2017 Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Infected Areas As on 6 August 1987 — Zones Infectées Au 6 Août 1987

U kl\ Epidem Rec Nu 32-7 August 1987 - 238 - Releve eptdem ftebd Nu 32 - 7 août 1987 PARASITIC DISEASES MALADIES PARASITAIRES Prevention and control of intestinal parasitic infections Lutte contre les parasitoses intestinales New WHO publication1 Nouvelle publication de l’OM S1 This report outlines new approaches to the prevention and con Ce rapport décrit les nouvelles méthodes de lutte contre les parasitoses trol of intestinal parasitic infections made possible by the recent intestinales mises au point grâce à la découverte de médicaments efficaces discovery of safe and effective therapeutic drugs, the improvement et sans danger, à l’amélioration et à la simplification de certaines and simplification of diagnostic procedures, and advances in the méthodes de diagnostic et aux progrès réalisés en biologie des populations understanding of parasite population biology. Newly available parasitaires. A partir de données nouvelles sur l'impact économique et information on the economic and social impact of these infections social de ces infections, il montre qu’il est nécessaire et possible de les is used to illustrate the necessity, as well as the feasibility, of maîtriser. bringing these infections under control. In view of the staking variations in the biology of different La biologie des différents parasites intestinaux ainsi que la forme et la intestinal parasites and in the form and severity of the diseases gravité des maladies qu’ils provoquent varient énormément, aussi le they cause, the book opens with individual profiles for each of the rapport commence-t-il par dresser un profil des principales helminthiases main helminthic and protozoan infections of public health impor et protozooses qui revêtent une importance du point de vue de la santé tance. -

Assessment of Greater Mekong Subregion Economic Corridors

About the Assessment of Greater Mekong Subregion Economic Corridors The transformation of transport corridors into economic corridors has been at the center of the Greater Mekong Subregion (GMS) Economic Cooperation Program since 1998. The Asian Development Bank (ADB) conducted this Assessment to guide future investments and provide benchmarks for improving the GMS economic corridors. This Assessment reviews the state of the GMS economic corridors, focusing on transport infrastructure, particularly road transport, cross-border transport and trade, and economic potential. This assessment consists of six country reports and an integrative report initially presented in June 2018 at the GMS Subregional Transport Forum. About the Greater Mekong Subregion Economic Cooperation Program The GMS consists of Cambodia, the Lao People’s Democratic Republic, Myanmar, the People’s Republic of China (specifically Yunnan Province and Guangxi Zhuang Autonomous Region), Thailand, and Viet Nam. In 1992, with assistance from the Asian Development Bank and building on their shared histories and cultures, the six countries of the GMS launched the GMS Program, a program of subregional economic cooperation. The program’s nine priority sectors are agriculture, energy, environment, human resource development, investment, telecommunications, tourism, transport infrastructure, and transport and trade facilitation. About the Asian Development Bank ADB is committed to achieving a prosperous, inclusive, resilient, and sustainable Asia and the Pacific, while sustaining -

The 20 Years National Strategy (2018-2037)

The linkage between the 20-Year National Strategy and the 12th National Economic and Social Development Plan9/12/59 SEZ Building and Development SEZ is an economic development tool which contributes The 20 Years National Strategy 2 prosperity to the region, improves income and quality of life, Strategy (2018-2037) National Competitiveness Enhancement and solves security problem. SEZ promotes development on Development Guideline 4 trade, investment and tourism with focus on potential of each Developing high quality infrastructure SEZ area connecting with SEZ in neighboring countries. to connect Thailand with the world. Border Special Economic Zones Ten high-potential border areas will be developed to be new economic gateways connecting Thailand with neighboring th The 12 National Economic countries with the aim of sustainable and tangible and Social Development Plan Strategy 9 development by 1) Promoting and facilitating investments (2017-2021) Regional, Urban and Economic Zone 2) encouraging and promoting environmental friendly economic Development activities 3) encouraging people and other development Development Guideline 3 partners to participate in and get benefit from SEZ Key Economic Area Development development and public participation in natural resources and environmental management in SEZ and 4) managing public health, labor and security issues Special Economic Zone Key element of SEZ development To contribute prosperity to the (SEZ) . SEZ designated area . Infrastructure and customs region and benefit from ASEAN, . Incentives checkpoints development reduce income inequality, improve . One Stop Service . Agricultural product quality of life and solve border . Labor management management July 2019 security problem 1 Special economic zones will become an economic gateway connecting with the neighboring Vision countries, and the people will have better quality of life. -

Living with Style

iving with St L yle LATITUDE TREE HOLDINGS BERHAD (302829-W) ANNUAL REPORT 2013 Latitude Tree Holdings Berhad Lot 3356, Batu 7¾, Jalan Kapar, 42200 Kapar, Selangor. Tel: 603-3291 5401 Fax: 603-3291 0048 www.lattree.com Annual Report 2013 contents 1 Corporate Information 2 Financial Highlights 3 Chairman and Managing Director’s Statement 4 Corporate Profile 6 Profile of Board of Directors 8 Corporate Governance Statement 11 Statement on Risk Management and Internal Control 23 Audit Committee Report 25 Statement of Board of Directors’ Responsibilities 30 Financial Statements 31 Properties Held by the Company & its Subsidiaries 111 Analysis of Shareholdings 113 Notice of Annual General Meeting 115 Notice of Dividend Payment 118 Form of Proxy | AnnuAl RepoRt 2013 2 corporate InformatIon BOARD OF DIRECTORS PLACE OF INCORPORATION AND DOMICILE Dato’ Haji Shaharuddin Bin Haji Haron Malaysia Chairman / Senior Independent Director STOCK EXCHANGE LISTING / STOCK NAME Mdm Lin Chen, Jui-Fen Deputy Chairman / Non-Independent Non-Executive Director Main Market of Bursa Malaysia Securities Berhad Stock Short Name : LATITUD Mr Lin, Chin-Hung Stock Code : 7006 Managing Director REGISTERED OFFICE Mr Lin, Tzu-Lang Executive Director Lot 6.05, Level 6, KPMG Tower 8 First Avenue, Bandar Utama Mr Toh Seng Thong 47800 Petaling Jaya Independent Director Selangor Darul Ehsan Telephone : 603-7720 1188 Mr Yek Siew Liong Facsimile : 603-7720 1111 Non-Independent Non-Executive Director Website : www.lattree.com COMPANY SECRETARIES SHARE REGISTRAR Ms Tai Yit Chan (MAICSA -

The Role of Chinese Traders on the Growth of Songkhla

® THE ROLE OF CHINESE actually the Chinese quarter. Kinship was TRADERS ON THE fostered among the Chinese in the community through inter-marriage. Multi-ethnic GROWTH OF interactions between the Thais, the Chinese and SONGKHLA, 1775-1912 the Muslims were carried out through trading activities in which the Chinese acted as Srisu.porn Choungsakul intermediaries. During the same period, Songkhla town had become the center of government for the lower South: the Abstract commanding seat of Monthon Nakhon Si Thammarat and other official centers. The article aims to study the growth of 1 Songkhla between 1775-1912, marked Thus the study shows the development and by two periods of change within growth of Songkhla proper between Songkhla proper. First, the Na 1896-1912, the crucial time in terms of Songkhla family played a major role in government administration and the economy the growth of Songkhla between 1775- when the Chinese traders played the significant 1896, and its development into an role in perpetuating the importance of important port city on the gulf coast. Songkhla as a vital city in the economic sphere Second, between 1896-1912, after the on the foundation laid down by the Na gradual decline of the role and Songkhla family. influence of the Na Songkhla family, Chinese traders ascended and took its Introduction place, enabling Songkhla to sustain its economic development and dynamism Formerly known as Singora among Western as a port city . people, Songkhla is a major natural port on the lower Gulf of Thailand and has long been an The study reveals the significant role of important center of trade on the eastern side of families of Chinese traders in the isthmus. -

IOM Thailand COVID-19 Newsletter JUNE-AUGUST 2020

IOM Thailand COVID-19 Newsletter JUNE-AUGUST 2020 IOM ENUMERATORS CONDUCTING MIGRANT SURVEY IN RANONG. IOM ENUMERATORS CONDUCTING MIGRANT SURVEY IN RANONG. © IOM 2020/VISARUT SANKHAM © IOM 2020/VISARUT SANKHAM OVERVIEW As the number of COVID-19 cases worldwide continue to grow KEY FIGURES AND FACTS exponentially with many countries reporting a second wave of new cases, the situation in Thailand from June to August was stable with no reported cases of community transmission. The State of Emergency Order was The number of non-Thai residents extended until September 30 and although there is no confirmed date for within the country has increased from an estimated 3.7 million in 2014 to 4.9 the reopening of borders, the Department of Employment has extended million in 2018, according to the 2019 the permission to stay or return to migrant workers that have completed UN Thailand Migration Report. four years of employment, workers who have changed or are changing employers, pink card holders1 and cross-border seasonal workers. Migrant workers account for 10 % of Through its continued engagement with migrants, IOM assessed that the Thailand’s labour force and primarily biggest COVID-19 impact felt by these communities relate to the loss of originate from Cambodia, Lao People’s employment and livelihoods, resulting in their inability to meet basic Democratic Republic, Myanmar and needs and access essential services including healthcare. The situation of Viet Nam. migrants in detention centres is particularly alarming: in May, 65 migrant detainees held at the Songkhla Immigration Detention Centre (IDC) in Sadao District were infected by COVID-19. -

Tax & Legal Services Newsletter

Tax & Legal Services Newsletter Vol. September 2014 ๖ Proposal for 10-Year Corporate Income Tax Exemption for Special Economic Zones The Ministry of Finance is considering the granting of incentives in the form of a tax exemption to five special economic zones established by the National Council for Peace and Order. The affected zones are the Mae Sot district in Tak province, the Aranyaprathet district in Sa Kaeo province, the Khlong Yai district in Trat province, Mukdahan province and the Sadao district in Songkhla province. The incentives would be granted more favorable treatment than incentives in Zone 3 currently granted by the Thailand Board of Investment (e.g. a 8-year exemption from corporate income tax with 50% reduction for another 3- 5 years) in order to promote investment in the above zones. Studies of Negative Income Tax The Fiscal Policy Office of the Ministry of Finance has released a study of negative income tax. According to a proposal in the study, the government would provide assistance to low income individuals, i.e. individuals who earn income below THB 30,000 would receive a payment from the government in an amount equal to 20% of their annual income. The payment would decrease as income rises and cease once income exceeds THB 80,000. If the initiative is approved, the government would use information provided in the personal income tax return to determine whether an individual qualifies for the payment. Revenue Department Rulings Specific Business Tax Treatment of Intercompany Guarantee Company A, a major shareholder of Company B, shares a board of directors with Company B. -

(Translation) Chotika Chummee and Srinarin Phaophongpaiboon

(Translation) SPECIAL ECONOMIC ZONE…THAILAND’S ROADMAP AND GOLDEN OPPORTUNITY TO KEEP AN EYE ON? Chotika Chummee and Srinarin Phaophongpaiboon EIC has considered districts of Mae Sod, Aranyaprathet and Sadao as 3 pilot areas with high potentials to be developed as special economic zones (SEZ) as they are more prepared in terms of infrastructure than other areas and having had the production bases in trading and industrial sectors. Textile, food processing and other labour-intensive businesses shall benefit from the transfer of production bases to the special economic zones; meanwhile, service businesses and urban growth supporting businesses such as warehouses, distribution centers, logistics services, wholesale and retail of consumer products and public health services shall benefit from urban growth and investment promotion in SEZ. In July of this year, the Government has passed its resolution to approve the establishment of special economic zones (SEZ) initially in 5 border areas including (1) Mae Sod District of Tak Province; (2) Aranyaprathet District of Sa Kaew Province; (3) Trat Province; (4) Mukdahan Province; and (5) Sadao District of Songkhla Province (Sadao and Padangbezar Checkpoints) (Figure 1) with the primary goals of attracting FDI, creating jobs, extending modernity to local areas to reduce inequality, organizing border areas and increasing the country’s competitiveness to be prepared for the upcoming AEC in 2015; and solving problems of smuggling of agricultural products and illegal foreign labour into inner areas within the Country; whereas all of the 5 target areas (with the total area of approx. 1.83 million rai) are regarded as having potentials and preparedness in terms of infrastructure and labour and having advantages of geographical locations and rather outstanding production bases and having no severe calamities or problems of international security. -

IMPLEMENTATION BLUEPRINT 2017-2021 Ii IMT-GT IMPLEMENTATION BLUEPRINT 2017-2021 Iv IMT-GT Implementation Blueprint 2017-2021 V

IMPLEMENTATION BLUEPRINT 2017-2021 ii IMT-GT IMPLEMENTATION BLUEPRINT 2017-2021 iv IMT-GT Implementation Blueprint 2017-2021 v Contents LEADERS’ DECLARATION ON THE ADOPTION Chapter 6 OF IMPLEMENTATION BLUEPRINT 2017-2021 vi THE ENABLERS — ENABLING DEVELOPMENT 55 EXECUTIVE SUMMARY viii Transport and ICT Connectivity 56 ABBREVIATIONS xvi Trade and Investment Facilitation 63 Environment 68 Chapter 1 Human Resource Development, Education and Culture 73 THE CONTEXT OF IMT-GT IMPLEMENTATION BLUEPRINT 2017-2021 1 Chapter 7 ENHANCED PROJECT MANAGEMENT 79 Chapter 2 IB 2017-2021 — Chapter 8 THE FIRST LEG TOWARDS VISION 2036 7ENGAGING STAKEHOLDERS FOR BETTER RESULTS 93 Chapter 3 Appendix 1: Physical Connectivity Projects 104 IMPLEMENTING IB 2017-2021 25 ACKNOWLEDGEMENTS 114 Chapter 4 TRANSLATING FOCUS AREA STRATEGIES TO PROJECTS 33 Chapter 5 THE LEAD FOCUS AREAS — SPEARHEADING GROWTH 37 Agriculture and Agro-based Industry 38 Tourism 45 Halal Products and Services 50 vi IMT-GT LEADERS’ DECLARATION ON THE ADOPTION OF THE IMT-GT IMPLEMENTATION BLUEPRINT 2017-2021 WE, the leaders of the Member Countries of the Indonesia-Malaysia-Thailand Growth Triangle (hereinafter referred to as IMT-GT), namely, the Republic of Indonesia, Malaysia and the Kingdom of Thailand, on the occasion of the 10th IMT-GT Summit in Manila, the Philippines; RECALLING our agreement at the Ninth IMT-GT Summit in Langkawi, Kedah, Malaysia in April 2015 to review the IMT-GT strategy and to identify future strategic directions to ensure the subregional stays relevant and competitive; -

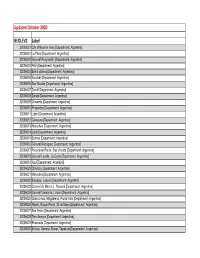

GEOLEV2 Label Updated October 2020

Updated October 2020 GEOLEV2 Label 32002001 City of Buenos Aires [Department: Argentina] 32006001 La Plata [Department: Argentina] 32006002 General Pueyrredón [Department: Argentina] 32006003 Pilar [Department: Argentina] 32006004 Bahía Blanca [Department: Argentina] 32006005 Escobar [Department: Argentina] 32006006 San Nicolás [Department: Argentina] 32006007 Tandil [Department: Argentina] 32006008 Zárate [Department: Argentina] 32006009 Olavarría [Department: Argentina] 32006010 Pergamino [Department: Argentina] 32006011 Luján [Department: Argentina] 32006012 Campana [Department: Argentina] 32006013 Necochea [Department: Argentina] 32006014 Junín [Department: Argentina] 32006015 Berisso [Department: Argentina] 32006016 General Rodríguez [Department: Argentina] 32006017 Presidente Perón, San Vicente [Department: Argentina] 32006018 General Lavalle, La Costa [Department: Argentina] 32006019 Azul [Department: Argentina] 32006020 Chivilcoy [Department: Argentina] 32006021 Mercedes [Department: Argentina] 32006022 Balcarce, Lobería [Department: Argentina] 32006023 Coronel de Marine L. Rosales [Department: Argentina] 32006024 General Viamonte, Lincoln [Department: Argentina] 32006025 Chascomus, Magdalena, Punta Indio [Department: Argentina] 32006026 Alberti, Roque Pérez, 25 de Mayo [Department: Argentina] 32006027 San Pedro [Department: Argentina] 32006028 Tres Arroyos [Department: Argentina] 32006029 Ensenada [Department: Argentina] 32006030 Bolívar, General Alvear, Tapalqué [Department: Argentina] 32006031 Cañuelas [Department: Argentina] -

53917 8. Chiang Rai Special Economic Zone

THAILAND'STH AILAND'S SPECIALSPECIAL ECONOMIC ZONES Chiang Rai Nong Khai Nakorn Phanom Tak Mukdahan Contact Addresses: Office of the National Committee on Special Economic Zone Development (NC-SEZ) Office of the National Economic and Social Development Board Kanchanaburi Sa Kaeo 962 Krung Kasem Road, Pomprab, Bangkok 10100 Tel. +66 2280 2740 Fax. +66 2280 2743 Email: [email protected] One Start One Stop Investment Center (OSOS),(OSOS), Board of Investment (BOI) Trat 18th Floor, Chamchuri Square Building, Phayathai Road, Pathumwan Bangkok 10330 Tel: +66 2209 1100 Fax: +66 2209 1199 Email: [email protected] One Stop Service Investment Centers in 10 SEZs Tak Tel. +66 55 532 263 Fax. +66 55 532 263 Email : [email protected] Mukdahan Tel. +66 42 614 777 Fax. +66 42 614 777 Email : [email protected] Sa Kaeo Tel. +66 37 425 353 Fax. +66 37 425 127 Email : [email protected] Trat Tel. +66 39 511 300 Fax. +66 39 511 282 Email : [email protected] Songkhla Songkhla Tel. +66 74 211 565 Fax. +66 74 211 904 Email : oss.songkhlagmail.com Narathiwat Nong Khai Tel. +66 42 990 462 Fax. +66 42 990 462 Email : [email protected] Narathiwat Tel. +66 73 532 026 Fax. +66 73 532 024 Email : [email protected] AUGUST 2016 Chiang Rai Tel. +66 53 150 181 Fax. +66 53 150 194 Email : [email protected] Spatial Development Planning and Strategy Office Nakorn Phanom Tel. +66 42 532 888-90 Fax. +66 42 532 888-90 Email : [email protected] Office of the National Economic and Social Development Board Kanchanaburi Tel. -

Opinion of the Independent Financial Advisor Concerning the Asset

Enclosure No. 2 Opinion of the Independent Financial Advisor Concerning the Asset Acquisition and Connected Transactions (Supporting Document for Agenda 1-4 of the Extraordinary General Meeting of Shareholders No. 1/2020) of Sri Trang Gloves (Thailand) Public Company Limited The Independent Financial Advisor Capital Advantage Company Limited November 28, 2020 Enclosure No. 2 - TRANSLATION - The English Translation of the Independent Financial Advisor’s Opinion has been prepared solely for the convenience of foreign shareholders of Sri Trang Gloves (Thailand) Public Company Limited and should not be relied upon as the definitive and official document. The Thai language version of the Independent Financial Advisor’s Opinion is the definitive and official document and shall prevail in all aspects in the event of any inconsistency with this English Translation. No. 100/2020 November 28, 2020 Subject: Opinion of the Independent Financial Advisor concerning the Asset Acquisition and Connected Transactions of Sri Trang Gloves (Thailand) Public Company Limited Attention: Shareholders Sri Trang Gloves (Thailand) Public Company Limited Attachments: 1) Business overview and operating performance of Premier System Engineering Company Limited 2) Business overview and operating performance of Sadao P.S. Rubber Company Limited 3) Summary of agreements concerning the Asset Acquisition and Connected Transactions Business overview and operating performance of Sri Trang Gloves (Thailand) Public Company Limited is shown in Clause 5 of Information Memorandum