Summary of Disability-Related Complaint Data U.S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

Air Travel Consumer Report

U.S. Department of Transportation Air Travel Consumer Report A Product Of The OFFICE OF AVIATION ENFORCEMENT AND PROCEEDINGS Aviation Consumer Protection Division Issued: May 2006 1 Flight Delays March 2006 12 Months Ending March 2006 1 Mishandled Baggage March 2006 January-March 2006 1 st Oversales 1 Quarter 2006 2 Consumer Complaints March 2006 (Includes Disability and January-March 2006 Discrimination Complaints) Customer Service Reports to the Dept. of Homeland Security3 March 2006 Airline Animal Incident Reports4 March 2006 1 Data collected by the Bureau of Transportation Statistics. Website: http://www.bts.gov/ 2 Data compiled by the Aviation Consumer Protection Division. Website: http://airconsumer.ost.dot.gov/ 3 Data provided by the Department of Homeland Security, Transportation Security Administration 4 Data collected by the Aviation Consumer Protection Division TABLE OF CONTENTS Section Page Section Page Introduction ......................…2 Flight Delays Mishandled Baggage Explanation ......................…3 Explanation ....................…..25 Table 1 ......................…4 Ranking--Month ....................…..26 Overall Percentage of Reported Flight Ranking--YTD ..................…....27 Operations Arriving On Time, by Carrier Table 1A ......................…5 Oversales Overall Percentage of Reported Flight Explanation ....................…..28 Operations Arriving On Time and Carrier Rank, Ranking--Quarter ..................…....29 by Month, Quarter, and Data Base to Date Table 2 ......................…6 Consumer Complaints -

United States Court of Appeals for the DISTRICT of COLUMBIA CIRCUIT

USCA Case #11-1018 Document #1351383 Filed: 01/06/2012 Page 1 of 12 United States Court of Appeals FOR THE DISTRICT OF COLUMBIA CIRCUIT Argued November 8, 2011 Decided January 6, 2012 No. 11-1018 REPUBLIC AIRLINE INC., PETITIONER v. UNITED STATES DEPARTMENT OF TRANSPORTATION, RESPONDENT On Petition for Review of an Order of the Department of Transportation Christopher T. Handman argued the cause for the petitioner. Robert E. Cohn, Patrick R. Rizzi and Dominic F. Perella were on brief. Timothy H. Goodman, Senior Trial Attorney, United States Department of Transportation, argued the cause for the respondent. Robert B. Nicholson and Finnuala K. Tessier, Attorneys, United States Department of Justice, Paul M. Geier, Assistant General Counsel for Litigation, and Peter J. Plocki, Deputy Assistant General Counsel for Litigation, were on brief. Joy Park, Trial Attorney, United States Department of Transportation, entered an appearance. USCA Case #11-1018 Document #1351383 Filed: 01/06/2012 Page 2 of 12 2 Before: HENDERSON, Circuit Judge, and WILLIAMS and RANDOLPH, Senior Circuit Judges. Opinion for the Court filed by Circuit Judge HENDERSON. KAREN LECRAFT HENDERSON, Circuit Judge: Republic Airline Inc. (Republic) challenges an order of the Department of Transportation (DOT) withdrawing two Republic “slot exemptions” at Ronald Reagan Washington National Airport (Reagan National) and reallocating those exemptions to Sun Country Airlines (Sun Country). In both an informal letter to Republic dated November 25, 2009 and its final order, DOT held that Republic’s parent company, Republic Airways Holdings, Inc. (Republic Holdings), engaged in an impermissible slot-exemption transfer with Midwest Airlines, Inc. (Midwest). -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Airline Business & Law: Aircraft Acquisition, Finance & Leasing

Airline Business & Law: Aircraft Acquisition, Finance & Leasing Airline Business & Law (ASPL 614) McGill Institute of Air & Space Law Mark Lessard Pillsbury Winthrop Shaw Pittman LLP Table of Contents 1. Introduction: Aircraft as Investments 2. The Principal Players a. Aircraft Operators b. The Metal-Heads c. Sources of Finance 3. Aircraft Acquisition Process a. Selecting Equipment b. OEM Aircraft Purchase Agreements c. Pre-Delivery Payments and Financing d. Secondary Market 4. The Aircraft Leasing Industry a. Operating Leasing vs. Finance Leasing b. Asset Risk Arbitrage vs. Credit Arbitrage c. Depreciation Table of Contents 5. Aircraft Financing Methods a. Airline Credit vs. Asset Values b. Commercial Bank Lending c. Export Credit Agencies d. Capital Markets 6. Legal and Contractual Protections a. Perfecting Security in Aircraft b. Operation, Maintenance and Return Conditions c. Insurance 7. Default and Remedies a. Lease and Loan Defaults b. Airline Bankruptcies c. Foreclosure and Repossession d. Transition and Deficiency 8. Conclusion: Risk and Reward Introduction: Aircraft as Investments Q: What is the surest way to become a millionaire? A: Become a billionaire and start an airline… - Richard Branson Introduction: 10 Reasons for Investor Caution 1. Danger and liability = highly regulated industry (SAFETY!) 2. Variable operating costs, mainly driven by fuel and personnel 3. Highly mobile, crossing national borders and subject to expropriation 4. Expensive to maintain even when not in use 5. Value dependent on maintenance status, variant, upgrades, engine type, operating conditions, line number etc… 6. Highl y cycli cal i nd ust ry (GDP growth necessary b u t not suffi c ien t) 7. Long-dated asset (30 + years) 8. -

2011 Economic Report

2011 ECONOMIC REPORT We Connect the World A4A airlines and their affiliates transport more than 90 percent of all U.S. airline passenger and cargo traffic. Airlines for America ® Contents A4A Members ................................................... 2 Members: Operating and Financial Results ....................... 3 Safety Trend ...................................................... 5 U.S. Airline Rankings ..................................... 7-9 Employees and Operating Revenues ............ 7 Aircraft Departures/Passengers Enplaned ....8 Cargo/Passenger Traffic and Capacity ......... 9 Top U.S. City Pairs by O&D Passengers .........11 Revenue Collected per Passenger ................. 12 Airport Passengers/Cargo and Departures .... 14 Profitability ....................................................... 16 U.S. Passenger Airline Costs vs. Inflation ...... 17 Fuel Expense per Passenger Mile .................. 18 Passengers Enplaned ..................................... 19 Domestic Capacity Trend ................................ 20 Customer Service ........................................... 22 Federal Aviation Taxes .................................... 24 U.S. Export Value by Transport Mode ............ 26 Associate Member: Noise Reduction .............................................. 28 Fuel Efficiency Gains ...................................... 29 Report Content Unless otherwise noted, the data provided in this report reflects the worldwide operations of all U.S. passenger and cargo airlines as recorded by the Bureau of Transportation -

APR 2009 Stats Rpts

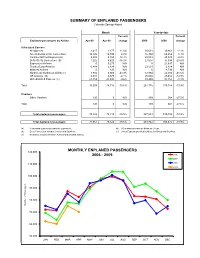

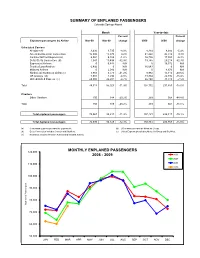

SUMMARY OF ENPLANED PASSENGERS Colorado Springs Airport Month Year-to-date Percent Percent Enplaned passengers by Airline Apr-09 Apr-08 change 2009 2008 change Scheduled Carriers Allegiant Air 2,417 2,177 11.0% 10,631 10,861 -2.1% American/American Connection 14,126 14,749 -4.2% 55,394 60,259 -8.1% Continental/Cont Express (a) 5,808 5,165 12.4% 22,544 23,049 -2.2% Delta /Delta Connection (b) 7,222 8,620 -16.2% 27,007 37,838 -28.6% ExpressJet Airlines 0 5,275 N/A 0 21,647 N/A Frontier/Lynx Aviation 6,888 2,874 N/A 23,531 2,874 N/A Midwest Airlines 0 120 N/A 0 4,793 N/A Northwest/ Northwest Airlink (c) 3,882 6,920 -43.9% 12,864 22,030 -41.6% US Airways (d) 6,301 6,570 -4.1% 25,665 29,462 -12.9% United/United Express (e) 23,359 25,845 -9.6% 89,499 97,355 -8.1% Total 70,003 78,315 -10.6% 267,135 310,168 -13.9% Charters Other Charters 120 0 N/A 409 564 -27.5% Total 120 0 N/A 409 564 -27.5% Total enplaned passengers 70,123 78,315 -10.5% 267,544 310,732 -13.9% Total deplaned passengers 71,061 79,522 -10.6% 263,922 306,475 -13.9% (a) Continental Express provided by ExpressJet. (d) US Airways provided by Mesa Air Group. (b) Delta Connection includes Comair and SkyWest . (e) United Express provided by Mesa Air Group and SkyWest. -

Hooters Air: Hot Wings Don't

Journal of Business Cases and Applications Volume 15, December, 2015 Hooters Air: Hot wings don’t fly Dennis Kimerer The University of Tampa Hauimu Xing The University of Tampa Steven Lewis The University of Tampa Erika Matulich The University of Tampa Melissa Walters The University of Tampa Phil Michaels The University of Tampa ABSTRACT This instructional case is designed to develop students’ understanding of growth strategies, segment focusing, target market buying behavior, and brand expansion. The case explores a failed attempt at brand expansion by Hooters, a popular American restaurant chain that attempted to diversify into the airline industry. Hooters entered a highly competitive yet stagnant growth airline industry in 2003 as Hooters Air, targeting itself toward vacationers and golfers. Hooters Air sought to differentiate itself from other carriers with specialized flight destinations, a distinctive style of in-flight service, and first-class seating at an affordable price. After facing numerous challenges, including sky-rocketing fuel costs and general brand confusion, Hooters Air folded its wings in early 2006. The failure of Hooters Air is considered an ill-fated example of brand expansion. Keywords: Hooters Air, brand extension, marketing segmentation/positioning, diversification, marketing growth strategy Copyright statement: Authors retain the copyright to the manuscripts published in AABRI journals. Please see the AABRI Copyright Policy at http://www.aabri.com/copyright.html Hooters Air, Page 1 Journal of Business Cases and Applications Volume 15, December, 2015 TARGETED COURSES AND LEARNING OBJECTIVES This case is suitable for both undergraduate and graduate courses in marketing, management or entrepreneurship, as well as courses in which students are studying business strategies and marketing planning topics such as marketing growth strategy, branding strategy/brand expansion, new product introduction, market segmentation/positioning, and entrepreneurship. -

Airline Quarterly Financial Review

AIRLINE QUARTERLY FINANCIAL REVIEW FOURTH QUARTER 2019 PASSENGER NATIONALS DEPARTMENT OF TRANSPORTATION OFFICE OF AVIATION ANALYSIS: COMPETITION AND POLICY ANALYIS DIVISION Table of Contents INTRODUCTION ........................................................................................................................................................................................................................... 2 SYSTEM PASSENGER NATIONALS ................................................................................................................................................................................................ 3 Chart 1. Operating Profit and Net Income (Loss) for the Quarter .................................................................................................................................. 4 Chart 2. Operating Profit and Net Income (Loss) for the Year Ended ............................................................................................................................ 4 Chart 3. Operating Profit (Loss) by Quarter ................................................................................................................................................................... 5 Chart 4. Net Income (Loss) by Quarter .......................................................................................................................................................................... 5 Chart 5. Operating Profit (Loss) Year Ended by Quarter ............................................................................................................................................... -

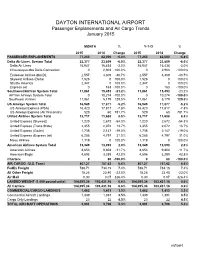

DAYTON INTERNATIONAL AIRPORT Passenger Enplanements and Air Cargo Trends January 2015

DAYTON INTERNATIONAL AIRPORT Passenger Enplanements and Air Cargo Trends January 2015 MONTH % Y-T-D % 2015 2014 Change 2015 2014 Change PASSENGER ENPLANEMENTS 77,253 82,000 -5.8% 77,253 82,000 -5.8% Delta Air Lines, System Total 22,377 23,809 -6.0% 22,377 23,809 -6.0% Delta Air Lines 15,947 16,434 -3.0% 15,947 16,434 -3.0% Chautauqua dba Delta Connection 0 2,903 -100.0% 0 2,903 -100.0% Endeavor Airlines dba DL 2,557 4,309 -40.7% 2,557 4,309 -40.7% Skywest Airlines (Delta) 1,526 0 100.0% 1,526 0 100.0% Shuttle America 2,347 0 100.0% 2,347 0 100.0% Express Jet 0 163 -100.0% 0 163 -100.0% Southwest/AirTran System Total 11,861 15,453 -23.2% 11,861 15,453 -23.2% AirTran Airways System Total 0 10,274 -100.0% 0 10,274 -100.0% Southwest Airlines 11,861 5,179 129.0% 11,861 5,179 129.0% US Airways System Total 16,949 17,877 -5.2% 16,949 17,877 -5.2% US Airways Express (PSA) 16,420 17,817 -7.8% 16,420 17,817 -7.8% US Airways Express (Air Wsconsin) 529 60 781.7% 529 60 781.7% United Airlines System Total 12,717 11,688 8.8% 12,717 11,688 8.8% United Express (Skywest) 1,220 2,672 -54.3% 1,220 2,672 -54.3% United Express (Trans State) 2,355 2,072 13.7% 2,355 2,072 13.7% United Express (GoJet) 1,738 2,147 -19.0% 1,738 2,147 -19.0% United Express (Express Jet) 6,285 4,797 31.0% 6,285 4,797 31.0% Mesa Airlines 1,119 0 100.0% 1,119 0 100.0% American Airlines System Total 13,349 13,093 2.0% 13,349 13,093 2.0% American Airlines 8,653 9,804 -11.7% 8,653 9,804 -11.7% American Eagle 4,696 3,289 42.8% 4,696 3,289 42.8% Charters 0 80 -100.0% 0 80 -100.0% AIR CARGO (U.S. -

MAR 2009 Stats Rpts

SUMMARY OF ENPLANED PASSENGERS Colorado Springs Airport Month Year-to-date Percent Percent Enplaned passengers by Airline Mar-09 Mar-08 change 2009 2008 change Scheduled Carriers Allegiant Air 3,436 3,735 -8.0% 8,214 8,684 -5.4% American/American Connection 15,900 15,873 0.2% 41,268 45,510 -9.3% Continental/Cont Express (a) 6,084 6,159 -1.2% 16,736 17,884 -6.4% Delta /Delta Connection (b) 7,041 10,498 -32.9% 19,785 29,218 -32.3% ExpressJet Airlines 0 6,444 N/A 0 16,372 N/A Frontier/Lynx Aviation 6,492 0 N/A 16,643 0 N/A Midwest Airlines 0 2,046 N/A 0 4,673 N/A Northwest/ Northwest Airlink (c) 3,983 6,773 -41.2% 8,982 15,110 -40.6% US Airways (d) 7,001 7,294 -4.0% 19,364 22,892 -15.4% United/United Express (e) 24,980 26,201 -4.7% 66,140 71,510 -7.5% Total 74,917 85,023 -11.9% 197,132 231,853 -15.0% Charters Other Charters 150 188 -20.2% 289 564 -48.8% Total 150 188 -20.2% 289 564 -48.8% Total enplaned passengers 75,067 85,211 -11.9% 197,421 232,417 -15.1% Total deplaned passengers 72,030 82,129 -12.3% 192,861 226,953 -15.0% (a) Continental Express provided by ExpressJet. (d) US Airways provided by Mesa Air Group. (b) Delta Connection includes Comair and SkyWest . (e) United Express provided by Mesa Air Group and SkyWest. -

REJECTED CONTRACTS Non-Debtor Party Contract

REJECTED CONTRACTS Non-Debtor Party Contract Description ACG 1030 Higgins LLC Office Lease Dated October 1, 2002 between Atlantic Coast Airlines and ACG 1030 Higgins LLC ACG 1030 Higgins LLC Rider 1 to Lease Agreement between Atlantic Coast Airlines and ACG 1030 Higgins LLC dated 1/15/2003 ACG 1030 Higgins LLC Rider 2 to Lease Agreement between Atlantic Coast Airlines and ACG 1030 Higgins LLC signed 10/1/2002 ACG 1030 Higgins, LLC Consent to Assignment among Atlantic Coast Airlines, ACG 1030 Higgins, LLC, and Air Wisconsin Airlines Corporation dated 12/1/2003 Aero Snow Removal a Division of East Coast Amendment I to Snow Removal Agreement between Atlantic Sweeping Inc Coast Airlines and Aero dated 11/1/2004 Snow Removal Agreement between Atlantic Coast Airlines, Inc. Aero Snow Removal, a division of East Coast dba United Express and Aero Snow Removal, a division of East Sweeping, Corp. Coast Sweeping, Corp. signed 11/19/1999 Airport Group International Agreement for Airport Services between Atlantic Coast Airlines dba Independence Air and Airport Group International dated 6/15/2004 Airport Group International Agreement for Into-Plane Fueling Services between Atlantic Coast Airlines dba Independence Air and Airport Group International Airline Use and Lease Agreement between Independence Air and Albany County Airport Authority Albany County Airport Authority dated 6/1/2004 Agreement Regarding Boarding Assistance between Atlantic Albany International Airport Coast Airlines and Albany International Airport Amadeus Global Travel Distribution, SA Amadeus AIS Agreement for Airlines between Independence Air, Inc. and Amadeus Global Travel Distribution, SA dated 2/1/2005 Amadeus Global Travel Distribution, SA Amadeus Instant Marketing Agreement between Independence Air, Inc.