KIATNAKIN BANK PLC No

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

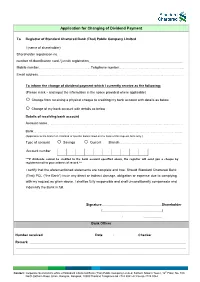

Application for Changing of Dividend Payment

Application for Changing of Dividend Payment To Registrar of Standard Chartered Bank (Thai) Public Company Limited I (name of shareholder) Shareholder registration no. number of identification card / juristic registration Mobile number………………………………………………….……….....Telephone number…………………..……………………………………….……………….. Email address……………………………………………………………………………………………………………….……………………………………………………………… To inform the change of dividend payment which I currently receive as the following: (Please mark and input the information in the space provided where applicable) Change from receiving a physical cheque to crediting my bank account with details as below Change of my bank account with details as below Details of receiving bank account Account name………………………………………………………………………………………………………………………………………………………..…….….. Bank………………………………………………………………………………………………………………………………………………………..……………………….... (Applicable to the branch in Thailand of specific banks listed on the back of this request form only.) Type of account Savings Current Branch…………………………………………………….……………………. Account number ***If dividends cannot be credited to the bank account specified above, the registrar will send you a cheque by registered mail to your address of record.*** I certify that the aforementioned statements are complete and true. Should Standard Chartered Bank (Thai) PCL (“the Bank”) incur any direct or indirect damage, obligation or expense due to complying with my request as given above. I shall be fully responsible and shall unconditionally compensate and indemnify the Bank in full. Signature Shareholder ( ) / / Bank Officer Number received Date / / Checker Remark Contact: Corporate Secretariat’s office of Standard Chartered Bank (Thai) Public Company Limited, Sathorn Nakorn Tower, 12th Floor, No. 100 North Sathorn Road, Silom, Bangrak, Bangkok, 10500 Thailand Telephone 66 2724 8041-42 Fax 66 2724 8044 Documents to be submitted for changing of dividend payment (All photocopies must be certified as true) For Individual Person 1. -

Banks in Thailand

Siam International Legal Group | Thailand´s Largest Legal Network Service Banks in Thailand KasikornBank Public Co. Ltd. Established in 1945, KasikornBank is the fourth largest commercial bank in Thailand as measured by total assets. KasikornBank (formerly known as Thai Farmers Bank) provides a broad range of consumer, commercial, and corporate banking services. These include lending, deposit– taking, credit card services, international trade financing, custodian services, asset management, and investment banking services. For more information you can visit http://www.kasikornbank. com/GlobalHome/EN/homepage.html. Bangkok Bank Public Co. Ltd. Known as Bangkok’s largest private bank, the bank offers a full range of banking products and an extensive distribution network with more than 600 branches, Internet banking, phone banking, and self–service ATM and Express Banking machines. To know more about their services, you can log on to http://www.bangkokbank.com/Bangkok+Bank/main.htm. TISCO Bank Public Co. Ltd. TISCO was established in 1969 as the first investment bank in Thailand. Tisco Bank started its commercial banking operations on July 1st, 2005 with its head office located atTisco Tower on the North Sathorn Road and 14 branches in strategic locations nationwide. Visit their official website at http://www.tisco.co.th/. SCB Easy Net - Thailand’s First Internet Banking Siam Commercial Bank offers a wide range of online banking services. Just log on to http:// www.scbeasy.com. Siam Commercial Bank Public Co. Ltd. With over a hundred years of service, Siam Commercial Bank offers Personal banking services such as Thai baht deposits, foreign currency deposits, international remittances, currency exchange, fund management, internet banking, consumer loans, life and accident insurance. -

Annual Report 2018

Annual Report 2018 Contents 04 Milestone 155 Personnel 06 Awards and Ranking 161 Corporate Governance Policy 08 Financial Highlights and Practices 10 Message from the Board of Directors 187 Supervision of Subsidiaries 15 Vision and Mission and Affiliates 16 Policy and Business Overview 188 Supervision of Usage of 33 Business Operations Internal Information 63 Risk Factors 189 Auditor’s Remuneration 72 General Information 190 Internal Controls 76 Securities and Shareholders 197 Related Party Transactions Information 201 Report of the Board of 82 Dividend Policy Director’s Responsibility for 83 Organization Structure Financial Statements 84 Management Structure 202 Report of the Audit Committee 98 Nomination and Appointment of 204 Report of the Nomination Directors and Executives and Remuneration Committee 100 Remuneration of Directors and 206 Report of the Compliance and Executives Governance Committee 108 Profiles of the Directors, Executives, 208 Report of the Risk Management Controlling Persons and Committee Corporate Secretary 209 Report of the Executive Committee 152 Directorship of Directors and 211 Management Discussion Executives in Subsidiaries, and Analysis Associated Companies 223 Credit Rating and Related Companies 224 Independent Auditor’s Report 154 Directors of Subsidiaries 231 Financial Statements 240 Notes to the Financial Statements Please see Corporate Social Responsibility Report 2018. Renewable electricity from Hydropower Milestone Kiatnakin Phatra Financial Group 1971 1972 1993 Kiatnakin Finance and Phatra Thanakit Finance and Kiatnakin Finance and Securities Company Securities Public Company Securities Company Limited was founded by Limited was founded. Limited went public. Mr. Kiat Wattanavekin. 1997 1998 • Kiatnakin Finance and Securities Public Kiatnakin Finance and Securities Public Company Limited along with other 57 financial Company Limited was granted permission institutions were temporarily discontinued by the Ministry of Finance to resume because of the 1997 Asian Financial Crisis. -

Kiatnakin Bank Target Price: THB58.00 Price: THB51.30 Superior Growth and Dividends Market Cap: USD1,254M Bloomberg Ticker: KKP TB

Reinitiating Coverage Thailand 2 September 2016 Financial Services | Banks Buy (from Neutral) Kiatnakin Bank Target Price: THB58.00 Price: THB51.30 Superior Growth And Dividends Market Cap: USD1,254m Bloomberg Ticker: KKP TB Reinitiate coverage on KKP with a BUY rating and TP of THB58.00 (13% Share Data upside). We project continued strong earnings growth recovery and a Avg. Daily Turnover (THB/USD) 175m/5.01m healthier balance sheet on: 52-wk Price low/high (THB) 30.3 - 52.5 1. Improved quality of auto HP loans and higher LLC ratio, which will Free Float (%) 76 reduce future credit costs; Shares outstanding (m) 847 2. Loan growth rebound from higher corporate and SME loans; Estimated Return 13% 3. Sustainable high NIM from good control of funding costs. Our GGM-based TP implies FY17F P/BV of 1.1x and P/E of 10.1x. Shareholders (%) Credit Suisse AG, Hong Kong 8.5 Growth and dividend stock. We reinitiate coverage on Kiatnakin Bank (KKP) with a BUY call to reflect: Chase Nominees 7.4 Thai NVDR 6.0 i. Projected strong earnings 16% CAGR for 2016F-2018F, more than double the 7% average for Thai banks under our coverage (TH banks); Share Performance (%) ii. Higher ROEs of 11.7-11.9% for 2016F-2018F; YTD 1m 3m 6m 12m iii. Improved asset quality with lower non-performing loans (NPLs) and higher Absolute 41.4 (2.4) 25.8 13.9 56.5 loan loss coverage (LLC) ratio; Relative 21.5 (3.7) 16.5 (2.0) 43.5 iv. Superior 2016-2018 dividend yields (5.8-6.6%), highest among TH Banks. -

Stock Comparison

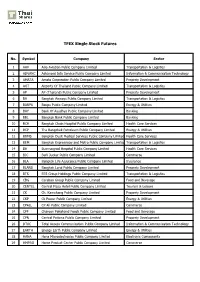

TFEX Single Stock Futures No. Symbol Company Sector 1 AAV Asia Aviation Public Company Limited Transportation & Logistics 2 ADVANC Advanced Info Service Public Company Limited Information & Communication Technology 3 AMATA Amata Corporation Public Company Limited Property Development 4 AOT Airports Of Thailand Public Company Limited Transportation & Logistics 5 AP AP (Thailand) Public Company Limited Property Development 6 BA Bangkok Airways Public Company Limited Transportation & Logistics 7 BANPU Banpu Public Company Limited Energy & Utilities 8 BAY Bank Of Ayudhya Public Company Limited Banking 9 BBL Bangkok Bank Public Company Limited Banking 10 BCH Bangkok Chain Hospital Public Company Limited Health Care Services 11 BCP The Bangchak Petroleum Public Company Limited Energy & Utilities 12 BDMS Bangkok Dusit Medical Services Public Company Limited Health Care Services 13 BEM Bangkok Expressway and Metro Public Company Limited Transportation & Logistics 14 BH Bumrungrad Hospital Public Company Limited Health Care Services 15 BJC Berli Jucker Public Company Limited Commerce 16 BLA Bangkok Life Assurance Public Company Limited Insurance 17 BLAND Bangkok Land Public Company Limited Property Development 18 BTS BTS Group Holdings Public Company Limited Transportation & Logistics 19 CBG Carabao Group Public Company Limited Food and Beverage 20 CENTEL Central Plaza Hotel Public Company Limited Tourism & Leisure 21 CK Ch. Karnchang Public Company Limited Property Development 22 CKP Ck Power Public Company Limited Energy & Utilities 23 CPALL CP All Public Company Limited Commerce 24 CPF Charoen Pokphand Foods Public Company Limited Food and Beverage 25 CPN Central Pattana Public Company Limited Property Development 26 DTAC Total Access Communication Public Company Limited Information & Communication Technology 27 EARTH Energy Earth Public Company Limited Energy & Utilities 28 HANA Hana Microelectronics Public Company Limited Electronic Components 29 HMPRO Home Product Center Public Company Limited Commerce TFEX Single Stock Futures No. -

Kiatnakin Bank (KKP TB) Share Price: Bt66.25 Target Price: Bt74.00 (+12.6%)

March 13, 2017 OUTPERFORM Kiatnakin Bank (KKP TB) Share Price: Bt66.25 Target Price: Bt74.00 (+12.6%) Company Update Company Best dividend yield among Thai banks Loans to reverse to growth trend after contracting in the past three years, driven by retail loans (non-HP); asset quality to improve further with lower NPL ratio Expect Bt5.5/Bt6.0 DPS for FY17F/18F based on 80% payout ratio; ROE should reach 15% by 2018 Raised FY17-18F net profit by 4% each; maintain OUTPERFORM rating and raised TP to Bt74, implying 11x PE and 1.5x P/BV; stock offers 20% total return including 8% dividend yield Expect positive loan growth with lower NPL ratio Jesada TECHAHUSDIN, CFA We forecast 5% loan growth this year driven by Lombard loans and non- 662 - 659 7000 ext 5004 HP retail lending such as mortgage, micro-SME and personal loans. [email protected] These retail loans helped KKP to report flat loan growth mom in Jan COMPANY RESEARCH | RESEARCH COMPANY Remark: KSS is a subsidiary of Bank of Ayudhya Plc. 2017 vs 0.8-1.0% contraction at other banks which focus on HP. We and is therefore unable to issue a report on Bank of expect flat growth for HP loans this year, after contracting 6.4%/2.7% in Ayudhya Plc. 2015/ 2016, led by growth of used car loans (including car quick-cash) which will offset drop in new car loans. On asset quality, we forecast Key Data NPL ratio will improve further to 5.20% in 2017 from 5.65% in 2016, led 12-mth high/low (Bt) 68 / 39.5 by improving quality of HP and real estate loans. -

Frequently Asked Questions CIMB Thai Will Be Enabling Access for Foreigners to Use CIMB THAI Digital Banking Mobile Application

Frequently Asked Questions CIMB Thai will be enabling access for foreigners to use CIMB THAI Digital Banking mobile application. Hopefully this FAQ would be able to answer any questions that you have! 1. What is CIMB THAI Digital Banking (CIMB TH)? CIMB THAI Digital Banking is the latest mobile banking application from CIMB THAI Bank that provides a wide range of financial services. It is meant to replace the obsolete CIMB Clicks services. 2. I am a foreigner using CIMB Clicks. What should I expect when I upgrade to the new CIMB THAI Digital Banking mobile application? Most of the functionalities provided through CIMB Clicks will be provided by the CIMB TH app. However, there are some that are not yet fully functioning, such as some parts of the app are not translated, and some new functionalities are not available for foreigners yet like Mutual Funds, Bonds and Insurance. However, we are progressively improving our app so that in the near future, you will be able to enjoy the app fully. 3. When will the CIMB THAI Digital Banking be available for foreigners to use? We will be enabling access to foreigners on the 25th of March 2020. You will be able to register and use our application using non-Thai passport details, and a working Thai mobile number to receive the OTP (One Time Password) for security and verification purposes. 4. What should I do if I want to change my mobile phone number? If you want to change your mobile phone number, you will need to go to any of our branches to update your personal information. -

Kiatnakin Bank PLC

COMPANY UPDATE Kiatnakin Bank PLC January 25, 2012 NEUTRAL Moving into a year of transformation Merging with PHATRA, sets moderate targets, raises LLR coverage Stock Data Ambitious goal of raising CASA mix Last close (Jan 24) (Bt) 31.50 New fees bring risk; TP and forecast under review until numbers available 12-m target price (Bt) 38.00 Upside (Downside) to TP (%) 20.63 Moderate 2012 loan growth & NPA sale target. KK set moderate 2012 loan Mkt cap (Btbn) 19.99 growth target at 21% (vs. 26.5% for 2011), focusing on auto loans (71% of total), with a Mkt cap (US$mn) 636 forecast of 2012F domestic car sales at 0.957-1mn units (21-26% growth). Hit by the Bloomberg code KK TB floods, real estate loans (12% of loans) are expected to be flat in 2012. It plans to bulk Reuters code KK.BK up NPA sales to Bt3.5bn in 2012 from Bt3.2bn in 2011. Risk rating H LLR coverage upped ahead of rising NPLs. KK expects the floods to raise NPLs to Mkt cap (%) SET 0.23 Sector % SET 17.33 3.5-3.7% of total loans in 2012 vs. 3.4% at YE2011 and thus lifted LLR coverage to 108% Shares issued (mn) 635 at 4Q11 from 95% at 3Q11. Of concern are its real estate loans, one-third of which are Par value (Bt) 10 out to flood-impacted projects; plus ~15,000 of its 300,000 auto loan clients asked for a 12-m high / low (Bt) 37.8 / 25.8 6-month debt moratorium. -

DBD Department of Business Development Creative Services Ministry of Commerce Hotline 1570

(Translation) Department of Business Development No. SorJorKor. 001753 - Garuda - Ministry of Commerce AFFIDAVIT It is hereby certified that this Company is a juristic person registered under the law governing public limited companies on this 7th day of September B.E. 2536, Registration No. 0107536000986 with the registered particulars as of the date hereof as follows: 1. Name of the Company: Kiatnakin Phatra Bank Public Company Limited 2. The Company has 12 directors as listed below: 1. Mr. Supol Wattanavekin 2. Mrs. Dayana Bunnag 3. Mr. Chet Pattrakornkul 4. Mr. Pongtep Polanun 5. Mr. Veravat Chutichetpong 6. Mr. Suvit Mapaisansin 7. Mr. Anya Khanthavit 8. Mr. Banyong Pongpanich 9. Miss Thitinan Wattanavekin 10. Mr. Aphinant Klewpatinond 11. Mr. Philip Chen Chong Tan 12. Mrs. Patchanee Limapichat./ 3. The name and numbers of the directors who are authorized to sign on behalf of the Company shall be: “Any two of the four directors, namely Mr. Banyong Pongpanich, Mr. Aphinant Klewpatinond, Ms. Thitinan Wattanavekin and Mr. Philip Chen Chong Tan jointly sign together with the Company’s seal affixed.” The directors’ scope of authority is limited as follows: -None-/ 4. Capital: Registered capital is Baht 8,467,511,090.00/ (Eight Thousand Four Hundred Sixty Seven Million and Five Hundred Eleven Thousand Ninety Baht Only) Paid-up capital is Baht 8,467,511,090.00/ (Eight Thousand Four Hundred Sixty Seven Million and Five Hundred Eleven Thousand Ninety Baht Only) 5. Head Office is located at 209 KKP Tower, Sukhumvit 21 (Asoke) Road, Khlong Toey Nua Sub-district, Wattana District, Bangkok Metropolis./ 6. -

Total Factor Productivity of Commercial Banks in Thailand

International Journal of Business and Society, Vol. 15 No. 2, 2014, 215 - 234 TOTAL FACTOR PRODUCTIVITY OF COMMERCIAL BANKS IN THAILAND Supachet Chansarn♣ Bangkok University ABSTRACT This study employed growth accounting equation to examine the total factor productivity of 14 commercial banks in Thailand during 2000 – 2009. The findings revealed that commercial banks in Thailand on average had low and very volatile total factor productivity with the average total factor productivity growth rate ranging from -13.35 – 10.06 percent per annum. In terms of individual bank, the findings revealed that most of commercial banks had the negative average total factor productivity growth rate during the study period, implying their lower productivity. In addition, the findings suggested that there were four factors which significantly determined the total factor productivity growth of commercial banks. They were credit risk as measured by the percentage of loan to total asset, management quality as measured by the percentage of non-interest expense to total asset, diversification as measured by the percentage of non-interest income to total asset and capital adequacy as measured by the percentage of owners’ equity to total asset. Furthermore, small commercial banks were found to have the highest total factor productivity growth whereas large banks were found to have the lowest one. Keywords: Total Factor Productivity; Commercial Bank; Banking Sector; Thailand. 1. INTRODUCTION Commercial banks have long been considered as the most important financial intermediaries in Thailand. In 2009, more than 7.1 trillion baht of deposits or deposits equivalent was accepted by Thailand’s commercial banks. This figure was approximately accounted for 79 percent of Thailand’s gross domestic product in 2009 (Bank of Thailand, 2010). -

Settlement Agent As of December 21,2020 Member Name Symbol Website Remark ID

Settlement agent As of December 21,2020 Member Name Symbol Website Remark ID. 301 CITIBANK, N.A. - CUSTODY SERVICES CTB-CUS http://www.citibank.co.th/ 302 THE SIAM COMMERCIAL BANK PUBLIC COMPANY LIMITED SCB https://www.scb.co.th/th/personal-banking.html 303 BANGKOK BANK PUBLIC COMPANY LIMITED - CUSTODY BBL http://www.bangkokbank.com/ 304 THE HONGKONG AND SHANGHAI BANKING CORP.,LIMITED BKK. HSBC http://www.hsbc.co.th/ 308 KASIKORNBANK PUBLIC COMPANY LIMITED (CUSTODIAN) KBANK-CD http://www.kasikornbank.com/TH/Pages/Default.aspx 312 STANDARD CHARTERED BANK (THAI) PUBLIC COMPANY LIMITED SCBT https://www.sc.com/en/index.html 320 DEUTSCHE BANK AKTIENGESELLSCHAFT BANGKOK BRANCH-CU DB - CS https://www.db.com/index_e.htm 328 BANK OF AYUDHYA PUBLIC COMPANY LIMITED BAY http://www.krungsri.com/ 329 TMB BANK PUBLIC COMPANY LIMITED TMB-CUS https://www.tmbbank.com/ 334 TSFC SECURITIES PUBLIC COMPANY LIMITED - CUSTODIAN TSFC-CD http://www.tsfc.co.th/ 339 TISCO BANK PUBLIC COMPANY LIMITED (CUSTODIAN) TISCO-CS http://www.tisco.co.th/ 343 CIMB Thai Bank Public company Limited CIMBT http://www.cimbthai.com/ - KIATNAKIN BANK PUBLIC COMPANY LIMITED (KKB_SBO) has changed its name to Kiatnakin 347 Kiatnakin Phatra Bank Public Company Limited KKPSBO www.kkpfg.com Phatra Bank Public Company Limited (KKPSBO) effective from August 18, 2020 425 THE KRUNG THAI BANK PUBLIC COMPANY LIMITED KTB-CUS http://www.ktb.co.th/ Remark : Resigned Settlement Agent : 1. THANACHART BANK PUBLIC COMPANY LIMITED FOR CUSTODIAN resigned from the TCH's Settlement Agent efficetive from December 21,2020 onwards.. -

Truemove H Is Trusted by 6 Financial Institutions, Collaborating to Issue Letters of Guarantee for 900 Mhz License, Worth Thb 73,036.06 Million

TRUEMOVE H IS TRUSTED BY 6 FINANCIAL INSTITUTIONS, COLLABORATING TO ISSUE LETTERS OF GUARANTEE FOR 900 MHZ LICENSE, WORTH THB 73,036.06 MILLION Bangkok, March 1, 2016: True Move H Universal Communication (TUC) today holds an agreement signing ceremony with 6 financial institutions, comprising the Industrial and Commercial Bank of China (Thai) Plc – ICBC (Thai), Bangkok Bank Plc, Kasikornbank Plc, Siam Commercial Bank Plc, Krung Thai Bank Plc and Kiatnakin Bank Plc to secure letters of guarantee, worth a total of Baht 73,036.06 million, while nearly 50% of the amount of these letters of guarantee was provided by ICBC (Thai). The letters will be submitted with TUC’s first payment of Baht 8,040 million to the National Broadcasting and Telecommunication Commission (NBTC) for the 900-MHz frequency it won from the auction in December last year. Mr. Suphachai Chearavanont, President & CEO of True Group said “On behalf of True Group, I would like to thank the 6 financial institutions, especially a global player like ICBC (Thai), as well as Bangkok Bank, Kasikornbank, Siam Commercial Bank, Krung Thai Bank and Kiatnakin Bank for their trust in us. Their joint support will enable True Group to officially own and operate the frequency to the fullest of its capacity in order to more effectively meet market demand and strengthen Thailand’s telecommunications infrastructure with its world- class quality 4G services. True is determined to continually develop its superior communications network, supported by the largest amount of bandwidth and frequencies, comprising 900, 1800, 2100 and 850 MHz (under CAT Telecom) that support 4G, 3G and 2G technologies.