West Salem School District Parent Liaison Project

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Iroquaarea School District

iroqua Area School District pupil records. They include records maintained in any way including, but not limited • Grade level • Activity participation to, computer storage media, video and audiotape, film, microfilm, and microfiche. • Degrees, honors and awards • Weight, height for athletic teams Records maintained for personal use by a teacher and not available to others and Asbestos Notification In compliance with the U.S. Environmental Protection records available only to persons involved in the psychological treatment of a child Agency (EPA) and the Asbestos Hazard Emergency Response Act (AHERA), this is are not pupil records. notice that the Viroqua Area School District is free of all asbestos. Public Notice Regarding Student Records Notice of Nondiscrimination Applications for employment, students, parents, Four-Year-Old Kindergarten The Viroqua School District maintains student records in the interest of the student employees, sources of referral of applications for employment, and all unions Class offerings for the four year old to assist in providing appropriate educational experiences. Two classes of records or professional organizations holding collective bargaining or professional are maintained: behavioral and progress records. Progress records means those agreements with the Viroqua Area School District are hereby notified that this Kindergarten program will be all day on pupil records which include the pupil’s grades, a statement of the courses the institution does not discriminate on the basis of sex, race, religion, national student has taken, the pupil’s attendance record and records of the pupil’s school origin, ancestry, creed, pregnancy, martial or parental status, sexual orientation, or Monday/Thursday or Tuesday/Friday with extracurricular activities. -

March/April 2021

MARCH/APRIL 2021 WBA Awards Gala Update on Page 3! Sen. Smith to visit Summer Conference CHAIR’S COLUMN The President and CEO of the National Association Positivity important as end to pandemic nears of Broadcasters is coming to the WBA Summer Con- ference in August. Is it spring? As I write this, we are experiencing mild weather and many parts of Wisconsin have hit 50 Senator Gordon Smith will be the keynote speaker degrees. After the bitter cold temperatures we had in on Aug. 26, the second day of the conference at the February how can a person not think of spring. Blue Harbor Resort in Sheboygan. Sue Keenom, Senior Vice President, State, Interna- We are steadily showing signs of ending the COVID Smith tional, and Board Relations for NAB, will be joining pandemic. There was a recent article from Dr. Marty him. Makary of John Hopkins University that read the U.S. could reach herd immunity early in the second “We’re thrilled to have Sen. Smith join us as we celebrate the 70th Chris Bernier quarter this year and may already be reaching it. He year of the WBA,” said WBA President and CEO Michelle Vetterkind. WBA Chair states that COVID cases have dropped 77 percent in “This will be our first opportunity to gather since the pandemic and the Untied States in the last six weeks. We try to provide positive facts a perfect occasion to celebrate.” like this to our staff, particularly our salespeople. When making sales Smith joined the National Association of Broadcasters as president calls, I want our people to be positive. -

Annual Abstract of Statistics

Annual Abstract of Statistics No 144 2008 Edition Editor: Ian Macrory Office for National Statistics ISBN 978-0-230-54560-1 Copyright and reproduction ISSN 0072-5730 © Crown copyright 2008 A National Statistics publication Published with the permission of the Office for Public Sector National Statistics are produced to high professional standards set out Information (OPSI) in the National Statistics Code of Practice. They are produced free from You may re-use this publication (excluding logos) free of charge in any political influence. Not all the statistics contained within this publication format for research, private study or internal circulation within an are national statistics because it is a compilation from various sources. organisation providing it is used accurately and not in a misleading context. The material must be acknowledged as Crown copyright and About us you must give the title of the source publication. Where we have The Office for National Statistics identified any third party copyright material you will need to obtain The Office for National Statistics (ONS) is the executive office of the UK permission from the copyright holders concerned. Statistics Authority, a non-ministerial department which reports directly For re-use of this material you must apply for a Click-Use Public Sector to Parliament. ONS is the UK government’s single largest statistical Information (PSI) Licence from: producer. It compiles information about the UK’s society and economy which provides evidence for policy and decision-making and in the Office of Public Sector Information, Crown Copyright Licensing and allocation of resources. Public Sector Information, St Clements House, 2–16 Colegate, Norwich NR3 1BQ The Director of ONS is also the National Statistician. -

The Southern Bluffs

Holiday Fair pgs. 5-7 Staff Spotlight pgs. 8-9 See what teacher “experiences” have Learn more about Mrs. been happening since Ahern, Mr. Fuglsang In this issue: our Holiday Fair and Mr. Peace January 2019 The Southern Bluffs Over the past several years, as a district we have taken significant steps to enhance the physical safety and security of our school building. During the school year, the students and staff practice a number of drills, including monthly fire drills, a several weather drill, and a lockdown drill. The U.S. Department of Education has recommended that school districts implement a protocol that provides more options than traditional “hide and hope” lockdown to student and staff when facing threat or harm from a violent intruder. With the assistance of the La Crosse Police Department, our Southern Bluffs Staff has been trained in a protocol called ALICE. The acronym ALICE is a non-sequential acronym to help staff and students remember options that stands for: Alert: Get the word out using clear concise language and describe the location of the event. Lockdown: Lockdown students in secure areas if evacuation is not an option. Enhance traditional lockdown by barricading. Inform: Keeping the staff and students informed continually allows for good decision making. Counter: As a last resort if the intruder enters the room, distract, confuse, and gain control. Evacuate: Reduce the number of potential targets for the intruder by evacuating the building to predetermined rally points off of school grounds. We will be discussing some of these options with students in an age appropriate manner, and class- room teachers will be reading and discussing a book with students entitled, I’m Not Scared, I‘m Pre- pared! Because I Know All About ALICE. -

Minnesota Emergency Alert System Statewide Plan 2018

Minnesota Emergency Alert System Statewide Plan 2018 MINNESOTA EAS STATEWIDE PLAN Revision 10 Basic Plan 01/31/2019 I. REASON FOR PLAN The State of Minnesota is subject to major emergencies and disasters, natural, technological and criminal, which can pose a significant threat to the health and safety of the public. The ability to provide citizens with timely emergency information is a priority of emergency managers statewide. The Emergency Alert System (EAS) was developed by the Federal Communications Commission (FCC) to provide emergency information to the public via television, radio, cable systems and wire line providers. The Integrated Public Alert and Warning System, (IPAWS) was created by FEMA to aid in the distribution of emergency messaging to the public via the internet and mobile devices. It is intended that the EAS combined with IPAWS be capable of alerting the general public reliably and effectively. This plan was written to explain who can originate EAS alerts and how and under what circumstances these alerts are distributed via the EAS and IPAWS. II. PURPOSE AND OBJECTIVES OF PLAN A. Purpose When emergencies and disasters occur, rapid and effective dissemination of essential information can significantly help to reduce loss of life and property. The EAS and IPAWS were designed to provide this type of information. However; these systems will only work through a coordinated effort. The purpose of this plan is to establish a standardized, integrated EAS & IPAWS communications protocol capable of facilitating the rapid dissemination of emergency information to the public. B. Objectives 1. Describe the EAS administrative structure within Minnesota. (See Section V) 2. -

Success Highlights Importance of Member Involvement

MARCH/APRIL 2020 CHAIR’S COLUMN Success highlights importance of member involvement The Wisconsin Broadcasters Association is regarded If you need background on important issues for one of these as one of the best state broadcasting association in meetings, don’t hesitate to contact the WBA office for support. Also, the country. This is according to Sen. Gordon Smith, when we have these local meetings, we should constantly remind the President and CEO of the National Association the elected officials of our value, how we are involved in virtually of Broadcasters. everything that happens in our communities, and the millions of During our recently completed legislative trip to dollars that Wisconsin Broadcasters help raise for their communities Washington DC, we also heard this from many every year. leaders of other state associations. The WBA is so We recently celebrated another legislative victory in the state Chris Bernier highly regarded because of the dedicated work by when Governor Evers signed into law the bill regarding the use of WBA Chair our President, Michelle Vetterkind, and the staff, but law enforcement body cameras. This was one of our talking points equally as important, is our membership! during State Legislative Day and in local meetings, plus the phone Our membership’s relationships with our elected officials are one of blitz that many of you participated in just before the vote. This is most significant things we can do as local broadcasters. Calling on another triumph in a long list of successes we have had thanks to them during State Legislative Day and in DC is very important. -

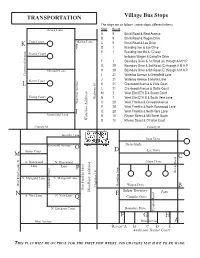

I J K L M N P Q a G F C D E B

TRANSPORTATION Village Bus Stops The stops are as follows: (same stops, different letters) Acorn Lane Stop Bus # A 9 Brickl Road & West Avenue B 9 Brickl Road & Wagon Drive K Vista Court Martin Lane C 9 Brickl Road & Lee Drive J D 1 Branding Iron & Lee Drive Scenic Court E 1 Branding Iron Rd & 1/2 way between Wagon & Campfire Drive F 1 Boundary Drive & 1st Road (A) through A.M.H.P. G 29 Boundary Drive & 3rd Road (C) through A.M.H.P. Meadow Lane H 29 Boundary Drive & 5th Road (E) through A.M.H.P. Crestwood Avenue I 21 Waterloo Avenue & Greenfield Lane Dottie Court J 21 Waterloo Avenue & Martin Lane L K 21 Crestwood Avenue & Vista Court L 21 Crestwood Avenue & Dottie Court M 7 West Elm/CTH B & Susan Court Young Court Highway 16 N 7 West Elm/CTH B & South Vera Lane Waterloo Avenue Waterloo O 28 West Franklin & Griswold Avenue P 28 West Franklin & North Rosewood Lane I Q 28 West Franklin & North Vera Lane Greenfield Lane R 10 Rhyme Street & Mill Street South Waterloo Addition Waterloo S 10 Rhyme Street & O’Fallon Court County M County M Jennifer Lane Lynn Drive Griswold Avenue O Twin Oaks Susan Court D Lee Drive 5 M C S. Rosewood N. Rosewood Olson Drive Lane Lane P Brickl Road S. Marigold Lane N. Marigold Lane Branding Iron West Elm/County B West Highway 16 Wagon Drive Daffodil Street Daffodil B West Franklin Street West Woodbury Addition Woodbury Salem Territory PARK N S. Vera Lane N. -

Tattler Master

more food and drink weren’t supplied, so that’s why the TalenTrak Happy Volume XXXI • Number 36 • September 9, 2005 Hour wraps up the day! Faculty for all these sessions will be announced THE shortly. The price for all this learning? Just $49 – for one more week. On 9/16, tuition rises to $59...so why wait? (The group rate of $39 each AIN TREET for a group of 4 or more from the same station/cluster who register at M S the same time has been extended until 9/16, as well!). For more details, Communicator Network check www.theconclave.com or call the Conclave office at 952-927- 4487. AA TT TT LL EE TT RR Changes. Former News Director Tom Peterson will retire from his current morning anchor position at Tribune Talk WGN/Chicago at the Publisher: Tom Kay Associate Publisher/Editor • Claire Sather end of 2005...Nikki Chuminatto gets Assistant MD stripes added to her air talent role at Bonneville Hot AC WTMX/Chicago...Clear Channel “Doesn’t Know How To Play The Blame Game” Top 40 WSNX/Grand Rapids hires Michelle Taylor for middays...Ryan Springer is promoted to PD at New Life Media Network Christian The blogosphere, spearheaded by conservative scribe Michelle Malkin WGBL/Champaign, Il. (www.michellemalkin.com), is buzzing this week about the latest developments in the Air America/Gloria Wise Boys and Girls Club South Dakota’s Stockinrock Records is proud to announce the signing affair, only this time the ire is focused not on former executive Evan to exclusively represent country music artist and Wilmot, SD native, Cohen, but on 2005 Conclave Keynoter Al Franken. -

The Magazine for TV and FM Dxers

The Official Publication of the Worldwide TV-FM DX Association DECEMBER 2004 The Magazine for TV and FM DXers TV and FM DXing was never so much Fun! IN THIS ISSUE MAPPING THE JULY 6TH Es CLOUD BOB COOPER’S ARTICLE ON COLOR TV CONTINUES THE WORLDWIDE TV-FM DX ASSOCIATION Serving the UHF-VHF Enthusiast THE VHF-UHF DIGEST IS THE OFFICIAL PUBLICATION OF THE WORLDWIDE TV-FM DX ASSOCIATION DEDICATED TO THE OBSERVATION AND STUDY OF THE PROPAGATION OF LONG DISTANCE TELEVISION AND FM BROADCASTING SIGNALS AT VHF AND UHF. WTFDA IS GOVERNED BY A BOARD OF DIRECTORS: DOUG SMITH, GREG CONIGLIO, BRUCE HALL, DAVE JANOWIAK AND MIKE BUGAJ. Editor and publisher: Mike Bugaj Treasurer: Dave Janowiak Webmaster: Tim McVey Editorial Staff:, Victor Frank, George W. Jensen, Jeff Kruszka Keith McGinnis, Fred Nordquist, Matt Sittel, Doug Smith, Adam Rivers and John Zondlo, Our website: www.anarc.org/wtfda ANARC Rep: Jim Thomas, Back Issues: Dave Nieman, DECEMBER 2004 _______________________________________________________________________________________ CONTENTS Page Two 2 Mailbox 3 Finally! For those of you online with an email Satellite News… George Jensen 5 address, we now offer a quick, convenient TV News…Doug Smith 6 and secure way to join or renew your FM News…Adam Rivers 14 membership in the WTFDA from our page at: Photo News…Jeff Kruszka 20 Eastern TV DX…Matt Sittel 23 http://fmdx.usclargo.com/join.html Western TV DX…Victor Frank 25 Northern FM DX…Keith McGinnis 27 Dues are $25 if paid to our Paypal account. Translator News…Bruce Elving 34 But of course you can always renew by check Color TV History…Bob Cooper 37 or money order for the usual price of just $24. -

Integrated Public Alert and Warning System Committee

STATEWIDE EMERGENCY COMMUNICATIONS BOARD INTEGRATED PUBLIC ALERT AND WARNING SYSTEM COMMITTEE Thursday, May 17, 2018 Call-in Number: 844-302-0362 1:00 – 3:00 p.m. Access Code: 745 498 588 Join WebEx Meeting WebEx password: IPAWS CHAIR: Trevor Hamdorf / VICE-CHAIR: Lillian McDonald MEETING LOCATION / WebEx and Conference Call AGENDA Call to Order Approval of Agenda Approval of Previous Meeting’s Minutes • April 2018 Announcements Standing Committee Reports • Policy Work Group ............................................................................................Lillian McDonald o Multi-lingual Survey Results • Infrastructure ........................................................................................................... John Dooley o Overview of EAS Report and Order from FCC 10APR18 o Overview of Stevens County Exercise Special Reports • Public Information .................................................................................. Amber Schindeldecker Old Business New Business • IPAWS Committee Strategic Planning for 2019-21 Session Outcomes ............. Discussion Item • IPAWS Committee Work Plan ............................................................................ Discussion Item o Identify / Choose leadership for the new work groups . Alerting Authorities . EAS Participants o Dividing up the work between the new workgroups o FCC addition of Blue Alert: planning for – course of action o EAS Plan Report and Order – changes that could affect our work plan timeline IPAWS Committee May 17, 2018 Page 1 STATEWIDE -

Exhibit 2181

Exhibit 2181 Case 1:18-cv-04420-LLS Document 131 Filed 03/23/20 Page 1 of 4 Electronically Filed Docket: 19-CRB-0005-WR (2021-2025) Filing Date: 08/24/2020 10:54:36 AM EDT NAB Trial Ex. 2181.1 Exhibit 2181 Case 1:18-cv-04420-LLS Document 131 Filed 03/23/20 Page 2 of 4 NAB Trial Ex. 2181.2 Exhibit 2181 Case 1:18-cv-04420-LLS Document 131 Filed 03/23/20 Page 3 of 4 NAB Trial Ex. 2181.3 Exhibit 2181 Case 1:18-cv-04420-LLS Document 131 Filed 03/23/20 Page 4 of 4 NAB Trial Ex. 2181.4 Exhibit 2181 Case 1:18-cv-04420-LLS Document 132 Filed 03/23/20 Page 1 of 1 NAB Trial Ex. 2181.5 Exhibit 2181 Case 1:18-cv-04420-LLS Document 133 Filed 04/15/20 Page 1 of 4 ATARA MILLER Partner 55 Hudson Yards | New York, NY 10001-2163 T: 212.530.5421 [email protected] | milbank.com April 15, 2020 VIA ECF Honorable Louis L. Stanton Daniel Patrick Moynihan United States Courthouse 500 Pearl St. New York, NY 10007-1312 Re: Radio Music License Comm., Inc. v. Broad. Music, Inc., 18 Civ. 4420 (LLS) Dear Judge Stanton: We write on behalf of Respondent Broadcast Music, Inc. (“BMI”) to update the Court on the status of BMI’s efforts to implement its agreement with the Radio Music License Committee, Inc. (“RMLC”) and to request that the Court unseal the Exhibits attached to the Order (see Dkt. -

March/April 2016

MARCH/APRIL 2016 CHAIR’S COLUMN Who’d have thought...? No matter what your political we blanketed lawmakers with solid and persuasive arguments on a number of issues vital to both radio and television. It was rewarding to persuasion, few of us would have witness first-hand the attention our Association and our issues received predicted at the start of this year’s when dozens of local broadcasters met with nearly every state presidential campaign that Donald legislator on the same day in January. And when we headed to Washington in February, the Wisconsin delegation was the largest of Trump and Bernie Sanders would still any state association in attendance. Many thanks to all of the Wisconsin Tom Allen be in the headlines (much less broadcast professionals who joined us in those efforts. WBA Chair winning primaries), at While our collective voice is impressive, our It was rewarding to witness first- individual voices as local broadcasters are also this point in the 2016 campaign. hand the attention our Association essential. That’s why it’s so important that each of Whatever you think about the race so far, one and our issues received when us make an effort to have regular contact with our thing is clear. This certainly isn’t politics as usual. dozens of local broadcasters met local, state and federal officials. Let’s make sure that And given the current atmosphere of political in this unpredictable election year one thing is uncertainty, our efforts to make broadcaster’s with nearly every state legislator on certain: That anyone in elected office will clearly voices heard at the state and national level are the same day in January.