Trucking & Logistics Industry Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Werner Enterprises, Inc. 2016 Annual Report

2016 ANNUAL REPORT FINANCIAL HIGHLIGHTS Dollars in thousands, except per share amounts 2016 2015 2014 2013 2012 Operating revenues $2,008,991 $2,093,529 $2,139,289 $2,029,183 $2,036,386 Net income 79,129 123,714 98,650 86,785 103,034 Diluted earnings per share 1.09 1.71 1.36 1.18 1.40 Cash dividends declared per share* 0.24 0.22 0.20 0.20 1.70 Return on average 8.2% 14.1% 12.4% 11.7% 13.6% stockholders’ equity Operating ratio 93.7% 90.4% 92.5% 93.1% 91.6% Operating ratio - 92.2% 86.7% 88.7% 90.8% 88.4% truckload segment** Total assets 1,793,003 1,585,647 1,480,462 1,354,097 1,334,900 Total debt 180,000 75,000 75,000 40,000 90,000 Stockholders’ 994,787 935,654 833,860 772,519 714,897 equity* * Cash dividends include the following special dividends (per share): $1.50 in 2012. ** Operating expenses (net of fuel surcharge revenues) expressed as a percentage of operating revenues (net of fuel surcharge revenues). OPERATING REVENUES $2,008,991 2016 $2,093,529 2015 $2,139,289 2014 $2,029,183 2013 $2,036,386 2012 TOTAL ASSETS $1,793,003 2016 $1,585,647 2015 $1,480,462 2014 $1,354,097 2013 $1,334,900 2012 DILUTED EARNINGS PER SHARE $1.09 2016 $1.71 2015 $1.36 2014 $1.18 2013 $1.40 2012 TO OUR SHAREHOLDERS We invested heavily in our trucks, trailers, talent, terminals 2016 was and technology in 2016 to propel Werner forward in our renewed and unwavering strategy to achieve best-in-class a year of customer service. -

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85 -

Driver Detention Impacts on Safety and Productivity

DRIVER DETENTION IMPACTS ON SAFETY AND PRODUCTIVITY September 2019 Erin Speltz Research Analyst American Transportation Research Institute Minneapolis, MN Dan Murray Senior Vice President American Transportation Research Institute Minneapolis, MN ATRI BOARD OF DIRECTORS Ms. Judy McReynolds Mr. Benjamin J. McLean Chairman of the ATRI Board Chief Executive Officer Chairman, President and Chief Ruan Transportation Management Executive Officer Systems ArcBest Corporation Des Moines, IA Fort Smith, AR Mr. Dennis Nash Mr. Andrew Boyle Executive Chairman of the Board Co-President Kenan Advantage Group Boyle Transportation North Canton, OH Billerica, MA Mr. Clifton Parker Mr. Rich Freeland President and General Manager President and Chief Operating G&P Trucking Company, Inc. Officer Gaston, SC Cummins Inc. Columbus, IN Mr. James D. Reed President and Chief Executive Mr. Darren D. Hawkins Officer Chief Executive Officer USA Truck YRC Worldwide Van Buren, AR Overland Park, KS Ms. Annette Sandberg Mr. Dave Huneryager President and Chief Executive President and Chief Executive Officer Officer Transsafe Consulting, LLC Tennessee Trucking Association Davenport, WA Nashville, TN Mr. John Smith Mr. Derek Leathers President and Chief Executive President and Chief Executive Officer Officer FedEx Freight Werner Enterprises Memphis, TN Omaha, NE Ms. Rebecca Brewster Mr. Robert E. Low President and Chief Operating President and Founder Officer Prime Inc. ATRI Springfield, MO Atlanta, GA Mr. Rich McArdle Mr. Chris Spear President President and Chief Executive UPS Freight Officer Richmond, VA American Trucking Associations Arlington, VA ATRI RESEARCH ADVISORY COMMITTEE Ms. Karen Rasmussen, RAC Mr. Stephen Laskowski Mr. Steve Raetz Chairman President Director, Research & Market Chief Executive Officer Canadian Trucking Alliance Intelligence PrePass Safety Alliance C.H. -

Lowe's Truckload Carrier Website Addresses

Lowe’s Truckload Carrier Website Addresses CARRIER NAME WEB ADDRESS (www.) ABSOULUTE TRANSPORT absoulutetransport.com AMERICAN CENTRAL TRANSPORT, INC americancentral.com AMERICAN EAGLE LINES aeal.com AMERICAN TRANSPORT, INC transportinvestment.com AN WEBBER, INC. anwebber.com ARNOLD TRANSPORTATION arnoldtrans.com AVERITT EXPRESS averittexpress.com BARNES TRANSPORTATION SERVICES, INC. NO WEBSITE BARR-NUNN TRANSPORTATION barr-nunn.com BEARDEN, ROBERT INC. rbitrucking.com BIAGI BROTHERS, INC. biagibros.com BISON TRANSPORT bisontransport.com BLACKHAWK TRANSPORT, INC. blackhawktransport.com BLACKJACK EXPRESS, INC. blackjackexpress.net BLM GROUP, INC. blm.com BNSF LOGISTICS bnsflogistics.com BOWERS TRUCKING INC. bowerstrucking.com BOWMAN, D.M. dmbowman.com C & C TRUCKING OF DUNCAN cctrucking.com CANADIAN AMERICAN TRANSPORTATION cat.ca CARDINAL FREIGHT CARRIERS cardlog.com CARGO TRANSPORTERS cgor.com CARROLL FULMER LOGISTICS CORPORATION cfulmer.com CELADON TRUCKING SERVICES, INC. celadontrucking.com CH ROBINSON WORLDWIDE, INC. chrobinson.com COASTAL TRANSPORT INC. ctdrivers.com CONSOLIDATED LUMBER TRANSPORT, INC. jrctransportation.com CONTINENTAL EXPRESS, INC. continentalx.com CONTRACT FREIGHTERS, INC. cfi-us.com CORRIHER TRUCKING, INC. NO WEBSITE COVENANT TRANSPORT covenanttransport.com CRETE CARRIER CORP. cretecarrier.com CRST crst.com CYPRESS TRUCK LINES, INC. cypresstruck.com D & S DISTRIBUTION, INC. dsdistribution.com DANNY HERMAN TRUCKING, INC. dannyherman.com DART TRANSIT CO. dartadvantage.com DAVIS TRANSFER CO. davistransfer.com DDI TRANSPORTATION, INC. dditransportation.com DECKER TRANSPORT CO., INC. deckertransport.com Updated: November 28, 2006 DENNIS TRUCKING CO., INC. NO WEBSITE DOUG ANDRUS DIST, LLC. dougandrus.com DOUGLAS AND SONS, INC. NO WEBSITE DREAMIN' NORTHWEST, INC. NO WEBSITE EASTERN FREIGHTWAYS, INC. easternfreightways.com EPES TRANSPORT SYSTEM, INC epestransport.com ERWIN BROTHERS TRUCKING erwinbrostrucking.com EXPRESS WAY expresswaygroup.com FIRSTEXPRESS, INC firstexpress.net FLATOUT TRUCKING flatouttrucking.com FLS TRANSPORT, INC. -

Werner 2020 Annual Report

2020 ANNUAL REPORT 2020 20 20 20 20 Operating revenues 22 20 2 2 200 * Net income 0 202 2 Diluted earnings per share* 2. 2. 2. 2.0 .0 Cash dividends declared per share** 0. 0. 0.2 0.2 Return on average stockholders equity* . .2 Operating ratio 0. 0. 0. .2 . Operating ratio Truckload Segent .0 . .2 . .0 Total assets 2 2 200 0 00 Total debt 200000 00000 2000 000 0000 Stockholders equity* 00 00 2 2 $994,787 Dollars in thousands except per share amounts * 20 includes the aorale ipact o the noncash reduction in deerred incoe tax expense o illion, or .2 per diluted share, in ourth uarter 20 due to the Tax uts and Jos Act o 20. ** 20 includes a . per share special diidend declared in ay 20. Total assets Operating revenues 2020 2,156,676 2020 22 2019 2,143,864 2019 20 2018 2,083,04 2018 2 2017 $1,807,991 2017 2 2016 $1,793,003 2016 200 Diluted earnings per share 2020 2.4 2019 2.3 2018 2.3 2017 $2.0 2016 $.09 Diersity, Euity and nclusion Drie Us ndustry Leader in Enironental Health and Saety pact At Werner, we support and encourage the diverse voices and perspectives of our associates, our customers and our suppliers. Diversity contributes Batteries to innovation and connects us to the many commu- tires nities we serve. We commit to embrace these values liquids as we move toward an increasingly inclusive culture where every associate feels empowered to bring their REDUCTION IN ACCIDENTS LIGHTING AT ALL FACILITIES whole self to Werner. -

Fidelity® Nasdaq Composite Index® Fund

Fidelity® Nasdaq Composite Index® Fund Semi-Annual Report May 31, 2021 Contents Note to Shareholders 3 Investment Summary 4 Schedule of Investments 6 Financial Statements 85 Notes to Financial 89 Statements Shareholder Expense 97 Example Board Approval of 98 Investment Advisory Contracts and Management Fees Liquidity Risk 106 Management Program To view a fund’s proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission’s (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines. Nasdaq®, OMX®, NASDAQ OMX®, Nasdaq Composite®, and The Nasdaq Stock Market®, Inc. are registered trademarks of The NASDAQ OMXGroup, Inc. (which with its Affiliates are the Corporations) and are licensed for use by Fidelity. The product has not been passed on by the Corporations as to its legality or suitability. The product is not issued, endorsed or sold by the Corporations. The Corporations make no warranties and bear no liability with respect to shares of the product. Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation. Other third-party marks appearing herein are the property of their respective owners. All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved. This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. -

Valuation Multiples by Industry

Valuation Multiples by Industry https:// www.eval.tech SIC Sector: (4000-4999) Transportation, Communications, Electric, Gas and Sanitary service Report Date: 31 May 2019 Country: United States of America (U.S.A.) Industry Valuation Multiples The table below provides a summary of median industry enterprise value (EV) valuation multiples, as at the Report Date. The data is grouped by industry SIC code: EV Multiple Max # Rev EBITDA EBIT TotAss TanAss Railroads, Line-Haul Operating (4011) 7 5.32 11.73 15.20 1.79 1.81 Trucking (No Local) (4213) 16 0.74 5.41 11.23 0.88 1.14 Water Transportation (4400) 23 3.67 8.93 14.48 0.75 0.77 Deep Sea Foreign Transportation Of Freight (4412) 40 3.12 10.19 17.29 0.66 0.68 Air Transportation, Scheduled (4512) 19 1.27 7.71 11.86 0.82 0.94 Pipe Lines (No Natural Gas) (4610) 16 3.52 11.18 14.05 1.37 1.56 Transportation Services (4700) 9 1.23 9.86 22.91 0.84 1.12 Arrangement Of Transportation Of Freight & Cargo (4731) 9 0.39 10.56 14.06 1.29 2.08 Radiotelephone Communications (4812) 14 1.27 5.78 18.55 0.69 0.88 Telephone Communications (No Radiotelephone) (4813) 32 1.64 5.31 11.67 0.73 0.98 Radio Broadcasting Stations (4832) 10 1.40 9.28 12.43 0.62 1.98 Television Broadcasting Stations (4833) 13 2.38 8.27 10.37 0.89 2.35 Cable & Other Pay Television Services (4841) 17 2.86 9.46 13.84 1.07 2.20 Communications Services, Nec (4899) 13 1.59 14.09 66.13 1.05 1.38 Electric Services (4911) 45 3.43 11.01 17.98 0.83 0.89 Natural Gas Transmission (4922) 20 3.84 13.07 20.15 0.98 1.19 Natural Gas Distribution (4924) 11 3.73 11.70 17.06 1.06 1.14 Electric & Other Services Combined (4931) 19 3.84 12.30 20.31 0.98 1.00 Water Supply (4941) 13 7.03 18.22 28.25 1.17 1.30 Refuse Systems (4953) 8 3.25 13.63 28.16 1.70 3.46 Hazardous Waste Management (4955) 6 1.28 34.73 - 1.21 1.90 © 2018 eVal 1 03 June 2019 EV/Revenue Valuation Multiple We provide additional data relating to industry EV/Revenue valuation multiples: # Average Median Std. -

2020 Media Kit

1 ™ 2020 MEDIA KIT Redefining The Road Magazine | 2019 Media Kit | 1 Dear WIT Members and Colleagues, The mission of the Women In Trucking Association is to encourage the employment of women in the trucking industry, to promote their accomplishments and to minimize the obstacles they face. Tie your organization to this mission through advertising and thought leadership strategy in our official magazine, Redefining the Road (RTR). This magazine provides thought-provoking content to educate the market and encourage gender diversity. It also will recognize Top Women to Watch (Edition 1), Top Women-Owned Businesses (Edition 2), and Top Companies for Women to Work For (Edition 3). RTR magazine and related channels reach thousands of association members and more decision-makers 2020 MEDIA KIT and industry influencers who are stakeholders in this critical mission. The magazine is committed to educating our readership on all important issues affecting women in transportation. Our readers are in Published by: diverse roles that range from Leadership, Operations, and Safety to HR/Talent Management, and Sales MindShare Strategies, Inc. and Marketing. 9382 Oak Ave. The magazine will be distributed three times in 2020 to our entire membership of corporate professionals Waconia, MN 55387 USA and managers, professional drivers, students, and other key stakeholders, and distributed at industry events – including the Mid-America Trucking Show in March in Louisville, Ky., and the Accelerate! For more information and Conference & Expo in September in Dallas. RTR is also available in a digital version at our online library. to place advertising: Through a well-defined editorial mission and a targeted readership, Redefining the Road has evolved into Carleen Herndon, an award-winning magazine with loyal, captive readers that will help to build your brand, your reputation, Vice President, Business Development and your business. -

Motor Carrier Industry Profile

FMCSA-RI-06-042 Motor Carrier Industry Profile: An Update 2004-2005 Prepared by: Thomas M. Corsi Michelle Smith Professor of Logistics Co-Director, Supply Chain Management Center Robert H. Smith School of Business University of Maryland College Park, MD 20742 Prepared for: Analysis Division Office of Research and Analysis Federal Motor Carrier Safety Administration August 2005 Introduction This report updates the Motor Carrier Industry Profile: 2001-20031 and Stock Market Performance of Publicly Traded Trucking Sector Stocks by Industry Segment, 2000-20042 to reflect more recent developments of particular significance to the industry and its various segments. The Motor Carrier Industry Profile: 2001-2003 relied heavily on Motor Carrier Annual Reports from over two thousand of the largest for-hire motor carriers for calendar years 2001, 2002, and 2003. However, there is a significant lag in the publication of annual report data. In fact, the 2004 calendar year data will not be available until late in 2005 or early in 2006. As a result, this report will fill in the gaps as best is possible without the benefit of the detailed annual report data. This report’s objective will be to identify trends and major events that have impacted the trucking industry during 2004 and 2005. It is based on available reports, trade journal articles, roundtable discussions, etc. The report will also update the stock market information included in Stock Market Performance of Publicly Traded Trucking Sector Stocks by Industry Segment, 2000-2004 to reflect stock market performance in the second half of 2004 and first half of 2005. -

Werner ESG Presentation November 2020 DISCLOSURE STATEMENT

Building on a Strong Foundation to Drive Greater Sustainability at Werner ESG Presentation November 2020 DISCLOSURE STATEMENT This presentation may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements are based on information presently available to the Company’s management and are current only as of the date made. Such statements are by nature subject to uncertainties and risks, including but not limited to, the impact of the coronavirus pandemic (COVID-19) and the operational, financial and legal risks detailed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 and subsequently filed Quarterly Reports on Form 10-Q. These risks and uncertainties could cause actual results or events to differ materially from historical results or those anticipated. For those reasons, undue reliance should not be placed on any forward-looking statement. The Company assumes no duty or obligation to update or revise any forward-looking statement, although it may do so from time to time as management believes is warranted or as may be required by applicable securities law. Any such updates or revisions may be made by filing reports with the U.S. Securities and Exchange Commission, through the issuance of press releases or by other methods of public disclosure. WERNER ENTERPRISES 2 WERNER SNAPSHOT (NASDAQ: WERN) PREMIUM TRUCKLOAD TRANSPORTATION & LOGISTICS SERVICES PROVIDER Omaha, NE 4,715 Headquarters Dedicated Fleet Size1 WE KEEP $2.7B AMERICA 2,995 Market Cap1 One-Way Fleet Size1 MOVINGTM 0.9% 12,714 Dividend Yield1 Associates2 2019 Revenue Breakdown Segment Vertical (Top 50 Customers) Customer Rank 3% Retail 51% Top 5 30% 20% Manuf./Ind. -

Company County Industry NAICS Address

North Florida Manufacturers Directory Company County Industry NAICS Address City State Zip (Joe) Patti Marine Escambia Marine Pensacola FL 32087 Actigraph Escambia Medical Device Pensacola FL 32087 Advanced Sawmill Machinery Okaloosa Holt FL 32219 Airlift Technologies/Zodiac Santa Rosa Aviation Milton FL 32254 American Elite Molding Okaloosa Plastics Crestview FL 32216 Arizona Chemical Bay Chemical Panama City FL 32223 Arizona Chemical Escambia Chemical Pensacola FL 32254 Armada Systems Inc. Okaloosa Marine Fort Walton FL 32206 Ascend Performance Materials Escambia Textile, Chemical Cantonment FL 32206 AUS Holmes Metal/Machining Bonifay FL 32225 Automation Control Services LLC Escambia Water/Wastewater Pensacola FL 32220 Avalex Santa Rosa Aviation Gulf Breeze FL 32205 B&C Technology Bay Panama City Beach FL 32216 BAE Systems Okaloosa Defense, Aviation Fort Walton FL 32254 Barker Syrup Company Jackson Food Graceville FL 32254 Beluga (Sturgeon AquaFarms?) Jackson Food Bascom FL 32218 Berg Steel Pipe Bay Oil & Gas Panama City FL 32226 Bote Boards Okaloosa Marine Fort Walton FL 32246 Breeze Boat Lifts Okaloosa Marine Fort Walton FL 32254 Cerex Advanced Fabrics Inc Escambia Textile Cantonment FL 32218 Certified Manufacturing Okaloosa Aerospace Holt FL 32226‐2434 Chautauqua Vineyard & Winery Walton Food DeFuniak Springs FL 32221 CHR International/Safari Jackson Aviation Marianna FL 32224 Crane Electronics Okaloosa Defense, Aviation Fort Walton FL 32207 Custom Control Solutions Escambia Aviation Pensacola FL 32209 Custom Production Okaloosa -

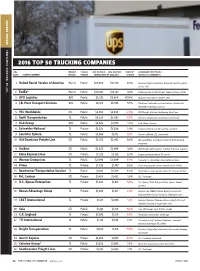

2016 Top 50 Trucking Companies 2016 Top 50 Trucking Companies

SPECIAL REPORT SPECIAL 2016 TOP 50 TRUCKING COMPANIES 2016 TOP 50 TRUCKING COMPANIES 2016 PRIMARY PUBLIC/ 2015 REVENUE 2016 REVENUE PERCENT SUBSIDIARY PORTFOLIO / RANK PARENT COMPANY SERVICE PRIVATE (IN MILLIONS OF DOLLARS) CHANGE SERVICES & COMMENTS 1 United Parcel Service of America Parcel Public $29,829 $31,770 6.5% Ground, freight, brokerage. Acquired Coyote Logistics in July 2015 TOP 50 TRUCKING COMPANIES TRUCKING 50 TOP 2 FedEx* Parcel Public $20,307 $22,127 9.0% FedEx Ground, FedEx Freight, FedEx Custom Critical 3 XPO Logistics IMC Public $3,273 $6,860 109.6% Acquired Con-way in October 2015 4 J.B. Hunt Transport Services IMC Public $6,188 $6,555 5.9% Truckload, dedicated contract service, intermodal, integrated capacity solutions 5 YRC Worldwide LTL Public $4,832 $4,698 -2.8% YRC Freight, Holland, Reddaway, New Penn 6 Swift Transportation TL Public $4,229 $4,032 -4.7% Dry-van, refrigerated, dedicated, nntermodal 7 Hub Group IMC Public $3,526 $3,573 1.3% Hub, Mode, Unyson 8 Schneider National TL Private $3,423 $3,506 2.4% Largest privately owned trucking company 9 Landstar System TL Public $3,364 $3,172 -5.7% Dry-van, flatbed, LTL, intermodal 10 Old Dominion Freight Line LTL Public $2,972 $2,992 0.6% Most profitable asset-based publicly held trucking company 11 ArcBest LTL Public $2,422 $2,496 3.0% ABF Freight, ABF Logistics, Panther Premium Logistics 12 Estes Express Lines LTL Private $2,135 $2,155 0.9% Largest privately owned LTL carrier 13 Werner Enterprises TL Public $2,094 $2,009 -4.0% One-way TL, dedicated, value-added services 14 Prime TL Private $1,736 $1,747 0.6% Prime Refrigerated, Prime Flatbed, Prime Tanker 15 Roadrunner Transportation Services TL Public $1,610 $1,709 6.2% Truckload revenue growth offset LTL revenue decline 16 R+L Carriers LTL Private $1,429 $1,452 1.6% LTL, Truckload 17 U.S.