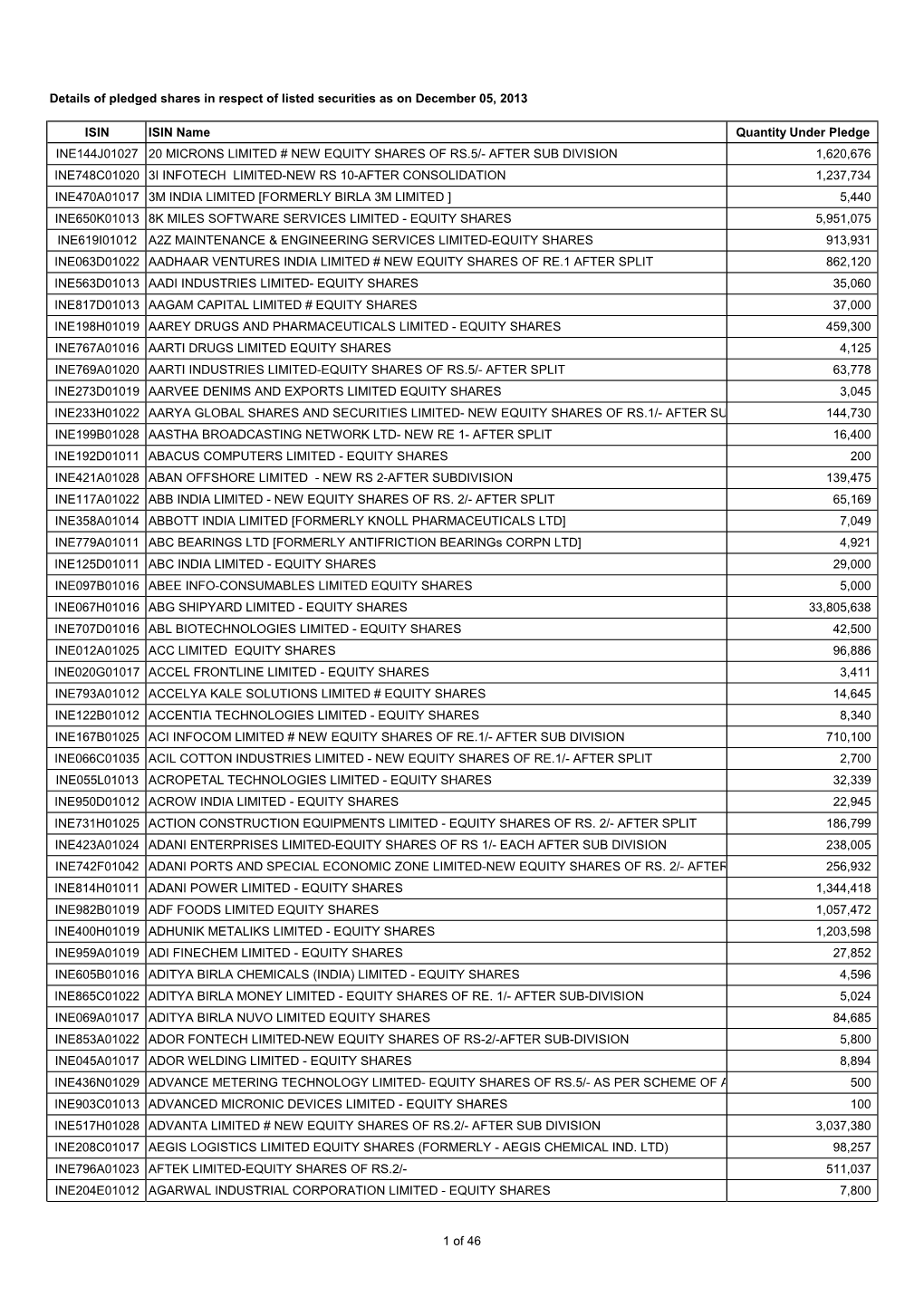

Details of Pledged Shares in Respect of Listed Securities As on December 05, 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dimensional Investment Group

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2008-04-29 | Period of Report: 2008-02-29 SEC Accession No. 0001104659-08-027772 (HTML Version on secdatabase.com) FILER DIMENSIONAL INVESTMENT GROUP INC/ Business Address 1299 OCEAN AVE CIK:861929| IRS No.: 000000000 | State of Incorp.:MD | Fiscal Year End: 1130 11TH FLOOR Type: N-Q | Act: 40 | File No.: 811-06067 | Film No.: 08784216 SANTA MONICA CA 90401 2133958005 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number 811-6067 DIMENSIONAL INVESTMENT GROUP INC. (Exact name of registrant as specified in charter) 1299 Ocean Avenue, Santa Monica, CA 90401 (Address of principal executive offices) (Zip code) Catherine L. Newell, Esquire, Vice President and Secretary Dimensional Investment Group Inc., 1299 Ocean Avenue, Santa Monica, CA 90401 (Name and address of agent for service) Registrant's telephone number, including area code: 310-395-8005 Date of fiscal year end: November 30 Date of reporting period: February 29, 2008 ITEM 1. SCHEDULE OF INVESTMENTS. Dimensional Investment Group Inc. Form N-Q February 29, 2008 (Unaudited) Table of Contents Definitions of Abbreviations and Footnotes Schedules of Investments U.S. Large Cap Value Portfolio II U.S. Large Cap Value Portfolio III LWAS/DFA U.S. High Book to Market Portfolio DFA International Value Portfolio Copyright © 2012 www.secdatabase.com. -

Issn 2229-4104 Asia Pacific Journal of Research

APJRBM Volume 3, Issue 1 (January, 2012) ISSN 2229-4104 The Journal of Sri Krishna Research & Educational Consortium ASIA PACIFIC JOURNAL OF RESEARCH IN BUSINESS MANAGEMENT Internationally Indexed & Listed Referred e-Journal APPLICATION OF Z SCORE ANALYSIS IN EVALUATING STEEL INDUSTRY IN INDIA DR. KAVITA CHAVALI*; MS. KARTHIKA.S** *Associate Professor, Alliance University, Bangalore – 562106. **Research Associate, Alliance University, Bangalore – 562106. ABSTRACT The paper is an empirical study to understand the financial soundness of steel industry in India. For this purpose twenty large and medium steel units which are listed are taken. A sample period of 2001 - 2010 was selected for the study. The financial performance of the Steel industry was monitored and measured by using Altman’s Z-score model which was extensively used by practitioners and researchers in the past. This study analyses the possibility of business failure with reasonable accuracy by using the z-score model. The research findings are that the steel industry is in good financial performance inspite of the impact of sluggish demand and global economic slowdown with an exception of two companies in the study period. KEYWORDS: Steel Industry, Z score, Bankruptcy, Financial Soundness. ______________________________________________________________________________ INTRODUCTION Companies exist for making profits and to create value to the share holder. It is very important for bankers, researchers, regulatory agencies to predict the bankruptcy to lessen the impact of it. If a company goes bankrupt / fail the shareholders of the company and also the public at large get affected. The impact is much more if it is a manufacturing industry like Steel. “Failure” is defined as the inability of a firm to pay its financial obligations as they mature (Beaver, 1966). -

Ma M Hhih Nddraa R & Mahinndr D a a Lt L D. Ann A

MAM HHINDDRARA & MAHINNDRD A LTL D. ANANNUNUALA REPE ORRT 2001515 WorldReginfo - 0cd6c777-56c0-4f13-9576-4861e33bf4aa WorldReginfo - 0cd6c777-56c0-4f13-9576-4861e33bf4aa RESILIENCE THROUGH RESILIENCE THROUGH MARKET LEADERSHIP CUSTOMER CENTRICITY Sustained market leadership in Tractors Ranked 3rd in JD Power SSI survey for over 3 decades Ranked 4th in JD Power CSI Study 5 millionth vehicle rolled out in January 2015 RESILIENCE THROUGH RESILIENCE THROUGH PORTFOLIO DIVERSIFICATION STRONG FINANCIALS Market value of investments in EBITDA (including MVML) grew listed entities ~ Rs. 30,000 at 19% CAGR over the last crores (invested value – Resilience decade ~ Rs. 4,200 crores) AAA rating from all major rating agencies citing Mahindra’s “Resilience to Economic Cycles” RESILIENCE THROUGH INNOVATION RESILIENCE IN VALUE CREATION World class R&D Center at Mahindra Research Valley, Chennai Share price growth at 25% 100% increase in patent applications CAGR over the last decade Unbroken dividend record since listing on BSE in 1956 WorldReginfo - 0cd6c777-56c0-4f13-9576-4861e33bf4aa In January 2015, Mahindra rolled out its 5 millionth vehicle from its automotive plant at Kandivali, Mumbai. The company’s legendary 4x4 off-road vehicle, the Mahindra Thar was chosen for this momentous milestone. Dr. Pawan Goenka, Executive Director, Mahindra & Mahindra Ltd. and Group President (Auto & Farm Sector) presided over the ceremony and dedicated this significant achievement to each and every member of the Mahindra family. WorldReginfo - 0cd6c777-56c0-4f13-9576-4861e33bf4aa Mahindra Drives in the New Age XUV500 The New Age XUV 500 is packed with a host of cutting-edge technology features, bold new cheetah-inspired exterior styling, plush and premium new interiors, exhilarating performance and best-in-class safety. -

BAP / BHEL / RANIPET Page

CONTRACTS CONCLUDED / AWARDED DURING NOVEMBER 2012 ( 01-NOV-12 TO 30-NOV-12 ) BAP / BHEL / RANIPET 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Tender No Item / Nature of Work Mode of Date of Type of Bidding Last date Nos of Nos. and names of parties qualified Nos. and names of parties not Whether Contract No. & Date Name of Contractor Value of Scheduled Tender Publishing (Single / Two of receipt tenderers after technical evaluation qualified after technical evaluation contract Contract (Rs) date of Enquiry of NIT Bid Type) of Tender contacted awarded completion to lowest of supplies tenderer/ Evaluate d L1 4420547E CS ROUNDS - ASTM A105 LIMITED TENDER 19-JUL-12 TWO PART 31-JUL-12 6 1 MUKAND LTD, YES 4422558 16-NOV-12 VIKRANT FORGE LIMITED 5,41,52,285 23-JUL-13 2 MAHINDRA UGINE STEEL COMPANY LTD.,, 3 STEEL AUTHORITY OF INDIA LIMITED, 4 FACOR STEELS LIMITED, 5 VIKRANT FORGE LIMITED, 6 STAR WIRE (INDIA)LIMITED, 4220392E CONTROL CABLES LIMITED TENDER 21-JUN-12 TWO PART 10-JUL-12 13 1 DELTON CABLES LIMITED, YES 4222599 22-NOV-12 KEI INDUSTRIES LIMITED 3,73,23,847 24-DEC-12 2 KEI INDUSTRIES LIMITED, 3 C M I LTD.,, 4 KEC INTERNATIONAL LTD, 5 ELKAY TELELINKS LTD, 6 PARAMOUNT COMMUNICATION LTD, 7 POLYCAB WIRES PVT LTD, 8 CORDS CABLE INDUSTRIES LIMITED, 9520343E INNER ARM ASSEMBLY LIMITED TENDER 11-JUN-12 TWO PART 26-JUN-12 5 1 CAUVERY ENGINEERING WORKS, YES 9522611 24-NOV-12 THILLAI ENGINEERING WORKS, 3,06,25,000 04-JUL-13 2 THILLAI ENGINEERING WORKS,, 3 SREENIVASA ENGINEERING, 4 MICRON INDUSTRIES, 7420546E ALLOY STEEL ROUNDS - SA193 B7 LIMITED TENDER 19-JUL-12 TWO PART 31-JUL-12 7 1 MAHINDRA UGINE STEEL COMPANY LTD.,, YES 7422590 21-NOV-12 STEEL AUTHORITY OF INDIA LIMITED 2,90,60,944 15-FEB-13 2 STAR WIRE (INDIA)LIMITED, 3 STEEL AUTHORITY OF INDIA LIMITED, 4 MUKAND LTD, 5 FACOR STEELS LIMITED, 6 VIKRANT FORGE LIMITED, 7 SUNFLAG IRON & STEEL CO. -

Goldman Portfolio

GOLDMAN SACHS MUTUAL FUND 951-A, Rational House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025. Tel. (9122) 6616 9000 Fax: (9122) 6627 9245 Toll Free: 1800-266-1220 E-mail us at [email protected]. Visit us at www.gsam.in HALF-YEARLY FINANCIAL RESULTS (UNAUDITED) FOR THE PERIOD ENDED MARCH 31, 2014 Investors / Unit holders are requested to note that the unaudited fi nancial results of the schemes of Goldman Sachs Mutual Fund for the half-year ended March 31, 2014 have been hosted on the website of Mutual Fund www.gsam.in HALF-YEARLY PORTFOLIO AS ON MARCH 31, 2014 ( Pursuant to Regulation 59A of Securities and Exchange Board of India [ Mutual Funds ] Regulations, 1996 ) Goldman Sachs Nifty Exchange Traded Scheme (GS NIFTY BeES) Sr. ISIN Name of Instrument Sub - Industry Quantity Market value % to Net No. Classifi cation* (Rs. in lakhs) Assets Sr. ISIN Name of Instrument Sub - Industry Quantity Market value % to Net No. Classifi cation* (Rs. in lakhs) Assets 39 INE465A01025 Bharat Forge Limited Industrial Products 20,651 87.11 1.43% 40 INE094A01015 Hindustan Petroleum Corporation Limited Petroleum Products 27,576 85.43 1.40% (a) EQUITY & EQUITY RELATED 41 INE092A01019 Tata Chemicals Limited Chemicals 29,255 84.02 1.38% INSTRUMENTS 42 INE264A01014 GlaxoSmithKline Consumer Healthcare Limited Consumer Non Durables 1,929 82.95 1.36% LISTED 43 INE614G01033 Reliance Power Limited Power 116,889 82.58 1.35% 1 INE154A01025 ITC Limited Consumer Non Durables 924,010 3,260.37 8.68% 44 INE084A01016 Bank of India Banks 35,629 81.41 1.33% 2 INE009A01021 -

1 Reliance Industries Limited 2 Tata Consultancy Services (TCS)

1 Reliance Industries Limited 2 Tata Consultancy Services (TCS) 3 Infosys Technologies Ltd 4 Wipro Limited 5 Bharti Tele-Ventures Limited 6 ITC Limited 7 Hindustan Lever Limited 8 ICICI Bank Limited 9 Housing Development Finance Corp. Ltd. 10 TATA Steel Limited 11 Ranbaxy Laboratories Limited 12 HDFC Bank Ltd 13 Tata Motors Limited 14 Larsen & Toubro Limited (L&T) 15 Satyam Computer Services Ltd. 16 Maruti Udyog Limited 17 Bajaj Auto Ltd. 18 HCL Technologies Ltd. 19 Hero Honda Motors Limited 20 Hindalco Industries Ltd 21 Reliance Energy Limited 22 Grasim Industries Limited 23 Jet Airways (India) Ltd. 24 Sun Pharmaceuticals Industries Ltd 25 Cipla Ltd. 26 Gujarat Ambuja Cements Ltd. 27 Videsh Sanchar Nigam Limited 28 The Tata Power Company Limited 29 Sterlite Industries (India) Ltd. 30 Associated Cement Companies Ltd. 31 Nestlé India Ltd. 32 Hindustan Zinc Limited 33 GlaxoSmithKline Pharmaceuticals Limited 34 Siemens India Ltd. 35 Motor Industries Company Limited 36 Mahindra & Mahindra Limited 37 UTI Bank Ltd. 38 Zee Telefilms Limited 39 Bharat Forge Limited 40 ABB Limited 41 i-Flex Solutions Ltd. 42 Dr. Reddy's Laboratories Ltd. 43 Nicholas Piramal India Limited 44 Kotak Mahindra Bank Limited 45 Reliance Capital Ltd. 46 Ultra Tech Cement Ltd. 47 Patni Computer Systems Ltd. 48 Wockhardt Limited 49 Indian Petrochemicals Corporation Limited 50 Biocon India Limited 51 Essar Oil Limited. 52 Asian Paints Ltd. 53 Dabur India Limited 54 Jaiprakash Associates Limited 55 JSW Steel Limited 56 Tata Chemicals Limited 57 Tata Tea Limited 58 Tata Teleservices (Maharashtra) Limited 59 The Indian Hotels Co. Ltd. 60 Glenmark Pharmaceuticals Limited 61 NIRMA Limited 62 Jindal Steel & Power Ltd 63 HCL Infosystems Ltd. -

Backup of CNIB Tombstones 6 Pg Brochure Final.CDR

Transaction Banking Investment Banking Mergers & Acquisitions Delivering value through Knowledge Banking Cash Management Services USD 1.64 bn USD 565 mn USD 137 mn USD 140 mn United Phosphorus Suzlon Energy Suzlon Energy United Phosphorus United Phosphorus Acquisition of agrichem Building Banking Partnerships with Top Corporates in India Acquisition of Repower Systems Acquisition of Hansen Transmissions Acquisition of Advanta Receivables Management Payables Management Acquisition of Ceraxagri, France business in India AG, Germany International NV, Belgium Netherlands Holdings BV IRCTC Havell’s NCDEX First RTGS based Straight Through Payment Havell’s United Phosphorus w Centralized salary payments to accounts USD 22.5 mn USD 21.5 mn USD 21.5 mn INR 2.08 bn Vendor and Broker RTGS Collect, Customized MIS Jain Irrigation Systems INR 2100 Mn INR 1100 Mn in other banks through NEFT/RTGS Aegis Jain Irrigation Systems Jain Irrigation Systems Piramyd Retail Payment Solutions Customized ERP Integration - SAP System Strategic investment in w Acquisition of Vendor Payments Automatic Beneficiary advising Acquisition of Aquarius Acquisition of NaanDan Irrigation Eurodrip SA, Greece Sale of controlling stake Global Vantedge Brands, Inc., USA Systems C.S. Ltd, Israel to Indiabulls Real Estate USD 21.5 mn USD 38 mn Shriram Group MCX/ NHBC Ranbaxy Laboratories Ranbaxy Laboratories Bajaj Electricals Steel Authority of India Sintex Industries Sintex Industries Joint Venture with Sanlam, Vendor Payments through Suzlon Group PTC India Online e-payments platform Online Beneficiary Validation Acquisition of Cardinal Divestment of Ranbaxy Fine RTGS/NEFT bulk uploads Acquisition of Wausaukee Acquisition of South Africa for Life INR 3000 Mn INR 4500 Mn Drugs Ltd. -

Dealtracker Providing M&A and PE Market Insights 7Th ANNUAL EDITION 2011 7Th ANNUAL EDITION 2011 Contents

Dealtracker Providing M&A and PE market insights 7th ANNUAL EDITION 2011 7th ANNUAL EDITION 2011 Contents From the 3 - Foreword Editor's 4 - Year Round Up Desk 2011: 7 – M&A Round Up Mergers & Acquisitions 8 – Domestic 9 – Cross border 1026 13 – PE Round Up Private 14 – Top Deals and Sectors Equity 16 – PE – City Break up deals 17 – IPO &QIP Other 18 – Regulatory Aspects Features 20 – Deal List $54bn 7th ANNUAL EDITION 2011 Foreword Despite the on-going global economic woes, rising However, unlike the earlier years, we have not seen inflation and interest rates, weakening rupee and a any significant metal sector acquisitions on the “We witnessed a volatile stock market, 2011 has seen robust deal outbound or domestic front. The telecom sector which notable trend reversal in numbers. The year saw Mergers & Acquisition (M&A) typically used to contribute multibillion dollar levels of and Private Equity (PE) in India together clocking transactions has been caught up in the regulatory the year in cross border 1026 deals contributing to US$ 54 billion, as problems and we did not see any significant deal here M&A with focus shifting compared to 971 deals amounting to US$62 billion in also. 2010. from outbound to PE activity showed resurgence in the face of sluggish We witnessed a notable trend reversal in the year in IPO & QIP activity coupled with return in confidence inbound as compared to cross border M&A with focus shifting from outbound levels which were seen lacking in 2009 and the first 2010. Of the 10 billion to inbound as compared to 2010. -

India 6/4/06 11:50 Page 1

india 6/4/06 11:50 Page 1 INDIA hough the Indian steel industry has been touted for years as one with great potential for India: Potential and growth Tdevelopment, the promise never quite seems to materialise. In the These 9 pages are devoted to the development of the steel industry in mid to late nineties, after India finally concluded the liberalisation of the sector, India. With a population close to that of China of 1bn, India’s steel many investments in steel capacity were industry produced just 38.4Mt of crude steel in 2005 compared to announced with great pomp. With the private sector allowed a freer hand in China’s 349.4Mt. This feature looks at India’s potential to boost production, entrepreneurs with vision output to 110Mt by 2010 as announced by its government. could take advantage of India’s wealth in natural resources, particularly iron ore, and BY G DE BASSOMPIERRE & L ARENDSE bring the country into the forefront of international steelmaking. However, when it became clear a few years later that the investments would not Major steelmaking plants in India be pursued – for a number of reasons – the (Based on a map by Joint Plant Committee of India) great expectation turned into great disappointment and a whole decade went by with the impression that India was destined PAKISTAN to remain nothing but a hopeful candidate. In the meantime, Chinese output skyrocketed, pushed by the need to cover its own growing appetite for steel, and became a much more believable destination for NEPAL investment: in short, a developing market Ɂ Delhi that kept its alluring promises. -

RHP Cover.P65

C M Y K RED HERRING PROSPECTUS Please read Section 60B of the Companies Act, 1956 Dated February 8, 2006 100% Book Built Issue MAHINDRA & MAHINDRA FINANCIAL SERVICES LIMITED (Originally incorporated as Maxi Motors Financial Services Limited on January 1, 1991 under the Companies Act, 1956 as a public limited company and the name was changed to Mahindra & Mahindra Financial Services Limited on November 3, 1992). Registered Office: Gateway Building, Apollo Bunder, Mumbai 400 001, Maharashtra, India Tel: 91 22 2202 1031; Fax: 91 22 2287 5485 Corporate Office: Sadhana House, 2nd Floor, Behind Mahindra Towers, 570, P. B. Marg, Worli, Mumbai 400 018, Maharashtra, India Tel: 91 22 5652 6000; Fax: 91 22 2497 2741 E-mail: [email protected]; Website: www.mahindrafinance.com Contact Person: Mr. V Ravi; Tel: 91 22 5652 6000 Public Issue of 20,000,000 Equity Shares of Rs. 10 each for cash at a price of Rs. [] per Equity Share aggregating Rs. [] million, comprising a Fresh Issue of 10,000,000 Equity Shares of Rs. 10 each by Mahindra & Mahindra Financial Services Limited (“Mahindra Finance”, the “Company” or the “Issuer”) and an Offer for Sale of 10,000,000 Equity Shares of Rs. 10 each by Mahindra & Mahindra Limited (“M&M”) and certain other shareholders of the Company (together with M&M the “Selling Shareholders”). The Fresh Issue and the Offer for Sale are jointly referred to herein as the Issue (“the Issue”). The Issue will constitute 23.26% of the fully diluted post issue paid-up capital of the Company. PRICE BAND: RS. -

Mahindra Everyday

ISSUE 3, 2013 ISSUE 3, 2013 WHAT’S INSIDE? Mahindra Partners: Bright Prospects Ahead Excitement-packed AQ Grand Finale 2013 Mahindra Tractors' Mega Customer Meet in Zaheerabad Tech Mahindra & Juniper Networks: Strategic Alliance New MUSCO Stampings Plant Mahindra Everyday 1 ISSUE 3, 2013 CONTENTS QUALITY COVER STORY 05 FOCUS 46 A peek into the glamour, speed and As ever there was a sustained focus on drama of the World Motorcycle Racing Quality with awards, in-depth training Championships and the Mahindra and quality assessments being part of Racing team’s performance therein. this focus. PEOPLE SECTOR BRIEFS 15 INITIATIVES 48 A round-up of what the past quarter Innovative people-building initiatives held for the Mahindra Group's diverse were held across the Mahindra Group sectors – new products, awards, – workshops, people interactions and conferences and collaborations. much more. CORPORATE AWARDS FOR SOCIAL EXCELLENCE 39 RESPONSIBILITY 51 A brief round-up of companies and The Mahindra team located around the individuals across the Group which won country and across the globe, reached national and international kudos for out to the less fortunate through a exceptional achievement. series of caring initiatives. Please write in to [email protected] to give feedback on this issue. ME TEAM Associate Editors: Zarina Hodiwalla, Darius Lam Automotive Division Amit Agarwal Information Technology Bonita Fernandes Ritesh Gaind Vrinda Pisharody Rajeev Malik After-Market Defence Systems Preeti Nair Geethu Menon Sanjit Tiwari Pavithra Kamdadai Tushar Dharkar KVN Prasad Sustainability Mayank Maini Venecia Paulose Poonam Bagwe Pooja Thawrani Systech Corporate Social Responsibility Anita Beri Swapnil Soudagar Gilroy Correia Farm Division Mahindra Partners Sharmila Subramanian Rujuta Nadkarni Ritu Yadav Nitin Pandey Infrastructure & Realty Edited and Published by Roma Balwani Phiruzi Kasad Rishika Mehrotra for Mahindra & Mahindra Limited, Gateway Two Wheeler Subrata Sengupta Building, Apollo Bunder, Mumbai 400 001. -

I I T K the Annual News Letter of Process & Steel Research Laboratory

Department of Materials Science and Engineering I I T The Annual News Letter of Process & Steel Research Laboratory Vol. V K November, 2011 Theme: Industry- research- academia synergy From Prof. Mazumdar’s desk Since the resurgence of steel industry, a steady increase in steel production has been reflected in the performance of Indian steelmakers. From a meager 40 MMTpa production in the late nineties, nearly 80 MMT of finished steel was produced in the country in 2010. This is expected to increase further, reaching a figure of about 200 MMTpa by the year 2020. Accordingly, several new steel plants are being set up in the country. Parallely, existing steel mills are being modernized and process route upgraded. In the changing scenario, steel plants are relentlessly trying to be more competitive and cost effective in terms of man power, material, energy, productivity, emission and so on. As a consequence, industrial R & D and continuing education have assumed considerable significance in steel plant management. Serious efforts are being made by steelmakers to pursue various R & D activities for improving process efficiency and to empower their task force with knowledge and know how, essential to combat shop floor problems on a routine basis. Academicians and Institutions are naturally playing increasingly important roles in such endeavors. Thus, industry – academia interaction which used to be largely absent in the country during the past decades, has gained significant momentum in recent years. In their efforts to up-grade and improve existing processes, remove obsolesce, improve productivity and minimize specific energy consumption, many domestic steel plants have joined hands with the Process and Steel Research Laboratory, IIT Kanpur, a pioneering centre for steel education and research.