Présentation Powerpoint

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Unibail-Rodamco: Innovative Performance

Unibail-Rodamco: Innovative performance 2012 ANNUAL ANd sUstAiNAbLe deveLopmeNt report 02 milestones 2012 CorporAte The values which distinguish us 08 interview with the Ceo and the Chairman of the management board 12 interview with the Chairman of the supervisory board 14 Corporate governance and risk management 16 Figures on the rise 18 eprA performance measures 20 shareholder’s report strAtegy Re-inventing the customer experience 24 re-inventing the customer experience 26 so ouest – a new generation shopping centre 28 the 4 star shopping experiencel 30 projects in the pipeline operAtioNs Iconic Assets 36 moments to remember 42 iconic shopping centres 48 our shopping centre managers 50 offices 52 Convention & exhibition sUstAiNAbLe deveLopmeNt Creating sustainable value everyday 56 Unibail-rodamco’s sustainability journey 58 A transparent governance for sustainability 60 material issues to create sustainable value 62 re-align our sustainability vision and priorities with the group’s strategy 64 A motivated workforce empowered to deliver change 66 Creating opportunities for communities to prosper 70 building resilience through innovation citizenship 74 Unlock opportunities for tenants and customers to make sustainable decisions 82 shopping centres Nordic countries * in Europe Germany* 9 shoppiNg CeNtres Netherlands 7 Central Europe* 5 shoppiNg CeNtres shoppiNg CeNtres 8 shoppiNg CeNtres France Austria 34 shoppiNg CeNtres 3 shoppiNg CeNtres Spain 16 shoppiNg CeNtres Offices and Convention & Exhibition venues in Paris C&E oFFiCes MAJOR eUROpeAn cities from west to east which host Unibail-Rodamco assets: seviLLe / vALeNCiA / mAdrid / bArCeLoNA / bordeAUX / LYON / NiCe / pAris / LiLLe / AmsterdAm / the hAgUe / CopeNhAgeN / STOCKhoLm / prAgUe / vieNNA / brAtisLAvA / WArsAW / heLsiNKi / * Including shopping centres consolidated under the equity menthod: • Central europe: Złote tarasy. -

PARIS PREVIEW/10-17 FACTORS WARY on KMART/2 Women’Swwd Wear Daily • the Retailers’ Dailymonday Newspaper • September 30, 2002 Vol

PARIS PREVIEW/10-17 FACTORS WARY ON KMART/2 Women’sWWD Wear Daily • The Retailers’ DailyMONDAY Newspaper • September 30, 2002 Vol. 184, No. 65 $1.75 Accessories/Innerwear/Legwear Strip Tease MILAN — The spring collection Tom Ford showed for Gucci on Saturday was short, hot and sexy. It was also a major departure from his dark vision for fall — and not just because it featured pink, soft blue and colorful Asian prints. There was another factor: the special, labor- intensive methods and techniques used to create it. Here, one racy little number that’s a literal embodiment of the term “gold-digger”: a microminidress in strips of 18-karat pink gold. For more on the season, see pages 4 to 7. Is Target Cooling? Slow Growth Feared At Hot Discounter By Evan Clark NEW YORK — Target Corp. may have trouble retaining its status as a retailing phenomenon while it tries to keep up with its own ultrahip image, ultratough competition and ultrahigh expectations. While Wall Street generally remains bullish on the Minneapolis- based retailer, analysts acknowledge the firm, with its own presence expanding and bankrupt Kmart waning, is increasingly going toe-to- toe with Wal-Mart — the world’s largest company and a competitor See Hot, Page21 PHOTO BY PHOTO DAVIDE BY MAESTRI 2 Kmart Vendors Face Double RL Chooses WWDMONDAY West Hollywood Accessories/Innerwear/Legwear Stiffer Credit Terms GENERAL For Newest Store Gucci, Fendi, Prada and Dolce & Gabbana were among the top collections as the Milan shows rolled along. By Vicki M. Young calls seeking comment. LOS ANGELES — Double RL is 4 Although his firm isn’t among heading west. -

PARIS Cushman & Wakefield Global Cities Retail Guide

PARIS Cushman & Wakefield Global Cities Retail Guide Cushman & Wakefield | Paris | 2019 0 Regarded as the fashion capital of the world, Paris is the retail, administrative and economic capital of France, accounting for near 20% of the French population and 30% of national GDP. Paris is one of the top global cities for tourists, offering many cultural pursuits for visitors. One of Paris’s main growth factors is new luxury hotel openings or re-openings and visitors from new developing countries, which are fuelling the luxury sector. This is shown by certain significant openings and department stores moving up-market. Other recent movements have accentuated the shift upmarket of areas in the Right Bank around Rue Saint-Honoré (40% of openings in 2018), rue du Faubourg Saint-Honoré, and Place Vendôme after the reopening of Louis Vuitton’s flagship in 2017. The Golden Triangle is back on the luxury market with some recent and upcoming openings on the Champs-Elysées and Avenue Montaigne. The accessible-luxury market segment is reaching maturity, and the largest French proponents have expanded abroad to find new growth markets. Other retailers such as Claudie Pierlot and The Kooples have grown opportunistically by consolidating their positions in Paris. Sustained demand from international retailers also reflects the current size of leading mass-market retailers including Primark, Uniqlo, Zara brands or H&M. In the food and beverage sector, a few high-end specialised retailers have enlivened markets in Paris, since Lafayette Gourmet has reopened on boulevard Haussmann, La Grande Épicerie in rue de Passy replacing Franck & Fils department store, and more recently the new concept Eataly in Le Marais. -

List of Assets June 30, 2021 Download

LIST OF GROUP’S STANDING ASSETS 1. FRANCE: SHOPPING CENTRES GLA of Portfolio as at June 30, 2021 the whole complex Consolidation method1 (sqm) SHOPPING CENTRES IN THE PARIS REGION Westfield Carré Sénart (Lieusaint) 155,500 FC Westfield Les 4 Temps (La Défense) 142,200 FC Westfield Parly 2 (Le Chesnay) 129,500 FC Westfield Vélizy 2 (Vélizy-Villacoublay) 124,400 FC Westfield Rosny 2 (Rosny-sous-Bois) 115,200 FC & EM-JV Aéroville (Roissy-en-France) 85,000 EM-A Westfield Forum des Halles (Paris 1) 70,500 FC So Ouest (Levallois-Perret) 56,900 EM-A Ulis 2 (Les Ulis) 54,200 FC CNIT (La Défense) 28,500 FC L'Usine Mode & Maison (Vélizy-Villacoublay) 21,100 FC Carrousel du Louvre (Paris 1) 13,400 FC Les Ateliers Gaîté2 (Paris 14) n.a FC SHOPPING CENTRES IN THE FRENCH PROVINCES La Part-Dieu (Lyon) 156,400 FC La Toison d’Or (Dijon) 78,700 EM-A Polygone Riviera (Cagnes-sur-Mer) 75,200 FC Westfield Euralille (Lille) 67,800 FC Villeneuve 2 (Villeneuve-d'Ascq) 56,500 FC Rennes Alma (Rennes) 55,700 EM-A Confluence (Lyon) 53,900 EM-A La Valentine (Marseille) 39,500 FC OTHER ASSETS Bel-Est (Bagnolet) 48,800 FC Aquaboulevard (Paris) 38,400 FC Maine Montparnasse (Paris) 35,500 FC Villabé (Corbeil) 35,300 FC Go Sport (Saintes) 2,500 FC 1 FC = Fully Consolidated; EM-JV = Joint Venture under the equity method; EM-A = Associates under the equity method; JO = Joint Operation. 2 Under redevelopment. 1 2. FRANCE: OFFICES & OTHERS Total floor space Portfolio as at June 30, 2021 Consolidation method of the asset (sqm) Trinity (La Défense) 50,000 FC Les Villages de l’Arche (La Défense) 19,800 FC CNIT (La Défense) 37,100 FC Versailles Chantiers (Versailles) 16,300 FC Tour Rosny (Rosny-sous-Bois) 13,600 FC Le Sextant (Paris 15) 13,400 FC 7 Adenauer (Paris 16) 12,300 FC Hilton CNIT (La Défense) 10,800 FC 29, rue du Port (Nanterre) 10,300 FC Novotel Lyon Confluence (Lyon) 7,600 EM-A Lightwell3 (La Défense) n.a. -

Mission Valley

MISSION VALLEY GERMANY CentrO - Oberhausen Gera Arcaden - Gera Gropius Passagen - Berlin Höfe am Brühl - Leipzig Minto - Mönchengladbach Palais Vest - Recklinghausen Pasing Arcaden - Munich Paunsdorf Center - Leipzig OUR PORTFOLIO Ring-Center - Berlin Ruhr Park - Bochum Westfield Hamburg- Überseequartier - Hamburg THE NETHERLANDS Citymall Almere - Almere SWEDEN Westfield Mall of Greater Stockholm the Netherlands - Leidschendam Westfield Mall of Scandinavia Stadshart Amstelveen - Amstelveen Nacka Forum SEATTLE Stadshart Zoetermeer - Zoetermeer Solna Centrum Westfield Southcenter Täby Centrum POLAND SAN FRANCISCO AREA Warsaw Westfield Galleria at Roseville UNITED KINGDOM DENMARK Westfield Arkadia Westfield Oakridge CHICAGO London Copenhagen Centrum Ursynów Westfield San Francisco Centre Westfield Old Orchard Westfield Stratford City Fisketorvet Galeria Mokotów Westfield Valley Fair Chicago O’Hare International CONNECTICUT Croydon Galeria Wileńska Westfield Meriden Westfield London Złote Tarasy Westfield Trumbull Wrocław Wroclavia BELGIUM Brussels CZECH REPUBLIC Mall of Europe Prague SLOVAKIA Westfield Chodov NEW YORK AREA Bratislava Bubny Westfield Garden State Plaza Aupark Centrum Černý Most Metropole Zličín Westfield South Shore ITALY Westfield Sunrise Milan Westfield World Trade Center Westfield Milano JFK International AUSTRIA Newark Liberty International Vienna Donau Zentrum Shopping City Süd WASHINGTON D.C. AREA Westfield Annapolis Westfield Montgomery Westfield Wheaton SPAIN FRANCE UNITED STATES Benidorm - Benidorm Westfield Carré Sénart - Greater Paris -

1 List of Group's Standing Assets 1. France: Shopping

LIST OF GROUP’S STANDING ASSETS 1. FRANCE: SHOPPING CENTRES GLA of Portfolio as at Dec. 31, 2020 the whole complex Consolidation method1 (sqm) SHOPPING CENTRES IN THE PARIS REGION Westfield Carré Sénart (Lieusaint) 155,500 FC Westfield Les 4 Temps (La Défense) 142,000 FC Westfield Parly 2 (Le Chesnay) 129,800 FC Westfield Vélizy 2 (Vélizy-Villacoublay) 124,300 FC Westfield Rosny 2 (Rosny-sous-Bois) 114,500 FC & EM-JV Aéroville (Roissy-en-France) 84,900 EM-A Westfield Forum des Halles (Paris 1) 75,700 FC So Ouest (Levallois-Perret) 56,900 EM-A Ulis 2 (Les Ulis) 54,200 FC CNIT (La Défense) 28,400 FC L'Usine Mode & Maison (Vélizy-Villacoublay) 21,100 FC Carrousel du Louvre (Paris 1) 13,500 FC Les Ateliers Gaîté2 (Paris 14) n.a FC SHOPPING CENTRES IN THE FRENCH PROVINCES La Part-Dieu (Lyon) 156,400 FC La Toison d’Or (Dijon) 78,700 EM-A Polygone Riviera (Cagnes-sur-Mer) 75,200 FC Westfield Euralille (Lille) 67,700 FC Villeneuve 2 (Villeneuve-d'Ascq) 56,600 FC Rennes Alma (Rennes) 55,700 EM-A Confluence (Lyon) 53,900 EM-A La Valentine (Marseille) 39,500 FC OTHER ASSETS Bel-Est (Bagnolet) 48,800 FC Aquaboulevard (Paris) 38,400 FC Maine Montparnasse (Paris) 35,500 FC Villabé (Corbeil) 35,300 FC Go Sport (Saintes) 2,500 FC 1 FC = Fully Consolidated; EM-JV = Joint Venture under the equity method; EM-A = Associates under the equity method; JO = Joint Operation. 2 Under redevelopment. 1 2. FRANCE: OFFICES & OTHERS Total floor space Portfolio as at Dec. -

Télécharger PDF Euroméditerranée

L’OPERATION QUI TRANSFORME MARSEILLE EUROMÉDITERRANÉE Marseille, EcoCité Méditerranéenne : Dynamique de projet & Performances du marché SIMI 2014 S O M M A I R E Partie 1 L’opération Euroméditerranée, EcoCité Méditerranéenne Partie 2 Un marché immobilier tertiaire d’envergure internationale sur Euroméditerranée Partie 3 Analyse du marché des commerces 2 Partie 1 L’opération Euroméditerranée, EcoCité Méditerranéenne L’opération Euroméditerranée, EcoCité Méditerranéenne Marseille : Une accélération économique, sociale et culturelle • Euroméditerranée aura 20 ans en • Créateur de développement • Euroméditerranée entame l’aménagement 2015 et a déjà participé à la économique, social et culturel, des 170 hectares de son extension. transformation de la métropole en Euroméditerranée est un • Le projet labellisé « EcoCité » démarrera par développant notamment pour les accélérateur de l’attractivité et une opération pilote de 60.000 m² sur une entreprises : du rayonnement de la parcelle de 2,4 hectares située près du Le 3ème plus grand quartier d’affaires métropole marseillaise : siège régional d’EDF. de France ; Evénements d’affaires • Cet îlot démonstrateur permettra Un pôle média intégrant une chaîne internationaux d’expérimenter des dispositifs d’éco- complète d’accompagnement des Equipements à rayonnement construction appelés à être déclinés à entrepreneurs. international. grande échelle sur le périmètre de l’opération d’aménagement et sur l’arc Méditerranéen. NÉE D’UNE INITIATIVE DE L’ETAT ET DES COLLECTIVITÉS TERRITORIALES, EUROMÉDITERRANÉE -

PDF__1563791417226.Pdf

WELCOME LES SALLES DU CARROUSEL CONTENTS A ROYAL PALACE ART, HISTORY, LUXURY AN EYE TO THE FUTURE LES SALLES DU CARROUSEL A ROYAL PALACE FACTS AND FIGURES AT A GLANCE THE STORY OF LES SALLES DU CARROUSEL A PRESTIGIOUS CLIENT LIST FACTS AND FIGURES elegant, Inside the 4 contemporary spaces world’s FROM 750 TO 1,900 SQ.M, THREE OF WHICH ARE number EQUIPPED WITH ADJUSTABLE 1 RISERS museum fully customisable spaces 2 PERFECT FOR CREATING 7,125 SQ.M ONE-OF-A-KIND EVENTS OF MODULAR INTERIOR SPACES IN THE HEART OF PARIS events each year IN55 PARIS, THE CHIC, CULTURAL CAPITAL A ROYAL PALACE . 4 AT A GLANCE A royal welcome, A venue made to measure rich in history and culture A timeless setting with contemporary Sumptuous, appeal one-of-a-kind events Unforgettable encounters in the heart of Paris A ROYAL PALACE . 5 THE STORY OF LES SALLES DU CARROUSEL Les Salles du Carrousel is located at the very centre of the Louvre Palace, a place inextricably linked to French history, and a royal residence until the reign of Louis XIV. Within its walls are archaeological vestiges that were Septembre discovered during its construction. 1993 1991 Inauguration of the Inverted Construction begins on Pyramid, designed by I.M. Pei. 2012 Carrousel du Louvre as an extension Measuring 16 metres on a side, The reception of the museum's main entrance. weighing 180 tons and 7 metres rooms are fitted 1202 The contract is awarded to architects with “sound and 2016 tall, it becomes the architectural Construction of I.M. -

Description Stores Street Zipcode City L'occitane AEROVILLE 30 Rue

France Description Stores Street Zipcode City L'OCCITANE AEROVILLE 30 rue des buissons 93290 Tremblay en France L'OCCITANE AIX 21 rue Espariat 13100 AIX EN PROVENCE L'OCCITANE ANNECY 1 rue Jean-Jacques Rousseau 74000 ANNECY L'OCCITANE ARCOLE 1 rue d'Arcole 75004 PARIS L'OCCITANE ARLES 58 rue de la République 13200 ARLES L'OCCITANE AVANT CAP Chemin de la Grande Campagne 13480 CABRIES L'OCCITANE AVIGNON 10 Bis Rue de la République 84000 AVIGNON L'OCCITANE BEAUGRENELLE 12 rue Linois 75015 PARIS L'OCCITANE BELLE EPINE CC Belle Epine / Avenue du Luxembourg Niveau 1 94561 THIAIS CEDEX L'OCCITANE BORDEAUX 6 Rue Porte Dijeaux 33000 BORDEAUX L'OCCITANE BORDEAUX LAC Avenue des 40 journaux 33300 BORDEAUX LAC L'OCCITANE BOULOGNE 93 Bd Jean-Jaurès 92100 BOULOGNE BILLANCOURT L'OCCITANE CANNES 54 rue d'Antibes 06400 CANNES L'OCCITANE CARRE SENART CC Carré Sénart 3, allée du Préambule 77566 LIEUSAINT L'OCCITANE CHAMBERY 222 place Saint Léger 73000 CHAMBERY L'OCCITANE CLERMONT BREZET CC Géant Le Brezet - Boulevard Saint -Jean 63100 CLERMONT FERRAND L'OCCITANE CLERMONT JAUDE CC Clermont Jaude - Rue Giscard de la Tour Fondue 63000 CLERMONT FERRAND LOCCITANE 86CHAMPS 86 Avenue des Champs-Elysées 75008 PARIS L'OCCITANE COMMERCE 27 rue du Commerce 75015 PARIS L'OCCITANE CRETEIL SOLEIL CC Créteil Soleil 94000 CRETEIL L'OCCITANE DIJON LIBERTE 81 bis rue de la Liberté 21000 DIJON LOCCITANE GARE DE LYON Galerie Diderot Hall 1 75012 PARIS L'OCCITANE GENERAL LECLERC 22 Avenue du Général Leclerc 75014 PARIS L'OCCITANE GRENOBLE GRAND PLACE 102 Centre Commercial Grand -

Un Nouvel Éclat

CARROUSEL DU LOUVRE UN NOUVEL ÉCLAT DOSSIER DE PRESSE ÉDITO « En 1993, Le Carrousel du Louvre voyait de ré-enchantement confié à l’architecte le jour dans le prolongement du Musée Jean-Michel Wilmotte, notamment pour du Louvre, au carrefour de la culture et sa capacité à intervenir sur la signature du cœur historique de Paris. inimitable de leoh Ming Pei et Macary, à l’origine des bâtiments historiques. Abritant l’incontournable Pyramide Inversée de leoh Ming Pei et les Une réalisation architecturale murailles du Hall Charles V, ce haut lieu contemporaine et design pour du patrimoine parisien s’est rapidement permettre au Carrousel du Louvre de imposé comme un lieu de shopping moderniser son identité et de continuer incontournable, notamment grâce à son à séduire les parisiens et les touristes. environnement unique et son mix exclusif de marques, reflet En 2016, après 3 ans de réflexion et de « l’excellence à la française » et du de travail, nous sommes fiers savoir-faire d’Unibail-Rodamco, qui de dévoiler le nouvel éclat du carrousel a racheté ce lieu iconique en 1998. du Louvre. » En 2013, près de 20 ans après la pose de la première pierre, le Groupe a souhaité donner un nouvel éclat au Valérie Britay, Directrice Générale Retail Carrousel du Louvre. Un programme France Unibail-Rodamco 3 UN PROJET AMBITIEUX AU SERVICE D’UN CENTRE ICONIQUE LE CARROUSEL DU LOUVRE EN QUELQUES DATES • 1989 - Inauguration de la Pyramide Inversée : 180 tonnes, 16 mètres de côté, UN ENJEU FORT POUR LE CARROUSEL DU LOUVRE 7 mètres de haut, une face de 84 losanges et de 28 triangles • Octobre 1993 - Inauguration de la Galerie et des salles du Carrousel du Louvre er Le Carrousel du Louvre a vu le jour pour répondre à un objectif : proposer une • Septembre 2009 - Ouverture du 1 Apple Store de France offre commerciale de qualité aux parisiens et touristes du quartier Palais Royal– • Janvier 2014 - Ouverture du Printemps du Louvre Musée du Louvre. -

Hotel Regina Paris the Family Room

Your Parisian Gateway near the Louvre Welcome to the hotel Regina Paris The Family Room • 2 Connecting rooms or Suites with sofa bed • Guest room with king bed or twin beds • 2 Bathrooms • Complimentary soft drinks • VIP welcome and gifts for the children • Total surface area: 40/50 sqm • Free access to the summer kid’s playroom • Free Wi-Fi Personalized VIP welcome For our young guests…. • Softball illustrated Le Petit Prince • Bath’s products signed Le Petit Prince • Bib Regina offer • Children’s facilities on request : changing table, SOGEX 2014 SOGEX 2014 Licence AD Distribution baby bath amenities, bottle warmer, baby cot, … ™ © ™ © • Babysitting services on request Exupéry Exupéry LPP 2014 - ™ © Succession Antoine de Saint Petit Petit Prince Le Le Personalized VIP welcome For the children…. • Coloring books and pencils Le Petit Prince • Le Petit Prince figure & Memory game Le Petit Prince • Welcome “kids snack” in room upon arrival • 2 tickets (per family) for the Fun Fair hosted at the Tuileries Garden (from June 28th to August 24th 2014) SOGEX 2014 SOGEX 2014 Licence AD Distribution • Kids’ TV channels in room ™ © ™ © • Mini bathrobes and slippers • Bath’s products signed Le Petit Prince Exupéry Exupéry LPP 2014 - • Wii® & balloons available in the playroom ™ © Succession Antoine de Saint Petit Petit Prince Le Le Enjoy the Fun Fair Personalized VIP welcome For the teenagers…. • Card games • Kids’ TV channels in room • Welcome “teenagers snack” in room upon arrival • 2 tickets (per family) for the Fun Fair hosted at the Tuileries -

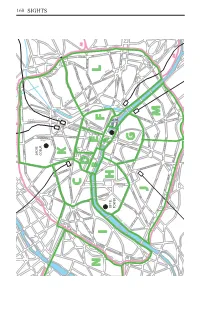

Sights Davout Soult

DAVOUT SOULT MORTIER BD BD BD D’AVRON AV GAMBETTA AV R CRS DEVINCENNES R BELGRAND L PONIATOWSKI BD DE CHARONNE BD MENILMONTANT BELLEVILLE DAUMESNIL DE AV GAMBETTA AV MENILMONTANT DE MANIN JAURES DE ST-ANTOINE BERCY RUE BD BD VOLTAIRE DIDEROT DE RUE RUE BD DE BERCY JEAN BD DU G DU BD BD DE SIMON JEAN O FLANORE BELLEVILLE REPUBLIQUE AV PARMENTIER TOLBIAC DE AV BD DE LA VOLTAIRE BD R DU FBG BOULEVARD LA VILLETTE DE MASSENA AV AV O DE LA RAPEE AV BD O D’AUSTERLITZ AV D’IVRY BD M FAYETTE BD V AURIOL V BD DE CHOISY NEY F BD DE L’HOPITAL DE BD D’ITALIE R DE LA AV DE CHAPELLE AV R ST-ANTOINE Q ST - BERNARD RUE DU TEMPLE DU RUE 160 DE TURBIGO DE DEDENIS ST- FRG DU R LA BD SEBASTOPOL DE BD R POISSONNIERE R DU FBG DU R ARAGO CLIGNANCOURT BD A. SIGHTS RD.DE GERMAIN BLANQUI G RUE E BD ORNANO A BD DE BD RIVOLI R E MARCEL BD BOCHECHOUART MICHEL - SAINT BD SACRE RUE COEURD’ALESIA SAINT K AV DE L’OPERA DE MONTPARNASSE BOULEVARD RUE DE RENNES DE BD DE CLICHY RASPAIL BD JOURDAN R DE CLICHY D HAUSSMANN AV DE ST- OUEN ST- DE AV BD B RUE CLICHY BD DU RUE SEVRES AVENUE DU MAINE BD D’ALESIA BESSIERES R DE ROME BES DE BD DES BD H BATIGNOLLES BD BD BRUNE MALESHER RUE RUE AVENUE DE VAUGIRARD BRETEUIL C AV DE AV J BERTHIER BD BD VILLIERS AV DES CH.