United States Securities and Exchange Commission Form

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

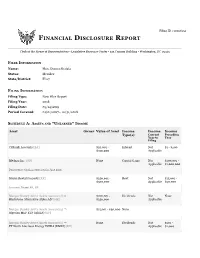

Financial Disclosure Report

Filing ID #10026155 financial DiScloSure report Clerk of the House of Representatives • Legislative Resource Center • 135 Cannon Building • Washington, DC 20515 filer information name: Hon. Donna Shalala Status: Member State/District: FL27 filing information filing type: New Filer Report filing year: 2018 filing Date: 05/14/2019 period covered: 01/01/2017– 12/31/2018 ScheDule a: aSSetS anD "unearneD" income asset owner Value of asset income income income type(s) current preceding year to year filing Citibank Accounts [BA] $50,001 - Interest Not $1 - $200 $100,000 Applicable Mednax Inc. [OP] None Capital Gains Not $100,001 - Applicable $1,000,000 DESCRIPTION: Options exercised in June 2018. Miami Rental Property [RP] $250,001 - Rent Not $15,001 - $500,000 Applicable $50,000 LOCATION: Miami, FL, US Morgan Stanley Active Assets Account (1) ⇒ $100,001 - Dividends Not None Blackstone Alternative Alpha Adv [HE] $250,000 Applicable Morgan Stanley Active Assets Account (2) ⇒ $15,001 - $50,000 None Algerian MLP ETF (AMLP) [EF] Morgan Stanley Active Assets Account (2) ⇒ None Dividends Not $201 - FT North American Energy INFRA (EMLP) [EF] Applicable $1,000 asset owner Value of asset income income income type(s) current preceding year to year filing Morgan Stanley Active Assets Account (2) ⇒ $50,001 - None ISHARES CORE MSCI EUROPE (IEUR) [EF] $100,000 Morgan Stanley Active Assets Account (2) ⇒ $15,001 - $50,000 Dividends Not $1,001 - ISHARES EDGE MSCI MIN VOL EAFE (EFAV) [EF] Applicable $2,500 Morgan Stanley Active Assets Account (2) ⇒ $15,001 - -

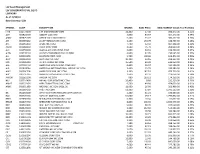

LSV Asset Management LSV CONSERVATIVE VAL EQ FD LSVFNDRV As Of: 9/30/19 Base Currency: USD

LSV Asset Management LSV CONSERVATIVE VAL EQ FD LSVFNDRV As of: 9/30/19 Base Currency: USD SYMBOL CUSIP DESCRIPTION SHARES BASE PRICE BASE MARKET VALUE% of Portfolio FITB 316773100 5TH 3RD BANCORP COM 14,400 27.38 394,272.00 0.51% ABT 002824100 ABBOTT LAB COM 3,600 83.67 301,212.00 0.39% ABBV 00287Y109 ABBVIE INC COM USD0.01 5,100 75.72 386,172.00 0.50% AYI 00508Y102 ACUITY BRANDS INC COM 1,400 134.79 188,706.00 0.24% AFL 001055102 AFLAC INC COM 7,400 52.32 387,168.00 0.50% AGCO 001084102 AGCO CORP COM 3,500 75.70 264,950.00 0.34% ALK 011659109 ALASKA AIR GROUP INC COM 3,000 64.91 194,730.00 0.25% ALSN 01973R101 ALLISON TRANSMISSION HOLDING 4,900 47.05 230,545.00 0.30% ALL 020002101 ALLSTATE CORP COM 5,700 108.68 619,476.00 0.80% ALLY 02005N100 ALLY FINL INC COM 10,200 33.16 338,232.00 0.44% MO 02209S103 ALTRIA GROUP INC COM 15,500 40.90 633,950.00 0.82% AAL 02376R102 AMERICAN AIRLINES INC COM USD1 6,800 26.97 183,396.00 0.24% AIG 026874784 AMERICAN INTERNATIONAL GROUP INC COM 3,400 55.70 189,380.00 0.24% AMP 03076C106 AMERIPRISE FINL INC COM 3,200 147.10 470,720.00 0.61% ABC 03073E105 AMERISOURCEBERGEN CORP COM 2,600 82.33 214,058.00 0.28% AMGN 031162100 AMGEN INC COM 900 193.51 174,159.00 0.22% NLY 035710409 ANNALY CAP MGMT INC COM 26,400 8.80 232,320.00 0.30% AMAT 038222105 APPLIED MATERIALS INC COM 9,500 49.90 474,050.00 0.61% ARNC 03965L100 ARCONIC INC COM USD1.00 11,900 26.00 309,400.00 0.40% T 00206R102 AT&T INC COM 51,300 37.84 1,941,192.00 2.50% BK 064058100 BANK NEW YORK MELLON CORP COM STK 4,300 45.21 194,403.00 0.25% BAC 060505104 -

Massachusetts Licensed Property & Casualty Agencies

COMMONWEALTH OF MASSACHUSETTS DIVISION OF INSURANCE PRODUCER LICENSING 1000 Washington Street, Suite 810 Boston, MA 02118-6200 FAX (617) 753-6883 http://www.mass.gov/doi Massachusetts Licensed Property & Casualty Agencies February 01, 2018 License # Licensure Agency Address City State Zip Phone # 1 1987679 10/14/2015 1 & Done Agency, LLC 2461MAIN STREET, 4TH FLR. GLASTONBURY CT 06033 860-554-0470 2 1880124 02/05/2010 12 Interactive, LLC 216 West Ohio Street, 4th Floor Chicago IL 60654 312-962-2817 3 2039936 11/07/2017 21st Century Benefit & Insurance Brokerage, Inc. 1 EDGE HILL ROAD HOPKINTON MA 01748 508-435-3164 21st Century Insurance And Financial Services, 4 1805771 03/14/2005 3 Beaver Valley Rd Wilmington DE 19803 302-252-2165 Inc. 5 1878897 12/23/2009 21st Mortgage Corporation 620 Market Street, Ste 100 Knoxville TN 37902 800-955-0021 6 1951629 03/05/2014 4D Insurance Agency, LLC 3609 Williams Dr, Suite 101 Georgetown TX 78628 512-930-3239 7 1949100 01/22/2014 501(C) Insurance Programs, Inc. 400 Race St., Ste. 200 San Jose CA 95126 408-213-1140 WEST 8 2021191 02/10/2017 A - One Insurance Agency Inc. 22 COPPER BEECH CIRCLE MA 02379 508-659-5969 BRIDGEWATER 9 2007813 08/01/2016 A & G Insurance LLC 11 VICTORY STREET ENFIELD CT 06082 860-627-0377 10 1780999 10/14/1998 A & P Insurance Agency,Inc. 273 Southwest Cutoff Worcester MA 01604 508-756-4300 11 2026140 01/11/2018 A & R Associates, Ltd. 6379 LITTLE RIVER TURNPIKE ALEXANDRIA VA 22312 703-333-5100 12 1781698 09/12/1998 A .James Lynch Insurance Agency,Inc. -

Ingredion Annual Report 2021

Ingredion Annual Report 2021 Form 10-K (NYSE:INGR) Published: February 24th, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-13397 INGREDION INCORPORATED (Exact name of registrant as specified in its charter) Delaware 22-3514823 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 5 Westbrook Corporate Center, Westchester, Illinois 60154 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code (708) 551-2600 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, par value $0.01 per share INGR New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Features & Benefits

NOVATION TM 4600 Description: Pregelatinized food starch refined from waxy maize Appearance: Fine, cream / off-white coloured powder Features Benefits 4600 Consumer friendly simple "starch" labelling Potential for marketing and labelling claims (e.g. can enable TM a no additives claim*). Ideal in wide range of foods, where thickening combined with clean, simple consumer friendly Classed as a food ingredient in the EU labelling is a requirement. May be used in foods labelled as organic, permitted within 5% of the ingredients of non- organic origin. *depends on other ingredients in the recipe Cold water swelling For the food manufacturer requiring instant thickening. NOVATION 4600 is a fine powder and therefore may require dispersion with other dry ingredients or oil to avoid lumping. Bland flavour profile Allows the inherent flavours within a recipe to be NOVATION delivered cleanly with no masking. Excellent process tolerance Will withstand moderate amounts of heat and shear in a process. Suitable for a wide range of applications from mayonnaise production to fruit preparations for pie fillings. Smooth, short texture Improved textural properties and gloss when compared to a traditional drum dried product. Shelf life stable Provides thickening and stability to applications and does not gel over life. APPLICATION AND USAGE INFORMATION Application Summary: NOVATION 4600 is a functional native food starch with cold water swelling properties. It has been designed as a thickener and stabilising agent for a wide range of cold prepared food products. Typical applications include: Chilled dips & dressings: For chilled dips and dressings where a “clean label” is a must this product excels. -

S P O T L I G H T Pa R T I C I Pa N

SPOTLIGHT PARTICIPANTS 12 Copyright © 2019 Mercer (US) Inc. All rights reserved. ORGANIZATION LISTING 3M (Minnesota Mining & Manufacturing) Atlas Energy Group LLC City of Overland Park, KS Cleveland Indians Baseball Co. A&E Television Networks Auburn University City of Winston-Salem, NC CliftonLarsonAllen, LLP A.O. Smith Corporation Automatic Data Processing California Health Care Foundation CMA CGM (America) LLC American Automobile Association, Inc., The Automobile Club of Southern California Cabot Oil & Gas Corporation CNH Industrial America LLC Accenture LLP AXA XL Cactus Feeders, Inc. CNO Financial Group Accudyne Industries, LLC Badger Meter, Inc. Cadmus Holding Company CNOOC Petroleum U.S.A. Inc. Advance Auto Parts Baltimore Orioles California Endowment, The CNX Resources ADVICS North America, Inc. Bank of the Ozarks, Inc. California ISO Colorado Rockies Baseball Club AECOM Building & Construction Bank of New York Mellon California Wellness Foundation Cobb Electric Membership Corporation AECOM Enterprise Baptist Health - FL Cambia Health Solutions (Regence Group) Coca-Cola Company, Inc., The AECOM Management Services Crestline Hotels & Resorts, LLC Canadian Imperial Bank of Commerce COG Operating, LLC Aera Energy Services Company Barnes & Noble, Inc. Canadian National Cognizant Technology Solutions Corporation Affinity Federal Credit Union BASF Corporation Canadian Pacific Railway CohnReznick LLP AgReserves Inc. Basin Electric Power Co-op Canadian Solar, Inc. Colby College Agri Beef Company Bates College Capital Group Companies, Inc., The Colonial Group, Inc. American International Group, Inc. (AIG) Battelle Memorial Institute Capital One Financial Corporation Columbia Sportswear Company Aimbridge Hospitality Baylor College of Medicine CarMax Auto Superstores, Inc. Columbia University American Institutes for Research BB&T Corporation Carilion Clinic Columbus McKinnon Corporation Air Liquide USA Blue Cross Blue Shield of Kansas Carrix, Inc. -

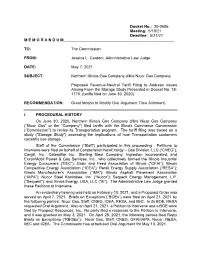

Docket No.: 20-0606 Meeting: 5/10/21 Deadline: 5/21/21 M E M O R a N D U M______

Docket No.: 20-0606 Meeting: 5/10/21 Deadline: 5/21/21 M E M O R A N D U M___________________________________________________ TO: The Commission FROM: Jessica L. Cardoni, Administrative Law Judge DATE: May 7, 2021 SUBJECT: Northern Illinois Gas Company d/b/a Nicor Gas Company Proposed Revenue-Neutral Tariff Filing to Address Issues Arising From the Storage Study Presented in Docket No. 18- 1775. (tariffs filed on June 30, 2020) RECOMMENDATION: Grant Motion to Modify Oral Argument Time Allotment. I. PROCEDURAL HISTORY On June 30, 2020, Northern Illinois Gas Company d/b/a Nicor Gas Company (“Nicor Gas” or the “Company”) filed tariffs with the Illinois Commerce Commission (“Commission”) to revise its Transportation program. The tariff filing was based on a study (“Storage Study”) assessing the implications of how Transportation customers currently use storage. Staff of the Commission (“Staff”) participated in this proceeding. Petitions to Intervene were filed on behalf of Constellation NewEnergy – Gas Division, LLC (“CNEG”); Cargill, Inc., Caterpillar Inc., Sterling Steel Company, Ingredion Incorporated, and ExxonMobil Power & Gas Services, Inc., who collectively formed the Illinois Industrial Energy Consumers (“IIEC”); Grain and Feed Association of Illinois (“GFAI”); Illinois Competitive Energy Association (“ICEA”); Retail Energy Supply Association (“RESA”); Illinois Manufacturer’s Association (“IMA”); Illinois Asphalt Pavement Association (“IAPA”); Nucor Steel Kankakee, Inc. (“Nucor”); Sequent Energy Management, L.P. (“Sequent”); and Illinois Energy, USA, LLC (“IE”). The Administrative Law Judge granted these Petitions to Intervene. An evidentiary hearing was held on February 10, 2021, and a Proposed Order was served on April 7, 2021. Briefs on Exceptions (“BOEs”) were filed on April 21, 2021 by the following parties: Nicor Gas, Staff, CNEG, ICEA, RESA, and IIEC. -

DTC Participant Alphabetical Listing June 2019.Xlsx

DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER ABN AMRO CLEARING CHICAGO LLC 0695 ABN AMRO SECURITIES (USA) LLC 0349 ABN AMRO SECURITIES (USA) LLC/A/C#2 7571 ABN AMRO SECURITIES (USA) LLC/REPO 7590 ABN AMRO SECURITIES (USA) LLC/ABN AMRO BANK NV REPO 7591 ALPINE SECURITIES CORPORATION 8072 AMALGAMATED BANK 2352 AMALGAMATED BANK OF CHICAGO 2567 AMHERST PIERPONT SECURITIES LLC 0413 AMERICAN ENTERPRISE INVESTMENT SERVICES INC. 0756 AMERICAN ENTERPRISE INVESTMENT SERVICES INC./CONDUIT 7260 APEX CLEARING CORPORATION 0158 APEX CLEARING CORPORATION/APEX CLEARING STOCK LOAN 8308 ARCHIPELAGO SECURITIES, L.L.C. 0436 ARCOLA SECURITIES, INC. 0166 ASCENSUS TRUST COMPANY 2563 ASSOCIATED BANK, N.A. 2257 ASSOCIATED BANK, N.A./ASSOCIATED TRUST COMPANY/IPA 1620 B. RILEY FBR, INC 9186 BANCA IMI SECURITIES CORP. 0136 BANK OF AMERICA, NATIONAL ASSOCIATION 2236 BANK OF AMERICA, NA/GWIM TRUST OPERATIONS 0955 BANK OF AMERICA/LASALLE BANK NA/IPA, DTC #1581 1581 BANK OF AMERICA NA/CLIENT ASSETS 2251 BANK OF CHINA, NEW YORK BRANCH 2555 BANK OF CHINA NEW YORK BRANCH/CLIENT CUSTODY 2656 BANK OF MONTREAL, CHICAGO BRANCH 2309 BANKERS' BANK 2557 BARCLAYS BANK PLC NEW YORK BRANCH 7263 BARCLAYS BANK PLC NEW YORK BRANCH/BARCLAYS BANK PLC-LNBR 8455 BARCLAYS CAPITAL INC. 5101 BARCLAYS CAPITAL INC./LE 0229 BB&T SECURITIES, LLC 0702 BBVA SECURITIES INC. 2786 BETHESDA SECURITIES, LLC 8860 # DTCC Confidential (Yellow) DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER BGC FINANCIAL, L.P. 0537 BGC FINANCIAL L.P./BGC BROKERS L.P. 5271 BLOOMBERG TRADEBOOK LLC 7001 BMO CAPITAL MARKETS CORP. -

Premium Comparison and Complaint Ratios for Automobile Insurance

2019 Premium Comparison and Complaint Ratios for Automobile Insurance Arizona Department of Insurance 100 N. 15th Avenue Suite 102 Phoenix, AZ 85007 (602) 364-2499 (1-800) 325-2548 Outside Phoenix https://insurance.az.gov Table of Contents Premium Comparison and Complaint Ratio for Automobile Insurance Introduction and Important Information 1 Unmarried Male, Age 18 Hypothetical 1: Minimum Liability Limit Quotations 2 Hypothetical 2: Other than Minimum Liability Limits Quotations 5 Unmarried Female, Age 18 Hypothetical 3: Minimum Liability Limit Quotations 8 Hypothetical 4: Other than Minimum Liability Limits Quotations 11 Married Couple, Age 42 Hypothetical 5: Minimum Liability Limit Quotations 14 Hypothetical 6: Other than Minimum Liability Limits Quotations 17 Married Couple, Age 42, with At-Fault Accidents Hypothetical 7: Minimum Liability Limit Quotations 20 Hypothetical 8: Other than Minimum Liability Limits Quotations 23 Single Female, Age 81 Hypothetical 9: Minimum Liability Limit Quotations 26 Hypothetical 10: Other than Minimum Liability Limits Quotations 29 Unmarried Female, Age 41 Hypothetical 11: Rides Bus to work 32 Hypothetical 12: Drives 15 Miles One-Way to Work 35 Family w/ 17 Year Old Male Son Hypothetical 13: Minimum Liability Limit Quotations 38 Hypothetical 14: Other than Minimum Liability Limits Quotations 41 Automobile Insurers’ Telephone Numbers 44 Coverages 46 Notes to the Hypotheticals 48 Abbreviations Used in the this Publication 48 Important Note Regarding Complaint Rations in this Publication 48 INTRODUCTION AND IMPORTANT INFORMATION Private Passenger Automobile Premium Comparison and Complaint Ratios The purpose of this Arizona Department of Insurance (ADOI) publication is to encourage consumers to do some comparison shopping for automobile insurance before making a purchase. -

CMAC February Agenda Packet

REGIONAL TRANSPORTATION COMMISSION CITIZENS MULTIMODAL ADVISORY COMMITTEE MEETING AGENDA Wednesday, February 6, 2018 at 5:30 pm Regional Transportation Commission 1st Floor Conference Room 1105 Terminal Way, Reno NV 89502 I. The Regional Transportation Commission 1st floor conference room is accessible to individuals with disabilities. Requests for auxiliary aids to assist individuals with disabilities should be made with as much advance notice as possible. For those requiring hearing or speech assistance, contact Relay Nevada at 1.800.326.6868 (TTY, VCO or HCO). Requests for supporting documents and all other requests should be directed to RTC Metropolitan Planning at 775-348-0480. Supporting documents may also be found on the RTC website: www.rtcwashoe.com. II. The Citizens Multimodal Advisory Committee (CMAC) has a standing item for accepting Public Comment on topics relevant to the RTC CMAC that are not included on the agenda. No action may be taken on a matter raised under this item of the agenda until the matter itself has been specifically included on an agenda as an item upon which action will be taken. For specific items on the CMAC agenda, public comment will be taken at the time the item is discussed. Individuals providing public comment will be limited to three minutes. Individuals acting as a spokesperson for a group may request additional time. Individuals will be expected to provide public input in a professional and constructive manner. Attempts to present public input in a disruptive manner will not be allowed. Remarks will be addressed to the CMAC as a whole and not to individual members. -

The Safety Company Annual Report 2006 the Mission, Vision and Business of MSA

The Safety Company Annual Report 2006 The Mission, Vision and Business of MSA Our Mission The Business of MSA That men and women may work in is in the business MS Aof developing, safety and that they, their families manufacturing and selling innova - tive and sophisticated products that and their communities may live in enhance the safety and health of health throughout the world. workers throughout the world. Critical to MSA’s mission is a clear understanding of customer processes Our Vision and safety needs. MSA dedicates significant resources to research To be the leading innovator and which allows the company to develop a keen understanding of the customer safety requirements for a diverse provider of quality safety and range of markets, including the fire service, homeland security, construction, public utilities, mining, chemical, petroleum, HVAC, hazardous materials instrument products and services remediation, military and retail. MSA’s principal products, each designed to that protect and improve people’s serve the needs of these target markets, include respiratory protective equipment, thermal imaging cameras, gas detection instruments, ballistic health, safety and the environment. protection, as well as head, eye, face, hearing and fall protection products. MSA was founded in 1914 by John T. Ryan and George H. Deike, two mining engineers who had firsthand knowledge of the terrible human loss that To satisfy customer needs through was occurring in underground coal mines. Their knowledge of the mining the efforts of motivated, involved, industry provided the foundation for the development of safety equipment to better protect underground miners. While the range of highly trained employees dedicated markets served by MSA has expanded greatly over the years, the founding philosophy of to continuous improvement in quality, understanding customer safety needs and designing innovative safety equipment service, cost, value, technology solutions remains unchanged. -

Bankers' Bank of the West

1099 18th Street Suite 2700 BANKERS’ BANK OF THE WEST Denver, CO 80202 Tel: 303-291-3700 FEDERAL FUND AGENCY AGREEMENT – EXHIBIT A Fax: 303-291-3714 EFFECTIVE February 7, 2020 Based on December 31, 2019 call report data Associated Bank, NA First Horizon Bank People’s United Bank, NA Bank of Hawaii First National Bank of Pennsylvania Regions Bank Bank of the West First Republic Bank Signature Bank Bankers' Bank of the West Fulton Bank, NA Silicon Valley Bank Bank of Oklahoma (BOKF, NA) Hancock Whitney Bank Sterling National Bank BMW Bank of North America Huntington National Bank Texas Capital Bank, NA Capital One Bank (USA), NA JPMorgan Chase Bank, NA Truist Financial Corporation Citibank, NA Manufacturers & Traders Trust Company Trustmark National Bank Citizens Bank, NA MUFG Union Bank, National Association US Bank, NA Commerce Bank New York Community Bank Webster Bank, N.A Federal Reserve Bank of Kansas City [1] Northern Trust Company Zions Bancorporation, NA First Hawaiian Bank Old National Bank [1] Excess funds placed with the Federal Reserve Bank are subject to the terms and conditions established by the Federal Reserve Bank’s Excess Balance Account program. Prior approval of the Federal Reserve Bank is required. Bankers’ Bank of the West (“BBW”) may sell Respondent’s Agency Funds to any one or more of the approved purchasers listed above. Respondent may instruct BBW in writing that Agency Funds shall not be sold to certain approved purchasers. BBW may amend Exhibit A at any time by adding or deleting purchasers upon written or verbal notice as soon as practical to Respondent, and BBW may sell Agency Funds to such additional purchasers unless the Respondent shall have directed BBW prior to the sale not to sell Agency Funds to such additional purchasers.