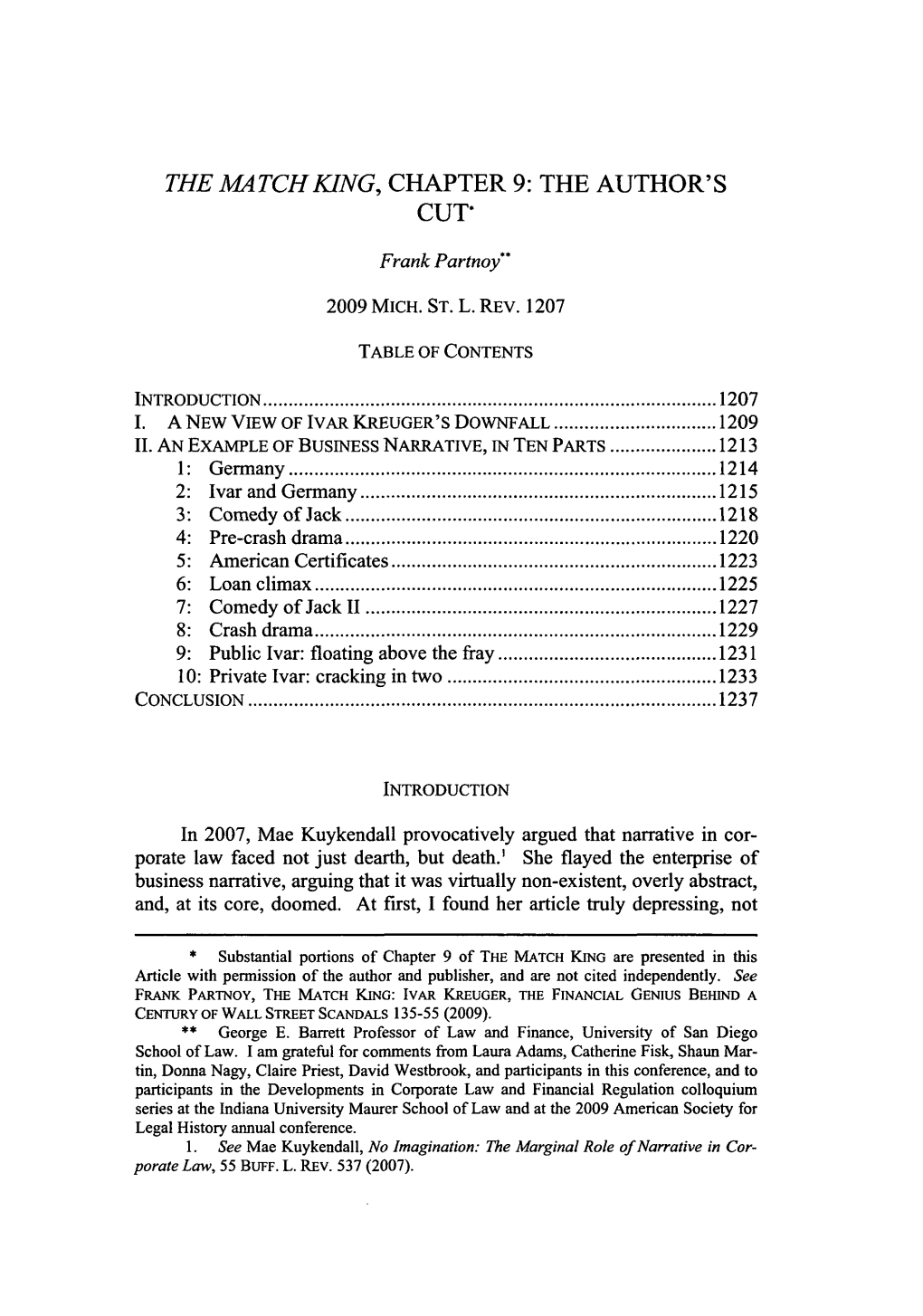

The Match King, Chapter 9: the Author's Cut*

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Is Japan 'Back'?

IS JAPAN ‘BACK’? Japan Society of Northern California/Federal Reserve Bank of San Francisco, May 9th 2013 SOME PRELMINARY OBSERVATIONS SOME PRELMINARY “It is the one sphere of life and activity where victory, security and success is always to the minority and never to the majority. When you find any one agreeing with you, change your mind.” Keynes, speaking of Investment, 1937 5/8/2013 2 SUMMARY o Causes of Japan’s “Lost Decades” o First – Strategic irrelevance post-1989 o Second – early ‘90s headwinds strong in proportion to the size of the bubble o Third - 1997-2012- persistent macro-economic policy mistakes. o No insuperable “structural problems o Last headwinds dropped to nothing in 2009 o Senkaku spat marks Japan’s recovery of a strategic role o “Abe-nomics” represents reversal of the mistakes of 1997-2012 o Anyway, monetary policy has actually been loose since 3/11 o Deflation may already be over o PM Abe may just be “in the right place at the right time” o Both the initial, long period of error and its reversal echo the ‘30s. 5/8/2013 3 WHAT ACTUALLY HAPPENED? Is Real Life lived in Real or Nominal Numbers? Year Nominal GDP Population Nominal GDP/head Real GDP Real GDP/head (Y mil) (Thou) (Y mil) (Y mil) (Y mil) 1995 501,707 125,570 4.00 455,460 3.63 2000 509,860 126,926 4.02 474,847 3.74 2005 503,903 127,768 3.94 503,921 3.94 2010 482,384 128,057 3.77 512,364 4.00 2011 470,623 127,799 3.68 509,450 3.99 Period Nominal GDP per Capita Real GDP per Capita Change 1995-2011 -7.8% 9.9% 2000-2011 -8.3% 6.6% Note: GDP for Fiscal Years, Seasonally -

The Development and Character of the Nazi Political Machine, 1928-1930, and the Isdap Electoral Breakthrough

Louisiana State University LSU Digital Commons LSU Historical Dissertations and Theses Graduate School 1976 The evelopmeD nt and Character of the Nazi Political Machine, 1928-1930, and the Nsdap Electoral Breakthrough. Thomas Wiles Arafe Jr Louisiana State University and Agricultural & Mechanical College Follow this and additional works at: https://digitalcommons.lsu.edu/gradschool_disstheses Recommended Citation Arafe, Thomas Wiles Jr, "The eD velopment and Character of the Nazi Political Machine, 1928-1930, and the Nsdap Electoral Breakthrough." (1976). LSU Historical Dissertations and Theses. 2909. https://digitalcommons.lsu.edu/gradschool_disstheses/2909 This Dissertation is brought to you for free and open access by the Graduate School at LSU Digital Commons. It has been accepted for inclusion in LSU Historical Dissertations and Theses by an authorized administrator of LSU Digital Commons. For more information, please contact [email protected]. INFORMATION TO USERS This material was produced from a microfilm copy of the original document. While the most advanced technological means to photograph and reproduce this document have been used, the quality is heavily dependent upon the quality of the original submitted. « The following explanation of techniques is provided to help you understand markings or patterns which may appear on this reproduction. 1.The sign or "target" for pages apparently lacking from the document photographed is "Missing Page(s)". If it was possible to obtain the missing pega(s) or section, they are spliced into the film along with adjacent pages. This may have necessitated cutting thru an image and duplicating adjacent pages to insure you complete continuity. 2. When an image on the film is obliterated with a large round black mark, it is an indication that the photographer suspected that the copy may have moved during exposure and thus cause a blurred image. -

October 19, 1987 – Black Monday, 20 Years Later BACKGROUND

October 19, 1987 – Black Monday, 20 Years Later BACKGROUND On Oct. 19, 1987, “Black Monday,” the DJIA fell 507.99 (508) points to 1,738.74, a drop of 22.6% or $500 billion dollars of its value-- the largest single-day percentage drop in history. Volume surges to a then record of 604 million shares. Two days later, the DJIA recovered 289 points or 16.6% of its loss. It took two years for the DJIA to fully recover its losses, setting the stage for the longest bull market in U.S. history. Date Close Change Change % 10/19/87 1,738.70 -508.00 -22.6 10/20/87 1,841.00 102.30 5.9 10/21/87 2,027.90 186.90 10.2 Quick Facts on October 11, 1987 • DJIA fell 507.99 points to 1,738.74, a 22.6% drop (DJIA had opened at 2246.74 that day) o Record decline at that time o Friday, Oct. 16, DJIA fell 108 points, completing a 9.5 percent drop for the week o Aug. 1987, DJIA reached 2722.42, an all-time high; up 48% over prior 10 months o Today, DJIA above 14,000 • John Phelan, NYSE Chairman/CEO -- Credited with effective management of the crisis. A 23-year veteran of the trading floor, he became NYSE president in 1980 and chairman and chief executive officer in 1984, serving until 1990 NYSE Statistics (1987, then vs. now) 1987 Today (and current records) ADV - ytd 1987 (thru 10/19): 181.5 mil ADV – 1.76 billion shares (NYSE only) shares 10/19/1987: 604.3 million shares (reference ADV above) 10/20/1987: 608.1* million shares (reference ADV above) Oct. -

2020 WWE Finest

BASE BASE CARDS 1 Angel Garza Raw® 2 Akam Raw® 3 Aleister Black Raw® 4 Andrade Raw® 5 Angelo Dawkins Raw® 6 Asuka Raw® 7 Austin Theory Raw® 8 Becky Lynch Raw® 9 Bianca Belair Raw® 10 Bobby Lashley Raw® 11 Murphy Raw® 12 Charlotte Flair Raw® 13 Drew McIntyre Raw® 14 Edge Raw® 15 Erik Raw® 16 Humberto Carrillo Raw® 17 Ivar Raw® 18 Kairi Sane Raw® 19 Kevin Owens Raw® 20 Lana Raw® 21 Liv Morgan Raw® 22 Montez Ford Raw® 23 Nia Jax Raw® 24 R-Truth Raw® 25 Randy Orton Raw® 26 Rezar Raw® 27 Ricochet Raw® 28 Riddick Moss Raw® 29 Ruby Riott Raw® 30 Samoa Joe Raw® 31 Seth Rollins Raw® 32 Shayna Baszler Raw® 33 Zelina Vega Raw® 34 AJ Styles SmackDown® 35 Alexa Bliss SmackDown® 36 Bayley SmackDown® 37 Big E SmackDown® 38 Braun Strowman SmackDown® 39 "The Fiend" Bray Wyatt SmackDown® 40 Carmella SmackDown® 41 Cesaro SmackDown® 42 Daniel Bryan SmackDown® 43 Dolph Ziggler SmackDown® 44 Elias SmackDown® 45 Jeff Hardy SmackDown® 46 Jey Uso SmackDown® 47 Jimmy Uso SmackDown® 48 John Morrison SmackDown® 49 King Corbin SmackDown® 50 Kofi Kingston SmackDown® 51 Lacey Evans SmackDown® 52 Mandy Rose SmackDown® 53 Matt Riddle SmackDown® 54 Mojo Rawley SmackDown® 55 Mustafa Ali Raw® 56 Naomi SmackDown® 57 Nikki Cross SmackDown® 58 Otis SmackDown® 59 Robert Roode Raw® 60 Roman Reigns SmackDown® 61 Sami Zayn SmackDown® 62 Sasha Banks SmackDown® 63 Sheamus SmackDown® 64 Shinsuke Nakamura SmackDown® 65 Shorty G SmackDown® 66 Sonya Deville SmackDown® 67 Tamina SmackDown® 68 The Miz SmackDown® 69 Tucker SmackDown® 70 Xavier Woods SmackDown® 71 Adam Cole NXT® 72 Bobby -

Walking List CLERMONT MILFORD EXEMPTED VSD Run Date:05/19/2021

Walking List CLERMONT MILFORD EXEMPTED VSD Run Date:05/19/2021 SELECTION CRITERIA : ({voter.status} in ['A','I']) and {district.District_id} in [112] 535 HOWELL, JANET L REP MD-A - MILFORD CITY A 535 HOWELL, STACY LYNN NOPTY BELT AVE MILFORD 45150 535 HOWELL, STEPHEN L REP 538 BREWER, KENNETH L NOPTY 502 KLOEPPEL, CODY ALAN REP 538 BREWER, KIMBERLY KAY NOPTY 505 HOLSER, AMANDA BETH NOPTY 538 HALLBERG, RICHARD LEANDER NOPTY 505 HOLSER, JOHN PERRY DEM 538 HALLBERG, RYAN SCOTT NOPTY 506 SHAFER, ETHAN NOPTY 539 HOYE, SARAH ELIZABETH DEM 506 SHAFER, JENNIFER M NOPTY 539 HOYE, STEPHEN MICHAEL NOPTY 508 BUIS, DEBBIE S NOPTY 542 #APT 1 LANIER, JEFFREY W DEM 509 WHITE, JONATHAN MATTHEW NOPTY 542 #APT 3 MASON, ROBERT G NOPTY 510 ROA, JOYCE A DEM 543 AMAYA, YVONNE WANDA NOPTY 513 WHITE, AMBER JOY NOPTY 543 NORTH, DEBORAH FAY NOPTY 514 AKERS, TONIE RENAE NOPTY 546 FIELDS, ALEXIS ILENE NOPTY 518 SMITH, DAVID SCOTT DEM 546 FIELDS, DEBORAH J NOPTY 518 SMITH, TAMARA JOY DEM 546 FIELDS, JACOB LEE NOPTY 521 MCBEATH, COURTTANY ALENE REP 550 MULLEN, HEATHER L NOPTY 522 DUNHAM CLARK, WILMA LOUISE NOPTY 550 MULLEN, MICHAEL F NOPTY 525 HACKMEISTER, EDWIN L REP 550 MULLEN, REGAN N NOPTY 525 HACKMEISTER, JUDY A NOPTY 554 KIDWELL, MARISSA PAIGE NOPTY 526 SPIEGEL, JILL D DEM 554 LINDNER, MADELINE GRACE NOPTY 526 SPIEGEL, LAWRENCE B DEM 554 ROA, ALEX NOPTY 529 WITT, AARON C REP 529 WITT, RACHEL A REP CHATEAU PL MILFORD 45150 532 PASCALE, ANGELA W NOPTY 532 PASCALE, DOMINIC VINCENT NOPTY 2 STEVENS, JESSICA M NOPTY 532 PASCALE, MARK V NOPTY 2 #APT 1 CHURCHILL, REX -

The Treaty of Versailles on June 28, 1919

World War I World War I officially ended with the signing of the Treaty of Versailles on June 28, 1919. Negotiated among the Allied powers with little participation by Germany, it changed German boundaries and made Germany pay money for causing the war. After strict enforcement for five years, the French agreed to the modification of important provisions, or parts of the treaty. Germany agreed to pay reparations (Money) under the Dawes Plan and the Young Plan, but those plans were cancelled in 1932, and Hitler’s rise to power and his actions did away with the remaining terms of the treaty. <<< Hitler Rose to Power in Germany in 1933 The treaty was written by the Allies (Great Britain, U.S, France) with almost no participation by the Germans. The negotiations revealed a split between the French, who wanted to dismember Germany to make it impossible for it to renew war with France, and the British and Americans, who wanted the terms to be kind enough to Germany to not encourage anger. The Following are Parts of The Treaty of Versailles Part I: created the Covenant of the New League of Nations, which Germany was not allowed to join until 1926. The League of Nations was an idea put forward by United States President Woodrow Wilson. He wanted it to be a place where representatives of all the countries of the world could come together and discuss events and hopefully avoid future fighting. However, the United States congress refused to join the League of Nations. Even though the United States played a huge role in creating it, they did not join it! President Woodrow Wilson Held office 1913 - 1921 Part II: specified Germany’s new boundaries, giving Eupen-Malm[eacute]dy to Belgium, Alsace-Lorraine back to France, substantial eastern districts to Poland, Memel to Lithuania, and large portions of Schleswig to Denmark. -

Trianon 1920–2020 Some Aspects of the Hungarian Peace Treaty of 1920

Trianon 1920–2020 Some Aspects of the Hungarian Peace Treaty of 1920 TRIANON 1920–2020 SOME ASPECTS OF THE HUNGARIAN PEACE TREATY OF 1920 Edited by Róbert Barta – Róbert Kerepeszki – Krzysztof Kania in co-operation with Ádám Novák Debrecen, 2021 Published by The Debreceni Universitas Nonprofit Közhasznú Kft. and the University of Debrecen, Faculty of Arts and Humanities, Department of History Refereed by Levente Püski Proofs read by Máté Barta Desktop editing, layout and cover design by Zoltán Véber Járom Kulturális Egyesület A könyv megjelenését a Nemzeti Kulturális Alap támomgatta. The publish of the book is supported by The National Cultural Fund of Hungary ISBN 978-963-490-129-9 © University of Debrecen, Faculty of Arts and Humanities, Department of History, 2021 © Debreceni Universitas Nonprofit Közhasznú Kft., 2021 © The Authors, 2021 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopy- ing, recording, or otherwise, without the prior written permission of the Publisher. Printed by Printart-Press Kft., Debrecen Managing Director: Balázs Szabó Cover design: A contemporary map of Europe after the Great War CONTENTS Foreword and Acknowledgements (RÓBERT BARTA) ..................................7 TRIANON AND THE POST WWI INTERNATIONAL RELATIONS MANFRED JATZLAUK, Deutschland und der Versailler Friedensvertrag von 1919 .......................................................................................................13 -

Regime Change Q2 2018 COMMENTARY

Chief Market Strategist, Dr. Quincy Krosby Prudential Financial Regime Change Q2 2018 COMMENTARY The second quarter— Highlights which statistically • Federal Reserve chairman Jerome Powell takes the helm is not the most • A brief history of recent regime changes at the Federal Reserve • The market enters a period of crosscurrents hospitable in terms of returns—should enjoy Q2 OPENING BELL solid growth here The term “regime change” is currently trending in the headlines, from “More expect Venezuela will collapse and have regime change within 12 months” to “Pushing back against Iran: Is it time and abroad; solid, if for regime change?” As we enter the second quarter of 2018, however, the term is increasingly not stellar, earnings; used to describe a subtle but equally important shift in economic policy. Monetary policy stands out as a significant economic catalyst, and with the departure of Federal Reserve Chair Janet the fiscal stimulus Yellen, we’ve seen headlines blare: “How to survive the regime change in markets.” beginning to filter into Referring to February’s market correction, triggered by fears that inflation was beginning to assert itself, the Financial Times succinctly stated: “Whether correction turns into regime the real economy; and change is down to the Fed.” But do members of the Federal Open Market Committee (FOMC) a Federal Reserve of the Federal Reserve view their job as protectors of stock market performance, the way they seemingly did coming out of the financial crisis? that wants to maintain Newly installed Fed Chairman Jerome Powell, greeted on his first official day with a 4 percent the “middle ground” market sell-off, appeared upbeat about prospects for the economy. -

Scripophily Journal 2004-05

Why Do So Many Dealers and Collectors Consign or Sell to Smythe? Top Dollar Paid on Direct Purchases. Record Breaking Auction Prices. Competitive MAYMAY 2004 2004 Auction Commissions Rates. Friendly, Personalized Service. Impeccable References. Expert Staff of Nationally-Recognized Specialists. Thoroughly Researched & Beautifully Illustrated Catalogues. Generous Cash Advances, Flexible Terms. Stephen Goldsmith (Stocks, Bonds, U.S. Coins) Diana Herzog (Autographs) Scott Lindquist (U.S. Small Size, Nationals) Martin Gengerke (U.S. Large Size, Fractionals) Tom Tesoriero (Ancient & Foreign Coins) David Vagi (Ancient Coins) Jay Erlichman (U.S. Coins) Robert Litzenberger (Autographs) WITTE KREUGER BRUNEL 2 Rector Street, 12th Floor, New York, NY 10006-1844 TEL: 212-943-1880 TOLL FREE: 800-622-1880 FAX: 212-312-6370 E-MAIL: [email protected] INTERNET: smytheonline.com INTERNATIONAL BOND & SHARE SOCIETY • YEAR 27 • ISSUE 1 SCRIPOPHILY DEALERS’ LISTS LIBRARY COLLECTORS’ BILLBOARD Alistair Gibb, 17 Floors Place, Kirkcaldy, Fife, IBSS publishes a series of illustrated monographs Collectors’ ads on this Billboard are FREE by members on aspects of scripophily. KY2 5SF, UK WANTED - SCRIPOPHILY AUCTION Company Histories 04/1 lists around 100 used These titles are currently available: CATALOGUES AND FIXED PRICE LISTS books of company history and business biography. ... encouraging collecting since 1978 # 1 Gregor MacGregor, Cazique of Poyais P rior to 2001 (especially Gypsyfoot and Smythe). Mostly British but some Dutch and US. by Richard T Gregg, 1999 Paying up to $5 each. Please write first! Reasonable prices from £2 up. Max Hensley, P.O. Box 741, # 2 T he Emergence of the Railway in Britain Lake Forest, IL 60045, USA. -

The Federal Reserve's Response to the 1987 Market Crash

PRELIMINARY YPFS DISCUSSION DRAFT | MARCH 2020 The Federal Reserve’s Response to the 1987 Market Crash Kaleb B Nygaard1 March 20, 2020 Abstract The S&P500 lost 10% the week ending Friday, October 16, 1987 and lost an additional 20% the following Monday, October 19, 1987. The date would be remembered as Black Monday. The Federal Reserve responded to the crash in four distinct ways: (1) issuing a public statement promising to provide liquidity as needed, “to support the economic and financial system,” (2) providing support to the Treasury Securities market by injecting in-high- demand maturities into the market via reverse repurchase agreements, (3) allowing the Federal Funds Rate to fall from 7.5% to 7.0%, and (4) intervening directly to allow the rescue of the largest options clearing firm in Chicago. Keywords: Federal Reserve, stock market crash, 1987, Black Monday, market liquidity 1 Research Associate, New Bagehot Project. Yale Program on Financial Stability. [email protected]. PRELIMINARY YPFS DISCUSSION DRAFT | MARCH 2020 The Federal Reserve’s Response to the 1987 Market Crash At a Glance Summary of Key Terms The S&P500 lost 10% the week ending Friday, Purpose: The measure had the “aim of ensuring October 16, 1987 and lost an additional 20% the stability in financial markets as well as facilitating following Monday, October 19, 1987. The date would corporate financing by conducting appropriate be remembered as Black Monday. money market operations.” Introduction Date October 19, 1987 The Federal Reserve responded to the crash in four Operational Date Tuesday, October 20, 1987 distinct ways: (1) issuing a public statement promising to provide liquidity as needed, “to support the economic and financial system,” (2) providing support to the Treasury Securities market by injecting in-high-demand maturities into the market via reverse repurchase agreements, (3) allowing the Federal Funds Rate to fall from 7.5% to 7.0%, and (4) intervening directly to allow the rescue of the largest options clearing firm in Chicago. -

Kreuger Byggde Olympiastadion Sporrong Gjöt Medaljerna Kodak Tog Bilderna

EDWARDS HÖRNA SVENSKEN BAKOM GreYHOUND Edward Blom berättar saker Svenskamerikanska entreprenören Wretman du inte visste om OS 1912. grundade USA:s berömda bussbolag. no 3 2012 MAGASINET OM NÄRINGSLIVETS HISTORIA pris 59 kr Olympiska Spelen i Stockholm 1912 Kreuger byggde olympiastadion Sporrong gjöt medaljerna Kodak tog bilderna Rekord i läsk +Gotlandsbolaget Sigfrid Edström Fråga Företagsminnen företagsminnen 2012:3 Korsord 1 Ledare | edward blom Nu blir det byte! allting gör man en gång för sista tad påbyggnad på min spretiga studi- gången, men det var först när jag um generale-examen, fick jag fortsätta knattrade in ordet ledare i det tomma att skriva. Återkommen som arkivarie dokumentet, som jag insåg att jag ald- till Centrum för Näringslivshistoria rig mer kommer att formulera en så- hade en kollega tagit över som re- dan text till Företagsminnen. Och efter- daktör. Han använde mig flitigt som som jag alltsedan barnsben har haft en skribent och snart satt jag även med i sentimental, nostalgisk läggning kan ett nygrundat redaktionsråd. jag inte låta bli att bli självbespeglande. Och så 2003 var det plötsligt jag som Det första numret av Företagsminnen var redaktören. Jag minns hur jag satt utkom 1997 – så vi fyller 15 år i år! Det på mitt tjänsterum med två känslor i var ett enkelt layoutat medlemsblad samma bröst: skräcken över hur sjut- J. H. Duncan, USA som tog brons i diskus- på åtta sidor, ton jag skulle hitta kastning, med bästa hand. OS i Stockholm helt i svartvitt, ”När jag blev redaktör skribenter och 1912 officiella brefkort. Fotograf okänd. förutom ljus- artikelidéer nog att Ansvarig utgivare: Alexander Husebye, gröna rubriker, var Företagsminnen fylla ett helt num- [email protected], där den längsta ännu en svartvit mer – särskilt som 08-634 99 14 artikeln uppgick vi på den tiden inte Chefredaktör: Edward Blom, edward.blom@ till en sida och tidskrift på 28 sidor” betalade en krona i naringslivshistoria.se, 08-634 99 29 bilderna var små arvode. -

BASE BASE CARDS 1 AJ Styles Raw 2 Aleister Black Raw 3 Alexa Bliss Smackdown 4 Mustafa Ali Smackdown 5 Andrade Raw 6 Asuka Raw 7

BASE BASE CARDS 1 AJ Styles Raw 2 Aleister Black Raw 3 Alexa Bliss SmackDown 4 Mustafa Ali SmackDown 5 Andrade Raw 6 Asuka Raw 7 King Corbin SmackDown 8 Bayley SmackDown 9 Becky Lynch Raw 10 Big E SmackDown 11 Big Show WWE 12 Billie Kay Raw 13 Bobby Lashley Raw 14 Braun Strowman SmackDown 15 "The Fiend" Bray Wyatt SmackDown 16 Brock Lesnar Raw 17 Murphy Raw 18 Carmella SmackDown 19 Cesaro SmackDown 20 Charlotte Flair Raw 21 Daniel Bryan SmackDown 22 Drake Maverick SmackDown 23 Drew McIntyre Raw 24 Elias SmackDown 25 Erik 26 Ember Moon SmackDown 27 Finn Bálor NXT 28 Humberto Carrillo Raw 29 Ivar 30 Jeff Hardy WWE 31 Jey Uso SmackDown 32 Jimmy Uso SmackDown 33 John Cena WWE 34 Kairi Sane Raw 35 Kane WWE 36 Karl Anderson Raw 37 Kevin Owens Raw 38 Kofi Kingston SmackDown 39 Lana Raw 40 Lacey Evans SmackDown 41 Luke Gallows Raw 42 Mandy Rose SmackDown 43 Naomi SmackDown 44 Natalya Raw 45 Nia Jax Raw 46 Nikki Cross SmackDown 47 Peyton Royce Raw 48 Randy Orton Raw 49 Ricochet Raw 50 Roman Reigns SmackDown 51 Ronda Rousey WWE 52 R-Truth Raw 53 Ruby Riott Raw 54 Rusev Raw 55 Sami Zayn SmackDown 56 Samoa Joe Raw 57 Sasha Banks SmackDown 58 Seth Rollins Raw 59 Sheamus SmackDown 60 Shinsuke Nakamura SmackDown 61 Shorty G SmackDown 62 Sonya Deville SmackDown 63 The Miz SmackDown 64 The Rock WWE 65 Triple H WWE 66 Undertaker WWE 67 Xavier Woods SmackDown 68 Zelina Vega Raw 69 Adam Cole NXT 70 Angel Garza NXT 71 Angelo Dawkins Raw 72 Bianca Belair NXT 73 Boa NXT 74 Bobby Fish NXT 75 Bronson Reed NXT 76 Cameron Grimes NXT 77 Candice LeRae NXT 78 Damian