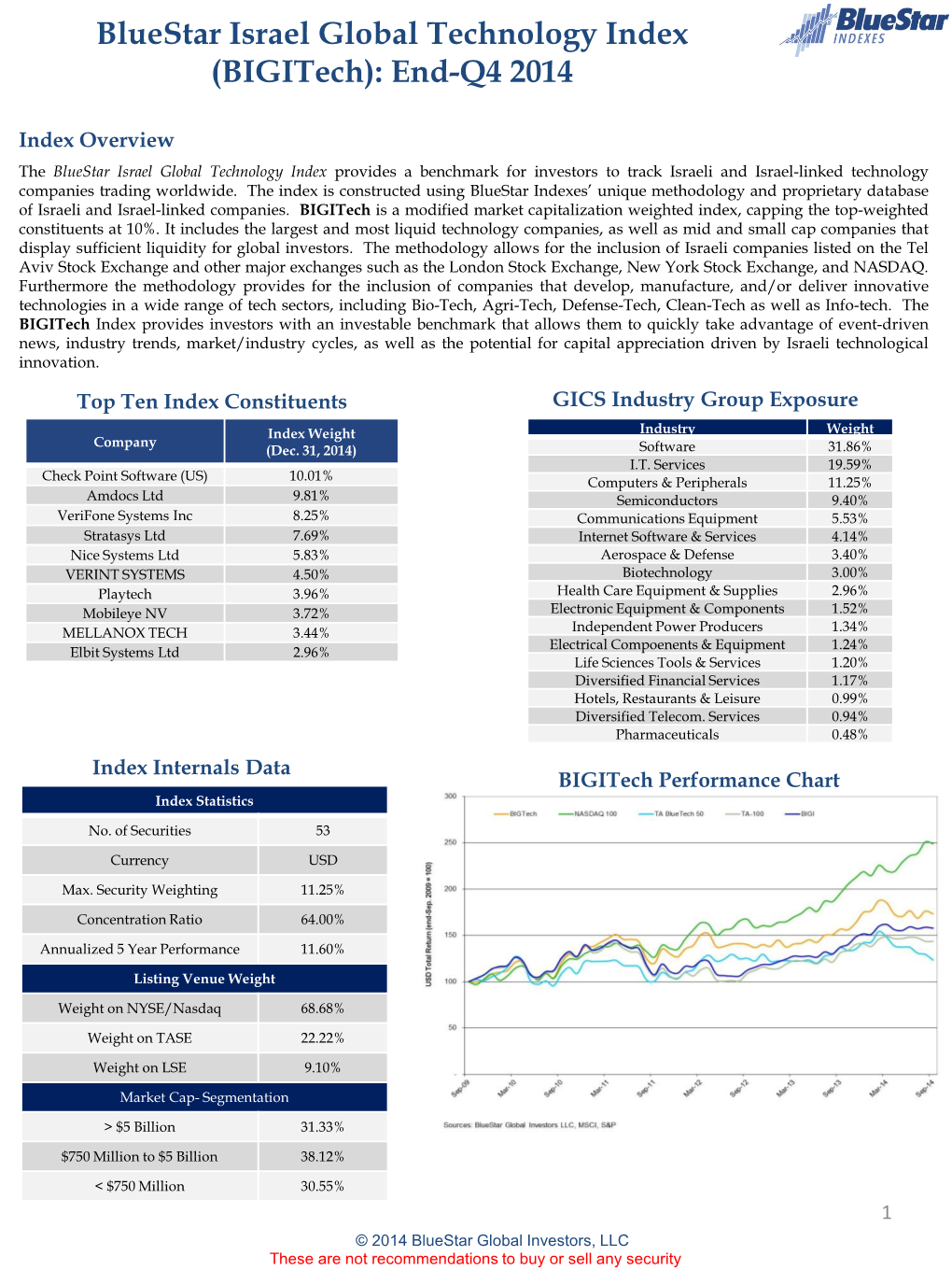

Bluestar Israel Global Technology Index (Bigitech): End-Q4 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Marginable OTC Stocks

List of Marginable OTC Stocks @ENTERTAINMENT, INC. ABACAN RESOURCE CORPORATION ACE CASH EXPRESS, INC. $.01 par common No par common $.01 par common 1ST BANCORP (Indiana) ABACUS DIRECT CORPORATION ACE*COMM CORPORATION $1.00 par common $.001 par common $.01 par common 1ST BERGEN BANCORP ABAXIS, INC. ACETO CORPORATION No par common No par common $.01 par common 1ST SOURCE CORPORATION ABC BANCORP (Georgia) ACMAT CORPORATION $1.00 par common $1.00 par common Class A, no par common Fixed rate cumulative trust preferred securities of 1st Source Capital ABC DISPENSING TECHNOLOGIES, INC. ACORN PRODUCTS, INC. Floating rate cumulative trust preferred $.01 par common $.001 par common securities of 1st Source ABC RAIL PRODUCTS CORPORATION ACRES GAMING INCORPORATED 3-D GEOPHYSICAL, INC. $.01 par common $.01 par common $.01 par common ABER RESOURCES LTD. ACRODYNE COMMUNICATIONS, INC. 3-D SYSTEMS CORPORATION No par common $.01 par common $.001 par common ABIGAIL ADAMS NATIONAL BANCORP, INC. †ACSYS, INC. 3COM CORPORATION $.01 par common No par common No par common ABINGTON BANCORP, INC. (Massachusetts) ACT MANUFACTURING, INC. 3D LABS INC. LIMITED $.10 par common $.01 par common $.01 par common ABIOMED, INC. ACT NETWORKS, INC. 3DFX INTERACTIVE, INC. $.01 par common $.01 par common No par common ABLE TELCOM HOLDING CORPORATION ACT TELECONFERENCING, INC. 3DO COMPANY, THE $.001 par common No par common $.01 par common ABR INFORMATION SERVICES INC. ACTEL CORPORATION 3DX TECHNOLOGIES, INC. $.01 par common $.001 par common $.01 par common ABRAMS INDUSTRIES, INC. ACTION PERFORMANCE COMPANIES, INC. 4 KIDS ENTERTAINMENT, INC. $1.00 par common $.01 par common $.01 par common 4FRONT TECHNOLOGIES, INC. -

Market Cap Close ADV 1598 67Th Pctl 745,214,477.91 $ 23.96

Market Cap Close ADV 1598 67th Pctl $ 745,214,477.91 $ 23.96 225,966.94 801 33rd Pctl $ 199,581,478.89 $ 10.09 53,054.83 2399 Ticker_ Listing_ Effective_ Revised Symbol Security_Name Exchange Date Mkt Cap Close ADV Stratum Stratum AAC AAC Holdings, Inc. N 20160906 M M M M-M-M M-M-M AAMC Altisource Asset Management Corp A 20160906 L M L L-M-L L-M-L AAN Aarons Inc N 20160906 H H H H-H-H H-H-H AAV Advantage Oil & Gas Ltd N 20160906 H L M H-L-M H-M-M AB Alliance Bernstein Holding L P N 20160906 H M M H-M-M H-M-M ABG Asbury Automotive Group Inc N 20160906 H H H H-H-H H-H-H ABM ABM Industries Inc. N 20160906 H H H H-H-H H-H-H AC Associated Capital Group, Inc. N 20160906 H H L H-H-L H-H-L ACCO ACCO Brand Corp. N 20160906 H L H H-L-H H-L-H ACU Acme United A 20160906 L M L L-M-L L-M-L ACY AeroCentury Corp A 20160906 L L L L-L-L L-L-L ADK Adcare Health System A 20160906 L L L L-L-L L-L-L ADPT Adeptus Health Inc. N 20160906 M H H M-H-H M-H-H AE Adams Res Energy Inc A 20160906 L H L L-H-L L-H-L AEL American Equity Inv Life Hldg Co N 20160906 H M H H-M-H H-M-H AF Astoria Financial Corporation N 20160906 H M H H-M-H H-M-H AGM Fed Agricul Mtg Clc Non Voting N 20160906 M H M M-H-M M-H-M AGM A Fed Agricultural Mtg Cla Voting N 20160906 L H L L-H-L L-H-L AGRO Adecoagro S A N 20160906 H L H H-L-H H-L-H AGX Argan Inc N 20160906 M H M M-H-M M-H-M AHC A H Belo Corp N 20160906 L L L L-L-L L-L-L AHL ASPEN Insurance Holding Limited N 20160906 H H H H-H-H H-H-H AHS AMN Healthcare Services Inc. -

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85 -

Market Cap Close ADV

Market Cap Close ADV 1598 67th Pctl $745,214,477.91 $23.96 225,966.94 801 33rd Pctl $199,581,478.89 $10.09 53,054.83 2399 Listing_ Revised Ticker_Symbol Security_Name Exchange Effective_Date Mkt Cap Close ADV Stratum Stratum AAC AAC Holdings, Inc. N 20160906 M M M M-M-M M-M-M Altisource Asset Management AAMC Corp A 20160906 L M L L-M-L L-M-L AAN Aarons Inc N 20160906 H H H H-H-H H-H-H AAV Advantage Oil & Gas Ltd N 20160906 H L M H-L-M H-M-M AB Alliance Bernstein Holding L P N 20160906 H M M H-M-M H-M-M ABG Asbury Automotive Group Inc N 20160906 H H H H-H-H H-H-H ABM ABM Industries Inc. N 20160906 H H H H-H-H H-H-H AC Associated Capital Group, Inc. N 20160906 H H L H-H-L H-H-L ACCO ACCO Brand Corp. N 20160906 H L H H-L-H H-L-H ACU Acme United A 20160906 L M L L-M-L L-M-L ACY AeroCentury Corp A 20160906 L L L L-L-L L-L-L ADK Adcare Health System A 20160906 L L L L-L-L L-L-L ADPT Adeptus Health Inc. N 20160906 M H H M-H-H M-H-H AE Adams Res Energy Inc A 20160906 L H L L-H-L L-H-L American Equity Inv Life Hldg AEL Co N 20160906 H M H H-M-H H-M-H AF Astoria Financial Corporation N 20160906 H M H H-M-H H-M-H AGM Fed Agricul Mtg Clc Non Voting N 20160906 M H M M-H-M M-H-M AGM A Fed Agricultural Mtg Cla Voting N 20160906 L H L L-H-L L-H-L AGRO Adecoagro S A N 20160906 H L H H-L-H H-L-H AGX Argan Inc N 20160906 M H M M-H-M M-H-M AHC A H Belo Corp N 20160906 L L L L-L-L L-L-L ASPEN Insurance Holding AHL Limited N 20160906 H H H H-H-H H-H-H AHS AMN Healthcare Services Inc. -

Audiocodes AGM Proxy Statement 2021

Exhibit 99.1 August 10, 2021 Dear Shareholder, You are cordially invited to attend the 2021 Annual General Meeting of Shareholders (the “Meeting”) of AudioCodes Ltd. (the “Company” or “AudioCodes”), to be held on September 14, 2021, at 2:00 p.m., local time, or at any adjournment or postponement thereof, for the purposes set forth herein and in the enclosed Notice of Annual General Meeting of Shareholders. The Meeting will be held at the offices of the Company located at 1 Hayarden Street, Airport City, Lod 7019900, Israel. The telephone number at that address is +972-3-976-4000. The health and well-being of our employees and shareholders are paramount, and we are closely monitoring developments related to the novel coronavirus, or COVID-19. Although we intend to hold the Meeting in person, we are sensitive to the public health and travel concerns our shareholders may have and the protocols that governments may impose. We reserve the right to convert to a virtual only meeting format should meeting in person become unsafe as a result of COVID-19. If we convert to a virtual only online meeting, we will announce the decision to do so in advance and provide instructions for shareholder participation in the virtual meeting in a Form 6-K filed with the Securities and Exchange Commission. As always, we encourage you to vote your shares prior to the Meeting. At the Meeting, shareholders will be asked to consider and vote on the matters listed in the enclosed Notice of Annual General Meeting of Shareholders. AudioCodes’ Board of Directors recommends that you vote FOR all of the proposals listed in the Notice. -

TUESDAY, MAY 24, 2016 07:30-17:00 Registration Open 09

TUESDAY, MAY 24, 2016 07:30-17:00 Registration Open Welcome Ruti Alon, General Partner, Pitango Venture Capital, IATI Biomed Co- Chairperson 09:00 - 09:20 Dr. Benny Zeevi, Managing General Partner, Tel Aviv Venture Partners, IATI Biomed Co-Chairperson Yaky Yanay, President, Pluristem and IATI Co-Chairperson Opening Keynote Lecture: Patrick Terry, President, GMPO Orphan and Sharon Terry, President and 09:20-10:00 CEO of Genetic Alliance Interviewer: Francois Maisonrouge, Senior Managing Director, Evercore Partners Keynote Lecture: Francois Maisonrouge, Senior Managing Director, Evercore Partners - 10:00-10:40 ''The recent market correction in Health Care: a reflection of changing fundamentals?'' 10:40-11:10 Coffee Break Early Stage Challenges The Promise of Immuno- Neurological Disorders 11:10-17:30 and Opportunities Hall Oncology Hall A Hall B C 11:10-11:20: Jay D Kranzler, VP and Global Head, External 11:10-11:55: R&D Innovation – 11:10 - 11:20: Chairperson: Prof. Gal Biotherapeutics and Chairperson: Assaf Markel, MD, PhD, Sheba Strategic Investments, Barnea, CEO, Sanara Medical Center Pfizer, Inc. - ''CNS Ventures Therapeutics: From Starting Point to Tipping Point'' 11:55-12:40: Dr. Arie 11:20-12:00: Henry O Belldegrun, MD, Gosebruch, Executive Chairman, President & Vice President and 11:20 - 12:00: Jeroen Chief Executive Officer, Chief Strategy officer, Tas, CEO, Connected Kite Pharma - Abbvie - ''The Starting Care & Health "Engineered T cell Point: The CNS Informatics, Philips Immunotherapy: The Ecosystem as it Stands future is here" Today'' 12:00-12:40: Tetsuyuki Dr. Wei Siang Yu, Maruyama, Chief Medical Doctor, 12:40-13:25: TBA Scientific Officer, Medical Inventor, Dementia Discovery Healthcare ICT Fund - ''New Financing Entrepreneur and Vehicles: The Visionary, Founder of Dementia Discovery Borderless Healthcare Fund Example'' Group 12:00 - 13:30: Round Table Discussions: 1. -

Life Sciences in Israel

STATE OF ISRAEL Ministry of Industry Trade and Labor Investment Promotion Center Inspiration Invention Innovation Life Sciences in Israel www.investinisrael.gov.il Table of Contents .......................................... 3 Israel: A Powerhouse of Opportunities ............................................................ 3 Israel’s Life Science Sectors Medical Devices ........................................................................ 4 Healthcare IT ............................................................................ 4 BioPharmaceutical .................................................................... 7 Israel’s Biomedical Engineering - ................................................... 11 Spotlight on Stem Cell Research ....................................... 15 Israel’s Life Sciences Competitive Edge ..................................................................... 19 Government Support 2 Life Sciences in Israel Israel: A Powerhouse of Opportunities Why Israel’s Life Sciences Over the last decade, Israel has introduced a wealth of groundbreaking More than 1,000 Life and valuable innovations in Life Sciences. Israel’s Life Sciences sector Sciences Companies - is supported by a strong foundation of academic excellence, including Biopharma and Medical some of the world’s leading research institutes, renowned R&D Devices facilities and cutting-edge medical centers. Bolstered by a highly skilled Over 1/3 of LS Start-Ups workforce, a flourishing high-tech environment, and an entrepreneurial already generate revenue -

Alphabetical Listing by Company Name

FOREIGN COMPANIES REGISTERED AND REPORTING WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION December 31, 2015 Alphabetical Listing by Company Name COMPANY COUNTRY MARKET 21 Vianet Group Inc. Cayman Islands Global Market 37 Capital Inc. Canada OTC 500.com Ltd. Cayman Islands NYSE 51Job, Inc. Cayman Islands Global Market 58.com Inc. Cayman Islands NYSE ABB Ltd. Switzerland NYSE Abbey National Treasury Services plc United Kingdom NYSE - Debt Abengoa S.A. Spain Global Market Abengoa Yield Ltd. United Kingdom Global Market Acasti Pharma Inc. Canada Capital Market Acorn International, Inc. Cayman Islands NYSE Actions Semiconductor Co. Ltd. Cayman Islands Global Market Adaptimmune Ltd. United Kingdom Global Market Adecoagro S.A. Luxembourg NYSE Adira Energy Ltd. Canada OTC Advanced Accelerator Applications SA France Global Market Advanced Semiconductor Engineering, Inc. Taiwan NYSE Advantage Oil & Gas Ltd. Canada NYSE Advantest Corp. Japan NYSE Aegean Marine Petroleum Network Inc. Marshall Islands NYSE AEGON N.V. Netherlands NYSE AerCap Holdings N.V. Netherlands NYSE Aeterna Zentaris Inc. Canada Capital Market Affimed N.V. Netherlands Global Market Agave Silver Corp. Canada OTC Agnico Eagle Mines Ltd. Canada NYSE Agria Corp. Cayman Islands NYSE Agrium Inc. Canada NYSE AirMedia Group Inc. Cayman Islands Global Market Aixtron SE Germany Global Market Alamos Gold Inc. Canada NYSE Alcatel-Lucent France NYSE Alcobra Ltd. Israel Global Market Alexandra Capital Corp. Canada OTC Alexco Resource Corp. Canada NYSE MKT Algae Dynamics Corp. Canada OTC Algonquin Power & Utilities Corp. Canada OTC Alianza Minerals Ltd. Canada OTC Alibaba Group Holding Ltd. Cayman Islands NYSE Allot Communications Ltd. Israel Global Market Almaden Minerals Ltd. -

DSP Group Annual Report 2020

DSP Group Annual Report 2020 Form 10-K (NASDAQ:DSPG) Published: March 11th, 2020 PDF generated by stocklight.com SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TOSECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 31, 2019 ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ________to________ Commission File Number 001-35256 DSP GROUP, INC. (Exact name of registrant as specified in its charter) Delaware 94-2683643 (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporation and organization) 2055 Gateway Place, Suite 480, San Jose, California 95110 (Address of principal executive offices, including zip code) 408-986-4300 (Registrant’s telephone number) Securities registered pursuant to Section 12(b) of the Act: None Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.001 per share (Title of class) Securities registered pursuant to Section 12(b) of the Act Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, $.001 per share DSPG The NASDAQ Stock Market LLC Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Company Country

Company Country 1 Teva Pharmaceutical ISR 2 Coca-Cola HBC AG GRC 3 Bank Hapoalim ISR 4 Israel Chemicals ISR 5 Bank Leumi ISR 6 Bezeq ISR 7 Azrieli Group ISR 8 Hellenic Telecommunications Organization S.A. GRC 9 Nice Systems ISR 10 Elbit Systems ISR 11 OPAP GRC 12 Mizrahi Tefahot Bank Ltd. ISR 13 Delek Group ISR 14 Frutarom ISR 15 Osem Investments ISR 16 Israel Discount Bank ISR 17 Israel Corporation ISR 18 Hellenic Petroleum S.A. GRC 19 Gazit Globe (1982) Ltd ISR 20 BANK OF CYPRUS PUBLIC COMPANY LTD CYP 21 Titan Cement Co. S.A. GRC 22 Melisron ISR 23 Alpha Bank S.A. GRC 24 National Bank of Greece S.A. GRC 25 Paz Oil ISR 26 Strauss Group ISR 27 Folli Follie GRC 28 Motor Oil Hellas Corinth Refineries S.A. GRC 29 First Intl Bank of Israel (5) ISR 30 Public Power Corp. S.A. GRC 31 Jumbo S.A. GRC 32 Oil Refineries ISR 33 Alony Hetz Properties & Inv ISR 34 Tower Semiconductor Ltd ISR 35 Migdal Insurance & Financial Holdings Ltd. ISR 36 Grivalia Properties R.E.I.C GRC 37 Harel Investments & Finance ISR 38 Delek Automotive Systems ISR 39 Amot Investments Ltd. ISR 40 Clal Insurance ISR 41 Delta Galil Industries ISR 42 Shikun & Binui Ltd ISR 43 Airport City Ltd ISR 44 Kenon Holdings ISR 45 Athens Water Supply & Sewerage GRC 46 Ezchip Semiconductor ISR 47 Jerusalem Oil Exploration ISR 48 Phoenix Holdings ISR Company Country 49 IDI Insurance Company Ltd ISR 50 Cellcom Israel Ltd. ISR 51 Partner Communications ISR 52 VIOHALCO SA/NV (CB) GRC 53 Mytilineos Holdings S.A. -

Fidelity® Nasdaq Composite Index® Fund

Fidelity® Nasdaq Composite Index® Fund Semi-Annual Report May 31, 2021 Contents Note to Shareholders 3 Investment Summary 4 Schedule of Investments 6 Financial Statements 85 Notes to Financial 89 Statements Shareholder Expense 97 Example Board Approval of 98 Investment Advisory Contracts and Management Fees Liquidity Risk 106 Management Program To view a fund’s proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission’s (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines. Nasdaq®, OMX®, NASDAQ OMX®, Nasdaq Composite®, and The Nasdaq Stock Market®, Inc. are registered trademarks of The NASDAQ OMXGroup, Inc. (which with its Affiliates are the Corporations) and are licensed for use by Fidelity. The product has not been passed on by the Corporations as to its legality or suitability. The product is not issued, endorsed or sold by the Corporations. The Corporations make no warranties and bear no liability with respect to shares of the product. Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation. Other third-party marks appearing herein are the property of their respective owners. All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved. This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. -

Fidelity® Nasdaq Composite Index® Fund

Quarterly Holdings Report for Fidelity® Nasdaq Composite Index® Fund February 28, 2021 EIF-QTLY-0421 1.814098.116 Schedule of Investments February 28, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 99.7% Shares Value COMMUNICATION SERVICES – 16.7% Diversified Telecommunication Services – 0.2% Alaska Communication Systems Group, Inc. 34,501 $ 112,818 Anterix, Inc. (a) 7,844 331,252 ATN International, Inc. 7,220 351,470 Bandwidth, Inc. (a) (b) 12,082 1,913,306 Cogent Communications Group, Inc. (b) 25,499 1,526,115 Consolidated Communications Holdings, Inc. (a) 21,768 114,500 Iridium Communications, Inc. (a) 77,117 2,954,352 Liberty Global PLC: Class A (a) 112,326 2,766,028 Class B (a) 327 7,521 Class C (a) 204,417 4,967,333 Liberty Latin America Ltd.: Class A (a) 17,405 190,933 Class C (a) 105,781 1,159,360 ORBCOMM, Inc. (a) 54,925 419,078 Radius Global Infrastructure, Inc. (a) (b) 37,222 460,808 Sify Technologies Ltd. sponsored ADR (a) (b) 7,275 22,916 Vonage Holdings Corp. (a) 142,421 1,882,806 19,180,596 Entertainment – 2.5% Activision Blizzard, Inc. 429,734 41,086,868 Bilibili, Inc. ADR (a) (b) 99,200 12,496,224 Blue Hat Interactive Entertainment Technology (a) (b) 13,117 16,659 Chicken Soup For The Soul Entertainment, Inc. (a) 2,009 51,370 Cinedigm Corp. (a) 73,305 102,627 CuriosityStream, Inc. Class A (a) 24,573 426,833 DouYu International Holdings Ltd. ADR (a) 82,330 1,180,612 Electronic Arts, Inc.