FORM 10-K Annual Report Pursuant to Section 13 and 15(D)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Sustainability and Annual Report FINANCIAL HIGHLIGHTS

Ready TRIUMPH GROUP 2021 Sustainability and Annual Report FINANCIAL HIGHLIGHTS (in millions, except per share data) TOTAL BACKLOG Fiscal Year Ended March 31 2021 2020 2019 $ in billions $ 1,870 Net sales $ 2,900 $ 3,365 $ Ready to fly Adjusted operating income 108 218 166 ( ) Adjusted net income 2 137 115 Adjusted diluted earnings per share $ (0.03) $ 2.69 $ 2.38 ( ) Cash flow from operations 173 97 (174) Total assets $ 2,451 $ 2,980 $ 2,855 Total debt 1,958 1,808 1,489 Total equity (819) (781) (573) AFTER ONE OF THE TOUGHEST YEARS OUR INDUSTRY HAS EVER NON-GAAP RECONCILIATION FACED, IT IS ENCOURAGING TO HAVE AN ABUNDANCE OF GOOD Operating (loss) income – GAAP $ (326) $ 58 $ (275) Loss on sale of assets & businesses 105 57 235 NEWS. TRIUMPH GROUP HAS EMERGED FROM FIVE YEARS OF Forward losses — — 87 SALES BY END MARKET ARDUOUS RESTRUCTURING AS A MUCH STRONGER AND MORE Restructuring 53 25 31 Legal judgment gain, net — (9) — Regional Jet .% .% Non-Aviation AGILE COMPANY. OUR MARKETS ARE POISED FOR GROWTH, AND Impairments 276 66 — Business Jet Other — 21 87 % Adjusted operating income* 108 218 166 WE ARE POSITIONED FAVORABLY AND SUSTAINABLY WITHIN Interest & other (171) (122) (115) % THEM. OUR PEOPLE ARE SUPPORTED AND FOCUSED. OUR Non-service defined benefit income 50 41 57 % 15 Less: Financing charges 3 1 Military Adjusted income before income taxes* 1 140 110 Commercial PROFITABILITY IS IMPROVING. UP IS WHERE WE ARE GOING. (3) Income taxes (6) 5 DECISIVELY, DECIDEDLY UP. Tax effect of adjustments — 3 — Adjusted net income (2) 137 115 ADJUSTED SEGMENT OPERATING INCOME Diluted earnings per share – GAAP $ (8.55) $ (0.58) $ (6.58) Per share impact of adjustments 8.52 3.27 8.96 ( ) Aerospace Adjusted diluted earnings per share $ 0.03 $ 2.69 $ 2.38 Structures Weighted average diluted shares 53.0 52.0 49.7 % *Differences due to rounding ABOUT TRIUMPH % Triumph Group, Inc. -

Rosuvastatin Calcium Patent Litigation

IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF DELAWARE IN RE: ROSUVASTATIN CALCIUM MDL No. 08-1949-JJF PATENT LITIGATION, ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-805-JJF-LPS MYLAN PHARMACEUTICALS INC., Defendant. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-806-JJF-LPS SUN PHARMACEUTICAL INDUSTRIES LTD. , Defendant. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-807-JJF-LPS SANDOZ INC., Defendant. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-808-JJF-LPS PAR PHARMACEUTICALS INC., Defendant. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-809-JJF-LPS APOTEX CORP., Defendants. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-810-JJF-LPS AUROBINDO PHARMA LTD. AND AUROBINDO PHARMA USA INC., Defendants. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-811-JJF-LPS COBALT PHARMACEUTICALS INC. AND COBALT LABORATORIES INC., Defendants. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 08-359-JJF-LPS AUROBINDO PHARMA LTD. AND AUROBINDO PHARMA USA INC., Defendants. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. -

Pinnacle Foods Inc. 2016 Annual Report

PINNACLE FOODS INC. FOODS PINNACLE 2016 ANNUAL REPORT ANNUAL 2016 399 Jefferson Road • Parsippany, NJ 07054 PINNACLE FOODS INC. 2016 ANNUAL REPORT pinnaclefoods.com 98199_Pinnacle_Cover.indd 1 4/5/17 3:36 PM 2016 HIGHLIGHTS CORPORATE & INVESTOR INFORMATION (in millions except per share) 2015 2016 Change Net Sales $2,656 $3,128 +17.8% Headquarters Dividends Pinnacle Foods Inc. Dividends are paid quarterly in January, Adjusted Gross Profit $750 $921 +22.8% 399 Jefferson Road April, July and October. % Net Sales 28.2% 29.4% +120 bps Parsippany, NJ 07054 (973) 541-8620 Adjusted EBIT $443 $539 +21.6% www.pinnaclefoods.com Independent Registered Public Accounting Firm % Net Sales 16.7% 17.2% +50 bps Deloitte & Touche LLP Adjusted Net Earnings $225 $254 +12.8% Stock Exchange Listing Parsippany, NJ New York Adjusted Diluted EPS $1.92 $2.15 +12.0% Ticker Symbol: PF Diluted Shares Outstanding 117.3 118.2 +0.8% Corporate News and Reports A wide range of information about the Free Cash Flow1 $265 $387 +$122 Investor Relations Company, including news releases, Maria Sceppaguercio financial reports, investor information, Senior Vice President, Investor Relations corporate governance and career email: [email protected] opportunities are available on our website: website: http://investors.pinnaclefoods.com www.pinnaclefoods.com 2016 was another good year (973) 434-2924 for Pinnacle, demonstrating the Printed materials such as the Annual Report enduring nature of our business on SEC Form 10-K and quarterly reports on model and value creation strategy. Virtual Annual Meeting of Stockholders SEC Form 10-Q may be requested via our The annual meeting of stockholders website or by calling (973) 434-2924. -

IN the SUPREME COURT of the STATE of DELAWARE the BANK of NEW YORK § MELLON TRUST COMPANY, § N.A., As Trustee, § No

IN THE SUPREME COURT OF THE STATE OF DELAWARE THE BANK OF NEW YORK § MELLON TRUST COMPANY, § N.A., as Trustee, § No. 284, 2011 § Defendant Below, § Court Below – Court of Chancery Appellant, § of the State of Delaware § C.A. No. 5702 v. § § LIBERTY MEDIA CORPORATION § and LIBERTY MEDIA LLC, § § Plaintiffs Below, § Appellees. § Submitted: September 14, 2011 Decided: September 21, 2011 Before STEELE , Chief Justice, HOLLAND , BERGER , JACOBS and RIDGELY , Justices, constituting the Court en Banc . Upon appeal from the Court of Chancery. AFFIRMED . Joel Friedlander, Esquire, and Sean M. Brennecke, Esquire, Bouchard, Margules & Friedlander, P.A., Wilmington, Delaware, Steven D. Phol, Esquire (argued), Timothy J. Durken, Esquire, Brown, Rudnick, LLP, Boston, Massachusetts, Sigmund S. Wissner-Gross, Brown Rudnick LLP, New York, New York, Mark S. Baldwin, Esquire and Stephen R. Klaffky, Esquire, Brown, Rudnick LLP, Hartford, Connecticut, for Bank of New York Mellon Trust Company, N.A. Donald J. Wolfe, Jr., Esquire, Arthur L. Dent, Esquire, Michael A. Pittenger, Esquire (argued), Brian C. Ralston, Esquire, and Matthew F. Lintner, Esquire, Potter, Anderson & Corroon, LLP, Wilmington, Delaware, and Frederick H. McGrath, Esquire, Richard B. Harper, Esquire and Renee L. Wilm, Esquire, Baker Botts L.L.P., New York, New York, for Liberty Media Corporation and Liberty Media LLC. HOLLAND , Justice: 2 The plaintiffs-appellees, Liberty Media Corporation (“LMC”) and its wholly owned subsidiary Liberty Media LLC (“Liberty Sub,” together with LMC, “Liberty”) brought this action for declaratory and injunctive relief against the defendant-appellant, the Bank of New York Mellon Trust Company, N.A., in its capacity as trustee (the “Trustee”). -

Wilmington Trust Franklin Templeton Funds

WILMINGTON TRUST COLLECTIVE INVESTMENT TRUST FUNDS SUB-ADVISED BY FRANKLIN ADVISERS, INC. FINANCIAL STATEMENTS DECEMBER 31, 2019 WITH INDEPENDENT AUDITOR'S REPORT Wilmington Trust Collective Investment Trust Funds Sub-Advised by Franklin Advisers, Inc. CONTENTS Independent Auditor's Report ..................................................................................................................................................................... 1 Fund Index ................................................................................................................................................................................................. 3 Wilmington Trust Franklin DynaTech CIT ................................................................................................................................................... 4 Wilmington Trust Franklin Growth CIT ..................................................................................................................................................... 13 Wilmington Trust Franklin Real Estate Securities CIT .............................................................................................................................. 21 Wilmington Trust Franklin Templeton Global Bond Plus Trust ................................................................................................................. 27 Wilmington Trust Franklin U.S. Aggregate Bond CIT .............................................................................................................................. -

Fund Holdings

Wilmington International Fund as of 7/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS ISHARES MSCI CANADA ETF 3.48% TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.61% DREYFUS GOVT CASH MGMT-I 1.83% SAMSUNG ELECTRONICS CO LTD 1.79% SPDR S&P GLOBAL NATURAL RESOURCES ETF 1.67% MSCI INDIA FUTURE SEP21 1.58% TENCENT HOLDINGS LTD 1.39% ASML HOLDING NV 1.29% DSV PANALPINA A/S 0.99% HDFC BANK LTD 0.86% AIA GROUP LTD 0.86% ALIBABA GROUP HOLDING LTD 0.82% TECHTRONIC INDUSTRIES CO LTD 0.79% JAMES HARDIE INDUSTRIES PLC 0.78% DREYFUS GOVT CASH MGMT-I 0.75% INFINEON TECHNOLOGIES AG 0.74% SIKA AG 0.72% NOVO NORDISK A/S 0.71% BHP GROUP LTD 0.69% PARTNERS GROUP HOLDING AG 0.65% NAVER CORP 0.61% HUTCHMED CHINA LTD 0.59% LVMH MOET HENNESSY LOUIS VUITTON SE 0.59% TOYOTA MOTOR CORP 0.59% HEXAGON AB 0.57% SAP SE 0.57% SK MATERIALS CO LTD 0.55% MEDIATEK INC 0.55% ADIDAS AG 0.54% ZALANDO SE 0.54% RIO TINTO LTD 0.52% MERIDA INDUSTRY CO LTD 0.52% HITACHI LTD 0.51% CSL LTD 0.51% SONY GROUP CORP 0.50% ATLAS COPCO AB 0.49% DASSAULT SYSTEMES SE 0.49% OVERSEA-CHINESE BANKING CORP LTD 0.49% KINGSPAN GROUP PLC 0.48% L'OREAL SA 0.48% ASSA ABLOY AB 0.46% JD.COM INC 0.46% RESMED INC 0.44% COLOPLAST A/S 0.44% CRODA INTERNATIONAL PLC 0.41% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.41% STRAUMANN HOLDING AG 0.41% AMBU A/S 0.40% LG CHEM LTD 0.40% LVMH MOET HENNESSY LOUIS VUITTON SE 0.39% SOFTBANK GROUP CORP 0.39% NOVARTIS AG 0.38% HONDA MOTOR CO LTD 0.37% TOMRA SYSTEMS ASA 0.37% IMCD NV 0.37% HONG KONG EXCHANGES & CLEARING LTD 0.36% AGC INC 0.36% ADYEN -

Wilmington Trust Collective Investment Trust Funds Sub-Advised by Brandywine Global Investment Management, LLC

WILMINGTON TRUST COLLECTIVE INVESTMENT TRUST FUNDS SUB-ADVISED BY BRANDYWINE GLOBAL INVESTMENT MANAGEMENT, LLC FINANCIAL STATEMENTS DECEMBER 31, 2020 WITH INDEPENDENT AUDITOR'S REPORT Wilmington Trust Collective Investment Trust Funds Sub-Advised by Brandywine Global Investment Management, LLC CONTENTS Independent Auditor's Report ..................................................................................................................................................................... 1 Fund Index ................................................................................................................................................................................................. 3 BrandywineGLOBAL – Diversified US Large Cap Value CIT ..................................................................................................................... 4 BrandywineGLOBAL – Dynamic US Large Cap Value CIT ...................................................................................................................... 15 BrandywineGLOBAL – US Fixed Income CIT .......................................................................................................................................... 22 Notes to the Financial Statements............................................................................................................................................................ 29 INDEPENDENT AUDITOR'S REPORT Wilmington Trust, N.A, Trustee for W ilmington Trust Collective Investment Trust Report on the Financial -

Complaint in Action Manufacturing Co Inc Et Al

SDMS DocID 2037769 IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF PENNSYLVANIA ACTION MANUFACTURING CO., INC., ALCOA INC. f/k/a ALUMINUM COMPANY OF AMERICA, ARMSTRONG WORLD INDUSTRIES, INC., CIVIL ACTION ABB INC. f/k/a FISCHER & PORTER COMPANY, NO. 02- BECKETT COMPANY, L.P., GENERAL ELECTRIC COMPANY/RCA, GENERAL MOTORS CORPORATION, HAMILTON TECHNOLOGIES, INC. (BULOVA TECHNOLOGIES, L.L.C.), HAMILTON WATCH COMPANY, INC. (SWATCH GROUP U.S., INC.), HANDY & HARMAN , HAYFORK, L.P. f7k/a HAMILTON PRECISION METALS, INC., TUBE CO., HERCULES INCORPORATED, J.W. REX, LAFRANCE CORPORATION, LUCENT TECHNOLOGIES INC., PENFLEX, INC., PLYMOUTH TUBE COMPANY, REILLY PLATING COMPANY, SIEMENS ENERGY & AUTOMATION, INC. f/k/a MOORE PRODUCTS, CO., SUNROC CORPORATION, SYNTEX (USA), INC., UNISYS CORPORATION, AND VIZ LIQUIDATION TRUST Plaintiffs, v. SIMON WRECKING COMPANY, SIMON WRECKING COMPANY, INC., SIMON RESOURCES, INC., MID-STATE TRADING COMPANY, INC., S & S INVESTMENTS, INC., SCHWAB-SIMON REALTY CORPORATION, TRENTON REALTY CORPORATION, QUAKER CITY CHEMICALS, INC., CENTRAL PENN CHEMICALS, CENTRAL PENNSYLVANIA CHEMICALS, QUAKER CITY, INC., AROOOOOI J & J SPILL SERVICE & SUPPLIES, INC., J & J TRANSPORT, INC., A & A SEPTIC SERVICE, INC., CONTINENTAL VANGUARD, INC., LIGHTMAN DRUM COMPANY, LIGHTMAN DRUM CO., INC., RESOURCE TECHNOLOGY SERVICES, INC. BISHOP TUBE CO., ELECTRALLOY CORP., MERCEGAGLIA USA, INC., AMP INCORPORATED, TYCO ELECTRONICS CORPORATION, TYCO INTERNATIONAL (US), INC., TYCO INTERNATIONAL LTD., PETROCON INC., ANTROL INDUSTRIES, INC. MCCLAPJN PLASTICS, INC., LAVELLE AIRCRAFT COMPANY, AMETEK, INC., LEEDS AND NORTHRUP COMPANY, CSS INTERNATIONAL CORP., CSS METAL FABRICATION CORPORATION, CSS MACHINE & TOOL CO., INC., ECOLOGY SYSTEMS EQUIPMENT MANUFACTURING CO., INC., TECHNITROL, INC., FBF INDUSTRIES, INC., FBF, INC., ARK PRODUCTS CO, INC., MALCO. -

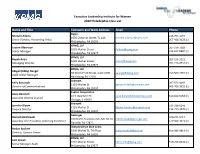

Name and Title Company and Work Address Email Phone 2020

Executive Leadership Institute for Women 2020 Philadelphia Class List Name and Title Company and Work Address Email Phone Cigna Michele Adams 215-761-1467 1601 Chestnut Street, TL 14A [email protected] Senior Director, Accounting Policy 267-418-3629 (c) Philadelphia, PA 19192 KPMG, LLP Lauren Albertson 267-256-3183 1601 Market Street [email protected] Senior Manager 215-817-0889 (c) Philadelphia, PA 07677 KPMG, LLP Rupali Amin 267-256-3221 1601 Market Street [email protected] Managing Director 267-210-4331 (c) Philadelphia, PA 07677 KPMG, LLP Abigail (Abby) Aungst 30 North Third Street, Suite 1000 [email protected] 717-507-7707 (c) Audit Senior Manager Harrisburg, PA 17101 Aramark Kelly Banaszak 267-671-4469 1101 Market St [email protected] Director of Communications 609-760-3332 (c) Philadelphia, PA 19107 Exelon Corporation Anne Bancroft 10 S. Dearborn St [email protected] 610-812-5454 (c) Associate General Counsel Chicago, IL 60603 Aramark Jennifer Bloom 215-238-8143 1101 Market St [email protected] Finance Director 215-779-1025 (c) Philadelphia, PA 19107 Geisinger Hannah Bobrowski 570-271-5417 100 North Academy Ave, MC 28-10 [email protected] Associate Vice President, Achieving Excellence 570-926-3071 (c) Danville, PA 17822 Independence Blue Cross Roslyn Boskett 1900 Market St, 7th Floor [email protected] 856-986-9814 (c) Director, Contact Center Philadelphia, PA 19103 KPMG, LLP Kelli Brown 1601 Market Street [email protected] 610-256-0628 (c) Senior Manager Audit Philadelphia, PA 07677 -

Investor Overview February 2020 Forward Looking Statements

Investor Overview February 2020 Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are often, but not always, identified by the use of words such as “anticipate”, “believe”, “expect”, “plan”, “intend”, “project”, “may”, “will”, “should”, “could”, or similar words suggesting future outcomes or outlooks. These forward-looking statements include, but are not limited to, statements of expectations of or assumptions about strategic actions, objectives, expectations, intentions, aerospace market conditions, aircraft production rates, financial and operational performance, revenue and earnings growth and profitability and earnings results. These statements are based on the current projections, expectations and beliefs of Triumph’s management. These forward looking statements involve known and unknown risks, uncertainties and other factors which could cause actual results to differ materially from any expected future results, performance or achievements, including, but not limited to, competitive and cyclical factors relating to the aerospace industry, dependence on some of Triumph’s business from key customers, requirements of capital, uncertainties relating to the integration of acquired businesses, general economic conditions affecting Triumph’s business segments, product liabilities in excess of insurance, technological developments, limited availability of raw materials or skilled personnel, changes in governmental regulation and oversight and international hostilities and terrorism. Further information regarding the important factors that could cause actual results, performance or achievements to differ from those expressed in any forward looking statements can be found in Triumph’s reports filed with the SEC, including in the risk factors described in Triumph’s Annual Report on Form 10-K for the fiscal year ended March 31, 2019. -

Supplier Attendance List

2004 Global Supplier Conference Supplier Attendance List Last Name First Name Company City State Country Sopp Robert AAR Garden City NY USA Jones Alan Able Engineering Inc. Goleta CA USA Henderson Mark Accra Manufacturing Inc Bothell WA USA Lyon Daniela Accra Manufacturing Inc Bothell WA USA Mehus Keith Accra Manufacturing Inc Bothell WA USA Farr Keith Advanced Optical Systems Huntsville AL USA Nelson Kimberly Advanced Optical Systems Huntsville AL USA Magpayo Michael Aerojet General Corp. Aerospace Industries Association Of America, Lewandowski William Inc. Arlington VA USA Feutz John AIM Aviation Auburn Inc Auburn WA USA Larson John AIM Aviation Auburn Inc Auburn WA USA Hendricksen John Air Cruisers Company Inc. Wall Township NJ USA Redento Jose Air Cruisers Company Inc. Wall Township NJ USA Belnoski Lawrence Air Products And Chemicals, Inc. Allentown PA USA McNallen John Air Products And Chemicals, Inc. Allentown PA USA Meyer James Airgas Radnor PA USA Whinfrey Thomas Aitech Chatsworth CA USA Clelland Jim Alcoa Engineered Products Lafayette IN USA Vandedrinck Caroline Alcoa Wheel And Forged Products Cleveland OH USA Thomas Paul Alcoa Chicago IL USA Kiskaddon Harry Alcoa Zappa Giorgio Alenia Aeronautica Rome Italy Assereto Roberto Alenia Aeronautica Spa Torino Italy Braccini Sergio Alenia Aeronautica Spa Pomigliano d'Arco (NA) Italy Caruso Guglielmo Alenia Aeronautica Spa Pomigliano d'Arco Italy Giuseppe Giordo Alenia Aeronautica SPA Caiazzo Vincenzo Alenia Inc. Washington, DC USA McGee Charles All Points Logistics Inc Gainesville GA USA Monkress Phillip All Points Logistics Inc Gainesville GA USA Beard Eric AMI Metals, Inc Brentwood TN USA Cole Cecil Applied Industrial Technologies Cleveland OH USA Geddes Norman Applied Systems Intelligence Inc. -

Amerigas Partners, LP

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): March 15, 2012 AmeriGas Partners, L.P. (Exact name of registrant as specified in its charter) Delaware 1-13692 23-2787918 (State or other jurisdiction (Commission (IRS Employer of incorporation) File Number) Identification No.) 460 No. Gulph Road, King of Prussia, Pennsylvania 19406 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (610) 337-7000 Not Applicable (Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Item 8.01 Other Events. On March 15, 2012, AmeriGas Partners, L.P. (the “Partnership”), AmeriGas Propane, L.P., the operating partnership of the Partnership, and AmeriGas Propane, Inc., the general partner of the Partnership and AmeriGas Propane, L.P., entered into an underwriting agreement, attached as Exhibit 1.1 hereto, with Wells Fargo Securities, LLC, Barclays Capital Inc., Citigroup Global Markets Inc., Credit Suisse Securities (USA) LLC, J.P.