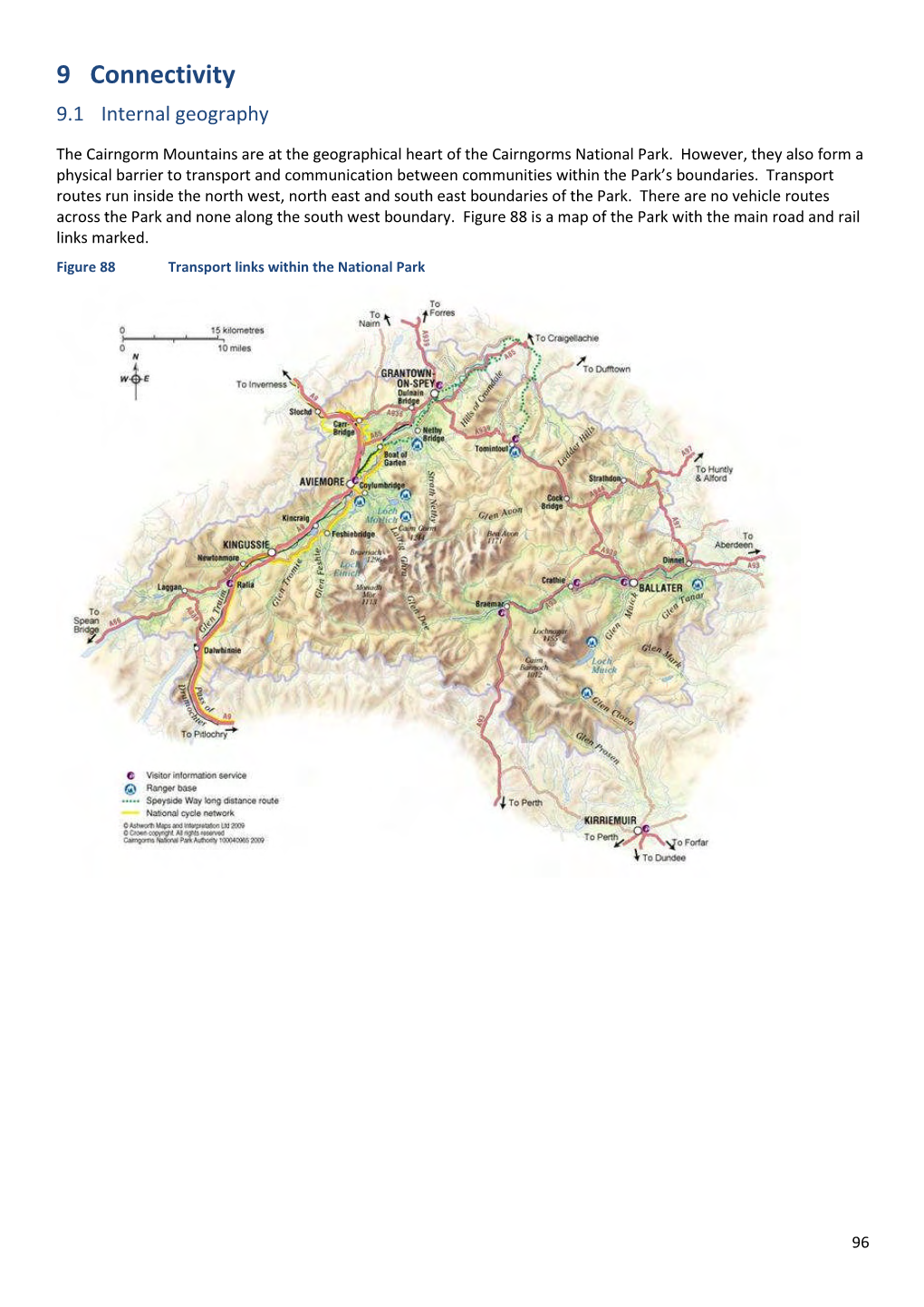

9 Connectivity 9.1 Internal Geography

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Aberdeenshire)

The Mack Walks: Short Walks in Scotland Under 10 km Kincardine O'Neil-Old Roads Ramble (Aberdeenshire) Route Summary This is a pleasant walk in a mixed rural landscape on Deeside. The ascent from the river to the old grazing pastures on the ridge of the Hill of Dess is gradual. There are good views throughout, and many historical associations. Duration: 2.5 hours. Route Overview Duration: 2.5 hours. Transport/Parking: Frequent Stagecoach bus service along Deeside. Check timetables. On-street, or small car-park near the village hall, off The Spalings road. Length: 7.550 km / 4.72 mi. Height Gain: 163 meter. Height Loss: 163 meter. Max Height: 204 meter. Min Height: 94 meter. Surface: Moderate. On good paths and tracks. Good walking surfaces throughout and some sections have walking posts to assist route-finding. Difficulty: Medium. Child Friendly: Yes, if children are used to walks of this distance and overall ascent. Dog Friendly: Yes, but keep dogs on lead on public roads and near to farm animals. Refreshments: Freshly made sandwiches in village shop. Also, newly opened cake shop across the road. Description This walk, in an elongated figure of eight, provides a range of country and riverside environments to enjoy in scenic Deeside. The walk starts and finishes at the historic ruin of the Church of St Mary in Kincardine O’Neil, the oldest village on Deeside. The present structure dates back to the 14thC but it is believed to have been a place of Christian worship from the 6thC. This walking route takes in a number of old roads, starting with Gallowhill Road, its purpose deriving from Medieval times when every feudal baron was required to erect a gibbet (gallows) for the execution of male criminals, and sink a well or pit, for the drowning of females! Soon after, the route follows a short section of the Old Deeside Road, now a farm track, which dates to before the great agricultural improvements that started in the 1700's. -

The Cairngorms Guia

2018-19 EXPLORE The cairngorms national park Pàirc Nàiseanta a’ Mhonaidh Ruaidh visitscotland.com ENJOYA DAY OUT AND VISIT SCOTLAND’S MOST PRESTIGIOUS INDEPENDENT STORE The House of Bruar is home to in our Country Living Department the most extensive collection and extensive Present Shop. Enjoy of country clothing in Great a relaxing lunch in the glass- Britain. Our vast Menswear covered conservatory, then spend an Department and Ladieswear afternoon browsing our renowned Halls showcase the very best in contemporary rural Art Galley leather, suede, sheepskin, waxed and Fishing Tackle Department. cotton and tweed to give you Stretch your legs with a stroll up the ultimate choice in technical the Famous Bruar Falls, then and traditional country clothing, treat yourself in our impressive while our Cashmere and Knitwear Food Hall, Delicatessen and Hall (the UK’s largest) provides award-winning Butchery. a stunning selection of luxury To request our latest mail natural fibres in a vast range of order catalogue, please colours. Choose from luxurious call 01796 483 236 or homeware and inspirational gifts visit our website. The House of Bruar by Blair Atholl, Perthshire, PH18 5TW Telephone: 01796 483 236 Email: offi[email protected] www.houseofbruar.com COMPLETE YOUR VISIT NEWFANTASTIC FISH & CHIP REVIEWS SHOP welcome to the cairngorms national park 1 Contents 2 The Cairngorms National Park at a glance 4 Heart of the park 6 Wild and wonderful ENJOYA DAY OUT AND VISIT 8 Touching the past SCOTLAND’S MOST PRESTIGIOUS INDEPENDENT STORE 10 Outdoor -

The Cairngorms National Park Pàirc Nàiseanta A’ Mhonaidh Ruaidh

EXPLORE 2020-2021 the cairngorms national park Pàirc Nàiseanta a’ Mhonaidh Ruaidh visitscotland.com Welcome to… Contents 2 The Cairngorms National the cairngorms Park at a glance 4 Heart of the park national park 6 Wild and wonderful THE HOME OF COUNTRYCLOTHING Fàilte gu Pàirc Nàiseanta 8 Touching the past SCOTLAND’SMOST PRESTIGIOUS INDEPENDENT STORE a’ Mhonaidh Ruaidh 10 Outdoor adventures 12 Natural larder 14 Year of Coasts and Waters 2020 16 What’s on 18 Travel tips 20 Practical information 24 Places to visit 32 Leisure activities 35 Food & drink 35 Tours 35 Events & festivals 36 Family fun 37 Accommodation 44 Regional map The Watchers at Corgarff, SnowRoads scenic route Are you ready for a wild and wonderful welcome? Then step inside Britain’s biggest National Park. This really is a mighty place of towering mountains, arctic plateaux, hidden glens and deep forests. You could fit two Lake Districts into the Cairngorms National Ashopping destination like no other, exquisite gift ideas in our Country Park, so it’s fair to say that you will have more than enough The House of Bruar showcases Living Department, then enjoy spectacular Scottish scenery, exhilarating the very best in Scottish style astroll through our Art Gallery adventures and family-friendly activities to with original creations in luxury and Fishing Department. The make your stay unforgettable. natural fibres. Premium lambswool, best of Scotland’snatural larder Cover: Kincraig fine merino and pure cashmere takes centre stage throughoutour Come and get a real feel for adventure, are all beautifully represented in Food Hall, Restaurant, Bakery enjoy family-friendly activities and exciting Credits: @VisitScotland, agorgeous cascade of colours, and Delicatessen, while our events across the Cairngorms National Park Kenny Lam, Damian Shields, complementedbytraditional and award-winning Butchery continues throughout the year. -

10294 Atholl Functions Brochure

An invitation to mark the occasion Welcome From Blair Castle, the ancient seat of the alternative to hotels and conference centres. Dukes and Earls of Atholl, comes an invitation Here, history and tradition combine with to stage your next event – perhaps an important 21st century facilities and service to create an anniversary dinner, the romantic wedding of unforgettable backdrop to your business event the century or a major product launch – in the or family celebration. heart of Highland Perthshire. Easily accessible from all major Scottish cities, As one of Scotland’s most ancient and historic this is a venue of incomparable splendour and family homes, Blair Castle makes an exciting a unique place to mark a significant milestone. The castle embraces an inspirational mix of The Setting architectural styles, so whatever the occasion, there is a space that will bring your event vividly to life. The contemporary Banvie Hall with the With surviving architectural roots going back design accent on glass, the Georgian splendour as far as 1269, Blair Castle is one of Britain’s of the State Dining Room, or the sumptuous oldest continuously inhabited houses. One of delights of the Victorian Ballroom are just three the first private homes in Scotland to open to of the magnificent spaces that could be yours. the public, Blair Castle and the surrounding Surrounded by tranquil gardens and with the estate welcomes more visitors than any other, wild beauty of the Highlands beyond, you will and is uniquely placed to help you make the know you have chosen the best place in Scotland most of the event you are planning. -

The Aberdeenshire (Electoral Arrangements) Order 1998

Status: This is the original version (as it was originally made). This item of legislation is currently only available in its original format. STATUTORY INSTRUMENTS 1998 No. 3239 (S. 198) LOCAL GOVERNMENT, SCOTLAND The Aberdeenshire (Electoral Arrangements) Order 1998 Made - - - - 21st December 1998 Coming into force - - 1st January 1999 Whereas under section 17(1) of the Local Government (Scotland) Act 1973(1), as read with Schedule 5 to that Act(2), the Local Government Boundary Commission for Scotland on 16th October 1998 submitted to the Secretary of State a report on a review together with its proposals for the future electoral arrangements for the area of Aberdeenshire Council; Now, therefore, in exercise of the powers conferred on him by sections 17(2) and 233(3) of, and Schedule 5 to, the said Act and of all other powers enabling him in that behalf, the Secretary of State hereby makes the following Order: Citation and commencement 1. This Order may be cited as the Aberdeenshire (Electoral Arrangements) Order 1998 and shall come into force on 1st January 1999. Interpretation 2. In the Schedule to this Order– (a) a reference to– (i) an electoral ward is a reference to that electoral ward as constituted in this Order; and (ii) a road, footpath, railway line, river, burn or canal shall, where the context so admits, be construed as a reference to the centre line of the feature concerned; and (b) the following abbreviations are used:– “EW” for electoral ward; “NG Ref” for National Grid Reference as published on Ordnance Survey Maps. Electoral arrangements 3. -

The Mack Walks: Short Walks in Scotland Under 10 Km Invercauld

The Mack Walks: Short Walks in Scotland Under 10 km Invercauld-Keiloch-Craggan Rour Circuit (Aberdeenshire) Route Summary A very scenic walk in the sheltered mature woodland on the slopes of Craig Leek, above the Invercauld mansion house. There are good views at every turn on the track of the mountainous Highland landscape all around, towering above the valley of the River Dee near Braemar. Duration: 2.25 hours. Route Overview Duration: 2.25 hours. Transport/Parking: Start/end point is 220 m from the main A93. Regular Stagecoach bus service along A93 Deeside to Braemar. Check timetables. Invercauld Estate walkers car-park at the walk start/end point. Fee £3 at May 2021. Length: 5.710 km / 3.57 mi Height Gain: 217 meter. Height Loss: 217 meter. Max Height: 469 meter. Min Height: 329 meter. Surface: Moderate. Good estate roads and grassy tracks. A 1.7 km section on a tarred estate access road at the end of the walk. Difficulty: Easy. Child Friendly: Yes, if children are used to walks of this distance and overall ascent. Dog Friendly: Yes, keep dogs on lead on public roads and near farm animals. Refreshments: Options in Braemar and Ballater. Description This is a very pleasant short walk amongst mature open conifer woodland, with fine open views down to the valley of the upper River Dee, and of the mountainous landscape all around Keiloch on the Invercauld Estate. The route slowly climbs onto the area known as Craggan Rour on the SW shoulder of Craig Leek. There are good views initially, on the NE aspect, down to the wide Felagie Glen and hills beyond. -

Glenshee Outdoor Activity Guide Enjoy 22 Great Walking Or Cycling Trails in the Glorious Countryside at the Gateway to the Cairngorms National Park

Glenshee Outdoor activity guide Enjoy 22 great walking or cycling trails in the glorious countryside at the gateway to the Cairngorms National Park Strathardle Bridge of Cally Blackwater Glenshee Glenisla GGlensheelenshee TTouristourist AAssoc.pdfssoc.pdf 1 223/03/20113/03/2011 111:201:20 The walks and trails of Glenshee deserve to be better known than they are, particularly as so many take the walker or mountain biker to areas of outstanding beauty and scenery which are rich in wildlife. Walking in Glenshee is a great pleasure The 22 walks and mountain bike trails of mine, and as well as the 9 Munros to compiled by the Glenshee Tourist be found in the area which are well Association within this guide are just a documented, there are other excellent taste of the multitude of routes available and distinctive hills to enjoy including in the area. Ben Gulabin and Mount Blair. Whether you are visiting the Glen for just The Cateran Trail, a 64 mile circular route, a short while or for a longer stay I trust which starts in Blairgowrie takes in that this guide will whet your appetite and nearly all of the Glenshee area from the Glenshee will become a special place for moors above Bridge of Cally to the rich you too! farmlands of Strathardle before heading over the heather moors to the grandeur I commend the Glenshee Tourist Association of upper Glenshee. For mountain bikers for producing this booklet and for their there is a good range of trails for all excellent efforts to promote the area. -

BLELACK FARM Dinnet, Aboyne, Aberdeenshire

BLELACK FARM Dinnet, Aboyne, Aberdeenshire BLELACK FARM Dinnet, Aboyne, Aberdeenshire AB34 5NH Aboyne – 8 miles, Banchory – 21 miles, Aberdeen – 36 miles Unique opportunity to acquire an eminent livestock farm, set in a sought-after and accessible location in Aberdeenshire Lot 1 – Blelack Farm Attractive, recently renovated and well-presented farmhouse (5 bedrooms and 3 reception rooms) 3 self-catering cottages (3 bedrooms) and a studio flat / farm office An extensive range of modern buildings, including cattle courts and pens, outside feed area, covered handling system and feed store Approx. 453 acres: 383 acres arable – 35 acres rough grazing Lot 2 – Land at Mill of Newton Approx. 56 acres of arable land Lot 3 – Field at Carrue Approx. 5.8 acres of arable land Lot 4 – Land at Balnastraid Approx. 121 acres of arable land Lot 5 – Balnastraid Steading Approx. 2.6 acres A range of general purpose buildings, with planning in principle for residential development About 640.33 acres (259.14 hectares) in total of predominately Class 3 (2) Land For sale as a whole or in 5 lots Savills Aberdeen Savills Edinburgh 37 Albyn Place 8 Wemyss Place Aberdeen Edinburgh AB10 1YN EH3 6DG +44 (0) 1224 971 111 +44 (0) 131 247 3720 [email protected] [email protected] Situation Blelack Farm is an extensive and fully equipped holding located in the popular Deeside region of Aberdeenshire, on the outskirts of the Cairngorms National Park. Aberdeenshire is recognised as one of Scotland’s principal livestock regions and is well suited for mixed farming enterprises. Accordingly, the area is well served by agricultural suppliers and markets. -

Aberdeen Western Peripheral Route / Balmedie - Tipperty

Aberdeen Western Peripheral Route / Balmedie - Tipperty Competition for the Design, Build, Finance and Operation of the Aberdeen Western Peripheral Route / Balmedie - Tipperty Volume Five Schedule 4: O&M Works Requirements Part 5: Specification 709/ACP/600 AWPR / B-T DBFO Schedule 4: O&M Works Requirements Volume Five Part 5: Specification THIS PAGE IS BLANK Page 2 of 439 AWPR / B-T DBFO Schedule 4: O&M Works Requirements Volume Five Part 5: Specification SCHEDULE 04: O&M WORKS REQUIREMENTS PART 5: SPECIFICATION CONTENTS PART 1: GENERAL REQUIREMENTS PART 2: ROUTINE MAINTENANCE PART 3: HANDBACK PART 4: DESIGN AND CONSTRUCTION CRITERIA PART 5: SPECIFICATION PART 6: CERTIFICATION PART 7: REPORTS, INFORMATION AND RECORDS PART 8: THIRD PARTIES PART 9: LIAISON PROCEDURES PART 10: ACCESS ROAD SERVICES PART 11: RESTRICTED SERVICES Page 3 of 439 AWPR / B-T DBFO Schedule 4: O&M Works Requirements Volume Five Part 5: Specification SCHEDULE 4: O & M WORKS REQUIREMENTS PART 5: SPECIFICATION CONTENTS Page Number Preamble to the Specification ....................................................................................................... 6 Appendix 0/1: Additional, Substitute and Cancelled Clauses, Tables and Figures Specific to This Agreement ............................................................................................................................ 14 Appendix 0/2: Minor Alterations to Existing Clauses, Tables and Figures Specific to This Agreement ................................................................................................................................. -

Aberdeenshire)

The Mack Walks: Short Walks in Scotland Under 10 km Aboyne-Court Hill-River Dee Circuit (Aberdeenshire) Route Summary A varied walk, taking in the extended parkland grounds of Aboyne Castle before a gentle ascent onto the wooded shoulder of Court Hill where there are good views. The final section on the bank of the Dee provides an opportunity to appreciate the often sparkling clear waters. Duration: 3.25 hours. Route Overview Duration: 3.25 hours. Transport/Parking: Stagecoach run regular bus services to Aboyne. Check timetables. Free parking in the village car-park at the walk start/end point. Length: 8.460 km / 5.29 mi Height Gain: 123 meter. Height Loss: 123 meter. Max Height: 200 meter. Min Height: 123 meter. Surface: Moderate. Some walking on quiet tarred roads. Mostly good paths and tracks. Difficulty: Medium. Child Friendly: Yes, if children are used to walks of this distance and overall ascent. Dog Friendly: Yes, keep dogs on lead on public roads and close to farm animals. From April to July, dogs should be kept on a short lead on the riverbank to avoid disturbing ground-nesting birds such as dippers and sandpipers, inhibiting successful breeding. Refreshments: Options in Aboyne. Description Although never far from the busy Deeside village of Aboyne, this varied rural walk often has an “away from it all” feel to it. Leaving the village centre, the route initially enters a parkland environment via the impressive entrance drive to Aboyne Castle, bordered at times on one side by giant Sequoia trees and, on the other side, the gently flowing Tarland Burn. -

Aberdeenshire)

The Mack Walks: Short Walks in Scotland Under 10 km Kincardine O'Neil-Hill of Dess Circuit (Aberdeenshire) Route Summary Walking from an historic Deeside village, the route is mainly through mixed open farmland. From the higher points on the route there are fine views down to the Dee Valley, and of some prominent hilltops, principally Clachnaben, Mt. Battock, Mt. Keen, and Mortlich. Duration: 2 hours. Route Overview Duration: 2 hours. Transport/Parking: Typically, Stagecoach #201/#202 to Banchory from Aberdeen, then #202 to Kincardine O’Neil. Check timetables. Easy parking on the main (N Deeside Road) village street. Length: 6.020 km / 3.76 mi Height Gain: 120 meter. Height Loss: 120 meter. Max Height: 204 meter. Min Height: 94 meter. Surface: Moderate. A mix of tarred minor road and good grassy tracks. Difficulty: Medium. Child Friendly: Yes, if children are used to walks of this distance and overall ascent. Dog Friendly: Yes. On lead on public roads and near farm animals. Refreshments: The Village Store in Kincardine O’Neil does excellent hot drinks, hot snacks, and sandwiches. Otherwise, options in Aboyne and Banchory. Description This is a pleasant and undemanding walk in a mixed rural environment on Deeside, with a final section along the River Dee itself. There are splendid views throughout. The walk starts and finishes at the historic ruin of the Church of St Mary in Kincardine O’Neil, the oldest village on Deeside. The present structure dates back to the 14thC but it is believed to have been a place of Christian worship from the 6thC. -

Aberdeenshire)

The Mack Walks: Short Walks in Scotland Under 10 km Aboyne Loch-Mortlich Hill Circular (Aberdeenshire) Route Summary The walk enjoys a particularly rewarding section around Aboyne Loch, followed by fine hillside and summit views taking in lower and upper Strathdee. There is a steep ascent to the historically interesting summit. The route is best walked when the bracken has died back! Duration: up to 4 hours. Route Overview Duration: Up to 4 hours. Transport/Parking: Stagecoach run regular bus services to Aboyne. Check timetables. The start-point on Golf Road is about 1 km NE of Aboyne centre, off the A93 road to/from Aberdeen. There is on-street parking close to the walk start-point. Please consider the privacy and access of local residents. If you start the walk in the centre of Aboyne, where there is a car-park, adds 2km distance overall. Max Height: 374 meter Min Height: 128 meter Height Gain: 280 meter Height Loss: 280 meter Length: 8.820 km / 5.51 mi Surface: Rough and steep summit section. We found route-finding difficult between Waypoints 12 and 14 due to the path being heavily overgrown with bracken, gorse and broom. We advise doing this walk at a time when the bracken will have died back and the route between these points should be clearer. Child Friendly: Yes, if children are used to walks of this distance and overall ascent. Please note comments in terms of route-finding in heavy bracken. Difficulty: Hard. Dog Friendly: See Aboyne Golf Club link, below. Keep dogs on a short lead on the golf course and near to any livestock.