PMI Powerpoint Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tabak Und Zigaretten Der Vegan News-‐Einkaufsguide

Tabak und Zigaretten Der Vegan News-Einkaufsguide VEGAN* Imperial Tobacco Quelle: www.imperial-tobacco.at/component/itrfile/?view=download&id=209 Davidoff JPS Drum R1 Ernte 23 Rizla Gauloises Route 66 Gauloises Brunes Stuyvesant Gitanes Van Nelle Golden Virginia West Von-Eicken Quelle: http://www.von-eicken.com/de/umweltschutz/ Allure Dockers Burton Manitou Organic Denim Pepe Dimitrinos St. Pauli Pöschl Tabak Quelle: E-Mail Anfrage Black Hawk Manila Bounty Pontiac Brookfield Pueblo Holland Art Red Bull JBR Turner *Vegan in Zusammenhang mit Zigaretten/Tabak meint an dieser Stelle, dass in den Produkten keine tierischen Inhaltsstoffe vorhanden sind sowie seitens des Unternehmens keine TierversuChe durChgeführt werden. Vegan News Stand: 31. Dezember 2015 NICHT FÜR VEGANER GEEIGNET Lorillard Tobacco Kent Old Gold Maverick Satin Max True Newport R.J. Reynolds Tobacco Company Barclay Monarch Belair More Capri Natural American Spirit Carlton Now Doral Salem Eclipse Tareyton GPC Vantage Kool Viceroy Misty Philip Morris Accord Diana Number 7 Alpine Dji Sam Soe Optima Apollo-Soyuz Eve Papastratos Assos English Ovals Parisienne Jaune Basic f6 Parliament Belmont Fajrant Peter Jackson Best Fortune Petra Bond Street Hope Philip Morris Boston Juwel Players Bristol Karo Polyot Bucks L&M Red & White Cambridge Lark Sampoerna A Canadian Classics Longbeach Saratoga Chesterfield Marlboro SG Classic Merit Sparta Collector’s Choice Moven Gold Start Commander Multi DeLuxe U Mild Daves Multifilter Vatra Delicados Muratti Virginia Slims Vegan News Stand: 31. Dezember 2015 British American Tobacco Dunhill Prince Fair Play Samson HB Schwarzer Krauser Javaanse Jongens Vogue Lord Vype (E-Zigarette) Lucky Strike Westpoint Pall Mall Japan Tobacco International Benson & Hedges Nil Camel Old Holborn Club Overstolz Coronas Peter I Ducat Reyno Export 'A' Ronson Glamour Russian Style M Salem Magna Silk Cut Mayfair Sobranie Memphis Sovereign Mi Ne St George Mild Seven Tawa Mercedes de Luxe Troika Monte Carlo Winston More Winchester Vegan News Stand: 31. -

Marilyn E. Jackler Memorial Collection of Tobacco Advertisements AC1224

Marilyn E. Jackler Memorial Collection of Tobacco Advertisements AC1224 Date: 1971 Brand: Virginia Slims Manufacturer: Philip Morris Campaign: You’ve come a long way, baby. Theme: Targeting women, power, independence Key Phrase: We make Virginia Slims especially for women because they are biologically superior to men. Key Words: Virginia Slims, Long way, baby, cape, “W”, Superior, men women, superwomen Quote: “Women are more resistant to starvation, fatique, exposure, shock and illness than men are.” Comment: For more information contact the Archives Center at [email protected] or 202-633-3270 1 Marilyn E. Jackler Memorial Collection of Tobacco Advertisements AC1224 Date: 1989 Brand: Virginia Slims Manufacturer: Philip Morris Campaign: You’ve come a long way, baby., Menthol and Lights Menthol Theme: Targeting women, power, independence Key Phrase: We make Virginia Slims especially for women because they are biologically superior to men. Key Words: Virginia Slims Quote: You’ve come a long way, baby. Comment: The body of a women is no longer hidden behind big hoop skirts and layers. A women is now allowed to flaunt her healthy body. How long will she stay healthy if she is smoking? For more information contact the Archives Center at [email protected] or 202-633-3270 2 Marilyn E. Jackler Memorial Collection of Tobacco Advertisements AC1224 Date: 1991 Brand: Virginia Slims Manufacturer: Philip Morris Campaign: You’ve come a long way, baby., Menthol, Lights Theme: Targeting women Key Phrase: Virginia Slims remembers what most women’s bank accounts looked like in 1957. Key Words: Virginia Slims, Quote: Comment: Why in 1957 did women have to keep money in jars? They were not allowed to have a bank account separate from their husbands. -

Supplementary Table 10.7

Factory-made cigarettes and roll-your-own tobacco products available for sale in January 2019 at major Australian retailers1 Market Pack Number of Year Tobacco Company segment2 Brand size3 variants Variant name(s) Cigarette type introduced4 British American Super-value Rothmans5 20 3 Blue, Gold, Red Regular 2015 Tobacco Australia FMCs 23 2 Blue, Gold Regular 2018 25 5 Blue, Gold, Red, Silver, Menthol Green Regular 2014 30 3 Blue, Gold, Red Regular 2016 40 6 Blue, Gold, Red, Silver, Menthol Green, Black6 Regular 2014 50 5 Blue, Gold, Red, Silver, Menthol Green Regular 2016 Rothmans Cool Crush 20 3 Blue, Gold, Red Flavour capsule 2017 Rothmans Superkings 20 3 Blue, Red, Menthol Green Extra-long sticks 2015 ShuangXi7 20 2 Original Red, Blue8 Regular Pre-2012 Value FMCs Holiday 20 3 Blue, Gold, Red Regular 20189 22 5 Blue, Gold, Red, Grey, Sea Green Regular Pre-2012 50 5 Blue, Gold, Red, Grey, Sea Green Regular Pre-2012 Pall Mall 20 4 Rich Blue, Ultimate Purple, Black10, Amber Regular Pre-2012 40 3 Rich Blue, Ultimate Purple, Black11 Regular Pre-2012 Pall Mall Slims 23 5 Blue, Amber, Silver, Purple, Menthol Short, slim sticks Pre-2012 Mainstream Winfield 20 6 Blue, Gold, Sky Blue, Red, Grey, White Regular Pre-2012 FMCs 25 6 Blue, Gold, Sky Blue, Red, Grey, White Regular Pre-2012 30 5 Blue, Gold, Sky Blue, Red, Grey Regular 2014 40 3 Blue, Gold, Menthol Fresh Regular 2017 Winfield Jets 23 2 Blue, Gold Slim sticks 2014 Winfield Optimum 23 1 Wild Mist Charcoal filter 2018 25 3 Gold, Night, Sky Charcoal filter Pre-2012 Winfield Optimum Crush 20 -

ASH NEW ZEALAND Tobacco Returns Analysis 2013 1 TOBACCO

ASH NEW ZEALAND Tobacco Returns Analysis 2013 TOBACCO RETURNS ANALYSIS 2013 Tobacco manufacturers and importers in New Zealand are required to file their annual tobacco returns pursuant to section 35 of the Smokefree Environments Act 1990. The tobacco returns consist of two components – Schedule A and Schedule B. Schedule A is the information about ingredients and amounts used in their tobacco products. Schedule B is the company list of all their products, retail price and sale quantity We analysed data from Schedule B in order to understand the brand positioning of the major tobacco companies. This includes analysis of retail price, sale volume and estimated sales returned of all tobacco brands. Market share also is estimated based on this data. This analysis accounted for cigarette and loose leaf tobacco products sold within New Zealand (or domestic market). Information provided by tobacco companies may vary and hence the results of the analysis. British American Tobacco New Zealand (BATNZ) provided recommended retail prices as at January 2013 while Imperial Tobacco New Zealand and Philip Morris provided theirs as at December 2013. This had resulted in artificially higher estimates of average retail price and sale return for BATNZ products due to the January 2014 tax increase. Having considered this, most of the results on overall tobacco market in this analysis were presented according to the sale quantity and hence better accuracy. Fourteen companies filed their tobacco returns in 2013. As this analysis only included cigarette and loose leaf tobacco products, three companies were excluded as they sold cigar or other tobacco products. Tobacco Returns 2012 can be accessed through the National Drug Policy New Zealand website (http://www.ndp.govt.nz/moh.nsf/indexcm/ndp-tobacco-returns-2012 ). -

How Western Invests in Arms, Tobacco and Oil Companies

Equities RBC Wealth Management defines equities as pieces of a company, also known as "stocks." When you buy stocks or shares of a company, you're basically purchasing an ownership interest in that company. A company's stockholders or shareholders all have equity in the company, or own a fractional portion of the whole company. Western’s U.S. equities Western’s U.S. equities are managed by State Street Global Advisors and J.P. Morgan Asset Management. The SSGA man- ages large cap U.S. equities and tries to match the S&P 500 index. It also manages U.S. mid cap equities and tries to match the S&P mid cap 400. International Equities Western’s international equities are managed by Franklin Tem- pleton Institutional and MFS Investment management. Tem- pleton manages international equities with a bottom-up value process. MFS manages international equities with a bot- tom-up “growth-at-a-reasonable price” (GARP) process. Market capitalization Market capitalization is the total dollar market value of all of a company's outstanding shares. Market capitalization is cal- culated by multiplying a company's shares outstanding by the current market price of one share. The investment community uses this figure to determine a company's size, as opposed to sales or total asset figures. (Source: Investopedia) S&P 500: Unadjusted company market capitalization of US $5.3 billion or more. S&P MidCap 400: Unadjusted company market capitalization of US $1.4 billion to US $5.9 billion. Equity investments, which account or 65.8 per cent o Western’s total operating and endowment portolio, are managed by third party investment companies and Western does not have direct control over these investments. -

Appendix 1. Categorization of Cigarette Brands As Either Premium Or Discount

Appendix 1. Categorization of Cigarette Brands as either Premium or Discount Category Name of Cigarette Brand Premium Accord, American Spirit, Barclay, Belair, Benson & Hedges, Camel, Capri, Carlton, Chesterfield, Davidoff, Du Maurier, Dunhill, Dunhill International, Eve, Kent, Kool, L&M, Lark, Lucky Strike, Marlboro, Max, Merit, Mild Seven, More, Nat Sherman, Newport, Now, Parliament, Players, Quest, Rothman’s, Salem, Sampoerna, Saratoga, Tareyton, True, Vantage, Virginia Slims, Winston, Raleigh, Business Club Full Flavor, Ronhill, Dreams Discount 24/7, 305, 1839, A1, Ace, Allstar, Allway Save, Alpine, American, American Diamond, American Hero, American Liberty, Arrow, Austin, Axis, Baileys, Bargain Buy, Baron, Basic, Beacon, Berkeley, Best Value, Black Hawk, Bonus Value, Boston, Bracar, Brand X, Brave, Brentwood, Bridgeport, Bronco, Bronson, Bucks, Buffalo, BV, Calon, Cambridge, Campton, Cannon, Cardinal, Carnival, Cavalier, Champion, Charter, Checkers, Cherokee, Cheyenne, Cimarron, Circle Z, Class A, Classic, Cobra, Complete, Corona, Courier, CT, Decade, Desert Gold, Desert Sun, Discount, Doral, Double Diamond, DTC, Durant, Eagle, Echo, Edgefield, Epic, Esquire, Euro, Exact, Exeter, First Choice, First Class, Focus, Fortuna, Galaxy Pro, Gauloises, Generals, Generic/Private Label, Geronimo, Gold Coast, Gold Crest, Golden Bay, Golden, Golden Beach, Golden Palace, GP, GPC, Grand, Grand Prix, G Smoke, GT Ones, Hava Club, HB, Heron, Highway, Hi-Val, Jacks, Jade, Kentucky Best, King Mountain, Kingsley, Kingston, Kingsport, Knife, Knights, -

Temporary Compliance Waiver Notice the Linked Files May Not Be Fully Accessible to Readers Using Assistive Technology

Temporary Compliance Waiver Notice The linked files may not be fully accessible to readers using assistive technology. We regret any inconvenience that this may cause our readers. In the event you are unable to read the documents or portions thereof, please email [email protected] or call 1-877-287-1373. Philip Morris Products S.A. THS Page 1 PMI Research & Development 2.7 Executive Summary MRTPA Section 2.7 Executive Summary Confidentiality Statement Confidentiality Statement: Data and information contained in this document are considered to constitute trade secrets and confidential commercial information, and the legal protections provided to such trade secrets and confidential information are hereby claimed under the applicable provisions of United States law. No part of this document may be publicly disclosed without the written consent of Philip Morris International. Philip Morris Products S.A. THS Page 2 PMI Research & Development 2.7 Executive Summary TABLE OF CONTENTS 2.7.1 EXECUTIVE SUMMARY .....................................................................................9 2.7.2 PROPOSED MODIFIED RISK AND MODIFIED EXPOSURE CLAIMS ........15 2.7.3 MODIFIED RISK TOBACCO PRODUCTS AND HARM REDUCTION .........17 2.7.4 PRODUCT DESCRIPTION AND SCIENTIFIC RATIONALE ..........................19 Development Rationale and Product Description for THS ............................................19 Heating Instead of Burning Reduces Harmful Constituents ......................................19 Product Description ...................................................................................................20 -

Heated Tobacco Products' Reduced Exposure Claims

Research paper Tob Control: first published as 10.1136/tobaccocontrol-2018-054324 on 12 September 2018. Downloaded from Light and mild redux: heated tobacco products’ reduced exposure claims are likely to be misunderstood as reduced risk claims Lucy Popova,1 Lauren Kass Lempert,2 Stanton A Glantz2,3 ► Additional material is ABStract As of February 2018, the new HTPs, like PMI’s published online only. To view Introduction Heated tobacco products (HTPs) are IQOS, were being sold in multiple countries around please visit the journal online being marketed in several countries around the world the world in minimalist high-tech looking stores (http:// dx. doi. org/ 10. 1136/ 5–7 tobaccocontrol- 2018- 054324). with claims that they are less harmful than combusted that resemble Apple stores. Advertisements and cigarettes, based on assertions that they expose users marketing materials for IQOS emphasise both its 1School of Public Health, to lower levels of toxicants. In the USA, Philip Morris superiority over combustible cigarettes (in terms Georgia State University, International (PMI) has submitted an application to the of cleanliness and customisability) and similarity Atlanta, Georgia, USA 2Center for Tobacco Control Food and Drug Administration (FDA) in 2016 seeking to them (in terms of product’s taste, size and 6 Research & Education, authorisation to market its HTPs, IQOS, with reduced risk providing similar behavioural experience). Claims University of California, San and reduced exposure claims. about health benefits or lower risks of IQOS are not Francisco, California, USA Methods We examined the PMI’s Perception and emphasised in the marketing materials and some of 3Department of Medicine, Cardiovascular Research Behavior Assessment Studies evaluating perceptions of the materials carry minimal health warnings, such Institute, Philip R. -

Directory of Fire Safe Certified Cigarette Brand Styles Updated 11/20/09

Directory of Fire Safe Certified Cigarette Brand Styles Updated 11/20/09 Beginning August 1, 2008, only the cigarette brands and styles listed below are allowed to be imported, stamped and/or sold in the State of Alaska. Per AS 18.74, these brands must be marked as fire safe on the packaging. The brand styles listed below have been certified as fire safe by the State Fire Marshall, bear the "FSC" marking. There is an exception to these requirements. The new fire safe law allows for the sale of cigarettes that are not fire safe and do not have the "FSC" marking as long as they were stamped and in the State of Alaska before August 1, 2008 and found on the "Directory of MSA Compliant Cigarette & RYO Brands." Filter/ Non- Brand Style Length Circ. Filter Pkg. Descr. Manufacturer 1839 Full Flavor 82.7 24.60 Filter Hard Pack U.S. Flue-Cured Tobacco Growers, Inc. 1839 Full Flavor 97 24.60 Filter Hard Pack U.S. Flue-Cured Tobacco Growers, Inc. 1839 Full Flavor 83 24.60 Non-Filter Soft Pack U.S. Flue-Cured Tobacco Growers, Inc. 1839 Light 83 24.40 Filter Hard Pack U.S. Flue-Cured Tobacco Growers, Inc. 1839 Light 97 24.50 Filter Hard Pack U.S. Flue-Cured Tobacco Growers, Inc. 1839 Menthol 97 24.50 Filter Hard Pack U.S. Flue-Cured Tobacco Growers, Inc. 1839 Menthol 83 24.60 Filter Hard Pack U.S. Flue-Cured Tobacco Growers, Inc. 1839 Menthol Light 83 24.50 Filter Hard Pack U.S. -

Unmanufactured Tobacco, Burley

Foreign Agricultural Service GAIN Report Global Agriculture Information Network Voluntary Report - public distribution Date: 11/30/2000 GAIN Report #PO0032 Portugal Tobacco and Products Annual 2000 Approved by: Robert Wicks U.S. Embassy, Madrid Prepared by: Leonor Ramos Report Highlights: Portuguese 2000 tobacco output is to remain at 6,193 Mt, farm weight basis, and in 2001 at forecast 6,111 Mt. A boosted industrial activity is to lead to an expansion of 2000 total un-manufactured tobacco imports up to estimated 15,000 Mt, and of 2001 imports up to forecast 17,000 Mt. Tobacco imports from the U.S. are to reach estimated 7,500 Mt in 2000, and forecast 8,100 Mt in 2001. 1 USD = 236 Pte. Includes PSD changes: Yes Includes Trade Matrix: Yes Unscheduled Report Madrid [SP1], PO GAIN Report #PO0032 TABLE OF CONTENTS Executive Summary .....................................................1 Commodity Name: Unmanufactured Tobacco, Total ..................................2 Production, Supply & Distribution Table .....................................2 Production ............................................................2 Consumption ..........................................................3 Trade .................................................................4 Policy ................................................................7 Production Quotas .................................................7 Prices and Subsidies ................................................8 Marketing .............................................................9 -

2009 Annual Report About PMI

2009 Annual Report About PMI Philip Morris International Inc. (PMI) is the leading inter- Contents 2 Highlights national tobacco company, with seven of the world’s top 3 Letter to Shareholders 15 brands, including Marlboro, the number one cigarette 6 2009 Business Highlights 8 Profitable Growth Through brand worldwide. PMI has more than 77,000 employees Innovation 16 Responsibility and its products are sold in approximately 160 coun- 17 Board of Directors/ tries. In 2009, the company held an estimated 15.4% Company Management 18 Financial Review share of the total international cigarette market outside 85 Comparison of Cumulative of the U.S., or 26.0% excluding the People’s Republic of Total Return 86 Reconciliation of China and the U.S. Non-GAAP Measures 88 Shareholder Information Highlights n Full-Year Reported Diluted Earnings per Share of $3.24 versus $3.31 in 2008 n Full-Year Reported Diluted Earnings per Share excluding currency of $3.77, up 13.9% n Full-Year Adjusted Diluted Earnings per Share of $3.29 versus $3.31 in 2008 n Full-Year Adjusted Diluted Earnings per Share excluding currency of $3.82, up 15.4% n During 2009, PMI repurchased 129.7 million shares of its common stock for $5.5 billion n PMI increased its regular quarterly dividend during 2009 by 7.4%, to an annualized rate of $2.32 per share n In July 2009, PMI announced an agreement to purchase the Colombian cigarette manufacturer, Productora Tabacalera de Colombia, Protabaco Ltda., for $452 million n In September 2009, PMI acquired Swedish Match South Africa (Proprietary) Limited, for approximately $256 million n In February 2010, PMI announced a new share repurchase program of $12 billion over 3 years n In February 2010, PMI announced the creation of a new company in the Philippines resulting from the unification of the business operations of Fortune Tobacco Corporation and Philip Morris Philippines Manufacturing Inc. -

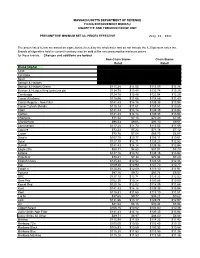

Cigarette Minimum Retail Price List

MASSACHUSETTS DEPARTMENT OF REVENUE FILING ENFORCEMENT BUREAU CIGARETTE AND TOBACCO EXCISE UNIT PRESUMPTIVE MINIMUM RETAIL PRICES EFFECTIVE July 26, 2021 The prices listed below are based on cigarettes delivered by the wholesaler and do not include the 6.25 percent sales tax. Brands of cigarettes held in current inventory may be sold at the new presumptive minimum prices for those brands. Changes and additions are bolded. Non-Chain Stores Chain Stores Retail Retail Brand (Alpha) Carton Pack Carton Pack 1839 $86.64 $8.66 $85.38 $8.54 1st Class $71.49 $7.15 $70.44 $7.04 Basic $122.21 $12.22 $120.41 $12.04 Benson & Hedges $136.55 $13.66 $134.54 $13.45 Benson & Hedges Green $115.28 $11.53 $113.59 $11.36 Benson & Hedges King (princess pk) $134.75 $13.48 $132.78 $13.28 Cambridge $124.78 $12.48 $122.94 $12.29 Camel All others $116.56 $11.66 $114.85 $11.49 Camel Regular - Non Filter $141.43 $14.14 $139.35 $13.94 Camel Turkish Blends $110.14 $11.01 $108.51 $10.85 Capri $141.43 $14.14 $139.35 $13.94 Carlton $141.43 $14.14 $139.35 $13.94 Checkers $71.54 $7.15 $70.49 $7.05 Chesterfield $96.53 $9.65 $95.10 $9.51 Commander $117.28 $11.73 $115.55 $11.56 Couture $72.23 $7.22 $71.16 $7.12 Crown $70.76 $7.08 $69.73 $6.97 Dave's $107.70 $10.77 $106.11 $10.61 Doral $127.10 $12.71 $125.23 $12.52 Dunhill $141.43 $14.14 $139.35 $13.94 Eagle 20's $88.31 $8.83 $87.01 $8.70 Eclipse $137.16 $13.72 $135.15 $13.52 Edgefield $73.41 $7.34 $72.34 $7.23 English Ovals $125.44 $12.54 $123.59 $12.36 Eve $109.30 $10.93 $107.70 $10.77 Export A $120.88 $12.09 $119.10 $11.91