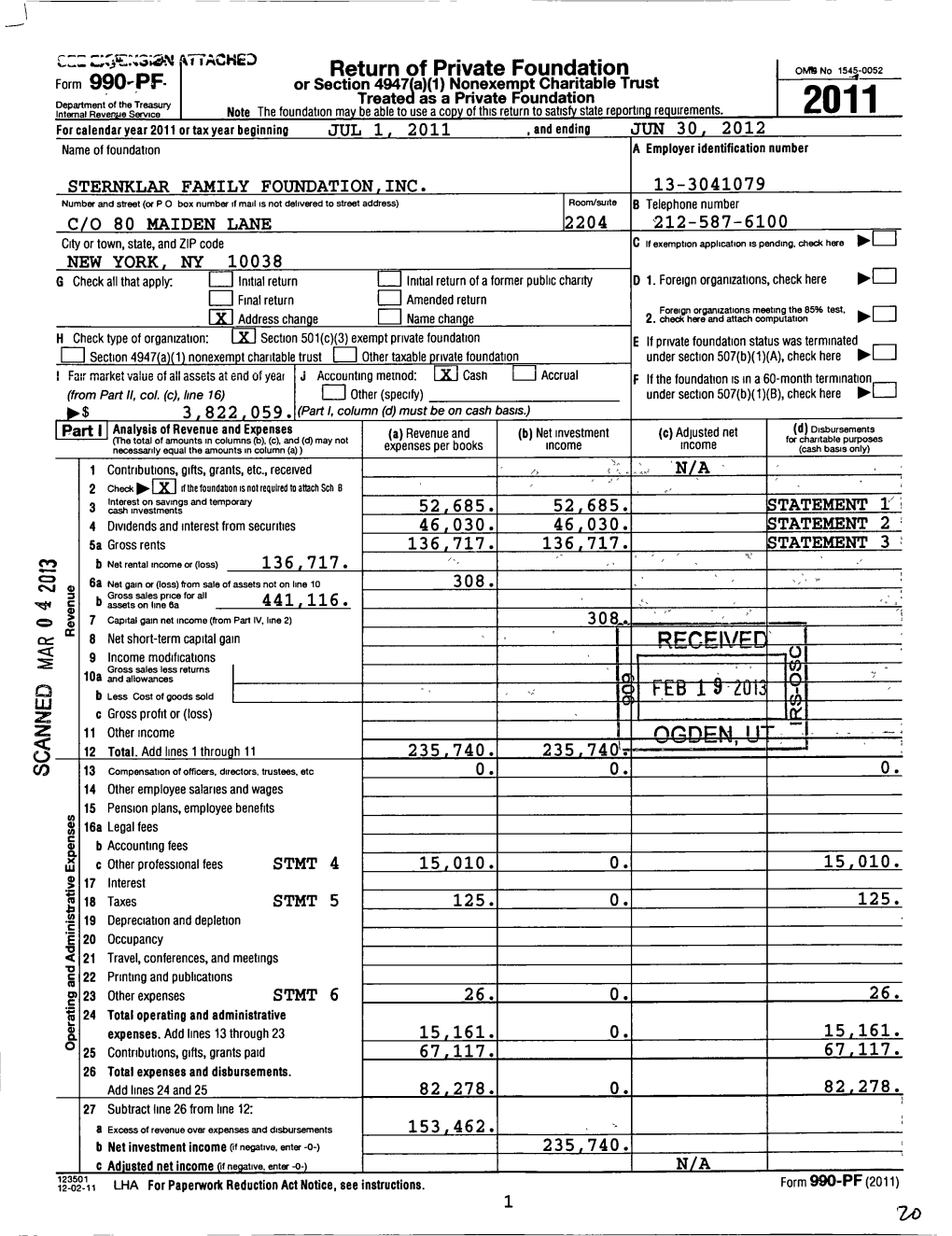

C/O 80 Maiden Lane 2204 212-587-6100 $ 52 , 685. 52 , 685

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Introduction

Introduction Forty Years with the Jews of Harlem— the Old and the Renewed In the spring of 2002, David Dunlap, architecture columnist for the New York Times, came to my office to discuss an article he was com- posing about a lost and forgotten Jewish community. The subject of his investigation was Harlem. I was taken aback by the idea that a New York Jewish settlement that once had housed close to 175,000 Jews was not remembered. After all, I had written my first book, When Harlem Was Jewish, 1870– 1930, in 1978. And for more than the next quarter century, I had reminded everyone who would hear me out— fellow academicians and the general public alike— how important the com- munity had been in the history of Gotham. I argued everywhere that the saga of immigrant Jewish life and advancement in the metropolis during the early decades of the prior century was incomplete without considering Harlem. One of the prime intellectual conceits was that a complex set of forces motivated Jewish relocation from one area of the city to the next and greatly influenced the types of group identifica- tions that were maintained. Prior historians had not been sensitive to the reality that downtown—that is, the Lower East Side—and uptown alike were home, at least after 1900, to both poor and more affluent Jews. Previous scholars also had not discussed how these two sibling communities likewise included both acculturated Jews and those who were just starting to learn American ways. Indeed, the fact was that more immigrants and their children moved to Harlem, or were pushed out of the so-called “ghetto,” before they achieved financial success than as a sign that they had begun to make it in America. -

Conference P14 Art P3 Wellness P8 2 AUGUST 21, 2019 • MANHATTAN TIMES • in Living Color Hese Walls Do Speak

AUGUST 21 - AUGUST 27, 2019 • VOL. 20 • No. 33 WASHINGTON HEIGHTS • INWOOD • HARLEM • EAST HARLEM NORTHERN MANHATTAN’S BILINGUAL NEWSPAPER EL PERIODICO BILINGUE DEL NORTE DE MANHATTAN NOW EVERY WEDNESDAY TODOS LOS MIERCOLES Hailing Hartman p7 Canto de Hartman p7 Photo: Gregg McQueen Conference p14 Art p3 Wellness p8 2 AUGUST 21, 2019 • MANHATTAN TIMES • www.manhattantimesnews.com In Living Color hese walls do speak. Ray “Sting Ray” Rodríguez dubbed the concrete walls of the now Jackie Robinson T The Graffiti Hall of Fame (GHOF) Educational Complex’s schoolyard the started in the El Barrio section of East “GHOF,” and it has been attracting some of Harlem, at a playground on the corner of the best street artists in the world for more 106th Street and Park Avenue. than 30 years. It was a local meet up for graffiti writers Much of the contemporary street art from around the city as a place to hang out origins began within the GHOF’s four walls, An artist touches up his piece. and exchange tales of subway bombing runs and the pieces there reflect the vision of many VASE, SPHERE, NOVER, PHETUS, (painting expeditions). The walls of the pioneers who laid the foundation to mural art. opportunity for artists around the globe to CHRISRWK, HEK TAD, SHIRO, MODUS, playground served as a safe haven to practice As the face of the city changes, GHOF come and paint. DONTAY TC5, AND OTHERS and test new skills and forge relationships. supporters have continued to host an annual Among those expected this weekend on Looking to formally establish this place event at which fans gather to celebrate the art August 24th and 25th to participate are TATS For more information and tickets, where graffiti artists could hone their craft form, its history and its artists. -

AIA NJ Ambassador Tour to Cuba

The Quarterly Newsletter for the Architects League of Northern New Jersey Leagu elin e 3Q 3Q.2014 www.alnnj.org AIA NJ CUBA President’s Column This year is moving Joe David hosted another spectacular Ted THE ARCHITECTS LEAGUE by fast! Kessler Walking Tour of Upper Manhattan OF NORTHERN NEW JERSEY on Sunday, May 18th; sites included Many architects have RUTH A. BUSSACCO, AIA Cathedral Church of St. John the Divine, asked what does the PRESIDENT AIA do for ME? On the General Grant National Monument and the George Washington Bridge! Thanks to PAUL S. BRYAN, AIA local level there are PRESIDENT-ELECT meetings and events one of our members, we were fortunate to be welcomed inside of the Old Broadway RALPH ROSENBERG, AIA offered by the ALNNJ. Just look at the FIRST VICE PRESIDENT events that have already taken place Synagogue for a tour. If you haven’t taken the opportunity to attend one of the KENNETH P. MIHALIK, AIA and those yet to come! AIA-NJ acts as SECRETARY our liaison with National, provides COTE, Kessler walking tours, you are missing out on a great afternoon of NYC architecture. Bryan PENNINGTON, AIA Disaster Response training, assists emerg- TREASURER ing professionals and tends to Legislative At our June meeting we hosted the winners R. Terry DURDEN, AIA & Government Affairs (LG&A), in addition of our Scholarships and their families. PAST PRESIDENT to various other programs. AIA National The Board would like to thank the dinner advocates for the profession on many sponsors who covered the dinner cost TRUSTEES 2014 levels, including student loan relief – of the Award winners. -

HEBREW on CAMPUS: WHY a TOUGH SELL? Ari L

critical/constructive VOLUME 16 NUMBER 2 / WINTER 2015 IN THIS ANALYSIS: Missed HebrewH on Transcultural Art: ISSUE: Opportunities for CCampus: A Mosaic of Indian, Jewish Life in WWhy a American and Renewed Urban TTough Sell? Jewish Motifs Neighborhoods ARIA L. GOLDMAN SIONA BENJAMIN STEVEN I. WEISS CRITICAL / CONSTRUCTIVE Introducing the new CONTACT VOLUME 16, NUMBER 2 / WINTER 2015 elcome to the relaunch of CONTACT, the magazine of The Steinhardt Foundation for Jewish Life that provides critical Eli Valley and constructive commentary on the Jewish community. Editor W In its sixteen years of existence, CONTACT has offered a Ari L. Goldman Editorial Consultant forum for leaders and academics to assess programs and trends in the Jewish Erica Coleman world. Starting with this, our fifty-third issue, CONTACT will add Copy Editor journalistic pieces to the mix in an effort to investigate, isolate and uncover Yakov Wisniewski problems and potential solutions. We feel that the addition of independent Design Director voices calling out inefficiency, waste and missed opportunities will help make CONTACT a compelling force for change in the community. THE STEINHARDT FOUNDATION In addition, while in the past CONTACT was a journal devoted to a different FOR JEWISH LIFE theme in each edition, the new CONTACT will explore a range of topics. It will feature at least four sections dedicated to various aspects of Jewish life Michael H. Steinhardt Chairman today: LANDSCAPE, the structures of Jewish institutional life and borders of Sara Berman practice; LANGUAGE, the historic and current vernacular of Jewish Vice Chair expression; LIVES, personal profiles of people forging individual paths Rabbi David Gedzelman towards Jewish engagement; and LAYERS, the art, culture and joy that President and CEO defines Jewish creativity today. -

Exploring Interfaith Bringing People and Places Together

COMMON VolumeBOND 30, Number 1, Summer 2020 10thANNIVERSARY ISSUE Celebrating All Faiths: A Decade of Sacred Sites Open House Visit Sites Program nylandmarks.org A Sacred Exploring Interfaith Bringing people and places together Inside: Preservation Partnerships | Worship during COVID-19 | Restoration of Hope | Moslem Mosque | Preservation in Québec | Diverse Restorations | Fire Protection | Accessibility| 2019 Grants Common Bond is the technical From the President journal of the Sacred Sites Program of the NY Landmarks Conservancy. The New York Landmarks Dear Friends, Conservancy’s Sacred Sites Program offers congregations TABLE OF CONTENTS We hope you are safe and well and throughout New York State adjusting to our new reality. We financial and technical assistance understand what a difficult time this to maintain, repair, and restore their is for congregations. Our annual buildings. In addition to providing 02 The Robert David Lion Gardiner Foundation, Inc. – A Sacred Sites Open House is an op- hundreds of thousands of dollars Funding Partnership for Long Island’s Sacred Sites portunity to let your communities in matching grants each year, the By Mari S. Gold know about your history and your Conservancy offers technical help, social service and cultural programs. workshops for building caretakers, Because of the current circumstanc- and publications. 10 Worship in the time of COVID-19: es, this year’s Open House, our 10th Anniversary, will take place virtually, Editor: Ann-Isabel Friedman How Some NY Congregations are Responding throughout the month of August, Contributors: Mari S. Gold, Claire By Mari S. Gold allowing us to share New York’s extraordinary houses of worship with Cancilla, Chris Marrion, Emily Sottile, a global audience. -

Chapter 3: Land Use, Zoning, and Public Policy

Chapter 3: Land Use, Zoning, and Public Policy A. INTRODUCTION This chapter examines the Proposed Actions’ effects on land use and development trends, their compatibility with surrounding land use, and their consistency with public land use and zoning policies. As described in Chapter 1, “Project Description,” the Proposed Actions recognize the need for redevelopment to support the revitalization of the Manhattanville section of West Harlem. The Proposed Actions include a rezoning and related land use approvals to permit new land uses and a broader range of uses than currently allowed under the existing zoning and would require the adoption of a General Project Plan (GPP). Because the Proposed Actions involve the rezoning of a sizable area in Manhattanville in West Harlem, this chapter provides an assessment of existing and future conditions with and without the Proposed Actions for three separate study areas: the Project Area, the primary study area, and the secondary study area. These three study areas are described in further detail below. PRINCIPAL CONCLUSIONS As described in greater detail below, the Proposed Actions would improve conditions in the Project Area, would not result in significant adverse impacts on land use and zoning, and would be consistent with public policies for the Project Area, primary study area, and secondary study area. The floor area ratio (FAR) and use restrictions under the current zoning are not conducive to redevelopment and economic growth. The Proposed Actions are intended to provide the zoning and land use changes needed to revitalize this section of West Harlem and to allow Columbia University to develop a new Academic Mixed-Use Development for Columbia’s long- term growth needs. -

A Tribute to Rabbi Jacob Kret {1909-2007}

Profile The Diminutive Giant: A TRIBUTE TO RABBI JACOB KRET {1909-2007} Photo courtesy of Norman Kret By Chava Willig Levy o,when are you hannouncing?” from the moment my husband-to-be, largest Jewish community. But when “She asked me. soon after we began dating, introduced Rabbi Kret became its spiritual leader in I loved talking with—and listen- us on February 26, 1983. (He asked 1950, he struggled mightily just to ing to—Rabbi Kret. There were superfi- when we were hannouncing eight round up a minyan, or quorum of ten cial reasons for this: As a wheelchair weeks later.) men, for services. His smile never left user accustomed to speaking to people’s him. He was happy to be alive. stomachs, I found it a pleasure to con- An eyewitness to World War II verse with Rabbi Jacob Kret, who meas- “The Krets’ hospitality (and World War I, for that matter), ured little over five feet tall. Talking Rabbi Kret lost his parents and all of his with him meant never having to strain taught me a fundamental siblings—in fact, over 120 close rela- to gaze at his face. And as a wordsmith, truth: Some people have tives—to Hitler’s henchmen. A brilliant I was amused by his fractured English everything and give noth- Talmudic scholar, he shepherded his (in one sermon, he referred to a tele- Polish yeshivah eastward, always one scope as a microphone) and counter- ing; others have nothing step ahead of the Nazis’ claws. In 1940, Cockney accent (or, as he would have and give everything.” he was imprisoned and sent to a forced called it, haccent). -

Congressional Record United States Th of America PROCEEDINGS and DEBATES of the 112 CONGRESS, FIRST SESSION

E PL UR UM IB N U U S Congressional Record United States th of America PROCEEDINGS AND DEBATES OF THE 112 CONGRESS, FIRST SESSION Vol. 157 WASHINGTON, MONDAY, NOVEMBER 7, 2011 No. 169 House of Representatives The House met at 10 a.m. and was THE JOURNAL ceived October 27, 2011, pursuant to 5 U.S.C. 801(a)(1)(A); to the Committee on Agri- called to order by the Speaker pro tem- The SPEAKER pro tempore. The pore (Mr. UPTON). culture. Chair has examined the Journal of the 3768. A letter from the Assistant Secretary, f last day’s proceedings and announces Department of Defense, transmitting a re- to the House his approval thereof. port entitled, ‘‘Combating Terrorism Activi- DESIGNATION OF THE SPEAKER Pursuant to clause 1, rule I, the Jour- ties FY 2012 Budget Estimates’’; to the Com- PRO TEMPORE nal stands approved. mittee on Armed Services. 3769. A letter from the Secretary, Depart- The SPEAKER pro tempore laid be- f ment of Health and Human Services, trans- mitting a report entitled ‘‘Performance fore the House the following commu- PLEDGE OF ALLEGIANCE nication from the Speaker: Evaluation of Accreditation Bodies under The SPEAKER pro tempore. The the Mammography Quality Standards Act of WASHINGTON, DC, Chair will lead the House in the Pledge 1992 as amended by the Mammography Qual- November 7, 2011. ity Standards Reauthorization Acts of 1998 I hereby appoint the Honorable FRED of Allegiance. The SPEAKER pro tempore led the and 2004’’ covering the year 2011; to the Com- UPTON to act as Speaker pro tempore on this mittee on Energy and Commerce. -

YCJC-Newsletter-Aug-2010

August 2010/5770 WWW.ETZCHAIMME.ORG York County Jewish Community News Congregation Etz Chaim The Mulcahy sisters (above) and Shona and Sam Workman (right) at the Hebrew School party at Pizza Hut Maia’s Bat Mitzvah: August 7 Making it in Maine: Jewish stories from the Pine Tree State Inside this issue: by David Freidenreich Making it in Maine 1 Bar/Bat Mitzvahs Free Jewish Books 2 Please join David Freidenreich, of Colby College, on Library Info Thursday, November 11, 7:00 p.m., for an evening of stories depicting Jewish experiences in Maine, from the mid- Confirmation Class 3 nineteenth century until today. Teen Trip to NY 4 Prof. Freidenreich, one of the only academic scholars Graduating from Teen Class 5 researching Jewish life in Maine, will offer a framework for From her Diary understanding our state's rich Jewish history, illustrating it with anecdotes from around the state. Custom of Aliyos Auctioning 6 Whether you're a native Mainer or a recent arrival Know Judaism - Florence 7 from away, come prepared to contribute your own stories to Melton Adult Mini-School this mosaic! All are welcome at this free event, which has coming been made possible by funding from the Legacy Heritage David Freidenreich Jewish Studies Project. High Holidays 2010 8 Sunday School Note So, What’s Nu? Mikvat Shalom 9 $$$$$$$$$$$$$$$$$$$$$$$$$$$ Bar/Bat Mitzvahs Sunday School 2010-11 10 You could save trees & August 7 Maia Mulcahy money by receiving your Holiday Note - Mazel Tov Maia! Well done. newsletter & all Jewish They’re Dying to be Admitted 11 community announcements October 16 Sandra Moreau Hebrew School electronically. -

Complex Networks of Urban Environments

Springer Complexity Springer Complexity is an interdisciplinary program publishing the best research and academic-level teaching on both fundamental and applied aspects of complex systems – cutting across all traditional disciplines of the natural and life sciences, engineering, economics, medicine, neuroscience, social and computer science. Uses Complex Systems are systems that comprise many interacting parts with the abil- ity to generate a new quality of macroscopic collective behavior the manifestations of which are the spontaneous formation of distinctive temporal, spatial or functional structures. Models of such systems can be successfully mapped onto quite diverse “real-life” situations like the climate, the coherent emission of light from lasers, chemical reaction-diffusion systems, biological cellular networks, the dynamics of stock markets and of the internet, earthquake statistics and prediction,Educational freeway traf- fic, the human brain, or the formation of opinions in social systems, to name just some of the popular applications. For Although their scope and methodologies overlap somewhat, one can distinguish the following main concepts and tools: self-organization, nonlinear dynamics, syn- ergetics, turbulence, dynamical systems, catastrophes, instabilities, stochastic pro- cesses, chaos, graphs and networks, cellular automata, adaptive systems, genetic al- gorithms and computational intelligence. The two major book publication platforms of the Springer Complexity program are the monograph series “Understanding Complex -

Chapter 8: Historic Resources

Chapter 8: Historic Resources A. INTRODUCTION This chapter analyzes the potential of the Proposed Actions to impact historic resources, which include both archaeological and architectural resources. The Proposed Actions would result in the rezoning of the approximately 35-acre Project Area, which was predominantly developed in the early 20th century and contains a number of notable, undesignated historic structures. Several of these resources are located in the Academic Mixed-Use Area (Subdistrict A), the 17 acres to be redeveloped by Columbia. To understand fully historic issues and to prepare a comprehensive historic resources analysis, Columbia has consulted with the New York State Office of Parks, Recreation and Historic Preservation (OPRHP) and the New York City Landmarks Preservation Commission (LPC). The historic resources analysis has been prepared in accordance with City Environmental Quality Review (CEQR), the State Environmental Quality Review Act (SEQRA), and the New York State Historic Preservation Act of 1980 (SHPA). These laws and regulations require that City and State agencies, respectively, consider the impacts of their actions on historic properties. This technical analysis follows the guidance of the 2001 CEQR Technical Manual. The CEQR Technical Manual recommends that an analysis of archaeological resources be undertaken for actions that would result in any in-ground disturbance. It also recommends that an architectural resources assessment be performed if a proposed action would result in any of the following (even if no known architectural resources are located nearby): new construction; physical alteration of any building; change in scale, visual context, or visual setting of any building, structure, object, or landscape feature; or screening or elimination of publicly accessible views. -

Page Project Title Program Address1 Program Address2 City State Zip

Project Title Program Address1 Program Address2 City State Zip Program Phone Program Contact County 09-10FundingSenator's NameMajority/MinorityAgency Code AstroCare Medical Center 22-44 119th Street College Point New York 11356 718-445-4700 Peggy Washington Kings (Brooklyn) $10,000 Adams Majority Health Bay Ridge Saint Patrick's Parade, Inc. PO BOX 233 7304 5th Avenue Brooklyn New York 11209 718-440-5775 Jack Malone Kings (Brooklyn) $5,000 Adams Majority AgMkts Black Equity Alliance 2 Park Avenue, 2nd Floor Brooklyn New York 10016 212-251-2480 Joyce S. Johnson New York (Manhattan) $10,000 Adams Majority DCJS Body Sculpt of New York, Inc. 487 East 49th Street Brooklyn New York 11203 718-346-5852 Vincent L. Ferguson Kings $15,000 Adams Majority Health Brooklyn Animal Foster Network 271 Stratford Rd. Brooklyn New York 11218 917-754-3537 Laurie Bleier Kings (Brooklyn) $5,000 Adams Majority Health Brooklyn Housing & Family Services, Inc. 415 Albemarle Road Brooklyn New York 11218 718-435-7585 Larry Jayson Kings (Brooklyn) $20,000 Adams Majority Housing Brooklyn Information & Culture (aka BRIC Arts/Media/Bklyn) 647 Fulton Street Brooklyn New York 11217 718-855-7882 Leslie G. Schultz Kings (Brooklyn) $10,000 Adams Majority Parks Brooklyn Institute of Arts & Sciences (Brooklyn Museum) 200 Eastern Parkway Brooklyn New York 11238 718-501-6332 Terri Jackson Kings (Brooklyn) $10,000 Adams Majority Parks Brooklyn Public Library 10 Grand Army Plaza Brooklyn New York 11238 718-230-2792 Brenda Bentt-Peters Kings (Brooklyn) $40,000 Adams Majority Educ Central Brooklyn Jazz Consortium, Inc. 1958 Fulton Street Brooklyn New York 11233 718-773-2252 Jitu K.