MRM : First Half 2016 Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Paris & Northwest France

INSPIRING STUDENT TRAVEL ® PARIS & NORTHWEST FRANCE Experience the beauty of Paris before discovering the majestic castles of Northwest France. Witness the seaside charm of Mont-Saint-Michel, practice your French at local markets, and enjoy world-famous cuisine in the Loire Valley. Why Brightspark? Quality, Custom Tours Our programs are designed for you, by you. From STEM-based Safety And Security DC tours to performance trips to some of our country’s top music We regularly conduct strict audits of our vendors, ensuring they cities, we have a destination for every budget and every passion. act in accordance with safety, security, and quality standards. Industry Experience Our Tour Directors With over 50 years of experience providing custom tours, You deserve the best, so we only use experienced and Brightspark is a leader in student travel. enthusiastic Tour Directors who are experts on their destinations. Travel Protection & Incident Coverage With our 24/7 emergency hotline and comprehensive travel insurance options, we’ve got you covered at home and abroad. brightsparktravel.com SAMPLE ITINERARY ® PARIS & NORTHWEST FRANCE Day 1: Board your flight to France. Day 6: Paris Day 2: Honfleur & Deauville • Explore the Musée Louvre! Formerly a royal palace, it houses masterpieces like the Venus de Milo and the Mona Lisa. Mixing • Meet with your Tour Director at Paris Charles de Gaulle Airport. classic and modern, a Nintendo 3DS guides you through the • Board your private motor coach and discover the high cliffs of many collections. Étretat. Take a stroll along a hiking trail leading you to the gate • Travel back to ancient times at the ruins of a Gallo-Roman of Aval. -

CAPEX: +€41.6M • Acquisitions: +€18.7M (Including Transfer Taxes)

Combined Annual General Meeting 11 June 2009 Presentation Contents Overview of 2008 2008 operations 2008 consolidated financial statements Recent events and outlook 11 June 2009 – 2 Overview of 2008 2008 highlights First full year for MRM as a listed real estate investment company (SIIC , french REIT) Progress made in the value-enhancement programmes Beginning of the operations of Marques Avenue A6 in Corbeil -Essonnes Strong business activity Tougher market conditions since the 2 nd half-year 2008 Credit crunch Depreciation of stabilised assets Unfavourable evolutions of interest rates 11 June 2009 – 4 2008 key figures Portfolio value 1: €537.1m An increase of €60.2m, +12.6%, comprising 2: • CAPEX: +€41.6m • Acquisitions: +€18.7m (including transfer taxes) Gross rental income: €28.3m Current operating income: €18.3m Net Asset Value per share 3: Liquidation NAV: €20.5 , –9.4% Replacement NAV: €28.5 , –2.1% Bank LTV: 74% Net income: -€7.5m, -€2.15 per share 3 Figures as of 31.12.2008, variation from 31.12.2007 1 Appraisal value excluding transfer taxes 2 The difference in value excluding investments and acquisitions is –€0.1m 3 On the basis of 3,501,977 shares as of 31 December 2008, restated for treasury shares 11 June 2009 – 5 A mixed and balanced asset portfolio Appraisal value 1: €537.1m Focused on offices and retail property Portfolio breakdown by value as of 31 December 2008 18 office buildings, all located in the Stabilised retail Paris region: €303.9m Stabilised 23% offices 13 retail properties in the Paris -

Pursuing Paris and Unlocking French – Group 2 Paris, the Most Visited

UCEAP Paris Spring 2017 Program in Global Cities Urban Realities PCC 80 – City and Language Group 2 City Course Instructor: French Instructor: Christina von Koehler [email protected] Claudia Fontu [email protected] Pursuing Paris and Unlocking French – Group 2 COURSE DESCRIPTION Paris, the most visited city in the world, is both an historical city and a modern global capital that fashionably wears the old and the new on its sleeve. It is also home to Parisians, whose clichéd image has been shaped in cultural imaginaries from around the globe, but whose identities and cultures are increasingly plural. The city and language course poses this two-fold question: just who is this city for, and how does one unlock its levels? More than a picturesque concentration of streets and buildings, Paris’s urban landscape provides a tableau upon which people have inscribed meaning, message, and significance to state, nation, and culture. To decipher these messages and gain an understanding of Paris’s history and the French culture that has shaped it, we will look at the histories of the conception, construction, and public perception of Parisian sites and place their stories within the larger context of the development of French identity. The city and language course introduces students to French history, culture, and language through team-taught instruction. In the “Pursuing Paris” sessions, you will learn about French history and culture by visiting sites important to the evolution of the capital city—these sessions will be taught in English. In the “Unlocking French” sessions, you will learn targeted language skills through situational communication, so you will have the opportunity to use everything you learn as you go about your daily activities. -

Grand Paris Express, Europe's Biggest Building Project

02 Grand Paris Express, 03 Le Mesnil-Amelot Start-up schedule 17 2019 Mairie de Saint-Ouen 14 H Aéroport Charles de Gaulle T4 Europe's biggest BARREAU Saint-Lazare DE GONESSE B Aéroport H RER C Charles de Gaulle T2 H RER D RER B CDG EXPRESS buildingA RER project J Triangle de Gonesse 2022 L H J B Noisy – T13 Parc des Expositions J 17 Champs T11 Aulnay Pont de Sèvres 200 KM EXPRESS K of new lines T11 Le Bourget Aéroport Aulnay 15 RER A - E 16 T11 13 Sevran – Beaudottes J EXPRESS Le Blanc-Mesnil 2023-2024 T11 Sevran – Livry 17 CDG (T2) Bois-Colombes Les Grésillons La Courneuve A J - L “Six Routes” 16 17 RER B 4 RER A - E 13 Saint-Denis Saint-Denis Pleyel Le Bourget RER Colombes Pleyel T4 16 additionalEXPRESS T13 Mairie Mairie de Saint-Ouen 14 d’Aubervilliers Drancy – Bobigny lines La Garenne-Colombes Les Agnettes Stade de 12 Olympiades Noisy – France 7 Bobigny Pablo Picasso T4 Saint-Ouen Mairie 15 Clichy – Montfermeil Champs Nanterre La Folie de Saint-Ouen Fort 5 Pont de Bondy Bécon- T4 CEA RER A les-Bruyères Saint-Ouen RER C d’Aubervilliers T13 15 T11 T4 RER E Saint-Aubin 18 A Porte de Clichy L Bondy 1 Aéroport d’Orly Rueil La Défense 3 Pont 90 % U LIGNE 11 16 Cardinet Villemomble Seine L 14 underground Nanterre 2025 La Boule U Rosny Bois-Perrier Saint-Lazare E Chelles P Saint-Denis A Rueil - Neuilly Rosny Pleyel L Suresnes Les Fauvettes Châtelet Les Halles 3 Marne Nanterre Rosny “Mont- Neuilly Bois-Perrier 68 Valérien” RER C Val de Fontenay Hôpitaux 15 9 15 RER A RER A stations T13 EXPRESS 15 11 Gare de Lyon 11 Pont de Sèvres Saint-Cloud -

Peter's Paris: Les Halles 16/05/09 11:12

Peter's Paris: Les Halles 16/05/09 11:12 RECHERCHER LE BLOG SIGNALER LE BLOG Blog suivant» PETER'S PARIS PARIS AS SEEN BY A RETIRED SWEDE. 17.4.09 LINK TO MY PREVIOUS BLOG Les Halles My previous blog, PHO, was in operation for a year as from March 2007. It contains similar posts as this one, basically talking about different well known or more secrete sites in Paris. You can reach it by clicking HERE. You can also see photos - only - on my photo-blogs (previous one, present one). You can also find some of my photos on IPERNITY. ABOUT ME PETER A retired Swede, living in Paris. This is a new blog, started in March 2008. My previous ones This is what until the 70's used to be can be reached on the following called the "belly of Paris", when for addresses: http://peter- hygienic and congestion reasons the olson.blogspot.com/ and http://peter- activities which used to take place here were transferred to new premises in the olson-photos.blogspot.com/ suburbs (Rungis). What usually goes under the name "Les Halles" was from VIEW MY COMPLETE PROFILE the 12th century until around 1970 Paris' central market (including wholesales) for fresh products. During the second half of OTHER BLOGS ABOUT PARIS the 19th century the so famous "Baltard pavilions" were constructed, thus D'HIER A AUJOURD'HUI demolished during the 70's. Several projects were planned and even launched Every Moment and abandoned for new activities on this large area. In the meantime, and for I Prefer Paris years, this was known as "le trou (the hole) des Halles". -

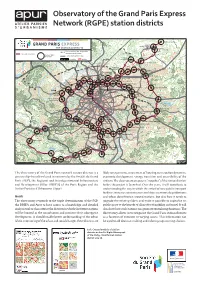

Observatory of the Grand Paris Express Network (RGPE) Station Districts

Observatory of the Grand Paris Express Network (RGPE) station districts Le Mesnil-Amelot Aéroport Charles de Gaulle THE STATION DISTRICTS (T4) Aéroport Charles de Gaulle New metro lines, RER, Tangentielles, (T2) Barreau The Grand Paris metro Charles de Gaulle Express Radius of ^VV m de Gonesse 17 around the Existing metro and RER lines Triangle Vegetation Building de Gonesse CDG EXPRESS Parc des Expositions Tangentielle Nord 17 Le Blanc- Aulnay Le Bourget Mesnil Aéroport 16 Sevran — Beaudottes Tangentielle La Courneuve RER E Nord "Six Routes" Les Saint- Stade RER E Les Sevran — Livry Agnettes Denis de Grésillons 16 CDG EXPRESS Tangentielle Pleyel France 17 Le Bourget RER Ouest Colombes ] 15 Drancy — Bobigny La Garenne- 16 Colombes Bobigny P. Picasso Bois- 15 Colombes Nanterre Mairie WX de St-Ouen Fort Pont de Bondy Clichy — Montfermeil La Folie d'Aubervilliers St-Ouen RER C Rueil 15 Bécon- Mairie Les-Bruyères Porte de Clichy d'Aubervilliers Bondy Nanterre Pont Cardinet La Boule RER WW Rosny La Défense E 14 Bois Perrier WW Chelles Gare de l’Est Rueil — Suresnes Saint-Lazare WW "Mont-Valérien" _ 15 15 Châtelet- Les Halles W 16 Val de Fontenay WW Noisy — Champs Saint-Cloud WV Nogent Le Perreux Tangentielle Ouest Olympiades 15 Pont de Sèvres Châtillon WX WV Montrouge Maison Blanche Issy RER Z Paris XIIIe Bry — Villiers Champigny 15 Kremlin-Bicêtre Champigny Centre Fort d'Issy Hôpital Vanves Clamart 14 15 Bagneux M4 Vitry Centre Saint-Maur — Créteil 18 Versailles Chantiers Arcueil — Cachan Créteil l'Échat Villejuif Institut G. Roussy Satory Le Vert de Maisons Chevilly Villejuif "Trois Communes" L. -

Walking Tours the Central Paris Set

Walking Tours The Central Paris Set Table of Contents Culture and History Stroll from Saint Germain to Notre Dame Louvre to Opera Walk Stroll from Saint Germain to the Louvre Walk from the Palais Royal to Pompidou Through Fashionable Paris in the Steps of Audrey Hepburn Stroll from St. Germain to Notre Dame (6th - 5th) 28 Stroll from St. Germain to Notre Dame (6th - 5th) cont’d 1. Carrefour de L’Odeon – starting point 2. 5 Carrefour de L’Odeon – Le Comptoir du Relais 2b. 4-6-8 Cour de Commerce – Un Dimanche à Paris 3. 13 rue de l’Ancienne Comedie – Le Procope 4. 41 rue St. Andre des Arts – Allard 5. St. Severin Church 6. St. Julien le Pauvre 7. 56 rue Galande – Aux Trois Mailletz 8. 50 & 52 rue Galande – Le Chat Huant 9. 14 rue St. Julien le Pauvre – the Tea Caddy 10. 4 rue St. Julien le Pauvre – Hotel Esmeralda 11. 37 rue de la Bucherie – Shakespeare and Co. 12. 21 Quai Montebello – Café Panis 13. Eglise Notre Dame 14. Square de Ile de France - Memorial des Martyrs 2 2 29 Stroll from St. Germain to Notre Dame (6th - 5th) cont’d 15. 55 Quai de Bourbon – Brasserie de l’Île St. Louis 16. 31 rue St. Louis-en-L’ile – Berthillon Ice Cream 3 3 30 Stroll from St. Germain to Notre Dame (6th - 5th) cont’d This tour takes between 2 and 4 hours vards we now see on the right bank. depending on how long you linger. Note the 4. Bistro Allard at 41 St. -

First Half2008 Results

First half2008 results 12 september2008 LIABILITY LIMITATION Declaration of Forward-Looking Statements (Safe Harbor) This presentation includes forward-looking statements (drawn up in accordance with the provisions of the Private Securities Litigation Reform Act of 1995). Intrinsically, these statements contain an element of risk and uncertainty. These forward-looking statements are part of the opinion formed by the company on future events and are basedon the information currently available. Therefore, the company cannot guarantee their accuracy or exhaustiveness. Moreover, the actual results can differ tangibly from the company‘s projections, due to a certain number of uncertain matters, which for the most part arenot known to the company. For more information on these items and other key factors that are liable to change the actual results of the company compared to expectations and projections, please consult the reports filed by the company with the Autorité des Marchés Financiers (French Financial Markets Regulatory Authority). 12 septembre 2008 œ 2 First half2008 Introduction MRM Asset portfolio Value creationprogrammes Consolidatedfinancialstatements Outlook Introduction H1 2008 highlights (figures as of 30.06.2008, variations from 31.12.2007) ° Continuation ofthestrategyimplementedin 2007 ° SIIC status from 1 January2008 ° Increasein thevalue(1) oftheportfolio: ⁄507m (+6.3% ) ° Progress on value creationprogrammes ° Robust business activity: ° Gross rentalrevenue: ⁄13.6m ° Net income: ⁄6.5m, or ⁄1.86 per share(2) ° Increasein -

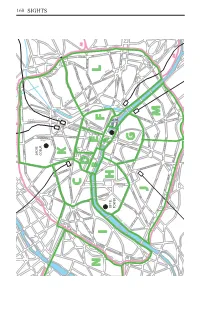

Sights Davout Soult

DAVOUT SOULT MORTIER BD BD BD D’AVRON AV GAMBETTA AV R CRS DEVINCENNES R BELGRAND L PONIATOWSKI BD DE CHARONNE BD MENILMONTANT BELLEVILLE DAUMESNIL DE AV GAMBETTA AV MENILMONTANT DE MANIN JAURES DE ST-ANTOINE BERCY RUE BD BD VOLTAIRE DIDEROT DE RUE RUE BD DE BERCY JEAN BD DU G DU BD BD DE SIMON JEAN O FLANORE BELLEVILLE REPUBLIQUE AV PARMENTIER TOLBIAC DE AV BD DE LA VOLTAIRE BD R DU FBG BOULEVARD LA VILLETTE DE MASSENA AV AV O DE LA RAPEE AV BD O D’AUSTERLITZ AV D’IVRY BD M FAYETTE BD V AURIOL V BD DE CHOISY NEY F BD DE L’HOPITAL DE BD D’ITALIE R DE LA AV DE CHAPELLE AV R ST-ANTOINE Q ST - BERNARD RUE DU TEMPLE DU RUE 160 DE TURBIGO DE DEDENIS ST- FRG DU R LA BD SEBASTOPOL DE BD R POISSONNIERE R DU FBG DU R ARAGO CLIGNANCOURT BD A. SIGHTS RD.DE GERMAIN BLANQUI G RUE E BD ORNANO A BD DE BD RIVOLI R E MARCEL BD BOCHECHOUART MICHEL - SAINT BD SACRE RUE COEURD’ALESIA SAINT K AV DE L’OPERA DE MONTPARNASSE BOULEVARD RUE DE RENNES DE BD DE CLICHY RASPAIL BD JOURDAN R DE CLICHY D HAUSSMANN AV DE ST- OUEN ST- DE AV BD B RUE CLICHY BD DU RUE SEVRES AVENUE DU MAINE BD D’ALESIA BESSIERES R DE ROME BES DE BD DES BD H BATIGNOLLES BD BD BRUNE MALESHER RUE RUE AVENUE DE VAUGIRARD BRETEUIL C AV DE AV J BERTHIER BD BD VILLIERS AV DES CH. -

Claiming Les Halles: Architecture and the Right to the City

809 Claiming Les Halles: Architecture and the Right to the City ROBERT WEDDLE Drury University In 1985, Jacques Chirac, then mayor of Paris, as- sisted in the inauguration of what seemed at the time the fi nal step in the long and complicated effort to renovate the Les Halles quarter in cen- tral Paris, which for centuries housed the city’s fresh food markets. The day marked, for Chirac, “the fi nal act in the most signifi cant urban opera- tion undertaken in Paris in decades.”1 Others in- volved in the project echoed Chirac’s sense of fi - nality. Three years later, the semi-public company founded to oversee the quarter’s transformation was dissolved; the group’s president, sociologist and politician Christian de la Malène, declared the work at Les Halles completed.2 But de la Malène’s statements were tempered by a recognition of the contingent nature of planning. “Parisians,” he pre- Les Halles, Rue Lescot, 2007 dicted, … have not only appointed themselves censors of But the efforts of Delanöe, as well as the designs the project; they will in a thousand ways be the of Mangin and others, have been subjected to dynamic creators of tomorrow. Over the months and years the trees will grow and the facades will withering criticism in the press and, especially, patina, and the inhabitants of Paris will give the from neighborhood groups representing inhabit- quarter its role and its face. In the end, Les Halles ants, shopkeepers, and business people who have 3 will only be what Parisians make of it. -

La Conciergerie Pont Neuf La Place Dauphine Samaritaine. Les

La Conciergerie This is ancient royal palace, built by Philippe the Fair (1284-1314). It is a place of imprisonment, torture, and death. Its gothic halls date from the Middle Ages. During the Revolution, it became a prison for thousands of arrested and condemned people. During the Reign of Terror, nearly 3 000 people left from here to meet their death on the Guillotine. See if you can track down the lists of their names. Marie Antoinette, Louis XVI and their children were imprisoned here, and the King and Queen left from here to be beheaded. The Revolutionary Tribunal kept court here. In the cells, prisoners were housed according to their means. The “pailleux” were the most numerous and slept on “paille” or straw in “La Rue de Paris” as they could not afford to bribe the guards for better accommodation. The “pistolés" were those who could pay “un pistol” (the name of a coin) and they could share a bed. There were the privileged who could afford their own private cell. You can also visit the women’s courtyard and the dungeon occupied by Marie Antoinette which is now a chapel dedicated to her memory. Pont Neuf the « new bridge » is in fact, the oldest bridge in Paris, so called because in 1578 it was the newest, and the only, stone bridge across the river. The contemporary Parisians liked their bridge because it was innovative: there were no houses built on it, so you could admire the views over the river and the Louvre; it was large, and its passing bays made it even larger; there were footpaths to protect pedestrians from mud and people on horseback. -

Empire and Belle Epoque Walking Tour 4Pages

The 19th century was a fascinating time in Paris. It’s hard to choose among the city’s many 19th-century landmarks. As a result, this walking tour is potentially the longest in this series. But the guide includes options for tailoring the walk to fit your time, energy and personal interests. The tour begins with a look at monuments to Napoleon I and Napoleon III’s imperial aspirations including the Arc de Triomphe and the 19th-century Louvre. It also includes buildings which are emblematic of the city’s 19th-century economic aspirations including the Paris stock exchange, several banks, and the Saint-Lazare railroad station. You’ll see how shopping evolved in Paris, from atmospheric covered passages such as the Galeries Vivienne and Colbert, to grand department stores like Galeries Lafayette and Au Printemps. The Palais-Royal, the Opéra Garnier and the Musée Jacquemart- André provide a glimpse into how wealthy Parisians lived and entertained themselves during this era. And you’ll visit two beautiful churches, Saint-Augustin and Saint-Eugène-Saint-Cecile. The tour ends with an optional visit to the 19th- century structure that has become the city’s most iconic monument, the Tour Eiffel. Start: Arc de Triomphe (Métro: Charles de Gaulle/Etoile) or Place de la Concorde (Métro: Concorde) Finish: Musée Jacquemart-André (Métro: Saint-Philippe-du-Roule) or Tour Eiffel (Métro: Bir-Hakeim) Distance: 3 - 4 miles (short version); 4 - 5 miles (long version) Time: 4 - 5 hours (short version); the better part of a day (long version) Best Days: Tuesday - Friday Copyright © Ann Branston 2011 HISTORY In 1848, a series of revolutions finally unseated the monarchy for good.