MACQUARIE BANK LIMITED (ABN 46 008 583 542) (Incorporated with Limited Liability in the Commonwealth of Australia)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Close Brothers Group Plc Annual Report 2006

(1,1) -1- 836858_cover.indd 2/10/06 3:32:35 pm Close Brothers Group plc Annual Report 2006 836858_cover.indd 1 22/10/06/10/06 33:32:35:32:35 ppmm (1,1) -2- 836858_cover.indd 2/10/06 3:32:16 pm 303 Close Brothers is an independent merchant bank and is amongst the top 200 listed companies in the UK. Our goal is to deliver consistent, long term growth in profi t and dividends. We strive to achieve this through our core strategy of specialisation and diversifi cation across a range of fi nancial services and, in particular, by: • focusing on higher margin activities • managing business risk whilst maintaining a healthy return on capital • attracting and supporting management teams of the highest calibre • fostering entrepreneurialism, independent thinking and a willingness to innovate • placing the highest importance on quality, professionalism and integrity in everything we do. 8836858_cover.indd36858_cover.indd 2 2/10/06 3:32:16 pm Close Brothers Group plc Annual Report 2006 1 Our Results at a Glance Profit £157m +21% Financial Highlights 2005 2006 Profit before goodwill and taxation £129m £157m +21% Earnings per share before goodwill 62.0p 74.1p +19% Profit before taxation £112m £157m +41% Earnings per share 49.8p 74.1p +49% Dividends per share 28.5p 32.5p +14% Shareholders’ funds £578m £662m +15% Total assets £4.8bn £4.8bn Operational Highlights • Asset Management profit up 21% to £38 million. FuM up 16% to £8.2 billion. • Corporate Finance record profit of £17 million. • Securities profit up 34% to £48 million. -

S/1 Records of Hill Samuel & Company

Lloyds TSB Group Archives: Catalogue S/1 Records of Hill Samuel & Company Level: Fonds S/1/a Establishment Level: Series S/1/a/1 Memorandum and articles of association of Hill 1969 Samuel and Company Level: Item S/1/a/2 Memorandum and articles of association of Hill 1969 Samuel Group. Includes copy of certificate of name change from Hill Samuel and Company to Hill Samuel Group Level: Item S/1/b Operation Level: Series S/1/b/1 Minutes of general meetings of Hill Samuel 1920-1978 Group (M.Samuel and Company until March1965; Hill Samuel and Company April 1965 - March 1969) (signed, indexed). Enclosed are papers relating to the proposed merger with Philip Hill, Higginson and Erlangers (1965). Level: Item S/1/b/2 Minutes of meetings of Board of Directors (M. 1965-1970 Samuel and Company record, January - March 1965; Hill Samuel and Company record, April 1965 - March 1969; Hill Samuel Group record, March 1969 - 1970) (indexed and signed). Level: Item S/1/b/3 Minutes of meetings of Board of Directors and 1970-1975 Committee of the Board of Directors (indexed, signed). Level: Item Lloyds TSB Group Archives: Catalogue S/1/b/4 Minutes of meetings of Board of Directors and 1975-1978 Committee of Board of Directors (indexed, signed). Level: Item S/1/b/5 Minutes of meetings of Board of Directors; 1979-1982 Committee of the Board of Directors; Group Chief Executive's Committee; Chairman's Committee; Emoluments Committee; Audit Committee; annual general meetings (indexed, signed). Level: Item S/1/b/6 Minutes of meetings of Committee of the Board 1983-1986 of Directors; Group Chief Executive's Committee; and Emoluments Committee (signed). -

LLOYDS BANK Plc

PROSPECTUS Dated 30 March 2017 LLOYDS BANK plc (incorporated in England with limited liability with registered number 2065) £35,000,000,000 Euro Medium Term Note Programme This Prospectus (the “Prospectus”) is issued in connection with the Programme (as defined below). Save where otherwise specified in the applicable Final Terms, any Notes (as defined below) issued under the Programme on or after the date of this Prospectus are issued subject to the provisions described herein. This does not affect any Notes already in issue. Under the Euro Medium Term Note Programme described in this Prospectus (the “Programme”), Lloyds Bank plc (the “Bank” or “Lloyds Bank”), subject to compliance with all relevant laws, regulations and directives, may from time to time issue Euro Medium Term Notes (the “Notes”). The aggregate nominal amount of Notes outstanding will not at any time exceed £35,000,000,000 (or the equivalent in other currencies), subject to increase as provided herein. Notes to be issued under the Programme may comprise (i) unsubordinated Notes (“Senior Notes”) and (ii) Notes which are subordinated as described herein and have terms capable of qualifying as Tier 2 Capital (as defined below) (the “Dated Subordinated Notes”). The term “Tier 2 Capital” has the meaning given to it from time to time by the laws, regulations, requirements, guidelines and policies relating to capital adequacy then in effect in the United Kingdom. Application has been made to the Financial Conduct Authority (the “FCA”) under Part VI of the Financial Services and Markets Act 2000 (the “UK Listing Authority”) for Notes issued under the Programme for the period of twelve months from the date of this Prospectus to be admitted to the Official List of the UK Listing Authority (the “Official List”) and to the London Stock Exchange plc (the “London Stock Exchange”) for such Notes to be admitted to trading on the London Stock Exchange’s Regulated Market (the “Market”). -

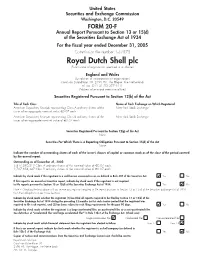

2005 Annual Report on Form 20-F

United States Securities and Exchange Commission Washington, D.C. 20549 FORM 20-F Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2005 Commission file number 1-32575 Royal Dutch Shell plc (Exact name of registrant as specified in its charter) England and Wales (Jurisdiction of incorporation or organisation) Carel van Bylandtlaan 30, 2596 HR, The Hague, The Netherlands tel. no: (011 31 70) 377 9111 (Address of principal executive offices) Securities Registered Pursuant to Section 12(b) of the Act Title of Each Class Name of Each Exchange on Which Registered American Depositary Receipts representing Class A ordinary shares of the New York Stock Exchange issuer of an aggregate nominal value €0.07 each American Depositary Receipts representing Class B ordinary shares of the New York Stock Exchange issuer of an aggregate nominal value of €0.07 each Securities Registered Pursuant to Section 12(g) of the Act None Securities For Which There is a Reporting Obligation Pursuant to Section 15(d) of the Act None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. Outstanding as of December 31, 2005: 3,817,240,213 Class A ordinary shares of the nominal value of €0.07 each. 2,707,858,347 Class B ordinary shares of the nominal value of €0.07 each. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

130516 Ncdofst FACWI.Qxd

MONDRIAN May 16, 2013 INVESTMENT PARTNERS LIMITED Representing Mondrian: ELIZABETH A. DESMOND, CFA DIRECTOR, CHIEF INVESTMENT OFFICER P RESENTATION TO: INTERNATIONAL EQUITIES MONDRIAN INVESTMENT PARTNERS LIMITED NORTH CAROLINA PATRICIA M. KAROLYI, CFA DEPARTMENT OF STATE EXECUTIVE VICE PRESIDENT MONDRIAN INVESTMENT PARTNERS (U.S.), INC. TREASURER M ONDRIAN F OCUSED A LL C OUNTRIES W ORLD E X -US EQUITY A GENDA 1ORGANIZATION 2INVESTMENT PHILOSOPHY 3YEAR PERFORMANCE 4QUARTER PERFORMANCE 5INVESTMENT STRATEGY ANY OTHER BUSINESS Mondrian Investment Partners Limited Mondrian Investment Partners (U.S.), Inc. Fifth Floor Two Commerce Square 10 Gresham Street 2001 Market Street, Suite 3810 London EC2V 7JD Philadelphia, PA 19103 Telephone 020 7477 7000 Telephone (215) 825-4500 Mondrian Investment Partners Limited is authorised and regulated by the Financial Conduct Authority www.mondrian.com BIOGRAPHIES MONDRIAN INVESTMENT PARTNERS Elizabeth A. Desmond, CFA DIRECTOR, CHIEF INVESTMENT OFFICER INTERNATIONAL EQUITIES MONDRIAN INVESTMENT PARTNERS LIMITED LONDON Ms. Desmond is a graduate of Wellesley College and the Masters Program in East Asian Studies at Stanford University. After working for the Japanese government for two years, she began her investment career as a Pacific Basin investment manager with Shearson Lehman Global Asset Management. Prior to joining Mondrian in 1991, she was a Pacific Basin Equity Analyst and Senior Portfolio Manager at Hill Samuel Investment Advisers Ltd. Ms. Desmond is a CFA Charterholder, and a member of the CFA Institute and the CFA Society of the UK. Patricia M. Karolyi, CFA EXECUTIVE VICE PRESIDENT MONDRIAN INVESTMENT PARTNERS (U.S.), INC. PHILADELPHIA Ms. Karolyi is a graduate of Villanova University, where she earned an MBA, and Temple University, where she earned a Bachelor of Science degree. -

Extracts from the Macquarie Group Limited 2019 Annual Report PDF 6

ANNUAL REPORT Macquarie Group Year ended 31 March 2019 MACQUARIE GROUP LIMITED ACN 122 169 279 50 years of financial service Macquarie’s predecessor organisation, Hill Samuel Australia, opened in Sydney in December 1969 with three staff, capital of $A250,000 and an ambition to provide advisory and investment banking services of an international standard to the Australian market. Today Macquarie is a global financial services group operating in 30 markets providing asset management, leasing and asset financing, retail banking and wealth management, market access, commodity trading, investment banking and principal investment. 2019 Annual General Meeting Macquarie Group Limited’s 2019 Annual General Meeting will be held at 10:30 am on Thursday, 25 July 2019 at the Sheraton Grand Sydney Hyde Park, Grand Ballroom, 161 Elizabeth St, Sydney NSW 2000. Details of the business of the meeting will be contained in the Notice of Annual General Meeting, to be sent to shareholders separately. Cover image Macquarie’s global headquarters at 50 Martin Place, Sydney is a connected, flexible and sustainable workplace and the largest heritage redevelopment of its size to be awarded a Six Star Green Star Rating from the Green Building Council of Australia. Crowning the building with a new steel-frame glass dome, daylight harvesting reduces energy consumption by 40%. Table of 50 years of financial service 6 1 Letter from the Chairman 8 0 Letter from the Managing Director and CEO 10 contents ABOUT Operating and Financial Review 14 Corporate Governance Summary -

1914 and 1939

APPENDIX PROFILES OF THE BRITISH MERCHANT BANKS OPERATING BETWEEN 1914 AND 1939 An attempt has been made to identify as many merchant banks as possible operating in the period from 1914 to 1939, and to provide a brief profle of the origins and main developments of each frm, includ- ing failures and amalgamations. While information has been gathered from a variety of sources, the Bankers’ Return to the Inland Revenue published in the London Gazette between 1914 and 1939 has been an excellent source. Some of these frms are well-known, whereas many have been long-forgotten. It has been important to this work that a comprehensive picture of the merchant banking sector in the period 1914–1939 has been obtained. Therefore, signifcant efforts have been made to recover as much information as possible about lost frms. This listing shows that the merchant banking sector was far from being a homogeneous group. While there were many frms that failed during this period, there were also a number of new entrants. The nature of mer- chant banking also evolved as stockbroking frms and issuing houses became known as merchant banks. The period from 1914 to the late 1930s was one of signifcant change for the sector. © The Editor(s) (if applicable) and The Author(s), 361 under exclusive licence to Springer Nature Switzerland AG 2018 B. O’Sullivan, From Crisis to Crisis, Palgrave Studies in the History of Finance, https://doi.org/10.1007/978-3-319-96698-4 362 Firm Profle T. H. Allan & Co. 1874 to 1932 A 17 Gracechurch St., East India Agent. -

Institutional Investment in Foreign Markets

Institutional Investment in Foreign Markets MICHAEL S.P. HOW National Manager, Marketing, National Trust Introduction The subject offoreign investments is not new to us in Canada-we have been interested in having foreigners invest in our country for many years now. However, the subject ofthis paper is Canadian investment in overseas markets and I would like to cover three particular areas: • the benefits of international investment; • international management and research; and • international investment performance. Canadian institutional investment outside Canadahas been slow to start. How ever, in recent years, more and more Canadian institutions have begun to invest in the United States ofAmerica, presumablybecause the marketis close by, and because events there may be followed on a daily basis. Indeed, when reviewing the recentperformance ofthe United States and Canadianstockmarketindices, the two markets may be considered almost as one. To illustrate the low level of Canadian investment outside Canada, recent statistics for trusteed Canadian pension plans indicate that, of$100 billion of assets, only some five per cent is invested outside Canada, and that 99 per cent of that five per cent is invested in the United States. However, in the United States itself, investment in non-North American markets is beginning to increase rapidly and it is projected that, over the next 10 years, while pension assets in North America will grow by a factor ofX5, the inter national commitment ofthose assets will grow by a factor ofXl0, or twice as fast. Since the trend in Canada is to follow trends in the United States, it seems probable that Canadian investment overseas will increase rapidly in the coming years. -

2008 Annual Report and Form 20-F for the Year Ended December 31, 2008 Contact Information

ROYAL DUTCH SHELL PLC ANNUAL REPORT AND FORM 20-F FOR THE YEAR ENDED DECEMBER 31, 2008 DELIVERY & GROWTH REPORT ANNUAL REPORT AND FORM 20-F FOR THE YEAR ENDED DECEMBER 31, 2008 OUR BUSINESS With around 102,000 employees in more than 100 countries and DOWNSTREAM territories, Shell helps to meet the world’s growing demand for Our Oil Sands business, the Athabasca Oil Sands Project, extracts energy in economically, environmentally and socially bitumen – an especially thick, heavy oil – from oil sands in responsible ways. Alberta, western Canada, and converts it to synthetic crude oils that can be turned into a range of products. UPSTREAM Our Exploration & Production business searches for and recovers Our Oil Products business makes, moves and sells a range of oil and natural gas around the world. Many of these activities petroleum-based products around the world for domestic, are carried out as joint venture partnerships, often with national industrial and transport use. Its Future Fuels and CO2 business oil companies. unit develops biofuels and hydrogen and markets the synthetic fuel and products made from the GTL process. It also leads Our Gas & Power business liquefies natural gas and transports company-wide activities in CO2 management. With around it to customers across the world. Its gas to liquids (GTL) process 45,000 service stations, ours is the world’s largest single-branded turns natural gas into cleaner-burning synthetic fuel and other fuel retail network. products. It develops wind power to generate electricity and is involved in solar power technology. It also licenses our coal Our Chemicals business produces petrochemicals for industrial gasification technology, enabling coal to be used as a chemical customers. -

The Separation of Banking from Insurance: Evidence from Europe

1 The Separation of Banking from Insurance: Evidence from Europe Mohamed Nurullah Glasgow Caledonian University, U.K. Sotiris K. Staikouras Cass Business School, U.K. The European market of banks and insurance companies has traditionally no exact boundaries between insurance and banking activities. Such business arena poses distinctive challenges to both banking and insurance industries. The paper statistically evaluates the feasibility of a hybrid portfolio integrating banking and insurance services. It examines the risk-return effects of European banks’ diversification into life and non-life insurance underwriting, as well as into insurance broking businesses. More specifically, it focuses on financial data and analyzes changes in profitability, return volatility and creditworthiness of those financial institutions. The empirical results indicate that diversification by European banks into life and non-life insurance underwriting activities increases banks’ risk. Unlike the non-life insurance sector, the return on life assurance underwriting increases significantly. On the other hand, insurance broking returns increase as well, while volatility and possible bankruptcy remain insignificant. This suggests that the interface of banks and insurance broking activities could be further explored (JEL: G21, G22, G28, G34). Keywords: Bancassurance, Financial institutions, Bank diversification, Insurance activities, Risk-return analysis. I. Introduction The globalization of financial markets has brought an unprecedented wave of competition among US, Japanese and European financial institutions. This has forced market participants to recognize the need * An earlier version of this paper has been presented to and benefited by discussions from the 17th Australasian Finance and Banking Conference, Sydney 2004. The authors are also grateful to Paul Dawson for his continuous support and David Blake, John Boyd, Kenneth Carow and Russell Gerrard for providing helpful advice. -

Annual Report 1981

The Bank's accounts The Banking Department accounts fo r the year profit transferred 10 reserves amounts to £17.4 ended 28 February 198 1 show an operating profit million, compared with £ 11.2 million last year. of £62.6 million, compared with £25.6 million in 1979/80. This is after charging a total of £13.3 million The current cost accounts, shown on page 29. show in respect of a further payment to the Pension a profit before tax of £34.3 million, some £13.3 Fund to maintain a flll ly-funded position, offset by million less than in the historical cost accounts. a net reduction in provisions for losses in respect of British government and other securities and against advances under the Bank's involvement in The Issue Department accounts are shown on support operations. After a payment in lieu of page 31. The profits of the note issue, payable to the dividend of £15.0 million (compared with £6.5 Treasury, amounted to £[,739.9 million compared million) and a tax charge of £30.2 million, the with £1,328.5 million in [979/80. 17 Report of the Auditors To the GOI'ernor ami Company of fhe Bank of England We have audited the accounts of the Banking 2 The statements of account of the Issue Department Department on pages 19 to 28, and the statements present fairly the outcome of the transactions of of account of the Issue Department set out on the Department for the year ended 28 February page 31, in accordance with approved Auditing 1981 and its balances on that date. -

Three Country House Collections at Christie’S South Kensington This June: Glebe House, Mont Pellier & Woodbury House

PRESS RELEASE | SOUTH KENSINGTON | 2 8 M A Y 2015 | FOR IMMEDIATE RELEASE THREE COUNTRY HOUSE COLLECTIONS AT CHRISTIE’S SOUTH KENSINGTON THIS JUNE: GLEBE HOUSE, MONT PELLIER & WOODBURY HOUSE AND THE REMARKABLE LIBRARY OF THE LATE ANTHONY HOBSON Left: Glebe House, Centre: Mont Pellier, Right: Woodbury House South Kensington – On 17 June Christie’s South Kensington will offer Three Country House Collections: Glebe House, the Property of the late Mr. Anthony Hobson; Mont Pellier, the Property of the late Mrs. Barbara Overland and Woodbury House, the Property of the late The Hon. Mr. & Mrs. Anthony Samuel. These three country house collections perfectly encapsulate the English home and together they present a superb selection of English and European furniture, Old Master paintings and drawings, decorative objects, silver and porcelain. The sale comprises over 350 lots with estimates ranging from £500 to £50,000. The pre-auction viewing at Christie’s 85 Old Brompton Road will be open from 12 to 16 June for connoisseurs, decorators and collectors alike to explore the essence of the English country house. GLEBE HOUSE, HAMPSHIRE THE COLLECTION OF THE LATE ANTHONY HOBSON The late Anthony Hobson, a bibliophile of great distinction, and a world expert on Renaissance bookbinding, was appointed Head of Sotheby’s Book department when he was only 27, as well as being a past president of the Association Internationale de Bibliophilie (1985-1999). He was also a lifelong collector of art and furniture and amassed an extensive collection on which the taste of his wife, Tanya Vinogradoff, the granddaughter of the painter Algernon Newton, R.A, was also a significant influence.