The Birth of the Continental Dollar, 1775

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Recession of 1797?

SAE./No.48/February 2016 Studies in Applied Economics WHAT CAUSED THE RECESSION OF 1797? Nicholas A. Curott and Tyler A. Watts Johns Hopkins Institute for Applied Economics, Global Health, and Study of Business Enterprise What Caused the Recession of 1797? By Nicholas A. Curott and Tyler A. Watts Copyright 2015 by Nicholas A. Curott and Tyler A. Watts About the Series The Studies in Applied Economics series is under the general direction of Prof. Steve H. Hanke, co-director of the Institute for Applied Economics, Global Health, and Study of Business Enterprise ([email protected]). About the Authors Nicholas A. Curott ([email protected]) is Assistant Professor of Economics at Ball State University in Muncie, Indiana. Tyler A. Watts is Professor of Economics at East Texas Baptist University in Marshall, Texas. Abstract This paper presents a monetary explanation for the U.S. recession of 1797. Credit expansion initiated by the Bank of the United States in the early 1790s unleashed a bout of inflation and low real interest rates, which spurred a speculative investment bubble in real estate and capital intensive manufacturing and infrastructure projects. A correction occurred as domestic inflation created a disparity in international prices that led to a reduction in net exports. Specie flowed out of the country, prices began to fall, and real interest rates spiked. In the ensuing credit crunch, businesses reliant upon rolling over short term debt were rendered unsustainable. The general economic downturn, which ensued throughout 1797 and 1798, involved declines in the price level and nominal GDP, the bursting of the real estate bubble, and a cluster of personal bankruptcies and business failures. -

Nber Working Paper Series the Continental Dollar

NBER WORKING PAPER SERIES THE CONTINENTAL DOLLAR: INITIAL DESIGN, IDEAL PERFORMANCE, AND THE CREDIBILITY OF CONGRESSIONAL COMMITMENT Farley Grubb Working Paper 17276 http://www.nber.org/papers/w17276 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 August 2011 Preliminary versions were presented at Queens University, Kingston, Canada, 2010; University of Cambridge, Cambridge, UK, 2010; and the National Bureau of Economic Research, Cambridge, MA, 2011. The author thanks the participants for their comments. Research assistance by Jiaxing Jiang and Zachary Rose, and editorial assistance by Tracy McQueen, are gratefully acknowledged. The views expressed herein are those of the author and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer- reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2011 by Farley Grubb. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. The Continental Dollar: Initial Design, Ideal Performance, and the Credibility of Congressional Commitment Farley Grubb NBER Working Paper No. 17276 August 2011 JEL No. E42,E52,G12,G18,H11,H56,H6,H71,N11,N21,N41 ABSTRACT An alternative history of the Continental Dollar is constructed from the original resolutions passed by Congress. The Continental Dollar was a zero-interest bearer bond, not a fiat currency. The public could redeem it at face value in specie at fixed future dates. -

Chapter 5 the Americans.Pdf

Washington (on the far right) addressing the Constitutional Congress 1785 New York state outlaws slavery. 1784 Russians found 1785 The Treaty 1781 The Articles of 1783 The Treaty of colony in Alaska. of Hopewell Confederation, which Paris at the end of concerning John Dickinson helped the Revolutionary War 1784 Spain closes the Native American write five years earli- recognizes United Mississippi River to lands er, go into effect. States independence. American commerce. is signed. USA 1782 1784 WORLD 1782 1784 1781 Joseph II 1782 Rama I 1783 Russia annexes 1785 Jean-Pierre allows religious founds a new the Crimean Peninsula. Blanchard and toleration in Austria. dynasty in Siam, John Jeffries with Bangkok 1783 Ludwig van cross the English as the capital. Beethoven’s first works Channel in a are published. balloon. 130 CHAPTER 5 INTERACT WITH HISTORY The year is 1787. You have recently helped your fellow patriots overthrow decades of oppressive British rule. However, it is easier to destroy an old system of government than to create a new one. In a world of kings and tyrants, your new republic struggles to find its place. How much power should the national government have? Examine the Issues • Which should have more power—the states or the national government? • How can the new nation avoid a return to tyranny? • How can the rights of all people be protected? RESEARCH LINKS CLASSZONE.COM Visit the Chapter 5 links for more information about Shaping a New Nation. 1786 Daniel Shays leads a rebellion of farmers in Massachusetts. 1786 The Annapolis Convention is held. -

Peasantry and the French Revolution

“1st. What is the third estate? Everything. 2nd. What has it been heretofore in the political order? Nothing. 3rd. What does it demand? To become something therein.” -Abbe Sieyes 1789 Pre-Revolution • Louis XVI came to the throne in the midst of a serious financial crisis • France was nearing bankruptcy due to the outlays that were outpacing income • A new tax code was implemented under the direction of Charles Alexandre de Calonne • This proposal included a land tax • Issues with the Three Estates and inequality within it Peasant Life pre-Revolution • French peasants lived better than most of their class, but were still extremely poor • 40% worked land, but it was subdivided into several small plots which were shared and owned by someone else • Unemployment was high due to the waning textile industry • Rent and food prices continued to rise • Worst harvest in 40 years took place during the winter of 1788-89 Peasant Life pre-Revolution • The Third Estate, which was the lower classes in France, were forced by the nobility and the Church to pay large amounts in taxes and tithes • Peasants had experienced a lot of unemployment during the 1780s because of the decline in the nation’s textile industry • There was a population explosion of about 25-30% in roughly 90 years that did not coincide with a rise in food production Direct Causes of the Revolution • Famine and malnutrition were becoming more common as a result of shortened food supply • Rising bread prices contributes to famine • France’s near bankruptcy due to their involvement in various -

The Constitutional Status of Women in 1787

Minnesota Journal of Law & Inequality Volume 6 Issue 1 Article 3 June 1988 The Constitutional Status of Women in 1787 Mary Beth Norton Follow this and additional works at: https://lawandinequality.org/ Recommended Citation Mary B. Norton, The Constitutional Status of Women in 1787, 6(1) LAW & INEQ. 7 (1988). Available at: https://scholarship.law.umn.edu/lawineq/vol6/iss1/3 Minnesota Journal of Law & Inequality is published by the University of Minnesota Libraries Publishing. The Constitutional Status of Women in 1787 Mary Beth Norton* I am tempted to make this presentation on the constitutional status of women in 1787 extremely brief. That is, I could accu- rately declare that "women had no status in the Constitution of 1787" and immediately sit down to listen to the comments of the rest of the panelists here this morning. However, I was undoubt- edly invited here to say more than that, and so I shall. If one looks closely at the words of the original Constitution, the term "man" or "men" is not used; rather, "person," "persons" and "people" are the words of choice. That would seem to imply that the Founding Fathers intended to include women in the scope of their docu- ment. That such an assumption is erroneous, however, was demonstrated in a famous exchange between Abigail and John Ad- ams in 1776. Although John Adams was not present at the Consti- tutional Convention, his attitudes toward women were certainly representative of the men of his generation. In March, 1776, when it had become apparent that indepen- dence would soon be declared, -

355 Adelman, Joseph. Revolutionary Networks: the Business And

Book Reviews Rothstein, Richard. 2017. The Color of Law: A Forgotten History of How Our Government Segregated America. Washington, DC: Economic Policy Institute. Adelman, Joseph. Revolutionary Networks: The Business and Politics of Printing the News, 1763-1789. Baltimore: Johns Hopkins University Press, 2019. 280 Pp. In Revolutionary Networks, colonial newspapers and the men and women behind the presses dominate the headlines. Joseph Adelman explores the oft overlooked business of printing in colonial America and how the industry influenced the American Revolution and the formation of the United States. He attempts to determine how colonial printers, most located in the major ports and towns of British North America, conducted the everyday business of printing and disseminating the news in the politically turbulent period of the late 1760s, 1770s, and 1780s. Colonial printers flowed between the working class and elite society, forming information and business networks that spanned the entire Atlantic Ocean. As a result, printers developed enormous influence by curating the news; they played a central role in the political turmoil of the American Revolution and development of the United State Constitution. Adelman charts the role of printers in Britain’s North American colonies in shaping the political economy of colonial America and the early United States in six chapters, an introduction, and a conclusion. Few authors attempt to place the American Revolution as a secondary focus, but Adelman does so successfully, placing printers and their business practices at the forefront of the political and social developments. He begins, in chapter one, with a description of the economic and business practices of printers in the colonies, including mundane details such as advertising and subscription rates. -

Working Paper No. 86

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Wray, L. Randall Working Paper The Origins of Money and the Development of the Modern Financial System Working Paper, No. 86 Provided in Cooperation with: Levy Economics Institute of Bard College Suggested Citation: Wray, L. Randall (1993) : The Origins of Money and the Development of the Modern Financial System, Working Paper, No. 86, Levy Economics Institute of Bard College, Annandale-on-Hudson, NY This Version is available at: http://hdl.handle.net/10419/186771 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu The Origins of Money and the Development of the Modem Financial System by L. Randall Wray* Working Paper No. -

Loyalists in War, Americans in Peace: the Reintegration of the Loyalists, 1775-1800

University of Kentucky UKnowledge University of Kentucky Doctoral Dissertations Graduate School 2008 LOYALISTS IN WAR, AMERICANS IN PEACE: THE REINTEGRATION OF THE LOYALISTS, 1775-1800 Aaron N. Coleman University of Kentucky, [email protected] Right click to open a feedback form in a new tab to let us know how this document benefits ou.y Recommended Citation Coleman, Aaron N., "LOYALISTS IN WAR, AMERICANS IN PEACE: THE REINTEGRATION OF THE LOYALISTS, 1775-1800" (2008). University of Kentucky Doctoral Dissertations. 620. https://uknowledge.uky.edu/gradschool_diss/620 This Dissertation is brought to you for free and open access by the Graduate School at UKnowledge. It has been accepted for inclusion in University of Kentucky Doctoral Dissertations by an authorized administrator of UKnowledge. For more information, please contact [email protected]. ABSTRACT OF DISSERATION Aaron N. Coleman The Graduate School University of Kentucky 2008 LOYALISTS IN WAR, AMERICANS IN PEACE: THE REINTEGRATION OF THE LOYALISTS, 1775-1800 _________________________________________________ ABSTRACT OF DISSERTATION _________________________________________________ A dissertation submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy in the College of Arts and Sciences at the University of Kentucky By Aaron N. Coleman Lexington, Kentucky Director: Dr. Daniel Blake Smith, Professor of History Lexington, Kentucky 2008 Copyright © Aaron N. Coleman 2008 iv ABSTRACT OF DISSERTATION LOYALISTS IN WAR, AMERICANS IN PEACE: THE REINTEGRATION OF THE LOYALISTS, 1775-1800 After the American Revolution a number of Loyalists, those colonial Americans who remained loyal to England during the War for Independence, did not relocate to the other dominions of the British Empire. -

Constitution of the United States of America, As Amended

110TH CONGRESS DOCUMENT " ! 1st Session HOUSE OF REPRESENTATIVES No. 110–50 THE CONSTITUTION OF THE UNITED STATES OF AMERICA As Amended Unratified Amendments Analytical Index E PL UR UM IB N U U S PRESENTED BY MR. BRADY OF PENNSYLVANIA July 25, 2007 • Ordered to be printed UNITED STATES GOVERNMENT PRINTING OFFICE WASHINGTON: 2007 For sale by the Superintendent of Documents, U.S. Government Printing Office Internet: bookstore.gpo.gov Phone: toll free (866) 512-1800; DC area (202) 512-1800 Fax: (202) 512-2104 Mail: Stop IDCC, Washington, DC 20402-001 [ISBN 978–0–16–079091–1] VerDate Aug 31 2005 11:11 Dec 10, 2007 Jkt 036932 PO 00000 Frm 00001 Fmt 5229 Sfmt 5229 E:\HR\OC\36932.XXX 36932 cprice-sewell on PROD1PC72 with HEARING E:\seals\congress.#15 House Doc. 110–50 The printing of the revised version of The Constitution of the United States of America As Amended (Document Size) is hereby ordered pursuant to H. Con. Res. 190 as passed on July 25, 2007, 110th Congress, 1st Session. This document was compiled at the di- rection of Chairman Robert A. Brady of the Joint Committee on Printing, and printed by the U.S. Government Printing Office. (ii) VerDate Aug 31 2005 11:19 Dec 10, 2007 Jkt 036932 PO 00000 Frm 00002 Fmt 7601 Sfmt 7601 E:\HR\OC\932.CC 932 cprice-sewell on PROD1PC72 with HEARING CONTENTS Historical Note ......................................................................................................... v Text of the Constitution .......................................................................................... 1 Amendments -

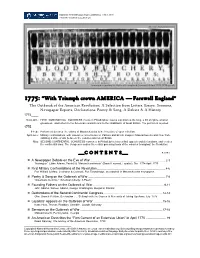

Colonists Respond to the Outbreak of War, 1774-1775, Compilation

MAKING THE REVOLUTION: AMERICA, 1763-1791 PRIMARY SOURCE COLLECTION American Antiquarian Society broadside reporting the Battle of Lexington & Concord,19 April 1775; 1775 (detail) 1775: “With Triumph crown AMERICA Farewell England” The Outbreak of the American Revolution: A Selection from Letters, Essays, Sermons, Newspaper Reports, Declarations, Poetry & Song, A Debate & A History 1774____* Sept.-Oct.: FIRST CONTINENTAL CONGRESS meets in Philadelphia; issues a petition to the king, a bill of rights, a list of grievances, and letters to the American colonists and to the inhabitants of Great Britain. The petition is rejected. 1775____ 9 Feb.: Parliament declares the colony of Massachusetts to be in a state of open rebellion. April-June: Military confrontations with casualties occur between Patriots and British troops in Massachusetts and New York, initiating a state of war between the colonies and Great Britain. May: SECOND CONTINENTAL CONGRESS convenes in Philadelphia, issues final appeals and declarations, and creates the continental army. The Congress remains the central governing body of the colonies throughout the Revolution. PAGES ___CONTENT S___ A Newspaper Debate on the Eve of War ............................................................................. 2-3 “Novanglus” (John Adams, Patriot) & “Massachusettensis” (Daniel Leonard, Loyalist), Dec. 1774-April 1775 First Military Confrontations of the Revolution...................................................................... 4-6 Fort William & Mary, Lexington & Concord, -

Few Americans in the 1790S Would Have Predicted That the Subject Of

AMERICAN NAVAL POLICY IN AN AGE OF ATLANTIC WARFARE: A CONSENSUS BROKEN AND REFORGED, 1783-1816 Dissertation Presented in Partial Fulfillment of the Requirements for the Degree Doctor of Philosophy in the Graduate School of The Ohio State University By Jeffrey J. Seiken, M.A. * * * * * The Ohio State University 2007 Dissertation Committee: Approved by Professor John Guilmartin, Jr., Advisor Professor Margaret Newell _______________________ Professor Mark Grimsley Advisor History Graduate Program ABSTRACT In the 1780s, there was broad agreement among American revolutionaries like Thomas Jefferson, James Madison, and Alexander Hamilton about the need for a strong national navy. This consensus, however, collapsed as a result of the partisan strife of the 1790s. The Federalist Party embraced the strategic rationale laid out by naval boosters in the previous decade, namely that only a powerful, seagoing battle fleet offered a viable means of defending the nation's vulnerable ports and harbors. Federalists also believed a navy was necessary to protect America's burgeoning trade with overseas markets. Republicans did not dispute the desirability of the Federalist goals, but they disagreed sharply with their political opponents about the wisdom of depending on a navy to achieve these ends. In place of a navy, the Republicans with Jefferson and Madison at the lead championed an altogether different prescription for national security and commercial growth: economic coercion. The Federalists won most of the legislative confrontations of the 1790s. But their very success contributed to the party's decisive defeat in the election of 1800 and the abandonment of their plans to create a strong blue water navy. -

Town Meetings and Other Popular Assemblies in the American Founding

Journal of Public Deliberation Volume 15 Issue 2 Town Meeting Politics in the United States: The Idea and Practice of an American Article 7 Myth 2019 A ‘Peaceable and Orderly Manner’: Town Meetings and other Popular Assemblies in the American Founding Robert W. T. Martin Hamilton College, [email protected] Follow this and additional works at: https://www.publicdeliberation.net/jpd Part of the Political Science Commons Recommended Citation Martin, Robert W. T. (2019) "A ‘Peaceable and Orderly Manner’: Town Meetings and other Popular Assemblies in the American Founding," Journal of Public Deliberation: Vol. 15 : Iss. 2 , Article 7. Available at: https://www.publicdeliberation.net/jpd/vol15/iss2/art7 This Article is brought to you for free and open access by Public Deliberation. It has been accepted for inclusion in Journal of Public Deliberation by an authorized editor of Public Deliberation. A ‘Peaceable and Orderly Manner’: Town Meetings and other Popular Assemblies in the American Founding Abstract The New England town meeting has often been seen as the archetypical deliberative citizen forum (see, e.g., Mansbridge 1980). More recently, political theorists have begun to appreciate the way in which any particular public forum might be better understood as part of the larger deliberative system (Parkinson, Mansbridge, 2012). Much of this work draws on modern-day examples (Parkinson 2006). But a return to the American founding era reveals that while town meetings are often praised and have many democratic virtues, they also embody a limitation on popular action generally and especially on democratic dissent. Keywords deliberative democracy, town meetings, citizen assemblies, dissent, James Madison, American Founding This article is available in Journal of Public Deliberation: https://www.publicdeliberation.net/jpd/vol15/iss2/art7 Martin: A ‘Peaceable and Orderly Manner’ Introduction Much like the ancient Athenian assembly, the New England town meeting has often been seen as an archetypical deliberative citizen forum (see, e.g., Mansbridge 1980).