Cost Effectiveness and Operations of the New Mexico Rail Runner Express

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Commuter Rail System Study

TRANSPORTATION PROGRAMS Commuter Rail System Study Transit Committee March 11, 2010 TRANSPORTATION PROGRAMS Study Purpose Study Requested by MAG Regional Council in 2008 Commuter Rail Study Funding in 2004 RTP Study Feasibility of Commuter Rail Service in MAG Region Ridership Forecasting and Cost Effectiveness Capital and Operating Cost Estimates Vehicle Technology Recommendation Implementation Requirements Copyright © 2009 TRANSPORTATION PROGRAMS Peer Regions ~ Commuter Rail Systems WHAT IS COMMUTER RAIL? Peak Period, Peak Direction Service. Traditionally caries less daily riders than light rail, but for longer distances. Similar market and characteristics with Bus Rapid Transit / Express. SOUNDER-Seattle CALTRAIN-San Francisco ALTAMONT COMMUTER EXPRESS – San Jose Can share ROW and track with freight railroads and can operate concurrently (does not require exclusive right-of-way) . Typically longer station spacing (every 3-7 miles on average) than light rail (1-2 miles) with emphasis on park-and-rides and traditional city CBDs. Locomotive technology (diesel or clean/green hybrid Genset). Passenger coaches (push-pull). Engines and cars meets federally mandated structural requirements for rolling stock crash resistance Larger, heavier profile than light rail vehicles. METROLINK – Los Angeles COASTER – San Diego FRONT RUNNER – Salt Lake City-Ogden Higher max.speed (79mph), slower acceleration and deceleration than light rail. Average speed approx 44mph. Lower capital cost per mile ($10-$20M) due to existing right of way use / reuse. Light -

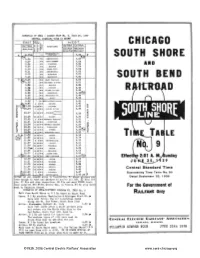

SOUTH SHORE LINE" by A

SCHEI1J1E OF CERA - CSS&SB TRIP HO. 9. June 25. 1939 CENTRAL STANDARD TIla IS SHOWN ~~P~~~tl WE c. T EAST Iof Sld.lli~ S \..J CHICAGO EXTRA ~ ~ ~ i STATIONS EXTRa EXTRA RAILF'AN ~ :i ~~ RAILFAI"I RAJlFAN ~ ~ (AUVAL1iMf) (~PO$ED) SOUTH SHORE ~9.06 --K2 KENSINGTON:~.-. 7.07~ 9.07 16.6 12lth STREET.... 7.06 9.08 UJ.4 PARSONS. .. •. 7.05 AID 9.09 17.2 BRIDGE....... 7.04 9.10 17.Sl FORD CITY..... 7.03 9.11 18.9 HEGEWISCH..... 7.02 9.12 19.1 BURNHAM...... 7.01 9lt15 20.9 HAMMOND.... 7.00 SOUTH BEND B t ~ 9.25 ...... 22.S ...EAST CIDCAGO... 6.55 '.!!I 9.32 23.8.CALUMET X-OVER. 6.51 9.33 24.5 EMPIRE...... 6.50 9.3a 25.3 CUDAHY....... 6.49 9.31 26.8 CLARK X-OVER... 6.48 9.38 29.2 AMBRIDGE..... 6.45~ 9.39 30.2 BUCHANAN ST.. .. 6.44 9.40 30.8 GARY.. 6.43 9.42. 31.7END DOUBLE TRACK 6.42 :9.45 5 34.6 MILLER... .... 6.40 ~ . ~ 5 C (I'~0.10 113166 86.7 WAGNER...... 6. 38 ~ 0.1' 7 14 39.2 OGDEN DUNES... 6. 36 ~ ~ 1 {west End Ci 10.? 30 i2 to.2 WILBON East End 6.35 ~ ~ 10.. 18 82 48 18.1 BAILEY ....... 6. 32 ~ I 10.19 i 6 ".6 .MINERAL SPRINGS. 6.31 t 10.21 86 62 46.4 .....FORSY~'HE..... 6. 30 ~ ~ 10.24 10 20 60.6. BEVERLY SHORES. 6 27 ~ 10.25 48 71l 61.i TAMARACK.... -

California State Rail Plan 2005-06 to 2015-16

California State Rail Plan 2005-06 to 2015-16 December 2005 California Department of Transportation ARNOLD SCHWARZENEGGER, Governor SUNNE WRIGHT McPEAK, Secretary Business, Transportation and Housing Agency WILL KEMPTON, Director California Department of Transportation JOSEPH TAVAGLIONE, Chair STATE OF CALIFORNIA ARNOLD SCHWARZENEGGER JEREMIAH F. HALLISEY, Vice Chair GOVERNOR BOB BALGENORTH MARIAN BERGESON JOHN CHALKER JAMES C. GHIELMETTI ALLEN M. LAWRENCE R. K. LINDSEY ESTEBAN E. TORRES SENATOR TOM TORLAKSON, Ex Officio ASSEMBLYMEMBER JENNY OROPEZA, Ex Officio JOHN BARNA, Executive Director CALIFORNIA TRANSPORTATION COMMISSION 1120 N STREET, MS-52 P. 0 . BOX 942873 SACRAMENTO, 94273-0001 FAX(916)653-2134 (916) 654-4245 http://www.catc.ca.gov December 29, 2005 Honorable Alan Lowenthal, Chairman Senate Transportation and Housing Committee State Capitol, Room 2209 Sacramento, CA 95814 Honorable Jenny Oropeza, Chair Assembly Transportation Committee 1020 N Street, Room 112 Sacramento, CA 95814 Dear: Senator Lowenthal Assembly Member Oropeza: On behalf of the California Transportation Commission, I am transmitting to the Legislature the 10-year California State Rail Plan for FY 2005-06 through FY 2015-16 by the Department of Transportation (Caltrans) with the Commission's resolution (#G-05-11) giving advice and consent, as required by Section 14036 of the Government Code. The ten-year plan provides Caltrans' vision for intercity rail service. Caltrans'l0-year plan goals are to provide intercity rail as an alternative mode of transportation, promote congestion relief, improve air quality, better fuel efficiency, and improved land use practices. This year's Plan includes: standards for meeting those goals; sets priorities for increased revenues, increased capacity, reduced running times; and cost effectiveness. -

Co M M U Te R

RAIL COMMUTER Effective August 12, 2019 Monday – Saturday EBJ Union Station Victory Station Medical/Market Center Station Downtown Irving/ Heritage Crossing Station West Irving Station CentrePort DFW Airport Station (Fare Boundary) Bell Station Richland Hills Station Fort Worth Central Station Fort Worth T & P Station TRE Schedule booklet_AUG 2019 Designer: JH 525-008-0619 SIZE: 3.25X9 CMYK w/Bleeds TrinityRailwayExpress.org RideTrinityMetro.org DART.org 817-215-8600 214-979 -1111 DART TICKETS & PASS PRICES PRECIOS DE PASES Y BOLETOS DE DART FARES TARIFAS Fare Category FARE Categoría de tarifa TARIFA Single Ride - Local (Bus Only) $2.50 Viaje Sencillo - Local (Sólo Autobús) $2.50 Single Ride - Reduced* (Bus Only) $1.25 Viaje Sencillo - Reducido* (Sólo Autobús) $1.25 AM/PM Pass - Local $3.00 Pase AM/PM - Local $3.00 AM/PM Pass - Reduced* $1.50 Pase AM/PM - Reducido* $1.50 Midday - Local (9:30 a.m. - 2:30 p.m.) $2.00 Mediodía - Local (9:30 a.m. - 2:30 p.m.) $2.00 Day Pass - Local $6.00 Pase Diario - Local $6.00 Day Pass - Reduced* $3.00 Pase Diario - Reducido* $3.00 Day Pass - Regional $12.00 Pase Diario - Regional $12.00 Monthly Pass - Local † $96.00 Pase Mensual - Local † $96.00 Monthly Pass - Reduced* † $48.00 Pase Mensual - Reducido* † $48.00 Monthly Pass - Regional $192.00 Pase Mensual - Regional $192.00 Local: DART rail and buses; Trinity Railway Express Local: ferroviario y autobuses de DART; servicio de (TRE) service between EBJ Union Station & CentrePort Trinity Railway Express (TRE) entre EBJ Union Station y Station; GoLink & Flex service. -

DART / TRE / Texrail / DCTA Effective: August 12, 2019

Rail System Map DART / TRE / TEXRail / DCTA Effective: August 12, 2019 O R Parker Road P PLANO MAP LEGEND Fare ChangeDENTON — PLANO Downtown Plano Blue Line B UNT Dallas to Downtown Rowlett President George Bush Turnpike ExpresswayCentral to Denton (operated by DCTA) Red Line R Westmoreland to Parker Rd. Regional Zone Cityline/Bush P Downtown Denton TC Dallas North Tollway Green Line G 35E P LIMITED PARKING AVAILABLE 75 North Carrollton/Frankford to Buckner Med Park P Orange Line O Highland Village/Lewisville Lake DFW Airport to LBJ/Central P LIMITED PARKING AVAILABLE LBJ/Central to Parker, Galatyn Park G Old Town P Weekdays Peak Only P Parking Available North Fare Change Carrollton/ Hebron P — Trinity Railway Express Frankford George Turnpike Bush President P (No Sunday Service) ADDISON Arapaho Center P TEXRail CARROLLTON RICHARDSON 121 Regional Zone A-Train Trinity Mills P Regional Zone Fare Zone Boundry Downtown RICHARDSON Stemmons FreewayCarrollton P Regional Fares Apply 161 Spring Valley P FARMERS Regional Zone — Fare Change Only Peak Weekdays BRANCH ROWLETT P Farmers Branch P Grapevine/ GARLAND Lyndon B. Johnson Freeway Main Street Rd. Parker to LBJ/Central Line Orange B 635 635 Downtown Dallas North Tollway Downtown 114 Royal Lane P O LBJ/Central P Forest/Jupiter P 635 Garland Rowlett DFW P P P Airport Belt P 114 Line Walnut Hill/ Forest Lane P North North Irving Denton P P Lake Covention College Center 35E P Walnut Hill LBJ/Skillman Bachman P P R. L. Thornton Fwy Burbank Lake DFW DFW Las Colinas P Park Lane Highlands P 30 Airport Airport Urban P LOOP North P 12 Terminal Terminal Center Freeway Stemmons Richland Hills/ B A Lovers Lane White Rock P Smitheld DFW 161 University Inwood/ UNIVERSITY PARK of Dallas Love Field MESQUITE P North Richland P HIGHLAND 75 SMU/Mockingbird Hills/Iron Horse P 114 Southwestern PARK 183 Medical District/ Cityplace/Uptown P Mercantile Center LOOP Parkland Pearl/Arts 12 Market P District 635 P 35E LOOP North Side Center St. -

Caltrain Fare Study Draft Research and Peer Comparison Report

Caltrain Fare Study Draft Research and Peer Comparison Report Public Review Draft October 2017 Caltrain Fare Study Draft Research and Peer Comparison October 2017 Research and Peer Review Research and Peer Review .................................................................................................... 1 Introduction ......................................................................................................................... 2 A Note on TCRP Sources ........................................................................................................................................... 2 Elasticity of Demand for Commuter Rail ............................................................................... 3 Definition ........................................................................................................................................................................ 3 Commuter Rail Elasticity ......................................................................................................................................... 3 Comparison with Peer Systems ............................................................................................ 4 Fares ................................................................................................................................................................................. 5 Employer Programs .................................................................................................................................................. -

Senate Bill Policy Committee Analysis

SJR 30 Page 1 Date of Hearing: August 23, 2018 ASSEMBLY COMMITTEE ON TRANSPORTATION Jim Frazier, Chair SJR 30 (McGuire) – As Introduced August 9, 2018 SENATE VOTE: 33-0 SUBJECT: Amtrak National Network. SUMMARY: Urges the Congress and the President of the United States to support the retention of, and investment in, the National Railroad Passenger Corporation (Amtrak) National Network of passenger trains and for Congress to reject the President’s proposed budget cuts to Amtrak. Specifically, this resolution: 1) Makes findings and declarations including the history of Amtrak in the United States and its importance to the State of California that WHEREAS: a) Amtrak was created in 1970 to assume the common carriers’ obligations of the private railroads and provide intercity passenger rail service throughout the United States; and, b) Amtrak’s mission is to deliver intercity transportation that helps move people, the economy, and the nation forward; and, c) Amtrak operates a nationwide rail network, serving more than 500 destinations in 46 states, the District of Columbia, and three Canadian provinces, in addition to serving as a contractor in various capacities for several commuter rail agencies; and, d) Amtrak National Network trains are often the only form of public transportation available to thousands of small communities nationwide, and are a vital link between urban and rural America; and, e) The State of California has a vested interest in the continued success of the local and national Amtrak network as it is home to three of the -

Sunrail.Com Not to Scale

WELCOME ABOARD! BROCHURE LYMMO is your ride to great places M around Downtown Orlando. Whether you’re heading to work, a meal, or one of the many attractions Downtown, LYMMO’s frequent service and bus-only lanes will get you there faster. LYNX is the public transit provider for LYMMO Orange, Lime and And when you’re riding LYMMO, you Orange, Osceola and Seminole counties. never have to worry about parking. Additional connectivity with Grapefruit Lines If you don’t see your destination here, Lake and Polk counties. CONTACT US and we can connect you DIRECT SERVICE TO: to the right LYMMO. CONTACT US for information on fares, bus stops, schedules and trip planning: Amway Center Heritage Square Ready to roll? Look inside for more info... Bob Carr Theater Lake Eola Park 407-841-5969 phone County Courthouse LYNX Central Station 407-423-0787 tdd County Health Dept Orlando City Stadium Dr Phillips Center Parramore Notice of Title VI Rights: LYNX operates its programs and services without regard to race, color, golynx.com web religion, gender, age, national origin, disability, or family status in accordance with Title VI of the Civil Rights Act. Any person who believes Effective: he or she has been aggrieved by any unlawful discriminatory practice APRIL 2017 related to Title VI may file a complaint in writing to LYNX Title VI Officer Desna Hunte, 455 N. Garland Avenue, Orlando, Florida 32801 or by calling THANK YOU FOR RIDING LYNX! 407-254-6117, email [email protected] or www.golynx.com. Information in other languages or accessible formats available upon request. -

Passenger Rail System

Minnesota Comprehensive Statewide Freight and Passenger Rail Plan Passenger Rail System draft technical memorandum 3 prepared for Minnesota Department of Transportation prepared by Cambridge Systematics, Inc. with Kimley-Horn and Associates, Inc. TKDA, Inc. July 17, 2009 www.camsys.com technical memorandum 3 Minnesota Comprehensive Statewide Freight and Passenger Rail Plan Passenger Rail System prepared for Minnesota Department of Transportation prepared by Cambridge Systematics, Inc. 100 CambridgePark Drive, Suite 400 Cambridge, Massachusetts 02140 July 17, 2009 Minnesota Comprehensive Statewide Freight and Passenger Rail Plan Passenger Rail System Technical Memorandum Table of Contents Executive Summary .............................................................................................................. ES-1 1.0 Objective ........................................................................................................................ 1-1 2.0 Methodology ................................................................................................................. 2-1 3.0 Overview of Findings .................................................................................................. 3-1 4.0 Operating and Capacity Conditions and Existing Ridership Forecasts for Potential Passenger Rail Corridors ........................................................................... 4-1 4.1 CP: Rochester-Winona......................................................................................... 4-1 4.2 CP: St. Paul-Red -

20210419 Amtrak Metrics Reporting

NATIONAL RAILROAD PASSENGER CORPORATION 30th Street Station Philadelphia, PA 19104 April 12, 2021 Mr. Michael Lestingi Director, Office of Policy and Planning Federal Railroad Administrator U.S. Department of Transportation 1200 New Jersey Avenue, SE Washington, DC 20590 Dear Mr. Lestingi: In accordance with the Metrics and Minimum Standards for Intercity Passenger Rail Service final rule published on November 16, 2020 (the “Final Rule”), this letter serves as Amtrak’s report to the Federal Railroad Administration that, as of April 10, 2021, Amtrak has provided the 29 host railroads over which Amtrak currently operates (listed in Appendix A) with ridership data for the prior month consistent with the Final Rule. The following data was provided to each host railroad: . the total number of passengers, by train and by day; . the station-specific number of detraining passengers, reported by host railroad whose railroad right-of-way serves the station, by train, and by day; and . the station-specific number of on-time passengers reported by host railroad whose railroad right- of-way serves the station, by train, and by day. Please let me know if you have any questions. Sincerely, Jim Blair Sr. Director, Host Railroads Amtrak cc: Dennis Newman Amtrak Jason Maga Amtrak Christopher Zappi Amtrak Yoel Weiss Amtrak Kristin Ferriter Federal Railroad Administration Mr. Michael Lestingi April 12, 2021 Page 2 Appendix A Host Railroads Provided with Amtrak Ridership Data Host Railroad1 Belt Railway Company of Chicago BNSF Railway Buckingham Branch Railroad -

Sounder Commuter Rail (Seattle)

Public Use of Rail Right-of-Way in Urban Areas Final Report PRC 14-12 F Public Use of Rail Right-of-Way in Urban Areas Texas A&M Transportation Institute PRC 14-12 F December 2014 Authors Jolanda Prozzi Rydell Walthall Megan Kenney Jeff Warner Curtis Morgan Table of Contents List of Figures ................................................................................................................................ 8 List of Tables ................................................................................................................................. 9 Executive Summary .................................................................................................................... 10 Sharing Rail Infrastructure ........................................................................................................ 10 Three Scenarios for Sharing Rail Infrastructure ................................................................... 10 Shared-Use Agreement Components .................................................................................... 12 Freight Railroad Company Perspectives ............................................................................... 12 Keys to Negotiating Successful Shared-Use Agreements .................................................... 13 Rail Infrastructure Relocation ................................................................................................... 15 Benefits of Infrastructure Relocation ................................................................................... -

Director of Capital Development $146,000 - $160,000 Annually

UTAH TRANSIT AUTHORITY Director of Capital Development $146,000 - $160,000 annually Utah Transit Authority provides integrated mobility solutions to service life’s connection, improve public health and enhance quality of life. • Central Corridor improvements: Expansion of the Utah Valley Express (UVX) Bus Rapid Transit (BRT) line to Salt Lake City; addition of a Davis County to Salt Lake City BRT line; construction of a BRT line in Ogden; and the pursuit of world class transit-oriented developments at the Point of the Mountain during the repurposing of 600 acres of the Utah State Prison after its future relocation. To learn more go to: rideuta.com VISION Provide an integrated system of innovative, accessible and efficient public transportation services that increase access to opportunities and contribute to a healthy environment for the people of the Wasatch region. THE POSITION The Director of Capital Development plays a critical ABOUT UTA role in getting things done at Utah Transit Authority UTA was founded on March 3, 1970 after residents from (UTA). This is a senior-level position reporting to the Salt Lake City and the surrounding communities of Chief Service Development Officer and is responsible Murray, Midvale, Sandy, and Bingham voted to form a for cultivating projects that improve the connectivity, public transit district. For the next 30 years, UTA provided frequency, reliability, and quality of UTA’s transit residents in the Wasatch Front with transportation in the offerings. This person oversees and manages corridor form of bus service. During this time, UTA also expanded and facility projects through environmental analysis, its operations to include express bus routes, paratransit grant funding, and design processes, then consults with service, and carpool and vanpool programs.