H21cm X W14.85Cm H21cm X W14.85Cm

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Automotive-200103-1Q20 Strategy (Kenanga)

Sector Update 03 January 2020 Automotive NEUTRAL National Marques Overtaking on the Fast Lane ↔ By Wan Mustaqim Bin Wan Ab Aziz l [email protected] We maintain our NEUTRAL rating on the AUTOMOTIVE sector. The MIER consumer sentiment index scored 84.0 points (-9.0ppt QoQ, -23.5ppt YoY) in 3QCY19 which is below the optimistic threshold (>100pts) due to normalisation of consumer confidence post-tax holiday and weak macroeconomic outlook. Reflecting this, we are seeing car sales trending in favour of value-for-money national marques, as evident from their 11MCY19 TIV market share of 57%. Non-national marques on the other hand, are focusing on higher-margin lower-volume models (catering to higher purchasing power consumers). Notable developments in Automotive industry in 2019/2020 include: (i) national marques surpassing non-national marques in terms of market share, (ii) Proton has surpassed Honda as no.2 trailing behind Perodua, (iii) increasing number of new model launches, (iv) better incentives under National Automotive Policy 2020 (tentatively on 1QCY20), and (v) another OPR rate cut by 25bps (to 2.75%) in 2020, which should have minimal positive impact on vehicles loans. No changes to our 2019 TIV target of 600,000 units (+0.2%), and we introduce 2020 TIV target of 612,000 units (+2%) matching MAA’s target factoring the extra boost from national marques (Proton and Perodua). Our sector top-pick is BAUTO (OP; TP: RM2.65) for its defensible niche SUV market and attractive, steady dividend yield of 7.3%. National marques affirming leading market position . As of 11MCY19, the national marques (57%) continued to stay above non-national marques (43%) in terms of market share, marking a year not seen since 2013, owing to the outstanding sales from Perodua, especially after the introduction of its all-new Perodua Myvi and supported by the all-new Perodua Aruz (27,389 units delivered). -

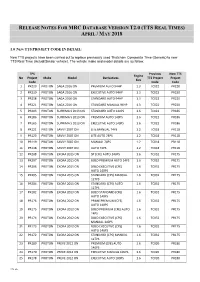

Release Notes for Mrc Database Version T2.0 (Tts Real Times) April / May 2018

RELEASE NOTES FOR MRC DATABASE VERSION T2.0 (TTS REAL TIMES) APRIL / MAY 2018 1.0 NEW TTS PROJECT CODE IN DETAIL: New TTS projects have been carried out to replace previously used Thatcham Composite Time (Generic) to new TTS Real Time (Actual/Similar vehicle). The vehicle make and model details are as follow: TPS Previous New TTS Engine No Project Make Model Derivatives TTS Project Project Size Code Code Code 1 PR220 PROTON SAGA 2016 ON PREMIUM AUTO 94HP 1.3 TC022 PR220 2 PR219 PROTON SAGA 2016 ON EXECUTIVE AUTO 94HP 1.3 TC022 PR220 3 PR218 PROTON SAGA 2016 ON STANDARD AUTO 94HP 1.3 TC022 PR220 4 PR221 PROTON SAGA 2016 ON STANDARD MANUAL 94HP 1.3 TC022 PR220 5 PR203 PROTON SUPRIMA S 2013 ON STANDARD AUTO 140PS 1.6 TC022 PR186 6 PR186 PROTON SUPRIMA S 2013 ON PREMIUM AUTO 140PS 1.6 TC022 PR186 7 PR165 PROTON SUPRIMA S 2013 ON EXECUTIVE AUTO 140PS 1.6 TC022 PR186 8 PR121 PROTON SAVVY 2007 ON LITE MANUAL 74PS 1.2 TC018 PR118 9 PR120 PROTON SAVVY 2007 ON LITE AUTO 74PS 1.2 TC018 PR118 10 PR119 PROTON SAVVY 2007 ON MANUAL 74PS 1.2 TC018 PR118 11 PR118 PROTON SAVVY 2007 ON AUTO 74PS 1.2 TC018 PR118 12 PR208 PROTON EXORA 2015 ON SP (CFE) AUTO 140PS 1.6 TC032 PR175 13 PR207 PROTON EXORA 2015 ON BOLD PREMIUM AUTO 14PS 1.6 TC032 PR175 14 PR206 PROTON EXORA 2015 ON BOLD EXECUTIVE (CFE) 1.6 TC032 PR175 AUTO 140PS 15 PR205 PROTON EXORA 2015 ON STANDARD (CPS) MANUAL 1.6 TC032 PR175 127PS 16 PR204 PROTON EXORA 2015 ON STANDARD (CPS) AUTO 1.6 TC032 PR175 127PS 17 PR182 PROTON EXORA 2013 ON BOLD STANDARD (CFE) 1.6 TC032 PR175 AUTO 140PS 18 PR176 PROTON -

Automotive-191003-4Q19 Strategy

Sector Update 03 October 2019 Automotive NEUTRAL National Marques Racing Ahead ↔ By Wan Mustaqim Bin Wan Ab Aziz l [email protected] We maintain our NEUTRAL rating on the AUTOMOTIVE sector. The MIER consumer sentiment inde x scored 93.0 pts (+7.4pts QoQ, -39.9pts YoY) in 2Q19 which is below the optimistic threshold (>100pts) due to muted growth post the zero-rated tax holiday. Reflecting this, we are seeing car sales trending in favour of value-for-money national marques. Non-national marques on the other hand, are focusing on higher-margin lower-volume models (catering to higher-purchasing power consumers). Notable developments in Automotive industry in 2019 include: (i) National Marques surpassing Non-National marques’ market share, (ii) Proton is expected to surpass Honda as no.2 trailing behind Perodua in total industry market share TIV powered by the all-new Proton X70, and supported by all-new and face-lifted models, (iii) increasing number of new model launches, and (iv) introduction of the third national car under National Automotive Policy 2019 by year-end. No changes to our 2019 TIV target of 600,000 units matching MAA’s target factoring the extra boost from national marques (Proton and Perodua). Our sector top-pick is BAUTO (OP; TP: RM2.75) which offers a steady dividend yield of 7.2%. National marques affirming leading market position . As of 8M19, the national marques (56%) continued to stay above non-national marques (44%) in terms of market share, marking a year not seen since 2013, attributed to the outstanding sales from Perodua, especially after the introduction of its all-new Perodua Myvi and supported by the all-new Perodua Aruz (25k bookings, 20.3k delivered). -

PROCLAMATION of SALE MOTOR VEHICLES for Sale by Public Auction on Monday 4Th November 2019 @ 2.30 P.M Venue : Unit Nos

PROCLAMATION OF SALE MOTOR VEHICLES For Sale By Public Auction On Monday 4th November 2019 @ 2.30 p.m Venue : Unit Nos. B-0-6 & B-0-7, Ground Floor, Block B Megan Avenue II, No 12, Jln Yap Kwan Seng, Kuala Lumpur www.ngchanmau.com/auto "Prospect bidders may submit bids for the Auto e-Bidding via www.ngchanmau.com/auto. *Please register at least one (1) working day before auction day for registration & verification purposes". To get a digital copy of auction listings by Car Make / Model, please SMS or Whatsapp to 012-5310600. LEGAL OWNER : PUBLIC BANK BERHAD (6463-H) / PUBLIC ISLAMIC BANK BERHAD (14328-V) REGISTRATION YEAR OF KEY RESERVE PRICE LOT NO MAKE & MODEL REMARKS NO MAKE (YES / NO) (RM) STORE YARD : INTER PACIFIC AUTO AUCTION SDN. BHD. PANDAN SAFARI SHOPPING COMPLEX, CAR PARK (LEVEL 3) , NO. 1, JALAN PERDANA 6/10A, PANDAN PERDANA, 55300 KUALA LUMPUR (TELEPHONE NO : 03-9274 7612 / 9274 7613) VIEWING DATES: 31st October 2019, 1st & 2nd November 2019 (10.00AM - 3.00PM) & 4th November 2019 (10.00AM - 12.00PM) P101 PMN7720 NISSAN ALMERA 1.5 2016 YES 20,000 P102 WB8814L TOYOTA CAMRY 2.5 HYBRID 2015 NO 72,000 Unable to determine engine P103 BMU1800 MAZDA 6 2.0 2014/15 NO 53,000 number. Unable to determine engine P104 WA3299T FORD FIESTA SPORT 1.0 2014 NO 25,000 number. P105 PLF8070 HONDA ACCORD 2.4 2011/12 NO 26,000 P106 VBB8871 NISSAN TEANA 200 2017 NO 55,000 P107 CBU6650 NAZA CITRA 2.0 2006 NO 2,500 P108 WYG7208 PEUGEOT 208 1.6 2013 YES Engine number differ. -

Welfare Effects of Trade Barriers on Malaysian Car Industry: an Alternative Approach

WELFARE EFFECTS OF TRADE BARRIERS ON MALAYSIAN CAR INDUSTRY: AN ALTERNATIVE APPROACH Wai Kun C Lau (1718460) A Dissertation Submitted In Fulfilment Of The Requirements For The Degree of DOCTOR OF PHILOSOPHY FACULTY OF BUSINESS & LAW SWINBURNE UNIVERSITY OF TECHNOLOGY April 2020 i Abstract Malaysian car industry has been heavily protected by tariff and non-tariff tools since it was founded in 1983. Despite excessive tariffs imposed on foreign cars, the demand for foreign cars increases after the Asian financial crisis 1997 while the demand for domestic cars declines. Partial equilibrium framework is applied in this research because the car industry’s contribution to GDP is very small and the focus of this research is specifically on the car industry. Since cars are durable and differentiated, changes due to technological advancement may influence car demand. This research applies Discrete Choice model to account for car characteristics in addition to socio-economic factors for analysis of car demand in Malaysia. Logistic regression analysis results show factors that influence car demand are: horsepower, fuel consumption, and car size that is measured by number of passengers. Results suggest that non-tariff barriers and government incentives given to the civil servants have significant influence on Proton cars’ demand, and foreign car makers that have been operating in Malaysia before the founding of Proton enjoy their reputation from their historical experience and performance. While it is often believed that European cars have ostentatious value in Malaysia, the results show otherwise. Price elasticity of demand for major car makes is estimated based on the average horsepower, car size and fuel consumption. -

Development of Life Cycle Cost Model of Passenger Car By

Development of Life Cycle Cost Model of Passenger Car by Muhamad Azlan Bin Yusoff (ID: 12042) Dissertation submitted in partial fulfilment of the requirements for the Bachelor of Engineering (Hons) (Mechanical Engineering) SEPTEMBER 2012 Universiti Teknologi PETRONAS Bandar Seri Iskandar 31750 Tronoh Perak Darul Ridzuan CERTIFICATION OF APPROVAL Development of Life Cycle Cost Model of Passenger Car by Muhamad Azlan Bin Yusoff (ID: 12042) A project dissertation submitted to the Mechanical Engineering Programme Universiti Teknologi PETRONAS In partial fulfilment of the requirement for the BACHELOR OF ENGINEERING (Hons) (MECHANICAL ENGINEERING) Approved by, ___________________________ DR. MASDI BIN MUHAMMAD Universiti Teknologi PETRONAS Tronoh, Perak September 2012 i CERTIFICATION OF ORIGINALITY This is certify that I am responsible for the work submitted in this project, that the original work is my own except as specified in the references and acknowledgements, and that the original work contained herein have not been undertaken or done by unspecified sources or persons. ________________________________________ MUHAMAD AZLAN BIN YUSOFF (ID: 12042) ii ABSTRACT Life cycle costing is the process of economic analysis to assess total cost of ownership and preparation of LCC model to provide inputs in the decision making process. The decision to purchase is not only influenced by the product’s initial cost but also by the product’s expected operation and maintenance cost over its service life and disposal cost. LCC model is a simplified representation of the real world as its extract each cost elements in each cost categories and in all phases through the cost breakdown structure then translates them into cost estimating relationships. -

LH & RH) Chrome Inner Door Handle (4Pcs/Set

85 (ADVANCE) Air-Cond Panel Switch PROTON EXORA Fog Lamp Panel Switch PROTON EXORA Door Mirror (LH & RH) Led Door Mirror (LH & RH) TOYOTA FORTUNER / HILUX PROTON PERSONA ELEGANCE * 7 wire Upgrade PERSONA “OLD” & GEN.2 Safety Belt (Rear) Security Alarm System Auto Adjustable with Motor System TOYOTA * LH. RH, Center Fog Lamp (LH & RH) Car Audio PROTON PREVE PROTON PREVE with GPS Chrome Inner Door Handle (4pcs/set) Chrome Fog Lamp Rim (LH & RH) PROTON PERSONA / EXORA PROTON EXORA © Copyright 2006 YAC AUTO (M) Sdn. Bhd. All Rights Reserved. 86 Fog Lamp (LH & RH) Fog Lamp (LH & RH) M.TRITON '09 / PROTON INSPIRA PROTON EXORA “campaign ” Chrome Front Garnish PROTON EXORA FL 'BOLD' Reverse Sensor (Colour) PROTON EXORA “campaign ” Air Scoop (w/out Paint) TOYOTA HILUX Aluminium Loading Sill PROTON EXORA/PERODUA MYVI/PERODUA ALZA YC1990 Lower Tie Frame Bar (Beaks Bar) PROTON - WIRA/WAJA/GEN.2/PERSONA PROTON - SATRIA/SATRIA NEO Blue | Gold | Red | Silver Polishing 15” Wheel Cover Door Handle Cover (4pcs/set) Silver | Titanium PEROUDA MYVI '2011 IS200 YC2947 © Copyright 2006 YAC AUTO (M) Sdn. Bhd. All Rights Reserved. 87 Head Lamp Lid Cover (2pcs/set) Head Lamp Lid Cover (2pcs/set) PERODUA MYVI '2011 PROTON EXORA Chrome | Black | Silver | White | Grey | Yellow | Chrome | Black | Silver | White | Elegance Brown | Purple | Orange | Carbon Fiber Carbon Fiber YC2987 YC3787 Tail Lamp Cover (2pcs/set) Ultra Car Seat Mat PERODUA MYVI '2011 Chrome | Black | Silver | White | Grey | Yellow | Purple | Orange | Carbon Fiber YC2997 Aluminium Loading Si (LH & RH) PROTON EXORA YC1990 Emergency Led Lid with Magnet * 36cm x 31.5cm © Copyright 2006 YAC AUTO (M) Sdn. -

Proton Exora E-Brochure Lowres

إﻛـﺴـﻮرا إﻟﻴﻜﻢ ﺑﺮوﺗﻮن إﻛﺴﻮرا ﺳﻴﺎرة ﻣﺘﻌﺪدة اﻷﻏﺮاض MPV ﻣﺰودة ﺑﻤﺤﺮك ﻗﻮى ذو ﺷﺤﻦ ﺗﻮرﺑﻴﻨﻰ ﻳﻮﻓﺮ أداء ﻳﻮازى اﻟﻤﺤﺮﻛﺎت اﻷﻛﺒﺮ ﻛﺜﻴﺮا ﻓﻲ اﻟﺤﺠﻢ. ﺗﺄﺗﻰ إﻛﺴﻮرا اﻟﺠﺪﻳﺪة ﺑﺘﺼﻤﻴﻢ رﻳﺎﺿﻰ ﺟﺬاب، وﺗﺠﻬﻴﺰات ﻣﺘﻄﻮرة ﺟﺪﻳﺪة، وﻋﻨﺎﺻﺮ إﺿﺎءة ﻣﺘﻌﺪدة، وﺗﺼﻤﻴﻢ ﻣﻤﻴﺰ ﻟﻌﺠﻠﺔ اﻟﻘﻴﺎدة ﺑﺎﻹﺿﺎﻓﺔ إﻟﻰ ﺗﻘﻨﻴﺎت ذﻛﻴﺔ ﻣﻠﻴﺌﺔ ﺑﺎﻟﻤﺘﻌﺔ. إﻧﻬﺎ ﺟﻤﻴﻌﺎ إﺿﺎﻓﺎت إﻟﻰ اﻟﻤﺘﻌﺔ اﻟﺘﻲ ﻳﻤﻜﻦ أن ﺗﺤﺼﻞ ﻋﻠﻴﻬﺎ أﻧﺖ و ٧ رﻛﺎب ﻓﻲ اﻟﺴﻴﺎرة. INTRODUCING THE PROTON EXORA The multi-purpose vehicle (MPV) has a powerful turbocharged engine that allows a performance equal to that of a much larger engine. The new Exora comes with a sporty styling, cool new features, light finishing, wheel design and gadgets packed fun. It’s a bonus added when all can be offered with 7 occupants. ﻣﺴﺎﺣﺔ ﻟﻸﻗﺔ! .SPACE FOR STYLE ءا ا ا و ط ا اداء وا ا , ن إرا ا ا ا ت. Starting from its bold front grille up to its black roof accent and rear spoiler, the Exora exudes style on many levels. ﭼﻨﻮط ﺳﺒﻮر ١٦ ﺑﻮﺻﺔ 16-INCH ALLOY WHEELS ﻣﺮاﻳﺎ ﺟﺎﻧﺒﻴﺔ ﻛﻬﺮﺑﺎﺋﻴﺔ ﻗﺎﺑﻠﺔ ﻟﻠﻄﻰ ELECTRIC FOLDING SIDE MIRRORS ﻣﺼﺎﺑﻴﺢ ﺷﺒﻮرة ﺑﺨﺎﺻﻴﺔ اﻹﺿﺎءة اﻟﻨﻬﺎرﻳﺔ DAYTIME RUNNING FOG LIGHTS ﺳﺒﻮﻳﻠﺮ رﻳﺎﺿﻰ REAR SPOILER ﻣﺘﻌﺔ ﻟﻠﺠﻤﻴﻊ! FUN FOR ALL! ﻣﺠﺎل واﺳﻊ ﻟﺘﳮﻮ ﺣﻼﻣﻚ! ROOM TO GROW YOUR DREAMS. ا ا دا رة ر ب إرا ا. إد ا رة , وأ, و ء ه و ا د . Embrace the luxury of space in the Exora’s capacious cabin. Step in to find room to fit more friends, family and everything you need for your next escape. ﻣﻘﺼﻮرﺗﻚ اﻟﺪاﺧﻠﻴﺔ YOUR INTERIOR ¢¡ . ﺷﺎﺷﺔ ﻋﺮض DVD ﻟﻠﺮﻛﺎب ٧ ﻣﻘﺎﻋﺪ ﻗﺎﺑﻠﺔ ﻟﻠﻄﻰ ﻓﺘﺤﺎت ﺗﻜﻴﻴﻒ ﺑﺼﻒ اﻟﻤﻘﺎﻋﺪ اﻟﺜﺎﻧﻰ واﻟﺜﺎﻟﺚ ﻛﺎﻣﻴﺮا رﻛﻦ ﺧﻠﻔﻴﺔ Reverse Camera 2nd & 3rd Row Air Condition 7 Foldable Seats Passenger DVD LCD Monitor A focus on everything carefully displayed. -

News Release

Perusahaan Otomobil Nasional Sdn Bhd (100995-U) Persiaran Kuala Selangor, Seksyen 26, 40400 Shah Alam Selangor Darul Ehsan, Malaysia. T (+603) 5102 6000 F (+603) 5191 9120 News Release PROTON CONFIDENT ON NETWORK SYNERGY OUTCOME - 170 applications received within 3 months for 3S/4S upgrade consisting of existing dealers and new investors - 66 Dealers and branches approved for upgrade to 3S/4S, ahead of schedule Subang Jaya, 16 April 2018 – 2018 is an important year for PROTON after the acquisition of 49.9% shares by Geely as the Company undergoes numerous initiatives internally to ensure a successful turnarounD in a short time. With the new partnership comes renewed hope and efforts are centred around uplifting its brand value whilst intensifying efforts to achieve its goal to have 109 3S/4S centres as part of a 180o approach in fulfilling customer satisfaction and ownership experience. This is also to prepare the network for the first Proton SUV, a premium segment offering, which will be launched in Q4 2018. 61% quota fulfilled for network upgrade The first of many future models to be co-Developed with Geely will be solD from outlets delivering a premium experience. Within 3 months of the Company announcing a one-of-its-kind scheme for dealers to upgrade or new investors to build 3S/4S centres, PROTON has receiveD 170 applications, with 82 of them, potentially approved for the upgrading exercise. To-date, 66 applications have been duly evaluated and approved with the rest of them being thoroughly reviewed to ensure adherence to set requirements and criteria. -

Prices Issued by Car Dealers As of 31 August 2020

PASSENGER MOTOR VEHICLES (PMV) PRICES ISSUED BY CAR DEALERS AS OF 31ST AUGUST 2020 Prices on the JPES website are every 2 weeks. For the most up-to-date prices, please download the PenggunaBijak mobile app SER SHOWROOM PRICE ON-THE-ROAD PRICE PMV MODEL & BRAND DESCRIPTION DATE ISSUED No. (SRP) (OTR) 1.00 ALFA ROMEO (G.H.K. MOTORS SDN BHD) 1.01 ALFA ROMEO GIULIA 620 GME 2.0L AUTO SEDAN PETROL $ 63,900.00 $ 65,800.00 17-Jul-20 1.02 ALFA ROMEO GIULIA 620 QV V6 2.9L AUTO SEDAN PETROL $ 139,973.00 $ 144,094.00 17-Jul-20 1.03 ALFA ROMEO GIULIA VELOCE 620 2.0L AUTO GME 2000 SEDAN PETROL $ 72,700.00 $ 74,800.00 17-Jul-20 1.04 ALFA ROMEO STELVIO 2.0L AUTO AWD SUV PETROL $ 75,500.00 $ 77,800.00 17-Jul-20 2.00 AUDI (T.C.Y. MOTORS SDN BHD) 2.01 AUDI A4 2.0L TFSI ULTRA QUATTRO S-TRONIC AUTO SEDAN PETROL $ 74,440.00 $ 76,448.00 16-Jul-20 2.02 AUDI A6 1.8L TFSI S-TRONIC S-LINE AUTO PETROL $ 72,570.00 $ 74,533.00 16-Jul-20 2.03 AUDI A3 1.2L S-LINE TFSI S-TRONIC AUTO SPORTBACK PETROL $ 52,600.00 $ 54,100.00 16-Jul-20 2.04 AUDI A3 1.2L TFSI S-TRONIC AUTO SEDAN PETROL $ 44,530.00 $ 45,847.00 16-Jul-20 2.05 AUDI A3 1.2L TFSI S-TRONIC AUTO SPORTBACK PETROL $ 49,350.00 $ 50,769.00 16-Jul-20 2.06 AUDI A4 2.0L TFSI ULTRA S-TRONIC AUTO S-LINE BLACK STYLING SEDAN PETROL $ 73,130.00 $ 75,117.00 16-Jul-20 2.07 AUDI A5 2.0L TFSI QUATTRO S-TRONIC AUTO COUPE PETROL $ 83,310.00 $ 85,501.00 16-Jul-20 2.08 AUDI A6 2.0L TFSI S-TRONIC AUTO SEDAN PETROL $ 78,790.00 $ 80,879.00 16-Jul-20 2.09 AUDI A6 3.0L TFSI QUATTRO S-TRONIC AUTO SEDAN PETROL $ 109,930.00 $ 112,716.00 16-Jul-20 -

PROCLAMATION of SALE MOTOR VEHICLES for Sale by Public Auction on Thursday, 25Th October 2018 @ 2.30 P.M Venue : Unit No

PROCLAMATION OF SALE MOTOR VEHICLES For Sale By Public Auction On Thursday, 25th October 2018 @ 2.30 p.m Venue : Unit No. 6 (B-0-6), Ground Floor, Block B Megan Avenue II, No 12, Jln Yap Kwan Seng, Kuala Lumpur www.ngchanmau.com/auto "Prospect bidders may submit bids for the Auto e-Bidding via www.ngchanmau.com/auto. *Please register at least one (1) working day before auction day for registration & verification purposes". To get a digital copy of auction listings by Car Make / Model, please SMS or Whatsapp to 012-5310600. LEGAL OWNER : CIMB BANK BERHAD (13491-P) / CIMB ISLAMIC BANK BERHAD (671380-H) REGN. TRANSM RESERVE LOT REGISTRATION YEAR OF PUSPAKOM ENGINE CHASSIS MAKE & MODEL CARD REMARKS ISSION PRICE NO NO MAKE VR 1 RESULT NUMBER NUMBER (YES / NO) TYPE (RM) STORE YARD : G-MART SUNGAI SERAI - LOT 8253, BATU 11 3/4, JALAN HULU LANGAT, 43100 HULU LANGAT, SELANGOR TELEPHONE NO : (03) 9074 3815 VIEWING DATES : 19th & 22nd October 2018 (10.00 AM - 4.00 PM) C101 WA5393H PROTON SAGA 1.3 2014 NO PASSED S4PEUD8365 PL1BT3SNREB456931 M 10,000.00 C102 MAW8778 KIA SPORTAGE 2.0 2002 NO PASSED FE-213681 KNAJA553325164435 A 3,000.00 AP COPY - FORM 1,8 & JK69 ONLY, MERCEDES BENZ C103 WUK6382 2008 NO ENGINE FAILED 27298530871758 WDD2193572A134970 A 57,000.00 CLS350 3.5 NUMBER CANNOT BE VERIFIY(DIRTY) C104 W642E PERODUA MYVI 1.3 2013 NO PASSED T41A31T PM2M602S002138245 A 18,000.00 VR-1 NOT C105 NCX3711 PERODUA VIVA 1.0 2014 NO WITHDRWAN L87B72D PM2L251S002236397 A 14,200.00 DONE C106 WXT8754 PERODUA VIVA 1.0 2012 NO PASSED L19B73A PM2L251S002200453 -

PROCLAMATION of SALE MOTOR VEHICLES for Sale by Public Auction on Monday 1St April 2019 @ 2.30 P.M Venue : Unit No

PROCLAMATION OF SALE MOTOR VEHICLES For Sale By Public Auction On Monday 1st April 2019 @ 2.30 p.m Venue : Unit No. 6 (B-0-6), Ground Floor, Block B Megan Avenue II, No 12, Jln Yap Kwan Seng, Kuala Lumpur www.ngchanmau.com/auto "Prospect bidders may submit bids for the Auto e-Bidding via www.ngchanmau.com/auto. *Please register at least one (1) working day before auction day for registration & verification purposes". To get a digital copy of auction listings by Car Make / Model, please SMS or Whatsapp to 012-5310600. LEGAL OWNER : PUBLIC BANK BERHAD (6463-H) / PUBLIC ISLAMIC BANK BERHAD (14328-V) REGN. REGISTRATION YEAR OF KEY RESERVE PRICE LOT NO MAKE & MODEL CARD REMARKS NO MAKE (YES / NO) (RM) (YES / NO) STORE YARD : INTER PACIFIC AUTO AUCTION SDN. BHD. PANDAN SAFARI SHOPPING COMPLEX, CAR PARK (LEVEL 3) , NO. 1, JALAN PERDANA 6/10A, PANDAN PERDANA, 55300 KUALA LUMPUR (TELEPHONE NO : 03-9274 7612 / 9274 7613) VIEWING DATES: 28th, 29th & 30th March 2019 (10.00AM - 3.00PM) & 1st April 2019 (10.00AM - 12.00PM) P101 WB3177S PROTON SAGA 1.3 2015 YES NO 12,000 P102 PGM2662 TOYOTA AVANZA 1.3 2005 YES NO 7,000 P103 WRR1627 HYUNDAI SONATA EF 2.4 2008 YES YES 5,000 P104 WWJ2704 PROTON EXORA 1.6 2012 YES NO 11,000 P105 PKV6892 PROTON SAGA 1.3 2012 NO NO 6,000 AP Incomplete. Only AP Form 1 P106 WXN3467 NISSAN MURANO 2.5 2009/12 YES NO 37,000 And 69 Available. P107 WRQ9922 MAZDA 6 2.5 2008 NO NO Engine number different.