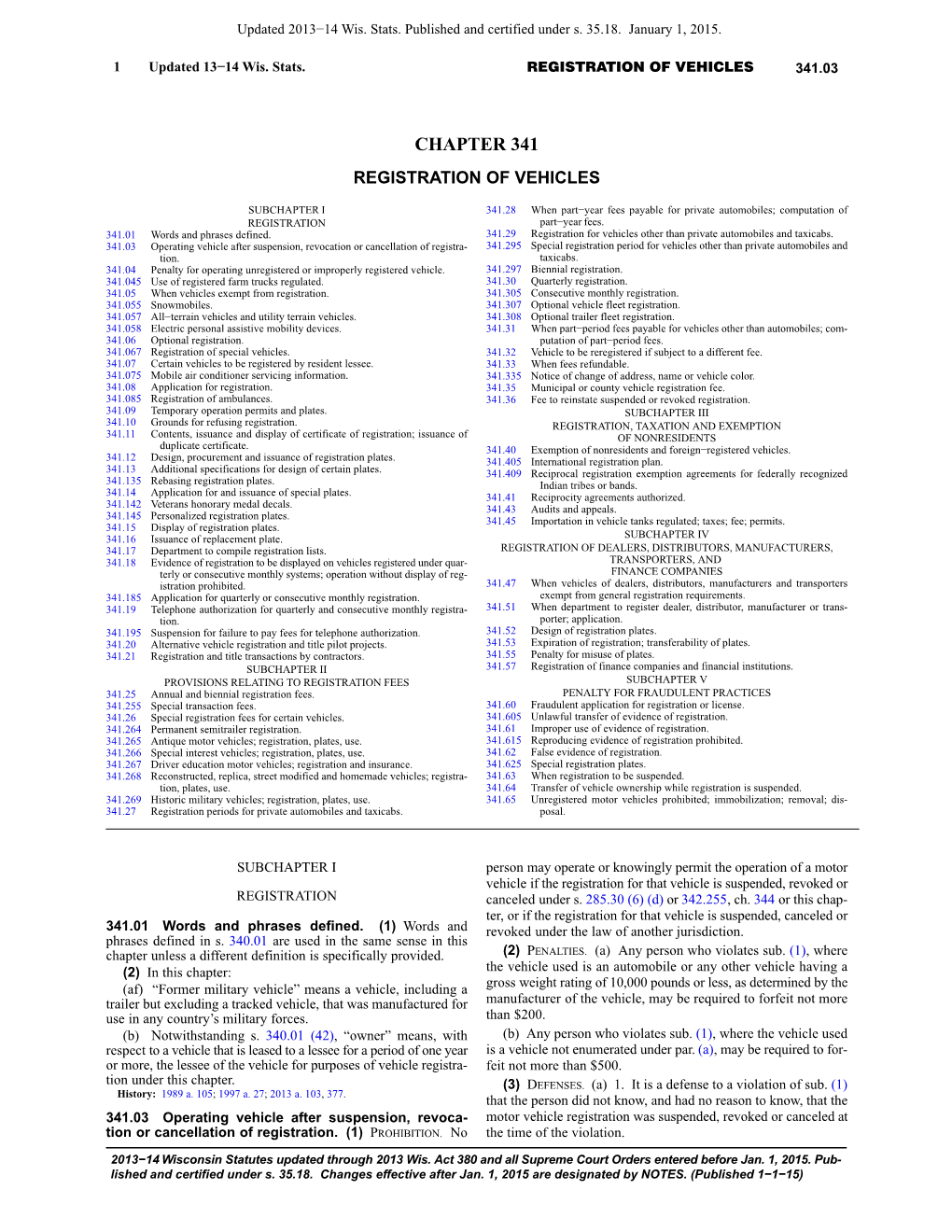

Chapter 341 Registration of Vehicles

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Department of Homeland Security Appropriations for Fiscal Year 2008

S. HRG. 110–36 DEPARTMENT OF HOMELAND SECURITY APPROPRIATIONS FOR FISCAL YEAR 2008 HEARINGS BEFORE A SUBCOMMITTEE OF THE COMMITTEE ON APPROPRIATIONS UNITED STATES SENATE ONE HUNDRED TENTH CONGRESS FIRST SESSION Department of Homeland Security Nondepartmental witnesses Printed for the use of the Committee on Appropriations ( Available via the World Wide Web: http://www.gpoaccess.gov/congress/index.html U.S. GOVERNMENT PRINTING OFFICE 33–920 PDF WASHINGTON : 2007 For sale by the Superintendent of Documents, U.S. Government Printing Office Internet: bookstore.gpo.gov Phone: toll free (866) 512–1800; DC area (202) 512–1800 Fax: (202) 512–2250 Mail: Stop SSOP, Washington, DC 20402–0001 COMMITTEE ON APPROPRIATIONS ROBERT C. BYRD, West Virginia, Chairman DANIEL K. INOUYE, Hawaii THAD COCHRAN, Mississippi PATRICK J. LEAHY, Vermont TED STEVENS, Alaska TOM HARKIN, Iowa ARLEN SPECTER, Pennsylvania BARBARA A. MIKULSKI, Maryland PETE V. DOMENICI, New Mexico HERB KOHL, Wisconsin CHRISTOPHER S. BOND, Missouri PATTY MURRAY, Washington MITCH MCCONNELL, Kentucky BYRON L. DORGAN, North Dakota RICHARD C. SHELBY, Alabama DIANNE FEINSTEIN, California JUDD GREGG, New Hampshire RICHARD J. DURBIN, Illinois ROBERT F. BENNETT, Utah TIM JOHNSON, South Dakota LARRY CRAIG, Idaho MARY L. LANDRIEU, Louisiana KAY BAILEY HUTCHISON, Texas JACK REED, Rhode Island SAM BROWNBACK, Kansas FRANK R. LAUTENBERG, New Jersey WAYNE ALLARD, Colorado BEN NELSON, Nebraska LAMAR ALEXANDER, Tennessee TERRENCE E. SAUVAIN, Staff Director BRUCE EVANS, Minority Staff Director SUBCOMMITTEE ON THE DEPARTMENT OF HOMELAND SECURITY ROBERT C. BYRD, West Virginia, Chairman DANIEL K. INOUYE, Hawaii THAD COCHRAN, Mississippi PATRICK J. LEAHY, Vermont JUDD GREGG, New Hampshire BARBARA A. MIKULSKI, Maryland TED STEVENS, Alaska HERB KOHL, Wisconsin ARLEN SPECTER, Pennsylvania PATTY MURRAY, Washington PETE V. -

2020 Training Cata

Training for the Military HIGH MOBILITY MULTIPURPOSE WHEELED VEHICLE 0665 FIELD SERVICE AND MILITARY TRAINING COURSE CATALOG Aftermarket Fulfillment and Training Center (AFTC) 5448 Dylan Drive, South Bend, Indiana 46628 Contents General Information 4 Student Registration 5 Payment Information 5 Advanced Mobility / Maintenance / BDAR 6 Field Maintenance Training 8 Sustainment Maintenance Training 10 4L80E Transmission Maintenance Training 12 “ Whether it is ‘training readiness,,’’ combat operations, Air Conditioning Systems Maintenance 14 oror domesticdomestic response to floods and other natural disasters, itit isis thethe soldiersoldier inin hishis oror herher HumveeHumvee thatthat AmeriAmerica sees Alternator / Starter / Electrical Systems Maintenance 16 ccoming to their aide.” —Major—Major GeneGenerral Courtneeyy CarCarrr,, IIndiana Naationaltional GuaGuarrd Diesel Fuel Injection Pump Maintenance Training 17 Visitor Information 18 2 3 2 Our program development experience has been Training gained throtugh the development of training on a myriad of equipment from the Humvee through Program various tactical bridging equipment, such as the Improved Ribbon Bridge, the Rapidly Emplaced Bridge Development System, all of the MK II series Bridge Erection Boats, as well as MRAP, LTAS Wrecker, water purification and AM General’s Military Training Department fuel distribution systems. is a TRADOC certified world leader in All of our training programs are written to comply with training program development. TRADOC Regulation 350-70. Our expert program writers and Military Training Department Staff graphic llustrators are highly trained, AM General’s Training Department provides and credentialed professionals. professional training programs at all military skill (echelon) levels for Army systems used in the military inventory. Our technical writers and program to develop professional programs of instruction (POI). -

Evaluation of Robotic Systems to Carry out Traverse Execution, Opportunistic Science, and Landing Site Evaluation Tasks

NASA/TM-2011-216157 Evaluation of Robotic Systems to Carry Out Traverse Execution, Opportunistic Science, and Landing Site Evaluation Tasks Stephen J. Hoffman, PhD1, Matthew J. Leonard2, Pascal Lee, PhD3 1Science Applications International Corporation, Houston 2NASA Johnson Space Center, Houston 3Mars Institute, SETI Institute, Moffett Field, California National Aeronautics and Space Administration Johnson Space Center Houston, TX 77058 September 2011 THE NASA STI PROGRAM OFFICE . IN PROFILE Since its founding, NASA has been dedicated to • CONFERENCE PUBLICATION. Collected the advancement of aeronautics and space papers from scientific and technical science. The NASA Scientific and Technical conferences, symposia, seminars, or other Information (STI) Program Office plays a key meetings sponsored or cosponsored by part in helping NASA maintain this important NASA. role. • SPECIAL PUBLICATION. Scientific, technical, or historical information from The NASA STI Program Office is operated by NASA programs, projects, and mission, Langley Research Center, the lead center for often concerned with subjects having NASA’s scientific and technical information. substantial public interest. The NASA STI Program Office provides access to the NASA STI Database, the largest • TECHNICAL TRANSLATION English- collection of aeronautical and space science STI language translations of foreign scientific in the world. The Program Office is also and technical material pertinent to NASA’s NASA’s institutional mechanism for mission. disseminating the results of its research and Specialized services that complement the STI development activities. These results are Program Office’s diverse offerings include published by NASA in the NASA STI Report creating custom thesauri, building customized Series, which includes the following report databases, organizing and publishing research types: results . -

AM General V. Activision Blizzard

Case 1:17-cv-08644-GBD-JLC Document 218 Filed 03/31/20 Page 1 of 29 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORI( -- -- ----- -- -- ------------------------- --x AM GENERAL LLC, Plaintiff, MEMORANDUM DECISION -against- AND ORDER ACTIVISION BLIZZARD, INC., ACTIVISION 17 Civ. 8644 (GBD) PUBLISHING, INC., and MAJOR LEAGUE GAMING CORP., Defendants. --------- -- --- -- --------- -- -- -- ---- -- - --x GEORGE B. DANIELS, United States District Judge: Plaintiff AM General LLC ("AMG") brings this action against Defendants Activision Blizzard, Inc. and Activision Publishing, Inc. (collectively, "Activision") and Major League Gaming Corp. ("MLG") for trademark infringement, trade dress infringement, unfair competition, false designation of origin, false advertising, and dilution under the Lanham Act, 15 U.S.C. §§ 1114, 1125, and 1125(c), respectively. (Compl., ECF No. 1, ~~ 82-147.) AMG also raises pendant New York state law claims for trademark infringement, unfair competition, false designation of origin, trade dress infringement, false advertising, and dilution. (Jd. ~~ 148-81.) On May 31, 2019, Defendants moved for summaty judgment on all of AMG's claims pursuant to Federal Rule of Civil Procedure 56. (Defs. Activision and MLG's Notice of Mot. for Summ. J., ECF No. 131.) On the same day, Plaintiff moved for partial summaty judgment on Defendants' laches claim pursuant to Federal Rule of Civil Procedure 56(a). (PI. AMG's Notice of Mot. for Partial Summ. J., ECF No. 138.) Subsequently, Defendants filed a motion to strike (1) certain portions of Plaintiffs Rule 56.1 statement of material facts and (2) the "experiment" contained in the rebuttal report of Plaintiff s expeli, Dr. Y oran Wind ("MTS I"). -

Soldier Armed M134D Minigun

Soldier Armed M134D Minigun By Scott R. Gourley said the company did not know much examples designed to debunk what he about ground vehicles at that time: “In characterized as “common misconcep - round the time these pages go to the early years, we developed some in - tions about the system.” The minigun Apress, selected U.S. Army ele - tegration kits. They worked well, they is frequently mischaracterized as an ments in Afghanistan should be receiv - got integrated overseas and customers aviation-specific piece of equipment ing the first several dozen integration were happy. We knew we could do that is not suited for ground purposes, kits designed to equip their Common better, so we got more and more into he said. Remotely Operated Weapon Stations the ground vehicle market. We did it “That myth has been busted now that (CROWS) with the M134D minigun. because we had customers who had we have fielded them, used them, got - “The M134D is a very, very small ground vehicle requirements. We knew ten into gunfights with them, and suc - family of weapons,” said Chris Dillon, we could do a better job, but we had ceeded tenfold at suppressing and elim - vice president at manufacturer Dillon no idea that ground vehicles were go - inating the enemy with the weapon Aero, Inc. “The M134 is a six-barreled, ing to be a big deal. system,” said a former Army Special electrically operated Gatling-type ma - “The ground environment has re - Forces NCO who has employed Hum- chine gun that fires at a fixed rate of ally adopted the weapons system be - vee-mounted M134Ds in combat. -

Department of Finance and Administration

Department of Finance and Administration Legislative Impact Statement Bill: HB1073 Bill Subtitle: CONCERNING FORMER MILITARY VEHICLES; TO AUTHORIZE THE ISSUANCE OF A CERTIFICATE OF TITLE FOR A FORMER MILITARY VEHICLE. --------------------------------------------------------------------------------------------------------------------------------------- Basic Change : Sponsor: Rep. Brandt Smith HB1073 amends Arkansas Code Title 27, Chapter 14, Subchapter 7 and adds a new section, § 27-14-728, to authorize DFA to issue of a certificate of title for a “former military vehicle”. Under the bill, a “former military vehicle” is a motor vehicle manufactured for use by the United States Armed Forces which is sold or transferred with a federal proof of ownership certificate that establishes the motor vehicle for off-road use only. Revenue Impact : Unknown revenue increase to the Highway and Transportation Department if former military vehicles are titled and registered. Taxpayer Impact : Owners of former military vehicles as defined in the bill could title such vehicles if the vehicle meets safety and equipment standards and if all application requirements are met. Resources Required : None. Time Required : Adequate time is provided. Procedural Changes : System Programming and revisions to the Motor Vehicle Procedures Manual would be required. Other Comments : May be subject to enforcement by the Federal Motor Vehicle Safety Administration and the Arkansas Highway Police if they do not meet the federal safety requirements. Another issue presented by the bill is that some former military vehicles do not have rubber or pneumatic tires as is currently required by Arkansas law for highway use. There are some former military vehicles that are tracked vehicles that are not equipped with tires. Legal Analysis : Under current Department of Finance and Administration (DFA) procedures, an owner of a High Mobility Multipurpose Wheeled Vehicle (Humvee) that is older than 25 years may obtain a certificate of title from the Office of Motor Vehicle (OMV). -

Worldwide Equipment Guide Volume 2: Air and Air Defense Systems

Dec Worldwide Equipment Guide 2016 Worldwide Equipment Guide Volume 2: Air and Air Defense Systems TRADOC G-2 ACE–Threats Integration Ft. Leavenworth, KS Distribution Statement: Approved for public release; distribution is unlimited. 1 UNCLASSIFIED Worldwide Equipment Guide Opposing Force: Worldwide Equipment Guide Chapters Volume 2 Volume 2 Air and Air Defense Systems Volume 2 Signature Letter Volume 2 TOC and Introduction Volume 2 Tier Tables – Fixed Wing, Rotary Wing, UAVs, Air Defense Chapter 1 Fixed Wing Aviation Chapter 2 Rotary Wing Aviation Chapter 3 UAVs Chapter 4 Aviation Countermeasures, Upgrades, Emerging Technology Chapter 5 Unconventional and SPF Arial Systems Chapter 6 Theatre Missiles Chapter 7 Air Defense Systems 2 UNCLASSIFIED Worldwide Equipment Guide Units of Measure The following example symbols and abbreviations are used in this guide. Unit of Measure Parameter (°) degrees (of slope/gradient, elevation, traverse, etc.) GHz gigahertz—frequency (GHz = 1 billion hertz) hp horsepower (kWx1.341 = hp) Hz hertz—unit of frequency kg kilogram(s) (2.2 lb.) kg/cm2 kg per square centimeter—pressure km kilometer(s) km/h km per hour kt knot—speed. 1 kt = 1 nautical mile (nm) per hr. kW kilowatt(s) (1 kW = 1,000 watts) liters liters—liquid measurement (1 gal. = 3.785 liters) m meter(s)—if over 1 meter use meters; if under use mm m3 cubic meter(s) m3/hr cubic meters per hour—earth moving capacity m/hr meters per hour—operating speed (earth moving) MHz megahertz—frequency (MHz = 1 million hertz) mach mach + (factor) —aircraft velocity (average 1062 km/h) mil milliradian, radial measure (360° = 6400 mils, 6000 Russian) min minute(s) mm millimeter(s) m/s meters per second—velocity mt metric ton(s) (mt = 1,000 kg) nm nautical mile = 6076 ft (1.152 miles or 1.86 km) rd/min rounds per minute—rate of fire RHAe rolled homogeneous armor (equivalent) shp shaft horsepower—helicopter engines (kWx1.341 = shp) µm micron/micrometer—wavelength for lasers, etc. -

HMMWV Operators Manual

ARMY TM 9-2320-280-10 AIR FORCE TO 36A12-1A-2091-1 MARINE CORPS TM 2320-10/6B (SUPERSEDES TM 9-2320-280-10, 18 JUNE 1991) OPERATOR’S MANUAL FOR TRUCK, UTILITY: CARGO/TROOP CARRIER, 1-1/4 TON, 4X4, M998 (2320-01-107-7155) (EIC: BBD); M998A1 (2320-01-371-9577) (EIC: BBN); TRUCK, UTILITY: CARGO/TROOP CARRIER, 1-1/4 TON, 4X4, W/WINCH, M1038 (2320-01-107-7156) (EIC: BBE); M1038A1 (2320-01-371-9578) (EIC: BBP); TRUCK, UTILITY: HEAVY VARIANT, 4X4, M1097 (2320-01-346-9317) (EIC: BBM); M1097A1 (2320-01-371-9583) (EIC: BBU); M1097A2 (2320-01-380-8604) (EIC: BB6); M1123 (2320-01-455-9593) (EIC: B6G); TRUCK, UTILITY: TOW CARRIER, ARMORED, 1-1/4 TON, 4X4, M966 (2320-01-107-7153) (EIC: BBC); M966A1 (2320-01-372-3932) (EIC: BBX); M1121 (2320-01-956-1282) (EIC: B6H); TRUCK, UTILITY: TOW CARRIER, ARMORED, 1-1/4 TON, 4X4, W/WINCH, M1036 (2320-01-107-7154) (EIC: BBH); TRUCK, UTILITY: TOW CARRIER, W/SUPPLEMENTAL ARMOR, 1-1/4 TON, 4X4, M1045 (2320-01-146-7191); M1045A1 (2320-01-371-9580) (EIC: BBR); M1045A2 (2320-01-380-8229) (EIC: BB5); TRUCK, UTILITY: TOW CARRIER, W/SUPPLEMENTAL ARMOR, 1-1/4 TON, 4X4, W/WINCH, M1046 (2320-01-146-7188); M1046A1 (2320-01-371-9582) (EIC: BBT); TRUCK, UTILITY: ARMAMENT CARRIER, ARMORED, 1-1/4 TON, 4X4, M1025 (2320-01-128-9551) (EIC: BBF); M1025A1 (2320-01-371-9584) (EIC: BBV); M1025A2 (2320-01-380-8233) (EIC: BB3); TRUCK, UTILITY: ARMAMENT CARRIER, ARMORED, 1-1/4 TON, 4X4, W/WINCH, M1026 (2320-01-128-9552) (EIC: BBG); M1026A1 (2320-01-371-9579) (EIC: BBQ); TRUCK, UTILITY: ARMAMENT CARRIER, W/SUPPLEMENTAL ARMOR, 1-1/4 TON, 4X4, -

Product Manager Excalibur Product Manager Mortars Systems

M1117 armored security vehicle tar weapon systems include the 60 mm, 81 mm and 120 mm mortars and related equipment. Fire-control systems, used to calculate mortar missions, include new, improved systems like the mortar fire-con- trol system-heavy (MFCS-H) and the light- weight handheld mortar ballistic com- puter (LHMBC). The M224 60 mm mortar weapon sys- tem is a lightweight, high-angle-of-fire, smooth-bore, manportable, muzzle-loaded mortar with improved rate-of-fire capabili- ties. The M224 consists of the following components: M225 cannon (tube), M170 bipod assembly, M7 baseplate, M8 auxil- tillery combat observation lasing teams Product Manager Excalibur iary baseplate and the M64A1 sight unit. (COLTs) in both heavy and Infantry brigade The Product Manager Excalibur (PM Ex- The M224 fires the complete family of 60 combat teams, the Armored Knight will calibur) is developing Excalibur, a preci- mm ammunition, such as high explosive, combine the proven armored security vehi- sion, autonomously guided, long-range ar- smoke, illumination, infrared illumination cle with the M707 Knight mission equip- tillery system. and practice cartridges. With ranges from ment package. The XM982 Excalibur is a 155 mm preci- 70 meters to 3,500 meters, the M224 meets The resultant M1200 Armored Knight sion-guided artillery round with extended lethality, range and weight requirements will provide COLTs with increased armor range. Already being fielded to warfight- for light forces without an additional trans- protection, payload and agility. Textron ers and successfully employed in combat portation requirement. Marine and Land Systems is presently un- operations, Excalibur uses GPS precision- The M252 81 mm mortar system is a der contract with the U.S. -

White Paper: VBS2

White Paper: VBS2 Release Version 2.0 January 06, 2012 Prepared by Bohemia Interactive Australia Pty Ltd Copyright © 2012 Bohemia Interactive Australia Pty Ltd White Paper: VBS2 Page ii Table of Contents 1. Executive Summary ............................................................................................................. 1 2. History of the Virtual Battlespace........................................................................................2 2.1 Virtual Battlespace 1 (VBS1) ......................................................................................................................... 2 2.2 Aircrewman Virtual Reality Simulator ......................................................................................................... 3 2.3 Virtual Battlespace 2 (VBS2) ......................................................................................................................... 4 2.3.1 VBS2 in non-military domains ................................................................................................................. 6 2.4 Real Virtuality 3 ............................................................................................................................................... 6 2.5 Five Keys to the Success of VBS ................................................................................................................. 8 3. Technology Overview ........................................................................................................ 10 3.1 Technology Roadmap ................................................................................................................................. -

July 2018 Page 2 Plains Guardian • July 2018 2Nd CAB, 137Th Infantry Family Day Event Draws More Than 1,000 by 1St Lt

Legislature Guardsmen 1968 mobiliza- expands tu- vie for regional tions largest ition benefits Best Warrior since World PlainsPlains . .2 GuardianGuardiantitle . .7 War II . .9 Volume 62 No. 1 Serving the Kansas Army and Air National Guard, Kansas Emergency Management, Kansas Homeland Security and Civil Air Patrol July 2018 The Plains Kansas Guard engineers prepare for Guardian rotation to National Training Center By Spc. Samantha J. Whitehead 105th Mobile Public Affairs Detachment is now on Two platoons of combat engineers spent April 7 atop a hill at a demolition range at DoDLive Fort Riley, reading exacting step-by-step instructions out of training manuals and The Plains Guardian has gone mo- setting up thousands of pounds of equip- bile… again. ment, all in preparation for one short radio The Plains Guardian has long been message: “Fire in the hole!” available online at www.kansastag.gov. Soldiers assigned to the Kansas National However, it has now been updated Guard’s 772nd Engineer Mobility Augmen- with a new format. Instead of waiting tation Company, 891st Engineer Battalion, for the paper to arrive in the mail or be were training with two inert Mine Clearing posted online every other month, the ar- Line Charges made of more than 1,500 ticles and photos of the Plains Guardian pounds of simulated C-4 designed to clear a are now available on a timelier basis at a 100-meter lane of mines and other obstacles. new Department of Defense website: “The purpose of this training is to in- plainsguardian.dodlive.mil crease our readiness level by actually de- In addition to stories and videos about ploying the MICLICs,” said Capt. -

1 in the United States District Court for the Southern

Case 1:17-cv-08644-GBD Document 1 Filed 11/07/17 Page 1 of 54 IN THE UNITED STATES DISTRICT COURT FOR THE SOUTHERN DISTRICT OF NEW YORK MANHATTAN DIVISION AM GENERAL LLC, Plaintiff, C.A. No. 2:17-cv-08644 v. JURY TRIAL DEMANDED ACTIVISION BLIZZARD, INC., ACTIVISION PUBLISHING, INC., and MAJOR LEAGUE GAMING CORP. Defendants. COMPLAINT Plaintiff AM General LLC (“AM General”) states the following for its Complaint against Defendants Activision Blizzard, Inc., Activision Publishing, Inc., and Major League Gaming Corp. (collectively, “Defendants”). INTRODUCTION Plaintiff AM General LLC (“AM General”) makes the HUMVEE®-branded vehicle and owns registrations for the HUMVEE® and HMMWV® marks and the distinctive elements that comprise the AM General Trade Dress. Wrongfully leveraging the goodwill and reputation AM General has developed in these marks, Defendants have used and continue to use AM General’s trademarks and trade dress in advertising and promotion of their Call of Duty® video game franchise; have featured and continue to feature AM General’s trademarks and vehicles bearing the distinctive elements of the AM General Trade Dress prominently in their video games; and have caused and continue to cause the manufacture and sale of collateral toys and books to 1 Case 1:17-cv-08644-GBD Document 1 Filed 11/07/17 Page 2 of 54 further derive wrongful profits from AM General’s intellectual property and to further promote Defendants’ infringing video games. Defendants’ video games have been successful but only at the expense of AM General and consumers who are deceived into believing that AM General licenses the games or is somehow connected with or involved in the creation of the games.