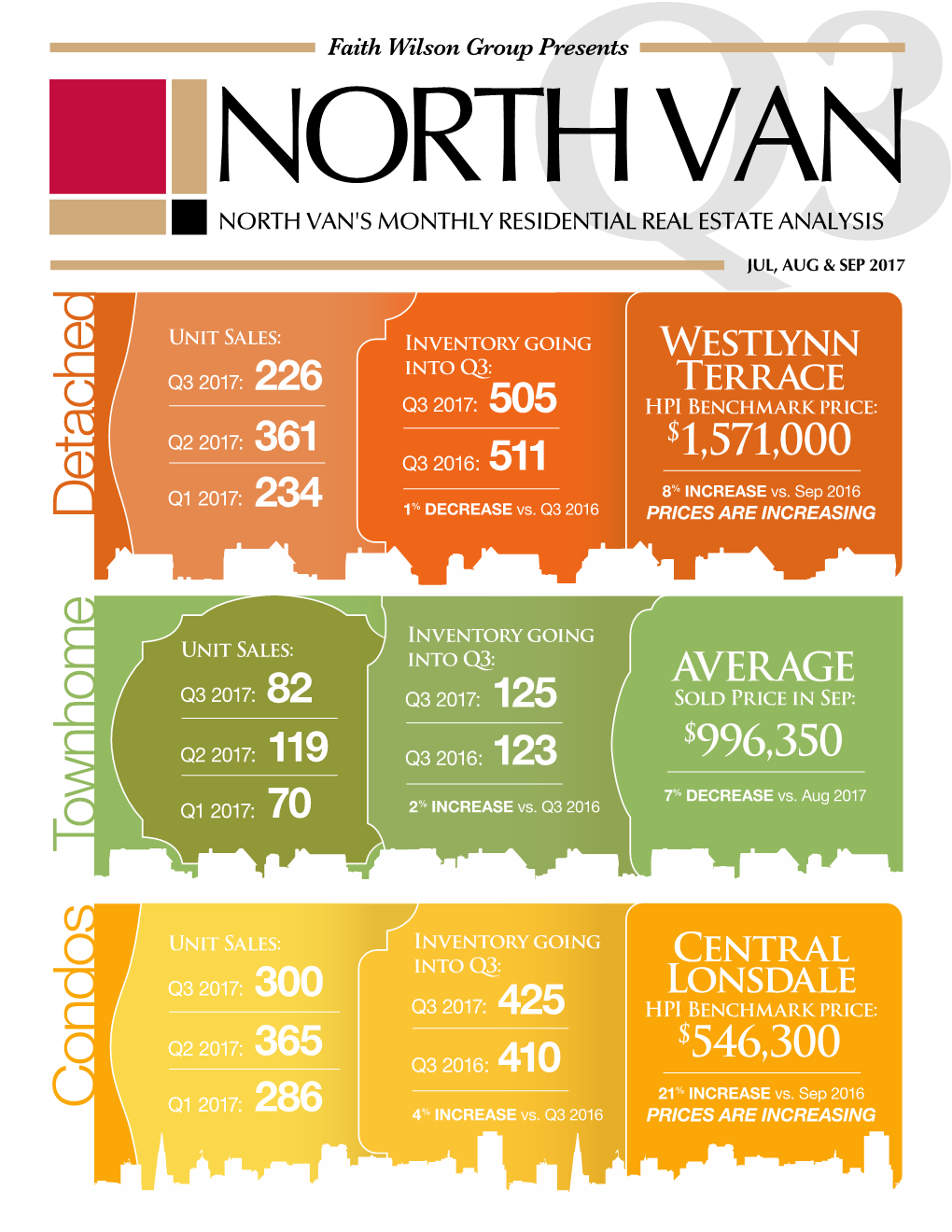

Condos Townhome Detached

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

32 -46.70% 123 -16.90% 42 14.70% 23 15.00% 61

February 2019 VS. February 2018 DETACHED UNIT SALES 32 -46.70% NEW LISTINGS 123 -16.90% AVE. DAYS ON MARKET 42 14.70% HPI (combined total) $1,492,400 -11.52% TOWNHOME UNIT SALES 23 15.00% NEW LISTINGS 43 16.20% AVE. DAYS ON MARKET 14 -31.60% HPI (combined total) $956,500 -4.2% CONDO UNIT SALES 61 -38.40% NEW LISTINGS 157 16.30% AVE. DAYS ON MARKET 27 32.70% HPI (combined total) February $ NORTH VAN 561,500 NORTH VAN -4.7% February 2019 JANUARY - SINGLE FAMILY DETACHED HOMES THE REAL NORTH VAN RESULTS: JAN 2019 THE REAL NEIGHBOURHOOD RESULTS: JAN 2019 SALES PRICE MONTHLY TREND SALES AND BENCHMARK BENCHMARK PRICE $2,100,000 PRICES BY NEIGHBOURHOOD CHANGE (%) $2,061,413 $ 2,000,000 MLS® Neighbourhood Unit Sales HPI Benchmark Price 1 Month 3 Months $ 1,900,000 $1,801,799 Average Sales Price $1,810,452 $1,813,727 Blueridge NV 2 $1,546,500 0.54 -4.92 $1,718,387 – $ 1,800,000 Boulevard 0 $1,651,700 0 -6.3 $ 1,700,000 $1,636,675 Braemar 1 $2,011,600 -4.59 -8.36 $1,600,000 $1,579,365 $ 1,700,000 $1,687,500 Calverhall 1 $1,390,200 0.74 -5.78 $ Median Sales Price Canyon Heights NV 1 $1,700,200 -3.93 -4.2 1,500,000 $1,600,000 $1,538,000 $1,546,500 – AUG SEP OCT NOV DEC JAN Capilano NV 0 $1,536,700 -2.62 -2.54 Central Lonsdale 0 $1,383,400 -1.09 -3.72 DAYS ON MARKET MONTHLY TREND Deep Cove 0 $1,486,000 -1.27 -3.6 60 Delbrook 0 $1,594,400 -3.17 -4.13 51 50 51 50 45 Dollarton 0 $1,648,900 0.48 -3.99 39 40 37 47 Edgemont 1 $1,855,900 -4.73 -3.91 42 Average Days on Market – Forest Hills NV 0 $1,786,900 -3.81 -4.76 30 36 Days Grouse Woods 0 $1,600,700 -

Agenda Addendum

AGENDA ADDENDUM COUNCIL WORKSHOP Wednesday, July 17, 2019 5:30 p.m. Committee Room, Municipal Hall 355 West Queens Road, North Vancouver, BC Council Members: Mayor Mike Little Councillor Jordan Back Councillor Mathew Bond Councillor Megan Curren Councillor Betty Forbes Councillor Jim Hanson Councillor Lisa Muri www.dnv.org THIS PAGE LEFT BLANK INTENTIONALLY District of North Vancouver 355 West Queens Road North Vancouver, BC, Canada V7N 4N5 604-990-2311 www.dnv.org COUNCIL WORKSHOP 5:30 p.m. Wednesday, July 17, 2019 Committee Room, Municipal Hall, 355 West Queens Road, North Vancouver AGENDA ADDENDUM THE FOLLOWING LATE ITEMS ARE ADDED TO THE PUBLISHED AGENDA 3. REPORTS FROM COUNCIL OR STAFF 3.3. Final Draft Heritage Strategic Plan File No. 13.6800.01/006.000 THAT the July 10, 2019 report of the Community Planner entitled Final Heritage Strategic Plan is received for information; AND THAT the Committee of Council recommend to Council: THAT the Heritage Strategic Plan is approved. 3 THIS PAGE LEFT BLANK INTENTIONALLY 4 3.3 AGENDA INFORMATION 0 Council Workshop Date: July 22, 2019 D Finance & Audit Date:-- ------- D Advisory Oversight Date: --------- Dept. D Other: Date:--------- Manager Director The District of North Vancouver REPORT TO COMMITTEE July 10, 2019 File: 13.6800.01/006.000 AUTHOR: Nicole Foth, Community Planner SUBJECT: Final Draft Heritage Strategic Plan RECOMMENDATION: THAT the July 10, 2019 report of the Community Planner entitled Final Draft Heritage Strategic Plan is received for information; AND THAT the Committee of Council recommend to Council: THAT the Heritage Strategic Plan is approved. REASON FOR REPORT: The purpose of this report is to seek Council's direction to consider approval of the Heritage Strategic Plan at a Regular Meeting of Council. -

North Vancouver September 2018

REALTOR® Report A Research Tool Provided by the Real Estate Board of Greater Vancouver North Vancouver September 2018 Detached Properties September August One-Year One-Year Activity Snapshot 2018 2017 Change 2018 2017 Change Total Active Listings 498 399 + 24.8% 454 352 + 29.0% Sales 41 74 - 44.6% 32 75 - 57.3% Days on Market Average 38 30 + 26.7% 54 31 + 74.2% MLS® HPI Benchmark Price $1,620,300 $1,713,000 - 5.4% $1,649,700 $1,711,100 - 3.6% Condos September August One-Year One-Year Activity Snapshot 2018 2017 Change 2018 2017 Change Total Active Listings 318 167 + 90.4% 242 121 + 100.0% Sales 57 107 - 46.7% 72 111 - 35.1% Days on Market Average 24 14 + 71.4% 25 17 + 47.1% MLS® HPI Benchmark Price $595,700 $561,800 + 6.0% $596,400 $559,000 + 6.7% Townhomes September August One-Year One-Year Activity Snapshot 2018 2017 Change 2018 2017 Change Total Active Listings 103 58 + 77.6% 103 58 + 77.6% Sales 20 23 - 13.0% 25 26 - 3.8% Days on Market Average 27 19 + 42.1% 34 15 + 126.7% MLS® HPI Benchmark Price $1,021,900 $964,700 + 5.9% $1,030,100 $968,400 + 6.4% Sales-to-Active Ratio Townhome Condo Detached [19.4%] [17.9%] [8.2%] 140% 120% 100% 80% Seller's Market 60% 40% 20% Balanced Market 0% Buyer's Market Current as of October 02, 2018. All data from the Real Estate Board of Greater Vancouver. Report © 2018 ShowingTime. -

North Vancouver December 2017

REALTOR® Report A Research Tool Provided by the Real Estate Board of Greater Vancouver North Vancouver December 2017 Detached Properties December November One-Year One-Year Activity Snapshot 2017 2016 Change 2017 2016 Change Total Active Listings 214 218 - 1.8% 370 326 + 13.5% Sales 70 48 + 45.8% 76 63 + 20.6% Days on Market Average 35 41 - 14.6% 24 36 - 33.3% MLS® HPI Benchmark Price $1,679,700 $1,596,600 + 5.2% $1,697,600 $1,636,900 + 3.7% Condos December November One-Year One-Year Activity Snapshot 2017 2016 Change 2017 2016 Change Total Active Listings 111 99 + 12.1% 183 201 - 9.0% Sales 78 73 + 6.8% 136 88 + 54.5% Days on Market Average 22 25 - 12.0% 19 24 - 20.8% MLS® HPI Benchmark Price $560,600 $458,600 + 22.2% $566,500 $458,600 + 23.5% Townhomes December November One-Year One-Year Activity Snapshot 2017 2016 Change 2017 2016 Change Total Active Listings 48 31 + 54.8% 57 47 + 21.3% Sales 16 15 + 6.7% 32 24 + 33.3% Days on Market Average 36 25 + 44.0% 12 24 - 50.0% MLS® HPI Benchmark Price $982,800 $846,200 + 16.1% $983,600 $877,400 + 12.1% Sales-to-Active Ratio Townhome Condo Detached [33.3%] [70.3%] [32.7%] 140% 120% 100% 80% Seller's Market 60% 40% 20% Balanced Market 0% Buyer's Market Current as of January 03, 2018. All data from the Real Estate Board of Greater Vancouver. Report © 2018 ShowingTime. -

SHARLA SAVA / "Igniting the Mercurial": a Conversation About North Vancouver Culture

SHARLA SAVA / "Igniting the mercurial": A Conversation about North Vancouver Culture SABINE BITTER is an artist who lives and works in Vancouver and Vienna; JEFF DERKSEN is a writer and Assistant Professor, Department of English, Simon Fraser University; FRANCIS MANSBRIDGE is a writer who worked for many years as an archivist at the North Vancouver Museum and Archives; REID SHIER is Director of Presentation House Gallery; and JERRY ZASLOVE is Professor Emeritus, English and Humanities, Simon Fraser University. We met in Sabine and Jeff's studio in February 2009 to talk about possibilities for culture in North Vancouver. What follows is our wide-ranging conversation about art, architecture, archives, and urban planning. REID SHIER When we are talking about cultural models, outside of very dense urban cores-it's one thing to talk about models we are all familiar with but another to talk about the context of North Vancouver in particular. North Vancouver is an old city that wasn't always the suburb it is now. FRANCIS MANSBRIDGE It is interesting that it grew up as a group of different towns or villages. You had Deep Cove, which was listed separately in the directories for a long time, not even part of North Vancouver. And you had Moodyville. And you had Lynn Valley. And you had Lonsdale. And these had post offices, and you had to send your mail to the region-you didn't mail to North Vancouver. This has probably affected its development and its current state. SHARLA SAVA When did the name "Moodyville" fall out of use? FM Quite early. -

North Vancouver May 2019

REALTOR® Report A Research Tool Provided by the Real Estate Board of Greater Vancouver North Vancouver May 2019 Detached Properties May April One-Year One-Year Activity Snapshot 2019 2018 Change 2019 2018 Change Total Active Listings 473 490 - 3.5% 465 429 + 8.4% Sales 105 90 + 16.7% 53 78 - 32.1% Days on Market Average 37 28 + 32.1% 34 29 + 17.2% MLS® HPI Benchmark Price $1,508,300 $1,696,900 - 11.1% $1,511,400 $1,702,000 - 11.2% Condos May April One-Year One-Year Activity Snapshot 2019 2018 Change 2019 2018 Change Total Active Listings 430 229 + 87.8% 441 180 + 145.0% Sales 106 106 0.0% 64 101 - 36.6% Days on Market Average 31 14 + 121.4% 23 15 + 53.3% MLS® HPI Benchmark Price $557,100 $610,500 - 8.7% $563,400 $617,600 - 8.8% Townhomes May April One-Year One-Year Activity Snapshot 2019 2018 Change 2019 2018 Change Total Active Listings 139 78 + 78.2% 155 67 + 131.3% Sales 41 36 + 13.9% 29 35 - 17.1% Days on Market Average 33 11 + 200.0% 23 16 + 43.8% MLS® HPI Benchmark Price $953,200 $1,035,500 - 7.9% $947,000 $1,030,900 - 8.1% Sales-to-Active Ratio Townhome Condo Detached [29.5%] [24.7%] [22.2%] 120% 100% 80% Seller's Market 60% 40% 20% Balanced Market 0% Buyer's Market Current as of June 13, 2019. All data from the Real Estate Board of Greater Vancouver. Report © 2019 ShowingTime. -

Scanned Document

Jennifer Janetka From: Info Package Subject: FW: Regarding the Edgemont Senior Living Proposal. (My note in italics prior to the council meeting) From: hyam susan [mailto:[email protected]] Sent: Tuesday, May 28, 2013 4:30 PM To: DNVCouncil Subject: Fwd: Regarding the Edgemont Senior Living Proposal. (My note in italics prior to the council meeting) there needs to be more than the two absolute options. It doesn't see possible that this would go ahead tonight and then the Refresh (or perhaps a rebranded "Stale" committee) would muddle along with the knowledge that they are really just re arranging the fitrnilure. and not serving any sign(ficantfunction at all. This is a major change. A sign!ficant number ofresidents need to have input on the nature and scope offitture building projects. I also question whether it is clear about whether there MUST be transition beds for seniors in the residence whose health may deteriorate and need more care and support. I don't like the idea ofplacementfor those -.,vith wealth and health, and then abrupt moves. when either ofthese decline. Is this what meaningful Social Policy Planning.for seniors should look like, or is it just a real estate project? I think planning should be about more than I he design, the construction details, the trafficflow. the paint colours. It is, basically about how all this qffects the lives (and deaths) (~[residents. Susan As I was late in arriving at last nights council meeting, I am forwarding some thoughts about the ESL project. I was startled to hear your staff person report that the developer has tweaked the accommodation to include Alzheimer's care.. -

Economic Development Information Package

Think City of North Vancouver www.cnv.org Message From the Mayor As Mayor of the City of North Vancouver, it gives me great pleasure to welcome you to our award winning municipality. Situated on the North Shore of Metro Vancouver, our vibrant community includes a full array of business, entertainment, cultural and recreational opportunity within a relatively compact area. Our business community is well diversified. We have major port terminals, shipbuilding facilities, shopping centres, a vibrant industrial area, a waterfront business park, and a mix of commercial and professional services, as well as infrastructure to support specialty manufacturing and advanced technology. The Lonsdale Avenue corridor is our most heavily populated residential and commercial area, and offers a wide variety of restaurants, art galleries, performing arts theatres, a regional hospital, a major recreation centre and a Mayor Darrell Mussatto state-of-the-art library. Residential accommodations range from single family homes to duplexes, townhouses, and three-storey or high rise condominiums. ARE YOU LOOKING FOR Our Lower Lonsdale neighbourhood, located on the City’s waterfront across GROWTH, OPPORTUNITY from downtown Vancouver, is undergoing major renewal and redevelopment. AND SUCCESS ALL IN The area is home to high rise waterfront condominiums and popular tourist ONE PLACE? attractions, such as the Lonsdale Quay Public Market, Waterfront Park and the 700-foot long Burrard Dry Dock Pier. With the Shipyard’s retail permit, THINK CITY OF the Shipbuilder’s Square, a new hotel and conference centre, along with new NORTH VANCOUVER. public amenities and cultureal facilities, Lower Lonsdale is quickly becoming a www.cnv.org highly sought after area to live and a must-see destination for visitors. -

Summary Report - June 12Th (Completion Rate: 100.0%)

Summary Report - June 12th (Completion rate: 100.0%) 1. The NVSD has 11 properties that are not required for public school use over the long term. Please identify the properties that interest you most: Response Chart Percentage Count Blueridge Elementary 48% 27 Cloverley School 14% 8 Fromme Elementary School 5% 3 Keith Lynn School 0% 0 Lonsdale Creek Annex 25% 14 Lucas Centre/Leo Marshall Curriculum 0% 0 Centre Maplewood School 0% 0 Monteray School 0% 0 Plymouth School 2% 1 Ridgeway Annex 2% 1 Westover School 4% 2 Total Responses 56 2. Please share any concerns that you might have regarding the future use of these properties. The 275 response(s) to this question can be found in the appendix. Category Chart Percentages Count Lucas - Test Category 0% 1 3. What options, ideas and/or opportunities do you have regarding the future use of these properties? The 293 response(s) to this question can be found in the appendix. 4. Do you have any recommendations for how we might engage stakeholders in the NVSD land management initiatives? The 242 response(s) to this question can be found in the appendix. 5. On a scale of 1 to 5, please rate your overall understanding of the Board's land management endeavours. Response Chart Percentage Count 1 15% 48 2 23% 74 3 37% 120 4 18% 60 5 7% 23 Total Responses 325 6. What information would be helpful for you to better understand the Board's land management processes and planning? The 213 response(s) to this question can be found in the appendix. -

DE 17 Lonsdale Energy Corp

1 Case Study: Lonsdale Energy Corporation Spring 2009 COMMUNITY ENERGY CASE STUDIES: Lonsdale Energy Corporation City of North Vancouver, BC District Energy Community Biomass Solar Wind CHP Heat Pump Integrated Community Energy System Application Archetype • Neighbourhood Energy Utility (NEU). Characterization • Low temperature community energy system that delivers hot water for space and water heat to buildings (in the Lower Lonsdale Development Plan Area). • Archetype: • Three mini-plants using natural gas fired boilers provide heat. District Heating • Two separate grids serving Lower Lonsdale and Central Lonsdale. • Density: 11 buildings • Long term objective is to connect the grids as the service area expands. • Mix: • Additional capacity will be based on GHG neutral sources, such as ocean Lower Lonsdale Grid source heat pump and solar thermal collectors. primarily residential towers Upper Lonsdale grid Context institutional • The City of North Vancouver strives to enhance the sustainability of the community through a range of environmental programs. • Energy efficiency has been a strong theme as part of the broader commitment to sustainability. Drivers and Rationale to do the Project • Reduce electricity use for space heat in buildings. • Demonstrate a sustainable re-development of an industrial site, with a mix of residential, institutional and commercial activities centred around a transportation hub. canmetenergy.nrcan.gc.ca 2 Case Study: Lonsdale Energy Corporation Benefits Timeline and Status • Reduced greenhouse gas emissions by 21% relative to conventional design. 2004 • Reduction in local air pollution – 21% reduction in NOx. Feasibility work commenced Project Description (Neighbourhood Energy Utility – NEU) 2006 • The Lonsdale Energy Corporation is a heating only system. LEC start-up provided heat to Development of the system has occurred incrementally as 2 buildings on the Lower Lonsdale redevelopment of the City’s waterfront has progressed. -

Community Energy and Emissions Plan City of North Vancouver

Community Energy and Emissions Plan City of North Vancouver Prepared for: Prepared by: April 6, 2010 (this page left blank to facilitate double sided printing) Page | 2 Acknowledgements This Plan was financed by the City of North Vancouver with support from BC Hydro. HB Lanarc was responsible for overall project management, analysis, strategic planning, and policy development with considerable contributions from the City‟s Project Steering Committee. The Plan benefitted from significant guidance and input from Council, community and staff. City of North Vancouver Mayor & Council Mayor Darrell Mussatto Councillor Pam Bookham Councillor Rod Clark Councillor Bob Fearnley Councillor Guy Heywood Councillor Craig Keating Councillor Mary Trentadue City Project Steering Committee Isabel Gordon* Director, Finance Mike Hunter Manager, Engineering, Planning and Design Caroline Jackson* Environmental Coordinator Larry Orr* Manager, Special Projects Doug Pope Deputy City Engineer Suzanne Smith* Planner Glenn Stainton* Manager, Civic Facilities and Vice President Operations, Lonsdale Energy Corp Richard White Director, Community Development * City of North Vancouver Climate Action Task Force Additional City of North Vancouver Staff Emilie Adin City Planner Tony Barber Manager, Engineering, Planning and Design Dragana Mitic Assistant City Engineer, Transportation Gary Penway Deputy Director, Community Development Connie Rabold Communications Manager Ben Themens Vice President of Finance and Corporate Affairs, Lonsdale Energy Corp Page | 3 Community -

Download Mini Transportation Review

2612 Lonsdale Apartments Mini Transportation Review DRAFT Version 1.0 Prepared for Tavan Developments Ltd. Date 5 May 2017 Project No. 6202-01 5 May 2017 6202-01 Troy Van Vliet Principal Tavan Developments Ltd. Unit 150 – 628 East Kent Avenue South Vancouver, BC V5X 0B2 Dear Troy: Re: 2612 Lonsdale Apartments Mini Transportation Review DRAFT Version 1 We are happy to provide this Mini Transportation Review in support of the proposed multifamily rental development at 2612 Lonsdale Avenue in North Vancouver The attached report has reviewed the transportation characteristics of the proposed development according to the Terms of Reference set out by the City of North Vancouver. The report ultimately finds that the proposed development is suitably designed to accommodate trips via a variety of modes, and that the development will have minimal impact on the neighbourhood’s transportation System. Yours truly, Bunt & Associates Brian Elery Phillips, MSC. EIT Dan Ross, CPEng. (NZ), MUP Transportation Analyst Senior Transportation Planner 6202-01 2612 Lonsdale Apartments | Mini Transportation Review | 5 May 2017 S:\PROJECTS\BP\6202-01 2612 Lonsdale Apartments\5.0 Deliverables\5.1 Draft Reports\20170421_6202-01_Lonsdale_Apts_RPT_v2.docx . 6202-01 2612 Lonsdale Apartments | Mini Transportation Review | 5 May 2017 S:\PROJECTS\BP\6202-01 2612 Lonsdale Apartments\5.0 Deliverables\5.1 Draft Reports\20170421_6202-01_Lonsdale_Apts_RPT_v2.docx TABLE OF CONTENTS 1. INTRODUCTION .................................................................................................