PEP BOYS Addison Williams 631 E

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Status NOT EQUAL to D

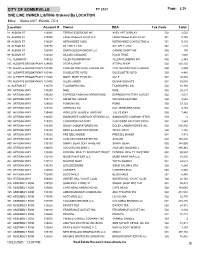

CITY OF SOMERVILLE FY 2021 Page: 1/29 ONE LINE OWNER LISTING Ordered By LOCATION Filter: Status NOT EQUAL TO d Location Account # Owner DBA Tax Code Total 81 ALBION ST 112090 TERRACE DESIGNS INC AVEY ART DISPLAY 502 3,520 83 ALBION ST 135580 FOUR WHEELS AUTO LLC FOUR WHEELS AUTO LLC 501 5,140 99 ALBION ST 136630 HERNANDEZ ALEX HERNANDEZ CONSULTING & 501 9,130 99 ALBION ST 109770 SILLARI T J INC SILLARI T J INC 502 2,210 99 ALBION ST 126530 SHAW DESIGN GROUP LLC CANINE SHOP THE 502 190 99 ALBION ST 133560 SILLARI CAROLINE ROCK TRIBE 501 1,060 112 ALBION ST 104820 ALLEN PLUMBING INC ALLEN PLUMBING INC 502 2,340 105 ALEWIFE BROOK PKWY 128680 STOP & SHOP STOP & SHOP 502 420,120 115 ALEWIFE BROOK PKWY 121390 CONTAN DISCOUNT LIQUOR INC CONTAN DISCOUNT LIQUOR 502 2,800 325 ALEWIFE BROOK PKWY 105540 DUCEUOTTE AUTO DUCEUOTTE AUTO 502 4,460 379 ALEWIFE BROOK PKWY 111540 MOBIL MART PLUS INC GULF 502 20,860 379 ALEWIFE BROOK PKWY 121450 ALLEN JAMES DUNKIN DONUTS 501 25,030 30 ALSTON ST 112570 FLAGRAPHIC INC FLAGRAPHIC INC 502 10,790 300 ARTISAN WAY 130290 NIKE NIKE 502 25,210 301 ARTISAN WAY 130280 EXPRESS FASHION OPERATIONS EXPRESS FACTORY OUTLET 502 3,510 330 ARTISAN WAY 129710 AM RETAIL GROUP WILSONS LEATHER 502 4,540 341 ARTISAN WAY 129660 PUMA NA INC PUMA 502 33,120 360 ARTISAN WAY 129720 STERLING INC KAY JEWELERS #2962 502 4,150 361 ARTISAN WAY 136440 WORLD OF JEANS & TOPS INC TILLYS #263 502 7,440 370 ARTISAN WAY 136450 SAMSONITE COMPANY STORES LLC SAMSONITE COMPANY STOR 503 0 390 ARTISAN WAY 129700 CONVERSE FACTORY CONVERSE FACTORY #3789 -

CAN Company Name 005004 3 M Company 005010 a a a 007372 a O N Corporation 005207 a T & T Corp 020609 Abbvie Corp. 017610

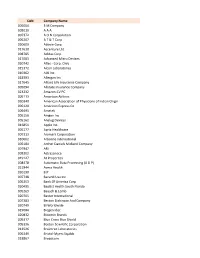

CAN Company Name 005004 3 M Company 005010 A A A 007372 A O N Corporation 005207 A T & T Corp 020609 Abbvie Corp. 017610 Accenture Ltd. 008785 Adidas Corp 017083 Advanced Micro Devices 020742 Aflac - Corp. Only 015372 Alcon Laboratories 010362 Aldi Inc 018393 Allergan Inc 017645 Allianz Life Insurance Company 005094 Allstate Insurance Company 023232 Amazon-CV PC 005113 American Airlines 020340 American Association of Physicians of Indian Origin 005120 American Express Co 009491 Ametek 005156 Amgen Inc 005162 Analog Devices 016851 Apple Inc. 005177 Apria Healthcare 007313 Aramark Corporation 010662 Arbonne International 005184 Archer Daniels Midland Company 007947 ARI 005202 Astrazeneca 019127 At Properties 008478 Automatic Data Processing (A D P) 021944 Avera Health 020190 B.P. 007748 Bacardi Usa Inc 005253 Bank Of America Corp 020495 Baptist Health South Florida 005269 Bausch & Lomb 020705 Baxter International 007383 Becton Dickinson And Company 020749 BI Worldwide 019084 Biogen Idec 020832 Bloomin Brands 005317 Blue Cross Blue Shield 005336 Boston Scientific Corporation 013526 Braintree Laboratories 005349 Bristol-Myers Squibb 018867 Broadcom 005357 Brown-Forman 007403 C B S Broadcasting Inc 005383 C V S 005384 Cablevision 010995 Caesars Entertainment Group 019659 Carefusion Corporation 020683 CARFAX 005407 Carolinas Healthcare System 005415 Caterpillar Inc 018396 Cb Richard Ellis Group 021467 CDK Global Inc. 005450 Chevron USA Inc. 007575 Church Of Jesus Christ L D S 005477 Cisco Systems 005481 Citigroup 006352 Citizens Financial Group -

ATRCOUN April 27, 20

January 2016 ▪ Volume 20 ▪ Issue 1 THE FORCE AWAKENS: A were signs of choppiness. The Dow plunged RESURGENCE OF M&A IN in September and the IPO markets have been LAWYER slow to gather steam, with very few successful 2015 IPOs in the fourth quarter. We hate to say it, but the current exuberant pace of M&A deals By Frank Aquila and Melissa Sawyer may not be sustainable unless the capital Frank Aquila and Melissa Sawyer are markets can continue to deliver new, up and partners in the Mergers & Acquisitions Group of Sullivan & Cromwell LLP. The coming companies into the mix of potential views and opinions expressed in this article buyers and targets. Meanwhile, the Fed’s de- are those of the authors and do not necessar- cision to raise interest rates will also surely ily represent those of Sullivan & Cromwell LLP or its clients. have an impact on the M&A environment as Contact: [email protected] or well. [email protected]. After close to a decade of anemic M&A, Best of Enemies: Activism 2015 was “the big year” that dealmakers have Developments been expecting for the last several years. Sig- Activism was somewhat old news in 2015 nicant deals took place across a wide range because activism has largely matured into be- The M&A of sectors and geographies. Dealmaking in ing the “new normal.” The level of engage- health care and life sciences continued to be ment between issuers, activists and institu- very active, but we also saw a lot of deals in tional investors has risen to dizzying heights, consumer and retail (Kraft/Heinz, AB InBev/ with all the attendant professionalization of SABMiller), media (Cablevision/Altice, Charter/Time Warner) and chemicals (Dow/ DuPont, Cytec/Solvay), to name a few IN THIS ISSUE: industries. -

Amerigas Partners, L.P. 2013 Annual Report

AmeriGas Partners, L.P. 2013 Annual Report Driving Every Day Our vision will span the country while our service goes door to door. Driving Every Day From the desk to the dashboard from the office to the road It is what we see from our stores. This is what we do. It is who we are. We are providers. Just like our customers. AmeriGas Partners, L.P. is a publicly traded master limited AmeriGas distributes nearly 1.4 billion gallons of propane partnership that operates the nation’s largest retail propane annually to over 2 million residential, commercial/industrial, distribution business. The common units of AmeriGas motor fuel, agricultural and wholesale customers in all Partners, L.P. are traded on the New York Stock Exchange 50 states. Through the Partnership’s AmeriGas Cylinder under the symbol “APU.” UGI Corporation, through Exchange “ACE” program, ACE cylinders are available at subsidiaries, is the sole General Partner and owns 26% nearly 47,500 retail locations throughout the United States. of the Partnership. An affiliate of Energy Transfer Partners, AmeriGas operates over 2,500 distribution locations and L.P. owns 24% of the Partnership and the public owns the has nearly 8,500 dedicated employees focused on fulfilling remaining 50%. AmeriGas’ commitment to be the most reliable, safest and As a clean versatile energy source, propane is used for a most responsive propane company in the nation. wide variety of applications. Residential and commercial customers use propane for space heating, water heating, cooking and drying while industrial customers use it to fire furnaces, as a cutting gas and in other process applications. -

Presentation Packet

MAXIMIZE FUNDING OPPORTUNITIES Bella Vista Middle School PTSA 1 Order Coupons Cart Wallet Share PARTNERSHIP DONATIONS With Dynamic Pay, you can now get a donation every time your supporters shop with any of our national retailer partners, while your supporters enjoy instant rebates as well. 300+ Supporters Supporters National Can Share Can Setup Retailers For Bonuses Recurring Donations In-app HOW IT WORKS Each app, branded with your logo, is downloaded as a yearly membership for $25 YOUR RESULTS Nonprofit Donor Dynamic $10 $10 $5 Whatever your fundraising goals are SUSTAINABLE GIVING for this year, our priority is supporting Every time your supporters shop with you as you change the world. our partner retailers, a percentage will be donated directly to your organization. SEE IT IN ACTION 10% 25% 50% 75% 100% www.bit.ly/dynamicpay RETAIL PARTNERS *Exact Pay available in app Apparel, Fragrance & Cosmetics *Abercrombie & Fitch 4% Champs Sports 5% *Justice 5% *Spafinder Wellness 365 10% *Aeropostale 5% *Charming Charlie 7% Kohls 5% *Spa & Wellness by Spa Week 12% *Adidas 5% *Chico's 5% *Lane Bryant 5% Stage 5% *Amazon 3% *Columbia 5% *Lord and Taylor 5% *Stein Mart 7% *American Eagle Outfitters 5% *DSW 5% *Nike 10% *The North Face 7% *Athleta 5% *DXL Men's Apparel 5% *Nordstrom 3% *Ulta Beauty 5% *Banana Republic 5% *Express 10% *Old Navy 5% Under Armour 8% Bath & Body Works 5% *Finish Line 6% *OshKosh B'gosh 8% Wine Enthusiast 7% Belk 7% Foot Locker 5% *PacSun 5% *Yankee Candle 10% *Burlington 5% *Forever21 5% *Ray Ban 8% *Zappos.com 5% *Buy -

Foxwoods Casino Philadelphia

Created in 1965, the Delaware Valley Regional Planning Commission (DVRPC) is an interstate, intercounty and intercity agency that provides continuing, comprehensive and coordinated planning to shape a vision for the future growth of the Delaware Valley region. The region includes Bucks, Chester, Delaware, and Montgomery counties, as well as the City of Philadelphia, in Pennsylvania; and Burlington, Camden, Gloucester and Mercer counties in New Jersey. DVRPC provides technical assistance and services; conducts high priority studies that respond to the requests and demands of member state and local governments; fosters cooperation among various constituents to forge a consensus on diverse regional issues; determines and meets the needs of the private sector; and practices public outreach efforts to promote two-way communication and public awareness of regional issues and the Commission. Our logo is adapted from the official DVRPC seal, and is designed as a stylized image of the Delaware Valley. The outer ring symbolizes the region as a whole, while the diagonal bar signifies the Delaware River. The two adjoining crescents represent the Commonwealth of Pennsylvania and the State of New Jersey. DVRPC is funded by a variety of funding sources including federal grants from the U.S. Department of Transportation’s Federal Highway Administration (FHWA) and Federal Transit Administration (FTA), the Pennsylvania and New Jersey departments of transportation, as well as by DVRPC’s state and local member governments. The authors, however, are solely -

Registered Attendees for 10.31.13 First Last Title Company Beth

Registered Attendees for 10.31.13 First Last Title Company Beth Albright SVP, Human Resources Day & Zimmermann Jonathan Berger VP Human Relations Bimbo Bakeries USA Emily Bland Vice President Comcast Joseph Cassidy Vice President, Human Resources Holy Redeemer Health System Douglas Clayton SVP, Learning & Development SES Martin Evans Chief Human Resources Officer BDP International Troy Fee VP-Human Resources AmeriGas Jim Flanagan SVP, CHRO Pep Boys John Forde Consultant Trion Doug German VP Human Resources Endo Health Solutions Susan Gunn Vice President, Human Resources Gardner Denver, Inc. David Howe Exec Dir HR US Market & Global Med Aff Merck & Co., Inc. Donald Hurford Vice President Human Resources Parkway Corporation Paul Jeffers Senior Vice President & CHRO The Penn Mutual Life Insurance Company Andrea Kaelin System Director, Comp & Org. Effectiveness Main Line Health Deb Kauffman VP HR Astrazeneca Rochelle Krombolz Vice-President, HR Americas VWR International Alice Lindenauer Managing Director Hamilton Lane Valerie Mattern VP HR ERT Ania Mikson SVP, Human Resources Delaware Investments Joe O'Brien Managing Director Client Solutions O.C. Tanner Company Assistant Vice President, Talent Management and Cristen Odian Radian Communications Dimitri Pappas Chief Administrative Officer Clement Pappas & Co. Dr. Michael Pepe Senior Partner Meaningful Growth Associates, Inc. Pat Pettinati Chief Human Resources Officer SAP America Linda Pickles Chief Operating Officer Berkadia David Pinette Senior Vice President Challenger, Gray & Christmas, Inc. George Podhor Managing Director O.C. Tanner Company Mary Robinson Director of Human Resources Duane Morris LLP Scott Rosen President The Rosen Group Gilles Rouleau President SAG Consulting Vice President, Organization Development and Chief Judy Schueler Penn Medicine Human Resources Officer Tony Smith Vice President, Human Resources Prudential Felicia Smith CHRO John Templeton Foundation Jeff Sprechini Strategic Account Manager Ultimate Software Theresa Tavernier SVP, Director of Human Resources Capmark Financial Group Inc. -

Amerigas Partners, Lp

2018 Annual Report Delighting the Customer AmeriGas Partners, L.P. is a publicly traded master limited benefits as an environmentally friendly fuel source for school bus partnership that operates the nation’s largest retail propane fleets, energy efficient combined heat and power generation, distribution business. The common units of AmeriGas Partners, and liquid injection systems designed to enhance mileage on L.P. are traded on the New York Stock Exchange under the diesel-powered vehicles. symbol “APU”. UGI Corporation, through subsidiaries, is the AmeriGas distributed over 1.1 billion gallons of propane in 2018 sole General Partner and owns 26% of the Partnership and the to over 1.7 million residential, commercial/industrial, motor fuel, public owns the remaining 74%. agricultural and wholesale customers in all 50 states. Through As a clean, versatile energy source, propane is used for a wide the Partnership’s AmeriGas Cylinder Exchange program, variety of applications. Residential and commercial customers cylinders are available at over 59,000 retail locations throughout use propane for home and space heating, water heating, the United States. cooking and drying while industrial customers use it to fire AmeriGas serves its customers from approximately 1,900 furnaces, as a cutting gas and in other process applications. propane distribution locations and has nearly 7,700 dedicated Propane is also used to power school buses and other over-the- employees focused on fulfilling AmeriGas’ commitment to be the road vehicles, forklifts, commercial lawnmowers and stationary most reliable, safest and most responsive propane company in engines. Agricultural applications include tobacco curing, crop the nation. -

SCHEDULE 14A INFORMATION PROXY STATEMENT PURSUANT to SECTION 14(A) of the SECURITIES EXCHANGE ACT of 1934

SCHEDULE 14A INFORMATION PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES EXCHANGE ACT OF 1934 Filed by the Registrant [X] Filed by a Party other than the Registrant [ ] ________________________ Check the appropriate box: [ ] Preliminary Proxy Statement [ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) [X] Definitive Proxy Statement [ ] Definitive Additional Materials [ ] Soliciting Material Pursuant to Section 240.14a-12 ________________________ ALEXANDER & BALDWIN, INC. (Name of Registrant as Specified in its Charter) ___________________________________ (Name of Person(s) Filing Proxy Statement if other than the Registrant) ________________________ Payment of Filing Fee (Check the appropriate box): [X] No fee required. [ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: [ ] Fee paid previously with preliminary materials. [ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: 822 Bishop Street, Honolulu, Hawaii 96813 March 10, 2011 To the Shareholders of Alexander & Baldwin, Inc.: You are invited to attend the 2011 Annual Meeting of Shareholders of Alexander & Baldwin, Inc., to be held in the Bankers Club on the 30th Floor of the First Hawaiian Center, 999 Bishop Street, Honolulu, Hawaii, on Tuesday, April 26, 2011 at 8:30 a.m. -

APPAREL Cabela’S $25 11%

Our Lady of Victories School Family Scrip Order Form Family Last Name ___________________ Student Name ____________ Grade/ Teacher ____________ E– Mail Address _____________________ Telephone # ___________ Order Date _______________ Order Total $ ______________ Cash Included: ______ Check #________ Your financial support provides the funds needed to maintain and update the equipment the students use in their everyday learning. Tuition alone does not cover the cost of education our children. Fundraising is nec- essary to insure the viability of Our Lady of Victories School. Your spiritual and Financial support are true testaments to your loyalty, support and love of Our Lady of Victories School. Questions? E-mail Marilyn at [email protected] or call/text (732)-991-7379. May God continue to bless you and your family. ORDER DELIVERY (Please check the appropriate box and sign) Please send my order home with my child I do not wish to have my order sent home with my child I will pick up during school house or make other arrangements to pick up. PARENT/ GUARDIAN SIGNATURE __________________________________________ Product Denom. % Qty. Total Product Denom. % Qty. Total Bass Pro Shop $25/100 9% APPAREL Cabela’s $25 11% American Eagle $25 10% Cabela’s $100 11% Burlington Coat Factory $25 8% Dick’s Sporting $25/$100 8% Express $25 10% DEPARTMENT STORES Famous Footwear $25 8% Boscov’s $25 8% Foot Locker $25 9% Christmas Tree Shop $25 7% Gap/Old Navy/ $25 14% Banana Republic Christmas Tree Shop $100 7% J. Crew $25 13% JC Penney $25 5% Land’s End $25 16% JC Penney $100 5% Land’s End $100 16% Kohl’s $25 4% Journey’s $25 10% Kohl’s $100 4% Lane Bryant $25 8% Macy’s $25 10% L.L. -

Newmark Knight Frank Wawa Ground Lease

Wawa Ground Lease South Easton Road and Waverly Road Glenside, Montgomery County, PA 19038 NKF Job No.: 19-0013166-1 Client Reference: 191119001 Appraisal Report Prepared For: Rosemary Rockwood Firstrust Bank 15 E Ridge Pike Conshohocken, PA 19428-2123 Prepared By: Newmark Knight Frank Valuation & Advisory, LLC 200 S. Broad St., Suite 510 Philadelphia, PA 19102 December 12, 2019 Rosemary Rockwood Firstrust Bank 15 E Ridge Pike Conshohocken, PA 19428-2123 RE: Appraisal of a proposed ground-leased convenience store with gas located at South Easton Road and Waverly Road, Glenside, Montgomery County, PA 19038, prepared by Newmark Knight Frank Valuation & Advisory, LLC (herein “Firm” or “NKF”) NKF Job No.: 19-0013166-1 Client Reference: 191119001 Dear Ms. Rockwood: The “Subject Property” is a 69,785 square foot development site, ground leased to Wawa. The development site is an assemblage of six parcels. Three of the parcels have been purchased by the developer, while the remaining three are under agreement of sale. The parcels that have been purchased are a former Lukoil gas station, which has been demolished. The remaining parcels all feature existing improvements which are to be demolished prior to delivery of the site to Wawa for development. The developer anticipates completion of site work and delivery of pad to tenant by June 2020, with rent expected to commence December 2020 upon completion of the improvements. The subject is 100% leased to Wawa for a twenty-year term on an absolute net basis, with 10% increases every five years. Upon expiration of the initial lease term, there are six, five-year options, each with 10% increases. -

SESSION III – Structural Changes in the Marine Terminal Industry- Implications for Terminal Operations

SESSION III – Structural Changes in the Marine Terminal Industry- Implications for Terminal Operations Marine Terminal Management Training Program, Long Beach, CA October 15, 2007 J Michael Zachary, PE, PPM Sr. VP, Ports & Maritime [email protected] The Supply Chain Consortium The Supply Chain Consortium is the premier source for supply chain benchmarking and best practices knowledge. The consortium sponsors a comprehensive repository of over 15,000 benchmark and best practice data points complemented by search capabilities, online analysis tools, topic forums, focused topic reports and peer networking for executives and practitioners. These resources are designed to drive world-class performance in member organizations. Leadership The Supply Chain Consortium is led by the needs of its membership and an Advisory Board that includes: 2 2 www.tompkinsinc.com 2 Consortium Membership In 2001, the Consortium began with 50 retail members. In 2007, membership has grown to over 180 members and contributing companies from retail, consumer products manufacturing, industrial/commercial manufacturing and wholesale/distributors. In September 2007, the Consortium Board of Directors authorized membership to services providers, specifically Ports, Ocean Carriers, national trucking firms and railroads 3 3 www.tompkinsinc.com 3 Consortium Membership Apparel, Fabric & Accessories Chico’s FAS Ann Taylor Stores Aramark Blair Corporation Limited Brands Eddie Bauer Fulfillment Services Lerner New York Levi Strauss & Co Nordstrom Polo Ralph Lauren Ross Stores Saks The Gap Timberland TJX Companies Too, Inc. Wolverine World Wide Charming Shoppes Inc.* Cornerstone Brands, Inc* Helzberg Diamonds* Land’s End, Inc.* Shoe Carnival* Vans, Inc.* Automotive & Truck Parts Honeywell Advance Auto Parts AutoZone ExxonMobil Faurecia Exhaust Systems, O’Reilly Automotive Inc*.