Print Preview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Consolidated Financial Statements of MTY Food Group Inc

Consolidated financial statements of MTY Food Group Inc. November 30, 2019 and 2018 Independent auditor’s report To the Shareholders of MTY Food Group Inc. Our opinion In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of MTY Food Group Inc. and its subsidiaries (together, the Company) as at November 30, 2019 and 2018, and its financial performance and its cash flows for the years then ended in accordance with International Financial Reporting Standards (IFRS). What we have audited The Company’s consolidated financial statements comprise: ● the consolidated statements of income for the years then ended; ● the consolidated statements of comprehensive income for the years then ended; ● the consolidated statements of changes in shareholders’ equity for the years then ended; ● the consolidated statements of financial position as at November 30, 2019 and 2018; ● the consolidated statements of cash flows for the years then ended; and ● the notes to the consolidated financial statements, which include a summary of significant accounting policies. Basis for opinion We conducted our audit in accordance with Canadian generally accepted auditing standards. Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the consolidated financial statements section of our report. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Independence We are independent of the Company in accordance with the ethical requirements that are relevant to our audit of the consolidated financial statements in Canada. We have fulfilled our other ethical responsibilities in accordance with these requirements. -

House Officers' Expenditures Report-From April 1, 2018 to March

HOUSE OFFICERS’ EXPENDITURES REPORT April 1, 2018 to March 31, 2019 The House Officers’ Expenditures Report for fiscal year 2018-2019 outlines House Officers’ expenditures processed by the House Administration between April 1, 2018 and March 31, 2019. These expenditures are subject to the policies of the Board of Internal Economy that are in effect when the expenses are incurred. The current budgetary allocations and policies are explained in the House Officers and Recognized Parties chapter of the Members’ Allowances and Services Manual available on ourcommons.ca. House Officers’ and National Caucus Research Offices’ expenditures are divided into five categories, as follows: 1. Employees’ salaries: This category includes the salaries of House Officers’ employees. 2. Service contracts: This category includes the costs for professional, technical and administrative services provided to House Officers. 3. Travel: This category includes transportation, per diem and accommodation expenses incurred by House Officers and their employees. o The Detailed Travel Expenditures Report provides information about House Officers' and employees' travel expenditures processed between April 1, 2018 and March 31, 2019. 4. Hospitality: This category includes expenses for meals, refreshments and receptions, as well as other expenses related to extending hospitality. It also includes the cost of gifts given as a matter of protocol. o The Detailed Hospitality Expenditures Report provides information about House Officers' hospitality expenditures processed between April 1, 2018 and March 31, 2019. 5. Office: This category includes expenses such as computers, equipment, telecommunication services, office supplies and training. For more information about the House Officers’ Expenditures Report, please refer to the Frequently Asked Questions. -

CP's North American Rail

2020_CP_NetworkMap_Large_Front_1.6_Final_LowRes.pdf 1 6/5/2020 8:24:47 AM 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Lake CP Railway Mileage Between Cities Rail Industry Index Legend Athabasca AGR Alabama & Gulf Coast Railway ETR Essex Terminal Railway MNRR Minnesota Commercial Railway TCWR Twin Cities & Western Railroad CP Average scale y y y a AMTK Amtrak EXO EXO MRL Montana Rail Link Inc TPLC Toronto Port Lands Company t t y i i er e C on C r v APD Albany Port Railroad FEC Florida East Coast Railway NBR Northern & Bergen Railroad TPW Toledo, Peoria & Western Railway t oon y o ork éal t y t r 0 100 200 300 km r er Y a n t APM Montreal Port Authority FLR Fife Lake Railway NBSR New Brunswick Southern Railway TRR Torch River Rail CP trackage, haulage and commercial rights oit ago r k tland c ding on xico w r r r uébec innipeg Fort Nelson é APNC Appanoose County Community Railroad FMR Forty Mile Railroad NCR Nipissing Central Railway UP Union Pacic e ansas hi alga ancou egina as o dmon hunder B o o Q Det E F K M Minneapolis Mon Mont N Alba Buffalo C C P R Saint John S T T V W APR Alberta Prairie Railway Excursions GEXR Goderich-Exeter Railway NECR New England Central Railroad VAEX Vale Railway CP principal shortline connections Albany 689 2622 1092 792 2636 2702 1574 3518 1517 2965 234 147 3528 412 2150 691 2272 1373 552 3253 1792 BCR The British Columbia Railway Company GFR Grand Forks Railway NJT New Jersey Transit Rail Operations VIA Via Rail A BCRY Barrie-Collingwood Railway GJR Guelph Junction Railway NLR Northern Light Rail VTR -

March 1, 2017 the Honorable John Bel Edwards Governor, State Of

March 1, 2017 The Honorable John Bel Edwards Governor, State of Louisiana P.O. Box 94004 Baton Rouge, LA 70804-9004 Dear Governor Edwards: I am pleased to submit to you the enclosed Annual Report from the Council for the Development of French in Louisiana dated March 1, 2017. Submission of this report is a requirement of Act No. 679 and sums up “actions taken and progress made toward achieving the purposes and duties established for the council.” Respectfully, William Arceneaux, Ph.D. President Cc: President John A. Alario, Jr. Speaker Taylor Barras Senator Dan “Blade” Moorish Representative Nancy Landry ANNUAL REPORT COUNCIL FOR THE DEVELOPMENT OF FRENCH IN LOUISIANA (CODOFIL) March 1, 2017 Governance Board All twenty-three seats on CODOFIL’s board are filled. The most recent board meeting was held December 10, 2016. Budget CODOFIL’s Existing Operating Budget for FY16 was $609,286 ((maximum budget authority for collecting/spending funds) - not actual funding. Staff The CODOFIL staff is currently comprised of 5 people: a full-time executive director, a full-time communications director, a full-time education program consultant, a full-time cultural program coordinator, and a full-time administrative coordinator. This staffing level is adequate to address the agency’s mandates but may be in need of extra human resources to better fulfill CODOFIL’s mandates. Office relocation CODOFIL continues to rent temporary office space at Lafayette City-Parish government’s International Center. Renovation is underway at the former headquarters of CODOFIL at 217 West Main Street in Lafayette. Projected return to the old office is early 2018. -

EXCLUSIVE 2019 International Pizza Expo BUYERS LIST

EXCLUSIVE 2019 International Pizza Expo BUYERS LIST 1 COMPANY BUSINESS UNITS $1 SLICE NY PIZZA LAS VEGAS NV Independent (Less than 9 locations) 2-5 $5 PIZZA ANDOVER MN Not Yet in Business 6-9 $5 PIZZA MINNEAPOLIS MN Not Yet in Business 6-9 $5 PIZZA BLAINE MN Not Yet in Business 6-9 1000 Degrees Pizza MIDVALE UT Franchise 1 137 VENTURES SAN FRANCISCO CA OTHER 137 VENTURES SAN FRANCISCO, CA CA OTHER 161 STREET PIZZERIA LOS ANGELES CA Independent (Less than 9 locations) 1 2 BROS. PIZZA EASLEY SC Independent (Less than 9 locations) 1 2 Guys Pies YUCCA VALLEY CA Independent (Less than 9 locations) 1 203LOCAL FAIRFIELD CT Independent (Less than 9 locations) No response 247 MOBILE KITCHENS INC VISALIA CA Independent (Less than 9 locations) 1 25 DEGREES HB HUNTINGTON BEACH CA Independent (Less than 9 locations) 1 26TH STREET PIZZA AND MORE ERIE PA Independent (Less than 9 locations) 1 290 WINE CASTLE JOHNSON CITY TX Independent (Less than 9 locations) 1 3 BROTHERS PIZZA LOWELL MI Independent (Less than 9 locations) 2-5 3.99 Pizza Co 3 Inc. COVINA CA Independent (Less than 9 locations) 2-5 3010 HOSPITALITY SAN DIEGO CA Independent (Less than 9 locations) 2-5 307Pizza CODY WY Independent (Less than 9 locations) 1 32KJ6VGH MADISON HEIGHTS MI Franchise 2-5 360 PAYMENTS CAMPBELL CA OTHER 399 Pizza Co WEST COVINA CA Independent (Less than 9 locations) 2-5 399 Pizza Co MONTCLAIR CA Independent (Less than 9 locations) 2-5 3G CAPITAL INVESTMENTS, LLC. ENGLEWOOD NJ Not Yet in Business 3L LLC MORGANTOWN WV Independent (Less than 9 locations) 6-9 414 Pub -

International Travel Report

International Travel Final Report Minister Carlier Mission to the United States January 6-8, 2017 Overview: Honourable Oneil Carlier, Minister of Agriculture and Forestry (AF), led a mission to Baton Rouge, Louisiana to attend the 2017 Legislative Agriculture Chairs (LAC) Summit and to address a session devoted to State/Provincial Response to Natural Disasters. The mission was designed to support Alberta’s international trade and intergovernmental relations priorities with our most important bilateral trading partner and largest export market for agriculture, food, and forestry products, the United States (US). Historically, the Summit has been used by Canada as an advocacy forum to address adverse trade policy or legislation, profile Alberta’s agriculture and forestry sectors, and to further encourage bilateral cooperation within the agriculture and forestry sectors. The 2017 Summit afforded Alberta/Canada the opportunity to reaffirm relations and positions, and to seek assurances from US legislators that a new US administration will not revisit past agricultural policies or legislation that would adversely impact Canada’s livestock industry. The 2017 Summit drew 125 legislators from 46 US states and six Canadian provinces. In attendance were ministers of Agriculture from Alberta and Manitoba, Saskatchewan’s Minister of Environment, along with members of the Legislative Assemblies of Manitoba, Ontario, Quebec, and Saskatchewan. The remainder of the Canada Delegation was comprised of representatives of Agriculture and Agri-Food Canada’s Market Access Secretariat, the Canadian Consulates of Minneapolis and Dallas, and industry representation from the Canadian Cattlemen’s Association, Canadian Pork Council, and Manitoba Pork. The Honourable Lawrence MacAulay, Minister of Agriculture and Agri-Food Canada (AAFC), also attended and gave a keynote address on working with the new US administration, bilateral agricultural trade, and cross-border cooperation. -

Annual Report 2018 Our Banners

ANNUAL REPORT 2018 OUR BANNERS TM ® MTYGROUP.COM Dear fellow Shareholders, The year that just ended has been a transformational year for MTY. First, we have completed five transactions, investing $325 million and adding 702 locations to our network, bringing our system sales to $2.8 billion for 2018 and easily surpassing last year’s record-breaking $2.3 billion. Second, our founder and our COO of Canadian operations have announced they would concentrate on their board of director duties while focusing on realizing additional acquisition opportunities for MTY. Last, in November we put a solid leadership team in place that will help MTY achieve its goals. Their experience and long list of past successes will all contribute to helping our franchisees prosper and accelerate MTY’s growth. Among the acquisitions realized during 2018, the acquisition of Imvescor Restaurant Group Inc. (“IRG”) was the most significant in terms of total purchase consideration but also in terms of expanding MTY into the casual dining segment of the restaurant industry. The expertise we gained when the IRG team joined was invaluable and we hope they can help us grow further into a segment in which we had previously been less present. The strong performance of IRG and The Counter Custom Burgers/Built Custom Burgers since their acquisition has largely driven the 36% growth in EBITDA realized during 2018. Our EBITDA surpassed the $100 million mark for the first time this year and reached $127.7 million. The business continues to provide a high conversion rate of our EBITDA into cash flows; our operating cash flows also reached a record high this year, at $97.6 million. -

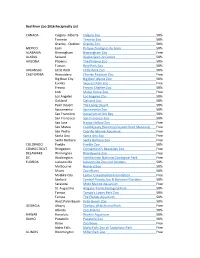

Red River Zoo 2016 Reciprocity List CANADA Calgary -Alberta Calgary

Red River Zoo 2016 Reciprocity List CANADA Calgary -Alberta Calgary Zoo 50% Toronto Toronto Zoo 50% Granby - Quebec Granby Zoo 50% MEXICO León Parque Zoológico de León 50% ALABAMA Birmingham Birmingham Zoo Free ALASKA Seward Alaska Sea Life Center 50% ARIZONA Phoenix The Phoenix Zoo 50% Tucson Reid Park Zoo 50% ARKANSAS Little Rock Little Rock Zoo 50% CALIFORNIA Atascadero Charles Paddock Zoo Free Big Bear City Big Bear Alpine Zoo 50% Eureka Sequoia Park Zoo Free Fresno Fresno Chaffee Zoo 50% Lodi Micke Grove Zoo Free Los Angeles Los Angeles Zoo 50% Oakland Oakland Zoo 50% Palm Desert The Living Desert 50% Sacramento Sacramento Zoo 50% San Francisco Aquarium of the Bay 50% San Francisco San Francisco Zoo 50% San Jose Happy Hollow Zoo Free San Mateo CuriOdyssey (formerly Coyote Point Museum) Free San Pedro Cabrillo Marine Aquarium Free Santa Ana Santa Ana Zoo Free Santa Barbara Santa Barbara Zoo Free COLORADO Pueblo Pueblo Zoo 50% CONNECTICUT Bridgeport Connecticut's Beardsley Zoo Free DELAWARE Wilmington Brandywine Zoo Free DC Washington Smithsonian National Zoological Park Free FLORIDA Jacksonville Jacksonville Zoo and Gardens 50% Melbourne Brevard Zoo 50% Miami Zoo Miami 50% Myakka City Lemur Conservation Foundation Free Sanford Central Florida Zoo & Botanical Gardens 50% Sarasota Mote Marine Aquarium Free St. Augustine Alligator Farm Zoological Park 50% Tampa Tampa's Lowry Park Zoo 50% Tampa The Florida Aquarium 50% West Palm Beach Palm Beach Zoo 50% GEORGIA Albany Chehaw Wild Animal Park Free Atlanta Zoo Atlanta 50% HAWAII Honolulu -

Management's Discussion and Analysis for the Three and Six

Management’s Discussion and Analysis For the three and six-months ended May 31, 2020 Key highlights • Non-cash impairment charge of $120.3 million related to property, plant and equipment, intangible assets and goodwill • Net loss attributable to shareholders of $99.1 million or ($4.01) per share • System sales of $670.7 million, down 19% compared to Q2-19 • 2,757 restaurants closed during the quarter, resulting in 138,931 business days lost during the quarter; 1,470 were still closed at quarter end, and 573 remain closed as of the date of this press release, which represents less than 8% of the network. • Amended existing credit facility with more flexible financial covenants for the next four quarters • Management initiatives resulting in a reduction of recurring controllable expenses of $10.1 million for Q2 • EBITDA of $18.2 million, down 47% compared to Q2-19 • Free cash flows of $28.9 million despite dramatic impact of COVID-19 • Repurchased and cancelled 364,774 shares for a total consideration of $18.9 million year-to- date • Cash on hand of $49.9 million as at May 31, 2020 (1) See section “Definition of non-GAAP measures” found in the Supplemental Information section for definition. Management’s Discussion and Analysis For the three and six-months ended May 31, 2020 General This Management's Discussion and Analysis of the financial position and financial performance ("MD&A") of MTY Food Group Inc. ("MTY") is supplementary information and should be read in conjunction with the Company’s condensed interim consolidated financial statements for the period ended May 31, 2020 and the audited consolidated financial statements and accompanying notes for the fiscal year ended November 30, 2019. -

Transit Times from Baton Rouge, La

Edmonton Campbell River• • •Prince Albert Nanaimo BRITISH Red Deer Lloydminster• • Vancouver Baie-Comeau • Kamloops • • • COLUMBIA Calgary Saskatoon• Victoria• Kelowna • Chicoutimi • •Bellingham • •Castlegar • •Everett Creston Cranbrook alberta Port • • SASKATCHEWAN MANITOBA Rivieve-du-Loup • Angeles •Seattle QUEBEC WA Lethbridge •Medicine Regina ONTARIO •Tacoma • Hat • Winnipeg Bremerton• •Olympia Brandon Spokane• Weyburn• Estevan • Houlton • •Wenatchee • • Trois-Rivieres • • Quebec Visit averittexpress.com or call •Yakima Sidney• Drummondville • ME 1-800-AVERITT for the most • •Kennewick Portland MT ND Sherbrooke • Pittsfield up-to-date, zip-to-zip transit times. Fargo• • Montreal • • Duluth Ottawa • Williston OR Bismarck • Cornwall • • For emergency shipping needs, •Eugene MN • Scarborough Kingston Windsor NH call our Expedited team at • ID • • Bend WI Belleville Oshawa • • Londonderry 1-800-283-1995. St. Cloud • • NY VT • Wausau Toronto •Medford • MA•Boston Watertown• St. Paul• • • Albany • Springfield Guaranteed Service: ask any Boise •Jackson SD Eau Claire Appleton Syracuse • • Courtland • • Rapid• City Cambridge Buffalo • Rochester• MI • customer service representative London• CT WY Sioux Falls• Newburgh RI how Averitt can provide CA Milwaukee • Janesville• • Battle Creek •Carlstadt guaranteed delivery of your IA • PA Hazleton • NJ Northern IL Allentown • • • Trenton Waterloo • Cleveland• •W. Middlesex • standard LTL shipments. •Elko Chicago Toledo Philadelphia • •Burlington NE • • OH •Pittsburgh •Harrisburg •Reno Salt Lake City -

Print Preview

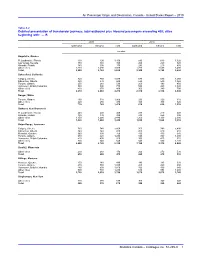

Air Passenger Origin and Destination, Canada - United States Report – 2010 Table 3-2 Detailed presentation of transborder journeys, total outbound plus inbound passengers exceeding 400; cities beginning with: — B 2009 2010 Outbound Inbound Total Outbound Inbound Total number Bagotville, Quebec Ft Lauderdale, Florida 730 700 1,430 680 640 1,320 Las Vegas, Nevada 180 180 360 260 260 520 Orlando, Florida 180 190 370 240 210 450 Other cities 1,810 1,690 3,500 1,720 1,680 3,400 Total 2,900 2,760 5,660 2,900 2,790 5,690 Bakersfield, California Calgary, Alberta 820 750 1,570 680 580 1,260 Edmonton, Alberta 330 270 600 520 530 1,050 Toronto, Ontario 250 280 530 260 190 450 Vancouver, British Columbia 380 390 770 550 490 1,040 Other cities 430 370 800 360 340 700 Total 2,210 2,060 4,270 2,370 2,130 4,500 Bangor, Maine Toronto, Ontario 490 510 1,000 290 320 610 Other cities 220 250 470 320 300 620 Total 710 760 1,470 610 620 1,230 Bathurst, New Brunswick Ft Lauderdale, Florida 240 220 460 210 210 420 Orlando, Florida 130 170 300 240 250 490 Other cities 1,150 1,290 2,440 1,200 1,100 2,300 Total 1,520 1,680 3,200 1,650 1,560 3,210 Baton Rouge, Louisiana Calgary, Alberta 710 740 1,450 700 790 1,490 Edmonton, Alberta 140 140 280 200 210 410 Montréal, Quebec 360 390 750 490 480 970 Toronto, Ontario 670 620 1,290 840 850 1,690 Vancouver, British Columbia 420 490 910 390 420 810 Other cities 300 340 640 540 580 1,120 Total 2,600 2,720 5,320 3,160 3,330 6,490 Bemidji, Minnesota Other cities 230 240 470 260 270 530 Total 230 240 470 260 270 530 Billings, Montana Montréal, Quebec 250 240 490 140 180 320 Toronto, Ontario 490 530 1,020 460 420 880 Vancouver, British Columbia 480 530 1,010 460 480 940 Other cities 500 730 1,230 610 990 1,600 Total 1,720 2,030 3,750 1,670 2,070 3,740 Binghamton, New York Other cities 300 370 670 300 340 640 Total 300 370 670 300 340 640 Statistics Canada – Catalogue no. -

Imvescor Restaurant Group Inc

JANUARY 27, 2016 Imvescor Restaurant Group Inc. IRG-T: $2.41 | Rating: Buy | Target price: $3.00 “Imvesting” with Franchisees Special Situations Michael Glen, CFA Elizabeth Johnston Special Situations Analyst Associate Tel: 514 350-2876 Tel: 514-350-2949 [email protected] [email protected] Imvescor Restaurant Group Inc. “Imvesting” with Franchisees Company Introduction .......................................................................................................................................................... 2 Brief Description of Each Imvescor Banner ........................................................................................................................................................... 3 Some Historical Perspective ................................................................................................................................................. 4 The Entrance of Frank Hennessey ........................................................................................................................................................................ 5 The Strategic Plan and Objectives ....................................................................................................................................... 7 Focal Points and Initiatives of the Strategic Plan ................................................................................................................................................... 8 The Renovation and Rejuvenation Plan ................................................................................................................................................................