Refillable Glass Beverage Container Systems in the UK

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Beer Specialty Drinks Martinis $9.00

Beer Specialty Drinks Martinis $9.00 North Carolina Craft Beers Absolut Mandarin Mambo—Absolut Mandarin, Triple Sec, Cranberry & a splash of Lime Juice OMB Copper - Olde Mecklenburg Brewery $5.00 Appletini—Absolut Citron, Sour Apple Pucker & OMB Hornets Nest-Old Mecklenburg Brewery-$5.00 Splash of Sour Mix OMB Seasonal - Olde Mecklenburg Brewery $5.00 Avion Silver Cosmo—Avion Silver Tequila, Carolina Blonde - Foot Hill Brewery $5.00 Cointreau, cranberry & a slash of Lime Juice Hoppyum IPA-Foot Hill Brewery-$5.00 Blue Martini—Vodka, Blue Curacao & Sour Mix People Porter-Foot Hill Brewery-$5.00 Caribbean Sunset Martini—Bacardi Light Rum, Torch Pilsner-Foot Hill Brewery-$5.00 Triple Sec & Lemon Juice Classic Martini—Vodka or Gin, Dry or Dirty with ESB Amber Ale-Green Man Brewery-$5.00 Olives IPA Indian Pale Ale-Green Man Brewery-$5.00 Cosmopolitan—Vodka, Cointreau, Cranberry Juice & Dale’s Pale Ale - Oskar Blues Brewery $5.00 Lime Juice Mama’s Little Yella Pils- Oskar Blues Brewery $5.00 French Martini—Absolut Citron, Chambord & Pinner IPA– Oskar Blues Brewery-$5.00 Pineapple Buck Shot Amber Ale - Natty Greene’s Brewery $5.00 Hot and Dirty Martini—Absolut Peppar Vodka, Dry Vermouth & a dash of Olive Juice Red Oak Amber Lager - Red Oak Brewery $5.00 Humming Bird Golden Lager - Red Oak Brewery $5.00 Lemon Drop—Absolut Citron, Triple Sec, Lemon Juice, Splash of Sour Mix with Sugar on the Rim Hop Drop’ N Roll IPA - NoDa Brewery 16oz. $7.00 Malibu Martini—Malibu Coconut Rum, Pineapple Coco Loco Porter - NoDa Brewery 16oz. -

Inspiring Mountain Backdrop | Local Flavors | Collaborative Spirit It Is No Secret That Asheville Has Grown Into the Eastern U.S

Inspiring Mountain Backdrop | Local Flavors | Collaborative Spirit It is no secret that Asheville has grown into the eastern U.S. craft beer destination. The story began in 1994 when retired engineer Oscar Wong opened Highland Brewing Company, Asheville’s first craft brewery. Wong’s insistence on high-quality product made Highland a success and led to a new wave of local breweries - Green Man, Asheville Brewing, French Broad, Pisgah and more. Today, there are 51 breweries in the Asheville area and that number is continually growing. National breweries Oskar Blues, Sierra Nevada and New Belgium have started East Coast operations here, boosting Asheville’s reputation. Asheville’s Must-Try Beers Beer City USA Backstory On any given day, hundreds of locally brewed Asheville’s beer scene got a major beers are on tap around Asheville. Here are boost in 2009 when noted brew writer some suggestions: Charlie Papazian conducted his first ► Highland Brewing | Gaelic Ale - the first Beer City USA poll. Asheville tied with craft brew made in Asheville. much bigger Portland, Ore., to share ► Asheville Brewing | Shiva IPA - enormously the title and went on to win or tie the popular beer bursting with smooth hoppy poll the next three years. The poll was retired in 2014, but the city’s craft flavor. beer scene was firmly established. The numbers tell the story - a 2018 ► Wicked Weed | Black Angel Cherry Sour - SmartAsset.com story on “The Best Cities for Beer Drinkers” found that this puckery delight is loaded with tart cherry Asheville has the most breweries per 100,000 residents of any U.S. -

NC Brewers Cup Results 2019

BEST OF SHOW NCBC Medal Category BJCP Style (Sub-Category) Place Brewery Beer Name Pale British Beer & Bitter 12A English Golden Ale BOS 1 Cabarrus Brewing Daisy Roots Historical Beer 27A Historical Beer BOS 2 Divine Barrel Brewing Beer Flavored Beer NC Home-Grown Beer NC Home-Grown Beer BOS 3 Little Brother Brewing Crispy Business Light American Hybrid 18A Blonde Ale BOS 4 Wilmington Brewing Company Moon Dance Blonde Ale FULL COMPETITION NCBC Medal Category BJCP Style (Sub-Category) Place Brewery Beer Name American Lager 1A American Light Lager 1 Brown Truck Brewery #10 American Light Lager American Lager 1B American Lager 2 Crystal Coast Brewing Company Atlantic Beach Blonde Lager American Lager 1B American Lager 3 Flying Machine Brewing Company Neo-Bohemia International Lager 2A International Pale Lager 1 Hopfly Brewing Co. Crunch Time International Lager 2A International Pale Lager 2 Cabarrus Brewing Travelin' Light Lager International Lager 2A International Pale Lager 3 Legion Brewing Co Project Pils Light American Hybrid 18A Blonde Ale 1 Wilmington Brewing Company Moon Dance Blonde Ale Light American Hybrid 1C Cream Ale 2 Makai Brewing Company Island Falls Cream Ale Light American Hybrid 1D American Wheat Beer 3 JollyRogerbrew Walk the plank Wheat Light American Hybrid 18A Blonde Ale 4 Sycamore Brewing Southern Girl Malty European Lager 4A Munich Helles 1 Pitt Street Brewing company Pactolus Light Lager Malty European Lager 4A Munich Helles 2 Mason Jar Lager Company, The Happy Place Golden Lager Malty European Lager 4A Munich Helles -

KD Menu Revised and Final

KELLY DAYS FIREHOUSE TAVERN SOUPS Cup 3.5 or Bowl 4.5 Firehouse Chili Specialty Soup A blend of our fresh ground meats, pinto beans and secret Ask your server or bartender what is the Chief’s soup of the day firehouse ingredients FIRE STARTERS SLIDERS *All Sliders come on Sweet Hawaiian Buns and come three to an order Fireball Whiskey BBQ Chicken Wings 9.5 *Add your choice of A side of Regular or Sweet Fries, Kelly’s Slaw, Red Potato Our signature Fireball whiskey BBQ Sauce served on crispy Salad or EBD Salad=Edamame, Black Bean and Roasted Corn Salad jumbo wings and served with a side of celery and ranch for only 2.5 *ask server if you would like in hot or BBQ sauce as an alternative Soon to be Famous, The 70/30 8 Fried Cheese Curds 6.5 Mixed with Neuskes Triple Smoked apple-wood bacon, topped with white Deep fried white cheddar cheese curds served with our cheddar cheese, black truffle ketchup and pickle house made marinara The Ybor Fritas 7.5 lemon Basil Hummus 7.5 Our KD beef blend and chorizo, topped with potato sticks, black truffle Fresh FLA lemon, basil hummus topped with olive oil, roasted red ketchup, smoked Gouda cheese and pickle peppers and served with grilled pita chips Pretzel Sticks 7 Lil’ Italian 7.5 Bavarian pretzel sticks served with Brie and beer cheese sauce Spiced up and blended meatball topped with marinara and provolone KD Meatballs 7.5 A blend of USDA Beef and Italian Sausage meatballs made with fresh Station One 8 herbs, marinara, melted provolone and crustinis Jackman Ranch Wagyu, white cheddar and caramelized -

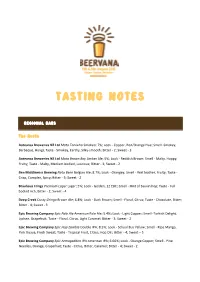

Tasting Notes

TASTING NOTES REGIONAL BARS The North Aotearoa Breweries NZ Ltd Mata Taniwha Smoked; 7%; Look - Copper, Red/Orange Hue; Smell -Smokey, Barbeque, Hangi; Taste - Smokey, Earthy, Silky-smooth; Bitter - 2; Sweet - 3 Aotearoa Breweries NZ Ltd Mata Brown Boy Amber Ale; 5%; Look - Reddish Brown; Smell - Malty, Hoppy, Fruity; Taste - Malty, Medium-bodied, Luscious; Bitter - 3; Sweet - 2 Ben Middlemiss Brewing Nota Bene Belgian Ale; 8.7%; Look - Orangey; Smell - Wet leather, Fruity; Taste - Crisp, Complex, Spicy; Bitter - 3; Sweet - 2 Brauhaus Frings Premium Lager Lager; 5%; Look - Golden, 12 EBC; Smell - Hint of Sauvin hop; Taste - Full bodied rich; Bitter - 2; Sweet - 4 Deep Creek Dusty Gringo Brown Ale; 6.8%; Look - Dark Brown; Smell - Floral, Citrus; Taste - Chocolate, Bitter; Bitter - 4; Sweet - 3 Epic Brewing Company Epic Pale Ale American Pale Ale; 5.4%; Look - Light Copper; Smell -Turkish Delight, Lychee, Grapefruit; Taste - Floral, Citrus, Light Caramel; Bitter - 3; Sweet - 2 Epic Brewing Company Epic Hop Zombie Double IPA; 8.5%; Look - School Bus Yellow; Smell - Ripe Mango, Pink Guava, Fresh Sweat; Taste - Tropical Fruit, Citrus, Hop Oil ; Bitter - 4; Sweet – 5 Epic Brewing Company Epic Armageddon IPA American IPA; 6.66%; Look - Orange Copper; Smell - Pine Needles, Orange, Grapefruit; Taste - Citrus, Bitter, Caramel; Bitter - 4; Sweet - 2 Galbraiths Munich Lager Pilsner; 5.5%; Look - Clear Gold; Smell - Malt, Floral; Taste - Crisp, Clean, Hoppy; Bitter - 4; Sweet – 3 Hallertau Porter Noir Barrel Aged Beer; 6.6%; Look - Dark, Ruby, Tan -

Event Menu Table of Contents

THE OMNI GROVE PARK INN EVENT MENU TABLE OF CONTENTS BREAKFAST | 1 BRUNCH | 7 BREAKS | 9 LUNCH | 13 RECEPTION | 19 DINNER | 26 BEVERAGES | 33 DETAILS | 37 Prices are subject to a 24% service charge and 7% state sales tax. All menus and prices are subject to change. PLATED All plated breakfasts are served with your choice of orange juice, CRABTREE FALLS BENEDICT Westrock Shade Grown regular coffee, decaffeinated coffee and Chef selected seasonal fruit Tea Forté hot teas, along with a basket of house made pastries with fruit preserves, honey and butter. Cage-free poached eggs, crab cakes, Consuming raw or undercooked meats, poultry, seafood, shellfish wilted spinach, hollandaise served on or eggs may increase your risk of foodborne illness. Prices are toasted biscuits subject to a 24% service charge and 7% state sales tax. All menus and prices are subject to change. O’Brien potatoes 38 per person ENTRÉE SELECTIONS BLUE RIDGE BREAKFAST BOWL THE GROVE PARK Overnight oats, served chilled Chef selected seasonal fruit Squash buritto bowl with charred butternut squash and puffed quiona, vegan cheese, bean sprouts Cage-free scrambled eggs Avocado fruit salad Roasted Roma tomato Vegan banana muffin Pecanwood smoked bacon or fresh sage sausage 32 per person Provençal lyonnaise potatoes 32 per person FRENCH BROAD Parfait French toast made with fresh challah bread, dipped in eggs, vanilla, cinnamon Toppings | powered sugar and Vermont maple syrup Fresh berries Pecanwood smoked bacon or fresh sage sausage 32 per person SUNSET MOUNTAIN Chai pudding with almond milk, served chilled Frittata, forest mushrooms, chives, spinach and local tomato Provençal Chicken apple sausage Multi-grain crossiant 32 per person Breakfast | THE OMNI GROVE PARK INN | EVENT MENU | 1 CONTINENTAL Additional juice options available at $85 per gallon. -

Vegan Beer List by David Hagan

Cheers for vegan beers – the New Zealand vegan beer list By David Hagan With summer here and the festive season just around the corner, what better time to bring you New Zealand’s most comprehensive list of beers suitable for vegans? We’ve compiled the list below so that you can make sure that the drinks you’re enjoying are fully free of animal products. Have a read of the information about the issues and then check the list to see if your favourite New Zealand beers are included. Cheers! Why do we need a vegan beer list? Not everyone may be aware that when it comes to beer, vegans need to be well informed to make sure they’re not choosing a brew which makes use of animal products. Animal products are sometimes used both in the ingredients and also in the beer-making process. Animal ingredients in beer can include honey or dairy products. Animal products used in the brewing process include isinglass (taken from fishes’ swim bladders) which is sometimes used to clarify or filter the beer in a process called fining; gelatine is also sometimes used as a fining agent. Unlike wines, which generally indicate on the bottle if they’ve used an animal derived product (egg, dairy or fish) in the fining process, beer bottles give no clues as to whether or not the brewers have used isinglass or similar substances. So a little research is required, the product of our research is this first attempt to list which beers brewed in New Zealand are suitable for vegans and which aren’t. -

Brewnz BEER AWARDS 2008 - FULL RESULTS

BrewNZ BEER AWARDS 2008 - FULL RESULTS PARKVIEW MOTORCAMP 2008 CHAMPION BREWERY - Tuatara Brewing HOSHIZAKI LANCER CLASS 1 CLASSIC HYBRID NEW ZEALAND STYLE Best in Class - Biman, Invercargill Brewery Gold - Biman, Invercargill Brewery Gold - Mac’s Gold - Lion Nathan Gold - Weka Native Lager - Moa Brewing Company Silver - Alpine Ale - Dux de Lux Silver - Mac’s Hop Rocker - Mac’s Brewery Silver - Pure Lager - Hawke’s Bay Independent Brewery Silver - Steinlager Classic - Lion Nathan Bronze - Force Lager - Hawke’s Bay Independent Brewery Bronze - Mates Draught - Hawke’s Bay Independent Brewery Bronze - Monteith’s New Zealand Lager - Waitemata Brewery Bronze - Speight’s Pilsner - Speight’s Brewery HORT RESEARCH CLASS 2 AMBER AND DARK LAGERS Best in class - Hereford Bitter - Dux Brew Company Silver - Hereford Bitter - Dux Brew Company NZ HOP PRODUCTS LTD CLASS 3 INTERNATIONAL GOLDEN LAGERS Best in class - James Squire Pilsener - Malt Shovel Brewery Gold - Genessee Beer - High Falls Brewery Gold - Genesee Cream Ale - High Falls Brewery Silver - Genesee Light - High Falls Brewery Silver - James Squire Pilsener - Malt Shovel Brewery Silver - Samuel Adams Light - Boston Beer Company Silver - Virgin Lager - Yellow Cross Brewery COSPAK CLASS 4 FRENCH AND BELGIAN STYLE ALES Best in class - Ardennes - Tuatara Brewing Gold - Ardennes - Tuatara Brewing Silver - Archipelago Explorer - Archipelago Brewing Bronze - Moa St Joseph’s - Moa Brewing Company CRYER MALT CLASS 5 NEW WORLD AMERICAN STYLE ALES Best in class - Epic Pale Ale - Epic Brewing Company Gold -

Awards Night Catalogue 2010

CONTENTS BREWNZ AWARDS 2010: JUDGING PANEL.................................................................... 2 RESULTS ............................................................................................................................ 3 Class A: New Zealand Champion Brewery ...................................................................... 3 Class B: Champion International Brewery........................................................................ 3 Class C: European Lager Styles....................................................................................... 3 Class D: International Lager Styles .................................................................................. 3 Class E: European Ale Styles........................................................................................... 4 Class F: New Zealand, US & International Ale Styles ...................................................... 5 Class G: Stout and Porter Styles ...................................................................................... 6 Class H: Wheat and Other Grain Styles ........................................................................... 6 Class I: Flavoured & Aged Styles (incl. Fruit/Spice/Herb/ Honey/Smoke) ....................... 7 Class J: New Zealand Draught ......................................................................................... 7 Class K: New Zealand Lager & Premium Lager Styles .................................................... 8 Class L: Reduced Alcohol, Reduced Carbohydrate & Gluten-free -

Fanta Orange ...3 Mexican Coke

DRAFT BEER Tecate Light, Mexico ............................................................................... 5 Dos Equis Ambar, Mexico ...................................................................... 5 NoDa Hop, Drop, and Roll IPA, North Carolina .................................... 6 Fanta Orange ............................ 3 Craft Beer of the Moment ...................................................................AQ Mexican Coke ............................ 3 BOTTLED AND CANNED BEER Topo Chico Mineral Water....... 3 Squirt.......................................... 3 Bohemia, Mexico ..................................................................................... 5 Corona Extra, Mexico .............................................................................. 5 Panna ......................................... 3 Modelo Especial, Mexico (can) .............................................................. 5 Jamaica Tea .............................. 3 Negra Modelo, Mexico ........................................................................... 5 Horchata .................................... 4 Shiner Bock, Texas ................................................................................. 5 Tecate, Mexico (can) ................................................................................ 5 Agua Fresca OTD ..................... 4 Bold Rock Hard Cider, Rose, Mills River .............................................. 6 Green Man Brewery ESB, Amber Ale, Asheville ................................... 6 Highland Brewing -

{Bowtie Barbecue Co. House Cocktails + Whiskey + Spirits + Beer + Wine + Whiskey Flights|

{BowTie Barbecue Co. House Cocktails + Whiskey + Spirits + Beer + Wine + Whiskey Flights| It’s the BowTie Barbecue Co. $4 Happy Hour Pours of Draught Beer. *not available for Happy Hour pricing With our Special Guests: -16 oz Pours- $4 COCKTAILS $4 Alltech Brewing. Race Day. Session India Pale Ale. 4.5% Lexington, KY. 5 Coastal Empire Beer Co. Halle. Berliner Weisse. 3.8% Savannah, GA. 5 BT Sangria – White Wine, Peach Brandy, Fresh Fruit Southbound Brewing Co. Hop’lin. India Pale Ale. 6.3% Savannah, GA. 6 Bourbon Punch – Larceny Bourbon, Amaretto, Ginger Beer Monday Night Brewing. Nerd Alert. Pseudo-Pilsner. 5% Atlanta, GA. 6 Miller Brewing Co. Miller Lite. Lager. 4.2 % Milwaukee, WI. 4 Jose Margarita – Jose Cuervo Gold, House Sour Mix, Triple Sec Beerbon On the Rock – Jim Beam, Lager, Lemon Juice -12 oz Pours- $4 DRAUGHT BEERS $4 Scofflaw Brewing Co. Sucker Punch. India Pale Ale. 6.5% Atlanta, GA. 7 Scofflaw Brewing Co. Hooligan. India Pale Ale. 7% Atlanta, GA. 7 All Beers are 12 oz pours Scofflaw Brewing Co. POG Basement. India Pale Ale. 7.5% Atlanta, GA. 7 $4 WELL LIQUORS $4 Scofflaw Brewing Co. Mandarina-Bavaria Double Jeopardy. Double India Pale Ale. 10.5% Atlanta, GA. 7 Bourbon – Four Roses, Vodka – 13th Colony Wild Heaven Beer. Ode to Mercy NITRO. Coffee Brown Ale. 7.2% Decatur, GA. 6 Wild Heaven Beer. White Blackbird. Belgian Style Saison. 6% Decatur, GA. 6 Tequila – Jose Cuervo Gold, Gin – New Amsterdam Alltech Brewing. Kentucky Bourbon Ale. Barrel-Aged Amber. 8.19% Lexington, KY. 6 Rum – Don Q Cherry Street Brewing Co-op. -

6 $10 828 417-3053

OYSTERS ON THE HALF SHELL . ea. 2.99 FRIED OYSTERS w. remoulade . 11.99 Served with pickled veggies and mustard. Order one, order many! DEVILED EGGS THREE WAYS . 2.99 Tete a Tete . 3.25 Three Graces Dairy - Marshall, NC BACON CARAMEL POPCORN . 3.99 St. Pauline . 3.25 MOLTEN CHEESE w. chorizo, green sauce, & jalapeno . 7.99 Three Graces Dairy - Marshall, NC Chevre Blanche . 3.25 FRESHLY BAKED PRETZEL w. beer cheese . 5.99 Spinning Cider Creamery - Fairview, NC Ridge Blue . 3.50 PIMENTO CHEESE . 6.99 Blue Ridge Mountain Creamery - Fairview, buttered saltines, b&b pickles, hot sauce NC Brebis de Pays . 3.25 POACHED EGG, BACON, & FRISEE SALAD . 9.99 Three Graces Dairy - Marshall, NC LOCAL LETTUCES w. aged tome & shallot citrus vinaigrette . 9.99 Singing Brook . 3.50 Blackberry Farm - Walland, TN FRITO PIE . 4.99 CRISP BUFFALO CHICKEN SKINS w. blue cheese dressing . 5.49 Black Pepper Sorghum ROAST BONE MARROW . 9.99 Salami. 5.25 Spotted Trotter - Atlanta, GA toast and red onion parsley salad Bresaola . 5.99 RICOTTA GNOCCHI WITH BOLOGNESE . 7.99/14.99 Spotted Trotter - Atlanta, GA 17 HOUR COOKED BENTON’S BACON . 10.99 Soppresatta . 3.50 Aunt Julia’s barbecue sauce, slaw and pickles (make it a sandwich San Giuseppe Salami Co - Elon, NC add $4) Milano Garlic Salami . 3.50 Hickory Nut Gap - Fairview, NC THE VEGETABLE PLATE Western North Carolina Agriculture . 18.00 Pepperoni . 3.50 Hickory Nut Gap - Fairview, NC SPECIAL NO. 1 COUNTRY HAM 24-oz prime cowboy ribeye, beef fat potatoes, Edwards Wigwam . 3.99 skillet greens $45.99 18 month aged - Surry, VA “The Original” H&F CHEESEBURGER .