How the Federal Reserve's Automated Clearing House Informs

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Neobank Varo on Serving Customers' Needs As P2P Payments See A

AUGUST 2021 Neobank Varo on serving customers’ needs as P2P payments see Nigerian consumers traded $38 million worth of bitcoin on P2P platforms within the past month a rapid rise in usage — Page 12 (News and Trends) — Page 8 (Feature Story) How P2P payments are growing more popular for a range of use cases, and why interoperability will be needed to keep growth robust — Page 16 (Deep Dive) © 2021 PYMNTS.com All Rights Reserved 1 DisbursementsTracker® Table Of Contents WHATʼS INSIDE A look at recent disbursements developments, including why P2P payments are becoming more valuable 03 to consumers and businesses alike and how these solutions are poised to grow even more popular in the years ahead FEATURE STORY An interview with with Wesley Wright, chief commercial and product officer at neobank Varo, on the rapid 08 rise of P2P payments adoption among consumers of all ages and how leveraging internal P2P platforms and partnerships with third-party providers can help FIs cater to customer demand NEWS AND TRENDS The latest headlines from the disbursements space, including recent survey results showing that almost 12 80 percent of U.S. consumers used P2P payments last year and how the U.K. government can take a page from the U.S. in using instant payments to help SMBs stay afloat DEEP DIVE An in-depth look at how P2P payments are meeting the needs of a growing number of consumers, how 16 this shift has prompted consumers to expand how they leverage them and why network interoperability is key to helping the space grow in the future PROVIDER DIRECTORY 21 A look at top disbursement companies ABOUT 116 Information on PYMNTS.com and Ingo Money ACKNOWLEDGMENT The Disbursements Tracker® was produced in collaboration with Ingo Money, and PYMNTS is grateful for the companyʼs support and insight. -

Eastern Caribbean Automated Clearing House System) Rules 2014

MONTSERRAT STATUTORY RULES AND ORDERS S.R.O. 63 OF 2014 PAYMENT SYSTEM (EASTERN CARIBBEAN AUTOMATED CLEARING HOUSE SYSTEM) RULES 2014 ARRANGEMENT OF RULES PART 1—PRELIMINARY.................................................................... 6 1. Citation ...................................................................................................... 6 2. Commencement ......................................................................................... 6 3. Definitions ................................................................................................. 6 4. Purpose ...................................................................................................... 9 5. International standards ............................................................................ 10 6. Compliance with Anti-Money Laundering and Combating the Financing of Terrorism Legislation .................................................................................... 10 7. Application .............................................................................................. 10 8. Rule binds system participants and third party agents ............................. 10 PART 2—PARTICIPATION, ACCESS AND RESPONSIBILITIES11 9. General .................................................................................................... 11 10. Direct or Indirect Settlement ................................................................... 11 11. Admission of system participants ........................................................... -

ACH (Automated Clearing House) Direct Payment Authorization

P.O. Box 3181, Baytown, Texas 77522 • 1.800.238.3228 • www.crcu.org ACH (Automated Clearing House) Direct Payment Authorization Description: Form used to set up, change or expire recurring transfer of funds to or from another financial institution Instructions: Please fill out form completely and sign A Wire Transfer/ACH Origination Request Agreement must be signed if not previously signed and on file with credit union For consumer accounts only Form must be received 5 business days before requested action is to be completed Completed form may be mailed or brought in to any CRCU branch location For questions, please call our Member Contact Center at 281.422.3611 or visit any CRCU branch location. P.O. Box 3181, Baytown, Texas 77522 • 1.800.238.3228 • www.crcu.org ACH (Automated Clearing House) Direct Payment Authorization New Change Delete Member Information Name: Account #: Account Suffix: *Loan #: CRCU Account Information Amount: Type: Deposit/Payment Withdrawal Effective Date: Expiration Date: Frequency Immediate Weekly Bi-Weekly Monthly Semi-Monthly External Financial Institution Information: Financial Institution: Routing #: Account #: Account Owner: Account Type: Savings Checking A Wire Transfer/ACH Origination Request Agreement must be signed before this authorization may be initiated. If an ACH Origination is applied directly to a loan, the transfer will expire when the loan is paid in full. If an ACH Origination is applied to a Savings account or a Checking account, the transfer will continue until it has been expired or cancelled, in writing, by the member. Community Resource Credit Union reserves the right to expire this ACH Origination at any time, without member consent. -

Automated Clearing House Payment Options

Automated Clearing House Payment Options The Department of Motor Vehicles (DMV) can accept payment ACH Credit (Business Customers Only) of fees and taxes from customers using electronic funds transfers through the Automated Clearing House (ACH). The ACH An ACH credit is initiated by a business customer who arranges provides two payment methods: to have funds transferred from the customer’s bank to DMV’s bank through an electronic funds transfer using the ACH system. ACH credits are currently not available for DMV’s individual ACH debit – initiated by DMV after being authorized customers. by the customer. Once authorized and established, business customer ACH debits are recurring without If a business customer wishes to make a payment to DMV using further authorization necessary, and ACH credit, and if DMV has agreed, the business customer ACH credit – initiated by business customers only. must arrange this option with his bank. In cases of ACH credit, DMV will not render the service or release any documents until receiving confirmation that the ACH credit arrived in DMV’s ACH Debit bank. Business Customers For the account number and routing transit number of DMV’s Business customers may make arrangements for DMV to collect ACH credit receiving bank, contact DMV’s Cashier’s Office at payments for services and products directly from their banks (804) 367-6838. Your company’s federal employer identification through the ACH. An ACH debit is viewed the same as cash and number (FEIN) or DMV account number is required for the DMV service is rendered as soon the ACH debit is initiated identification purposes. -

Get Paid Quickly and Efficiently with Automated Clearing House

©Szabo Associates, Inc. 2014. All PRESORTED rights reserved. Materials may not STANDARD be reproduced or transmitted U.S. Postage PAID without written permission. Atlanta, GA Permit No. 747 Collective Wisdom® is a publication of Media Collection Professionals, S Z A B O A S S O C I A T E S , I N C . V O L U M E 2 9 , I S S U E 1 , M A R C H 3 1 , 2 0 1 4 3355 Lenox Rd. NE, Suite 945, Atlanta, Georgia 30326 Tel: 404/266-2464, Fax: 404/266-2165 Website: www.szabo.com e-mail: [email protected] Get Paid Quickly and Efficiently with Automated Clearing House Processing Dear Friends: Many of today’s credit and collection Payments Association) was formed The method of payment that your challenges are the same challenges from regional organizations to customers choose can make a sub- that managers have always faced. establish rules and standards for stantial difference in your cost of Customers who pay late or never, ACH transactions. NACHA doing business. Checks and credit dispute and discrepancy issues, Operating Rules govern the ACH cards, respectively, top the list of bankruptcy . the list goes on. Network, guiding risk manage- preferred methods in the media One challenge that current technol- ment and creating payment cer- industry. We believe, however, that ogy may allow us to meet head-on tainty for participants. now may be the time to depose with relatively little effort and a very Historically, the ACH Network the number two choice, the credit high percentage of success, however, has been used for payroll direct card, and replace it with Automated is payment processing. -

Deposit Account Disclosures for Business Accounts TABLE of CONTENTS DEPOSIT ACCOUNT AGREEMENT

Deposit Account Disclosures For Business Accounts TABLE OF CONTENTS DEPOSIT ACCOUNT AGREEMENT . 4 GENERAL TERMS AND CONDITIONS . .5 Account Opening and Verification . 5 How We Communicate with You . .6 Telephone Recording . 6 Privacy, the USA PATRIOT Act, and Opening an Account . 6 Deposits . 6 Deposit Error Correction . 7 Claims . 7 Checks Made Payable to a Business . 7 Withdrawals . .8 Automated Clearing House (“ACH”) . 8 Interest-Bearing Account Information . 9 Interactive Teller Machine (ITM) . 9 Banking Day Cutoff . 9 Abandoned Accounts . 9 Right to Discontinue Accounts . .9 Right to Refuse Any Deposit, to Close Any Account, or to Terminate Account Services . 9 Account Information Services . 10 Agent . 10 Facsimile Signatures . 10 Right of Setoff . 11 Statement Production Date . 11 Statements of Account and Reasonable Care . 11 Security Procedures . 12 What Happens If You Owe Us Money or Cause Us to Sustain a Loss . .12 Fees and Charges . 12 Limits of Liability . 12 Address for Notices . .13 Not Transferable . 13 Confidentiality . 13 Legal Process . 14 Accounts or Services Governed By Special Rules Not Included in this Agreement . 14 Changes to this Agreement . 15 Waivers . 15 Assignment . 15 CUSTOMER REPRESENTATIONS AND WARRANTIES . 15 Valid Business Entity . 15 For Business Purposes Only . 15 Appropriate Business Resolution . 15 CHECKING ACCOUNTS . 15 FDIC Insurance Assessment Monthly Fee . 15 Earnings Credit . 16 Checks . 16 Order of Posting Transactions . 16 Stale Checks . 17 Postdated Checks . 17 Restrictive Legends . 17 Check Imaging . 18 Overdrafts/Insufficient Available Funds . 18 Stop Payments . 18 Preauthorized Drafts . 19 Checking Account Subaccounts . 19 Relationship Pricing . .19 1 SAVINGS ACCOUNTS AND MONEY MARKET ACCOUNTS . 20 Order of Posting Transactions . -

ACH) Rules for ACH Originators

Automated Clearing House (ACH) Rules for ACH Originators Important Terms ACH NETWORK – The ACH Network is a batch payment system. UniBank forwards entries received from its Originators to the Federal Reserve at the end of the banking day. The Federal Reserve distributes the entries to each Receiving Bank and the Receiving Bank in turn credits or debits its customers. NACHA RULES – NACHA administers the rules that govern the ACH Network. Banks, Originators, and Third Party Service Providers participating in the ACH Network agree to abide by the NACHA Rules. The online copy of the rules may be accessed at http://www.achrulesonline.org/ CREDIT ENTRY – An ACH entry that deposits (credits) funds to a Receiver’s account. DEBIT ENTRY – An ACH entry that withdraws (debits) funds from a Receiver’s account. ORIGINATOR – A company that initiates an ACH debit or credit, through an ODFI or Third-Party Sender, to a Receiver. RECEIVER – The company or individual that receives an ACH debit or credit entry from an Originator. ODFI (ORIGINATING DEPOSITORY FINANCIAL INSTITUTION) – UniBank RDFI (RECEIVING DEPOSITORY FINANCIAL INSTITUTION) – Receiver’s bank. ACH OPERATOR – The Federal Reserve THIRD PARTY SERVICE PROVIDER (TSPS)* – An Organization (not an Originator, ODFI, or RDFI) that performs any functions on behalf of the Originator, ODFI and/or RDFI. This can include the creation of files or acting as a sending point or receiving point for a Participating DFI. (An organization acting as a Third-Party Sender also is a TPSP – see next question for current definition) Examples of TPSP: data processing service bureau, correspondent bank, payable through bank, a banker’s bank, or even a financial institution acting on behalf of another financial institution. -

EUC SDD Position Paper

PAYMENT SYSTEM END-USERS COMMITTEE (EUC) POSITION PAPER ON SEPA DIRECT DEBIT July 2009 Contents . About the EUC . Executive summary . Chapter One: Introduction . Chapter Two: Direct Debit in Europe . Chapter Three: Problem Areas . Chapter Four: Alternative solution . Conclusion . Annexes i. Annex 1: Requirements of CMF+ ii. Annex 2: Current direct debit schemes (list) iii. Annex 3 and 4: differences in existing DD schemes. iv. Annex 5: Extract from McKinsey Report . Tables 1 About the EUC The authors of this research paper represent the community of users of payment system instruments at the European level. In particular, they constitute the group of users who sit on the European Payments Council (EPC) stakeholder consultation forum. They will be referred to in this paper as the End Users Committee (EUC). A full list of the organizations represented by the authors is given below. In early 2009, the EUC considered that, despite a number of meetings with the EPC and individual meetings had by various members of the committee with the European Commission and the European Central Bank, there was still insufficient understanding and clarity on the part of these three bodies as to the needs and views of SEPA users on the proposed SEPA direct debit scheme. There was also insufficient understanding within the user community of the issues at stake. The EUC therefore proposed to research and compile an analysis of the major problems confronting the adoption of the Single Euro Payments Area (SEPA), with specific focus on SEPA direct debit (SDD). To this end, the EUC appointed three experts who have written this paper, with the full collaboration of all members of the EUC who have endorsed it as fully representing their views. -

PUERTO RICO Executive Summary

Underwritten by CASH AND TREASURY MANAGEMENT COUNTRY REPORT PUERTO RICO Executive Summary Banking Puerto Rico does not have a central bank and relies on the US Federal Reserve System (the Fed), the US central bank, as its central regulatory institution. It does not maintain its own reserves. Puerto Rico does not apply central bank reporting requirements. Resident entities are permitted to hold fully convertible foreign currency bank accounts domestically and outside Puerto Rico. Non-resident entities are permitted to hold fully convertible domestic and foreign currency bank accounts within Puerto Rico. Puerto Rico has nine commercial banks. In addition, there are also two state-owned development banks, 75 mortgage institutions, 30 international banking entities (IBEs), savings and loan associations, investment banks, finance companies, and other financial institutions. Payments Banks in Puerto Rico are participants in the US check clearing system as well as the Fedwire and ACH funds transfer systems. The four main US clearing systems are Fedwire, CHIPS, ACH and check clearing. Liquidity Management Puerto Rican-based companies have access to a variety of short-term funding alternatives. There is also a range of short-term investment instruments available. Cash concentration is the more common technique used by Puerto Rican companies to manage company and group liquidity. Of the available techniques, zero-balancing is the most commonly used. Notional pooling is not available in Puerto Rico. Trade Finance Puerto Rico is part of the customs territory of the United States of America, and products imported from outside the USA are subject to the US tariff system and regulations and trade agreements. -

Banque De France Feedback on Fraud Prevention for EEA Payments Open

Banque de France feedback on fraud prevention for EEA payments Open Banking & Instant Payments Summit 24-25-26|MARCH|2021 OB & IP Forum 2021 www.kinfos.events/ob-ips/ Context Starting point The April 2016 BanglaDesh CB frauD has leadeD BDF to launch new services to secure customer transactions against frauD. To cover all the scope of payments, set of 3 services : Ø CORE Flows(1): Banque de France has subscribeD to the SCFP service (SEPA Core FrauD Prevention) provideD by STET anD baseD on Artificial Intelligence Ø SWIFT Flows(2): BaseD on the SWIFT Solution (Payment Control Services) coupleD with SAA Rules (White lists, ThresholDs) Ø STEP2 Flows(3): No frauD detection system provideD by EBA Clearing => NeeD to develop our own solution, referreD as OASIS (Current proof of concept anD project coming soon; most challenging issues to deal with were : 1. Real time/ near real time analysis of payments 2. Focus business analysis on most risky payments 3. Strengthen frauD detection with Artificial Intelligence (1) CORE (Compensation REtail) is an automated clearing house, managed by STET. CORE processes the clearing of retail payments (transfers, withdrawals, card transactions,…) between banks located in France. It also allows to exchange SEPA transfers in France and Europe (3) SWIFT (Society for Worldwide Interbank Financial Telecommunication) provides a network that enables financial institutions worldwide to send and receive information about financial transactions (3) STEP2 is a Pan-European Automated Clearing House, provided by EBA Clearing -

Electronic Funds Transfers

ELECTRONIC FUND1 TRANSFERS Effective 1/1/2021 YOUR RIGHTS AND RESPONSIBILITIES Indicated below are types of Electronic Fund Transfers we are capable of handling, some of which may not apply to your account. Please read this disclosure carefully because it defines your responsibilities and the responsibilities of Bank-Fund Staff Federal Credit Union® (BFSFCU®) with respect to certain electronic fund transactions. You should keep this notice for future reference. As used throughout this Agreement, the terms “you” and “your” mean each person who applies for and uses an electronic service or access device and all account own- ers if the accounts are joint accounts, jointly and sever- ally. The words “our”, “us”, “we”, “BFSFCU”, or “Credit Union” mean Bank-Fund Staff Federal Credit Union. The word “card” means the Debit Card access device issued to you by us, which permits you to conduct Transactions at automated teller machines (ATMs) owned and operated by us; at ATMs and point of sale (POS) terminals that are part of a network that accepts our card; and at any place that honors Visa cards for Transactions. The word “PIN” means your personal identification number for your card. The word “PIN” also means your personal identification number for accessing BFSFCU’s Audio Response System (ARS). The terms “user ID” and “password” refer to your access codes used for accessing BFSFCU’s Digital Banking. The word “Transaction” means an electronic fund transac- tion. These Transactions are performed through the use of ATMs, POS terminals, the Audio Response System, Digital Banking, the Automated Clearing House system and other electronic means. -

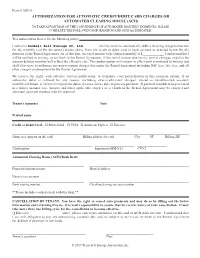

Authorization for Automatic Credit/Debit Card Charges

Form # ADD-6 AUTHORIZATION FOR AUTOMATIC CREDIT/DEBIT CARD CHARGES OR AUTOMATED CLEARING HOUSE (ACH) TO TAKE ADVANTAGE OF THE CONVENIENCE OF AUTOMATED MONTHLY PAYMENTS, PLEASE COMPLETE THE FOLLOWING INFORMATION AND SIGN AS INDICATED. This authorization form is for the following unit(s): I authorize ___________________________________________Sunbelt Self Storage XV, Ltd. (facility name) to automatically debit a recurring charge/transaction for the monthly rent for the unit(s) shown above from my credit or debit card or bank account as detailed below for the duration of the Rental Agreement. As of this date, the total amount to be charged monthly is $_____________. I understand that I will be notified in writing, as set forth in the Rental Agreement, if the rental amount due for my unit(s) changes, and that the amount debited monthly will reflect the effective rate. This authorization will remain in effect until terminated in writing and shall also serve to authorize any non-recurring charges due under the Rental Agreement including NSF fees, late fees, and all other charges contemplated by the Rental Agreement. We reserve the right, with advance written notification, to terminate your participation in this payment option. If an automatic debit is refused for any reason, including over-credit-limit charges, closed or unauthorized account, insufficient funds, or incorrect expiration dates, we may not be able to process payment. If payment is unable to be processed in a timely manner, late charges and other applicable charges as set forth