Inner 25 India Pharma & Healthcare Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Inner 20 Ethical Fund Low

Tata Ethical Fund (An open ended equity scheme following Shariah principles) As on 30th June 2020 PORTFOLIO No. of Market Value % of No. of Market Value % of INVESTMENT STYLE Company name Company name An equity scheme which invests primarily in equities of Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets Shariah compliant companies and other instrument if Equity & Equity Related Total 49401.57 90.21 Oil allowed under Shariah principles. Auto Oil & Natural Gas Co. 925000 752.49 1.37 INVESTMENT OBJECTIVE Hero Motocorp Ltd. 31300 797.20 1.46 Pesticides To provide medium to long- term capital gains by investing Auto Ancillaries Rallis India Ltd. 502000 1366.95 2.50 in Shariah compliant equity and equity related instruments Wabco India Ltd. 15800 1087.06 1.99 Petroleum Products of well-researched value and growth - oriented companies. Sundram Fasteners Ltd. 267000 999.38 1.83 Bharat Petroleum Corporation Ltd. 435000 1626.90 2.97 Tata Ethical Fund aims to generate medium to long term Amara Raja Batteries Ltd. 116849 759.99 1.39 Castrol India Ltd. 505000 634.79 1.16 capital growth by investing in equity and equity related Cement Pharmaceuticals instruments of shariah compliant companies. Shree Cement Ltd. 3800 875.94 1.60 Alkem Laboratories Ltd. 83000 1965.69 3.59 DATE OF ALLOTMENT Commercial Services Ipca Laboratories Ltd. 93750 1569.75 2.87 May 24,1996 3M India Ltd. 4500 845.79 1.54 Lupin Ltd. 145000 1322.11 2.41 Consumer Durables Software FUND MANAGER Titan Company Ltd. 113000 1073.33 1.96 Tata Consultancy Services Ltd. -

SANJEEVAK 1586083 01/08/2007 MANOJ ANANT JOSHI Trading As ;AKSHAY PHARMA REMEDIES KAVRANA HOUSE, OPP

Trade Marks Journal No: 1836 , 12/02/2018 Class 5 SANJEEVAK 1586083 01/08/2007 MANOJ ANANT JOSHI trading as ;AKSHAY PHARMA REMEDIES KAVRANA HOUSE, OPP. COTTON GREEN RLY. STN. MUMBAI-400033. MANUFACTURE & MERCHANT INDIAN NATIONAL Used Since :31/01/2001 MUMBAI MEDICINAL PREPARATIONS. 537 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 SEPTIGARD 1741718 08/10/2008 INDERJIT SINGH trading as ;INDERJIT SINGH B-104 , SWASTHYA SINGH , NEW DELHI -92 MERCHANTS & MANUFACTUERERS Address for service in India/Agents address: MAHTTA & CO. 43 - B/3, MAHTTA HOUSE,UDHAM SINGH NAGAR, LUDHIANA - 141 001, (PUNJAB). Proposed to be Used DELHI MEDICINAL & PHARMACEUTICAL PREPARATIONS. 538 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 FAIR & BEAUTY 1803779 08/04/2009 GALPHA LABORATORIES LIMITED 221, Kanakia Zillion, E Wing Bandra Kurla Complex Annex LBS Marg & CST Road Junction Kurla West MUMBAI 400070 MANUFACTURERS AND MERCHANTS INDIAN NATIONAL Used Since :15/11/2007 MUMBAI PHARMACEUTICAL AND MEDICINAL PREPARATIONS AND SUBSTANCES 539 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 O-BAMA 1815900 08/05/2009 KREMOINT PHARMA PVT. LTD. 151/5, SHRI KRISHNA DARSHAN, GARODIA NAGAR, GHATKOPAR (E), BOMBAY-400 077. MANUFACTURERS AND MERCHANTS. A CORPORATE ENTITY INCORPORATED IN INDIA UNDER THE COMPANIES ACT 1956. Address for service in India/Attorney address: KRISLAW CONSULTANTS BUILDING NO.4, C/104, SHANKESHWAR PALMS, BEHIND MODEL SCHOOL, KUMBHARKHANPADA, SUBHASH ROAD, DOMBIVILI(W) 421202 Used Since :02/05/2009 MUMBAI PHARMACETICAL AND MEDICINAL PREPARATIONS. 540 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 AYUSHAKTI D-VYRO 1815928 08/05/2009 SMITA NARAM BUNGALOW NO.31, NEXT TO M. -

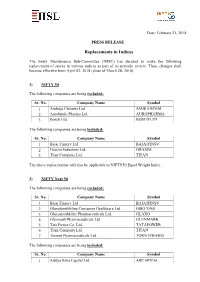

Replacements in Indices

Date: February 21, 2018 PRESS RELEASE Replacements in Indices The Index Maintenance Sub-Committee (IMSC) has decided to make the following replacement of stocks in various indices as part of its periodic review. These changes shall become effective from April 02, 2018 (close of March 28, 2018). 1) NIFTY 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Ambuja Cements Ltd. AMBUJACEM 2 Aurobindo Pharma Ltd. AUROPHARMA 3 Bosch Ltd. BOSCHLTD The following companies are being included: Sr. No. Company Name Symbol 1 Bajaj Finserv Ltd. BAJAJFINSV 2 Grasim Industries Ltd. GRASIM 3 Titan Company Ltd. TITAN The above replacements will also be applicable to NIFTY50 Equal Weight Index. 2) NIFTY Next 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Bajaj Finserv Ltd. BAJAJFINSV 2 GlaxoSmithkline Consumer Healthcare Ltd. GSKCONS 3 Glaxosmithkline Pharmaceuticals Ltd. GLAXO 4 Glenmark Pharmaceuticals Ltd. GLENMARK 5 Tata Power Co. Ltd. TATAPOWER 6 Titan Company Ltd. TITAN 7 Torrent Pharmaceuticals Ltd. TORNTPHARM The following companies are being included: Sr. No. Company Name Symbol 1 Aditya Birla Capital Ltd. ABCAPITAL Sr. No. Company Name Symbol 2 Ambuja Cements Ltd. AMBUJACEM 3 Aurobindo Pharma Ltd. AUROPHARMA 4 Bosch Ltd. BOSCHLTD 5 General Insurance Corporation of India GICRE 6 L&T Finance Holdings Ltd. L&TFH 7 SBI Life Insurance Company Ltd. SBILIFE 3) NIFTY 500 The following companies are being excluded: Sr. No. Company Name Symbol 1 Adani Enterprises Ltd. ADANIENT 2 Ahluwalia Contracts (India) Ltd. AHLUCONT 3 Apar Industries Ltd. APARINDS 4 AstraZenca Pharma India Ltd. ASTRAZEN 5 Corporation Bank CORPBANK 6 Dalmia Bharat Ltd. -

50 KW Offer Solar Copy 2

21st Century Enviro Engineers Pvt.Ltd. Plot No. 120(10 Marla), COMPANY Industrial Area Phase II Chandigarh - 160002, India PROFILE www.21stcenturyenviro.com INTRODUCTION 21st CENTURY ENVIRO ENGINEERS PVT. LTD. is a Company dealing in the field of Environmental Engineering related activities. We are Registered Environmental Consultants of Pollution Control Board to Supply ETP’s, STP’s, APCD’s, Incinerators, Water Treatment Plants, Reverse Osmosis, Evaporators, Solid Waste Management and Rain Water Harvesting and to carry out EIA Studies . The Directors of the company are young Technocrats having versatile experience in this field. We have a back up of highly qualified and experienced technical team having versatile experience in Designing, Erection, Commissioning and Operation of different types of Effluent Treatment Plants. Our Managing Director himself is a Chemical Engineer with almost 25 Years Experience in this line and Technical Director is PhD. in Environmental Science with almost 30 Years working experience on various types of effluent treatment Technologies. Our team comprises of almost 150 people from different backgrounds e.g. Chemical, Environmental, Mechanical, Instrumentation, Civil, Accounts, Purchase, Marketing etc. We have our Marketing/ Design Office in Chandigarh and regional offices in Dhaka, Mumbai, New Delhi, Sikkim etc. and have our own testing Laboratory for Effluent/Water Testing and to study treatability of effluent on pilot scale. We have our own full-fledged manufacturing unit of Pollution Control Equipments in Village Kunjhal Baddi (HP). We also undertake annual operation and maintenance contracts and liasining services for the systems supplied by us. We are also Registered with CREST (Chandigarh Renewable Energy & Technology Promotion Society) and SECI (Solar Energy Corporation of India) for supplying Online/Offline Solar systems in Chandigarh, Himachal Pradesh, Uttarakhand, J&K, Punjab, Haryana, Delhi, Bihar etc. -

Index Stock Update >> Marico Stock Update >> Gabriel India Stock Update >> PTC India Stock

Visit us at www.sharekhan.com November 04, 2015 Index Stock Update >> Marico Stock Update >> Gabriel India Stock Update >> PTC India Stock Update >> Ipca Laboratories Stock Update >> Skipper Viewpoint >> Lloyd Electric & Engineering For Private Circulation only REGISTRATION DETAILS Regd Add: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos. BSE - INB/INF011073351 ; BSE- CD ; NSE - INB/ INF231073330 ; CD-INE231073330 ; MSEI - INB/INF261073333 ; CD-INE261073330 ; DP - NSDL-IN-DP-NSDL-233-2003 ; CDSL-IN-DP-CDSL-271-2004 ; PMS- INP000000662 ; Mutual Fund-ARN 20669 ; Commodity trading through Sharekhan Commodities Pvt. Ltd.: MCX-10080 ; (MCX/TCM/CORP/0425) ; NCDEX- 00132 ; (NCDEX/TCM/CORP/0142) ; NCDEX SPOT-NCDEXSPOT/116/CO/11/20626 ; For any complaints email at [email protected] ; Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and Do’s & Don’ts by MCX & NCDEX and the T & C on www.sharekhan.com before investing. investor’s eye stock update Marico Reco: Buy Stock Update Enhanced focus to improve volume growth; maintain Buy CMP: Rs399 Company details Key points Price target: Rs460 Mixed operating performance: During Q2FY2016, Marico’s revenue grew by 4% to Rs1,485.4 crore, entirely driven by a 4% volume growth (domestic business’ volume Market cap: Rs25,735 cr growth stood at 5.5%). The gross profit margin (GPM) improved by almost 500BPS to 52 week high/low: Rs466/299 49.3% on the back of ~30% decline in the copra prices and 33% decline in the prices of liquid paraffin. -

Ajanta Pharma Limited

AJANTA PHARMA LIMITED CIN : L24230MH1979PLC022059 Registered & Corporate Office: ‘Ajanta House’, 98 Govt Industrial Area, Charkop, Kandivli (West), Mumbai - 400 067, Maharashtra, India Tel.: +91 22 6606 1000, Fax: +91 22 6606 1200 | E-mail: [email protected] | Website: www.ajantapharma.com POST BUYBACK PUBLIC ANNOUNCEMENT FOR THE ATTENTION OF EQUITY SHAREHOLDERS/ BENEFICIAL OWNERS OF EQUITY SHARES OF AJANTA PHARMA LIMITED This public announcement (the “Post Buyback Public Announcement”) is being made pursuant to the provisions of Regulation 24(vi) of the Securities and Exchange Board of India (Buy-Back of Securities) Regulations, 2018, for the time being in force including any statutory modifications and amendments from time to time (the “Buyback Regulations”). This Post Buyback Public Announcement should be read in conjunction with the Public Announcement dated November 4, 2020 which was published on November 5, 2020 (the “Public Announcement”) and the letter of offer dated November 25, 2020 (the “Letter of Offer”) issued in connection with the Buyback. The terms used but not defined in this Post Buyback Public Announcement shall have the same meanings as assigned in the Public Announcement and the Letter of Offer. 1. THE BUYBACK 1.1 Ajanta Pharma Limited (the “Company”) had announced the Buyback of not exceeding 7,35,000 (Seven Lakh Thirty Five Thousand) fully paid-up equity shares of face value of ₹2 each (“Equity Shares”) from all the existing shareholders / beneficial owners of Equity Shares as on the record date (i.e. Friday, November 13, 2020), on a proportionate basis, through the “Tender Offer” process at a price of ₹1,850/- (Rupees One Thousand Eight Hundred and Fifty Only) per Equity Share payable in cash for an aggregate consideration not exceeding ₹ 135,97,50,000 (Rupees One Hundred Thirty Five Crores Ninety Seven Lakhs and Fifty Thousand only) excluding the Transaction Costs (“Buyback Offer Size”). -

Inner 25 India Pharma & Healthcare Fund

Modera erate tely Mod High to e H w at ig o er h L d o M V e r y w H Tata India Pharma & Healthcare Fund o i L g (An open ended equity scheme investing in Pharma and Healthcare Services Sector) h Riskometer Investors understand that their principal As on 30th June 2021 PORTFOLIO will be at Very High Risk INVESTMENT STYLE Company name No. of Market Value % of Company name No. of Market Value % of Primarily focuses on investment in at least 80% of its net Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets assets in equity/equity related instruments of the companies in the Pharma & Healthcare sectors in India. Equity & Equity Related Total 55184.24 97.88 Glenmark Pharmaceuticals Ltd. 167000 1089.76 1.93 INVESTMENT OBJECTIVE Healthcare Services Sanofi India Ltd. 13000 997.39 1.77 The investment objective of the scheme is to seek long Apollo Hospitals Enterprise Ltd. 70500 2551.99 4.53 Gland Pharma Ltd. 19662 673.29 1.19 term capital appreciation by investing atleast 80% of its Fortis Healthcare Ltd. 795000 1935.03 3.43 Laurus Labs Ltd. 90000 619.79 1.10 net assets in equity/equity related instruments of the companies in the pharma & healthcare sectors in Syngene International Ltd. 265000 1545.75 2.74 India.However, there is no assurance or guarantee that the investment objective of the Scheme will be Narayana Hrudayalaya Ltd. 301420 1483.74 2.63 Other Equities^ 1186.14 2.10 achieved.The Scheme does not assure or guarantee any Metropolis Healthcare Ltd. -

MF 35 Fund One Pager

BR“BuyS RightT : BSit TightR” ST BRSnowT Bin fourRS differentTBRS colorsTBRS BRSTBRSTBRSTBR Motilal Oswal MOSt Focused Invests in enduring B25 RFund STBRSTBwRealth creaStors T Motilal Oswal MOSt Focused Invests in emerging BMidcapR 30 Fund TBRwealth creators T BRSTBSRSTBRSTBSRS Motilal Oswal MOSt Focused Invests in emerging and BMulticapRS 35 FundT BRSTBRenduringST wealthB creatorRs Lock in fund that invests Motilal Oswal MOSt Focused in wealth creators BLongR Term SFund TBRSTBplusR Saves TSax T BR TBR T BRSTBSRSTBRSTBSRS Focused Low Churn QGLP No load BRSTBPortfolioRSTBPortfolioRSTStocksBR BRSInvesTt nowB to addR colorSs Tto yourB porRolioST BRSCall:T 1800-200-6626B | SMS:R FOCUSS to 575753T BRSTBRS Website: www.motilaloswalmf.com Our Investment Philosophy The recommended way to create Wealth from equity- 'Buy Right : Sit Tight' At Molal Oswal Asset Management Company (MOAMC), our investment philosophy and invesng style is centered on 'Buy Right: Sit Tight‘ principal. ‘Buy Right' means buying quality companies at a reasonable price and 'Sit Tight' means staying invested in them for a longer me to realise the full growth potenal of the stocks. Buy Right Stock Characteristics Sit Tight Approach QGLP ‘Q’uality denotes quality of the business and Buy and Hold: We are strictly buy and hold management investors and believe that picking the right ‘G’rowth denotes growth in earnings and business needs skill and holding onto these sustained RoE businesses to enable our investors to benefit from the entire growth cycle needs even more ‘L’ongevity denotes longevity of the skill. competitive advantage or economic moat of the business Focus: Our portfolios are high conviction portfolios with 20 to 25 stocks being our ideal ‘P’rice denotes our approach of buying a good n u m b e r. -

Ipca Laboratories (IPCLAB)

Ipca Laboratories (IPCLAB) CMP: | 2040 Target: | 2290 (12%) Target Period: 12 months HOLD May 31, 2021 Upbeat guidance, execution remains key Q4 revenues remained subdued growing just 3.8% YoY to | 1115 crore. Strong YoY growth of 19.7% in export formulations to | 338 crore was partly Particulars offset by API sales decline of 5.5% YoY to | 260 crore. Domestic Particular Amount formulations remained flat at | 434 crore vs. | 431 crore in Q4FY20. EBITDA Market Capitalisation | 25873 crore margins improved 484 bps YoY to 20.5% due to better gross margins and Debt (FY21) | 267 crore lower other expenditure. EBITDA grew 35.8% YoY to | 229 crore. PAT grew Cash (FY21) | 365 crore 87.5% YoY to | 161 crore (I-direct estimate: | 204 crore). Delta vis-à-vis EV | 25775 crore EBITDA was due to higher other income, lower depreciation and tax rate. 52 week H/L (|) 2456/1467 Equity capital | 25.4 crore Update Result Export formulations main catalyst for growth Face value | 2 Price performance Growth in export formulations (29% of FY21 revenues) was on the back of growth in both international generics and international branded 2500 14000 formulations. The international anti-malarial institutional business has also 12000 2000 contributed substantially to overall exports growth. US traction will take 10000 longer than earlier estimated due to USFDA import alerts for the Ratlam 1500 8000 facility that is the only API source for Silvassa and Pithampur formulations 1000 6000 plants along with Silvassa and Pithampur (Indore) plants that are specifically 4000 500 earmarked for the US business, besides third party sales. -

CARE Ratings Ltd

CARE/HO/RL/2020-21/2749 Mr. Arvind Agrawal Chief Financial Officer Ajanta Pharma Limited Ajanta House, Charkop, Kandivali (W), Mumbai-400067 October 1, 2020 Confidential Dear Sir, Credit rating for bank facilities On the basis of recent developments including operational and financial performance of your company for FY20 (audited) and Q1FY21 (provisional), our Rating Committee has reviewed the following ratings: Facilities Amount Rating1 Rating (Rs. crore) Action Long-term/Short-term Bank 55.00 CARE AA; Stable/CARE A1+ Facilities (reduced from 87.50) (Double A; Outlook: Stable/A Reaffirmed One Plus) Total 55.00 (Rs. Fifty Five crore only) 2. Refer Annexure 1 for details of rated facilities. 3. The rationale for the rating will be communicated to you separately. A write-up (press release) on the above rating is proposed to be issued to the press shortly, a draft of which is enclosed for your perusal as Annexure-2. We request you to peruse the annexed document and offer your comments if any. We are doing this as a matter of courtesy to our clients and with a view to ensure that no factual inaccuracies have inadvertently crept in. Kindly revert as early as possible. In any case, if we do not hear from you by October 5, 2020 we will proceed on the basis that you have no any comments to offer. 4. CARE reserves the right to undertake a surveillance/review of the rating from time to time, based on circumstances warranting such review, subject to at least one such review/surveillance every year. 5. -

Availability and Regulatory Status of Major Antiretroviral Drugs (September 2009)

Availability and regulatory status of major antiretroviral drugs (September 2009) Medium price per patient per year (in U$) Suppliers International Preferred 2008 Dosage Nonproprietary Strengths form Lower Upper Name (INN) (adults) Low income Middle Middle Originator Generics income income Aurobindo Pharma Ltd.; Cipla Ltd.; Eastern Surgical Company; Emcure; Hetero Drugs 317 a 370 Ltd.; Laboratorio Elea S.A.C.I.F.y A; Abacavir tablets 300 mg 350 a GlaxoSmithKline (286-370) (353-401) Laborotorios Filaxis Argentina; Laborotorios (313-374) Richmond S.A.C.I.F; Matrix Laboratories Ltd.; Ranbaxy Ltd; Strides Arcolab Ltd. 238 a Matrix, Ranbaxy, Hetero; Cipla; Aurobindo; Tenofovir tablets 300 mg 166 a 207 a Gilead Sciences (238-420) Emcure; Aspen; Strides Arcolab Ltd. (151-207) (177-256) Apotex Mexico (Protein, S.A. de C.V.); Aspen Pharmacare Ltd.; Aurobindo Pharma Ltd.; Cipla Ltd.; Cristalia, productos quimicos 212 a 462 Bristol-Myers farmaceuticos Ltda.; Emcure; Hetero Drugs 100 mg 251 a (187-235) (242-1100) Squibb Ltd.; Laboratorio Dosa S.A; Laborotorios (187-310) Filaxis Argentina; Laborotorios Richmond buffered S.A.C.I.F; Ranbaxy Ltd.; Zhejiang Huahai tablets Pharmaceutical Co., Ltd. 208 b Bristol-Myers Aspen Pharmacare Ltd.; Aurobindo Pharma 150 mg Didanosine (172-244) Squibb Ltd.; Cipla Ltd. Aurobindo Pharma Ltd; Barr Laboratories, Inc; 242 a 238 a 220 Bristol-Myers 200 mg Cipla Ltd.; Laborotorios Richmond S.A.C.I.F; (197-310) (233-794) (217-235) Squibb Macleods Pharmaceuticals Ltd.; Ranbaxy Ltd.; 242 a 238 a 220 Bristol-Myers 200 mg Aurobindo Pharma Ltd; Barr Laboratories, Inc; (197-310) (233-794) (217-235) Squibb EC 223 799 997 Bristol-Myers Aurobindo Pharma Ltd.; Barr Laboratories, 250 mg capsules (214-223) (675-874) (613-997) Squibb Inc; Cipla Ltd.; Ranbaxy Ltd.; 288 1267 a 1269 Bristol-Myers Aurobindo Pharma Ltd.; Barr Laboratories; 400 mg (279-288) (507-1302) (1129-1386) Squibb Hetero Drugs Ltd.; Cipla Ltd.; Ranbaxy Ltd. -

Pharma Sector Report -Sept’20

Mutual Fund: Pharma Sector Report -Sept’20 Private & confidential. Only for limited circulation. Contact us: [email protected] Executive Summary: Since the outbreak of the Coronavirus crisis, the pharma sector stepped into the spotlight. Long overdue investments have been flowing towards the sector and even pharma funds in the mutual fund industry have begun to outperform. Nevertheless, there is still a clear need for government spending in this sector. Compared to the US, which has the highest per capita spending on healthcare at $5000, India spends merely ~ $50 per capita. The current situation presents the Indian government with a perfect opportunity to increase its expenditure in this sector, to facilitate its growth and fast-track its progress. Few points about the Pharma Funds: The market capitalization of the entire pharma & healthcare industry is ~ Rs. 10 lac crs, whereas the total size of pharma funds in the mutual fund is ~Rs. 10k crs, translating to ~ 1% of the entire sector in value terms. (This excludes the pharma holdings in other categories). There are 43 pharma & healthcare companies that form part of the Top 500 companies. Out of these, pharma funds have an exposure to 36 companies. There are 11 companies in the Top 100; 11 in the Midcap space (101-250) and 14 Smallcaps (251-500). The 7 companies that do not form part of the pharma funds’ portfolios are Caplin Point Lab, Glenmark Pharma, Granules India, Piramal Enterprises, Poly Medicure, Suven Pharma and Wockhardt Ltd. Cipla Ltd., Divis Laboratories Ltd. and Dr. Reddy’s Laboratories Ltd. are the only stocks that form part of every pharma fund.