Economic Review

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Re-Evaluating the Communist Guomindang Split of 1927

University of South Florida Scholar Commons Graduate Theses and Dissertations Graduate School March 2019 Nationalism and the Communists: Re-Evaluating the Communist Guomindang Split of 1927 Ryan C. Ferro University of South Florida, [email protected] Follow this and additional works at: https://scholarcommons.usf.edu/etd Part of the History Commons Scholar Commons Citation Ferro, Ryan C., "Nationalism and the Communists: Re-Evaluating the Communist Guomindang Split of 1927" (2019). Graduate Theses and Dissertations. https://scholarcommons.usf.edu/etd/7785 This Thesis is brought to you for free and open access by the Graduate School at Scholar Commons. It has been accepted for inclusion in Graduate Theses and Dissertations by an authorized administrator of Scholar Commons. For more information, please contact [email protected]. Nationalism and the Communists: Re-Evaluating the Communist-Guomindang Split of 1927 by Ryan C. Ferro A thesis submitted in partial fulfillment of the requirements for the degree of Master of Arts Department of History College of Arts and Sciences University of South Florida Co-MaJor Professor: Golfo Alexopoulos, Ph.D. Co-MaJor Professor: Kees Boterbloem, Ph.D. Iwa Nawrocki, Ph.D. Date of Approval: March 8, 2019 Keywords: United Front, Modern China, Revolution, Mao, Jiang Copyright © 2019, Ryan C. Ferro i Table of Contents Abstract……………………………………………………………………………………….…...ii Chapter One: Introduction…..…………...………………………………………………...……...1 1920s China-Historiographical Overview………………………………………...………5 China’s Long -

Records of the Immigration and Naturalization Service, 1891-1957, Record Group 85 New Orleans, Louisiana Crew Lists of Vessels Arriving at New Orleans, LA, 1910-1945

Records of the Immigration and Naturalization Service, 1891-1957, Record Group 85 New Orleans, Louisiana Crew Lists of Vessels Arriving at New Orleans, LA, 1910-1945. T939. 311 rolls. (~A complete list of rolls has been added.) Roll Volumes Dates 1 1-3 January-June, 1910 2 4-5 July-October, 1910 3 6-7 November, 1910-February, 1911 4 8-9 March-June, 1911 5 10-11 July-October, 1911 6 12-13 November, 1911-February, 1912 7 14-15 March-June, 1912 8 16-17 July-October, 1912 9 18-19 November, 1912-February, 1913 10 20-21 March-June, 1913 11 22-23 July-October, 1913 12 24-25 November, 1913-February, 1914 13 26 March-April, 1914 14 27 May-June, 1914 15 28-29 July-October, 1914 16 30-31 November, 1914-February, 1915 17 32 March-April, 1915 18 33 May-June, 1915 19 34-35 July-October, 1915 20 36-37 November, 1915-February, 1916 21 38-39 March-June, 1916 22 40-41 July-October, 1916 23 42-43 November, 1916-February, 1917 24 44 March-April, 1917 25 45 May-June, 1917 26 46 July-August, 1917 27 47 September-October, 1917 28 48 November-December, 1917 29 49-50 Jan. 1-Mar. 15, 1918 30 51-53 Mar. 16-Apr. 30, 1918 31 56-59 June 1-Aug. 15, 1918 32 60-64 Aug. 16-0ct. 31, 1918 33 65-69 Nov. 1', 1918-Jan. 15, 1919 34 70-73 Jan. 16-Mar. 31, 1919 35 74-77 April-May, 1919 36 78-79 June-July, 1919 37 80-81 August-September, 1919 38 82-83 October-November, 1919 39 84-85 December, 1919-January, 1920 40 86-87 February-March, 1920 41 88-89 April-May, 1920 42 90 June, 1920 43 91 July, 1920 44 92 August, 1920 45 93 September, 1920 46 94 October, 1920 47 95-96 November, 1920 48 97-98 December, 1920 49 99-100 Jan. -

Survey of Current Business March 1927

UNITED STATES DEPARTMENT OF COMMERCE WASHINGTON SURVEY. OF CURRENT BUSINESS MARCH, 1927 No. 67 COMPILED BY ' BUREAU OF THE CENSUS - ' " ' ' ·BUREAU.. OF FOREIGN AND DOMESTIC COMMERCE BUREAU OF STANDAR!JS IMPORTANT NOTICE. In addition to figures given from Government sources, there at:e also. incorporated for completeness of , krvite figures from ·other -sources .generally acqepted by the trades, the authority and respoh,sibil#y for which are noted in the "Sources of Data," on pages I35-I38 oftheFelwuary setrtiannualissue . ' .. Subscription price of the SuRVEY OF CuRRENT BusiNESS is $1.50 a year; sing!~ copies (monthly), lO cents; semiannual issues, 25 cents. Foreign subscriptions, $2.25; single copies (monthly issues), including postage, 14 cents; semiannual issues, 36 cents. Subscription price of CoMMERCE ~EPORTS is $4 a year; with the SuR:VEY, $5.50 a year. Make remittances only to Superintendent of Documents, Washington, :Q. C., by postal money order, express order, or New York draft. · Currency at sender's risk; Postage stamps or foreign ~oney not accepted U. I~ -QOVERNME'JIT PR'iNTIIfO OFFICE INTRODUCTION THE SuRVEY OF CuRRENT BusiNESS is designed to Relative. numbers may also be used to calculate the present each month a picture of the business situation approximate percentage increase or decrease in a move .by setting forth the principal facts regarding the vari- ment from one period to the next. Thus, if a.relative . ous lines of trade and industry. At semiannual inter number at one month is 120 and for a later month it vals detailed tables are published giving, for each item, is 144 there has been an increase of 20 per cent. -

Eepoet Oompteollee-Gekeeal

EEPOET OF THE OOMPTEOLLEE-GEKEEAL OF THE PROVINCE OF BRITISH COLUMBIA 192*7-1928 PURSUANT TO THE PROVISIONS OF THE "AUDIT ACT," CHAPTER 19, R.S.B.C. 1924 PRINTED BY AUTHORITY OF THE LEGISLATIVE ASSEMBLY. VICTORIA, B.C. : Printed by CHARLES F. BANFIELD, Printer to the King's Most Excellent Majesty. 192S. To His Honour ROBERT RANDOLPH BRUCE, Lieutenant-Governor of the Province of British Columbia. MAY IT PLEASE YOUR HONOUR : The undersigned has the honour to present to Your Honour statements of the Comptroller-General, pursuant to the provisions of the " Audit Act," chapter 19, R.S.B.C. 1924. Respectfully submitted. j. D. MACLEAN, Minister of Finance. Treasury Department, Victoria, January 24th, 1928. VICTORIA, January 24th, 1928. Hon. J. D. MacLean, Minister of Finance. SIR,—I have the honour to submit for the information of the Legislative Assembly, pursuant to the provisions of the " Audit Act," chapter 19, B.S.B.C. 1921, as follows:— (A.) Statement of Treasury Board Overrulings (siection 35). (B.) Statement of Expenditures on Services which have exceeded their Appropriations (clause (6) of section 36). (C.) Statement of Payments charged against the 1927-28 Appropriations which did not occur within the Period of the Account (clause (e) of section 36). (D.) Statehient of Special Warrants issued (subsection (4) of section 24). (E.) Statements showing the Kevenue and Expenditure for the First Nine Months of the Present Fiscal Year, viz., from 1st April to 31st December, 1927 (clause (a) of section 42) :— (1.) Eevenue. (2.) Expenditure (charged to Income). (3.) Expenditure (charged to Loans). -

The 1927 Geneva Naval Disarmament Conference: a Study in Failure Edward Adolph Goedeken Iowa State University, [email protected]

Iowa State University Capstones, Theses and Retrospective Theses and Dissertations Dissertations 1978 The 1927 Geneva Naval Disarmament Conference: a study in failure Edward Adolph Goedeken Iowa State University, [email protected] Follow this and additional works at: https://lib.dr.iastate.edu/rtd Part of the Diplomatic History Commons, and the Military History Commons Recommended Citation Goedeken, Edward Adolph, "The 1927 Geneva Naval Disarmament Conference: a study in failure" (1978). Retrospective Theses and Dissertations. 16657. https://lib.dr.iastate.edu/rtd/16657 This Thesis is brought to you for free and open access by the Iowa State University Capstones, Theses and Dissertations at Iowa State University Digital Repository. It has been accepted for inclusion in Retrospective Theses and Dissertations by an authorized administrator of Iowa State University Digital Repository. For more information, please contact [email protected]. ISa /978 GS~I ~/O The 1927 Geneva Naval Disarmament Conference: A study' in failure by Edward Adolph Goedeken A Thesis Submitted to the Graduate Faculty in Partial Fulfillment of The Requirements for the Degree of MASTER OF ARTS Major: History Signatures have been redacted for privacy Iowa State University Ames, Iowa 1978 ii TABLE OF CONTENTS Page ACKNOWLEDGMENTS iii THE CONFERENCE PRELIMINARIES 1 THE CONFERENCE BEGINS 34 THE CRUISER CONTROVERSY 58 THE CONFERENCE COLLAPSES 78 THE REPERCUSSIONS OF THE FAILURE AT GENEVA 104 BIBLIOGRAPHICAL ESSAY 139 WORKS CITED 148 iii ACKNOWLEDGMENTS The writer thanks Professors Richard N. Kottman, John M. Dobson, and Donald F. Hadwiger for their patience and guidance during this project. The staffs of the Public Record Office, the British Library, and the Herbert Hoover Presidential Library provided valuable assistance. -

MARCH, 1927 Mars.) Mathias, E

MARCH,1927 MONTHLY WEATHER REVIEW 135 Wendler, August. Meteoroiogical mcgaiine. London. v. 61. March, 1987. Dss Problem der technischen Wetterbeeinflussung. Hamburg. Brooks, C. E. P. An early essay in co-operative meteorology: 1927. 107 p, figs. 23 cm. (Probleme der kosmischen the great storm of 1703. p. 31-35. Physik. no. 9.) Fairgrieve, J. London fog, January 20th, 1927. p. 29-31. Wichtigste Ergebnisse der meteorologischen Beobachtungen in [With chart showing gradual advance of the fog in the city Hessen in dem zehnjahrigen Zeitraum 1911-1920 und in from 9 a. m. tu 4 p. m.] dem zwanzigjahrigen Zeitraum 1901-1920. Dsrmstadt. Lieutenant-Colonel Henry Mellish. p. 4&47. [Obituary.] nIdt3orologie. Pnris. 71. s. t. 3. 1927. 1926. 16 p. plates. 34 cm. (Anhang Deutschen met. Delcambre. Une applicntion imprevue de la m6t6orologie. Jahrbuch. Hessen. 1919 und 1920.) Conclusion d’un d6bat littbraire. p. 21-22. (Janvier.) Wiese, W. Hesselberg, Th. Ernst 0. Calwagen. p. 15-17. (Janvier.) Vergleich der im Sommer 1925 beobachteten Eisverhaltnisse [Obituary] im Barents- und Karischen Meer mit den vorhergesagten. Mellot, Arsene. Contribution B 1’6tude de laclimatologiede la p. 301-306. diagr. 254 cm. [Abstfact in German. Title France. p. 22-26. (Janvier.) [French weather records of and text also in Russian.] 17th, lSth & 19th centuries.] Per&, B. D6termination d’une region des cates francaises de RECENT PAPERS BEARING ON METEOROLOGY la hlanche et de 1’Atlantique le plus favorable h. une prise de films cinCmatugraphiques en jiiin et juillet. p. 64-67. The following titles have been selected froin the con- (FCrrier.) tents of the periodicals and serials recently received in Raymond, G. -

July, 1927.) “De Geer, Gerard

JULY,1927 MONTHLY WEATHER REVIEW 329 B I BL I OGRAPHY C. FITZHUGHTALMAN, in Charge of Library RECENT ADDITIONS Kassner, C. El estado actual de la climatologfa. p. 114-121. 28 cm. The following have been selected from among the (Rev. mkd. de Hamburgo.- Afio 8, n6m. 5. Mayo 1927. Kerlmen, J. titles of books recently received as representing those Temperaturkarten von Finnland. Helsinki. 1925. 21 p. most likely to be useful to Weather Bureau officials in illus. 24% cm. (Mitt. met. Zentralanst. des Finn. Staates. their meteorological work and studies: N:o 17.) ‘ -[With numerous charts and tabulated monthly Abell, T. H. temperature normals.] Some observations on winter injury in Utah peach orchards. ICipp P. J.; & Zonen. December, 1924. 28 p. illus. 23 cm. (Utah sgric. hstruments for measuring solar radiation: solarimeters and Dvrheliometers. n. p. 11927.1 8 p. ihS. 28 cm. exper. sta. Bull. 202. June, 1927.) .- Arctowski, Henryk. Kocou;ek, Ferdinand, & others.‘ 0 tak zwanych falach barometrycznych w rejonie Antarktydy. Iiatastroftilnf d&t a povodn6 dne 11. Srpna 1925 v EechAch. Notice sur les pseudo-ondes baromktriques observees dans La pluie catastrophique et l’inondation du 11 aoOt 1925 en les regions antarctique:‘ et ailleurs. Lw6w. 1927. 14 p. Boh6me. (Avec un r6sum6 en franpais). Praze. 1926. Egs. 24 cm. (Extr.: Kosmos” journ. Soc. Polon. natur. 25 p. fig. illus. plate (f Id.) 31% cm. (Sbornfk pracf Kopernik.” v. 52. fasc. 1-2. A. 1927.) a studii hydrologickjrch. 8islo 2.) 0 zalomach krzywej przebiegu dziennego cisnienia atniosfery- Korhonen, W. W. Ein Beitrag zur Icritik der Niederschlagsmessungen. -

Scrapbook Inventory

E COLLECTION, H. L. MENCKEN COLLECTION, ENOCH PRATT FREE LIBRARY Scrapbooks of Clipping Service Start and End Dates for Each Volume Volume 1 [sealed, must be consulted on microfilm] Volume 2 [sealed, must be consulted on microfilm] Volume 3 August 1919-November 1920 Volume 4 December 1920-November 1921 Volume 5 December 1921-June-1922 Volume 6 May 1922-January 1923 Volume 7 January 1923-August 1923 Volume 8 August 1923-February 1924 Volume 9 March 1924-November 1924 Volume 10 November 1924-April 1925 Volume 11 April 1925-September 1925 Volume 12 September 1925-December 1925 Volume 13 December 1925-February 1926 Volume 14 February 1926-September 1926 Volume 15 1926 various dates Volume 16 July 1926-October 1926 Volume 17 October 1926-December 1926 Volume 18 December 1926-February 1927 Volume 19 February 1927-March 1927 Volume 20 April 1927-June 1927 Volume 21 June 1927-August 1927 Volume 22 September 1927-October 1927 Volume 23 October 1927-November 1927 Volume 24 November 1927-February 1928 Volume 25 February 1928-April 1928 Volume 26 May 1928-July 1928 Volume 27 July 1928-December 1928 Volume 28 January 1929-April 1929 Volume 29 May 1929-November 1929 Volume 30 November 1929-February 1930 Volume 31 March 1930-April 1930 Volume 32 May 1930-August 1930 Volume 33 August 1930-August 1930. Volume 34 August 1930-August 1930 Volume 35 August 1930-August 1930 Volume 36 August 1930-August 1930 Volume 37 August 1930-September 1930 Volume 38 August 1930-September 1930 Volume 39 August 1930-September 1930 Volume 40 September 1930-October 1930 Volume -

The Foreign Service Journal, June 1927

rrHE AMERICAN FOREIGN SERVICE JOURNAL Photo by M- P. Dunlap A BANGKOK HIGHWAY JUNE, 1927 Put These New Improvements to the Test It would take many words to tell the complete story of the new improvements in Dodge Brothers Motor Car and the finer results they produce. But here is a partial list: New silent-action clutch; seats re-designed for greater comfort; new five-bearing crankshaft of finest alloy steel; new starting system; new steering ease; easier gear shifting; softer pedal action; new muffler; smart new lines and colors. Take the car out for a trial. Experience for yourself the new smoothness, quietness and ease of handling; and remember that these finer results are in addition to an enviable record for long life and low cost of operation and maintenance. DDD5E- ERDTHE-R5, INC. DETRDIT, U. 5. A. DODGE- BROTHERS MOTOR CARS Index To American Foreign Service Journal VOLUMES I, II, AND III (Articles and Authors’ Names) y0j p Abd El Kerim II 250 Agriculture and Foreign Service II 365 Albrecht, Charles H Ill 234 Algeria, Big Game Shooting in II 5 II 271 Aliens, Examination of, Abroad II 423 III 60 III 225 Allen, Charles E II 262 America and Europe Ill 41 Americans Abroad, Attitude of II 323 Anderson, Francis M II 180 Antwerp Luncheon Club, The II 81 Aphrodisias II 177 Appointments to the Consular Service, Early Ill 117 Archives, Historical Relics and Treaties in Department II 148 “Ascertain Discreetly and Report Promptly” II 222 Ashura at Damascus, The II 153 Bahia Ill 313 Baker, Henry D Ill 305 Barbarissi, The Tale of the Sacred I 39 Baseball: Midseason in the Pennant Races II 282 The World’s Series, 1924 I 41 The World’s Series, 1925 II 374 The World’s Series, 1926 Ill 343 Batik in Java I 80 Bigelow to John G. -

The Frontier, March 1927

University of Montana ScholarWorks at University of Montana The Frontier and The Frontier and Midland Literary Magazines, 1920-1939 University of Montana Publications 3-1927 The Frontier, March 1927 Harold G. Merriam Follow this and additional works at: https://scholarworks.umt.edu/frontier Let us know how access to this document benefits ou.y Recommended Citation Merriam, Harold G., "The Frontier, March 1927" (1927). The Frontier and The Frontier and Midland Literary Magazines, 1920-1939. 20. https://scholarworks.umt.edu/frontier/20 This Journal is brought to you for free and open access by the University of Montana Publications at ScholarWorks at University of Montana. It has been accepted for inclusion in The Frontier and The Frontier and Midland Literary Magazines, 1920-1939 by an authorized administrator of ScholarWorks at University of Montana. For more information, please contact [email protected]. Tire FRONTIER A Literary Magazine SHORT STORY NUMBER 1. The Devil’s Match. 2. He’ll Make a Good Sheriff. 3. The Homesteader. 4. Pride. 5. Old Pain. STATE UNIVERSITY of MONTANA MARCH, 1927 Thirty-five Cents One Dollar a Year VOL. VII NO. 2 You Can’t Afford Anything But the Best! Shabbiness is expensive! It costs too much, for it costs you your self-respect. The desire to be well-dressed is not a question of extravagance. It is a question of intelligence. It is the high road to success. And the state of being well-dressed is fortunately not expensive if one has learned the whereabouts of such shops as ours. Missoula Mergyntile Co. > > > YOUR COLLEGE DAYS are gone to soon Live them again in after years by keeping a Memor? Book It makes the most personal history of your College life. -

Maine Alumnus, Volume 8, Number 5, March 1927

The University of Maine DigitalCommons@UMaine University of Maine Alumni Magazines University of Maine Publications 3-1927 Maine Alumnus, Volume 8, Number 5, March 1927 General Alumni Association, University of Maine Follow this and additional works at: https://digitalcommons.library.umaine.edu/alumni_magazines Part of the Higher Education Commons, and the History Commons Recommended Citation General Alumni Association, University of Maine, "Maine Alumnus, Volume 8, Number 5, March 1927" (1927). University of Maine Alumni Magazines. 482. https://digitalcommons.library.umaine.edu/alumni_magazines/482 This publication is brought to you for free and open access by DigitalCommons@UMaine. It has been accepted for inclusion in University of Maine Alumni Magazines by an authorized administrator of DigitalCommons@UMaine. For more information, please contact [email protected]. The Maine Alumnus Member of tlie Alumni Magazines Associated VOL. 8, NO. 5 MARCH, 1927 TWENTY CENTS 1 1912 at Its Last Reunion Enteied as second-class matter at the post ofhce at Bangor, Maine, under act of March 3, 1879 March, 1927 66 THE MAINE ALUMNUS 1 UNIVERSITY STORE ■ COMPANY ! I£ qRGANIZED in 1911 and conducted for the £ past fifteen years in the c ■ 1 interest of the Athletic Asso < •• ■ 1 ciation, contributing yearly from \) pQl___tYVIP I You Can 80 abroad> and spend ■ r Cd IL d LI utC* a week in London or Pans, all 1 expenses paid, for $260. And the trip takes only 23 days! ■ its profits to the support of Or, if you can spare 37 days for your trip to Europe, you can visit En I gland, Holland, Belgium France—Sec the best of all four countries—for ■ only S385 Price includes round trip ocean passage; all tips abroad; athletics. -

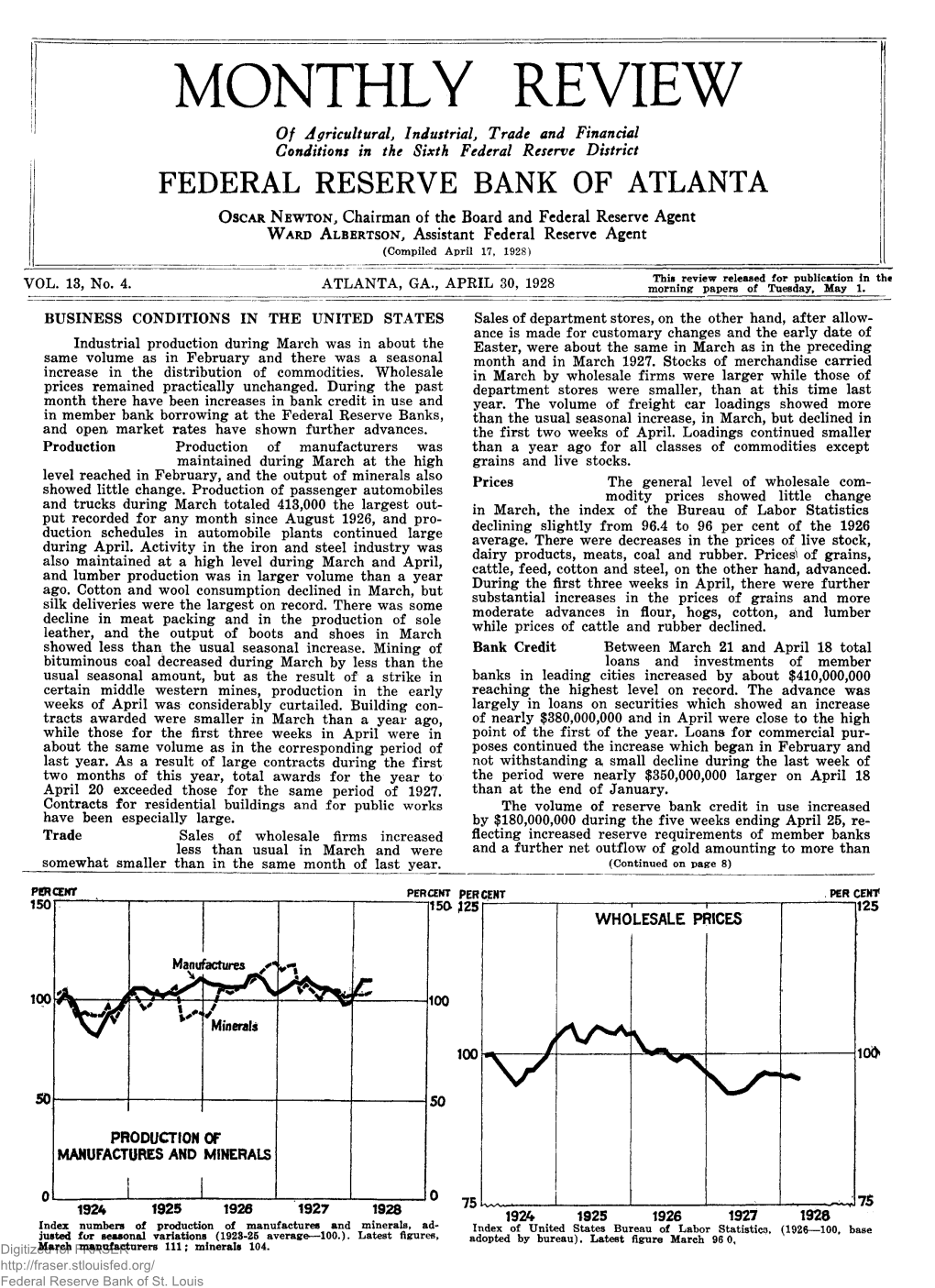

Business Review: May 1, 1928

i·'II.'.'U ..IIIIIIIII.IIIIIIIIIIIII.I.I.I.I.I.IIII •••• I11.III.UltIIIIUla ••••• I, •• I'''''''III ...... I.I'.'.'f'.111 ............ 11111 •••••••••• 11.11111 ••••••• 11111111111 •••••• I ••• II ••• III ••••• II.III ••••• UII •••• II •••• IIII •••••••• II ••• II ••••••• IIUIII ••••••• : ~ ! 1111.1111" .. 11111 ...... 111111 ............ 11 ......1111111111 ................... 111111111111 .. 1111111111111111111111111 .......... 11111 ....... 111 .. 1111111 ........... 1111 .... 111 .... 111 .. 111 ..... 11 ............ IIIIIU ...... III ......... IIIIIIIIII ... 'I· E I . I ~ ~ i n i n MONTHLY BUSINESS REVIEW q§ II OF THE , ~ § • ~ ~~ FEDERAL RESERVE BANK OF DALLAS i~ I!.. , ...., c. c. WAl:1'.l'.;.. •••• , F., .." RH'"' A'~~ompiled April 15, 1928) ~~~!!;, CF,l!~~'R;;;~; J.. ,!,,''..ANS, I! :111111111 .. :::::::::::::::::::::::::.1::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::: ::::::::::::::::::::::::::::::II~ This copy is r eleased for pub· VOlume 13, No.3 Dallas, Texas, May 1, 1928 Jicatic/n in afternoon papers April 28 DISTRICT SUMMARY IEIIIIIIIIIII"'IIIUI : 11111 ... 1111111111111111 ...... 1111 .. 111111 .... 11111111111111111111111111111111111111111111111111111111111 ....11111111111111111111 .. 111111111111111 .. 11111111 ........ 1 ............ 11111IIIIIIU.IIII1I .... UII ..... '"I1I1II'IIII .. IIU.m E THE SITUATION AT A GLAl'IfOE : : Eleventh Federal Reserve District : i B March February Inc.