The Mobile Games Landscape in 2015 | Newzoo

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Miniclip Free Games to Download

Miniclip free games to download Downloadable Games. Play 3 Foot Ninja 3 Foot Ninja Download · Play 3FootNinja 2 3FootNinja 2 Download · Play Slacking Slacking Download · Play Alien. Play Free Online Games, fun games, puzzle games, action games, sports you can try the games for free on Miniclip and then download them to your iPhone. 8 Ball Pool - Miniclip, free and safe download. 8 Ball Pool - Miniclip latest version: Free and addictive Multiplayer Pool Game. 8 Ball Pool - Miniclip is one of. Download 8 Ball Pool - Miniclip for Windows now from Softonic: % safe Free pool game with realistic physics A Full Version Sport game for Windows. Top Download Free Games by , Free Online Games, Adventure Games, Shooting Games, Action Games, Arcade Games, Sports Games, Racing. Find Miniclip software downloads at CNET , the most games are extremely popular because they are fun, free, high quality. Miniclip Roll on Miniclip War on Angry Gran Toss Free Run, Free Kick Expert. Free Board, 3G Free Kick, Free Kicker, A Game About Kingdoms CCG. All Games from Miniclip. Games from Miniclip. Sorted by date | Sorted by total downloads | Sorted by last week downloads Miniclip Alien Attack Updated: 07/29/ Miniclip FREE GAMES DOWNLOAD - PC Games Free Download. How to Download Miniclip Games. You can download Miniclip games, free and legitimately. Downloading "Miniclip games" is simple to do on a computer or on. This video is showing how to Download Miniclip Games Link: If you want to use the. Free download. Vote: 1 2 3 4 5 As a single player "practice" game, 8 Ball Pool stands up quite well. -

Ubisoft® Reports Third Quarter 2014-15 Sales

Ubisoft® reports third quarter 2014-15 sales . Record third-quarter sales, coming in above target at €810 million . Targets for full-year 2014-15 updated Paris, February 12, 2015 – Today, Ubisoft released its sales figures for the fiscal quarter ended December 31, 2014. Sales Sales for the third quarter of 2014-15 came to €809.7 million, up 55.8% (or 49.5% at constant exchange rates) compared with the €519.7 million recorded for third-quarter 2013- 14. For the first nine months of fiscal 2014-15, sales totaled €1,293.9 million versus €813.0 million in the corresponding prior-year period, representing an increase of 59.2% (or 58.3% at constant exchange rates). The third-quarter sales figure was higher than the target of approximately €730 million announced when Ubisoft released its first-half 2014-15 results. This performance reflects: . A sharp increase in market share to 12.8%1 for 2014 (from 9.6% in 2013). A very good performance delivered by the two Assassin’s Creed® opuses, Far Cry® 4 and The Crew®, with respective sales of 10 million, 7 million and 2 million units (sell- in): Far Cry 4 was voted “Best Shooter” at "The Games Awards 2014". Assassin’s Creed Unity won the prize for best “Character Animation in a Video Game” at the Annie Awards. To date, The Crew has recorded the best sales1 for the racing games released in late 2014. A solid showing from Just Dance® with 4 million units sold (sell-in). The continued success of Watch Dogs®, with 10 million units sold (sell-in) since its release. -

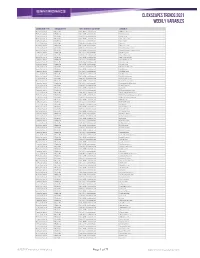

Clickscapes Trends 2021 Weekly Variables

ClickScapes Trends 2021 Weekly VariableS Connection Type Variable Type Tier 1 Interest Category Variable Home Internet Website Arts & Entertainment 1075koolfm.com Home Internet Website Arts & Entertainment 8tracks.com Home Internet Website Arts & Entertainment 9gag.com Home Internet Website Arts & Entertainment abs-cbn.com Home Internet Website Arts & Entertainment aetv.com Home Internet Website Arts & Entertainment ago.ca Home Internet Website Arts & Entertainment allmusic.com Home Internet Website Arts & Entertainment amazonvideo.com Home Internet Website Arts & Entertainment amphitheatrecogeco.com Home Internet Website Arts & Entertainment ancestry.ca Home Internet Website Arts & Entertainment ancestry.com Home Internet Website Arts & Entertainment applemusic.com Home Internet Website Arts & Entertainment archambault.ca Home Internet Website Arts & Entertainment archive.org Home Internet Website Arts & Entertainment artnet.com Home Internet Website Arts & Entertainment atomtickets.com Home Internet Website Arts & Entertainment audible.ca Home Internet Website Arts & Entertainment audible.com Home Internet Website Arts & Entertainment audiobooks.com Home Internet Website Arts & Entertainment audioboom.com Home Internet Website Arts & Entertainment bandcamp.com Home Internet Website Arts & Entertainment bandsintown.com Home Internet Website Arts & Entertainment barnesandnoble.com Home Internet Website Arts & Entertainment bellmedia.ca Home Internet Website Arts & Entertainment bgr.com Home Internet Website Arts & Entertainment bibliocommons.com -

Roventure- an Endless Runner Game

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056 Volume: 08 Issue: 05 | May 2021 www.irjet.net p-ISSN: 2395-0072 Roventure- An Endless Runner Game Purva Tekade[1], Bhavika Thakre[2], Kanaka Golwalkar[3], Anshuli Nikhare[4], Darshan Surte[5] [1-5]Student, Department of Information Technology, S.B. Jain Institute of Technology, Management and Research, Nagpur, India -------------------------------------------------------------------------***------------------------------------------------------------------------ Abstract: Endless Runners feature a perpetually moving character that players should navigate around obstacles. These games might feature levels with a beginning and end, or they will ne'er finish, however the most issue may be a character that ne'er stops moving, timing, and manual dexterity. The most object of the bulk of Endless Runners is to urge as much as attainable in an exceedingly level. Several Endless Runner games frequently generate an infinite quantity of 1 level. All Endless Runners feature confirmed momentum. We explore the consequences of pace of an endless runner game on user performance, preference, enjoyment, and engagement in stationary Platform settings (while walking). Index Terms— Endless runner, Roventure, Unity3D, real time, intensive competitiveness, assets. I. Introduction is based on Runner, a single player running game platform developed and maintained by Intelligent Along with the growth of digital technology, game Computer Entertainment Laboratory, Ritsumeikan industries have entered a stage of rapid development. We University. Runner is a running game, in which the are developing a game application Roventure. player character is continuously moving forward through an endless game world. Two important ‘Roventure’ is an endless runner game application. For elements in the game are traps and coins. -

'S Assassin's Creed® Rogue

ALLEGIANCES CHANGE AND REVENGE RULES IN UBISOFT®’S ASSASSIN’S CREED® ROGUE Be the Ultimate Assassin Hunter this November PARIS, FRANCE — August 5, 2014 — Today, Ubisoft® announced that Assassin’s Creed® Rogue, an exciting new installment in the franchise currently in development for the Xbox 360 video game and entertainment system from Microsoft and the PlayStation®3 computer entertainment system, will be available November 11. Assassin’s Creed Rogue is being developed by Ubisoft Sofia, in collaboration with Ubisoft’s Singapore, Montreal, Quebec, Chengdu, Milan and Bucharest studios. Set in the middle of the 18th century during the Seven Years War, Assassin’s Creed Rogue gives players new locations across North America to explore, including the frozen North Atlantic, the Appalachian River Valley and New York. In Assassin’s Creed Rogue, players experience the Assassin’s Creed universe through the eyes of a Templar. As Shay Patrick Cormac, players suffer the brotherhood’s betrayal and transform into an Assassin hunter. The acclaimed naval components from previous Assassin’s Creed games have been enhanced in Assassin’s Creed Rogue. The game also gives players new weapons to use on both land and sea in pursuit of taking down the Assassins, including a new ship called the Morrigan. “We know that there are many Assassin’s Creed fans with Xbox 360 and PlayStation 3 consoles who want to get their hands on a new Assassin’s Creed game this year,” says Martin Capel, game director, Ubisoft Sofia. “Assassin’s Creed Rogue completes the North American saga started with Assassin’s Creed® III and Assassin’s Creed® IV Black Flag™ and gives previous- generation console owners an exclusive opportunity to experience fan-requested features, such as playing as a Templar.” “The Assassin’s Creed series is a staple within the gaming industry, driving gamers to GameStop stores with each new release,” said Bob Puzon, GameStop’s senior vice president of merchandising. -

Ubisoft Opens New Office in Mexico

UBISOFT EXPANDS TO MEXICO, ANNOUNCES ELECTRONIC GAMES SHOW LINEUP Opens New Office to Strengthen Video Game Business in High-Growth Region Paris, FRANCE – October 25, 2006 – Today Ubisoft, one of the world’s largest video game publishers, announced the opening of a new business office in Mexico City, Mexico. The new office opens with a core team that will focus on establishing business relationships to help increase Ubisoft’s market share in Mexico. Etienne-Charles Nobert, Ubisoft’s Latin American area manager, will spearhead operations in the new location and will report to Olivier Ernst, general manager of Ubisoft operations in Canada and Latin America. Ubisoft will be present at the Electronic Games Show (EGS) at the World Trade Center in Mexico City from October 27 through 29. With over 30,000 people expected to attend, EGS is the most important games event in Latin America. Ubisoft will present some of this year’s most anticipated titles on its booth: • Red Steel ™ (first-person action, presented on the Wii™): The only original first-person game built from the ground up for Wii launch. • Rayman: Raving Rabbids ™ (action-adventure, presented on the Wii) Rayman® is back to fight crazed bunnies in this legendary series that has sold 17 million copies worldwide. • Tom Clancy’s Splinter Cell Double Agent™ (spy action, presented on the Wii): An amazing new installment in this series that has already sold 14 million units worldwide. • Open Season ™ (kids action-adventure, presented on the PlayStation®2 computer entertainment system): The video game adaptation of Sony Pictures Animation’s eagerly awaited first CGI movie. -

Brief Industry Trends Report 2H 2008

ISSN 1985 - 7535 Brief Industry Trends Report 2H 2008 Malaysian Communications and Multimedia Commission (SKMM), 2009 The information or material in this publication is protected under copyright and save where otherwise stated, may be reproduced for non commercial use provided it is reproduced accurately and not used in a misleading context. Where any material is reproduced, SKMM as the source of the material must be identified and the copyright status acknowledged. The permission to reproduce does not extend to any information or material the copyright of which belongs to any other person, organisation or third party. Authorisation or permission to reproduce such information or material must be obtained from the copyright holders concerned. This work is based on sources believed to be reliable, but SKMM does not warrant the accuracy or completeness of any information for any purpose and cannot accept responsibility for any error or omission. Published by: Malaysian Communications and Multimedia Commission Off Persiaran Multimedia 63000 Cyberjaya, Selangor Darul Ehsan Tel: +60 3 86 88 80 00 Fax: +60 3 86 88 10 06 Toll Free: 1- 800-888-030 http://www.skmm.gov.my CONTENTS FOREWORD 2 SUMMARY HIGHLIGHTS 3 C&M MARKET CAPITALISATION AND PERFORMANCE Feeling the Effects of Global Financial Crisis 4 C&M Market Capitalisation Plummeted Significantly 6 Individual C&M Companies Contribution to Bursa Malaysia 7 C&M Companies Share Price Movements 7 C&M Amongst Other Heavyweights 8 Local C&M versus Overseas by Market Capitalisation in US Dollar 9 GOOGLE -

Disruptive Innovation and Internationalization Strategies: the Case of the Videogame Industry Par Shoma Patnaik

HEC MONTRÉAL Disruptive Innovation and Internationalization Strategies: The Case of the Videogame Industry par Shoma Patnaik Sciences de la gestion (Option International Business) Mémoire présenté en vue de l’obtention du grade de maîtrise ès sciences en gestion (M. Sc.) Décembre 2017 © Shoma Patnaik, 2017 Résumé Ce mémoire a pour objectif une analyse des deux tendances très pertinentes dans le milieu du commerce d'aujourd'hui – l'innovation de rupture et l'internationalisation. L'innovation de rupture (en anglais, « disruptive innovation ») est particulièrement devenue un mot à la mode. Cependant, cela n'est pas assez étudié dans la recherche académique, surtout dans le contexte des affaires internationales. De plus, la théorie de l'innovation de rupture est fréquemment incomprise et mal-appliquée. Ce mémoire vise donc à combler ces lacunes, non seulement en examinant en détail la théorie de l'innovation de rupture, ses antécédents théoriques et ses liens avec l'internationalisation, mais en outre, en situant l'étude dans l'industrie des jeux vidéo, il découvre de nouvelles tendances industrielles et pratiques en examinant le mouvement ascendant des jeux mobiles et jeux en lignes. Le mémoire commence par un dessein des liens entre l'innovation de rupture et l'internationalisation, sur le fondement que la recherche de nouveaux débouchés est un élément critique dans la théorie de l'innovation de rupture. En formulant des propositions tirées de la littérature académique, je postule que les entreprises « disruptives » auront une vitesse d'internationalisation plus élevée que celle des entreprises traditionnelles. De plus, elles auront plus de facilité à franchir l'obstacle de la distance entre des marchés et pénétreront dans des domaines inconnus et inexploités. -

GAMING GLOBAL a Report for British Council Nick Webber and Paul Long with Assistance from Oliver Williams and Jerome Turner

GAMING GLOBAL A report for British Council Nick Webber and Paul Long with assistance from Oliver Williams and Jerome Turner I Executive Summary The Gaming Global report explores the games environment in: five EU countries, • Finland • France • Germany • Poland • UK three non-EU countries, • Brazil • Russia • Republic of Korea and one non-European region. • East Asia It takes a culturally-focused approach, offers examples of innovative work, and makes the case for British Council’s engagement with the games sector, both as an entertainment and leisure sector, and as a culturally-productive contributor to the arts. What does the international landscape for gaming look like? In economic terms, the international video games market was worth approximately $75.5 billion in 2013, and will grow to almost $103 billion by 2017. In the UK video games are the most valuable purchased entertainment market, outstripping cinema, recorded music and DVDs. UK developers make a significant contribution in many formats and spaces, as do developers across the EU. Beyond the EU, there are established industries in a number of countries (notably Japan, Korea, Australia, New Zealand) who access international markets, with new entrants such as China and Brazil moving in that direction. Video games are almost always categorised as part of the creative economy, situating them within the scope of investment and promotion by a number of governments. Many countries draw on UK models of policy, although different countries take games either more or less seriously in terms of their cultural significance. The games industry tends to receive innovation funding, with money available through focused programmes. -

Download on Our Platform and We Have Obtained Licenses from Many Content Providers

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 20-F (Mark One) ¨ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 or x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2013. or ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to or ¨ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report Commission file number: 000-51469 Baidu, Inc. (Exact name of Registrant as specified in its charter) N/A (Translation of Registrant’s name into English) Cayman Islands (Jurisdiction of incorporation or organization) Baidu Campus No. 10 Shangdi 10th Street Haidian District, Beijing 100085 The People’s Republic of China (Address of principal executive offices) Jennifer Xinzhe Li, Chief Financial Officer Telephone: +(86 10) 5992-8888 Email: [email protected] Facsimile: +(86 10) 5992-0000 Baidu Campus No. 10 Shangdi 10th Street, Haidian District, Beijing 100085 The People’s Republic of China (Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered American depositary shares (ten American depositary shares representing one Class A ordinary share, The NASDAQ Stock Market LLC par value US$0.00005 per share) (The NASDAQ Global Select Market) Class A ordinary shares, par value US$0.00005 per share* The NASDAQ Stock Market LLC (The NASDAQ Global Select Market) * Not for trading, but only in connection with the listing on The NASDAQ Global Select Market of American depositary shares. -

Australia India Institute Volume 20, February 2021 Fostering

Australia India Institute Volume 20, February 2021 Fostering Opportunities in Video Games between Victoria and India Dr Jens Schroeder Fostering Opportunities in Video Games between Victoria and India The Australia India Institute, based at The University of Melbourne, is funded by Australian Government Department of Education, Skills and Employment, the State Government of Victoria and the University of Melbourne. Video games are booming all over the world, during the COVID-19 pandemic more than Summary ever. Australia and India are no exceptions. This policy brief focuses on the opportunities for both Indian and Victorian game developers and educators in the context of the Victorian government's support for its creative industries. Based on desk research and discussions at the Victoria-India Video Games Roundtable conducted on 8 December 2020 by the Australia India Institute in collaboration with Creative Victoria and Global Victoria, this report identified the following avenues for collaboration: • Access to complementary expertise and talent in both countries • Joint education programs and exchanges • Victorian game developers working with Indian partners to adapt their games to the Indian market and its complexities and challenges Video games1 are one of the world's largest and fastest-growing entertainment and media Introduction industries. In Australia, Victoria is the hotspot for game development. With 33% of all studios and 39% of all industry positions,2 more studios call Victoria home than any other state in Australia. Meanwhile, India's smartphone penetration has skyrocketed to the point where the country has become the world's most avid consumer of mobile gaming apps. This policy brief sets out to explore how Victoria-based game developers and educators can take advantage of this emerging market and the opportunities it presents. -

The First Meaning Is the Holder of the Precious Thing and Literally Translates to “Gourd”, the Second Meaning Is “Interactive Recording”

1. The name of this website comes from two Mandarin Chinese words : the first meaning is the holder of the precious thing and literally translates to “gourd”, the second meaning is “interactive recording”. We saw both definitions highly relevant to our mission. Which website? Hulu 2. The term was first coined in 1996 by a member of The Cult of The Dead Cow. The term is defined as “the use of legal and/or illegal digital tools in pursuit of political ends”: Hactivism (Hacking+ Activism) 3. Petition to include X among the UNESCO’s world heritage site, will become first digital entry in the prestigious UNESCO list, a masterpiece of human creative genius and also of universal human value: Wikipedia 4. Tie-ins via 3 games- 2010 Haiti Earthquake Relief Fund; Virtual Sugar Beets were available for purchase; October 2009- players to contribute to charitable causes: Zinga 5. Trademark owned by Hormel Foods Corporation; Approx 80 to 85% of all emails fall in this category; Digital Equipment Corporation Computers- Gery Thoerk- ARPANET-1975: Spam 6. Mike Muuss-1983- Troubleshoot; Utility-Reach ability of a host; Blogging-XML-RPC based push mechanism – updates: Ping 7. Launched in 1997: Most User Friendly Website acc to JuxtConsult 2008 ; Anupam Mittal; World’s largest matrimonial website: Shaadi.com 8. Ward Cunningham; Hawaiian-Fast or Quick; Users can add, modify or delete content: Ward Cunningham, the developer of the first wiki software, WikiWikiWeb, originally described it as "the simplest online database that could possibly work". 9. President & CEO is Satoru Iwata; Card Company 1889; Leave Luck to Heaven: Nintendo of America 10.