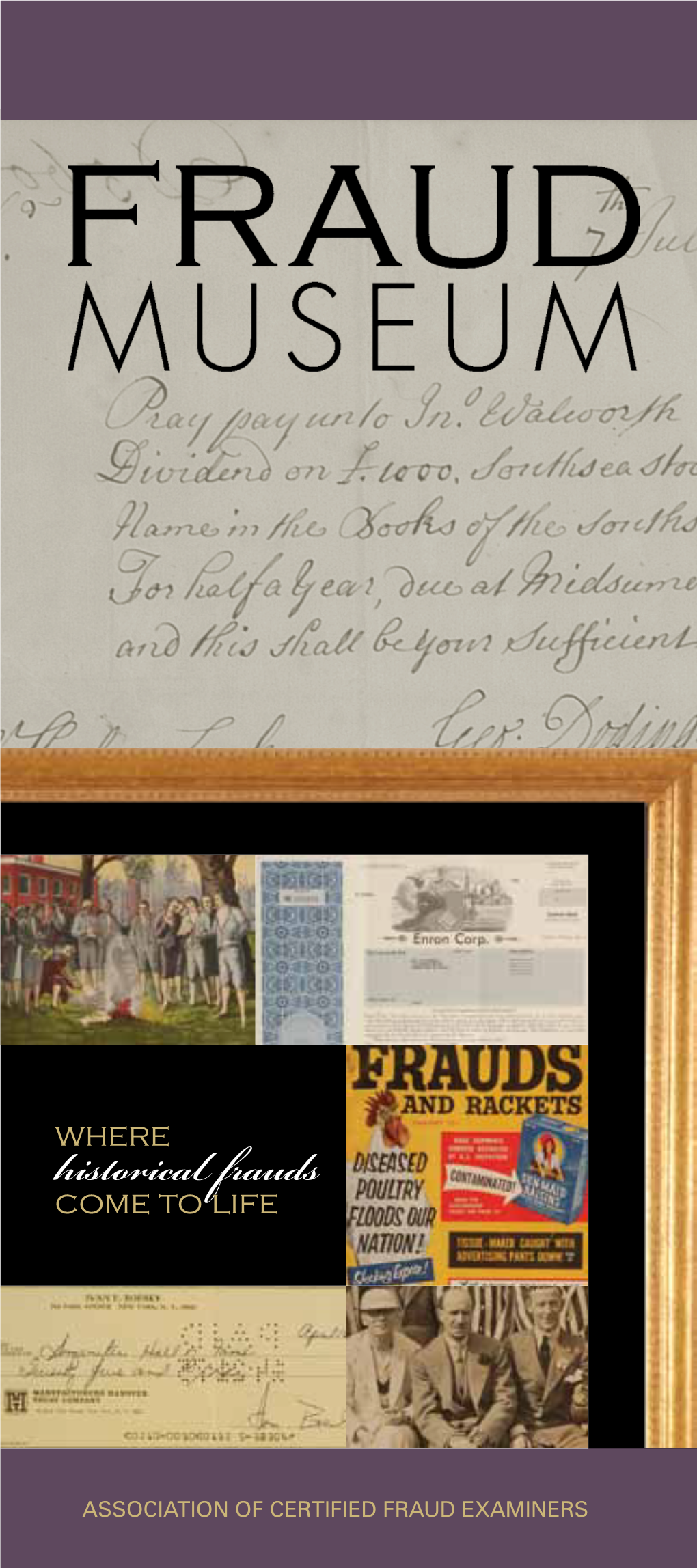

Historical Frauds

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Scripophily Journal 2004-05

Why Do So Many Dealers and Collectors Consign or Sell to Smythe? Top Dollar Paid on Direct Purchases. Record Breaking Auction Prices. Competitive MAYMAY 2004 2004 Auction Commissions Rates. Friendly, Personalized Service. Impeccable References. Expert Staff of Nationally-Recognized Specialists. Thoroughly Researched & Beautifully Illustrated Catalogues. Generous Cash Advances, Flexible Terms. Stephen Goldsmith (Stocks, Bonds, U.S. Coins) Diana Herzog (Autographs) Scott Lindquist (U.S. Small Size, Nationals) Martin Gengerke (U.S. Large Size, Fractionals) Tom Tesoriero (Ancient & Foreign Coins) David Vagi (Ancient Coins) Jay Erlichman (U.S. Coins) Robert Litzenberger (Autographs) WITTE KREUGER BRUNEL 2 Rector Street, 12th Floor, New York, NY 10006-1844 TEL: 212-943-1880 TOLL FREE: 800-622-1880 FAX: 212-312-6370 E-MAIL: [email protected] INTERNET: smytheonline.com INTERNATIONAL BOND & SHARE SOCIETY • YEAR 27 • ISSUE 1 SCRIPOPHILY DEALERS’ LISTS LIBRARY COLLECTORS’ BILLBOARD Alistair Gibb, 17 Floors Place, Kirkcaldy, Fife, IBSS publishes a series of illustrated monographs Collectors’ ads on this Billboard are FREE by members on aspects of scripophily. KY2 5SF, UK WANTED - SCRIPOPHILY AUCTION Company Histories 04/1 lists around 100 used These titles are currently available: CATALOGUES AND FIXED PRICE LISTS books of company history and business biography. ... encouraging collecting since 1978 # 1 Gregor MacGregor, Cazique of Poyais P rior to 2001 (especially Gypsyfoot and Smythe). Mostly British but some Dutch and US. by Richard T Gregg, 1999 Paying up to $5 each. Please write first! Reasonable prices from £2 up. Max Hensley, P.O. Box 741, # 2 T he Emergence of the Railway in Britain Lake Forest, IL 60045, USA. -

Kreuger Byggde Olympiastadion Sporrong Gjöt Medaljerna Kodak Tog Bilderna

EDWARDS HÖRNA SVENSKEN BAKOM GreYHOUND Edward Blom berättar saker Svenskamerikanska entreprenören Wretman du inte visste om OS 1912. grundade USA:s berömda bussbolag. no 3 2012 MAGASINET OM NÄRINGSLIVETS HISTORIA pris 59 kr Olympiska Spelen i Stockholm 1912 Kreuger byggde olympiastadion Sporrong gjöt medaljerna Kodak tog bilderna Rekord i läsk +Gotlandsbolaget Sigfrid Edström Fråga Företagsminnen företagsminnen 2012:3 Korsord 1 Ledare | edward blom Nu blir det byte! allting gör man en gång för sista tad påbyggnad på min spretiga studi- gången, men det var först när jag um generale-examen, fick jag fortsätta knattrade in ordet ledare i det tomma att skriva. Återkommen som arkivarie dokumentet, som jag insåg att jag ald- till Centrum för Näringslivshistoria rig mer kommer att formulera en så- hade en kollega tagit över som re- dan text till Företagsminnen. Och efter- daktör. Han använde mig flitigt som som jag alltsedan barnsben har haft en skribent och snart satt jag även med i sentimental, nostalgisk läggning kan ett nygrundat redaktionsråd. jag inte låta bli att bli självbespeglande. Och så 2003 var det plötsligt jag som Det första numret av Företagsminnen var redaktören. Jag minns hur jag satt utkom 1997 – så vi fyller 15 år i år! Det på mitt tjänsterum med två känslor i var ett enkelt layoutat medlemsblad samma bröst: skräcken över hur sjut- J. H. Duncan, USA som tog brons i diskus- på åtta sidor, ton jag skulle hitta kastning, med bästa hand. OS i Stockholm helt i svartvitt, ”När jag blev redaktör skribenter och 1912 officiella brefkort. Fotograf okänd. förutom ljus- artikelidéer nog att Ansvarig utgivare: Alexander Husebye, gröna rubriker, var Företagsminnen fylla ett helt num- [email protected], där den längsta ännu en svartvit mer – särskilt som 08-634 99 14 artikeln uppgick vi på den tiden inte Chefredaktör: Edward Blom, edward.blom@ till en sida och tidskrift på 28 sidor” betalade en krona i naringslivshistoria.se, 08-634 99 29 bilderna var små arvode. -

Book Reviews

Swedish American Genealogist Volume 30 | Number 1 Article 14 3-1-2010 Book Reviews Follow this and additional works at: https://digitalcommons.augustana.edu/swensonsag Part of the Genealogy Commons, and the Scandinavian Studies Commons Recommended Citation (2010) "Book Reviews," Swedish American Genealogist: Vol. 30 : No. 1 , Article 14. Available at: https://digitalcommons.augustana.edu/swensonsag/vol30/iss1/14 This Article is brought to you for free and open access by Augustana Digital Commons. It has been accepted for inclusion in Swedish American Genealogist by an authorized editor of Augustana Digital Commons. For more information, please contact [email protected]. Book Reviews Here you will find information about interesting books on the immigration experience, genealogical manuals, books on Swedish customs, and much more. We welcome contacts with SAG readers, suggestions on books to review perhaps. If you want to review a book yourself, please contact the Book Review Editor, Dennis L. Johnson, at <[email protected]> or Dennis Johnson, 174 Stauffer Road, Bucktown Crossing, Pottstown, PA 19465, so he knows what you are working on. and graduated at age 16. He then and assisted Kreuger and Toll until A great studied at the Royal Institute of Tech- the crash in 1932. nology in Stockholm, graduating Meanwhile, the Kreuger family’s financier with combined master’s degrees in match factories ran into financial mechanical and civil engineering in problems. Ivar and banker Rydbeck 1904. Soon after graduating he turned these factories into a stock The Match King, Ivar Kreuger, the trav_eled abroad and worked as an corporation to raise capital. This new Financial Genius Behind a Century engineer in the U.S., Mexico, South corporation became the base for the of Wall Street Scandals, by Frank Partnoy, 2009, Perseus Books Africa, and other countries, but spent growth of the reorganization of the Group, New York, NY: Can be most of his time in the U.S. -

Introduction

Introduction his issue of Business History Review is devoted to financial crisis, Tbusiness failure, and scandal. As readers of this journal know, white-collar fraud is not a new phenomenon. Public and private author- ities have confronted the problem for a long time, looking for ways to deal with it that will not stifle economic growth. Free-market economists hold that market discipline will take care of any problems that arise. Recently, economist Anna Schwartz told the Wall Street Journal, "Firms that make wrong decisions should fail.. You shouldn't rescue them. And once that's established as a principle, I think the market recognizes that it makes sense."1 While there are logi- cal, theoretical arguments supporting the free-market position, histori- cal evidence suggests a more complicated reality, one subject to bubbles and financial crises that cannot be fixed by free-market ideology alone.2 After the Great Depression, most economists came to believe that some degree of regulation was necessary, recognizing that the government must intervene when self-regulation by industries and private organi- zations does not suffice.3 At the same time, they agree that regulation has costs of its own.4 Crises, failures, white-collar fraud, and the private and public at- tempts to deal with them are not a twenty-first century invention but are as old as capitalism itself. In the 1630s, for example, tulip speculation 'Anna Schwartz, "The Weekend Interview: Bernanke Is Fighting the Last War," Wall Street Journal, 18 Oct. 2008. See also Anna Schwartz, "Real and Pseudo-Financial Crises," in Forrest Capie and Geoffrey Wood, eds., Financial Crises and the World Banking System, (London, 1986), 11-31. -

Monetary and Financial Reform in Two Eras of Globalization

This PDF is a selection from a published volume from the National Bureau of Economic Research Volume Title: Globalization in Historical Perspective Volume Author/Editor: Michael D. Bordo, Alan M. Taylor and Jeffrey G. Williamson, editors Volume Publisher: University of Chicago Press Volume ISBN: 0-226-06598-7 Volume URL: http://www.nber.org/books/bord03-1 Conference Date: May 3-6, 2001 Publication Date: January 2003 Title: Monetary and Financial Reform in Two Eras of Globalization Author: Barry Eichengreen, Harold James URL: http://www.nber.org/chapters/c9597 11 Monetary and Financial Reform in Two Eras of Globalization Barry Eichengreen and Harold James This paper reviews the history of successes and failures in international monetary and financial reform in two eras of globalization, the late nine- teenth century and the late twentieth century, and in the period in between. That history is rich, varied, and difficult to summarize compactly. We there- fore organize our narrative around a specific hypothesis. That hypothesis is that a consensus on the need for monetary and finan- cial reform is likely to develop when such reform is seen as essential for the defense of the global trading system. Typically the international monetary and financial system evolves in a gradual and decentralized manner in re- sponse to market forces. The shift toward greater exchange rate flexibility and capital account convertibility since 1973 is the most recent and there- fore obvious illustration of what is a more general point. Large-scale and discontinuous reform at a more centralized level—that is, reforms agreed to and implemented by groups of governments—tend to occur only when problems in the monetary and financial system are seen as placing the global trading system at risk. -

Det Här Verket Har Digitaliserats Vid Göteborgs Universitetsbibliotek

0 CM 1 2 3 4 5 Det här verket har digitaliserats vid Göteborgs universitetsbibliotek. Alla tryckta texter är OCR-tolkade till maskinläsbar text. Det betyder att du kan söka och 6 kopiera texten från dokumentet. Vissa äldre dokument med dåligt tryck kan vara svåra att OCR-tolka korrekt vilket medför att den OCR-tolkade texten kan innehålla fel och därför bör 7 man visuellt jämföra med verkets bilder för att avgöra vad som är riktigt. 8 This work has been digitised at Gothenburg University Library. 9 All printed texts have been OCR-processed and converted to machine readable text. This means that you can search and copy text from the document. Some early printed books 10 are hard to OCR-process correctly and the text may contain errors, so one should always visually compare it with the images to determine what is correct. 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 Belafonte, Harry ..................... 36:12, 48:34 Björnberg, Arne .................................. 19:15 Bell, Alexander Graham ................ 21:26 Björnstrand, Gunnar ...... 13:24, 49:12 Bell, June ................................................ 44:28 Björnstrand, Lillie oeh Kristina.. 31:18 Bellander, Birgitta de Vylder- .. 10:11 Blackwell, Francis William och Bellander, Kjell, Ella och Katinka 16:22 Berit, f. Eriksson-öst ................ 26:40 Bendz, Erik ................ 19:12, 20:21, 35:10 Blanck, Esther .................................. 27:37 Bendz, Ingrid, Olof och Amelie.. 35:10 Blievernich, Karin oeh Louis .... 41:15 IDUN 1957 Bénédicte, prinsessa av Danmark Blom, Esther ....................................... 28:37 1:1, 1£ 16:12 Blom, Holger ....................................... 17: 7 Bengtsson, Ewa .................................. -

Betongteknikens Utveckling Och Betydelse För Svensk Vattenkraftsutbyggnad

BETONGTEKNIKENS UTVECKLING OCH BETYDELSE FÖR SVENSK VATTENKRAFTSUTBYGGNAD RAPPORT 2018:481 VATTENKRAFT BETONGTEKNISKT PROGRAM VATTENKRAFT Betongteknikens utveckling och betydelse för svensk vattenkraftsutbyggnad MARTIN ROSENQVIST ISBN 978-91-7673-481-0 | © Energiforsk oktober 2018 | Omslagsfoto: Martin Rosenqvist Energiforsk AB | Telefon: 08-677 25 30 | E-post: [email protected] | www.energiforsk.se BETONGTEKNIKENS UTVECKLING OCH BETYDELSE FÖR SVENSK VATTENKRAFTSUTBYGGNAD Förord En grundlig redogörelse för betongteknikens utveckling och betydelse för den svenska vattenkraftsutbyggnaden har länge saknats. I och med fullbordandet av föreliggande skrift tillgängliggörs i samlat format ett omfattande underlag gällande vattenbyggnadsbetongens utveckling i Sverige. Hur betongen sammansattes, hur konstruktionerna utformades, samt vilka metoder som tillämpades vid betongarbetenas utförande är några av de frågeställningar som avhandlas i denna redogörelse. Vad som också framgår av redogörelsen är att många tekniska framsteg initierades av betongens bristande beständighet i vattenkraftsmiljön. För att sprida kunskap och förhindra att äldre misstag upprepades infördes det för första gången år 1924 statliga cement- och betongbestämmelser. Dessa bestämmelser, tillsammans med praktiska erfarenheter från genomförda kraftverksbyggen, utgjorde sedan basen för de egenhändigt framtagna anvisningarna för betongbyggnad, vilka parallellt gavs ut av Vattenfall och Vattenbyggnadsbyrån under mitten av 1900-talet. Föreliggande redogörelse har utarbetats av -

A Financial System Under Pressure: the Case of Sweden 1930-45

Uppsala Papers in Financial & Business History Report No 20 2006 A Financial System under Pressure: The Case of Sweden 1930-45 Peter Hedberg & Mats Larsson Department of Economic History © UPFBH och författarna ISSN 1652-5124 ISRN UU-EKHI-R-20-SE Abstract The Swedish financial market changed radically during the Second World War. The introduction of a special currency control left the Swedish com- mercial banks cut off from its traditional trade channels and financial markets. As a consequence, the market structure changed – not least with regard to bank deposits, advances and assets. These changes called for new institutional efforts, i.e. the central bank had to assume an increasingly important role on the Swedish financial mar- ket. This development marked a major step towards a larger governmental control over the country’s financial market. The demand for capital traditionally utilized by industry and especially construction was limited during the Second World War. Thus lending from both commercial and savings banks stagnated, while deposits continued to grow. Banks, insurance companies and other financial intermediaries on the Swedish financial market instead became financiers of the growing Swed- ish national debt. The Swedish economy was dependent on German foreign trade during the Second World War The clearing arrangement between the two coun- tries was originally established by a Swedish initiative in order to force Germany to settle their large debt payments with Sweden. Measured in prices, trade volumes and capital flows, there is little evidence that Germany, as a great power, took advantage of its position in the Swedish-German economic exchange. -

Robbing Peter to Pay Paul: Ponzi Schemes Throughout History

Ponzi Schemes Throughout History By Becky Laughner Ponzi schemes have captured the tors to support the fictitious returns. Instead, Ponzi paid dividends on his public’s attention recently with the The Museum’s new exhibition, “Scan- notes with money collected from subse- fall of Bernard Madoff’s investment dal! Financial Crime, Chicanery and quent investors, which in turn required Robbingfund, which, at approximately $36 PeteCorruption that RRocked to America,” Payhim to find yet Paulmore investors to cover billion, is the biggest financial fraud focuses on the most infamous Ponzi his increasing liabilities. Ponzi realized in history. The principle behind a artists: Charles Ponzi, Ivar Kreuger that such a plan is not an easy under- Ponzi scheme is simple. The Secu- and Bernie Madoff. taking, but he had confidence and rities Exchange Commission defines cunning in spades. He also concocted it as investment fraud involving the The Original Ponzi Artist a plausible investment strategy. payment of returns to existing inves- The eponymous Charles Ponzi gained To attract his initial investors, Ponzi tors from funds contributed by new his notoriety when he coaxed approxi- advertised his high returns, explain- investors, with the organizer usually mately $7 million from investors in ing that investment money was being focusing on soliciting new investors 1920. Ponzi began making a name used for the “lucrative” arbitrage of in order to provide promised payouts for himself in Boston, promising a International Reply Coupons (IRCs). to earlier investors instead of engag- 50% return in 45 days with the pur- The Universal Postal Union introduced ing in legitimate investment activity. -

Download This PDF File

Ivar Kreuger: An International Swindler of Magnitude TAGE ALALEHTO One of the most held securities in Western Europe during the 1920s were the securities of Kreuger & Toll Inc. (a Swedish match conglomerate). The company was headed by Ivar Kreuger, known as the “Match King”. His business operation is a story of great success from 1910 to the fall of his business empire in 1932, when it became clear that Kreuger & Toll Inc., operated by Kreuger himself, had been a company built on fal- sified accounts, forged documents and concealed misappropria- tion of funds of a massive scale. Kreuger has been described as one of the worst financial swindlers during the 20th century, with the epicenter at the Great Crash of 1929. It was a swindle that was described as Napoleonic in its size compared to the contemporary swindles of Samuel Insulls, Richard Whitney, and Clarence Hatry (Galbraith 2009). This case was discussed in the Paramalat fraud case in Italy in 2003–04, when the case against the company founder Calisto Tanzi was compared to the case of Kreuger (Kumar, Flesher, and Flesher 2007). Also, the case of Bernie Madoff was illustrated as an imitation of Kreuger, with Kreuger as “the original Bernard L. Madoff” (Partnoy 2010, 432). In fact, Kreuger constructed the financial instrument off-balance sheeting which together with credit rat- ing and regulatory licenses were one of the reasons for the fi- nancial meltdown in 2008 and to which Madoff owes credit to when he created his gigantic Ponzi-scheme. In this essay I will discuss the case of Ivar Kreuger and the financial world which he belonged. -

Courts and Sovereigns in the Pari Passu Goldmines

Georgetown University Law Center Scholarship @ GEORGETOWN LAW 2016 Courts and Sovereigns in the Pari Passu Goldmines Anna Gelpern Georgetown University Law Center, [email protected] This paper can be downloaded free of charge from: https://scholarship.law.georgetown.edu/facpub/1463 http://ssrn.com/abstract=2817693 11 CAP. MARKETS L.J. (ONLINE FIRST), Apr. 22, 2016, at 1-27 This open-access article is brought to you by the Georgetown Law Library. Posted with permission of the author. Follow this and additional works at: https://scholarship.law.georgetown.edu/facpub Part of the Banking and Finance Law Commons, Bankruptcy Law Commons, and the Finance Commons Draft February 2016 (v. 7b) Courts and Sovereigns in the Pari Passu Goldmines Anna Gelpern1 Introduction This article revisits a once-notorious case brought by a Swedish holder of defaulted German bonds, decided by the highest federal court in Switzerland in 1936.2 Like another notorious case, prompted by Argentina’s default and decided in New York between 2011 and 2014,3 it considered a sovereign debtor’s promise to rank its creditors pari passu (“on equal footing”). Swiss and U.S. courts both read this contract term to require the sovereign to make proportional payments to its creditors. Nonetheless, Germany’s creditors lost, while Argentina faced a worldwide financial boycott ordered by U.S. courts in the name of equal treatment.4 Courts and advocates in the United States, the United Kingdom, and Belgium, among others, have operated on the assumption that no court had considered the meaning of pari passu in sovereign 1 Professor, Georgetown Law, and Non-Resident Senior Fellow, Peterson Institute for International Economics. -

The Match King: Ivar Kreuger, the Financial Genius Behind a Century

[Free pdf] The Match King: Ivar Kreuger, The Financial Genius Behind a Century of Wall Street Scandals The Match King: Ivar Kreuger, The Financial Genius Behind a Century of Wall Street Scandals 26wWkXt7P yWGQmWDrh 7TsiqjQHm 2rtfF3gzv fsW1giniu Fsx74UvM1 6rN43Kw6o XbGT8J7gk KM2nrgq0k 5jKzJzE0J BQHJiCpzS The Match King: Ivar Kreuger, The Financial Genius Behind a Century of Wall D2nJcFoqr Street Scandals oXekjOYNj LU-46078 svUZmWUMf US/Data/History JFHSPGs6g 4/5 From 632 Reviews RpusGI8X2 Frank Partnoy iCBy1OREe ebooks | Download PDF | *ePub | DOC | audiobook EhhxbeLrF vPyM44zqN nxewBxliZ A3eEnkYzL cfbqXMcmq 1 of 1 people found the following review helpful. the rise and demise of financial 63lp8Yilt hero, victim, or crookBy KimSince reading his name mentioned in Galbraith ZhqCphVLC book, I wanna know more about Kruger, then this book turned out to be a perfect BOFg74V44 fit. It demonstrates clearly the complexity of what Ivar Kruger had achieved in the 3hLuMVelw financial history in the world, also done fraud against the bankers, other rich guy, L86yFPPCw or simply investor. This book reminds me Buffet's quote. "Building reputation uRAuO21hp takes several decades, but for collapse, it takes only five minute". But, this quote itself is too simple to get a grip of his life. Even though his reputation has atomized over dozens of decades, his legacy still harbors above this business world, including not merely Swedish Match in Sweden, but also Other financial instrument such as Class B share now Buffet uses or other off-balance sheet financial vehicle once swallowing the global economy in 2008. This book completely explain his, Ivar, sophisticated legacy, and wrong doing, and last the implication of those.The conclusion? I highly recommend this book.0 of 0 people found the following review helpful.