Automotive Council

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

(By Email) Our Ref: MGLA040121-2978 29 January 2021 Dear Thank You for Your Request for Information Which the GLA Received on 4

(By email) Our Ref: MGLA040121-2978 29 January 2021 Dear Thank you for your request for information which the GLA received on 4 January 2021. Your request has been dealt with under the Freedom of Information Act 2000. You asked for: Can I request to see the Mayor’s communications with the British bus manufacturers Alexander Dennis, Optare & Wrightbus from May 2016 to present day under current Mayor Sadiq Khan Our response to your request is as follows: Please find attached the information the GLA holds within scope of your request. If you have any further questions relating to this matter, please contact me, quoting the reference at the top of this letter. Yours sincerely Information Governance Officer If you are unhappy with the way the GLA has handled your request, you may complain using the GLA’s FOI complaints and internal review procedure, available at: https://www.london.gov.uk/about-us/governance-and-spending/sharing-our- information/freedom-information Optare Group Ltd th 20 July 2020 Hurricane Way South Sherburn in Elmet Mr. Sadiq Khan Leeds, LS25 6PT, UK T: +44 (0) 8434 873 200 Mayor of London F: +44 (0) 8434 873 201 Greater London Authority E: [email protected] City Hall, W: www.optare.com London SE1 2AA Dear Mayor Khan, Re: The Electrification of London Public Transport Firstly, let me show my deep appreciation for your tireless efforts in tackling the unprecedented pandemic crisis in London. I am confident that under your dynamic leadership, London will re-emerge as a vibrant hub of business. On Friday 17th July, I took on the role of Chairman of Optare PLC. -

Euro Bus Expo 2016 Previews Its Exhibitor Show Highlights

Euro Bus Expo 2016 previews its exhibitor show highlights A first look at new vehicles, accessories, equipment, technology & services at next month’s show With the full exhibitor line up now confirmed, Euro Bus Expo 2016 – the essential European showcase for the bus and coach industry, has released its exhibitor show highlights for 2016. Returning to the NEC Birmingham on 1-3 November for its biggest edition yet, the three day event will feature nearly 300 sector leading exhibitors representing every link of the supply chain – from the latest ‘must have’ vehicles (over 100 will be on display), vehicle interiors, accessories and workshop equipment, to IT solutions, training, legislation updates, and essential business services. Over 9,500 key industry buyers and decision makers from across Europe are expected to attend. The following is just a taste of what they’ll see at the show: Alexander Dennis (ADL) is exhibiting a wide range of low emission vehicles covering both single and double deck buses, and an extensive line-up of coaches; including a new-look Elite. Forefront technology will be on display, in the form of an electric midi bus – the Enviro200EV, and a double deck gas vehicle – the Enviro400CBG (stand D100). Five years ago, BMAC launched the first LED headlights for new buses. Now, they have launched generation two – full front of bus Opti-Lux LED high beam headlights and triple function front light. They are also previewing their new launch – the first light guide technology full suite of 122mm rear lights, which will complement their existing lighting programme (stand D95). -

SEMLEP Economic Plan

FIGURE 2: KEY ASSETS MAP LEICESTER LEICESTER AIRPORT Daventry International Rail Freight Terminal iCon BUNTINGTHORPE AIRFIELD & PROVING GROUND M1 M6 COVENTRY COVENTRY AIRPORT M45 DAVENTRY 4 M1 NORTHAMPTON 11 Silverstone Daventry SEMLEP Area M40 Local Authorities SOUTH NORTHAMPTONSHIRE Towns within SEMLEP Towcester Towns and Cities outside SEMLEP Main Rail Routes 10 Motorways Banbury Major A Roads Waterways Brackley 2 Buckingham Bicester ecotown I N K S T L W E Airports S T E A Hospitals Bicester AYLESBURY VALE Colleges Science/Technology/Business Hubs CHERWELL Northampton Enterprise Zone 7 Silverstone Aylesbur y Priors Hall Park Corby LONDON OXFORD AIRPORT Millbrook Proving Ground Arla Dairy Universities / University Technical Colleges (UTC) OXFORD 1 University of Bedfordshire 2 University of Buckingham 3 Cran�eld University 4 University of Northampton 5 Open University 6 University Campus Milton Keynes 7 Bucks New University at Aylesbury 8 Central Bedfordshire UTC 9 Buckinghamshire UTC 10 Silverstone UTC 11 Daventry UTC 8 SECTION 1 \\ OVERVIEW SEMLEP \\ STRATEGIC ECONOMIC PLAN 2015-2020 Priors Hall Park Corby Northampton Waterside Enterprise Zone PETERBOROUGH Colworth Science Park CORBY KETTERING Kettering Bedford i-Lab E A S T W E S T L I N K CAMBRIDGE BEDFORD 1 Sandy Cran�eld Technology Park MILTON KEYNES 3 Biggleswade 6 5 CENTRAL Stotfold BEDFORDSHIRE Millbrook Proving Ground 8 1 LUTON LONDON LUTON AIRPORT 9 LONDON STANSTED 7 AIRPORT y M1 Butter�eld Enterprise Hub A1(M) M40 London Luton Airport HEATHROW AIRPORT CITY AIRPORT LONDON Arla Dairy SEMLEP \\ STRATEGIC ECONOMIC PLAN 2015-2020 SECTION 1 \\ OVERVIEW 9 1.4 STRATEGIC OBJECTIVES 1.4.1. -

Chassis and Impact Attenuator Design for Formula Student Racing

CHASSIS AND IMPACT ATTENUATOR DESIGN FOR FORMULA STUDENT RACE CAR MECH 5825M Professional Project Chassis and Impact Attenuator design for Formula student Race car Ahmed Oshinibosi Project Supervisor: Prof. D.C Barton 30th August 2012 AKNOWLEGDEMENT Firstly, I would like to appreciate the effort of my supervisor, Professor David Barton who is the head of school of mechanical engineering for his invaluable contribution towards the successful completion of this project. Secondly, I am indebted to my employer, Tallent Automotive Limited who did not only provide financial assistance to me in order to pursue this postgraduate Master’s degree, but also gave me the permission to utilise the company’s software packages to carry out this project. I also want to use this opportunity to thank the faculty of engineering for awarding me the International Excellence scholarship which also contributed towards my tuition fees. ABSTRACT Generally, in the automotive industry, weight reduction, cost of engineering design and reduction in vehicle development cycle time are becoming increasingly focused on. In order to tackle this, Computer Aided Engineering (CAE) is popularly being used to lead design process. This is more efficient than just using CAE as a verification tool. In the design of the F15 chassis, suitable Finite Element Analysis (FEA) optimisation techniques have been adopted from the early design stage. The design problem in view of weight reduction and increasing torsional stiffness has been solved by means of topology optimisation and also by applying gauge optimisation at the later stage of the design phase to optimise the size of structural members of the chassis. -

UK Annual Report 2015 (Including the Transparency Report)

Investing to become the Clear Choice UK Annual Report 2015 (including the Transparency Report) December 2015 KPMG.com/uk Highlights Strategic report Profit before tax and Revenue members’ profit shares £1,958m £383m (2014: £1,909m) (2014: £414m) +2.6% -7% 2013 2014 2015 2013 2014 2015 Average partner Total tax payable remuneration to HMRC £623k £786m (2014: £715K) (2014: £711m) -13% +11% 2013 2014 2015 2013 2014 2015 Contribution Our people UK employees KPMG LLP Annual Report 2015 Annual Report KPMG LLP 11,652 Audit Advisory Partners Tax 617 Community support Organisations supported Audit Tax Advisory Contribution Contribution Contribution £197m £151m £308m (2014: £181m) (2014: £129m) (2014: £324m) 1,049 +9% +17% –5% (2014: 878) © 2015 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Strategic report Contents Strategic report 4 Chairman’s statement 10 Strategy 12 Our business model 16 Financial overview 18 Audit 22 Solutions 28 International Markets and Government 32 National Markets 36 People and resources 40 Corporate Responsibility 46 Our taxes paid and collected 47 Independent limited assurance report Governance 52 Our structure and governance 54 LLP governance 58 Activities of the Audit & Risk Committee in the year 59 Activities of the Nomination & Remuneration Committee in the year KPMG in the UK is one of 60 Activities of the Ethics Committee in the year 61 Quality and risk management the largest member firms 2015 Annual Report KPMG LLP 61 Risk, potential impact and mitigations of KPMG’s global network 63 Audit quality indicators 66 Statement by the Board of KPMG LLP providing Audit, Tax and on effectiveness of internal controls and independence Advisory services. -

Fleet List \251 Sheffield Omnibus Enthusiasts Society

Trent Barton Group {part of the Wellglade Group Including Kinchbus, Midland General and Notts & Derby | Unofficial Fleetlist provided by Sheffield Omnibus Enthusiasts Maun Valley Industrial Park, Junction Road, SUTTON IN ASHFIELD, NG17 5GS; Meadow Road Garage, DERBY, DE1 2BH; Station Road, LANGLEY MILL, NG16 4BG; Unit 3, Sullivan Way, LOUGHBOROUGH LE11 5QS; Manvers Street, NOTTINGHAM, NG2 4PQ Fleet No Registration Chassis Make and Model Body Make and Model Layout Livery Allocation Note 0001 YJ07 EFR Optare Solo M950SL Optare Solo Slimline B32F Sprint Loughborough 0002 YJ07 EFS Optare Solo M950SL Optare Solo Slimline B32F Sprint Loughborough 0003 YJ07 EFT Optare Solo M950SL Optare Solo Slimline B32F Sprint Loughborough 0004 YJ07 EFU Optare Solo M950SL Optare Solo Slimline B32F Sprint Loughborough 0005 YJ07 EFV Optare Solo M950SL Optare Solo Slimline B32F Sprint Loughborough 0006 YJ07 EFW Optare Solo M950SL Optare Solo Slimline B32F Sprint Loughborough 0007 YJ07 EFX Optare Solo M950SL Optare Solo Slimline B32F KinchBus Loughborough 0008 YN56 FDA Scania N94UD East Lancashire OmniDekka H45/32F Notts & Derby Derby 0009 YN56 FDU Scania N94UD East Lancashire OmniDekka H45/32F Notts & Derby Derby 0010 YN56 FDZ Scania N94UD East Lancashire OmniDekka H45/32F Notts & Derby Derby 0029 W467 BCW Volvo B7TL-5150 Plaxton President H41/24F Notts & Derby Derby 0030 W474 BCW Volvo B7TL-5150 Plaxton President H41/24F Notts & Derby Derby 0031 W475 BCW Volvo B7TL-5150 Plaxton President H41/24F Notts & Derby Derby 0032 W477 BCW Volvo B7TL-5150 Plaxton President -

2020 Annual Report and Accounts

Optare plc Optare ANNUAL REPORT AND ACCOUNTS 2020 ACCOUNTS AND REPORT ANNUAL OPTARE PLC ANNUAL REPORT AND ACCOUNTS 2020 REVIEW OF THE YEAR Performance highlights STRATEGIC REPORT 01 Chairman’s statement Operational highlights 02 CEO’s report 03 Our mission and values • Delivery of 114 Solos to RTA in Dubai. 04 Our key risks • Delivery of 30 Metrodecker EVs to Metroline for one of London’s first zero emission double decker routes commencing service in August 2019. • Delivery of the first of 21 Metrodecker EVs to York. Service to commence in quarter 3 2020. • Roll-out of the next generation Metrocity EV 240kwh. The new CORPORATE GOVERNANCE range is based on the existing platform with the addition of a 05 Board of Directors short derivative for congested urban environments due for 07 Corporate governance launch in late 2020. 09 Directors’ and Senior Officers’ remuneration report 11 Directors’ report Financial highlights 14 Statement of Directors’ responsibilities • Revenue for the period was £37.1m, a drop of 25% over prior year. • Gross loss was £0.9m over the twelve-month period (2018/19: £5.3m gross profit representing 11% of turnover). • Loss after tax was £15.5m (2018/19: £8.9m). • Operating cash outflow before working capital changes was £11.0m (2018/19: £5.8m). FINANCIAL STATEMENTS 15 Independent auditor’s report to the members of Optare plc 17 Consolidated income statement and statement of comprehensive income 18 Consolidated statement of changes in equity 19 Consolidated balance sheet 20 Consolidated cash flow statement 21 Summary of significant accounting policies 26 Notes to the consolidated financial statements 37 Company balance sheet 38 Company statement of changes in equity 39 Summary of significant accounting policies 40 Notes to the Company financial statements 44 Advisers CHAIRMAN’S STATEMENT Continued focus on long-term REPORT STRATEGIC growth and evolution emission technologies and solutions across during the COVID-19 pandemic, we have the product range; explored the online opportunities for blended learning. -

Program Review Department of Computer Science

PROGRAM REVIEW DEPARTMENT OF COMPUTER SCIENCE UNIVERSITY OF NORTH CAROLINA AT CHAPEL HILL JANUARY 13-15, 2009 TABLE OF CONTENTS 1 Introduction............................................................................................................................. 1 2 Program Overview.................................................................................................................. 2 2.1 Mission........................................................................................................................... 2 2.2 Demand.......................................................................................................................... 3 2.3 Interdisciplinary activities and outreach ........................................................................ 5 2.4 Inter-institutional perspective ........................................................................................ 6 2.5 Previous evaluations ...................................................................................................... 6 3 Curricula ................................................................................................................................. 8 3.1 Undergraduate Curriculum ............................................................................................ 8 3.1.1 Bachelor of Science ................................................................................................. 10 3.1.2 Bachelor of Arts (proposed) ................................................................................... -

OCTOBER 2015 L DHS 108 20 /-ISSUE I USD 5.99

TP www.tiresandparts.net DHS 20 /- I USD 5.99/- l 2015 l OCTOBER The Middle East’s First Automotive, Tires & Parts News Source ISSUE 108 108 ISSUE Snooz: The Sound of Sleep PAGE 64 www.alexiatires.com Bespoke tires Specifically designed and produced for you. ART 1100 ART 1200 ART 1300 ART 1400 ART 1500 ART 1600 ART 1700 ART 1900 Guided by the main principles of value, trust, honesty and quality Alexia tires has been proudly manufacturing commercial and OTR tires from Asia with the intention to fill a gap in the replacement tire market. Alexia Tires believes in delivering the greatest value, quality and service without com- promising on innovation and style. With over 35 years of experience in the industry, Alexia Tires is passionate about its work. We bring to the market unique tire products and designs that specialize in the manufacturing of custom products that fit the market requirements of the day. Alexia’s strength lies in its flexibility and its ability to listen to the demands of the market and make subsequent swift changes as needed. Alexia Tires is a global company comprised of passionate designers and engineers who continue to use the latest technology to deliver the most innovative and original tires in the market. With worldwide distribution, Alexia Tires looks forward to further reaching out to the masses with truly one of a kind products and continuing to be trailblazers in the industry. For exclusive territory enquiries pls contact [email protected]. PUBLISHER’S NOTE The Middle East is home to one of the fastest growing automotive markets in the region. -

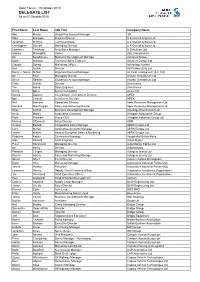

DELEGATE LIST As at 07 October 2015

Open Forum - 15 October 2015 DELEGATE LIST As at 07 October 2015 First Name Last Name Job Title Company Name Abs Master Global Key Account Manager 3M Mike Branigan Projects Director A E Oscroft & Sons Ltd Jonathan Griffiths Technical Sales A E Oscroft & Sons Ltd Christopher Oscroft Managing Director A E Oscroft & Sons Ltd Lawrence Peckham Area Sales Manager A.Schulman Ltd andrew Mcloughlin Owner ABL Components Ian Beardsmore Business Development Manager Advanex Europe Mark Wootton Technical Sales Engineer Advanex Europe Ltd Claudia Doring Marketing Officer Advantage Austria Karl Snitch Director AE Rubber (UK) Ltd Samir J. Nama Al-Safi Proprietor/General Manager Al-Taraf Trading LLC (ATTCO) Ian Ford Managing Director Amann Threads UK Ltd Steve Ribbitts Global key Account Manager Amann Threads UK Ltd Chris Gorvin Director Anochrome Tim Jones Sales Engineer Anochrome Helen Spree Senior Consultant Ansell UK Karina Bazuchi Co-ordinator - Investment Division APEX Igor Celeste Investment Division APEX Neil Johnson Operations Director Apex Resource Management Ltd Richard Marchington Sales and Marketing Director Apex Resource Management Ltd Sean Ashton Business Development Manager Aqualogy Environment Ltd Kevin Morley Automotive Chairman Arlington Automotive Group Mark Franckel Group CEO Arlington industries Group Ltd Marcus O'Donnell Sales Director ARM George Ballard Composites Sales Manager ARRK Europe Ltd Lucy Burrell Automotive Accounts Manager ARRK Europe Ltd James Walker Head of European Sales & Marketing ARRK Europe Ltd Rebekah Keeler Commercial -

Search for New Engineers

July 3 2012 Drive to recruit engineers for future MG cars High calibre engineers and designers are urgently needed to work on the next generation of MG cars. SAIC Motor’s UK Technical Centre, based at MG Birmingham, needs to recruit professional engineers and designers due to the huge international success of the MG brand. New MG cars, such as the award-winning MG6 models, now sell in dozens of countries. David Lindley, Managing Director of SMTC UK, said: “Modern MGs are designed and engineered in Birmingham and sold in an ever increasing number of markets throughout the world. “As well as the UK and China, MG has recently expanded into markets such as Egypt, Uruguay and New Zealand. This is a huge success story for British designers and engineers and, we have a fantastic range of future products to work on. “But the rate of growth has increased pressure on us and we new need to recruit more top class people. We are looking for bright, professional automotive specialists who have the enthusiasm and drive to help us push the MG and Roewe brands even further ahead.” SAIC Motor is the eighth largest automotive company in the world and includes both MG and Roewe, a brand sold exclusively in China, in its portfolio. Vacancies at the MG Birmingham site include specialists in body engineering, engines, transmissions, vehicle integration and design. A regional recruitment event took place on Tuesday, July 3 at Dunston Hall in Norwich. Further details can be found at saicmotor.co.uk or contact [email protected] Notes to editors 1. -

Make the Connection: the South East Midlands

MAKE THE CONNECTION The South East Midlands: Innovation, Connectivity, Opportunity THE SOUTH EAST MIDLANDS IS AT THE A thriving location for CENTRE OF WHAT IS FAST BECOMING THE £52bn UK’S INNOVATION CAPITAL – THE OXFORD- contributed to national innovation, creativity CAMBRIDGE ARC economy annually ur rapidly growing £52bn economy located between Oxford, Cambridge, and world-leading London and Birmingham make us one of the most exciting economic growth opportunities in the country. Fastest population OBusiness has benefited from the area’s rich heritage in engineering, growth outside London: motorsport and manufacturing expertise, which has transformed our area to 23.3% between technologies become a test-bed for new technologies with the potential to rapidly scale. 1997 - 2017 Today, entrepreneurs come here to build businesses based on technological innovation that will change the way we live and work. They enjoy the advantages of a connected location, tap into a highly skilled and entrepreneurial community and have a quality of life found rarely elsewhere. This is where progressive companies come to collaborate, to innovate and to 78% succeed. employment rate Welcome to the South East Midlands. THE MIDLANDS LEICESTER PETERBOROUGH £10bn BIRMINGHAM Corby goods and services Kettering Thrapston Coventry exported annually Rushden Wellingborough Daventry NORTHAMPTON CAMBRIDGE Towcester Bedford Sandy Biggleswade Brackley 1 in 25 MILTON Flitwick Buckingham KEYNES Houghton of all businesses created Regis Leighton Buzzard Dunstable LUTON are based here Aylesbury OXFORD LONDON 9% jobs growth over past 5 years (national rate 7.5%) Newlands Park, Luton: development plans THE SOUTH EAST MIDLANDS: INNOVATION CONNECTIVITY OPPORTUNITY 3 No 1 area in UK for % firms engaged in product Innovation or service innovation Mahle Powertrain Real Drive Emissions Where ideas Test Centre, Northampton become reality 79% Cranfield University’s Alumni network provided the local HE research catalyst for creating the ‘flying car’.