Glossary of Electronic Payments Industry Terms ACH: Automated

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Neobank Varo on Serving Customers' Needs As P2P Payments See A

AUGUST 2021 Neobank Varo on serving customers’ needs as P2P payments see Nigerian consumers traded $38 million worth of bitcoin on P2P platforms within the past month a rapid rise in usage — Page 12 (News and Trends) — Page 8 (Feature Story) How P2P payments are growing more popular for a range of use cases, and why interoperability will be needed to keep growth robust — Page 16 (Deep Dive) © 2021 PYMNTS.com All Rights Reserved 1 DisbursementsTracker® Table Of Contents WHATʼS INSIDE A look at recent disbursements developments, including why P2P payments are becoming more valuable 03 to consumers and businesses alike and how these solutions are poised to grow even more popular in the years ahead FEATURE STORY An interview with with Wesley Wright, chief commercial and product officer at neobank Varo, on the rapid 08 rise of P2P payments adoption among consumers of all ages and how leveraging internal P2P platforms and partnerships with third-party providers can help FIs cater to customer demand NEWS AND TRENDS The latest headlines from the disbursements space, including recent survey results showing that almost 12 80 percent of U.S. consumers used P2P payments last year and how the U.K. government can take a page from the U.S. in using instant payments to help SMBs stay afloat DEEP DIVE An in-depth look at how P2P payments are meeting the needs of a growing number of consumers, how 16 this shift has prompted consumers to expand how they leverage them and why network interoperability is key to helping the space grow in the future PROVIDER DIRECTORY 21 A look at top disbursement companies ABOUT 116 Information on PYMNTS.com and Ingo Money ACKNOWLEDGMENT The Disbursements Tracker® was produced in collaboration with Ingo Money, and PYMNTS is grateful for the companyʼs support and insight. -

Visa's Annual Report

Annual Report 2017 Annual Report 2017 Mission Statement To connect the world through the most innovative, reliable and secure digital payment network that enables individuals, businesses and economies to thrive. Financial Highlights (GAAP) In millions (except for per share data) FY 2015 FY 2016 FY 2017 Operating revenues $13,880 $15,082 $18,358 Operating expenses $4,816 $7,199 $6,214 Operating income $9,064 $7, 883 $12,144 Net income $6,328 $5,991 $6,699 Stockholders' equity $29,842 $32,912 $32,760 Diluted class A common stock earnings per share $2.58 $2.48 $2.80 Financial Highlights (ADJUSTED)1 In millions (except for per share data) FY 2015 FY 2016 FY 2017 Operating revenues $13,880 $15,082 $18,358 Operating expenses $4,816 $5,060 $6,022 Operating income $9,064 $10,022 $12,336 Net income $6,438 $6,862 $8,335 Diluted class A common stock earnings per share $2.62 $2.84 $3.48 Operational Highlights² 12 months ended September 30 (except where noted) 2015 2016 2017 Total volume, including payments and cash volume³ $7.4 trillion $8.2 trillion $10.2 trillion Payments volume³ $4.9 trillion $5.8 trillion $7.3 trillion Transactions processed on Visa's networks 71.0 billion 83.2 billion 111.2 billion Cards⁴ 2.4 billion 2.5 billion 3.2 billion Stock Performance The accompanying graph and chart compares the cumulative total return on $350 Visa’s common stock with the cumulative total return on Standard & Poor’s 500 Index and the Standard & Poor’s 500 Data Processing Index from September 30, $300 2012 through September 30, 2016. -

First Washington Associates Washington, D.C. December,,: 198

5 1- BANK JAMAICA/U.S. FULL SERVICE MERCHANT DEVELOPMENT CONCEPT-PAPER' Prepared by First Washington Associates Washington, D.C. December,,: 198 .2.1 TABLE!OF CONTENTS Page 1. Concept. * 1* II. Economic Climate and Private Investment . .4 III. Existing Financial Infrastructure ..... 7 IV. Activities of the New Bank . ... 13 V. Formation, Ownership, and Capitalization ,19 VI. Direction and Management,. .. " .22 VII. Implementation . ' .• ****25 0-H- I. CONCEPT 1. This discussion paper has been prepared at the,, request of the Bureau for Private Enterprise (PRE) and the Jamaican Mission of the U.S. Agency for International Development (AID) and is intended to describe the role which a new Jamaica/U.S. Full-Service Merchant Development Bank can play in helping achieve economic development and growth through expansion and stimulation of the private sector in Jamaica. 2. Under the Government of Prime Minister Seaga, Jamaica has embarked upon a serious, across-the-board program of measures to encourage expansion of private sector productivity and output and lead to substantial new investments in agri culture, manufacturing, and related service industries. The private sector is looked upon as the major driving force for economic rehabilitation, and investments from the United States and local entrepreneurs are being counted upon to bring new vitality and diversification to the Jamaican economy, reverse the outward flow of private capital, transfer new technologies, and help solve the country's balance of payments and unemployment problems. 3. Seriously limiting the achievement of these goals is the lack of an adequate institutional infrastructure to provide equity funding and aggressive medium- and long-term credit facilities to stimulate capital investment. -

How the Federal Reserve's Automated Clearing House Informs

Insight How The Federal Reserve’s Automated Clearing House Informs The Fed’s Proposed Real- Time Payments Entry THOMAS WADE | JULY 11, 2019 Executive Summary Since the 1970s the Federal Reserve has acted both as regulator and market participant in the provision of automated clearing house services. Twenty years of decreasing prices that are not matched by identified cost-savings suggest that the Federal Reserve is using its platform for non-market policy purposes that serve to undercut private providers and benefit the largest banks. These lessons and potential conflict of interest concerns must be considered as the Federal Reserve considers also entering the real-time payments space. Background The Federal Reserve (the Fed) is considering providing real-time payment services, but this move would not be the first time that the Fed has entered a market as both a regulator and participant. In the early 1970s, the Fed began providing an automated clearing house (ACH) service. An ACH is an electronic network for financial transactions that acts as a computer-based clearing house and settlement service, processing electronic payments made by financial institutions. It is this network that underpins electronic banking as we understand it today. Administered since 1985 by NACHA (previously the North American Automated Clearing House Association), each year it moves more than $41 trillion and 24 billion electronic financial transactions. Initially created in the late 1960s by Californian banks with the Calwestern Automated Clearing House Association, from the beginning of ACH history there has been close interaction between private industry and the Fed. ACH advances were inextricably linked with the development of computers, and in the 1960s private computing was not well developed; as a result industry relied on the Fed’s computer processing capacity. -

BR-69915-210X297mm-Update the UBS Securities China Brochure

UBS Securities First foreign-invested fully-licensed securities firm in China, 51% owned by UBS AG He Di Eugene Qian UBS Securities Co., Limited (UBS Securities) was incorporated on 11 December 2006 following the restructuring of Beijing Securities Co., Limited. In December 2018, UBS AG increased its shareholding in UBS Securities to 51%; the first time that a foreign financial institution had raised its stake to take majority control of a securities joint venture in China. With the support of the UBS Group and the dedication of our employees, UBS Securities remains at the forefront of the industry as the first foreign-invested fully-licensed securities firm in China. Client-centric and committed to the pursuit of excellence and sustainable performance, UBS Securities relies on international experience complemented by local expertise to maintain its market- leading position. Our success would not have been possible without our employees. We would also like to thank our clients, shareholders, business partners, as well as government and regulatory bodies for their support which has been a driving force for the business. Our market position today is a strong foundation for the decades to come. We are determined to build on our core strengths to capture the opportunities arising from ongoing wealth creation, market reforms and globalization in China. We will continue to offer world-class products, services and advice to our clients, and work with all stakeholders towards the further development of China’s financial markets. Very best wishes. He Di Eugene Qian Chairman President UBS Securities UBS Securities 2 Milestones Moving forward December 2018 UBS AG increased its shareholding in UBS Securities to 51%, first international bank to increase stake to take majority control in a China securities joint venture. -

Electronic Bill Payment and Presentment: a Primer

P Electronic Bill Payment and Presentment: A Primer Ann H. Spiotto Federal Reserve Bank of Chicago Emerging Payments Occasional Paper Series December 2001 (EPS-2001-5) FEDERAL RESERVE BANK OF CHICAGO Electronic Bill Payment and Presentment: A Primer Ann H. Spiotto Ann H. Spiotto is senior research counsel with the Emerging Payments Studies Department of the Federal Reserve Bank of Chicago. She previously spent twenty-five years as an attorney for First Chicago Corporation working with its retail banking and credit card operations – during her last ten years at First Chicago she was responsible for the legal work performed for the credit card business. Special thanks to Brian Mantel for his support in reviewing and critiquing this article. The views expressed in this article are those of the author alone and do not necessarily reflect the views of the Federal Reserve Bank of Chicago or the Board of Governors of the Federal Reserve System. The Occasional Paper Series is part of the Federal Reserve Bank of Chicago’s Public Policy Studies series. Address any correspondence about this paper to Ann H. Spiotto, Federal Reserve Bank of Chicago, 230 S. LaSalle Street, Chicago, Illinois 60604 or e-mail Ann at [email protected]. Requests for additional copies should be directed to the Public Information Center, Federal Reserve Bank of Chicago, P.O. Box 834, Chicago, Illinois 60690-0834 or telephone (312) 322- 5111. This paper is available at http://www.chicagofed.org/publications/publicpolicystudies. This paper first appeared in substantially similar form in the November 2001 edition of The Business Lawyer. -

ESTABLISHMENT of a DEPOSIT INSURANCE SYSTEM for the EASTERN CARIBBEAN CURRENCY UNION June 2020 Contents Toc43295216

Eastern Caribbean Central Bank ESTABLISHMENT OF A DEPOSIT INSURANCE SYSTEM FOR THE EASTERN CARIBBEAN CURRENCY UNION June 2020 Contents _Toc43295216 1.0 INTRODUCTION ................................................................................................................... 1 2.0 KEY MESSAGES ...................................................................................................................... 1 A. Policy Goals/Objective ........................................................................................................ 2 B. Summary of Proposed Core Design Features ................................................................ 2 3.0 BACKGROUND ...................................................................................................................... 4 4.0 CRITICAL ELEMENTS OF THE DEPOSIT INSURANCE FUND .................................. 6 4.1 Public Policy Objectives ..................................................................................................... 6 4.2 Mandate and Powers........................................................................................................... 7 4.3 Governance Structure ...................................................................................................... 11 4.4 Relationship with other Financial Safety Net Entities................................................. 13 4.5 Membership........................................................................................................................ 14 4.6 Qualifying Deposits and -

Foreign Bank Time Deposit Accounts Under the Securities Act of 1933: Wolf V

UCLA UCLA Pacific Basin Law Journal Title Foreign Bank Time Deposit Accounts under the Securities Act of 1933: Wolf v. Banco Nacional de Mexico, S.A. Permalink https://escholarship.org/uc/item/6gt821jb Journal UCLA Pacific Basin Law Journal, 1(2) Author Nitzkowski, Greg M. Publication Date 1982 DOI 10.5070/P812021891 Peer reviewed eScholarship.org Powered by the California Digital Library University of California CURRENT DEVELOPMENTS FOREIGN BANK TIME DEPOSIT ACCOUNTS UNDER THE SECURITIES ACT OF 1933: WOLF v. BANCO NA'CIONAL DE MEXICO, S.A. Greg M. Nitzkowski* In Wolf v. Banco Nacional de Mexico, S.A. I ("Wof"), the United States District Court for the Northern District of Califor- nia held that a time deposit account in a foreign bank is a "secur- ity" within the meaning of the term under section 2(1) of the Securities Act of 19332 because the plaintiff, a United States citi- zen and resident, was subject to a risk of devaluation in opening such an account. 3 In turn, the court held that defendant, Banco Nacional de Mexico ("Banamex"), which sold securities not regis- tered with the Securities and Exchange Commission 4 was strictly * Student, UCLA School of Law; A.B. 1979, Harvard University. 1. 549 F. Supp. 841 (N.D. Cal. 1982). 2. 15 U.S.C.A. § 77b(l) (West Supp. 1976), as amended by P.L. No. 97-303 (1982). The Act provides that unless the context otherwise requires-- (a) The term 'security' means any note, stock, treasury stock, bond, debenture, evidence of indebtedness, certificate of interest or par- ticipation in any profit-sharing -

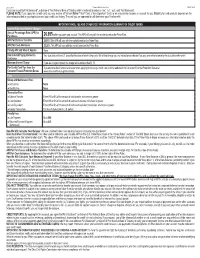

How We Will Calculate Your Balance:We Use a Method Called “Average Daily Balance (Including New Purchases)”. Index and When

232 - 121144 Platinum Edition® Visa® Card T-GULF-2005 Cards are issued by First Bankcard®, a division of First National Bank of Omaha, which is referred to below as “we”, “us”, “our”, and “First Bankcard”. PLEASE NOTE: If you apply for a credit card, you may receive a Platinum Edition® Visa® Card, a Visa Signature® Card, or we may decline to open an account for you. Eligibility for card products depends on the information provided in your application and your credit card history. The card you are approved for will determine your Visa benefits. IMPORTANT RATE, FEE AND OTHER COST INFORMATION (SUMMARY OF CREDIT TERMS) Interest Rates and Interest Charges Annual Percentage Rate (APR) for Purchases 26.99% when you open your account. This APR will vary with the market based on the Prime Rate. APR for Balance Transfers 26.99% This APR will vary with the market based on the Prime Rate. APR for Cash Advances 25.24%. This APR will vary with the market based on the Prime Rate. Penalty APR and When it Applies None How to Avoid Paying Interest on Your due date is at least 21 days after the close of each billing cycle. We will not charge you any interest on purchases if you pay your entire balance by the due date each month.1 Purchases Minimum Interest Charge If you are charged interest, the charge will be no less than $1.75. For Credit Card Tips from the To learn more about factors to consider when applying for or using a credit card, visit the website of the Consumer Financial Protection Bureau at Consumer Financial Protection Bureau www.consumerfinance.gov/learnmore. -

Federal Reserve Bank of Chicago

Estimating the Volume of Counterfeit U.S. Currency in Circulation Worldwide: Data and Extrapolation Ruth Judson and Richard Porter Abstract The incidence of currency counterfeiting and the possible total stock of counterfeits in circulation are popular topics of speculation and discussion in the press and are of substantial practical interest to the U.S. Treasury and the U.S. Secret Service. This paper assembles data from Federal Reserve and U.S. Secret Service sources and presents a range of estimates for the number of counterfeits in circulation. In addition, the paper presents figures on counterfeit passing activity by denomination, location, and method of production. The paper has two main conclusions: first, the stock of counterfeits in the world as a whole is likely on the order of 1 or fewer per 10,000 genuine notes in both piece and value terms; second, losses to the U.S. public from the most commonly used note, the $20, are relatively small, and are miniscule when counterfeit notes of reasonable quality are considered. Introduction In a series of earlier papers and reports, we estimated that the majority of U.S. currency is in circulation outside the United States and that that share abroad has been generally increasing over the past few decades.1 Numerous news reports in the mid-1990s suggested that vast quantities of 1 Judson and Porter (2001), Porter (1993), Porter and Judson (1996), U.S. Treasury (2000, 2003, 2006), Porter and Weinbach (1999), Judson and Porter (2004). Portions of the material here, which were written by the authors, appear in U.S. -

Eastern Caribbean Automated Clearing House System) Rules 2014

MONTSERRAT STATUTORY RULES AND ORDERS S.R.O. 63 OF 2014 PAYMENT SYSTEM (EASTERN CARIBBEAN AUTOMATED CLEARING HOUSE SYSTEM) RULES 2014 ARRANGEMENT OF RULES PART 1—PRELIMINARY.................................................................... 6 1. Citation ...................................................................................................... 6 2. Commencement ......................................................................................... 6 3. Definitions ................................................................................................. 6 4. Purpose ...................................................................................................... 9 5. International standards ............................................................................ 10 6. Compliance with Anti-Money Laundering and Combating the Financing of Terrorism Legislation .................................................................................... 10 7. Application .............................................................................................. 10 8. Rule binds system participants and third party agents ............................. 10 PART 2—PARTICIPATION, ACCESS AND RESPONSIBILITIES11 9. General .................................................................................................... 11 10. Direct or Indirect Settlement ................................................................... 11 11. Admission of system participants ........................................................... -

ACH (Automated Clearing House) Direct Payment Authorization

P.O. Box 3181, Baytown, Texas 77522 • 1.800.238.3228 • www.crcu.org ACH (Automated Clearing House) Direct Payment Authorization Description: Form used to set up, change or expire recurring transfer of funds to or from another financial institution Instructions: Please fill out form completely and sign A Wire Transfer/ACH Origination Request Agreement must be signed if not previously signed and on file with credit union For consumer accounts only Form must be received 5 business days before requested action is to be completed Completed form may be mailed or brought in to any CRCU branch location For questions, please call our Member Contact Center at 281.422.3611 or visit any CRCU branch location. P.O. Box 3181, Baytown, Texas 77522 • 1.800.238.3228 • www.crcu.org ACH (Automated Clearing House) Direct Payment Authorization New Change Delete Member Information Name: Account #: Account Suffix: *Loan #: CRCU Account Information Amount: Type: Deposit/Payment Withdrawal Effective Date: Expiration Date: Frequency Immediate Weekly Bi-Weekly Monthly Semi-Monthly External Financial Institution Information: Financial Institution: Routing #: Account #: Account Owner: Account Type: Savings Checking A Wire Transfer/ACH Origination Request Agreement must be signed before this authorization may be initiated. If an ACH Origination is applied directly to a loan, the transfer will expire when the loan is paid in full. If an ACH Origination is applied to a Savings account or a Checking account, the transfer will continue until it has been expired or cancelled, in writing, by the member. Community Resource Credit Union reserves the right to expire this ACH Origination at any time, without member consent.