SESSION III – Structural Changes in the Marine Terminal Industry- Implications for Terminal Operations

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

OSB Representative Participant List by Industry

OSB Representative Participant List by Industry Aerospace • KAWASAKI • VOLVO • CATERPILLAR • ADVANCED COATING • KEDDEG COMPANY • XI'AN AIRCRAFT INDUSTRY • CHINA FAW GROUP TECHNOLOGIES GROUP • KOREAN AIRLINES • CHINA INTERNATIONAL Agriculture • AIRBUS MARINE CONTAINERS • L3 COMMUNICATIONS • AIRCELLE • AGRICOLA FORNACE • CHRYSLER • LOCKHEED MARTIN • ALLIANT TECHSYSTEMS • CARGILL • COMMERCIAL VEHICLE • M7 AEROSPACE GROUP • AVICHINA • E. RITTER & COMPANY • • MESSIER-BUGATTI- CONTINENTAL AIRLINES • BAE SYSTEMS • EXOPLAST DOWTY • CONTINENTAL • BE AEROSPACE • MITSUBISHI HEAVY • JOHN DEERE AUTOMOTIVE INDUSTRIES • • BELL HELICOPTER • MAUI PINEAPPLE CONTINENTAL • NASA COMPANY AUTOMOTIVE SYSTEMS • BOMBARDIER • • NGC INTEGRATED • USDA COOPER-STANDARD • CAE SYSTEMS AUTOMOTIVE Automotive • • CORNING • CESSNA AIRCRAFT NORTHROP GRUMMAN • AGCO • COMPANY • PRECISION CASTPARTS COSMA INDUSTRIAL DO • COBHAM CORP. • ALLIED SPECIALTY BRASIL • VEHICLES • CRP INDUSTRIES • COMAC RAYTHEON • AMSTED INDUSTRIES • • CUMMINS • DANAHER RAYTHEON E-SYSTEMS • ANHUI JIANGHUAI • • DAF TRUCKS • DASSAULT AVIATION RAYTHEON MISSLE AUTOMOBILE SYSTEMS COMPANY • • ARVINMERITOR DAIHATSU MOTOR • EATON • RAYTHEON NCS • • ASHOK LEYLAND DAIMLER • EMBRAER • RAYTHEON RMS • • ATC LOGISTICS & DALPHI METAL ESPANA • EUROPEAN AERONAUTIC • ROLLS-ROYCE DEFENCE AND SPACE ELECTRONICS • DANA HOLDING COMPANY • ROTORCRAFT • AUDI CORPORATION • FINMECCANICA ENTERPRISES • • AUTOZONE DANA INDÚSTRIAS • SAAB • FLIR SYSTEMS • • BAE SYSTEMS DELPHI • SMITH'S DETECTION • FUJI • • BECK/ARNLEY DENSO CORPORATION -

List of Marginable OTC Stocks

List of Marginable OTC Stocks @ENTERTAINMENT, INC. ABACAN RESOURCE CORPORATION ACE CASH EXPRESS, INC. $.01 par common No par common $.01 par common 1ST BANCORP (Indiana) ABACUS DIRECT CORPORATION ACE*COMM CORPORATION $1.00 par common $.001 par common $.01 par common 1ST BERGEN BANCORP ABAXIS, INC. ACETO CORPORATION No par common No par common $.01 par common 1ST SOURCE CORPORATION ABC BANCORP (Georgia) ACMAT CORPORATION $1.00 par common $1.00 par common Class A, no par common Fixed rate cumulative trust preferred securities of 1st Source Capital ABC DISPENSING TECHNOLOGIES, INC. ACORN PRODUCTS, INC. Floating rate cumulative trust preferred $.01 par common $.001 par common securities of 1st Source ABC RAIL PRODUCTS CORPORATION ACRES GAMING INCORPORATED 3-D GEOPHYSICAL, INC. $.01 par common $.01 par common $.01 par common ABER RESOURCES LTD. ACRODYNE COMMUNICATIONS, INC. 3-D SYSTEMS CORPORATION No par common $.01 par common $.001 par common ABIGAIL ADAMS NATIONAL BANCORP, INC. †ACSYS, INC. 3COM CORPORATION $.01 par common No par common No par common ABINGTON BANCORP, INC. (Massachusetts) ACT MANUFACTURING, INC. 3D LABS INC. LIMITED $.10 par common $.01 par common $.01 par common ABIOMED, INC. ACT NETWORKS, INC. 3DFX INTERACTIVE, INC. $.01 par common $.01 par common No par common ABLE TELCOM HOLDING CORPORATION ACT TELECONFERENCING, INC. 3DO COMPANY, THE $.001 par common No par common $.01 par common ABR INFORMATION SERVICES INC. ACTEL CORPORATION 3DX TECHNOLOGIES, INC. $.01 par common $.001 par common $.01 par common ABRAMS INDUSTRIES, INC. ACTION PERFORMANCE COMPANIES, INC. 4 KIDS ENTERTAINMENT, INC. $1.00 par common $.01 par common $.01 par common 4FRONT TECHNOLOGIES, INC. -

Past Guests Include

Past Guests Include Laura Dolan Human Resources Citi Prepaid Aaron Boucher- HR Director, Renaissance Marble and Granite Adina Tayar Director of Director of Job Placement and College Transfer Services Alan Dean- Director of HR, Comar Alena DeLosReyes- AVP of HR, Harleysville Insurance Alex Godun Human Resources Director McCaffrey's Ali Steinman- HR Director, GMAC Alice Lindenauer- Principal, Global Human Resources Hamilton Lane Alicia Huppman, SPHR, MBA Assistant Professor, Program Manager, HRM Peirce College Amy Plasha Former SVP, Human Resources Rodale Inc. Anne Freese- Director of HR, Amec Ashlyn Kosma- Director of HR, Dilworth Paxon LLP Barbara Bell Director of HR Montgomery McCracken LLC Becky Almer HR Director 3SI Security Systems Beth Albright- SVP of HR, Day & Zimmerman Beth Glassman SVP of HR Brandywine Realty Trust Bill McMenamin, Head of Human Resources Americas HCL AXON Bob Bobrowski- Senior Director of HR Cephalon Bob Colvin- Senior Vice President, Director of Human Resources Managers Investment Group Bob Worn-- Director of HR TransAxle Brent O'Bryan- SPHR Region Director, HCM AlliedBarton Security Services Brett Saks VP, Human Resources KGB Bruce Sparks- Director of HR, Delta Community Supports Inc Carol Albright- Director of HR ASI (Advertising Specialty Institute) Carol Remmel- Director of HR Pinebrook Services for Children Carrington Carter- Former Human Resources Executive Strategic Business Partner Charity Hughes, SPHR Organizational Change Manager SCA Tissue North America, LLC Charlene Stiles HR Director Wiley Missions -

Status NOT EQUAL to D

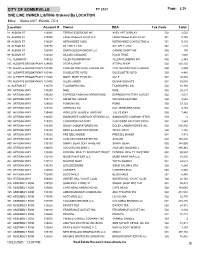

CITY OF SOMERVILLE FY 2021 Page: 1/29 ONE LINE OWNER LISTING Ordered By LOCATION Filter: Status NOT EQUAL TO d Location Account # Owner DBA Tax Code Total 81 ALBION ST 112090 TERRACE DESIGNS INC AVEY ART DISPLAY 502 3,520 83 ALBION ST 135580 FOUR WHEELS AUTO LLC FOUR WHEELS AUTO LLC 501 5,140 99 ALBION ST 136630 HERNANDEZ ALEX HERNANDEZ CONSULTING & 501 9,130 99 ALBION ST 109770 SILLARI T J INC SILLARI T J INC 502 2,210 99 ALBION ST 126530 SHAW DESIGN GROUP LLC CANINE SHOP THE 502 190 99 ALBION ST 133560 SILLARI CAROLINE ROCK TRIBE 501 1,060 112 ALBION ST 104820 ALLEN PLUMBING INC ALLEN PLUMBING INC 502 2,340 105 ALEWIFE BROOK PKWY 128680 STOP & SHOP STOP & SHOP 502 420,120 115 ALEWIFE BROOK PKWY 121390 CONTAN DISCOUNT LIQUOR INC CONTAN DISCOUNT LIQUOR 502 2,800 325 ALEWIFE BROOK PKWY 105540 DUCEUOTTE AUTO DUCEUOTTE AUTO 502 4,460 379 ALEWIFE BROOK PKWY 111540 MOBIL MART PLUS INC GULF 502 20,860 379 ALEWIFE BROOK PKWY 121450 ALLEN JAMES DUNKIN DONUTS 501 25,030 30 ALSTON ST 112570 FLAGRAPHIC INC FLAGRAPHIC INC 502 10,790 300 ARTISAN WAY 130290 NIKE NIKE 502 25,210 301 ARTISAN WAY 130280 EXPRESS FASHION OPERATIONS EXPRESS FACTORY OUTLET 502 3,510 330 ARTISAN WAY 129710 AM RETAIL GROUP WILSONS LEATHER 502 4,540 341 ARTISAN WAY 129660 PUMA NA INC PUMA 502 33,120 360 ARTISAN WAY 129720 STERLING INC KAY JEWELERS #2962 502 4,150 361 ARTISAN WAY 136440 WORLD OF JEANS & TOPS INC TILLYS #263 502 7,440 370 ARTISAN WAY 136450 SAMSONITE COMPANY STORES LLC SAMSONITE COMPANY STOR 503 0 390 ARTISAN WAY 129700 CONVERSE FACTORY CONVERSE FACTORY #3789 -

Building Minority Businesses to Scale Investors in the ECONOMY LEAGUE of GREATER PHILADELPHIA

GREATER PHILADELPHIA REGIONAL Issues and Ideas for Greater Philadelphia’s Leaders REVIEW Fall 2008 Everyone’s Business: Building Minority Businesses to Scale INVESTORS IN THE ECONOMY LEAGUE OF GREATER PHILADELPHIA Foundation Investors Sunoco, Inc. Barra Foundation Trion Lenfest Foundation University of Pennsylvania Philadelphia Foundation, University of Pennsylvania Health System Malinda R. Farrow Fund Wachovia Bank Samuel S. Fels Fund Regional Partner William Penn Foundation Aon Consulting, Inc. Corporate Investors Aqua America, Inc. Ballard, Spahr, Andrews & Ingersoll Regional Visionary Blank Rome, LLP PECO Energy Company Brandywine Global Investment Management Brandywine Realty Trust Regional Steward Buchanan Ingersoll & Rooney Charming Shoppes, Inc. The Children’s Hospital of Philadelphia Rohm & Haas Company Community College of Philadelphia Cozen O’Connor Regional Leader Deloitte Bank of America Drexel University Cephalon, Inc. Drinker, Biddle & Reath, LLP Citizens Bank Fox Rothschild, LLP Comcast Corp. Holy Redeemer Health System GlaxoSmithKline Jeffrey P. Lindtner & Associates Independence Blue Cross La Salle University Keystone Mercy Health Plan Liberty Property Trust KPMG, LLP Mendoza Group Lockheed Martin Mission & Mercator Advisors Combat Support Solutions Mitchell & Titus, LLP PNC Bank Montgomery, McCracken, Walker & Rhoads Radian Group, Inc. Naroff Economic’’ Advisors Right Management Norfolk Southern Corporation Shire Northmarq Advisors SEI, Inc. Parente Randolph, LLC Pennsylvania Economy League, Inc. Pepper Hamilton, LLP -

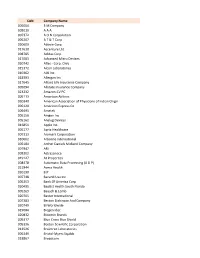

CAN Company Name 005004 3 M Company 005010 a a a 007372 a O N Corporation 005207 a T & T Corp 020609 Abbvie Corp. 017610

CAN Company Name 005004 3 M Company 005010 A A A 007372 A O N Corporation 005207 A T & T Corp 020609 Abbvie Corp. 017610 Accenture Ltd. 008785 Adidas Corp 017083 Advanced Micro Devices 020742 Aflac - Corp. Only 015372 Alcon Laboratories 010362 Aldi Inc 018393 Allergan Inc 017645 Allianz Life Insurance Company 005094 Allstate Insurance Company 023232 Amazon-CV PC 005113 American Airlines 020340 American Association of Physicians of Indian Origin 005120 American Express Co 009491 Ametek 005156 Amgen Inc 005162 Analog Devices 016851 Apple Inc. 005177 Apria Healthcare 007313 Aramark Corporation 010662 Arbonne International 005184 Archer Daniels Midland Company 007947 ARI 005202 Astrazeneca 019127 At Properties 008478 Automatic Data Processing (A D P) 021944 Avera Health 020190 B.P. 007748 Bacardi Usa Inc 005253 Bank Of America Corp 020495 Baptist Health South Florida 005269 Bausch & Lomb 020705 Baxter International 007383 Becton Dickinson And Company 020749 BI Worldwide 019084 Biogen Idec 020832 Bloomin Brands 005317 Blue Cross Blue Shield 005336 Boston Scientific Corporation 013526 Braintree Laboratories 005349 Bristol-Myers Squibb 018867 Broadcom 005357 Brown-Forman 007403 C B S Broadcasting Inc 005383 C V S 005384 Cablevision 010995 Caesars Entertainment Group 019659 Carefusion Corporation 020683 CARFAX 005407 Carolinas Healthcare System 005415 Caterpillar Inc 018396 Cb Richard Ellis Group 021467 CDK Global Inc. 005450 Chevron USA Inc. 007575 Church Of Jesus Christ L D S 005477 Cisco Systems 005481 Citigroup 006352 Citizens Financial Group -

Pennsylvania ENERGY STAR Fact Sheet

PENNSYLVANIA April 2017 ® Families and businesses are saving with the help of ENERGY STAR Pennsylvania is home to more than 519 businesses and organizations participating in the U.S. Environmental Protection Agency’s ENERGY STAR program: 81 manufacturers of ENERGY STAR certified products 32 companies supporting independent certification of ENERGY STAR products and homes 83 companies building ENERGY STAR certified homes, three of which are committed to building 100% ENERGY STAR as well as many businesses, school districts, governments, and faith-based groups using ENERGY STAR resources to reduce energy waste in their facilities. Across the state of Pennsylvania 5,654,291 customers are served by ENERGY STAR utility partners U.S. Steel Tower, Pittsburgh, PA. 22,107 homes have earned the ENERGY STAR ENERGY STAR Certified in 2016. 19,501 buildings (nearly 1.8 billion square feet) have been benchmarked using EPA’s ENERGY STAR Portfolio Manager State Spotlights 1,033 buildings have earned the ENERGY STAR for superior efficiency, including 284 schools, 16 hotels, 7 hospitals, Air King America offers one of the most complete lines of 274 office buildings, and 4 industrial plants ENERGY STAR qualified ventilation products on the market including Bathroom Exhaust Fans, Continuous Operation Exhaust Fans, Inline Exhaust, Under Cabinet and Chimney Recent Partner of the Year Winners Range Hoods. Air King America Brandywine Realty Trust “It’s an honor to be recognized again by the EPA for our EnergyCAP Inc innovative energy efficiency solutions that are helping our Liberty Property Trust customers save energy and money every day.” – Craig North Penn School District Adams, President and CEO, PECO PECO PPL Electric SEPTA's Headquarters in Center City Philadelphia, built in Ricoh USA, Inc. -

Historical List of Women Ceos of the Fortune Lists: 1972– 2019 May 2019 Fortune Magazine Annually Ranks the Largest Companies in the United States by Revenue

Historical List of Women CEOs of the Fortune Lists: 1972– 2019 May 2019 Fortune magazine annually ranks the largest companies in the United States by revenue. The revenues for each company are calculated by Fortune magazine at the end of each calendar year and are usually published in the spring of the subsequent year. Catalyst has researched and created a list of all the Fortune women CEOs. No other such detailed list exists. This document is divided into three sections: • Part 1: Women CEOs of the Fortune 500 List–Published Lists, 2014- 2019: Includes a list of the women CEOs at the time of the annual Fortune 500 list publication, as well as a non-exhaustive selection of notable changes from previous year. • Part 2: Women CEOs of the Fortune 1000, 1995-2013: Includes a snapshot of all women CEOs on each annual published list, as well as detailed information on appointments and departures during the interim period between list publications. • Part 3: Women CEOs of the 500 Largest US Industrial Corporations and the Largest Commercial Banking, Life Insurance, Diversified Financial, Retailing, Savings Institutions, Transportation, and Utility Companies, 1972-1994: Includes a snapshot of all women CEOs on each annual published list. Note the methodology changed beginning with the 1995 list. Part 1: Women CEOs of the Fortune 500 List--Published Lists, 2014-2019 For each year below, the list includes information on women who were CEOs of Fortune-ranked companies at the time each annual list was published (“Published List”), based on Fortune’s analysis of its list at the time of its publication. -

ATRCOUN April 27, 20

January 2016 ▪ Volume 20 ▪ Issue 1 THE FORCE AWAKENS: A were signs of choppiness. The Dow plunged RESURGENCE OF M&A IN in September and the IPO markets have been LAWYER slow to gather steam, with very few successful 2015 IPOs in the fourth quarter. We hate to say it, but the current exuberant pace of M&A deals By Frank Aquila and Melissa Sawyer may not be sustainable unless the capital Frank Aquila and Melissa Sawyer are markets can continue to deliver new, up and partners in the Mergers & Acquisitions Group of Sullivan & Cromwell LLP. The coming companies into the mix of potential views and opinions expressed in this article buyers and targets. Meanwhile, the Fed’s de- are those of the authors and do not necessar- cision to raise interest rates will also surely ily represent those of Sullivan & Cromwell LLP or its clients. have an impact on the M&A environment as Contact: [email protected] or well. [email protected]. After close to a decade of anemic M&A, Best of Enemies: Activism 2015 was “the big year” that dealmakers have Developments been expecting for the last several years. Sig- Activism was somewhat old news in 2015 nicant deals took place across a wide range because activism has largely matured into be- The M&A of sectors and geographies. Dealmaking in ing the “new normal.” The level of engage- health care and life sciences continued to be ment between issuers, activists and institu- very active, but we also saw a lot of deals in tional investors has risen to dizzying heights, consumer and retail (Kraft/Heinz, AB InBev/ with all the attendant professionalization of SABMiller), media (Cablevision/Altice, Charter/Time Warner) and chemicals (Dow/ DuPont, Cytec/Solvay), to name a few IN THIS ISSUE: industries. -

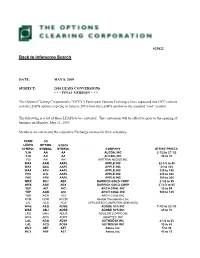

2010 Leaps Conversions * * * Final Version * * *

#25822 BackTO: to Infomemo ALL Search CLEARING MEMBERS FROM: FRANCES KRISCHUNAS, LEAD BUSINESS ANALYST NATIONAL OPERATIONS DATE: MAY 8, 2009 SUBJECT: 2010 LEAPS CONVERSIONS * * * FINAL VERSION * * * The Options Clearing Corporation's ("OCC's") Participant Options Exchanges have requested that OCC convert certain LEAPS options expiring in January 2010 from the LEAPS symbol to the standard "root" symbol. The following is a list of those LEAPS to be converted. The conversion will be effective prior to the opening of business on Monday, May 11, 2009. Members are referred to the respective Exchange memos for their schedules. FROM TO LEAPS OPTION STOCK SYMBOL SYMBOL SYMBOL COMPANY STRIKE PRICES YJA AA AA ALCOA, INC 2-1/2 to 27-1/2 YJA AJI AA ALCOA, INC 30 to 70 YGI AAI AAI AIRTRAN HLDGS INC WAA AAQ AAPL APPLE INC 22-1/2 to 40 WAA QAA AAPL APPLE INC 45 to 120 WAA APV AAPL APPLE INC 125 to 150 YHC AJL AAPL APPLE INC 210 to 400 YHC APV AAPL APPLE INC 155 to 200 WRX BXJ ABX BARRICK GOLD CORP 2-1/2 to 25 WRX ABX ABX BARRICK GOLD CORP 27-1/2 to 85 YEP ACI ACI ARCH COAL INC 20 to 95 YEP AQU ACI ARCH COAL INC 100 to 145 YBB AGH ACI ARCH COAL INC KCM QOR ACOR Acorda Therapeutics Inc LAI ACS ACS AFFILIATED COMPUTER SERVICES WAE AEQ ADBE ADOBE SYS INC 7-1/2 to 22-1/2 WAE ABJ ADBE ADOBE SYS INC 25 to 70 LRG UAH ADLR ADOLOR CORPCOM WYA APQ ADPT ADAPTEC INC LAL ADQ ADSK AUTODESK INC 2-1/2 to 25 LAL AYD ADSK AUTODESK INC 30 to 80 WLY AET AET Aetna, Inc. -

Wings for Success 2012 Annual Report

Outfitting Women with Hope & Confidence ANNUAL Wings for Success improves the employment opportunities of economically disadvantaged women by providing them with work appropriate attire, wardrobe guidance and life skills workshops. Clients of Wings for Success are survivors of domestic violence, homelessness or REPORT addiction. Some are experiencing prolonged unemployment or underemployment. Others are transitioning off government support. Many live in poverty and are struggling to rebuild their lives. By creating a professional outward image, Wings helps women grow their inner self-image to feel confident on job interviews, succeed in the workplace, and become financially self-sufficient. The outcome of such success is a more professional workforce and a stronger economy. A Message from our Board President Wings Family and Friends, In its 15th Anniversary year, Wings for Success has much to celebrate. From an idea and vision – developed by an ambitious group of women around a kitchen table – 2012 an organization has emerged that has served over 7,500 women in our community throughout the years. The perspective of time sheds light on everything that’s been accomplished from those humble beginnings: staff, facilities, a strong volunteer base, and financial stability. As the saying goes, “We’ve come a long way, baby!” Without a doubt, a key to the success of the organization has been the incredible support we have received from the community. Foundations. Volunteers. Civic organizations. Businesses. Each has played a significant role in helping us deliver on our mission. Through partnership, we are making our community a better place to live and work for everyone. Still, 2012 has had its struggles. -

Amerigas Partners, L.P. 2013 Annual Report

AmeriGas Partners, L.P. 2013 Annual Report Driving Every Day Our vision will span the country while our service goes door to door. Driving Every Day From the desk to the dashboard from the office to the road It is what we see from our stores. This is what we do. It is who we are. We are providers. Just like our customers. AmeriGas Partners, L.P. is a publicly traded master limited AmeriGas distributes nearly 1.4 billion gallons of propane partnership that operates the nation’s largest retail propane annually to over 2 million residential, commercial/industrial, distribution business. The common units of AmeriGas motor fuel, agricultural and wholesale customers in all Partners, L.P. are traded on the New York Stock Exchange 50 states. Through the Partnership’s AmeriGas Cylinder under the symbol “APU.” UGI Corporation, through Exchange “ACE” program, ACE cylinders are available at subsidiaries, is the sole General Partner and owns 26% nearly 47,500 retail locations throughout the United States. of the Partnership. An affiliate of Energy Transfer Partners, AmeriGas operates over 2,500 distribution locations and L.P. owns 24% of the Partnership and the public owns the has nearly 8,500 dedicated employees focused on fulfilling remaining 50%. AmeriGas’ commitment to be the most reliable, safest and As a clean versatile energy source, propane is used for a most responsive propane company in the nation. wide variety of applications. Residential and commercial customers use propane for space heating, water heating, cooking and drying while industrial customers use it to fire furnaces, as a cutting gas and in other process applications.