Annual Report 2018 Our Banners

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Consolidated Financial Statements of MTY Food Group Inc

Consolidated financial statements of MTY Food Group Inc. November 30, 2019 and 2018 Independent auditor’s report To the Shareholders of MTY Food Group Inc. Our opinion In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of MTY Food Group Inc. and its subsidiaries (together, the Company) as at November 30, 2019 and 2018, and its financial performance and its cash flows for the years then ended in accordance with International Financial Reporting Standards (IFRS). What we have audited The Company’s consolidated financial statements comprise: ● the consolidated statements of income for the years then ended; ● the consolidated statements of comprehensive income for the years then ended; ● the consolidated statements of changes in shareholders’ equity for the years then ended; ● the consolidated statements of financial position as at November 30, 2019 and 2018; ● the consolidated statements of cash flows for the years then ended; and ● the notes to the consolidated financial statements, which include a summary of significant accounting policies. Basis for opinion We conducted our audit in accordance with Canadian generally accepted auditing standards. Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the consolidated financial statements section of our report. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Independence We are independent of the Company in accordance with the ethical requirements that are relevant to our audit of the consolidated financial statements in Canada. We have fulfilled our other ethical responsibilities in accordance with these requirements. -

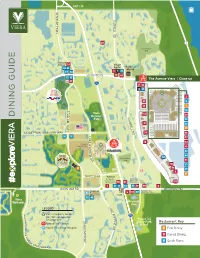

547Tvc Updates-Dining Guide Map Flyer 02-19-19.Ai

EXIT 195 N STADIUM PKWYSTADIUM MURRELL RD 20 1 Conservation Area Stadium Corner 22 Village 46 65 Center Shoppes at Murrell 29 34 8 3 26 32 30 47 21 63 VIERA BLVD The Avenue Viera | Close-up 48 48 95 23 58 12 27 Space Coast Stadium 2 43 6 14 7 STADIUM PKWY STADIUM 16 Viera 52 24 DINING GUIDE DINING Regional MURRELL RD Park 25 31 28 35 JUDGE FRAN JAMIESON WAY 54 36 18 17 L A 37 K E 15 39 Fairfield A Conservation Inn & Suites N Area 41 D R 42 E W 44 53 D Conservation R Area 55 10 61 57 56 63 47 9 65 NAPOLO DR Walmart La Quinta Holiday Inn Inn & Suites 45 Melbourne-Viera 38 Melbourne 19 Conference Center 1 51 11 13 33 59 40 4 WICKHAM RD EXIT WICKHAM RD Health First 5 50 60 Hampton Inn Pro-Health & 191 Melbourne-Viera H Fitness Center Target 62 49 Viera Wetlands Brevard Zoo L A LEGEND K E P A r Viera Discovery Center N o 95 p 2661-#105 Town Center Ave D o R Brevard Zoo s The Avenue Viera E STADIUM PKWYSTADIUM e W d Linear Park Restaurant Key # E Rescue/Fire Station D & Trail x t R e H Health First Viera Hospital # Fine Dining n s i o n # Casual Dining P IN E # D Quick Menu A C AUS EWAY EXT. DINING GUIDE VIERA 1 Asian Wok | Asian | CD 23 First Watch | American | CD 47 Sergio's Tacos Mexican Grill | Mexican | CD 8530 N Wickham Rd #110, Viera 2328 Citadel Way, Viera 5470 Murrell Rd, Rockledge AsianWok-FL.com FirstWatch.com SergiosTacosViera.com 2 Bean Sprout | Asian | CD 24 Five Guys Burgers | American | CD 48 Slow & Low Barbeque | Bar & Grill | CD 2221 Town Center Ave, Viera 2230 Town Center Ave, Viera 5490 Stadium Pkwy, Viera BeanSproutViera.com -

Energy, Saturated Fat, and Sodium Were Lower in Entrées at Chain

RESEARCH Original Research Energy, Saturated Fat, and Sodium Were Lower in Entrées at Chain Restaurants at 18 Months Compared with 6 Months Following the Implementation of Mandatory Menu Labeling Regulation in King County, Washington Barbara Bruemmer, PhD, RD; Jim Krieger, MD, MPH; Brian E. Saelens, PhD; Nadine Chan, PhD, MPH ARTICLE INFORMATION ABSTRACT Article history: Background Policies on menu labeling have been proposed as a method to improve the Accepted 17 April 2012 food environment. However, there is little information on the nutrient content of chain Available online 14 June 2012 restaurant menu items and changes over time. Keywords: Objective To evaluate the energy, saturated fat, and sodium content of entrÊes 6 and 18 Food labeling months post-implementation of restaurant menu labeling in King County of Washing- Restaurants ton State for items that were on the menu at both time periods, and across all items at 6 Energy intake and 18 months and to compare energy content to recommendations provided by the 2005 Dietary Guidelines for Americans. Copyright © 2012 by the Academy of Nutrition Setting Eligible restaurants included sit-down and quick-service chains (eg, burgers, and Dietetics. pizza, sandwiches/subs, and Tex-Mex) subject to King County regulations with four or 2212-2672/$36.00 doi: 10.1016/j.jand.2012.04.019 more establishments. One establishment per chain was audited at each time period. Statistical analyses Hypothesis one examined entrÊes that were on the menu at both time periods using a paired t test and hypothesis two compared quartiles at 6 months to the distribution at 18 months using a Mantel-Haentzel odds ratios and 95% CIs, and a Cochrane-Armitage test for trend. -

National Retailer & Restaurant Expansion Guide Spring 2016

National Retailer & Restaurant Expansion Guide Spring 2016 Retailer Expansion Guide Spring 2016 National Retailer & Restaurant Expansion Guide Spring 2016 >> CLICK BELOW TO JUMP TO SECTION DISCOUNTER/ APPAREL BEAUTY SUPPLIES DOLLAR STORE OFFICE SUPPLIES SPORTING GOODS SUPERMARKET/ ACTIVE BEVERAGES DRUGSTORE PET/FARM GROCERY/ SPORTSWEAR HYPERMARKET CHILDREN’S BOOKS ENTERTAINMENT RESTAURANT BAKERY/BAGELS/ FINANCIAL FAMILY CARDS/GIFTS BREAKFAST/CAFE/ SERVICES DONUTS MEN’S CELLULAR HEALTH/ COFFEE/TEA FITNESS/NUTRITION SHOES CONSIGNMENT/ HOME RELATED FAST FOOD PAWN/THRIFT SPECIALTY CONSUMER FURNITURE/ FOOD/BEVERAGE ELECTRONICS FURNISHINGS SPECIALTY CONVENIENCE STORE/ FAMILY WOMEN’S GAS STATIONS HARDWARE CRAFTS/HOBBIES/ AUTOMOTIVE JEWELRY WITH LIQUOR TOYS BEAUTY SALONS/ DEPARTMENT MISCELLANEOUS SPAS STORE RETAIL 2 Retailer Expansion Guide Spring 2016 APPAREL: ACTIVE SPORTSWEAR 2016 2017 CURRENT PROJECTED PROJECTED MINMUM MAXIMUM RETAILER STORES STORES IN STORES IN SQUARE SQUARE SUMMARY OF EXPANSION 12 MONTHS 12 MONTHS FEET FEET Athleta 46 23 46 4,000 5,000 Nationally Bikini Village 51 2 4 1,400 1,600 Nationally Billabong 29 5 10 2,500 3,500 West Body & beach 10 1 2 1,300 1,800 Nationally Champs Sports 536 1 2 2,500 5,400 Nationally Change of Scandinavia 15 1 2 1,200 1,800 Nationally City Gear 130 15 15 4,000 5,000 Midwest, South D-TOX.com 7 2 4 1,200 1,700 Nationally Empire 8 2 4 8,000 10,000 Nationally Everything But Water 72 2 4 1,000 5,000 Nationally Free People 86 1 2 2,500 3,000 Nationally Fresh Produce Sportswear 37 5 10 2,000 3,000 CA -

Infogroup Business Listing File

Infogroup Business Listing File Company location: Omaha, Nebraska Web address: www.infousa.com Description: Infogroup collects information on approximately 11 million private and public US companies. Individual businesses are located by address geocoding—not all will have an exact location. The Esri geocoder integrates an address-based approach with more than eighty-one million residential and commercial U.S. address records from the NAVTEQ Point Addressing database. This database maps street addresses to a physical location so each address is a fixed point and not an interpolation from an address range. The geocoder uses address locators in a cascading fallback approach to ensure a match for as many records as possible. The primary locator utilizes the NAVTEQ Point Addressing database. The secondary locator utilizes the NAVTEQ Street Address Range database. Records that did not match fall back to the geocode provided by Infogroup. Businesses can be retrieved by their Standard Industrial Classification Code (SIC) as well as by North American Industry Classification System (NAICS) Code and Location. The Infogroup Business File can be used for locating both competitors and marketing opportunities. This data is current as of July 2011. Fields: Note: Using the Identify a Business tool , click on a business in your map area to see these fields for an individual business. Fields marked in blue below are not visible in the business layer attribute table or exportable from Business Analyst. Company Name (Actual field name=CONAME) – The legal, incorporated business name. Example: ESRI, AT&T, IBM. Address – Physical address of location. The address field cannot be used for direct mailing purposes. -

House Officers' Expenditures Report-From April 1, 2018 to March

HOUSE OFFICERS’ EXPENDITURES REPORT April 1, 2018 to March 31, 2019 The House Officers’ Expenditures Report for fiscal year 2018-2019 outlines House Officers’ expenditures processed by the House Administration between April 1, 2018 and March 31, 2019. These expenditures are subject to the policies of the Board of Internal Economy that are in effect when the expenses are incurred. The current budgetary allocations and policies are explained in the House Officers and Recognized Parties chapter of the Members’ Allowances and Services Manual available on ourcommons.ca. House Officers’ and National Caucus Research Offices’ expenditures are divided into five categories, as follows: 1. Employees’ salaries: This category includes the salaries of House Officers’ employees. 2. Service contracts: This category includes the costs for professional, technical and administrative services provided to House Officers. 3. Travel: This category includes transportation, per diem and accommodation expenses incurred by House Officers and their employees. o The Detailed Travel Expenditures Report provides information about House Officers' and employees' travel expenditures processed between April 1, 2018 and March 31, 2019. 4. Hospitality: This category includes expenses for meals, refreshments and receptions, as well as other expenses related to extending hospitality. It also includes the cost of gifts given as a matter of protocol. o The Detailed Hospitality Expenditures Report provides information about House Officers' hospitality expenditures processed between April 1, 2018 and March 31, 2019. 5. Office: This category includes expenses such as computers, equipment, telecommunication services, office supplies and training. For more information about the House Officers’ Expenditures Report, please refer to the Frequently Asked Questions. -

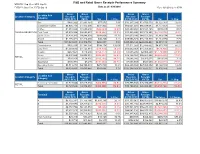

F&B and Retail Gross Receipts Performance Summary

F&B and Retail Gross Receipts Performance Summary MTD PFY: Sep 15 vs. MTD: Sep 16 FYTD PY: Sep 15 vs. FYTD: Sep 16 Data as of: 9/30/2016 Run: 12/1/2016 2:14:15 PM 12:00:00 AM Gross Gross Gross Gross Location Sub Location Category Receipts Receipts Receipts Receipts Category (MTD PFY) (MTD) Var % Chg (FYTD PFY) (FYTD) Var % Chg Bar $985,292 $1,063,164 $77,872 7.9% $10,237,209 $13,559,570 $3,322,361 32.5% Casual Dining/Bar $6,930,743 $7,472,696 $541,952 7.8% $83,051,037 $86,828,087 $3,777,051 4.5% Coffee $1,663,026 $1,620,456 ($42,569) (2.6%) $20,593,466 $21,123,745 $530,279 2.6% FOOD & BEVERAGE Fast Food $3,272,934 $2,653,679 ($619,254) (18.9%) $39,936,206 $37,772,391 ($2,163,816) (5.4%) Quick-Serve $3,439,385 $4,048,054 $608,669 17.7% $42,670,286 $44,553,560 $1,883,274 4.4% Snack $1,276,421 $1,316,689 $40,268 3.2% $15,056,923 $16,218,893 $1,161,970 7.7% Total $17,567,801 $18,174,738 $606,937 3.5% $211,545,128 $220,056,247 $8,511,119 4.0% Convenience $592,130 $1,341,304 $749,174 126.5% $7,511,263 $12,486,622 $4,975,359 66.2% Duty Free $1,203,685 $1,125,314 ($78,370) (6.5%) $15,632,363 $14,753,053 ($879,309) (5.6%) Kiosks $287,657 $118,240 ($169,417) (58.9%) $4,086,286 $2,906,298 ($1,179,988) (28.9%) News $2,597,882 $2,005,573 ($592,309) (22.8%) $32,124,769 $26,461,368 ($5,663,400) (17.6%) RETAIL News/Coffee $793,250 $678,050 ($115,199) (14.5%) $8,686,166 $9,305,677 $619,511 7.1% Spa/Salon $138,982 $7,429 ($131,553) (94.7%) $2,005,669 $541,657 ($1,464,012) (73.0%) Specialty Retail $3,711,278 $4,390,033 $678,755 18.3% $42,200,052 $47,368,052 -

Training Coordinator Job Description Direct Report Relationship: Vice President, Training & Customer Service Location: Scottsdale, Arizona FLSA Status: Exempt

Training Coordinator Job Description Direct Report Relationship: Vice President, Training & Customer Service Location: Scottsdale, Arizona FLSA Status: Exempt Equal Opportunity Employer M/F/D/V TRAINING COORDINATOR POSITION SUMMARY Help maximize the efforts and effectiveness of the Kahala Training Team by managing franchisee training registration, identifying gaps and efficiencies in processes, developing resources and providing training support. This position supports all of the Quick Service Restaurant (QSR) brands under the Kahala Brands umbrella (e.g., Cold Stone Creamery, Blimpie, TacoTime, Planet Smoothie, Pinkberry, etc.). TRAINING COORDINATOR KEY RESPONSIBILITIES Oversee all training registrations, communicating regularly with franchisees, training stores, field and office team Maintain training records Proctor monthly ServSafe exams Provide team support (e.g., room set up, scheduling, formatting PowerPoints) for the successful execution of classroom training and other training efforts Ensure training stores have the information and resources needed to successfully train franchisees Process training store payments Work with our print vendor to maintain and order all brand resources Manage content on franchisee portal Continuously provide innovative training solutions (e.g., quizzes, handouts, best practices, apps, etc.) Support team in executing company-wide events TRAINING COORDINATOR PERSONAL ATTRIBUTES Optimistic, enthusiastic and service-minded (to model values of the hospitality industry) Strong organizational -

Students' Council

University of Alberta Students’ Union STUDENTS’ COUNCIL Tuesday, January 23, 2018 6:00PM Council Chambers, University Hall LATE ADDITIONS (SC 2017-17) 2017-17/1 SPEAKERS BUSINESS 2017-17/2 PRESENTATIONS 2017-17/3 EXECUTIVE COMMITTEE REPORT 2017-17/4 BOARD AND COMMITTEE REPORT 2017-17/5 OPEN FORUM 2017-17/6 QUESTION PERIOD 2017-17/7 BOARD AND COMMITTEE BUSINESS 2017-17/8 GENERAL ORDERS 2017-17/9 INFORMATION ITEMS 2017-17/9a Food Court Feedback See SC-2017-17.01 Food Court Feedback By Levi Flaman: Open Studies Councillor Summary For approximately two weeks, I ran a survey asking for feedback from local stakeholders (anyone with an active CCID) for their top three choices on what they would like to see in the Students’ Union Building food court after the current leases expire this year as mentioned by VP Paches in his written report on Jan 9, 2018. From the responses, first choices were weighted 3 points, second choices 2 points and third choice one point then summed up to generate weighted responses as to which vendors were the most popular and in demand for any vacant spaces. Thai Express was by far the most popular in first place with 56 points, approximately 1.6 times as many points as the second highest choice, Freshii with 34 points. McDonald’s was the third highest choice with 28 points. Other interest names and options pop up as well; Taco Bell comes in fourth place with 25 points and would be a worthwhile replacement for Taco Time as they both do Mexican fast food. -

View Annual Report

Dear shareholders: First and foremost, I wish to personally thank each one of MTY’s franchisees, business partners and shareholders for their continuous support and contribution to our success in 2014. I truly appreciate and thank you for being a part of our growing family. In my letter last year, I indicated that 2014 would be a challenging year for MTY; our apprehensions did materialize and were compounded by the effect of adverse weather during the first half of 2014. Strong competitive pressure and a sluggish economy in many regions drove our same store sales down for a second straight year. We also saw 175 outlets close during the year, while 145 opened. Despite all its challenges, 2014 brought good news too; MTY closed 3 more acquisitions, adding 167 stores to the network and providing further depth into MTY’s portfolio of brands. Our system sales grew by 22%, reaching $888 million during the year. We expect system sales to exceed $1 billion in 2015 as a result of the recent acquisitions. MTY’s network stands at 2,727 stores at the end of our 2014 fiscal period. In that difficult environment, MTY’s employees executed strategies with discipline and creativity, and our expenses remained well-managed, enabling us to achieve satisfactory results. Excluding the impact of a one-time impairment charge taken on one of our trademarks, the income attributable to shareholder would have been up by 6% this year. Our EPS stood at $1.33 per share, a slight decline compared to 2013. Cash flows from operations were strong again during 2014, growing by 22% over last year. -

CP's North American Rail

2020_CP_NetworkMap_Large_Front_1.6_Final_LowRes.pdf 1 6/5/2020 8:24:47 AM 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Lake CP Railway Mileage Between Cities Rail Industry Index Legend Athabasca AGR Alabama & Gulf Coast Railway ETR Essex Terminal Railway MNRR Minnesota Commercial Railway TCWR Twin Cities & Western Railroad CP Average scale y y y a AMTK Amtrak EXO EXO MRL Montana Rail Link Inc TPLC Toronto Port Lands Company t t y i i er e C on C r v APD Albany Port Railroad FEC Florida East Coast Railway NBR Northern & Bergen Railroad TPW Toledo, Peoria & Western Railway t oon y o ork éal t y t r 0 100 200 300 km r er Y a n t APM Montreal Port Authority FLR Fife Lake Railway NBSR New Brunswick Southern Railway TRR Torch River Rail CP trackage, haulage and commercial rights oit ago r k tland c ding on xico w r r r uébec innipeg Fort Nelson é APNC Appanoose County Community Railroad FMR Forty Mile Railroad NCR Nipissing Central Railway UP Union Pacic e ansas hi alga ancou egina as o dmon hunder B o o Q Det E F K M Minneapolis Mon Mont N Alba Buffalo C C P R Saint John S T T V W APR Alberta Prairie Railway Excursions GEXR Goderich-Exeter Railway NECR New England Central Railroad VAEX Vale Railway CP principal shortline connections Albany 689 2622 1092 792 2636 2702 1574 3518 1517 2965 234 147 3528 412 2150 691 2272 1373 552 3253 1792 BCR The British Columbia Railway Company GFR Grand Forks Railway NJT New Jersey Transit Rail Operations VIA Via Rail A BCRY Barrie-Collingwood Railway GJR Guelph Junction Railway NLR Northern Light Rail VTR -

Restaurant Trends App

RESTAURANT TRENDS APP For any restaurant, Understanding the competitive landscape of your trade are is key when making location-based real estate and marketing decision. eSite has partnered with Restaurant Trends to develop a quick and easy to use tool, that allows restaurants to analyze how other restaurants in a study trade area of performing. The tool provides users with sales data and other performance indicators. The tool uses Restaurant Trends data which is the only continuous store-level research effort, tracking all major QSR (Quick Service) and FSR (Full Service) restaurant chains. Restaurant Trends has intelligence on over 190,000 stores in over 500 brands in every market in the United States. APP SPECIFICS: • Input: Select a point on the map or input an address, define the trade area in minute or miles (cannot exceed 3 miles or 6 minutes), and the restaurant • Output: List of chains within that category and trade area. List includes chain name, address, annual sales, market index, and national index. Additionally, a map is provided which displays the trade area and location of the chains within the category and trade area PRICE: • Option 1 – Transaction: $300/Report • Option 2 – Subscription: $15,000/License per year with unlimited reporting SAMPLE OUTPUT: CATEGORIES & BRANDS AVAILABLE: Asian Flame Broiler Chicken Wing Zone Asian honeygrow Chicken Wings To Go Asian Pei Wei Chicken Wingstop Asian Teriyaki Madness Chicken Zaxby's Asian Waba Grill Donuts/Bakery Dunkin' Donuts Chicken Big Chic Donuts/Bakery Tim Horton's Chicken