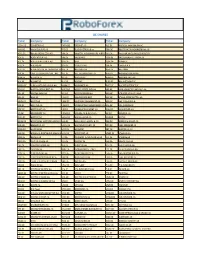

Geographic Listing by Country of Incorporation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fidelity® Emerging Markets Index Fund

Quarterly Holdings Report for Fidelity® Emerging Markets Index Fund January 31, 2021 EMX-QTLY-0321 1.929351.109 Schedule of Investments January 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 92.5% Shares Value Shares Value Argentina – 0.0% Lojas Americanas SA rights 2/4/21 (b) 4,427 $ 3,722 Telecom Argentina SA Class B sponsored ADR (a) 48,935 $ 317,099 Lojas Renner SA 444,459 3,368,738 YPF SA Class D sponsored ADR (b) 99,119 361,784 Magazine Luiza SA 1,634,124 7,547,303 Multiplan Empreendimentos Imobiliarios SA 156,958 608,164 TOTAL ARGENTINA 678,883 Natura & Co. Holding SA 499,390 4,477,844 Notre Dame Intermedica Participacoes SA 289,718 5,003,902 Bailiwick of Jersey – 0.1% Petrobras Distribuidora SA 421,700 1,792,730 Polymetal International PLC 131,532 2,850,845 Petroleo Brasileiro SA ‑ Petrobras (ON) 2,103,697 10,508,104 Raia Drogasil SA 602,000 2,741,865 Bermuda – 0.7% Rumo SA (b) 724,700 2,688,783 Alibaba Health Information Technology Ltd. (b) 2,256,000 7,070,686 Sul America SA unit 165,877 1,209,956 Alibaba Pictures Group Ltd. (b) 6,760,000 854,455 Suzano Papel e Celulose SA (b) 418,317 4,744,045 Beijing Enterprises Water Group Ltd. 2,816,000 1,147,720 Telefonica Brasil SA 250,600 2,070,242 Brilliance China Automotive Holdings Ltd. 1,692,000 1,331,209 TIM SA 475,200 1,155,127 China Gas Holdings Ltd. 1,461,000 5,163,177 Totvs SA 274,600 1,425,346 China Resource Gas Group Ltd. -

Economic Gains of Realized Volatility in the Brazilian Stock Market

TEXTO PARA DISCUSSÃO No. 624 Economic gains of realized volatility in the Brazilian stock market Francisco Santos Márcio Garcia Marcelo Medeiros DEPARTAMENTO DE ECONOMIA www.econ.puc-rio.br Economic gains of realized volatility in the Brazilian stock market Abstract This paper evaluates the economic gains associated with following a volatility timing strategy based on a multivariate model of realized volatility. To study this issue we build a high frequency database with the most actively traded Brazilian stocks. Comparing with traditional volatility methods, we find that economic gains associated with realized measures perform well when estimation risk is controlled and increase proportionally to the target return. When expected returns are bootstrapped, however, performance fees are not significant, which is an indication that economic gains of realized volatility are offset by estimation risk. Keywords: Realized volatility, utility, forecasting. JEL Code: G11, G17. 1. Introduction Given the growth of financial markets and the increasing complexity of its securities, volatility models play an essential role to help the task of risk management and investment decisions. Since realization of volatility returns based on daily data is not observable, the traditional approach is to invoke parametric assumptions regarding the evolution of the first and second moments of the returns, which is the idea behind ARCH and stochastic volatility models. Nevertheless, these models fail to capture some stylized facts such as autocorrelation persistence and fat tail of returns. The availability of intraday data opens up the possibility of approximating volatility directly from asset returns. The use of an observable variable, in turn, facilitates the task of dealing with problems that involves a significant number of assets. -

United States Securities and Exchange Commission Form

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F (Mark One) ☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2015 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . OR ☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report Commission file number: 001-33356 GAFISA S.A. (Exact name of Registrant as specified in its charter) GAFISA S.A. (Translation of Registrant’s name into English) The Federative Republic of Brazil (Jurisdiction of incorporation or organization) Av. Nações Unidas No. 8,501, 19th Floor 05425-070 – São Paulo, SP – Brazil| phone: + 55 (11) 3025-9000 fax: + 55 (11) 3025-9348 e mail: [email protected] Attn: Andre Bergstein – Chief Financial Officer and Investor Relations Officer (Address of principal executive offices) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Shares, without par value* New York Stock Exchange * Traded only in the form of American Depositary Shares (as evidenced by American Depositary Receipts), each representing two common shares which are registered under the Securities Act of 1933. Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. -

R Trader Instruments Cfds and Stocks

DE SHARES Ticker Company Ticker Company Ticker Company 1COV.DE COVESTRO AG FNTN.DE FREENET AG P1Z.DE PATRIZIA IMMOBILIEN AG AAD.DE AMADEUS FIRE AG FPE.DE FUCHS PETROLUB vz PBB.DE DEUTSCHE PFANDBRIEFBANK AG ACX1.DE BET-AT-HOME.COM AG FRA.DE FRAPORT AG FRANKFURT AIRPORTPFV.DE PFEIFFER VACUUM TECHNOLOGY ADJ.DE ADO PROPERTIES FRE.DE FRESENIUS PSM.DE PROSIEBENSAT.1 MEDIA SE ADL.DE ADLER REAL ESTATE AG G1A.DE GEA PUM.DE PUMA SE ADS.DE ADIDAS AG G24.DE SCOUT24 AG QIA.DE QIAGEN N.V. ADV.DE ADVA OPTICAL NETWORKING SE GBF.DE BILFINGER SE RAA.DE RATIONAL AFX.DE CARL ZEISS MEDITEC AG - BR GFT.DE GFT TECHNOLOGIES SE RHK.DE RHOEN-KLINIKUM AG AIXA.DE AIXTRON SE GIL.DE DMG MORI RHM.DE RHEINMETALL AG ALV.DE ALLIANZ SE GLJ.DE GRENKE RIB1.DE RIB SOFTWARE SE AM3D.DE SLM SOLUTIONS GROUP AG GMM.DE GRAMMER AG RKET.DE ROCKET INTERNET SE AOX.DE ALSTRIA OFFICE REIT-AG GWI1.DE GERRY WEBER INTL AG S92.DE SMA SOLAR TECHNOLOGY AG ARL.DE AAREAL BANK AG GXI.DE GERRESHEIMER AG SAX.DE STROEER SE & CO KGAA BAS.DE BASF SE HAB.DE HAMBORNER REIT SAZ.DE STADA ARZNEIMITTEL AG BAYN.DE BAYER AG HBM.DE HORNBACH BAUMARKT AG SFQ.DE SAF HOLLAND S.A. BC8.DE BECHTLE AG HDD.DE HEIDELBERGER DRUCKMASCHINENSGL.DE SGL CARBON SE BDT.DE BERTRANDT AG HEI.DE HEIDELBERGCEMENT AG SHA.DE SCHAEFFLER AG BEI.DE BEIERSDORF AG HEN3.DE HENKEL AG & CO KGAA SIE.DE SIEMENS AG BIO4.DE BIOTEST AG HLAG.DE HAPAG-LLOYD AG SIX2.DE SIXT SE BMW.DE BAYERISCHE MOTOREN WERKE AGHLE.DE HELLA KGAA HUECK & CO SKB.DE KOENIG & BAUER AG BNR.DE BRENNTAG AG HNR1.DE HANNOVER RUECK SE SPR.DE AXEL SPRINGER SE BOSS.DE HUGO BOSS -

ANNUAL REPORT 2018 to Generate Economic and Social Value Through Our Companies and Institutions

ANNUAL REPORT 2018 To generate economic and social value through our companies and institutions. We have established a mission, a vision and values that are both our beacons and guidelines to plan strategies and projects in the pursuit of success. Fomento Económico Mexicano, S.A.B. de C.V., or FEMSA, is a leader in the beverage industry through Coca-Cola FEMSA, the largest franchise bottler of Coca-Cola products in the world by volume; and in the beer industry, through ownership of the second largest equity stake in Heineken, one of the world’s leading brewers with operations in over 70 countries. We participate in the retail industry through FEMSA Comercio, comprising a Proximity Division, operating OXXO, a small-format store chain; a Health Division, which includes all drugstores and related operations; and a Fuel Division, which operates the OXXO GAS chain of retail service stations. Through FEMSA Negocios Estratégicos (FEMSA Strategic Businesses) we provide logistics, point-of-sale refrigeration solutions and plastics solutions to FEMSA’s business units and third-party clients. FEMSA’s 2018 integrated Annual Report reflects our commitment to strong corporate governance and transparency, as exemplified by our mission, vision and values. Our financial and sustainability results are for the twelve months ended December 31, 2018, compared to the twelve months ended December 31, 2017. This report was prepared in accordance with the Global Reporting Initiative (GRI) Standards and the United Nations Global Compact, this represents our Communication on Progress for 2018. Contents Discover Our Corporate Identity 1 FEMSA at a Glance 2 Value Creation Highlights 4 Social and Environmental Value 6 Dear Shareholders 8 FEMSA Comercio 10 Coca-Cola FEMSA 18 FEMSA Strategic Businesses 28 FEMSA Foundation 32 Corporate Governance 40 Financial Summary 44 Management’s Discussion & Analysis 46 Contact 52 Over the past several decades, FEMSA has evolved from an integrated beverage platform to a multifaceted business with a broad set of capabilities and opportunities. -

Femsa: Un Grupo Económico Nacional

ISSN: 2448-5101 Año 1 Número 1 621 Julio 2014 - Junio 2015 FEMSA: UN GRUPO ECONÓMICO NACIONAL Primer Autora: Dra. Beatriz Pérez Sánchez Institución De Adscripción: Universidad Juárez Autónoma De Tabasco Dirección: Calle Tabasco Número 115 Colonia Gil Y Sáenz Código Postal 06080 Villahermosa, Centro, Tabasco, México Correo Electrónico: [email protected] Nacionalidad: Mexicana Cuarto Autor: Estudiante Jesús Alberto Morales Méndez Institución De Adscripción: Universidad Juárez Autónoma De Tabasco Dirección: Calle Romelio Oropeza De La Cruz Número 143 Fraccionamiento Jalapa Código Postal 86850 Jalapa, Tabasco, México Correo Electrónico: [email protected] Nacionalidad: Mexicano Fecha de envio:19/Marzo/2015 Fecha de aceptación: 20/Mayo/2015 ____________________________________________________________________ RESUMEN Analizar como los grupos económicos o corporativos deben adaptarse a entornos dinámicos e inestables tanto en el ámbito nacional e internacional, así como la influencia política que logran alcanzar por su poder económico, sigue siendo vigente en la era de la globalización de los mercados. En México el rol de los grandes corporativos en el crecimiento y desarrollo del capitalismo permite visualizar sus estrategias. Se particulariza el caso de FEMSA en un periodo de estudio de 1899 a 2013. En el porfiriato, entre 1890 y 1910 se da una marcada diversificación de las inversiones que iniciaron tanto industrias dedicadas a abastecer el consumo productivo (grandes fundiciones, cemento, vidrio) como el consumo personal (cerveza y otras bebidas, textiles, artículos para higiene, materiales para la construcción, alimentos elaborados), el ramo minero, el crédito y los bancos, la propiedad y explotación de la tierra, los servicios y el transporte. En 1891 se creó la Fábrica de Cerveza y Hielo Cuauhtémoc comenzó a operar a finales de 1891 y es el origen de Femsa. -

Market Cap Close ADV 1598 67Th Pctl 745,214,477.91 $ 23.96

Market Cap Close ADV 1598 67th Pctl $ 745,214,477.91 $ 23.96 225,966.94 801 33rd Pctl $ 199,581,478.89 $ 10.09 53,054.83 2399 Ticker_ Listing_ Effective_ Revised Symbol Security_Name Exchange Date Mkt Cap Close ADV Stratum Stratum AAC AAC Holdings, Inc. N 20160906 M M M M-M-M M-M-M AAMC Altisource Asset Management Corp A 20160906 L M L L-M-L L-M-L AAN Aarons Inc N 20160906 H H H H-H-H H-H-H AAV Advantage Oil & Gas Ltd N 20160906 H L M H-L-M H-M-M AB Alliance Bernstein Holding L P N 20160906 H M M H-M-M H-M-M ABG Asbury Automotive Group Inc N 20160906 H H H H-H-H H-H-H ABM ABM Industries Inc. N 20160906 H H H H-H-H H-H-H AC Associated Capital Group, Inc. N 20160906 H H L H-H-L H-H-L ACCO ACCO Brand Corp. N 20160906 H L H H-L-H H-L-H ACU Acme United A 20160906 L M L L-M-L L-M-L ACY AeroCentury Corp A 20160906 L L L L-L-L L-L-L ADK Adcare Health System A 20160906 L L L L-L-L L-L-L ADPT Adeptus Health Inc. N 20160906 M H H M-H-H M-H-H AE Adams Res Energy Inc A 20160906 L H L L-H-L L-H-L AEL American Equity Inv Life Hldg Co N 20160906 H M H H-M-H H-M-H AF Astoria Financial Corporation N 20160906 H M H H-M-H H-M-H AGM Fed Agricul Mtg Clc Non Voting N 20160906 M H M M-H-M M-H-M AGM A Fed Agricultural Mtg Cla Voting N 20160906 L H L L-H-L L-H-L AGRO Adecoagro S A N 20160906 H L H H-L-H H-L-H AGX Argan Inc N 20160906 M H M M-H-M M-H-M AHC A H Belo Corp N 20160906 L L L L-L-L L-L-L AHL ASPEN Insurance Holding Limited N 20160906 H H H H-H-H H-H-H AHS AMN Healthcare Services Inc. -

Bluestar Israel Quarterly Update Q3 2013 Final.Pptx

BlueStar Israel Equity Update Third Quarter 2013 Q2 2013 in Review & Second Half 2013 Outlook What’s Inside Ø Global developed market equities pulled back slightly in Q2 2013 while U.S. stocks, as measured by the S&P 500 index, bucked the trend and posted a rise of 2.91%. Ø The BlueStar Israel Global Index was down by 95 bps in Q2 2013 while the MSCI Israel and TA-100 indexes were down 4.16% and 2.76%, respectively. 1. The BlueStar Ø Israeli consumer stocks, which are correlated with both domestic consumption as well as consumer spending in Israel’s export markets, lead Israeli Global Equities in Q2, while the Israel Global financial and energy stocks, which lead the Israeli Global Equity market’s rebound from the Index in Q1 2012 lows, consolidated. 2013 Ø The Israeli government decided on a 2013 and 2014 budget that will result in tax increases and spending cuts and the Shekel’s sharp appreciation versus the dollar and euro eased a bit. 2-5. About the Ø Mellanox Technologies announced it will delist its shares from the Tel Aviv Stock Exchange and the TASE’s bid to be included in MSCI’s European regional indexes was declined. Both BlueStar Israel events sparked concern about the future of the local exchange. Also, Israeli corporate Global Index pyramids come under attack by The Committee on Increasing Competitiveness in the Economy and the Business Concentration Law. (including Risk/ Ø The Energy sector is asserting itself as a major player in the Israeli economy, natural gas Return Data) reserve estimates and oil estimates are rising, and the government has decided upon an export strategy, clearing up uncertainty and removing some of the risk factors associated with investing in that sector. -

Cpfl Energia S.A

20-F 1 cpl_form20f2006.htm FORM 20-F 2006 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended December 31, 2006 Commission File Number 1-32297 CPFL ENERGIA S.A. (Exact name of registrant as specified in its charter) CPFL ENERGY INCORPORATED The Federative Republic of Brazil (Translation of registrant’s name into English) (Jurisdiction of incorporation or organization) ________________________________________________ Rua Gomes de Carvalho, 1,510, 14° andar - Cj 1402 CEP 04547-005 Vila Olímpia - São Paulo, São Paulo Federative Republic of Brazil +55 11 3841-8513 (Address of principal executive offices) ________________________________________________ Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class: Name of each exchange on which registered: Common Shares, without par value* American Depositary Shares (as evidenced by American New York Stock Exchange Depositary Receipts), each representing 3 Common Shares *Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission. Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None As of December 31, 2006, there were 479,756,730 common shares, without par value, outstanding Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Elbit Medical Technologies Initiation of Coverage

Elbit Medical Technologies Initiation of coverage Two promising private assets Pharma & biotech 28 June 2018 Elbit Medical Technologies is an Israel-based healthcare investment company traded on the TASE. It is invested in two private companies: Price* NIS1.12 InSightec is a commercial-stage medical device company marketing a non- Market cap NIS259m invasive thermal tissue ablation therapy in three indications and Gamida *Priced as at 26 June 2018 Cell is a cell and immune therapy company developing a universal bone NIS3.64/US$ marrow transplant (BMT) product for haematological malignancies. Net debt ($m) at 31 December 2017 42.4 Although their recent offerings of NIS182m of convertible notes lengthen Shares in issue 231.4m the cash runway it raises the prospect of dilution in 2022. In addition, the Free float 10.8% parent company Elbit Imaging (~89% owned) has its own challenges. We value Elbit Medical at NIS407m or NIS1.76 per share. Code EMTC Primary exchange TASE Revenue PBT* EPS* DPS P/E Yield Secondary exchange N/A Year end ($m) ($m) ($) ($) (x) (%) 12/15 1.8 (1.1) 0.0 0.0 N/A N/A Share price performance 12/16 0.0 (3.7) 0.0 0.0 N/A N/A 12/17 0.0 (5.2) 0.0 0.0 N/A N/A Note: *PBT and EPS are normalised, excluding amortisation of acquired intangibles, exceptional items and share-based payments. InSightec: A non-invasive operating room Elbit Medical currently holds a ~22% (~19% fully diluted) stake in InSightec, a commercial-stage medical device company. -

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85 -

Companhia Paranaense De Energia – Copel

As filed with the Securities and Exchange Commission on April 29, 2014 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 20-F ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2013 Commission file number: 001-14668 COMPANHIA PARANAENSE DE ENERGIA – COPEL (Exact Name of Registrant as Specified in its Charter) Energy Company of Paraná The Federative Republic of Brazil (Translation of Registrant’s Name into English) (Jurisdiction of Incorporation or Organization) Rua Coronel Dulcídio, 800 80420-170 Curitiba, Paraná, Brazil (Address of Principal Executive Offices) Lindolfo Zimmer +55 41 3222 2027 – [email protected] Rua Coronel Dulcídio, 800, 3rd floor – 80420 – 170 Curitiba, Paraná, Brazil (Name, telephone, e-mail and/or facsimile number and address of company contact person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Preferred Class B Shares, without par value* New York Stock Exchange American Depositary Shares (as evidenced by American Depositary Receipts), New York Stock Exchange each representing one Preferred Class B Share * Not for trading, but only in connection with the listing of American Depositary Shares on the New York Stock Exchange. Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the Issuer’s classes of capital or common stock as of December 31, 2013: 145,031,080 Common Shares, without par value 381,702 Class A Preferred Shares, without par value 128,242,593 Class B Preferred Shares, without par value Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.