5.483 Peer Reviewed & Indexed Journal

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Crowdfunding in Asia

Crowdfunding in Asia May 2018 Introducing the first free directory of crowdfunding platforms across Asia. The data is based on the AlliedCrowds Capital Finder, a database of over 7,000 alternative finance capital providers across emerging markets. Our data has been used by organizations like FSD Asia, UNDP, World Green Economy Organization, GIZ, World Bank, and others in order to provide unique, actionable insights into the world of emerging market alternative finance. This is the latest of our regular reports on alternative finance in emerging markets; you can find all previous reports here. Crowdfunding rose in prominence in the post-financial crisis years (starting in 2012), and for good reason: a global credit crunch limited the amount of funding available to entrepreneurs and small businesses. Since then, crowdfunding has grown rapidly around the world. Crowdfunding is especially consequential in countries where SMEs find it difficult to raise capital to start or grow their businesses. This is the case in many Asian countries; according to the SME Finance Forum, there is a $2.3 trillion MSME credit gap in East Asia and the Pacific. Crowdfunding can help to fill this gap by offering individuals and small businesses an alternative source of capital. This can come in the form of donation-based as well as lending-based (peer-to-peer or peer-to-business) crowdfunding. In order to help entrepreneurs and small business owners to find the crowdfunding platform that’s right for them, we are releasing the first publicly available list of all crowdfunding platforms across Asia. The report is split into two key sections: the first one is an overview of crowdfunding platforms, and how active they are across the largest markets on the continent. -

Social Infrastructure Needs: Financing Through Digital Platform

International Journal of Innovative Technology and Exploring Engineering (IJITEE) ISSN: 2278-3075, Volume-8, Issue-11S, September 2019 Social Infrastructure Needs: Financing Through Digital Platform Shruti Sharma, Adya Sharma Abstract:Infrastructure funding needs are demanding like social infrastructure is critical for not only social but spouse where it’s difficult to match demand with supply. This gap economic and political importance [4]. The high-powered which is way too wide as India needs investment of ₹50 trillion expert committee (HPEC) estimates need of ₹39 lakh crores (~US$ 777.73 billion) in infrastructure by 2022to have (at 2009-10 prices) for urban infrastructure in 20-year period sustainable development in the country; union budget 2018-19 allocated ₹4.56 lakh crore (~US$ 63.20 billion) for the sector [1]; from 2012 to 2032[5]. Traditionally government financed also, investment into the National Investment & Infrastructure for social amenities, emergence of public-private model and Fund (NIIF), Private equity and venture capital investments and municipal bonds is also witnessed; but these financing various M&A deal in the infrastructure sector are also witnessed. options are also not free from issues and lack sustainability Nevertheless, this is less than required and by the time funds are when there is already a huge funding gap exits for raised for new infrastructure, somewhere other existing infrastructure in total. This paper explores alternative infrastructure may be in need of upgrade; in essence, need of continuous and sustainable fund flow is need of the hour. financing tool and how this tool can route existing unused However, when infrastructure funding is done,economic fund from companies’ CSR kitty, bringing more form NRIs infrastructuregets default priority over social infrastructure. -

Charitable Crowdfunding: Who Gives, to What, and Why?

APRIL 2021 Charitable Crowdfunding: Who Gives, to What, and Why? RESEARCHED AND WRITTEN BY Indiana University Lilly Family School of Philanthropy RESEARCHED AND WRITTEN BY — Indiana University Lilly Family School of Philanthropy The Indiana University Lilly Family School of Philanthropy is dedicated to improving philanthropy to improve the world by training and empowering students and professionals to be innovators and leaders who create positive and lasting change. The school offers a comprehensive approach to philanthropy through its academic, research and international programs, and through The Fund Raising School, Lake Institute on Faith & Giving, Mays Family Institute on Diverse Philanthropy, and Women’s Philanthropy Institute. Learn more at www.philanthropy.iupui.edu INDIANA UNIVERSITY LILLY FAMILY SCHOOL OF PHILANTHROPY PROJECT TEAM — Una O. Osili, PhD Associate Dean for Research and International Programs Jonathan Bergdoll, MA Applied Statistician Andrea Pactor, MA Project Consultant Jacqueline Ackerman, MPA Associate Director of Research, Women’s Philanthropy Institute Peter Houston, MBA Visiting Research Associate With special thanks to Dr. Wendy Chen, Dr. Debra Mesch, and Dr. Pamala Wiepking for reviewing the survey questionnaire. The survey was fielded by AmeriSpeak at NORC. The report was designed by Luke Galambos at Galambos + Associates. This research was completed with funding from Facebook. The findings and conclusions contained within are those of the authors and do not necessarily reflect official positions or policies of Facebook. INDIANA UNIVERSITY LILLY FAMILY SCHOOL OF PHILANTHROPY — 301 University Boulevard, Suite 3000, Indianapolis, IN 46202 317.278.8902 / [email protected] / @IUPhilanthropy / www.philanthropy.iupui.edu Contents Introduction ................................................... 02 Key Findings ................................................. 02 Background ................................................... 05 What is Crowdfunding? ...................................... -

Název 1 99Funken 2 Abundance Investment 3 Angelsden

# Název 1 99funken 2 Abundance Investment 3 Angelsden 4 Apontoque 5 Appsplit 6 Barnraiser 7 Bidra.no 8 Bloom venture catalyst 9 Bnktothefuture 10 Booomerang.dk 11 Boosted 12 Buzzbnk 13 Catapooolt 14 Charidy 15 Circleup 16 Citizinvestor 17 CoAssets 18 Companisto 19 Crowdcube 20 CrowdCulture 21 Crowdfunder 22 Crowdfunder.co.uk 23 Crowdsupply 24 Cruzu 25 DemoHour 26 DigVentures 27 Donorschoose 28 Econeers 29 Eppela 30 Equitise 31 Everfund 32 Experiment 33 Exporo 34 Flzing v 35 Fondeadora 36 Fundit 37 Fundrazr 38 Gemeinschaftscrowd 39 Goteo 40 GreenVesting.com 41 Greenxmoney 42 Hit Hit 43 Housers 44 Idea.me 45 Indiegogo 46 Innovestment 47 Invesdor.com 48 JD crowdfunding 49 Jewcer 50 Karolina Fund 51 Katalyzator 52 Ketto 53 Kickstarter 54 KissKissBankBank 55 Kreativcisobe 56 Labolsasocial 57 Lanzanos 58 Lignum Capital 59 Marmelada 60 Massivemov 61 Mesenaatti.me 62 Monaco funding 63 Musicraiser 64 MyMicroInvest 65 Nakopni me 66 Namlebee 67 Octopousse 68 Oneplanetcrowd International B.V. 69 Penězdroj 70 Phundee 71 PledgeCents 72 Pledgeme 73 Pledgemusic 74 Pozible 75 PPL 76 Projeggt 77 Rockethub 78 Seed&Spark 79 Seedmatch 80 Seedrs 81 Snowballeffect 82 Spacehive 83 Spiele offensive 84 Start51 85 Startlab 86 Startme 87 Startnext 88 Startovac 89 Startsomegood 90 Syndicate Room 91 TheHotStart 92 Thundafund 93 Tubestart 94 Ulule 95 Venturate 96 Verkami 97 Vision bakery 98 Wemakeit 99 Wishberry 100 Zoomal Legenda: *Sociální média Vysvětlení zkratek pro sociální média F - Facebook T - Twitter Lin - LinkedIn G+ - Google plus YouT - YouTube Insta - Instagram -

Girişimciler Için Yeni Nesil Bir Finansman Modeli “Kitle Fonlamasi - Crowdfunding”: Dünya Ve Türkiye Uygulamalari Üzerine Bir Inceleme Ve Model Önerisi

T.C. BAŞKENT ÜNİVERSİTESİ SOSYAL BİLİMLER ENSTİTÜSÜ İŞLETME ANABİLİM DALI İŞLETME DOKTORA PROGRAMI GİRİŞİMCİLER İÇİN YENİ NESİL BİR FİNANSMAN MODELİ “KİTLE FONLAMASI - CROWDFUNDING”: DÜNYA VE TÜRKİYE UYGULAMALARI ÜZERİNE BİR İNCELEME VE MODEL ÖNERİSİ DOKTORA TEZİ HAZIRLAYAN ASLI VURAL TEZ DANIŞMANI DOÇ. DR. DENİZ UMUT DOĞAN ANKARA- 2019 TEŞEKKÜR Beni her konuda daima destekleyen, cesaretlendiren, güçlü olmayı öğreten, mücadeleden, öğrenmekten ve kendimi geliĢtirmekten vazgeçmemeyi ilke edindiren, sevgili babama ve rahmetli anneme, Sevgisini ve desteğini daima hissettiğim değerli eĢime, Tezimin her aĢamasında bana tecrübesi ve bilgi birikimiyle yol gösteren, ilgi ve desteğini esirgemeyen tez danıĢmanım Doç. Dr. Deniz Umut DOĞAN’a, Çok değerli görüĢleri ve yönlendirmeleri için Prof. Dr. Nalan AKDOĞAN’a, ÇalıĢma dönemimde destek ve yardımını benden hiç esirgemeyen Çiğdem GÖKÇE’ye ve sevgili dostlarıma, En içten duygularımla teĢekkür ederim. I ÖZET GiriĢimcilerin en önemli problemi finansal kaynaklara ulaĢmalarında yaĢadıkları zorluklardır. GiriĢimciler finansal sorunlarını çözmek için geleneksel finansman yöntemlerinden ve Risk Sermayesi, GiriĢim Sermayesi, Bireysel Katılım Sermayesi, Mikrofinansman gibi alternatif finansman modellerinden yararlanmaktadır. Günümüzde giriĢimcilerin gereksinim duydukları sermayeye ulaĢmak için kullandıkları yeni finansal yöntemlerden biri Kitle Fonlaması modelidir. ÇalıĢmada giriĢimcilik, giriĢim finansmanı ve Kitle Fonlaması modeli konusunda literatür taraması yapılarak ilgili kavramlara değinilmiĢtir. Dünya’da -

Sattva Publications Report ATE Matching Contributions in India

MATCHING CONTRIBUTIONS IN INDIA A case to boost formal giving and amplify social impact SUPPORTED BY RESEARCH BY Delivering High Impact MATCHING CONTRIBUTIONS IN INDIA A case to boost formal giving and amplify social impact Acknowledgements Published by A.T.E. Chandra Foundation in partnership with Sattva Consulting in March 2020. Copyright © A.T.E. Chandra Foundation 2019 & Sattva 2020. Study commissioned by A.T.E. Chandra Foundation Research and writing Aashika Ravi, Abhineet Nayyar, Ambika Jugran, Shivani Desai, Yashasvi Murali (Sattva Research) Editing Aarti Mohan Project advisors Deepa Varadarajan and Manasa Acharya (Pramiti Philanthropy Partners), Komal Goyal and Priyaka Dhingra (A.T.E. Chandra Foundation) Design and typesetting Bhakthi Dakshinamurthy (HolyF Design), [email protected] Contact [email protected] This work is licensed under the Attribution-NonCommercial-ShareAlike 4.0 International License: Table of Contents Foreword 1 About the report and toolkit 2 Executive summary 3 Background and context 4 Definition of a matching contribution 6 Global evidence in support of matching campaigns 7 Successful matching campaigns in India 8 Benefits of matching campaigns 10 Enablers to matching in India 11 Matching in India: Some exemplars 12 Barriers to matching 27 Key takeaways 28 Research methodology and limitations 29 List of interviewees 30 Foreword knowledge that their donation would automatically double during that period. Often, the fact that someone the donor knows is matching their donation also increases credibility and therefore encourages donor participation. My wife Archana and I have been match-funders for over a decade and our personal experience has been very encouraging. The first time we ran a campaign over a decade ago, was done anonymously, during the India Giving Challenge run by GiveIndia. -

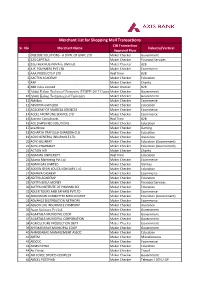

Merchant List for Shopping Mall Transactions CIB Transaction Sr

Merchant List for Shopping Mall Transactions CIB Transaction Sr. No Merchant Name Industry/Vertical Approval Flow 1 (N)CODE SOLUTIONS - A DIVN. OF GNFC LTD. Maker Checker Government 2 123 CAPITALS Maker Checker Financial Services 3 2GETHER HUB PRIVATE LIMITED Maker Checker B2B 4 A.R. POLYMERS PVT LTD Maker Checker Ecommerce 5 AAA PRODUCTS P LTD Real Time B2B 6 AACTEN ACADEMY Maker Checker Education 7 AAP Maker Checker Charity 8 ABB India Limited Maker checker B2B 9 Abdul Kalam Technical University (UPSEE-2017 Counselling)Maker Checker Government 10 Abdul Kalam Technological University Maker Checker Government 11 Abhibus Maker Checker Ecommerce 12 ABVIIITM-GWALIOR Maker Checker Education 13 ACADEMY OF MAGICAL SCIENCES Maker Checker Ecommerce 14 ACCEL FRONTLINE SERVICE LTD Maker Checker Ecommerce 15 Accrete Consultants Real Time B2B 16 ACE SIMPLIFIED SOLUTIONS Maker Checker Education 17 ace2three Maker Checker Gaming 18 ACHARYA PRAFULLA CHANDRA CLG Maker Checker Education 19 ACKO GENERAL INSURANCE LTD Maker Checker Insurance 20 ACPC-GUJARAT Maker Checker Education (Government) 21 ACPC-PHARMACY Maker Checker Education (Government) 22 ACTION AID Maker Checker Charity 23 ADAMAS UNIVERSITY Real Time Education 24 Adams Marketing Pvt Ltd Maker Checker Ecommerce 25 ADANI GAS LIMITED Maker Checker Utilities 26 ADDON GYAN EDUCATION SERV LTD Maker Checker Education 27 ADHAVA CASHEW Maker Checker Ecommerce 28 ADITYA ACADEMY Maker Checker Education 29 ADITYA BIRLA MONEY Maker Checker Financial Services 30 ADITYA INSTITUTE OF PHARMA SCI Maker Checker -

IDC Finance Technology Conference 20 Ekim 2016

FinTech İstanbul Platformu Prof. Dr. Selim YAZICI Co-Founder FinTech Istanbul @SelimYazici IDC Finance Technology Conference 20 Ekim 2016 Nedir bu FinTech? Girişimcilik dünyasında 2014 yılından beri en çok duyulan kelime: “FinTech” Bankacılık Sigortacılık “Finansal HİZMET” sağlamak için “TEKNOLOJİ” kullanımı ! Aracı Kurumlar FinTech Neden Gündemde? Finans dünyasına, dijitalleşme ile çözüm: “Yeniden Yapılanma” Dijital kanallardan anında; hızlı esnek bireysel çözümler sunar FinTech Neden Gündemde? “Dijital Dönüşüm” Dijital kanallardan anında; hızlı esnek bireysel çözümler sunar FinTech Finansal Hizmetler Dünyasını Yeniden Şekillendirecek “Korkunun Ecele Faydası Yok” • Önümüzdeki 5 yıl içinde global FinTech yatırımlarının 150 Milyar USD’yi aşması bekleniyor. • FinTech’ler %100 müşteri odaklı • Müşterinin çektiği acıyı biliyorlar • Yeni iş modelleri ile yeni ürün ve hizmetleri getiriyorlar • FinTech Startupları geleneksel şirketlerin işlerini tehdit edebilir • Blockchain Teknolojisi çok şeyi değiştirecek Çözüm: “Rekaberlik” Dünyada FinTech Sadece Aralık 2015’de 81 FinTech girişimi 1 milyar USD yatırım aldı. 894 224 Sadece Google, son 5 yılda 37 farklı FinTech 2010 2011 2012 2013 2014 2015 yatırımı yaptı Son 5 yılda FinTech odaklı girişim sermayesi (VC) sayısı Dünyada FinTech Yatırımları DEsignED BY POWERED BY PIERRE DREUX Fintech Landscape Banking & Payment (356) Investments (108) Financing (196) Insurance (82) Banking (54) P2P Lending (49) Banking Personal Finance Investment P&C Reinsurance (6) Platforms Mobile Virtual Banking (9) - Expense -

Crowdfunding Prospects in New Emerging Markets: the Cases of India and Bangladesh

13 Crowdfunding Prospects in New Emerging Markets: The Cases of India and Bangladesh Krishnamurthy Suresh, Stine Øyna, and Ziaul Haque Munim Introduction In 2013, the World Bank published a report on crowdfunding’s potential in emerging markets, which estimated a market opportunity for South Asia alone of close to USD 5 billion (The World Bank 2013). The South Asia region consists of predominantly collectivist societies (Hofstede Insights 2019)—India, Bangladesh, Sri Lanka, Pakistan, Bhutan, and Nepal—where helping others through donations is an integral part of K. Suresh (*) Indian Institute of Management Bangalore (IIM B), Bangalore, India S. Øyna School of Business and Law, University of Agder, Kristiansand, Norway e-mail: [email protected] Z. H. Munim Faculty of Technology, Natural Sciences and Maritime Sciences, University of South-Eastern Norway, Horten, Norway e-mail: [email protected] © The Author(s) 2020 297 R. Shneor et al. (eds.), Advances in Crowdfunding, https://doi.org/10.1007/978-3-030-46309-0_13 298 K. Suresh et al. prevailing religious obligations and societal norms. Thus, these countries share certain cultural and religious traits that are highly consistent with the principles of crowdfunding. Yet, by 2017, the alternative finance activity in the region amounted to no more than USD 269 million, 96% of which was related to the Indian market (see Table 13.1), indicating a vast untapped potential in the Asian economies. In the current chapter, we explore the history, ongoing activity, and future prospects of crowdfunding in new emerging markets. Specifically, we look into the cases of India and Bangladesh. -

Crowdfunding Platforms in India - Facts Based Comparison

© 2018 JETIR July 2018, Volume 5, Issue 7 www.jetir.org (ISSN-2349-5162) CROWDFUNDING PLATFORMS IN INDIA - FACTS BASED COMPARISON Prof. Rohini Sajjan1, Dr. H R Venkatesha2 Research Scholar1 , Professor & Director2 Department of Studies & Research inBusiness Administration1 Tumkur University, Tumkur, India Abstract: Crowdfunding is the employment of tiny funds from a big number of individuals to finance a new business enterprise. Mainly there are 3 parties involved in the process of Crowdfunding viz Investors, Fundraisers & Crowdfunding Platforms. Crowdfunding platforms acts as an intermediaries between fundraisers & investors and provides all services. The prime aim of this paper is to review &compare few top Indian Crowdfunding platforms. Crowdfunding industry is growing at a faster rate & many new platforms are emerging in the market to cater the personal, social, medical and other needs. They have raised crores of funds in a short span of time form their inception and served the society according to its requirements. IndexTerms: Crowdfunding, Crowdfunding Platforms, Crowdfunding Models, Funds, Investments. INTRODUCTION Crowdfunding is the employment of tiny funds from a big number of individuals to finance a new business enterprise. Crowdfunding can also be a fast and trouble-free way to meet unexpected, critical needs. Today, anyone with a smartphone can take part in making a difference with great ease. More and more people are now raising funds online with efficiently. Increasing digital access and the handiness of online payments are pushing more and more Indians to take the digital route to mobilize greater support for pressing needs on time. Mainly there are three parties involved in the process of Crowdfunding viz Investors, Fundraisers & Crowdfunding Platorms. -

A. Intellectual Disability (ID) 38 B

1 ChildRaise Resource Guide for Children with Special Needs Journey to Empowerment Kavita Shanbhag B.A (Psychology), B.Ed (Special Education), M.S (Counselling), Arts based Therapist. 2 © Kavita Shanbhag- 2018, Mumbai No part of this Publication maybe reproduced or transmitted by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher and the author. I Edition – 2004 (Published by: English Edition) II Edition (Revised) -2010, Reprint- 2012 (Published by: ChildRaise Trust) III Edition (Revised) -2018 (Published by: ChildRaise Trust) ChildRaise Trust Regd.Office-E /15, Karnatak Bldgs, Mogal Lane, Mahim, Mumbai- 400016, India. Admin.Office-B wing, Block No. 9, Jaldevi Niwas, New Karnatak Bldg, Mogal Lane, Matunga Road (West), Mumbai-400016, India. +91-22-24386767. ‘DISHA’- Toll Free No: 1800-22-1203 For Copies Contact: Author- Kavita Shanbhag: 09820256731, 08898785000 Founder & Managing Trustee- ChildRaise Trust E Mail- [email protected] Rs. 500/- Disclaimer The Author has taken utmost care and efforts to ensure the completeness and accuracy of information presented in this resource guide, but there may be some omissions and errors due to changes in telephone numbers and addresses. The author is not responsible for the authenticity of description of the institutions or services provided. 3 This book is dedicated To You, the Traveler of “Journey to Empowerment.” 4 FOREWORD This Resource Guide 'Journey to Empowerment' serves as a light-house amidst the unclear waters of ignorance, feeling of being lost, confused or unguided. Dissemination of information regarding certain handicapping conditions in simple words is effective in enabling people to understand the condition from all perspectives. -

Crowd-Funding in Microfinance in India: Issues, Challenges, and Opportunities

Policy Paper Crowd-Funding in Microfinance in India: Issues, Challenges and Opportunities under the aegis of Poorest States Inclusive Growth(PSIG) Programme September, 2015 Supported by: UK Government’s Department for International Development (DFID) and Small Industries Development Bank of India (SIDBI) Crowd-Funding in Microfinance in India: Issues, Challenges and Opportunities - Jayesh Kumar Jain Disclaimer “This document has been prepared under Poorest States Inclusive Growth (PSIG) Programme funded by the UK aid from the UK Government’s Department for International Development (DFID), however, the views expressed do not necessarily reflect the UK Government’s official policies” 1 Table of Contents Background and Scope ................................................................................................................................ 3 Structure of the paper ................................................................................................................................ 4 Crowd-Funding ............................................................................................................................................ 4 Current Status of Global Crowd-funding .................................................................................................... 5 The Indian Perspective ................................................................................................................................ 5 Profile of Prominent CFPs engaged in social lending/microfinance in India .............................................