiaries, partnerships, associates and joint ventures, the principal activity, the country of incorporation and the effective percentage of equity owned, as at 30 September 2017 are disclosed below. With the exception of Imperial Tobacco Holdings (2007) Limited, which is wholly owned by the Company, none of the shares in the subsidiaries is held directly by the Company. SUBSIDIARIES: REGISTERED IN ENGLAND AND WALES, WHOLLY OWNED Name Principal activity and registered address Attendfriend Limited Dormant 121 Winterstoke Road, Bristol, BS3 2LL, England British Tobacco Company Limited Dormant 121 Winterstoke Road, Bristol, BS3 2LL, England Congar International UK Limited Dormant 121 Winterstoke Road, Bristol, BS3 2LL, England Fontem UK Limited In liquidation BDO LLP, Two Snowhill, Birmingham, B4 6GA, England Imperial Brands Enterprise Finance Limited Provision of treasury services to other Group companies 121 Winterstoke Road, Bristol, BS3 2LL, England Imperial Brands Finance PLC Provision of treasury services to other Group companies 121 Winterstoke Road, Bristol, BS3 2LL, England Imperial Investments Limited Dormant 121 Winterstoke Road, Bristol, BS3 2LL, England Imperial Tobacco Altadis Limited Provision of finance to other Group companies 121 Winterstoke Road, Bristol, BS3 2LL, England Imperial Tobacco Capital Assets (1) Provision of finance to other Group companies 121 Winterstoke Road, Bristol, BS3 2LL, England Imperial Tobacco Capital Assets -

I UNITED STATES DISTRICT COURT for the DISTRICT OF

Case 1:99-cv-02496-PLF Document 6276 Filed 08/03/18 Page 1 of 59 UNITED STATES DISTRICT COURT FOR THE DISTRICT OF COLUMBIA ____________________________________ UNITED STATES OF AMERICA, ) Plaintiff, ) Civil Action No. 99-CV-2496 (PLF) ) and ) ) CAMPAIGN FOR TOBACCO-FREE ) KIDS, et al., ) Plaintiff-Intervenors, ) ) v. ) ) PHILIP MORRIS USA INC., et al., ) Defendants. ) ) and ) ) ITG BRANDS, LLC, et al., ) Post-Judgment Parties ) Regarding Remedies ) PLAINTIFFS’ 2018 SUPPLEMENTAL BRIEF ON RETAIL POINT OF SALE REMEDY TABLE OF CONTENTS TABLE OF AUTHORITIES ......................................................................................................... iv INTRODUCTION .......................................................................................................................... 1 FACTUAL BACKGROUND ......................................................................................................... 5 I. The Deal between Cigarette Manufacturers and Retailers ............................................... 5 II. Benefits to Participating Retailers .................................................................................... 6 III. Manufacturers’ Contractual Control over Space for Cigarette Marketing and Promotional Displays ....................................................................................................... 8 A. The types of retail advertising and marketing space ........................................8 B. The manufacturers’ contractual authority over participating retailers’ space 10 1. The -

Actor Vince Vaughn

internet only CigarJUNE 2, 2015 n VOL. 20,Insider NO. 11 n FROM THE PUBLISHER OF CIGAR AFICIONADO MAGAZINE CLICK HERE TO SUBSCRIBE IN THIS ISSUE: FEATURED CIGAR TASTING REPORT: MY FATHER LE BIJOU 1922 PREVIEWS FROM THE AUGUST 2015 BOX PRESS TORPEDO 93 ISSUE OF CIGAR AFICIONADO: NICARAGUA n PRICE: $11.40 n BODY: MEDIUM TO FULL POINTS n My Father Le Bijou 1922 Box Press Torpedo [page 2] For a full tasting, see page two. n Padrón Serie 1926 80 Years Maduro [page 2] n Trinidad Vigía [page 2] n Don Pepin Garcia Cuban Classic 1979 [page 2] BEST CIGARS THIS ISSUE n Por Larrañaga Picadores [page 3] n Fuente Fuente OpusX Angel’s Share Reserva d’Chateau [page 3] My Father Le Bijou 1922 Box Press Torpedo Nicaragua 93 n Partagás Serie D No. 6 [page 3] Padrón Serie 1926 80 Years Maduro Nicaragua 93 n H. Upmann Connossieur A [page 3] VERTICAL BRAND TASTINGS: Trinidad Vigía Cuba 93 n Romeo Añejo by Romeo y Julieta [page 4] Don Pepin Garcia Cuban Classic 1979 Nicaragua 92 NEW SIZES: Por Larrañaga Picadores Cuba 92 n Hoyo de Monterrey Edición de Cumpleaños 150 [page 4] Fuente Fuente OpusX Angel’s Share n Matilde Renacer Lancero [page 4] Reserva d’Chateau Dom. Rep. 92 CIGAR NEWS n The Avo Syncro Nicaragua [page 5] n El Centurion Wrapped in Connecticut [page 5] n Montecristo With a Vintage Wrapper [page 6] n Keystone State Looks to Tax Cigars [page 6] ACTOR VINCE VAUGHN n Quesada Cigars Distributes La Matilde [page 6] HE MIGHT BE KNOWN FOR COMEDY, but Vince Vaughn has a serious side, along with a n Nick Melillo Starts up Foundation [page 7] penchant for cigars. -

Annual Report and Accounts 2019

IMPERIAL BRANDS PLC BRANDS IMPERIAL ANNUAL REPORT AND ACCOUNTS 2019 ACCOUNTS AND REPORT ANNUAL ANNUAL REPORT AND ACCOUNTS 2019 OUR PURPOSE WE CAN I OWN Our purpose is to create something Everything See it, seize it, is possible, make it happen better for the world’s smokers with together we win our portfolio of high quality next generation and tobacco products. In doing so we are transforming WE SURPRISE I AM our business and strengthening New thinking, My contribution new actions, counts, think free, our sustainability and value creation. exceed what’s speak free, act possible with integrity OUR VALUES Our values express who we are and WE ENJOY I ENGAGE capture the behaviours we expect Thrive on Listen, challenge, share, make from everyone who works for us. make it fun connections The following table constitutes our Non-Financial Information Statement in compliance with Sections 414CA and 414CB of the Companies Act 2006. The information listed is incorporated by cross-reference. Additional Non-Financial Information is also available on our website www.imperialbrands.com. Policies and standards which Information necessary to understand our business Page Reporting requirement govern our approach1 and its impact, policy due diligence and outcomes reference Environmental matters • Occupational health, safety and Environmental targets 21 environmental policy and framework • Sustainable tobacco programme International management systems 21 Climate and energy 21 Reducing waste 19 Sustainable tobacco supply 20 Supporting wood sustainability -

Tobacco Deal Sealed Prior to Global Finance Market Going up in Smoke

marketwatch KEY DEALS Tobacco deal sealed prior to global finance market going up in smoke The global credit crunch which so rocked £5.4bn bridging loan with ABN Amro, Morgan deal. “It had become an auction involving one or Iinternational capital markets this summer Stanley, Citigroup and Lehman Brothers. more possible white knights,” he said. is likely to lead to a long tail of negotiated and In addition it is rescheduling £9.2bn of debt – Elliott said the deal would be part-funded by renegotiated deals and debt issues long into both its existing commitments and that sitting on a large-scale disposal of Rio Tinto assets worth the autumn. the balance sheet of Altadis – through a new as much as $10bn. Rio’s diamonds, gold and But the manifestation of a bad bout of the facility to be arranged by Citigroup, Royal Bank of industrial minerals businesses are now wobbles was preceded by some of the Scotland, Lehmans, Barclays and Banco Santander. reckoned to be favourites to be sold. megadeals that the equity market had been Finance Director Bob Dyrbus said: Financing the deal will be new underwritten expecting for much of the last two years. “Refinancing of the facilities is the start of a facilities provided by Royal Bank of Scotland, One such long awaited deal was the e16.2bn process that is not expected to complete until the Deutsche Bank, Credit Suisse and Société takeover of Altadis by Imperial Tobacco. first quarter of the next financial year. Générale, while Deutsche and CIBC are acting as Strategically the Imps acquisition of Altadis “Imperial Tobacco only does deals that can principal advisors on the deal with the help of has been seen as the must-do in a global generate great returns for our shareholders and Credit Suisse and Rothschild. -

PM 12.31.2014 Form 10K Wrap (Incl F/S & MD&A)

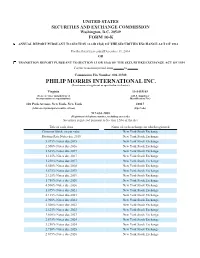

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2014 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 001-33708 PHILIP MORRIS INTERNATIONAL INC. (Exact name of registrant as specified in its charter) Virginia 13-3435103 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 120 Park Avenue, New York, New York 10017 (Address of principal executive offices) (Zip Code) 917-663-2000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, no par value New York Stock Exchange Floating Rate Notes due 2015 New York Stock Exchange 5.875% Notes due 2015 New York Stock Exchange 2.500% Notes due 2016 New York Stock Exchange 1.625% Notes due 2017 New York Stock Exchange 1.125% Notes due 2017 New York Stock Exchange 1.250% Notes due 2017 New York Stock Exchange 5.650% Notes due 2018 New York Stock Exchange 1.875% Notes due 2019 New York Stock Exchange 2.125% Notes due 2019 New York Stock Exchange 1.750% Notes due 2020 New York Stock Exchange 4.500% Notes due 2020 New York Stock Exchange 1.875% Notes due 2021 New York Stock Exchange 4.125% Notes due 2021 New York Stock Exchange 2.900% Notes due 2021 New York Stock Exchange -

Subject: ACCEPTED FORM TYPE 10-K (0001193125-12-076983) Date: 24-Feb-2012 09:29

Subject: ACCEPTED FORM TYPE 10-K (0001193125-12-076983) Date: 24-Feb-2012 09:29 THE FOLLOWING SUBMISSION HAS BEEN ACCEPTED BY THE U.S. SECURITIES AND EXCHANGE COMMISSION. COMPANY: Philip Morris International Inc. FORM TYPE: 10-K NUMBER OF DOCUMENTS: 17 RECEIVED DATE: 24-Feb-2012 09:28 ACCEPTED DATE: 24-Feb-2012 09:29 FILING DATE: 24-Feb-2012 09:28 TEST FILING: NO CONFIRMING COPY: NO ACCESSION NUMBER: 0001193125-12-076983 FILE NUMBER(S): 1. 001-33708 THE PASSWORD FOR LOGIN CIK 0001193125 WILL EXPIRE 09-Feb-2013 13:14. PLEASE REFER TO THE ACCESSION NUMBER LISTED ABOVE FOR FUTURE INQUIRIES. REGISTRANT(S): 1. CIK: 0001413329 COMPANY: Philip Morris International Inc. ACCELERATED FILER STATUS: LARGE ACCELERATED FILER FORM TYPE: 10-K FILE NUMBER(S): 1. 001-33708 24-Feb-2012 09:29 Page 1 of 1 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ⌧ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2011 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 001-33708 PHILIP MORRIS INTERNATIONAL INC. (Exact name of registrant as specified in its charter) Virginia 13-3435103 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 120 Park Avenue, New York, New York 10017 (Address of principal executive offices) (Zip Code) 917-663-2000 (Registrant’s telephone number, including area code) Securities registered -

Annual-Report-2020.Pdf

LAPORAN TAHUNAN LAPORAN TAHUNAN 2020 ANNUAL REPORT 2020 ANNUAL REPORT ANNUAL Kantor Pusat Headquarters Jl. Rungkut Industri Raya No.18 Surabaya 60293, Indonesia Telephone: +62-31-8431-699 Tbk. PT HM SAMPOERNA Facsimile: +62-31-8430-986 Kantor Perwakilan di Jakarta Corporate Representative Office in Jakarta One Pacific Place, 18th Floor Sudirman Central Business District (SCBD) Jl. Jend. Sudirman Kav.52-53 Jakarta 12190, Indonesia PT HM SAMPOERNA Tbk. Telephone: +62-21-5151-234 Facsimile: +62-21-5152-234 Website: www.sampoerna.com 2020 Email: [email protected] LAPORAN TAHUNAN | ANNUAL REPORT LAPORAN TAHUNAN LAPORAN TAHUNAN LAPORAN TAHUNAN 2020 ANNUAL REPORT 2020 ANNUAL REPORT ANNUAL Kantor Pusat Headquarters Jl. Rungkut Industri Raya No.18 Surabaya 60293, Indonesia Telephone: +62-31-8431-699 PT HM S Facsimile: +62-31-8430-986 Kantor Perwakilan di Jakarta Corporate Representative Office in Jakarta AMPOERNA One Pacific Place, 18th Floor Sudirman Central Business District (SCBD) Jl. Jend. Sudirman Kav.52-53 Jakarta 12190, Indonesia Telephone: +62-21-5151-234 Tbk. Facsimile: +62-21-5152-234 Website: www.sampoerna.com Email: [email protected] 2020 LAPORAN TAHUNAN | ANNUAL REPORT Daftar Isi Contents Ikhtisar Highlights Sekilas Sampoerna 4 Sampoerna at a Glance Fakta-fakta Penting 2020 6 2020 Key Facts Ikhtisar Utama 2020 8 Key Highlights 2020 Kinerja Utama dan Ikhtisar Keuangan 14 Key Performance and Financial Highlights Ikhtisar Saham 15 Stock Highlights Penghargaan dan Sertifikasi 16 Awards and Certifications -

Czech Republic

Annual General Meeting of Shareholders of Philip Morris ČR a.s. Kutná Hora April 29, 2016 András Tövisi Chairman of the Board of Directors Total Cigarette Market Czech Republic Total cigarette market up by 1.7% reflecting mainly • stronger seasonality • improving economic environment partially offset by • excise tax driven price increases in 2014-15 • growth of lower-taxed fine-cut category Source: Philip Morris ČR a.s. internal estimates © 2016 Philip Morris ČR a.s. 2 Price Increases 2012 – 2015 (CZK/pack) Czech Republic Dec'12 Dec'13 Dec'14 Dec'15 Premium 86 89 91 96 • Excise tax and VAT increase January 1, 2013 Medium 74 77 79 84 • Excise tax increase January 1, 2014 • Excise tax increase December 1, 2014 68 72 74 79 Low 66 70 72 77 Note: Retail prices in CZK/pack of 20 cigarettes Source: Price Gazettes of the Ministry of Finance © 2016 Philip Morris ČR a.s. 3 PMCR Cigarette Market Share and Shipments Czech Republic Market share decline by -1.5pp to 45.9% (Excluding RGD, decline by -1.6pp to 44.8%) • losses on local brands and Red & White • partially offset by increase of L&M, Philip Morris and Chesterfield Domestic cigarette shipments decline by -0.4% (Excluding RGD, decline by -0.5%) • lower cigarette market share • partially offset by higher total cigarette market Note: RGD included in SoM and volume reported under PMI brands as of April 1, 2014 Source: Nielsen Company (Europe) Sárl., Philip Morris ČR a.s. financials © 2016 Philip Morris ČR a.s. 4 Consolidation of brand portfolio Czech Republic 2013 2013 2015 Petra morph to L&M Start morph to Chesterfield Red & White morph to Chesterfield • Petra Klasik launched in low- • Start RS endorsed by • Red & White main variants price segment in January ‘13 Chesterfield morphed to Chesterfield in • other Petra variants migrated • Start KS morphed to September ’15 to L&M in November ’13 Chesterfield KS in December ’13 Source: Nielsen Company (Europe) Sárl. -

Transforming Our Business

Transforming our business A cigarette manufacturing line (on the left-hand side) and a heated tobacco unit manufacturing line (on the right-hand side) at our factory in Neuchâtel, Switzerland Replacing cigarettes with While several attempts have been made to develop better alternatives to smoking, smoke-free products drawbacks in the technological capability of these products and a lack of consumer In 2017, PMI manufactured and shipped acceptance rendered them unsuccessful. 791 billion cigarettes and other Recent advances in science and combustible tobacco products and technology have made it possible to 36 billion smoke‑free products, reaching develop innovative products that approximately 150 million adult consumers consumers accept and that are less in more than 180 countries. harmful alternatives to continued smoking. Smoking cigarettes causes serious PMI has developed a portfolio of disease. Smokers are far more likely smoke‑free products, including heated Contribution of Smoke-Free than non‑smokers to get heart disease, tobacco products and nicotine‑containing Products to PMI’s Total lung cancer, emphysema, and other e‑vapor products that have the potential diseases. Smoking is addictive, and it Net Revenues to significantly reduce individual risk and 13% can be very difficult to stop. population harm compared to cigarettes. The best way to avoid the harms of Many stakeholders have asked us about smoking is never to start, or to quit. the role of these innovative smoke‑free But much more can be done to improve products in the context of our business the health and quality of life of those vision. Are these products an extension of who continue to use nicotine products, our cigarette product portfolio? Are they through science and innovation. -

Appendix 1. Categorization of Cigarette Brands As Either Premium Or Discount

Appendix 1. Categorization of Cigarette Brands as either Premium or Discount Category Name of Cigarette Brand Premium Accord, American Spirit, Barclay, Belair, Benson & Hedges, Camel, Capri, Carlton, Chesterfield, Davidoff, Du Maurier, Dunhill, Dunhill International, Eve, Kent, Kool, L&M, Lark, Lucky Strike, Marlboro, Max, Merit, Mild Seven, More, Nat Sherman, Newport, Now, Parliament, Players, Quest, Rothman’s, Salem, Sampoerna, Saratoga, Tareyton, True, Vantage, Virginia Slims, Winston, Raleigh, Business Club Full Flavor, Ronhill, Dreams Discount 24/7, 305, 1839, A1, Ace, Allstar, Allway Save, Alpine, American, American Diamond, American Hero, American Liberty, Arrow, Austin, Axis, Baileys, Bargain Buy, Baron, Basic, Beacon, Berkeley, Best Value, Black Hawk, Bonus Value, Boston, Bracar, Brand X, Brave, Brentwood, Bridgeport, Bronco, Bronson, Bucks, Buffalo, BV, Calon, Cambridge, Campton, Cannon, Cardinal, Carnival, Cavalier, Champion, Charter, Checkers, Cherokee, Cheyenne, Cimarron, Circle Z, Class A, Classic, Cobra, Complete, Corona, Courier, CT, Decade, Desert Gold, Desert Sun, Discount, Doral, Double Diamond, DTC, Durant, Eagle, Echo, Edgefield, Epic, Esquire, Euro, Exact, Exeter, First Choice, First Class, Focus, Fortuna, Galaxy Pro, Gauloises, Generals, Generic/Private Label, Geronimo, Gold Coast, Gold Crest, Golden Bay, Golden, Golden Beach, Golden Palace, GP, GPC, Grand, Grand Prix, G Smoke, GT Ones, Hava Club, HB, Heron, Highway, Hi-Val, Jacks, Jade, Kentucky Best, King Mountain, Kingsley, Kingston, Kingsport, Knife, Knights, -

Sensational F1 Continues

Sensational F1 Continues Sponsorship Perspectives September 2009 Simon Lincoln, sponsorship expert at Ipsos MORI, talks about the impact and the trends in brand associations with Formula One. Formula One is never far away from What is the impact of this? the headlines these days: so it seems appropriate to share Ipsos ASI’s thoughts Interest in the sport reached an all-time high in October / November 2008 as Lewis Hamilton and data at this difficult time for the sport. became the sport’s youngest World Champion and as Honda sensationally pulled out the sport. At the Sensational F1! time, this level of interest compared favourably with the nation’s obsession – football. Whilst interest Brawn GP and Jenson Button sensationally domi- in the sport fell back during the close season, the nated the first seven Grand Prix of 2009, winning “Brawn GP factor” kicked in and interest quickly rose six. McLaren had a disastrous start the season with – peaking during the British Grand Prix in late June. an uncompetitive car and some poor management With the current on-and off-the-track headlines, I decision-making at the first Grand Prix in Australia. see no reason why interest should not reach similar Red Bull appeared to have the fastest car but levels in future months. repeatedly failed to make it count when it mattered. Oh, and there were a few off-circuit disputes about Ipsos ASI’s interest in Formula One measure asks the future of the sport and Renault’s admission that people how they follow the sport (watching on TV, three of their former employees conspired to influ- reading in the news / online, listening on the radio ence the outcome a race.